What Are Va Loan Limits And Why Are They So Complicated

The Department of Veterans Affairs does not loan money to veterans and active duty service members. It insures loans to make them safer for the lenders who issue them.

Specifically, the VA insures 25% of your loan amount. So $100,000 worth of VA insurance will allow a lender to underwrite a $400,000 mortgage loan with no down payment and no ongoing mortgage insurance.

Once again, all this math wont affect your loan size unless you have an active VA loan and are buying another home. Your first use of your VA loan entitlement is now unlimited by the VA.

This math also wont matter if your lender wont approve a loan as large as your loan limit. Even if the VA says it would insure a loan up to $400,000, your lender could cap your loan at $300,000 based on your credit report and debt-to-income ratio.

Va Loan Limits In Texas

New 2023 VA loan limits in Texas wont be released until November but were honoring them now effective September 11, 2022 for VA loans locked starting today.

- $715,000 for regular 14 unit VA loans

- $1,073,000 for regular 14 unit VA loans in AK and HI

VA jumbo loans starting $1 over the county loan limit up to $4M

If You Have Remaining Entitlement You Do Have A Home Loan Limit

With remaining entitlement, your VA home loan limit is based on the county loan limit where you live. This means that if you default on your loan, well pay your lender up to 25% of the county loan limit minus the amount of your entitlement youve already used.

You can use your remaining entitlementeither on its own or together with a down paymentto take out another VA home loan.

You may have remaining entitlement if any of these are true:

- You have an active VA loan youre still paying back, or

- You paid a previous VA loan in full and still own the home, or

- You refinanced your VA loan into a non-VA loan and still own the home, or

- You had a compromise claim on a previous VA loan and didnt repay us in full, or

- You had a deed in lieu of foreclosure on a previous VA loan , or

- You had a foreclosure on a previous VA loan and didnt repay us in full

You May Like: What Are Home Loan Interest Rates At

Va Loan Limits: No Maximum Loan Amounts In 2022

The U.S. Department of Veterans Affairs eliminated VA loan limits for many borrowers in 2020. See who qualifies for zero-down, no limit homebuying.

If youâre a military servicemember or veteran, you may have access to a zero-down loan with no limit, as long as you qualify for the payment.

The Department of Veterans Affairs eliminated VA loan limits for most borrowers in 2020. That means first-time VA homebuyers and others with full entitlement can borrow as much as lenders are willing to approve.

So the size of your VA loan now depends more on your financial credentials than on the local housing market.

VA loan limits still come into play for homebuyers who currently have VA loans and have partial entitlement available.

If youâre a qualifying veteran, active-duty military servicemember, or an eligible surviving military spouse, now may be a great time to buy, with a shot at a 0% down mortgage and no loan limit on the type of home you can buy.

What’s in this Article?

Va Loan Limits For 2023

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Starting in 2020, VA loan limits were eliminated for active-duty military and veterans who have full VA loan entitlement.

However, loan limits still apply to mortgage applicants who have defaulted on a VA loan or have other active VA loans.

Heres what you need to know.

» MORE:VA loan or conventional loan?

Recommended Reading: Home Loans First Time Buyers

Can I Buy A Million

It is possible to finance homes valued at $1 million or more with a VA loan. The VA will insure the loan if your VA lender is willing to lend the money. Lenders check your credit score, bank accounts, and current debt load to make sure you can afford the new loans payment. Youll need to use the new home as your primary residence and not as an investment property.

Please contact our support if you are suspicious of any fraudulent activities or have any questions. If you would like to find more information about your benefits, please visit the Official US Government website for theDepartment of Veteran Affairs or the US Department of Housing and Urban Development.

MilitaryVALoan.com is owned and operated by Full Beaker, Inc. NMLS #1019791.

Full Beaker, Inc. is not licensed to make residential mortgage loans in New York State. Mortgage loans are arranged with third-party providers. In New York State it is licensed by the Department of Financial Services.Please click here if you do not wish us to sell your personal information.

Why You Would Use A Va Loan If Your Home Costs More Than The Va Will Guarantee

There are several good reasons to apply for a VA loan. The first is that you may be able to buy a home with a lower down payment than you would with a conventional mortgage, unless you are willing to pay for private mortgage insurance , which may add a fairly substantial amount to your monthly payment.

Interest rates are another important factor in your decision. Because VA loans are guaranteed by the VA, they often have slightly lower interest rates than conventional loans .

That said, it pays to shop around. A mortgage is often the largest purchase you will ever make, and even a few decimal points on your interest rate can save you a substantial amount of money, or cost you thousands, over the life of your loan.

Don’t Miss: What Is Better Refinance Or Home Equity Loan

How Lenders Determine Loan Size

The private mortgage lender who issues your VA-backed loan will still base your loan size on your ability to repay the loan. Theyâll look at several key factors:

- VA borrowers typically need credit scores of at least 580 to 620 to qualify, though some lenders have more flexible credit score requirements

- Income: Lenders must verify your income for the past two years to make sure you earn enough steady income to make your monthly mortgage payment

- Debt-to-income ratio : Your DTI reflects your current monthly debt payments to your monthly income. The lender will follow the automated underwriting response to help determine eligibility. The VA gives the lender discretion to approve borrowers at a higher DTI if they have other compensating factors.

Plus, some lenders may set their own maximum loan limit. So even if you can afford a $5 million VA loan, you may have a hard time finding a lender for that loan amount.

Although there are no VA home loan limits in 2022, your lender and personal finances will dictate how much you can borrow.

Not having a loan limit can provide you more flexibility as a borrower, since you donât need to worry about finding a home within the local limits.

How Can I Find Out My Entitlement Level

Your VA Certificate of Eligibility , which tells lenders youâre eligible for a VA loan, also shows your level of entitlement.

| Hereâs a tip: You can request your COE from the VA through the VA ebenefits portal. But the COE can look kind of confusing to borrowers, so we recommend simply asking your lender to pull it for you when you apply for a loan. The process takes just a few minutes and itâs much easier on you! |

The COE is designed to help the VA and your lender communicate. Frankly, it doesnât always make sense to borrowers at first glance.

For example, your COE may show a basic entitlement level of $36,000. But this number doesnât reflect your borrowing power. It shows the amount of insurance the VA provides via the VA guaranty.

Full entitlement means the VA will back 25% of your home loan of any amount approved by the lender. This VA insurance lowers the lenderâs risk and eliminates the need for a down payment or ongoing mortgage insurance payments.

Don’t Miss: What Is An Acquisition Loan

Va Loan Limits: The Basics

There are technically no limits to VA loans. There are only limits to how much the VA will guarantee. The VA will guarantee up to 25% of the loan amount for lenders in the event that you default on your loan. The amount the VA will guarantee is dependent on the amount of your VA entitlement.

For the purposes of this discussion, VA loan limits can be defined as the amount you can borrow without having to make a down payment.

Most people getting a VA loan are going to have whats referred to as full entitlement. If you have full entitlement, as of 2020, you dont have a loan limit. The VA will guarantee 25% of whatever a lender is willing to approve you for.

You have full entitlement under any of the following four scenarios:

- Youve never used your VA loan entitlement.

- Youve used your entitlement to buy or refinance a property previously, but youve since sold and fully paid off your VA loan.

- You had a previous VA loan that wasnt fully paid off because of a foreclosure or short sale, but youve since fully repaid the VA.

- You paid off a VA loan without selling the property. You can have your entitlement restored this way one time.

If your COE says that you have some number greater than zero, but less than $36,000, you have remaining entitlement, but not full entitlement. This is also referred to as impacted entitlement. If thats the case, you are subject to a loan limit if you want to buy a home without a down payment.

Why Has There Been An Increase

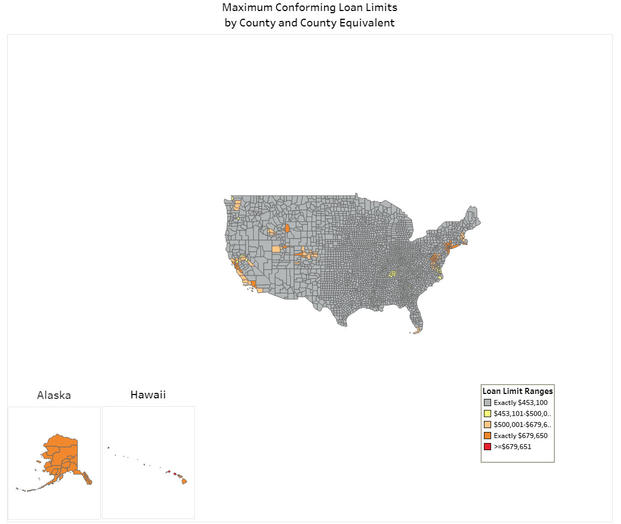

The VA loan limit is based on county boundaries and the median home values in the county. The average increase of nearly $30,000 per county results from rising home prices and increased demand for VA loans nationwide.

The VA loan limits were raised to help more veterans purchase homes because, according to the U.S. Census Bureau, the increase was also due to rising home prices. Rents have increased as well, but not by nearly as much as home prices have climbed over time this means that buying a house is becoming less affordable for many people, especially first-time buyers who are just starting in their careers or families and don’t have a lot of extra money saved up yet from past savings or investments.

You May Like: When To Apply For Ppp Loan Forgiveness

Va Buyers With Remaining Entitlement

Veterans can have more than one VA home loan. There is a maximum amount they can borrow on a second VA loan and make no down payment, however. They will need to know their remaining entitlement amount that is calculated using the conforming loan limit set by the Federal Housing Finance Agency each year.

In 2022, the Conforming Loan Limit is $970,800 in Hawaii.

Virginia Conforming Loan Limits 2023 For All Counties

The Virginia Conforming loan limits for 2023 have not been released, in anticipation of this change, effective as of 9/07/2022 we are now offering conventional loan limits up to $715,000 on all Virginia conventional loans. Because conforming loan limits are set using a formula mandated by federal law, lenders can anticipate what the FHFA will announce later this year as the numbers for 2023.

The table below contains the 2022 conforming limits for all counties in Virginia, listed in alphabetical order. In this table, 1 unit refers to a single-family home, 2 unit refers to a duplex-style home with two separate residents, and so on.

| County |

You May Like: Who Will Refinance An Upside Down Car Loan

What Is The Maximum Amount I Can Borrow With A Va Home Loan

There is no maximum amount you can borrow with a VA loan. Eligible borrowers with full VA entitlement can buy as much as they can afford without needing a down payment.

The words to key in on from the sentence above are “full VA entitlement.” The Department of Veterans Affairs guidelines restrict VA buyers without full VA entitlement to follow the VA loan limits.

Keep in mind, VA loan limits aren’t a max on what you can borrow. You can still borrow as much as a lender deems affordable. However, VA loan limits are a max on what you can buy without a down payment.

How Are Mortgage Limits Changing In 2021

As a result of the amendments made in 2020, an applicant with full entitlement will not be subject to any loan limits.

Most counties now have a maximum loan limit of $548,250, up from $510,400 in 2020. Prices can also reach $822,375 in other counties, an increase from $765,600 in 2020.

While these limits represent the amount you can borrow without making a downpayment, they do not represent a cap or maximum loan amount.

If the house costs more than your loan limit, you can still borrow the amount, provided that you are willing to pay a downpayment to make up the difference.

You May Like: What Is The Maximum Sba Loan

Contact Hawaii Va Loans

Lets help you become a Hawaii homeowner in 2022! Chat directly with a VA Loan Specialist at 808-792-4251 or get started online with our secure loan application.

808-792-4251

Speak with a VA Loan specialist.

Hawaii VA Loans is not affiliated with any government agencies, including the VA. Hawaii VA Loans is a division of Land Home Financial Services, Inc, a VA approved lender. NMLS #386040. This site is not authorized by the New York State Department of Financial Services. No mortgage loan applications for properties in the state of New York will be accepted through this site.

Hawaii VA Loans is not affiliated with any government agencies, including the VA. Hawaii VA Loans is a division of Land Home Financial Services, Inc, a VA approved lender. NMLS #386040. This site is not authorized by the New York State Department of Financial Services. No mortgage loan applications for properties in the state of New York will be accepted through this site.

What If I Can’t Get A Va Loan Right Now

If you had a previous VA loan that ended in foreclosure or a short sale and you canât afford to repay the funds at this time, you wonât be able to get a new VA loan right now. However, you may qualify for another government-backed mortgage with 0% or low money down:

- USDA loans: USDA loans are 0% down payment mortgages. Theyâre available to low- and moderate-income borrowers in qualifying rural and suburban areas.

- FHA loans: The Federal Housing Administration backs mortgages for borrowers with credit scores as low as 580 and down payments of 3.5%. These mortgages are subject to FHA loan limits, but they are available nationwide and there are no income restrictions, as there are with USDA loans.

Keep in mind that the government keeps record of defaults on any federal debt. That includes other government-backed mortgages and even student loans. Your lender may inform you that you have a CAIVRS alert and youâre not eligible for any government loan. If this is the case, check with your lender how long you have to wait to apply.

Read Also: How Is Student Loan Interest Compounded

Va Loan Limits And The Conforming County Loan Limits Are Going Up

Effective since January 1, 2022, VA Loan Limits and Conforming Loan Limits have been increased across the board. The limit for last year, 2021, was $548,250. For 2022, the limit has increased up to $647,200*, which is almost $100,000 more than 2021! There are other high-cost areas around the country, so make sure to check your specific area below.

If you currently have a VA Loan, the increase gives you more entitlement to use for your VA Home Loan Benefit. For instance, if you have a $450,000 VA Loan right now, with the increase in County Loan Limits, you will now have access to another $197,200 of your VA Loan Entitlement. This could be used for refinancing or for re-using your VA Loan for another home purchase.

If you have NOT used your VA Home Loan Benefit before OR if you have used it and paid it off, the Conforming County Loan Limit does not apply to you, meaning you DO NOT have a VA Loan Limit! You could purchase a $2 million home for zero down with the VA JUMBO Loan! .

Va Loan Limits By County No Longer Apply To Veterans And Active Duty Military Members Who Have Their Full Va Loan Entitlement

In the past there were limits on how much you could borrow based off of what county you lived in, but recently the VA changed their rules and no longer require a down payment for anything over the VA loan limits. Now those limits only apply to people trying to have two VA loans at the same time, or to those who have defaulted on a VA loan in the past, and lost part of their entitlement.

About VA Loan Limits

VA loan limits are not a cap on how much you can borrow nor are they the maximum you can get for a VA loan. Veterans with full entitlement can get as much as a lender is willing to lend them without a down payment. We can offer loan amounts up to $3 million dollars with nothing down, assuming you can qualify for the loan. There is also no limit on the amount of cash you can take out in a VA refinance.

VA loan limits increased in 2022 from $548,250 in 2021 to $647,200 this year.

VA Loan limits also went up in high cost counties, maxing out at $970,800 in the most expensive areas for a single family home.

Calculating your Entitlement for a Second Home or with reduced entitlement

Lets assume you have purchased a home in a standard county and you are currently using $50,000 if your entitlement, and would like to purchase a new home in the same area, so you can rent out the old one as an investment property.

The VA guarantees a quarter of the loan amount, so the maximum entitlement that you have in this county is $161,800 .

Also Check: Types Of Home Loans For First Time Buyers