How Does A Conventional Loan Work

A classic conventional loan is simple. In the most basic example, you put down 20% and the lender puts up the remaining 80% to purchase a home.

If a home costs $400,000, youd have an $80,000 down payment while the lender finances $320,000. This means the lender ideally wants an 80% loan-to-value ratio.

20% down is no longer required. These days, borrowers can get a conventional loan with as little as 3% down.

20% down used to be the norm for conventional mortgages. But 20% down is no longer required. These days, borrowers can get a conventional loan with as little as 3% down.

Of course, all mortgage programs have requirements in addition to the down payment. A few major requirements to keep in mind are:

Comparing Prices By Getting Pre

Most lenders allow you to find out both your rate and the amount you can borrow before moving forward. This is called getting pre-approved. You can compare mortgage rates by applying for pre-approval with multiple lenders. When you find a loan that works for you, you can formally apply for a conventional loan. The lender will complete the approval process at that point. The formal process includes an appraisal of the home you’re buying to ensure it can serve as collateral.

If all goes well, you’ll close on your loan. The lender will provide detailed documents about the total repayment costs. You’ll make monthly payments with your lender — or to another loan servicer if your loan is sold — until your home loan is fully repaid.

Is A Conventional Mortgage Right For You

If youre simply looking for the easiest loan to qualify for, FHA loans might be your best bet for buying a house. Or if you qualify for a special loan program like a VA loan or USDA loan, these are likely the smartest path forward, as they require no down payment and can allow you to secure a mortgage with low interest rates and favorable terms.

However, if youre well-qualified, conventional loans offer a host of advantages. Unlike government-backed loans, you wont have to pay any program-specific fees when taking out a conventional mortgage. And, even if you dont have 20% saved for a down payment, your loan servicer will automatically cancel your PMI once the LTV reaches 78%.

Whatever you decide, make sure you shop around for your loan first. Rates and terms can vary greatly depending on your lender. Credible Operations, Inc. doesnt offer every type of mortgage loan, but you can use us to compare multiple prequalified rates on conventional mortgages. It only takes at once in just a few minutes and wont affect your credit score.

Credible makes getting a mortgage easy

Don’t Miss: How To Take Name Off Car Loan

Fha Vs Conventional Loans Overview

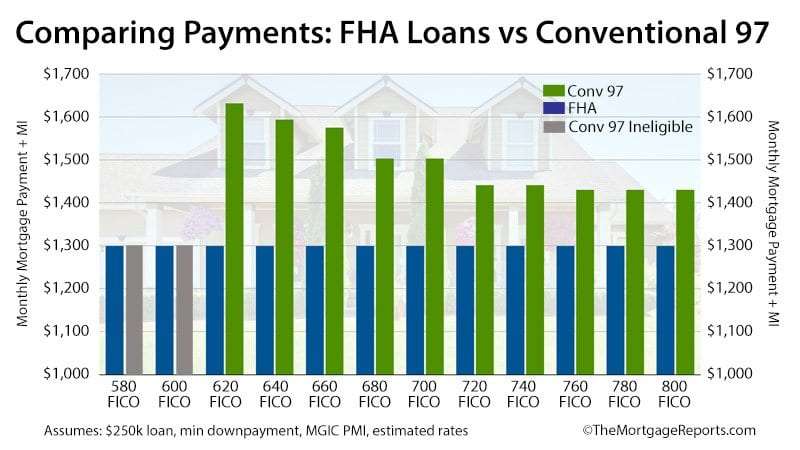

There arent large differences between FHA and conventional loans, but minor factors can make a big difference in how you qualify for either mortgage.

Conventional loans are for borrowers with good credit buying any type of home primary residence, second home, or an investment home.

FHA loans are good for borrowers trying to buy a primary residence only but who may have some credit or financial struggles.

How To Shop For Current Conventional Mortgage Rates

MISHKANET.COM” alt=”Fha vs conventional loan calculator > MISHKANET.COM”>

MISHKANET.COM” alt=”Fha vs conventional loan calculator > MISHKANET.COM”> NerdWallets mortgage rate tool provides you with real-time conventional-mortgage interest rates, based on just a small bit of information you provide. In the Refine results section, enter a few financial details about yourself and the property you want to buy. In moments, youll get a customized rate quote, without providing any personal information. From there, you can start the process of getting preapproved for your conventional mortgage. Its that easy.

Don’t Miss: Is Jumbo Loan Rates Higher

When Should You Consider An Fha Loan

If youre a first-time homebuyer or a subsequent homebuyer with a low credit score or youre having trouble establishing credit, an FHA loan can be a great start.

FHA loans more flexible guidelines make it easier to get approved. Because of the more relaxed guidelines, though, youll pay for it in mortgage insurance both upfront and monthly. The mortgage insurance lasts for the life of the loan.

I suggest starting with an FHA loan but working on improving your qualifying factors so you can refinance into a conventional loan when you owe less than 80% of the homes value.

How Does A Mortgage Work

A mortgage is a type of secured loan where the property often your home is the collateral. So youll never be able to take out a mortgage without having some sort of real estate attached to it. Mortgage loans are issued by banks, credit unions, and other different types of lenders.

Aside from paying the loan back, you pay for a mortgage in two ways: fees and interest. Interest is paid on your loan balance throughout the life of the loan, and is built into your monthly payment. Mortgage fees are usually paid upfront, and are part of the loans closing costs. Some fees may be charged annually or monthly, like private mortgage insurance.

Mortgages are repaid over what is known as the loan term. The most common loan term is 30 years. You can also get a mortgage with a shorter term, like 15 years. Short-term loans have higher monthly payments, but lower interest rates. Mortgages with longer terms have lower monthly payments, but youll typically pay a higher interest rate.

You May Like: How Much Construction Loan Can I Get

Jumbo Vs Conforming Loan: What’s The Difference

From big and small to high-interest and low-interest, mortgages come in all shapes and sizes. The two most common types are jumbo, or non-conforming, and conforming. To understand the difference between the two, let’s touch on federal loan limits.

The Federal Housing Finance Agency sets conforming loan limits annually. Loan limits determine whether mortgages are eligible for purchase by Fannie Mae and Freddie Mac. Mortgages that fall within these limits are considered conforming. Mortgages that fall outside these limits are considered non-conforming.

The government uses two businesses Fannie Mae and Freddie Mac to purchase conforming mortgages. That makes regular mortgages less risky for lenders to issue. But what happens when you need a house that costs more than the limit?

Some lenders will let you take out a jumbo mortgage. These are non-conforming mortgages used to finance mortgages over the FHFA loan limit. These mortgages are typically kept by the lender and are not guaranteed or insured, which makes them riskier. Every jumbo lender will have its own standards for making these loans.

What Are Conventional Loan Interest Rates Today

Markets fluctuate constantly, which means interest rates do, too. Rates also vary based on where you live and your lender, so its tough to nail down exactly what conventional loan interest rates are today. However, you can get a sense of the range by looking at the monthly averages published by the St. Louis branch of the Federal Reserve.

Of course, those are national averages and dont indicate the rate youll receive. Lenders set individual mortgage rates based on several factors, including your credit score, the purchase price of the home, and your loan-to-value ratio .

The LTV refers to how much youre borrowing vs. how much money youre putting down. A borrower who has a 700 credit score and puts down 3% on a $350,000 home may receive a higher interest rate than someone who puts down 20% and has a 780 credit score.

Rates also vary based on where you live and your lender, so its tough to nail down exactly what conventional loan interest rates are today.

Also Check: Is It Easy To Get Loan From Credit Union

Conventional Mortgages: Everything You Need To Know

6-minute read

*As of July 6, 2020, Rocket Mortgage® is no longer accepting USDA loan applications.

Conventional mortgages are a great choice for many homeowners because they offer lower costs than some other popular loan types. If you have a high enough credit score and a large enough down payment, a conventional mortgage might be right for you.

Renting Vs Buying A Home

However, over the long term, buying a home can be a good way to increase your net worth. And when you buy, you can lock in a fixed interest rate, which means your monthly payments are less likely to increase compared to renting. Owning a home also has the added benefit of providing a stronger sense of stability for you and your family. And when you own, you have the freedom to customize your living space however you like.

Read Also: How To Get Pmi Off Fha Loan

No Private Mortgage Insurance Required

Most lenders require the borrower to purchase PMI unless they can make a down payment of 20%.

| 2.626% |

Rates as of Sep 25, 2021 ET.

Discount Points:;The interest rate above shows the option of purchasing discount points to lower a loans interest rate and monthly payment. One point amounts to 1% of the loan amount and is paid at closing. Points dont always have to be round numbers. Purchasing 1.5 points would cost $3,000 on a $200,000 mortgage.

Rates displayed are the “as low as” rates for purchase loans and refinances.

Jumbo Loans: Loans over a certain amount are called jumbo loans. In most states, mortgage loans greater than $548,250 are jumbo loans. In AK and HI, any loan over $822,375 is considered a jumbo loan.

Movement Mortgage Best For Quick Closing

Overview

The South Carolina-headquartered Movement Mortgage was founded in 2008. Its a licensed mortgage lender in all 50 states and has over 650 branches nationwide.

What to keep in mind

;It offers all of the most popular types of mortgages from conventional loans to FHA loans, and niche options, such as reverse mortgages. But if you want any type of home equity loan or line of credit, youll have to go with another lender.

Movement Mortgage prides itself on quickly closing loans, and claims that 75% are closed within seven business days. It also gives a large amount of its profits to charity.;

Read Also: How To Calculate Loan Installment

What’s The Difference Between A Fixed And Variable Rate Why Should I Choose One Over The Other

Rate refers to the interest rate you’ll pay on your mortgage. You have two options to choose from:

TIP: Deciding between a fixed and variable rate: If rates are expected to go up soon, or if you have a strict budget, you may want to choose a fixed rate and lock in at the current low rates. But if you think rates are likely to stay the same or even drop, and youre comfortable with the possibility of some fluctuation in your payments, a variable rate could save you money.

How To Qualify For A Conventional Loan

Some people mistakenly believe that conventional loans are incredibly hard to qualify for. In reality, besides the higher credit requirement, they arent any more difficult to qualify for than government-backed loans, like FHA or VA.

Like with any type of mortgage, you need to be able to prove you are capable to make the monthly payments. Lenders will look at a variety of factors to determine whether or not a borrower qualifies.

Read Also: Can The Bank Loan You Money

What Is A Conventional Loan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Conventional mortgage or conventional loan is a term you’re bound to encounter when you’re shopping for a mortgage. After all, this common mortgage type is offered by most lenders.

Conventional loans are often the best option for borrowers with strong credit who can contribute a down payment of at least 3%, or perhaps quite a bit more. Find out what conventional means in the mortgage industry, and whether it might be the right type of home loan for you.

A conventional loan is a type of mortgage that isnt backed by a government agency, such as the Department of Veterans Affairs. Conventional mortgages often meet the down payment and income requirements set by Fannie Mae and Freddie Mac, and conform to the loan limits set by the Federal Housing Finance Administration, or FHFA.

You’ll generally need a credit score of at least 620 to qualify for a conventional loan, though a score that’s above 740 will help you get the best rate. Depending on your financial status and the amount you’re borrowing, you may be able to make a down payment that’s as low as 3% with a conventional loan.

» MORE: Understand

» MORE:

» MORE:

» MORE:

When Youll Need To Pay Private Mortgage Insurance

Any borrower with a conventional loan who puts less than 20% down is required to buy private mortgage insurance , which raises the annual cost of the loan. This mortgage insurance can be canceled once the homeowners equity in their home surpasses 20%. Mortgage insurance provides protection for your lender in case you default on your loan.

Recommended Reading: Is My Home Loan Secured

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Are Conventional Mortgage Rates Going Down In 2020

Its always been hazardous to predict mortgage rates and probably no year has been more uncertain than 2020. We not only have the usual economic ups and downs to consider, but also the coronavirus.

What we know is this: Mortgages rates are low.

In May 2020, the weekly rate for 30-year, fixed-rate financing reached 3.15% according to Freddie Mac. Thats the lowest rate since the company started to keep records in 1971.

Rates could fall lower still. Or, they could go up. This is always the case with mortgage rates but theyve never been as consistently low as they are now.

So if you get a quote youre happy with today, dont be afraid to lock it in.

Popular Articles

Step by Step Guide

Read Also: Does Home Loan Include Furniture

When Is The Right Time To Get A Mortgage

Before you apply for a mortgage, you should have a proven reliable source of income and enough saved up to cover the down payment and closing costs. If you can save at least 20% for a down payment, you can skip paying for private mortgage insurance and can qualify for better interest rates.

At the end of the day, the best time to apply is when youre ready. But there are other details to consider when timing your home purchase. Because home sales slow down during the winter, you may be able to get a better price in the spring. However, general nationwide trends wont necessarily apply to your local real estate market. To get a better sense of the nuances of your area its important to talk with local experts.