Boat Loan Payment Calculator

What if you have a boat in mind and just want to know what your monthly payment will be? The boat loan payment calculator can help you estimate your monthly payment.

Simply input the amount you wish to borrow, enter an estimated interest rate, and select a loan term.

The calculator gives you the monthly payment for terms ranging from 1, 3, 5, 7, 10 and 15 years.

The longer your term, the lower your monthly payment will be. However, the longer you finance a purchase, the more you will pay in interest charges.

Applying For A Boat Loan

There are a few steps youll need to take in order to apply for a boat loan. These include:

- Whether youre interested in a sailboat, motorboat, or houseboat, what boat you want to purchase will influence what type of loan you need from a lender.

- Compare rates: When shopping for a loan, you should compare rates from multiple different lenders. This can help to ensure that you get the best deal possible.

- Review your credit score: Some lenders have minimum credit score requirements, while others reserve the most competitive rates for borrowers with excellent credit. Make sure your score is in a good place before applying.

- Make sure you have enough for a down payment: Typical down payments range from 10% to 30% of the total loan amount.

- Complete a loan application: To apply for a loan, youll need to provide information about yourself and the boat you want to buy, including your name, address, social security number.

Recommended Reading: Boat Charter New York City

Calculate Payments With Our Boat Loans Calculator

Use our boat payment calculator to determine a monthly payment that you can afford when looking to finance a new or used boat.

Simply enter your desired amount, estimated interest rate, and the loan term over which you intend to pay back the loan. Once youve input the information, the calculator will generate your estimated monthly payment on your boat loan. Take this number and plug it into your current monthly budget.

Recommended Reading: How To Apply For Parent Plus Loan

How Does Our Boat Loan Calculator Work

The Bankrate boat loan calculator helps borrowers calculate monthly payments for fixed-rate boat loans. Boat loans are installment loans, meaning that you make monthly payments on the principal balance plus interest and fees until the loan is paid back. Since boat loans have fixed rates, the interest rate you pay will never change over the life of the loan. Our calculator shows you the estimated monthly payment for your boat loan, based on the loan amount, term length and interest rate you enter.

Local Economic Factors In Hawaii

While its pretty fair to assume that youve seen images of Hawaii in regards to a top vacation destination, tourism isnt the only source of industry in Hawaii, though it plays a large role. Defense, raw sugar and molasses and pineapple are some of the top export industries. In regards to defense, Hawaii is home to military bases for all five services: Army, Navy, Marine Corps, Air Force and Coast Guard. As for tourism, the state has numerous resorts, beaches, natural wonders like volcanoes and canyons and waterfalls.

According to Hawaiis Workforce Infonet, the largest employers are Altres Industrial, Kapiolani Medical Center, Queens Medical Center, Hawaii Health System Corp and Hawaii State Police Department.

Hawaii currently has higher unemployment rates than the national average. The states unemployment rate in December 2021 was 5.7% compared to the national rate of 3.9%, according to the Bureau of Labor Statistics. If you take a look at income numbers from the Bureau of Economic Analysis, Hawaii fares better. Its 2019 per capita personal income is $58,655, which is slightly above the national average of $59,510.

Sales tax technically doesnt exist in Hawaii, but the state has a general excise tax that businesses are required to pay. This tax is usually passed on to customers with higher prices for services and goods.

Recommended Reading: Does Car Insurance Cover Boat Trailer

Recommended Reading: How Can I Apply For Loan Forgiveness

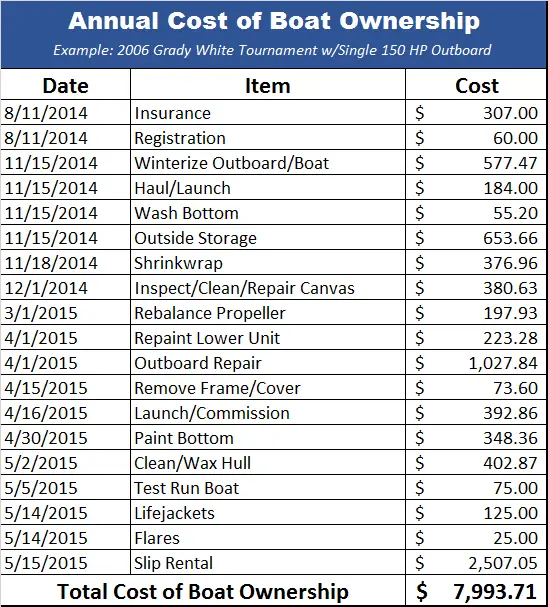

Understand The Costs Of Owning A Boat

Boat loan down payments typically range from 10% to 30%, so make sure you have enough money saved up to cover the cost of the down payment before you apply for a loan. Once you own a boat, youll also have to cover maintenance and related costs. Some of the expenses youll need to cover as a boat owner include:

- Trailer to transport and store your boat: If you dont plan on storing your boat near the water, youll need a trailer to transport it from your home.

- Boat insurance: Boat insurance can protect you in the case of an accident or if anything happens to your boat.

- If you dock your boat at a marina, youll typically have to pay monthly fees for the privilege.

- Registration: Just like a car, many states require boat owners to register their boat. Costs vary widely from state to state.

- Winter storage: If you live in an area where weather conditions arent suitable for boating year-round, youll need to store your boat in the winter.

- Maintenance: Routine maintenance costs include painting, cleaning, and replacing small parts.

- Gas: If your boat is powered by gas, youll need to fill it up regularly.

Best For Bad Credit: Southeast Financial

Southeast Financial

For borrowers with bad credit, Southeast Financial is a good choice for a boat loan. This lender has no minimum credit score requirements, and loans are available even for borrowers with past bankruptcies.

-

No minimum credit score requirement

-

Discharged bankruptcies okay

-

Rates starting at 3.74% APR

-

Not available in Alaska or Hawaii

-

$20,000 minimum loan

-

High debt ratios may be a limiting factor

With a history dating back to 1936, Southeast Financial has been providing loans and other financial products to customers across the country for over 80 years. When it comes to boat loans, though, Southeast Financial excels at connecting borrowers with poor credit to lenders willing to finance their purchase.

Through Southeast Financial, subprime borrowers can access boat loans ranging from $20,000 up to $4 million, with no published credit score minimum. Borrowers with low credit scores or high debt ratios may not qualify for the best possible rates, but loans are available even to those with past bankruptcies.

New and used boat loans are not available in Alaska or Hawaii, and borrowers are only allowed to finance their purchase if the boat is intended for recreational useno full-timers or liveaboards allowed. Repayment terms may vary according to the loan amount but are available for up to 15 years.

Also Check: Short Term Loans No Credit Check

Wells Fargo Personal Loans 2023 Review

Wells Fargo Bank

As one of the largest U.S. banks, Wells Fargo is a likely destination when you’re on the hunt for a personal loan.

You can use it to pay an upcoming expense, consolidate debt, buy a car, and more.

Find out whether Wells Fargo should be your lender of choice when you need financing.

In this Wells Fargo Personal Loans review, we’ll compare rates, fees, and services to other national and online banks.

Parental And Critical Caregiving Leaves

These paid leaves provide you with time away from work to help you care for the ones you love. Wells Fargo provides up to 16 weeks of paid parental leave for a primary caregiver and up to four weeks for a parent who is not the primary caregiver to care for a new child following birth or adoption . In addition, one regularly scheduled workweek per year of paid critical caregiving leave is available to care for a spouse, partner, parent, or child with a certified serious health condition. Additionally, team members are eligible for up to five days per calendar year of in-home, back-up adult care for yourself, your elderly parents or parents-in-law, an ill spouse or partner, or a child who is age 18 or older.

Also Check: What Is The Maximum Fha Loan Amount In Texas

How To Lower Your Monthly Mortgage Payment

Try one or all of the following tips to get a smaller monthly mortgage payment:

Choose the longest term possible A 30-year fixed-rate loan will give you the lowest payment compared to other shorter-term loans.

Make a bigger down payment Your principal and interest payments will drop with a smaller loan amount, and youll reduce your PMI expenses. With 20% down, youll eliminate the need for any PMI.

Consider an ARM If you only plan to live in your home for a few years, ask about an ARM. The initial rate is typically lower than fixed rates for a set time period once the initial low-rate period ends, the rate can adjust based on the ARM term you choose.

Shop for the best rate possible Studies have shown that comparing quotes from three to five lenders can save you big on your monthly payment and interest charges over your loan term.

What Youll Need To Apply For A Wells Fargo Personal Loan

There are several things youll need to apply for a personal loan from Wells Fargo, including:

- Your Social Security number and date of birth

- Your mothers maiden name

- Your email address, physical address and phone number

- Information about your job, including your employers name and telephone number

- Your gross monthly income from all sources

- Your monthly mortgage or rent payment amount

You may need to give the bank copies of supporting documents, such as your recent pay stubs, W2s, or tax returns.

Utility bills may be needed to verify your address and you should also keep your drivers license and Social Security card handy in case the loan officer needs a copy of these.

When you apply, youll need to tell Wells Fargo what type of loan youre applying for , the desired loan term, the amount you want to borrow and your preferred due date.

If youre approved, you can change your due date one time following your initial payment.

Remember, if youre applying with a joint applicant theyll need to provide all the same information that you do.

Also Check: How To Clean Vinyl Boat Seats

You May Like: Is An Fha Loan Assumable

Details Of Hawaii Housing Market

The most recent state to join the U.S., Hawaii is an archipelago of eight main islands. The state has an estimated population of just 1.43 million. To put it in perspective, the entire population of Hawaii is roughly one-sixth of New York Citys population. The Aloha State has 6,423 square miles of land area and 1,052 shoreline miles, according to the National Oceanic and Atmospheric Administration.

Hawaii is made up of the Island of Hawaii known as the Big Island Maui, Oahu, Kauai, Molokai, Lanai, Niihau and Kahoolawe. About 70% of the population is located on Oahu, home of the capital Honolulu. The next biggest city after the capital is Pearl City, located about 12 miles northwest from Honolulu. Hilo, Kailua and Waipahu are the next most-populous cities, according to the U.S. Census Bureau. Hilo is the only top-five city located on Hawaii Island the rest are on Oahu.

In our Healthiest Housing Markets study, Hawaii ranked near the bottom of national rankings. This was due to it having some of the most unaffordable housing in the nation, as well as very low stability markers. The other factors considered in the study were risk and ease of sale, which Hawaii fared a little better in, but not enough so to counterbalance the first two factors.

Fact #: If You Qualify For A Car Loan Youll Likely Qualify For A Boat Loan

Like any loan, lenders may look at your credit rating, debt-to-income ratio, job and homeownership stability, and net worth when considering you for a boat loan.

There are no tricks when it comes to getting approved for a boat loan, but there are some strategies that we can use to make sure your financial situation is represented correctly, noted Rogan. Weve worked with many of the same lenders for years and know what they are looking for and how to make sure that your information is presented in the best possible light.

Also Check: How To Qualify For 500k Home Loan

How Much Does A Boat Cost

The cost of buying a boat varies widely depending on the type of boat you buy and whether you buy it new or used. The average cost of a new boat is typically $60,000 to $75,000, but you could end up paying far less or far more than that depending on what youre looking for. If youre looking for a personal watercraft, for example, you could pay as little as $9,500 or as much as $70,000 depending on the year, make and model of the boat.

Buying the boat is just the first expense. You also need to consider regular maintenance costs, insurance costs and potentially storage fees if you plan to store your boat at a marina. If you plan to take out a boat loan to finance the purchase, you also need to factor in the interest rate and fees of the loan.

Is Wells Fargo Trustworthy

Wells Fargo currently doesn’t have a rating from the Better Business Bureau as the BBB, a non-profit organization focused on consumer protection and trust, investigates the company’s profile. In the past, the BBB gave Wells Fargo an F rating. The BBB measures companies by evaluating businesses’ responses to consumer complaints, honesty in advertising, and transparency about business practices.

Wells Fargo has been involved in a few recent controversies. Over the past few years:

- The company paid the city of Philadelphia $10 million as a result of the city’s claims that Wells Fargo engaged in predatory mortgage lending to racial minorities .

- The Consumer Financial Protection Bureau and Office of the Comptroller of the Currency charged Wells Fargo $1 billion for overcharging and selling extra products to customers with auto and home loans .

Also Check: What Does 85 Loan To Value Mean

How Do I Qualify For A Loan

Youll need to apply for a personal loan with Wells Fargo to find out if you qualify.

The bank doesnt include any specific qualification requirements on its website, and a quick chat with a customer service representative verified that each application is approved on its own merits.

With that in mind, here are some general tips that could help you qualify for a personal loan:

What Makes Them Different

Wells Fargo offers some nice options and products that many other banks do not.

Their specialty vehicle financing program is one of the best in the industry, offering loans for RVs, motorcycles, boats, yachts, and planes .

Wells Fargo Bank will also give you the option to easier qualify for your next auto loan by allowing you to add a co-signer to the loan application.

You can complete the loan application, provide all documentation, check your loan status, and pay your loan all online through the Wells Fargo dealer services program.

However, the Wells Fargo website has very little information about their auto loan process and lacks the transparency that most other auto lenders provide.

You will need to read your contract carefully as Wells Fargo has a history of charging their customers fees that were not in the auto loan contract.

Don’t Miss: Should I Refinance Car Loan

Regulatory Action Against Wells Fargo

Wells Fargo has experienced a series of hefty regulatory fines in the last few years.

In February 2020, the lender agreed to pay a $3 billion fine after it was found guilty of creating millions of fake savings and checking accounts in the names of real customers. In September 2021, the lender was fined $250 million by the Office of the Comptroller of the Currency after it failed to implement a mortgage loss mitigation program.

Though these instances do not directly affect its personal loans business, borrowers should keep them in mind.

Dont Miss: How To Document Your Boat

New And Used Boat Loans

Whether you want to purchase a brand-new boat or a used one, LendingTree can help. Advantages of getting a new or used boat loan through LendingTree include:

Fill out a single online form free and potentially receive multiple boat loan offers from lenders.

Youll be presented with an easy-to-read table of boat loan offers for clear rate shopping and comparison.

Get approved, shop for a new boat and cruise easy knowing you got the best rate for you.

Don’t Miss: Loans That Don T Check Credit

How Quickly Are Loans Funded

Loan funding timelines are determined in part by how long it takes you to get approved. Loan approval can take a few minutes, or up to two hours.

In some cases, approval may take longer if Wells Fargo needs to verify your personal or financial information.

If youre approved, it may be possible to get funding as soon as the next business day.

Boat And Yacht Loans And Financing Newmarket Ontario

If you are interested in purchasing a boat or yacht in Newmarket, then you may be delighted to hear that Newmarket offers an array of financing and leasing options for purchasing a boat or yacht. Not only that but since the entire application process now takes place online, obtaining a loan can be handled from the comfort of your home. As long you meet the qualifications, then you should be able to get ahold of a loan to help you purchase the jet boats, skeedoos, luxury yachts, luxury boats, sailboats, cabin cruisers and much more that you seek. If youve attempted to apply for a loan in the past but were stumped by piles of paperwork, ending wait times, and lack of guidance, you can now take comfort in the fact that Smarter Loans is here to guide you through all of the relevant information, straight to the provider that will accommodate you best.

To do this, Smarter Loans has compiled a directory of the most trustworthy loan providers from Newmarket along with their terms, rates and offers. Our goal at Smarter Loans is to empower you to be able to easily compare providers and identify a loan option that is a viable solution for your unique needs. Apply for a boat or yacht loan in Newmarket by clicking Apply Now beside your chosen provider. If you cant come to terms with any specific provider, you can alternatively pre-apply with Smarter Loans and well do the groundwork for you by researching and identifying a provider thats suitable to your lifestyle.

Don’t Miss: How To Apply For Minority Business Loan