There Are Two Ways To Buy A House With 100% Financing In South Carolina With No Money Down:

I know the neighborhoods that offer 100% financing with USDA, BUT you must have great credit, and a great job. There are NO exceptions. You first need to know how much you can afford because most homes begin at $140,000 $250,000.

Cookie And Privacy Settings

We may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

South Carolina Usda Home Loan Property Requirements

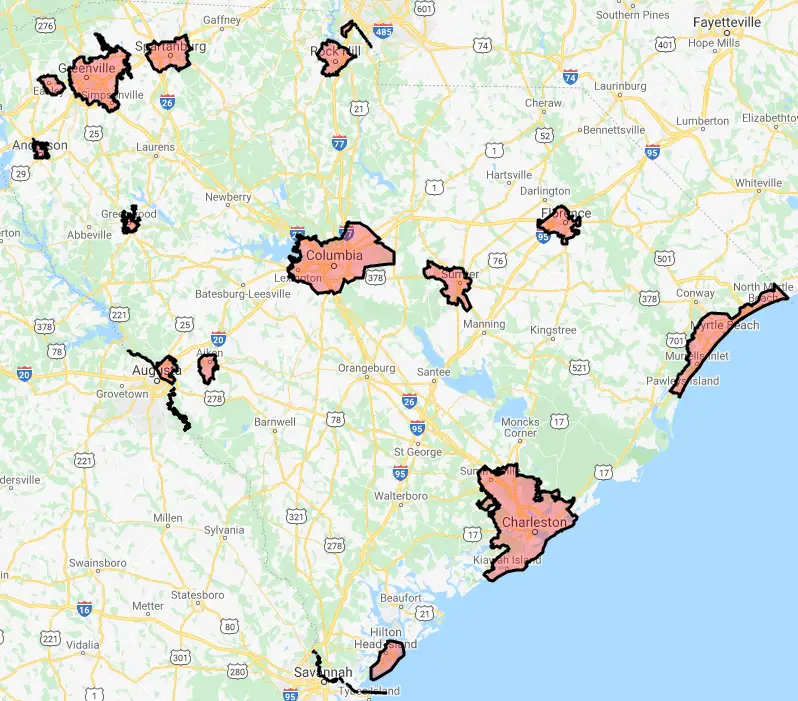

In order to get South Carolina USDA Home Loan, you need to meet the home loan property requirements as mentioned by USDA. The guidelines are related to income, credit history and property. The most important criterion is that you should be a citizen of South Carolina and the home to be bought should be situated within the designated area of South Carolina. USDA designated areas are usually any farm area with large open spaces, or rural communities that are small in size and has population less than 25,000 people.

It is not necessary that homes which may be aided by USDA should be situated in only in farmlands or isolated rural areas.

You May Like: Is There Loan Forgiveness For Parent Plus Loans

Best South Carolina Mortgage Lender: Guaranteed Rate

A Kingpin of the online mortgage trend that plays a large role in government-insured financing is Guaranteed Rate. Their participation in the digital mortgage wave leaves many other platforms lacking by comparison.

Guaranteed Rate is also extremely experienced with the origination of government-insured loan products such as FHA and VA loans. The ability to offer FHA and VA financing through one of the best digital mortgage platforms available makes them serious competition to other mortgage lenders, and highly favored among repeat and first time home buyers. FHA Mortgages are one of the highest selling loans through Guaranteed Rate.

The online platform makes securely uploading the important financial documentation requested for a loan approval fast and easy. Borrowers can even check their credit scores through the service, rather than go elsewhere. Guaranteed Rate is one of the rare few digital mortgage platforms where a mortgage loan can be closed without ever needing to speak with someone unless requested by the home buyer.

South Carolina Home Loans With 100% Financing

A USDA Home Loan is a Government insured loan that allows borrowers to obtain 100% NO MONEY DOWN financing. It is designed to meet the needs of people living in small communities, rural areas, as well as outlying metropolitan areas. These loans are offered by private lenders such as Primary Residential Mortgage and insured by the government.

At PRMI we specialize in USDA Loans. Since we underwrite all of our loans our team of Loan Officers, seasoned Underwriters and support staff have spent years helping people make the dream of homeownership a reality with USDA Loans. We live and work in the same communities where we do business so we truly understand the needs of our customers because they are our neighbors too.

Some of the eligibility standards that determine if you qualify for a USDA loan for your home include what county and zip code the home resides in, your current income and credit history, as well as the number of dependents you can claim.

You May Like: Bank Of America Rv Loans

Benefits Of South Carolina Usda Home Loans

One of the most popular things people know about the USDA Loans is that it is 100% No Money Down. While that is certainly a great feature there are several other benefits and perks to this loan. The USDA Rural Development Loan also has very flexible credit requirements. In most cases borrowers are allowed to have credit scores as low as 620. They are also only required to be 2 years removed from bankruptcy and 3 years from foreclosure. USDA Home Loans do have tramline requirements. Borrowers must have at least 3 trade lines reporting on their credit with at least a 12 month history. If a person does not have this they do allow credit that’s referred to as alternative trade lines. Alternative trade lines can be things such as utility bills and cell phone bills. Not only does someone have the benefit of no money down when obtaining one of the USDA Loans they can also benefit from the seller being allowed to pay up to 6% of the sales price towards the borrowers closings costs. In most cases this is more than enough to cover everything thus allowing the borrower to get into a home with no money out of pocket. USDA Home Loans are usually a cheaper loan compared to the other loan types because of the low monthly mortgage Insurance. This allows borrowers to either save money or afford more home.

Benefits & Disadvantages Of Usda Loans

A USDA guaranteed loan is a great option for some people. The biggest benefit of this loan is that it will offer competitive rates. Often, USDA loan rates are more affordable than conventional loan rates. In addition, your USDA mortgage may be easier to qualify for if you have a limited credit score.

The major disadvantage of a USDA mortgage is its location restriction. You have to be willing to buy a home in an area that is rural. You also need to fall within income limits, which may not work for all individuals and families.

USDA or FHA Home Loan? Which Is Better?

USDA home loans are often compared to FHA home loans because they are both are good opportunities for many people. USDA loans and FHA loans are both backed by the U.S. government, meaning they are less risky for lenders. However, they also have some key differences.

USDA loans do not require a down payment². That means you can finance 100% of the purchase price for your home. Thats a nice benefit to anyone hoping to buy a home. FHA loans require 3.5% of the sale price as a down payment. Who qualifies for a USDA loan can also be a factor for some with a higher income. FHA loans have no income limits.

On the other hand, USDA loan requirements NC and SC buyers have to meet can be limiting. The biggest factor is buying in an area that is considered rural.

You May Like: What Credit Score Is Needed For Best Auto Loan Rates

Latest South Carolina Home Loan Options

This page updated and accurate as of 10/22/2022 USDA Mortgage Source

The latest South Carolina home loan options allow homebuyers to purchase a home with little or NO down payment. Conventional mortgages have traditionally required a 5% -20% down payment, which is alright for more seasoned home buyers, but out of reach for the average first-time buyer.

In this article, we will discuss other options that allow buyers to purchase a home with little or no down money down in 2022.

Federal Housing Administration and the U.S. Department of Agriculture and Veterans Administration loans are very popular choices and we will take a closer look at them below. While the average home buyer may have a basic understanding of these programs, he or she may not understand the difference. Each option carries its own specific set of requirements that may or may not suit the applicants needs.

Sc Housing Homebuyer Program

Low-to-moderate income buyers may find what theyre looking for with South Carolinas homeownership assistance program. Support comes in the form of a 30-year mortgage with a fixed interest rate, which can be used with either a Conventional 97 or any of the government-backed loans: FHA, VA, or USDA.

Youll need a credit score of 620 or higher for an FHA loan and 640 or higher for all other types of mortgages. And there are household income limits as well as purchase price caps.

As is usual with state-run mortgage programs, youll need to choose a lender from SC Housings approved list. And you must complete a home buyer training course. You can download a PDF of SC Housings Homeownership Program handout for those caps and other details.

Recommended Reading: Can I Use Home Equity Loan To Buy Another House

Best Usda Mortgage Lenders Of 2022

If you live in an eligible area and are interested in a USDA loan, we’ll help you choose an approved lender for USDA financing.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If youre planning to buy a home in a rural area or even a suburb, a USDA loan may be an option for you. The U.S. Department of Agriculture offers these zero-down-payment loans to home buyers who qualify. The property must be in an eligible area of the country, and borrowers must meet certain income requirements.

The USDA issues some loans itself and guarantees USDA loans offered through approved lenders, such as those listed below. NerdWallet has reviewed some of the best USDA mortgage lenders to help you decide which is the right lender for you.

» MORE:Tips for getting the best USDA loan rates

If youre planning to buy a home in a rural area or even a suburb, a USDA loan may be an option for you. The U.S. Department of Agriculture offers these zero-down-payment loans to home buyers who qualify. The property must be in an eligible area of the country, and borrowers must meet certain income requirements.

Best for traditional lending experience

Best for first-time home buyers

Best for borrowers with weaker credit

Pros

Cons

Watermark Home Loans: Nmls#1838

Min. credit score

Watermark offers conventional loans with as little as 3% down.

View details

View details

Why we like it

Good for: borrowers looking for a decent selection of loan types with some not-so-standard options, such as reverse mortgages for seniors.

Pros

-

Offers reverse mortgages and interest-only loans for certain borrowers.

-

Online capabilities include a full application, as well as loan process updates.

Cons

-

Does not offer home improvement loans.

-

Fully customized mortgage rates not available without providing contact information.

Min. credit score

Carrington Mortgage Services offers conventional loans for as little as 5% down.

View details

Good for: first-time home buyers or credit-challenged borrowers interested in government loan products.

Pros

-

Offers multiple low-down-payment loan programs.

-

May consider alternative credit data, such as bank statements.

-

You can view customized rates for purchasing a home and apply online.

Cons

-

Doesn’t offer home equity lines of credit.

-

Lender fees are on the high side, according to the latest Federal data.

Min. credit score

Wells Fargo has a solid selection of mortgage products and offers easy-to-shop rates.

Pros

-

Provides numerous online conveniences, including loan application and process updates.

-

Current rates clearly posted for various loan products.

-

Offers a wide variety of loan types and products.

Cons

Min. credit score

View details

View details

Don’t Miss: Can I Get Loan From My Bank

Usda Rural Development Single Family Housing Direct Loans

The USDA Direct Loan Program is a payment assistance program offered by the USDA as a subsidy. This home loan program is often referred to as the Section 502 Direct Loan Program. This assistance program is only available to low and very-low income families. It is design to help those who are unable to obtain traditional mortgages and are without a safe and sanitary housing situation.

Low income is defined by the USDA as families that are between 50-80% of the areas median income , while very-low income is defined as less than 50% of the AMI. If you are unsure what your income is, contact us at 322-8201.

When the borrower no longer occupies the home, or decides to transfer the title, the loan will become due and must be repaid. To become eligible for a USDA Direct Home Loan, the borrower and property must meet several requirements.

Bnc National Bank: Nmls#418467

Min. credit score

BNC National Bank offers conventional loans for as little as 3% down.

View details

View details

Why we like it

BNC National Bank offers a robust variety of loans, but you have to reach out to a loan officer to get customized interest rates.

Pros

-

Offers a wide variety of loan types and products.

-

Has robust online capabilities, and an app for iOS and Android.

-

Mortgage interest rates are lower than typical, according to the latest data.

Cons

-

Has a limited number of physical mortgage offices.

-

No rate information is available without starting an application or speaking with a loan officer.

-

Does not offer home equity loans or lines of credit.

Read Also: How To Settle On Student Loan Debt

What Are The Benefits Of A Usda Home Loan

South Carolina USDA loans are structured just like conventional ones via Fannie Mae and Freddie Mac. Where they differ, though, is with respect to down payment requirements and mortgage insurance.

Unlike conventional loans or FHA Loans, USDA South Carolina loans have no down payment requirement, which allows a home buyer to finance a home for 100 percent of its purchase price. The U.S. Department of Agriculture will assess a two percent mortgage insurance fee to all loans, and the cost may to be added to the loan size at the time of closing, as can the costs of eligible home repairs and improvements.

You cant do that with a Fannie Mae or Freddie Mac loan.

Another RD Loan advantage is that its annual mortgage insurance fee is just 0.40% annually, no matter how large or small of a down payment.

This is less than half of the private mortgage insurance charged via a comparable conventional loan, and up to one-fourth of what the FHA will charge .

Furthermore, because USDA home loans do not have a specific loan size limitation, home buyers can theoretically borrow more money with a USDA mortgage than via conventional, VA or FHA routes.

Loans insured by the U.S. Department of Agriculture are available as 30-year fixed rate mortgages only, and come with their own USDA Streamline Refinance program.

Why Do Most Lenders Require A 640 Credit Score For Usda Loans

Lenders prefer to use the USDA Guaranteed Underwriting System for an efficient, streamlined underwriting process. GUS analyzes your risk and eligibility as a borrower using a scorecard.

Automatic GUS approval requires you to have a credit score of 640 or higher with no outstanding federal judgments or significant delinquencies.

Even if you dont have a 640 credit score, its still possible to apply and be approved for a USDA loan. USDA allows lenders to underwrite and approve USDA home loans manually at the lenders discretion. Once cleared by your lender, the USDA must review your loan for final loan approval before you can close.

Regardless of credit score, all USDA loan applications must receive final loan approval from the USDA once cleared by the lender.

Also Check: Are Jumbo Loan Rates Higher Than Conventional

How To Get Usda Home Loans In South Carolina

High demand and low supply have caused housing affordability in South Carolina to drop 10.9%, while the average home price has increased by over 18% since 2020. These changes make it even more difficult to buy a home.

Luckily, there are a few government-backed loan programs that can help. If youre looking at buying a home and have low- to moderate-income, USDA home loans in South Carolina can help make homeownership more affordable and easier to reach.

Lets take a look at what you need to do to get a USDA home loan.

For How Much Can I Get Approved With Usda Loan

For todays home buyers, current mortgage rates are low and theyre especially low with the USDA program. The USDA loan is designed for low rates and leniency so long as the buyers meets the USDAs property and income eligibility requirements.

Note, however, that the USDA changes its rural areas fairly regularly and an expanding town is apt to lose its rural loan eligibility with the next census tract update. Homes which are USDA-eligible today may not be USDA-eligible next year.

Get help with your rural home loan and determine your personal eligibility. See for how much of a mortgage you can be USDA-approved.

Fill out our short online application to get pre-approved in minutes

Read Also: Personal Loan For Home Renovation