Get Educated About Loan Origination Fees

Its important to be aware of how loan origination fees can affect your final borrowing costs. A small percentage may seem negligible, but depending on your loan amount origination fees can quickly rack up to be hundreds or thousands of dollars.

Its a good idea to try and get estimates from at least several lenders to ensure youre getting the best deal. Having good credit and strong financials will certainly help your case, as you may be able to use these credentials to negotiate reduced fees. In any case, dont be afraid to ask questions and ensure you have all the information you need to feel comfortable before signing anything.

What Does An Origination Fee Cost

Putting an exact dollar amount on origination fees can be a bit difficult because they are expressed as a percentage of the loan amount. But a standard origination fee for a conventional loanor a loan amount up to $424,100typically runs between $750 to $1,200, says Ventrone.

To see the breakdown of your origination fee, check out Page 2 of the loan estimate your lender provides.

Each fee will be itemized separately in Box A so you will know exactly what you are paying for, says Ventrone.

If a loan is $200,000 and the lender is charging a half-point to originate the loan, the borrower will need to pay an additional $1,000 in closing costs, says Reiss. If the lender is charging one point , the fee would rise to $2,000. The origination fee generally ranges from 0.5% or 1% of the loan amount, but it can change depending on the bank and the client.

Are Personal Loan Origination Fees Regulated By The Government

In many respects, yes. The Consumer Financial Protection Bureau and the Office of the Comptroller of the Currency require compliance with the Truth in Lending Act. This regulatory control came after the 2008 Financial Crisis. The regulations dont tell lenders how much they may charge for the fee, but they require lenders to disclose in writing all fees that the borrower must pay, and provide the APR so consumers can have transparency and compare loan offerings apples to apples.

Don’t Miss: How Much Can The Bank Loan Me

Mortgage Lenders With No Origination Fee

When market conditions are bad for lenders, they may have to work harder to earn their homebuyers business. Loan providers may charge no fee for their loan origination services and some are even offering a cash award that can be applied towards closing costs in addition to waiving the origination fees or points. Loan origination fee calculators can be useful tools when considering your closing costs.

Typically however, with average loan origination fees hovering around 1 percent, banks that do offer this no-fee service to make up that lost income elsewhere in the loan. Be sure to look carefully at the overall cost of borrowing when considering lender origination fees and mortgage offers. You may find youre being charged a higher overall annual percentage rate vs. banks that require a typical home loan origination fee.

While your reviewing mortgage offers and origination fee expenses, be sure to let your American Family Insurance agent know that youre planning to move in the near-future. Youll get a customized quote for your new home and will find greater peace of mind knowing that everything youve worked so hard for is well protected.

Compare Quotes From Different Lenders

Mortgage origination fees, rates, terms, and other fees can vary wildly from one mortgage company to the next. Its essential to get quotes from at least two or three lenders before deciding who to work with. This will allow you to see a wide range of fees and rates and ultimately determine the best choice for you.

Getting a few extra quotes will also better prepare you for negotiations. When negotiating fees, showing your mortgage expert a quote from another lender is the perfect way to lower your costs.

You May Like: When Does Ppp Loan End

Cash Advance From Credit Card

If using a credit card isnât an option, consider a cash advance. These usually come with their own fees, like a flat transaction fee or a percentage of what youâre taking out. They also come with their own APRs, usually higher than your regular credit card transaction APR and much higher than interest rates on personal loans.

Whatâs more, interest starts accruing on credit card cash advances right away, which means youâll owe more compared to loans that have a grace period or installment payments. This combination of factors makes cash advances an expensive alternative to personal loans so we rarelyâif everârecommend this option.

What Are Mortgage Origination Fees

Origination fees are costs that a lender charges in order to establish your mortgage. They are part of your loan closing costs as a home buyer and are designed to cover the many administrative costs associated with originating a new loan.

These fees typically include such items as document preparation, underwriting, appraisal costs, , tax research, and more. In many cases, origination costs amount to about 0.5% to 1% of the loan amount, though, depending on the lender, they may be less.

While most of what a lender makes in revenue or profit is on the back end when the loan is sold in the secondary market based upon the interest rate, that revenue does not cover all the expenses and the profit margins most lenders need to operate, says Mason Whitehead of Churchill Mortgage. As a result, its necessary to charge some fees upfront to offset the costs of processing, underwriting, and keeping the lights on.

You May Like: How To Remove Co Signer Off Student Loan

Cost Of Origination Fees

Most of the time, origination fees are a percentage of the loan amount. Its usually 0.5% 1% for U.S. mortgage loans. This is before accounting for discount points.

For lenders that split up underwriting and processing fees, add the percentages together to be sure youre comparing apples to apples.

Additionally, this is just one component in your overall closing costs. In order to get a better idea of the fees being charged by lenders for comparison purposes, be aware that lenders always have to publish two rates: the base interest rate and the annual percentage rate.

The annual percentage rate includes the base interest rate, plus closing costs associated with your loan. The bigger the difference between the base rate and the annual rate, the more the lender is charging in closing costs and fees.

Personal Loans With No Origination Fees

When compiling our list of the best personal loans, Select looked at key factors like interest rates, fees, loan amounts and term lengths offered, plus other features including how your funds are distributed, autopay discounts, customer service and how fast you can get your funds.

None of the lenders on our list charge early payoff penalties or upfront fees for processing your loan.

Also Check: Which Loan Should I Pay Off First

Tips To Save For A Home

- Planning financially for a home involves more than picking the right price range. You have to account for smaller costs, like origination fees. If you need help budgeting for the wide range of charges home buying brings, consider working with a financial advisor. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- SmartAssets mortgage calculator can help you know what you can afford by revealing the total cost of a loan spread over the duration of the mortgage.

- Mortgage rates are more volatile than they have been in a long time. Check out SmartAssets mortgage rates table to get a better idea of what the market looks like right now.

- You put plenty of funds into your home, whether its origination fees or a down payment. But did you know that you can use your house to pay for other costs in your life? Homeowners age 62 and above can borrow against the equity in their home with a reverse mortgage. Then, they can use any extra savings from it to fund their retirement.

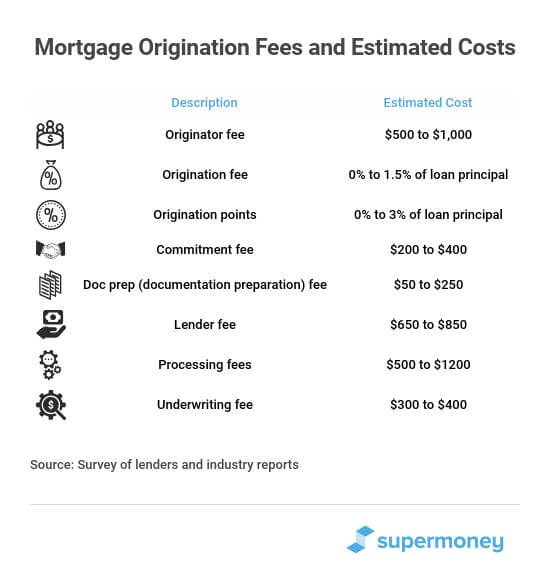

Most Common Origination Fees

The exact list of origination fees may vary slightly from lender to lender, and some lenders may use different titles for specific fees. However, some of the most common origination fees generally include:

- Processing or underwriting: This fee is designed to cover the lenders costs of gathering the required documentation to process your loan.

- Appraisal: As part of the closing process, the home being purchased must be appraised for its fair market value, which is the basis for this fee.

- The mortgage lender charges this fee to cover the cost of checking your credit score and profile.

- Tax service processing: This fee is charged by the lender to establish an escrow account that will be used to ensure that there is no interruption in the payment of property taxes as the home changes hands.

Its also important to note that there are some origination expenses or costs that a lender controls and others that the lender cannot control. For instance, application, processing, and underwriting fees are typically fees controlled by the lender. But and appraisals are fees charged by third parties and thus are fixed costs that the lender must pay.

Origination fees may sometimes also include whats known as up-front points, which are not to be confused with the discount points used to buy down the interest rate on a mortgage.

Also Check: Can Disabled Veterans Get Student Loan Forgiveness

What Is A Loan Origination Fee

A loan origination fee is a fee charged by lenders in exchange for processing a loan. Loan origination fees typically range between 0.5% to 1% of the total loan amount.

It covers the administrative costs and the customer service associated with processing the transaction. Loan origination fees are just some of the added costs that banks and lenders charge. Other examples include application fees, underwriting fees, and more.

Other Fees To Look Out For

When it comes to buying a home, the origination fee is just one of the expenses youll run into. Youll also be bringing money to the closing table for a variety of other fees and purposes.

Other common closing costs include:

- Application and underwriting fees: The application and underwriting fees are paid to the bank for processing your application and underwriting the loan. These fees are a part of the origination charges.

- Appraisal fee: An appraisal is necessary to determine the value of the home and ensure the bank isnt lending more money than the home is worth. As the buyer, youre responsible for paying for the appraisal.

- When you apply for the home, a lender will have to pull your credit report to determine whether you qualify for the mortgage. The credit report fee is a part of your closing costs.

- Title fees: There are several different title costs required with the purchase of the home. These include title insurance and title searches. Youre generally required to buy title insurance for the lender, but title insurance for yourself is optional.

- Taxes and government fees: When you close on your home, you are likely to pay recording fees and transfer taxes to transfer the home into your name.

- Points:Mortgage points are a way for you to buy down your interest rate . Points are entirely optional, but generally allow you to reduce your mortgage rate by a certain percentage usually 0.25% in exchange for a fee often 1% of the loan.

Also Check: First Time Home Buyers Loans

Additional Loan Fees To Look Out For

Origination fees aren’t the only loan costs you must take into account before signing on the dotted line. Lenders may charge a wide variety of other fees. These fees differ by loan type.

Mortgages:

- Appraisal fee: The appraisal fee covers the cost of having the property appraised to confirm the loan is big enough to cover the home’s value.

- Home inspection fee: Some lenders require a home inspection before they will approve you for a mortgage you’ll pay a fee for this service.

- Title insurance fee: his fee covers the title insurance company’s costs to insure the transfer of the deed into your name.

- Recording fee: Mortgage lenders may charge a fee for recording your deed to your new home with local government agencies.

Auto loans:

What Other Fees Should I Prepare For

Origination Charges are just the lender fees for obtaining a loan, but there are other fees for obtaining a loan, which also show up on the Loan Estimate and Closing Disclosure as follows:

- Services Borrower Did Not Shop For: These fees include a home appraisal, credit report, flood certification fee , and tax status fee . Lenders choose these service providers, which is why this category is labeled as such.

- Services Borrower Did Shop For: These fees include pest inspections, lenders title insurance, and escrow or attorney fees required to settle the transaction. Borrowers can shop for these service providers, which is why this category is labeled as such.

Beyond lender fees, there is another section on page two of the Loan Estimate and Closing Disclosure called Other Costs that captures all other non-lender fees associated with a mortgage transaction, including:

- Property transfer taxes, transactional recording fees, and other government fees

- Prepaid items like paying prorated mortgage interest when closing in the middle of a month, and homeowners insurance and property taxes that may be due at the time a transaction closes.

- Home inspection fees

- Owners title insurance

- Homeowners association dues if the property is a condo or a planned unit development

The Loan Estimate and Closing Disclosure forms are very clear about showing totals for all of these various categories of closing costs.

Read Also: How Much Loan Can You Afford

How Mortgage Origination Fees Work

It might seem like an easy process: Check your credit score, appraise the home, and hand over the money you want to borrow. But the truth is mortgage lenders put a lot of effort into making loans.

When you apply for a mortgage, your lender is likely to spend hours checking your credit history and looking at the documents you provide to show your financial situation. A mortgage is a long-term commitment, and the lender wants to ensure you can keep making payments, even decades down the road.

The lender also needs to hire professionals to do things like check the homes title for problems and physically inspect your home to ensure its in good condition and worth enough to justify the loan amount youre asking for.

All this work takes time and costs money, which is why it can take a long time to get final approval for a mortgage loan. Lenders use mortgage origination fees to compensate for the expenses involved in preparing your loan.

The origination fee you have to pay shouldnt be a surprise when you get to closing. Your lender should provide the info in your loan estimate as part of your closing disclosure. Though fees vary by lender based on many factors, theyre typically about 0.5% to 1.5% of the amount youre borrowing.

Ask Several Lenders For Quotes On A Mortgage

Its always worth shopping around for a loan, because lenders, fees, and other charges can vary significantly. A simple way to choose which lender is offering you better terms is to compare the origination fee and lender credit at a specific rate for the same time frame, because rates are constantly in flux.

For example, at 4% lender A is charging a $750 origination fee and giving you a $500 credit, meaning youll still pay $250, says Ventrone. Lender B is charging a $995 origination fee with a lender credit of $1,500, meaning youll get a net of $505. In this example, lender B is providing lower terms.

Keep your options open and be patient when shopping for a mortgage itll be worth it in the end when youre paying a rate that fits comfortably in your budget.

Don’t Miss: How To Find Interest On Loan

Can You Negotiate Origination Fees

You dont need to simply accept origination fees as is. As a consumer, you can certainly shop around with different lenders and try to obtain less expensive fees. You can also attempt to negotiate closing fees with the lender you ultimately decided to work with.

But bear in mind that there are some fees that may be flexible or at the lenders discretion and others that are not. Items like credit fees, appraisals, and others are less likely to be negotiable.

Homebuyers should take a close look at all fees and ask questions. You should not feel uncomfortable challenging or asking why these fees are there, says Jack Kammer, vice president of mortgage lending for national mortgage originator OriginPoint.

However, as you shop around for the lowest fees possible, its important to understand that youll often be faced with a trade-off between either lower origination costs or a lower interest rateits unlikely youll get both. Whats more, the lowest costs may not result in the best service.

If a lender has very low fees, they may not be able to perform as quickly, especially if you have a short close date, says Kammer. Remember the adage You get what you pay for. Purchasing a home is one of the biggest financial decisions of your life. Trusting this to the lowest bidder may not be the smartest move.

Which Loans Usually Charge Origination Fees

Even though a significant portion of the loans available in the U.S. market charge an origination fee, certain credit lines arent subject to them. For example, credit cards arent usually affected by origination fees.

Traditional loans, such as mortgages, consumer loans, commercial loans, personal loans, and student loans, require an origination fee. However, under certain circumstances, lenders may decide to waive the origination fee.

You May Like: How Do You Figure Loan To Value Ratio