Can A Business Have No Employees

Does a corporation have to have employees? No, there is no legal requirement that a corporation has to hire employees. In fact, many corporations will not need employees. If you do decide to hire employees for your corporation, however, there are several tax and reporting requirements with which you must comply.

Point 4 The New Sba Guidance Also Addressed Partnerships Without Payroll Expense

If you have such a partnership, the partnership must apply for the PPP loan. The loan amount is based on the combined self-employment income of the general active partners up to a maximum of $100,000 per partner.

For example, take a partnership with $500,000 in total self-employment income and 3 partners. The maximum loan is $300,000 divided by 12 x 2.5 = $62,500.

It is presumed that forgiveness would follow the same vein as forgiveness for sole proprietors. 8 weeks worth of the $300,000 of self-employment income would be forgiven. Using the above example that would be 8/52 x $300,000 = $46,154 forgiven.

If partners are not comfortable trusting in automatic forgiveness, it might be wise to issue guaranteed payments to the partners in the amount of the expected SE income forgiveness . That would create an audit-able cash trail to support forgiveness.

Like sole proprietor loans, the remainder of the loan could also be forgiven if spent on utilities, rent and interest within 8 weeks of receiving the loan.

Top Business Line Of Credit Providers

- Ideal for: Small businesses who need access to cash quickly.

- Funding Amounts: Up to $100,000 to be used at the borrowers discretion.

- Minimum Requirements: In order to qualify for a loan from OnDeck, you must have been in business for a year, have a credit score of 600+, and have $100,000 in annual revenue. You must be at least 18 years old and a citizen of the US.

- Repayment Terms and Fees: Repayment terms range from 6-36 months. There is a one-time origination fee as well as prepayment options if you choose to pay back your loan early.

- Funding Time: Applying to OnDeck is quick and simple. OnDeck is known for its customer service and easy online application. Once approved, you can receive your funding within 24 hours.

- Bottom Line: OnDeck is a trusted loan provider for small businesses and has an A+ BBB rating. You can apply online in minutes- or pick up the phone and speak with one of the highly-rated loan specialists.

Read our in-depth review of OnDeckto find out more about this lender.

You May Like: Can I Include Closing Costs In My Fha Loan

What Are The Types Of Business Loans Available For Small Businesses

Lenders offer a variety of loans for businesses depending on what the money is going to be used for and how companies are able to guarantee payment.

- Secured loans require collateral to back up the amount of the loan, meaning you could lose what you put up if you fail to pay in full.

- Unsecured loans are granted to companies with solid credit ratings and may offer lower interest rates than secured loans.

- Lines of credit work like a credit card, allowing you to borrow against a set amount as needed and only requiring interest payments on the money you use.

- Merchant cash advances are based on your volume of monthly credit card sales and are paid back using a percentage of each future sale.

- Accounts receivable loans use outstanding invoices as collateral to help pay off short-term debts.

- Equipment loans are granted specifically for the purchase of new equipment, using what you purchase as collateral.

- Construction loans provide funding to expand your existing location or build a new facility, and the building is considered collateral.

- Working Capital loans are granted to help fund daily operational tasks for businesses of all sizes.

Each loan type has a specific payment structure, term length, and interest rate. Some are more difficult to qualify for than others, and most require you to present detailed paperwork when applying. If your business qualifies, Small Business Administration loans can be advantageous, with lower rates and secure lending.

Turn To A Local Lender For Ppp

While Pursuit is offering PPP loans nationwide, were focused on helping businesses in NY, NJ and PA access the program. Applying with Pursuit means working with an experienced local lender thats already helped more than 7,000 small businesses access PPP. You can take advantage of responsive customer support and an easy to use online PPP application. We look forward to serving you!

Recommended Reading: Who Qualifies For Fha Home Loan

More Money Is Available

Maybe you dont have an official payroll. Thats OK. To figure out how much forgivable funds are available, youll need to look at your federal Schedule C form from either 2020 or 2019. Up until the White House acted, you had to calculate the size of your requested loan based on the net income on that form. But that amount was net of expenses, so it was pretty low for many.

But now you can calculate the loan based on your reported gross income , which is probably much higher. The calculation is 2.5 times your average monthly gross income for the year, but the gross income cant exceed $100,000 annually. If you do have employees, you can include their wages, too, but you have to deduct the expenses reported on lines 14 , 19 , and 26 of Schedule C from your gross income.

If You Have An Eidl That Will Be Financed By The Loan

Whether or not you have employees, you must take an additional step of adding the outstanding amount of any Economic Injury Disaster Loan awarded between January 31, 2020, and April 3, 2020, which must be refinanced into your PPP loan, although if you only received an EIDL advance, you will not need to refinance the advance amount into your PPP loan.

Read Also: How Often Can You Use The Va Loan

Ppp Updates: Sole Proprietors And Forms 3509/3510

The government recently released several important updates to the Paycheck Protection Program , including new loan calculation information for sole proprietors, as well as additional information concerning the governments review of certain PPP loans.

New Loan Criteria for Sole Proprietors Under the PPP

Taxpayers reporting their activities on Schedule C of their individual tax returns are often referred to as sole proprietors or Schedule C filers. Previous governmental guidance limited a sole proprietors payroll expense for PPP loan purposes to the sole proprietors actual employee payroll expenses plus an amount of the sole proprietors net taxable income . The owner-compensation replacement amount is capped at $20,833.

A sole proprietor cannot be an employee of its business, so sole proprietors without employees were generally limited to using their net taxable income. Recognizing that certain sole proprietors without employees and/or sufficient net income may not have received as much PPP aid as needed, the government now states that a Schedule C filer may elect to calculate the owner compensation share of its payroll coststhat is, the share of its payroll costs that represents compensation of the ownerbased on either net profit or gross income capped at $20,833 no matter if net profit or gross income is used.

Stay on top of changing PPP regulations and maximize your loan forgiveness options.

Governmental Review of PPP Loans- Forms 3509 and 3510

How Sole Property Ppp Tax Accounting Works

With a sole proprietor, though, the tax accounting works differently.

To keep things simple, assume a sole proprietor received a $20,000 PPP loan based on the sole proprietorship earning $100,000 in 2019.

In this case, the PPP accounting rules allow the sole proprietor to use all of the $20,000 for owner compensation replacement. And in fact, to get forgiveness, the business may need to use the entire PPP loan for that.

But the $20,000 isnt taxable. The reason? The payments made by a sole proprietorship to the owner arent tax deductions. The payments are, well, just payments.

Accordingly, a sole proprietorship doesnt have a tax deduction it can even lose when it uses PPP money for the payment.

Don’t Miss: Personal Loan For Good Credit

Applying For A Line Of Credit: The Basics

Like a business loan, a line of credit may be secured or unsecured. Secured credit lines need collateral to back them up. Unsecured lines are guaranteed by your business and require more trust on the part of the lender. In both cases, youre at risk of loss should you be unable to make payments. The lender will either take possession of your collateral or have the choice to sue you for what you owe.

To avoid these problems, work to build up a good credit score for your business and yourself. Have a dedicated business bank account, and stay on top of all your payments. Keep detailed records of cash flow, profit and loss, accounts payable and receivable, revenue streams, assets, and income. Most lenders will want to see this information when deciding whether or not to extend a line of credit to your business.

When applying, ask about any fees associated with the credit line. There may be fees for borrowing money or maintaining the account when you havent borrowed for a length of time. Make sure you understand the current business line of credit rates and the payment structure so that you can continue to practice good credit management.

How Much Can You Expect To Borrow

For most independent contractors, calculating your PPP borrowing limit is a 3-step process:

Find line 7 on your 2019 IRS Form 1040 Schedule C . If the amount on Line 7 is over $100,000, write $100,000. Effective March 8, 2021, most lenders will now accept line 7 .

If line 7 shows $0 or less, you do not qualify for a PPP loan.

Divide the amount from Step 1 by 12.

Multiply the amount from Step 2 by 2.5 . For most borrowers, this will be your maximum PPP loan amount.

NOTE: If you received an EIDL loan between January 31, 2020 and April 3, 2020 you can refinance that as part of your PPP loan .

Also Check: Second Chance Personal Loans With Bad Credit

First Draw Ppp Loan If You Have No Employees

If you are self-employed and have no employees, the SBA provides the following instructions in the March 3, 2021 for new PPP loan borrowers:

If you have no employees, use the following methodology to calculate your maximum loan amount:

Step 1: From your 2019 or 2020 IRS Form 1040, Schedule C, you may elect to use either your line 31 net profit amount or your line 7 gross income amount. If this amount is over $100,000, reduce it to $100,000. If both your net profit and gross income are zero or less, you are not eligible for a PPP loan.

Step 2: Calculate the average monthly net profit or gross income amount .

Step 3: Multiply the average monthly net profit or gross income amount from Step 2 by 2.5. This amount cannot exceed $20,833.

This is the amount most self employed borrowers with no employees will use to qualify for a first-time PPP loan.

How to Substantiate Your Income

You must provide the 2019 or 2020 Form 1040 Schedule C with your PPP loan application to substantiate the amount for which you applied. You must also include a 2019 or 2020 IRS Form 1099-MISC detailing non-employee compensation received , invoice, bank statement, or book of record that establishes you are self-employed. If using 2020 to calculate loan amount, this is required regardless of whether you have filed a 2020 tax return with the IRS. You must provide a 2020 invoice, bank statement, or book of record to establish you were in operation on or around February 15, 2020.

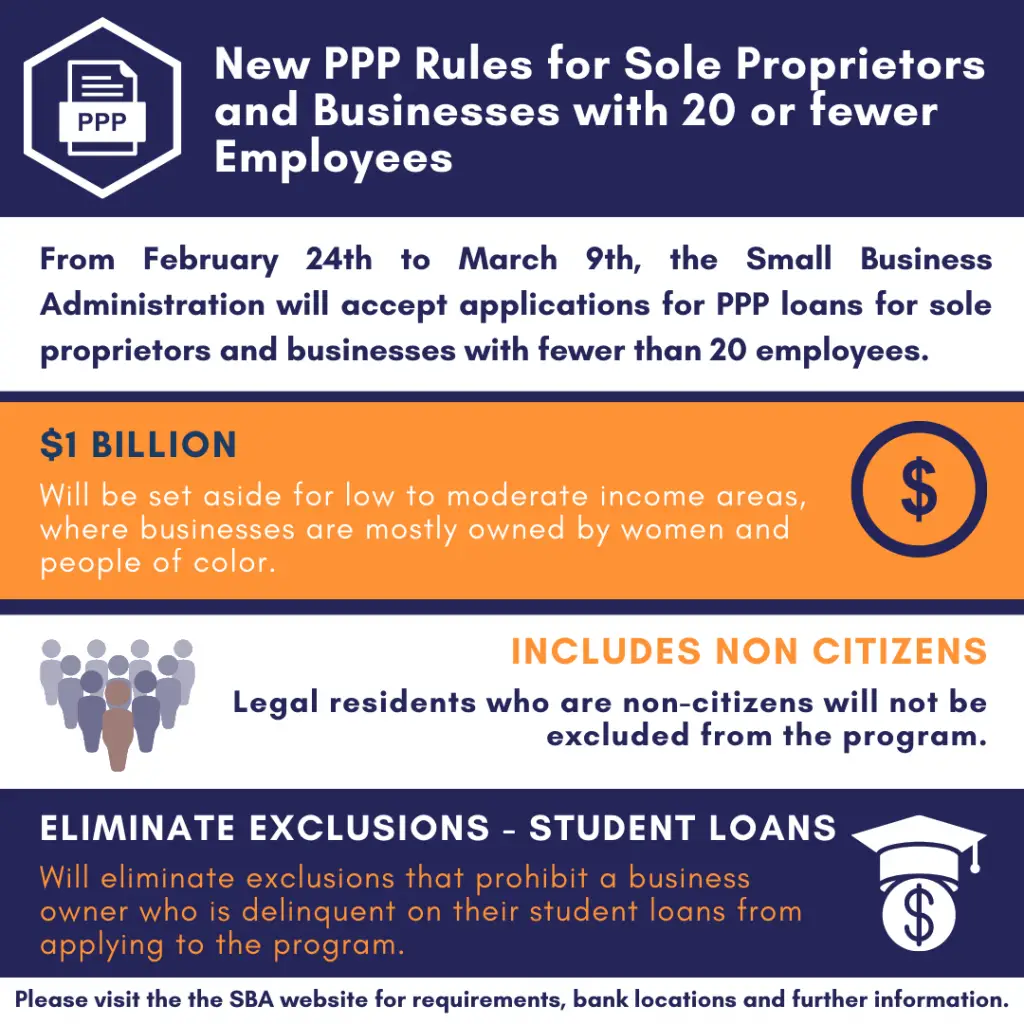

Sba Changes Ppp Loan Amount Eligibility For Sole Proprietors And Independent Contractors

In early March, the Small Business Administration issued new Paycheck Protection Program rules that allow Form 1040-Schedule C filers to calculate their maximum loan amount using gross income instead of net profit.

Recognizing that sole proprietors, independent contractors, and self-employed individuals were not able to borrow meaningful amounts because their net income was nominalespecially during the Covid-19 shutdownsthe SBA now allows new filers to choose to calculate the owner compensation share of their payroll costs based on either net profit or gross income.

The 32-page interim final rule and calculation changes are detailed in the SBA docket, Business Loan Program Temporary Changes Paycheck Protection Program Revisions to Loan Amount Calculation and Eligibility. There are additional calculation components for Schedule C filers with employees to avoid double-counting of any employee payroll costs.

Additionally, a new borrower application, Form 2483-C, is available for first-draw borrowers who choose to use the gross income calculation.

The SBA and Treasury have specified this change only applies to PPP loans approved after March 4, 2021. Loans that already had been approved cannot increase their loan amounts based on the new methodology.

SBA data shows that businesses with no employees are 70% owned by women and minorities, compared to 40% for businesses with employees.

Additional PPP Resources:

Don’t Miss: How To Apply For Second Home Loan

Other Sources For Money

Even though youre self-employed or have no employees, you may still be eligible for an Economic Injury Disaster Loan from the SBA. If youre in the arts industry, you may be qualified for a Shuttered Venue Operators Grant, although you cant participate in this program and the PPP program.

Also, a new grant program for the restaurant industry, called the Restaurant Revitalization Fund, may be available to you under the new stimulus bill. This is in addition to special grants for businesses in low to moderate income areas and grants for minority-owned businesses in the Delaware Valley.

Many self-employed entrepreneurs can qualify for these programs, but unfortunately several have hesitated because of the complexity.

Anything when you are going through it a first time is confusing, says Katz. Imagine preparing your own tax return for the first time if you had no experience. But keeping in mind that the end goal is that you will ultimately receive a grant of substantial money that you dont have to pay back, it is worth it.

Using Your Ppp Loan As A Self

When the coronavirus pandemic forced businesses across the country to close, the government created the Paycheck Protection Program to give small businesses an immediate influx of cash via forgivable loans. What you may not have known is that sole proprietors, independent contractors, and gig workers are also eligible for PPP.Although the PPP expired in August, Congress is in talks to renew the program in the coming months. If youre a sole proprietor, independent contractor, or gig worker who has been impacted by the pandemic, PPP may be a great option for you.

Don’t Miss: Student Loans Without Credit And No Cosigner

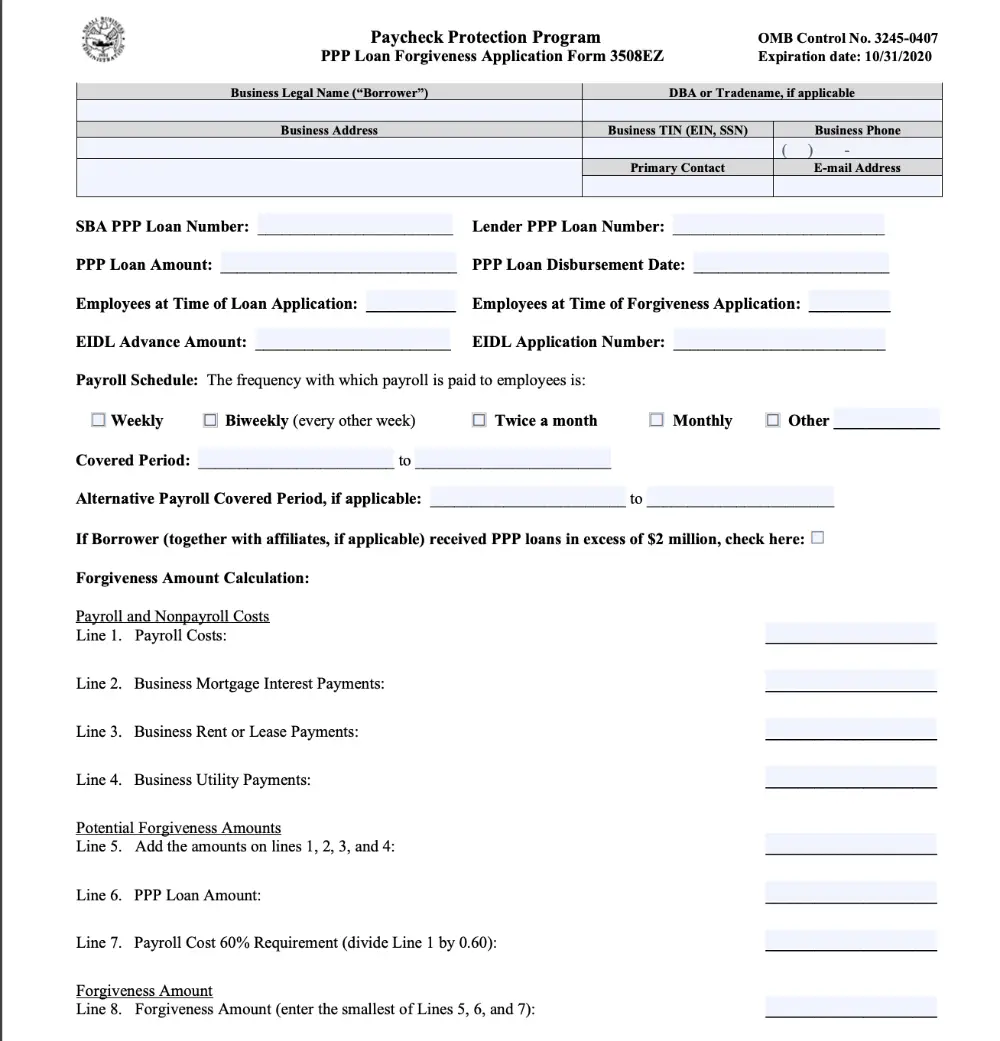

Applying For Ppp Loan

Once you have your number, you grab a copy of the PPP Loan application from either the Treasury.gov or the SBA website.

The top part of the form, shown below, provides the fields you fill in. Notice that you provide your name and address and your taxpayer identification number. And then you provide the monthly payroll amount and calculate the appropriate loan amount. And thats the only hard part

You will provide a bit of additional information in order to apply. For example, you will identify the sole proprietor by filling in a few blanks:

And then you go through some checklists.

The first checklist, for example, asks you indicate whether you have or havent done some stuff:

The second checklist, shown below, asks if youve been in trouble with the law, whether the businesss employees reside in the US, and whether youre a franchise operator:

Finally, a last checklist asks you to initial a small list of certifications. The first certification, for example? That you were in operation on February 15, 2020. The fragment below shows this part of the application:

But that is it. The only other thing you do is sign and date the application.

Like I said, for a sole proprietor without employees? This PPP application should be a snap. Two minutes or less. Once you have your Schedule C printed out or on the screen in front of you.

Why This Post For Sole Proprietors

Over the last few weeks, a nice fellow has been painting my house. Great painter. The house, when hes done, will never have looked better.

Which doesnt have anything to do with your sole proprietorship or with PPP loans. Except for one thing. In talking with the painter, I learned that he had failed to obtain a PPP loan earlier in the year. Though he clearly deserved one

I also learned that his brother, another self-employed painter, failed to get a PPP loan.

And then, no surprise, their dad who is also a painter? Yeah, he failed to get a PPP loan, too.

Partly, the guys didnt realize PPP loans amount to free money.

But mostly the PPP loan application program proved too complicated and confusing. Which turns out to have been true for too many small business owners.

Accordingly, Im going to explain here how to fill out the PPP application for a sole proprietor without W-2 employees. The actual work of completing the application takes, no kidding, about two minutes.

But before I get to that, let me explain why Im getting all pushy and nervous about this.

Recommended Reading: How To Calculate Fha Loan Amount

How Much Can A Self

The maximum amount for a PPP loan is 2.5 times your average monthly payroll costs. Income listed on a Schedule C in your personal tax return is the only payroll that can be used to calculate your PPP loan amount. If youve hired 1099 workers, they cannot be included in your PPP loan calculation and may apply for their own PPP loans.