Factors Affecting Sbi Home Loan Rates

Here are the factors that affect the SBI home loan interest rates:

-

MCLR: The marginal cost of funds lending rate is the lowest rate at which a bank can lend. It is affected by cash reserve ratio, tenure premium, marginal cost of funds and operating cost.

-

Interest type: Customers can choose from a fixed, floating or mixed interest rate.

-

Loan to value ratio: LTV ratio is the percentage of property value to be financed through the loan.

-

The borrowers credit history, which defines their , affects the type of home loan interest accrued.

-

Property location: Properties located in areas with good amenities will have a higher resale value, affecting the interest rate.

-

Job profile: Those with a stable source of income are considered low-risk customers.

-

Loan tenure: Short tenures have lower interest rates while long tenures attract a higher interest rate. Learn about home loan tenure before opting for a home loan.

Sbi Home Loan Interest Rates

State Bank of India , Indias largest bank, provides lucrative interest rates for home loans. They start as low as 8.05% p.a. The loan tenure ranges to a maximum 30 years. If you are looking to get a home loan, heres all you need to know about interest rates charged by SBI on home loans.

State Bank of India or SBI, country’s largest lender, has raised marginal cost of funds based lending rate or MCLR on loans by up to 20 basis points with effect from today. As a result, the equated monthly installments will get expensive for those who avail loans benchmarked against the MCLR.

| SBI Home Loan Highlights 2022 |

| Interest Rate |

| Up to 90% of property value |

| Loan Tenure |

| 0.35% of loan amount |

Given Below Are Few Types Of Home Loans Offered By Sbi:

SBI Flexipay Home Loan

SBI Flexipay home loan provides eligibility for a higher loan amount exclusively for salaried borrowers, according to SBI’s website. It offers customers the option to pay only interest during the moratorium period, and thereafter, pay moderated EMIs . The EMIs are stepped-up during subsequent years.

SBI Privilege Home Loan

SBI Privilege home loan is available exclusively for government employees, according to SBI’s website. Individuals who are employees of central or state government which includes public sector banks, public sector undertakings of central government and other individuals with pensionable services are eligible to apply for this home loan. The loan amount is determined by taking into consideration factors such as applicant income and repaying capacity, age, assets and liabilities, cost of proposed house/flat etc.

SBI Shaurya Home Loan

SBI Shaurya home loan scheme is available for the army and defence personnel of the nation. It offers lower interest rates, ease of repayment options and longer repayment period of the loaned amount.

SBI Pre-Approved Home Loan

SBI Pre-approved loan provides sanction of home loan limits to customers before finalisation of the property which enables them to negotiate with the builder/seller. The loan eligibility is assessed based on income details of the applicant. Non-refundable processing fee as applicable to the home loan are collected at the time of sanction, according to SBI’s website.

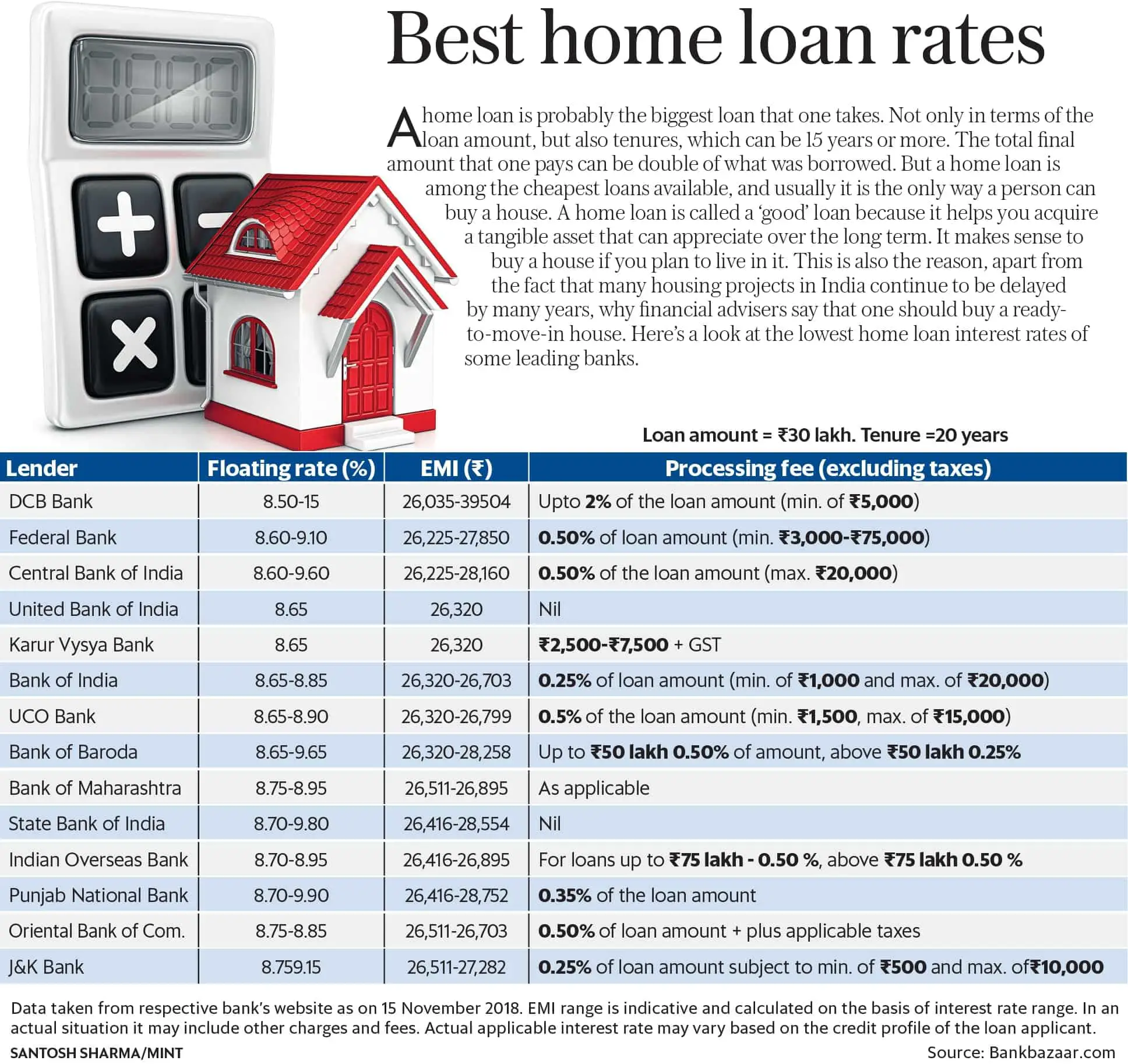

Don’t Miss: Home Loan Rates In India

Documents Required For Home Loan At Sbi

Here is the checklist of SBI NRI home loan documents that you will need to submit at the time of application:

Identity proof for salaried/non-salaried applicants:

- Duly filled SBI NRI home loan application form with 3 passport size photographs

- Employer ID Card

- Copy of Continuous Discharge Certificate -for borrowers working in the merchant navy

- PIO Card issued by the Government of India

- The documents may be attested by FOs/ Representative officers of Indian Embassy/Consulate or Overseas Notary Public or officials or Branch/Souring outfits based in India.

- Identity proof : PAN Card/ Passport/ Driving License/ Voter ID card

- Indian residential proof : Recent copy of Electricity Bill/Telephone Bill/Water Bill/ Piped Gas Bill or copy of Passport/ Driving License/ Aadhar Card

Property Papers:

- Permission for construction

- Registered Agreement for Sale /Allotment Letter/Stamped Agreement for Sale

- Occupancy Certificate for ready to move property

- Approved copy of plan & Registered Development agreement of the builder

- Approved Conveyance Deed

- Proof of payments like receipts or bank A/C statement showing all the payments made to Builder/Seller

Account Statement:

- Foreign bank account details for the previous 6 months showing salary and savings, and Indian account if any.

- Loan account statement for the last 1 year if any previous loan from other banks/lenders.

Proof of income for Salaried Applicant/ Co-applicant/ Guarantor:

Income Proof for Non-Salaried Applicant/ Co-applicant/ Guarantor:

Sbi Lowers Lending Rates By 005% After Rbi Governors Nudge

SBI has cut its lending rate by 0.05%, making it the third time in the financial year that it has cut rates by the same amount

A day after Reserve Bank of India governor Shaktikanta Das said he expects faster transmission of the three successive repo rate cuts, State Bank of India lowered its lending rates by 5 basis points across all tenors. The new rates, effective from July 10, 2019, is the third reduction by SBI in this financial year, having cut the rates by 5 bps each in April and May, while its home loan rates have come down by 20 bps during this period.

The one-year marginal cost of funds-based lending rate or minimum lending rate, to which all loans are linked, has been cut to 8.40% from 8.45%, the nations largest lender said in a statement, on July 9, 2019. From July 1, the bank had also introduced repo-linked home loan products. Talking to reporters after the customary post-budget meeting with the finance minister on July 8, 2019, Das had said after delivering three back-to-back rate cuts to the tune of 75 bps, the RBI expected a quicker transmission by banks.

See also: Following smaller peers, SBI cuts loan rates by a nominal 5 bps

After the 25 bps repo rate cut in the June policy, Bank of Maharashtra, Corporation Bank, Oriental Bank and IDBI Bank had reduced their MCLR by 5-10 bps.

Also Check: How To Repay Parent Plus Loan

Housing Finance Scheme For Nri And Pio

NRI- Non-resident Indians or PIO-Person of Indian origin are the people living outside India for the livelihood. These people, when aspire to own a house or to construct a property, can apply for the loan with State Bank of India under this scheme.

State Bank of India has particularly designed the schemes to cater to this particular segment of the Indian market especially.

When buying a property or constructing a house in India, these people can come under the pressure of many law and regulations which they may not be aware of, to help and solve this problem State Bank of India has taken special care in designing this product for the NRI and PIOs.

State Bank of India has a team who are experts in finding the best investment opportunities across India these expert teams are responsible for informing the customer about all the details.

To apply for the loan under NRI and PIO,certain eligibility criteria must be met:

| Minimum age required |

|---|

Special features of NRI and PIO loan:

Low processing fee: State Bank of India charges just 0.35% of the entire loan amount.

This is a minimum of Rs. 2000or- and maximum of Rs. 10000or- plus service tax. Any other expenses like obtention of TIRorvaluation report, CERSAI or registration, etc. are charged separately to the NRI loan applicant.

Signage Is Illuminated Atop A State Bank Of India Ltd Branch At Night In Bengaluru India On Tuesday May 7 2019 State Bank Of India The Country’s Largest Lender By Assets Posted A Fourth

The country’s largest lender, State Bank of India , has hiked the marginal cost of funds-based lending rate on 1-year tenure by 10 basis points for home loans and others, with effect from 15 January.

MCLR is the minimum rate at which lending rates are calculated.

Details on SBI website showed that the MCLR on 1-year tenure is hiked to 8.40 percent from the previous 8.30 percent. MCLR on other tenures has been kept unchanged.

Since May, RBI has hiked interest rates by 225 basis points to fight inflation. One bps is one hundredth of a percentage point.

Read Also: How To Handle Student Loan Debt

Home Loan Fees And Additional Charges

Depending on the loan type you are applying for, a few charges may be levied. They are mentioned below:

- Processing fees: This is a one-time fee that is to be paid to the home loan provider after the loan application has been approved. The processing charge is dependent on the bank and the loan scheme you are applying for, the processing charge thus is a variable metric. This fee is non-refundable.

- Prepayment charges: This is the fee or the penalty you will have to pay the lender, should you plan to repay your home loan before the completion of the tenure of the loan.

- Conversion fees: Some banks might also charge a small conversion fee if and when you decide to switch to a different loan scheme or even a different loan provider in order to decrease the interest rate associated with your current scheme.

- Cheque dishonor charges: This type of fee is levied when the loan provider, like the Bank or NBFC, is provided that a cheque issued by the borrower is found to be dishonored due to reasons such as insufficient funds in the borrowers account.

- Home insurance: One of the best ways to protect the home is to insure it. The premium of this insurance should be paid directly to the concerned company during the insurance term to make sure that the insurance policy is running during the home loan tenure.

- Incidental charges: These charges cover for the expenses and costs incurred by the bank to recover dues from a borrower who has failed to make his monthly instalments on time.

Sbi Home Loan Balance Transfer Rates

Already paying the home loan somewhere? Does that lender charge a greater rate of interest on the loan? In that case, you can transfer the outstanding loan balance to SBI and pay a lower EMI. The lower rate will further result in the reduction of interest outgo over time. But how much can you save on a balance transfer? That will depend on the outstanding balance amount, the difference in the rate of interest, and the time by which you transfer the outstanding balance. Lets consider an example to get an idea of the savings on offer.

Example You availed a home loan of INR 60 lakh for 20 years 3 years back at 9.00%. In 3 years time, the outstanding balance would reduce to INR 56,30,202. So, if you want to transfer the said balance to SBI, the rate of interest could be 7.55%-8.05% in the present scenario. Suppose you get the deal at 7.60%, how much can you save? The table below will give you the answer.

| Repayment Aspects | |

|---|---|

| Savings on a Balance Transfer | INR 6,84,540 |

SBI will ask for a nominal fee for the balance transfer. Pay that and get the transaction executed.

Read Also: What Does Refinance Auto Loan Mean

Benefits Of Sbi Home Loans

Home loans offered by SBI are affordable and the process involved is extremely transparent. Some of the purposes for which an individual can apply for a home loan are new house construction, home renovation, purchase of an already built house. Some of the advantages and features that SBI home loans offer to home loan seekers are listed below.

- SBI Home Loans are provided for both self-employed and salaried employees

- Women are offered SBI Home Loans at special interest rates lower than normal.

- The purchased property through SBI Home Loan will be taken as a mortgage of property

- SBI Home Loan Interest Rate is calculated based on daily reducing balance.

- There are various customised loan options provided by SBI to customers such as NRIs, defence personnel, government employees, existing home loan borrowers, etc.

- The SBI Home Loan processing is transparent and involves no hidden charges.

- The SBI Home Loan Interest Rate is the lowest among all the major banks of India

Sbi Home Loan For Nris: Nri Home Loan Simplified

State Bank of India has come up with SBI NRI home loan schemes, specially designed to help NRIs buy a house in India. SBI NRI housing loan comes with long repayment tenure, attractive interest rates, and a hassle-free documentation process.

Here is the full description of an SBI home loan for NRIs, including interest rates, the loan application process, features and benefits, etc.

Also Check: 10000 Loan No Credit Check

Sbi Home Loans Eligibility Criteria

There are certain criteria that one needs to comply by to be able to avail any home loan by SBI bank. These include the following:

The guarantor also needs to submit certain documents such as 2 passport-size photographs, identity proof, address proof, statement of assets and liabilities, and signature identification from the present banker.

How To Apply For Sbi Home Loan

You can apply for a home loan from SBI in two simple ways:

Also Check: How Do I Pay My Unsubsidized Student Loan

Application Process To Get An Easy Home Loan From Sbi

There is a 5-step process to get an easy Home Loan from SBI. It is listed below

- Step1: Visit the nearest Home Loan branch of SBI or the official website and fill the application form.

- Step 2: After the application is submitted, an official from SBI or its online partner will call the loan applicant and will discuss the eligibility criteria.

- Step3: Once the applicant agrees to the terms and conditions of the home loan, the relevant documents have to be submitted either online or an SBI official will visit and collect them.

- Step4: The applicant has to pay the processing fees and after that SBI will evaluate the repayment ability.

- Step 5: After the processing is completed, a loan agreement will be signed and within a few days the home loan amount will be credited to the bank account.

Personal Home Loans Heading

Home Loan

At SBI, we strive to help you own your dream home! If you are buying your first property or refinancing an existing one, you will find our mortgage plans easy to understand and flexible to suit your needs. We offer attractive home loan packages for HDB as well as private properties.

How we can help:

3 simple steps to owning your dream home

Let us know your needs and our relationship managers will help you own your dream home in 3 simple steps:

Step 1Step 2Step 3

To find out more, email us at [email protected]

You May Like: Is The Loan Forgiveness Program Worth It

What Are The Advantages Of An Sbi Home Loan

- Easy application with minimum documentation and paperwork.

- It is a part of the Pradhan Mantri Awas Yojana.

- Provides loan approval prior to the selection of the property.

- Provide a 0.05% concession to women to encourage them for their own homeownership.

- Provide several repayment methods to choose from and opt for the one best suited to you.

- Full transparency as SBI promises no hidden costs and fees.

Sbi To Link Home Loans To Repo Rate From July 2019

After linking its short-term loans and large savings deposits rates to the repo rate, the largest lender State Bank, said it will introduce repo-linked home loans from July 2019

Indias largest lender, State Bank of India , on June 7, 2019, in a statement, said that it will introduce repo rate-linked home loans from July 1, 2019. The lender has also reduced the interest rate on cash credit account and overdraft customers with limits above Rs 1 lakh, after the RBI reduced the repo rate by 25 basis points on June 6, 2019. The monetary policy committee had unanimously decided to reduce the repo rate by 25 basis points to 5.75% in the second bi-monthly policy, taking it down to a nine-year low, citing sagging growth and to cushion the rising headwinds to the economy. It was the third consecutive repo rate cut by RBI, with a cumulative reduction of 75 basis points in 2019, so far.

See also: RBI cuts interest rates for the third time this year, to boost growth

The benefit of reduction in the repo rate by 25 bps has been passed in its entirety to our CC/OD customers , with effect from July 1, SBI said. The effective repo-linked lending rate for CC/OD customers is 8% now, it said, while for savings deposits above Rs 1 lakh the new rate would be 3%. In March 2019, the bank had linked all CC accounts and ODs with limits above Rs 1 lakh, to the repo rate plus a spread of 2.25%. For above Rs 1 lakh, it had set its savings deposit rates to 2.75% below the repo rate.

Also Check: How To Refinance Student Loan Debt