What Are Sba Express Loans

The SBA Express loan is a simplified SBA loan program designed to reduce paperwork and speed up funding approvals. At present, the maximum loan amount for SBA Express loans is $350,000.

Because of the Coronavirus pandemic and its economic crisis, the limit increased to $1 million until its permanently set at $500,000 on October 1, 2021.

The difference between small loans and short-term loans is that for the latter, the lender can obtain a decision from the SBA within 36 hour turnaround time.

Loan proceeds can serve the same purposes as other SBA loans, such as working capital, debt refinancing, and even real estate. Also attractive is that SBA Express loans may not require collateral on loans of up to $25,000.

Acceptable Uses Of Eidl Loans

These funds can be used for normal operating expenses and working capital. The SBA lists the following expenses to provide some possible examples.

- Continuation of health care benefits

- Rent

- Utilities

- Fixed debt payments

As of Sept. 8, 2021, acceptable uses for COVID-19 EIDL funds have been expanded to include prepaying commercial debt and paying federal business debt.

Sba Loans Can Help Sellers Get Paid In Full At Closing

Seller financing can be an acceptable arrangement for some sellers. However, most will greatly prefer to get paid in full immediately.

With an SBA loan, both parties can often have their needs met. Buyers can invest less money upfront. Sellers can typically receive the entire purchase price at closing.

From a lending industry perspective, the many advantages of SBA loans lead to one clear outcome: SBA loans make more deals possible.

Obviously, a buyer or sellers decision to enter into an asset purchase agreement is dependent on the deal terms. A lot of buyers will hesitate if theyre required to pay the full purchase price upfront.

Don’t Miss: How Do I Get My Student Loan Number

Option : Export Working Capital

This loan is meant to max out between $500,000 to $5 million to support businesses that need extra capital to generate more sales. The SBA guarantees 90% to interested business owners no matter the size of the loan.

The lenders and borrowers negotiate on the interest rate, but the SBA makes the credit decision.

Eidl Loan Requirements: What Are They

EIDL is short for an Economic Injury Disaster Loan and EIDL loans are available to small businesses, most private nonprofit agencies and small agricultural cooperatives. Backed by the U.S. Small Business Administration , these loan funds are intended to help these types of organizations when they are struggling to meet typical operating expenses because of a disaster, including natural disasters like earthquakes and hurricanes, and now the COVID-19 pandemic.

Through the signing of the Coronavirus Aid, Relief, and Economic Security Act in March 2020, the EIDL program received an additional $10 billion in funding to help small businesses and organizations that were financially affected by the pandemic. In April 2020, another $10 billion was added. And in September 2021, the maximum amount that an organization can borrow was raised to $2 million for COVID-related injury.

Related: How to value a business: 7 valuation methods

Recommended Reading: What Is The Commitment Fee On Mortgage Loan

Defaulting On An Sba Loan

As long as you consistently make the required payments on your loan, the topic of default isnt even relevant. But if you fall behind on your payments, its helpful to know what to expect.

First, the lender would contact you to discuss the situation and offer possible solutions. If youre unable or unwilling to make the necessary payments, the lender will initiate the collection process as described in the SBA loan agreement.

After the lender has exhausted their recovery options, they will submit a claim to the SBA. This stage is when the federal governments guarantee comes into play, and the SBA will repay a significant portion of the loan for you.

At this point, the lender will move on to greener pastures, and youll be dealing directly with the SBA. The agency will contact you and request the remaining balance. They will also allow you to make an offer in compromise, which means you suggest an amount smaller than what is owed. If your financial situation is compelling enough, they may accept your offer.

Even if the SBA rejects your offer, youll typically have the chance to submit another offer in compromise. Be aware, however, that the SBA also has the right to send your account to the Department of the Treasury. Unlike the SBA, the Treasury has the power to begin collection through actions such as wage garnishments and claiming your tax returns.

Offer Collateral And Personal Guarantee

Although this SBA loan requirement can vary based on the program, generally, the SBA requires lenders to obtain âadequate collateral,â when available, to secure an SBA loan. Youâll want to keep in mind that when youâre offering your business property as part of the collateral, youâll need to offer a lenderâs loss payable in your loan application.

Collateral can be anything that youâre willing to pledge if you canât repay your SBA loanâwhether thatâs real estate, equipment, or inventory you use in your small businessâs operations.

Lenders evaluate collateral on a case-by-case basis, but a personal guarantee is almost always a universal SBA requirement. SBA lending guidelines state that anyone who owns 20% or more of the business must sign a personal guarantee using SBA Form 148 or 148L.

Use our guide to learn more about SBA loan personal guarantees.

You May Like: How Much Commission Do Loan Officers Make

Faqs About Sba Loans For Startups & New Businesses

Yes. Startups can qualify for SBA loans as long as they can demonstrate the ability to repay the loan.

To qualify for an SBA loan, youll need to provide proof that your business is legitimate and you have the ability to repay the loan. Depending on the loan program, you might have to provide documentation like:

- Business plans

Learn more in our guide to SBA loan requirements.

Getting an SBA loan for your startup can be quite hard. You will have to provide extensive documentation that proves that you have the experience, plan, and resources necessary to run a business and repay your loan.

Yes, SBA startup loans often require collateral. However, some SBA loans might not require collateral, such as CDC/504 loans, microloans, and some loans under $25,000.

How Much Can I Expect To Be Given

As our experts here have found, SBA Economic Injury Disaster Loans provide small businesses with working capital loans of up to $2 million. Which can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing. $10 billion has been provided by the government to make EIDL loans.

The amount one will receive is dependent upon ones qualifications and current standing and therefore differs between businesses and industries. If youd like to learn more about your potential funding, chat with one of our experts here at REIL Capital.

Read Also: How To Transfer Car Loan To Another Person

Benefits Of Eidl Loans

There are numerous benefits to this loan program, including the following:

- Easy Application Process: You can apply online, which can streamline the process. Theres no need to make an appointment or travel to a financial institution to apply.

- Flexible Loan Amounts: If your application is approved, the SBA will let your business know how much you qualify for. Then you can borrow up to that amount. So, if you get approved for $125,000 but need only $100,000, you can borrow that amount.

- Low-Interest Rates: Theyre currently 3.75%, fixed, for small businesses, and 2.75%, fixed, for non-profit agencies.

- Long Terms: The term is 30 years.

- Flexibility About When Payments Start: There is a year of deferment , which means your business can wait a year to start making payments if you wish.

- No Fees or Prepayment Penalties: If you want to start making your payments right away, you can, without penalty.

Know The Lenders Qualifications And Requirements

This article is a great place to start in terms of understanding what an SBA-preferred lender looks for, but make sure you talk specifics with your lender. Lenders often prefer to lend to certain types of businesses. As long as they meet the minimum SBA requirements and dont discriminate, they can add their own requirements.

Read Also: Usaa Auto Loan Pre Approval

Different Types Of Sba Loans

There are several types of SBA loans, each with a purpose tied to them. Certain loan types only allow you to use it in specific situations, so you need to do your research beforehand.

The 7 Loan Program is the flagship SBA loan. It’s the most flexible type that can be used in a wide variety of situations. Businesses can borrow up to $2 million, with a maturity period of 10 years for working capital and 25 years for fixed assets.

Within the 7 Loan Program, there are also subcategories for specific situations. The Express Program, for instance, is for business owners who need funding within 36 hours. Another one is the Rural Lender Advantage Program, which is for businesses in disadvantaged rural communities.

Another type of SBA loan is the CDC/504 Loan Program. This is for the specific purpose of acquiring assets for business expansion. For small, short term financing, the Microloan Program offers quick loans of up to $35,000.

What Can The Loan Be Used For

SBA loans give entrepreneurs access to funding that they can use to jumpstart their small businesses. It acts as a security loan that allows them to fund daily operations during lean months or have a line of credit in case of emergencies.

Business owners can also use SBA loans to take advantage of market conditions. Funds can be used to buy more inventory in anticipation of peak seasons like Christmas or Thanksgiving.But probably the best use of the loan is to fund business expansion by investing in equipment and assets.

SBA loans are a fantastic last resort solution for business owners, but theyre by no means your only option. L3 Funding has a number of merchant funding alternatives with easy approval and payment terms. Schedule a free one-on-one consultation with us today and see if you qualify for any of our loan products.

Read Also: Firstloan Com Legit

How Sba Lenders Look At An Application

SBA lenders might ask for a lot of documents and information to support your application. But these are meant to help them draw a few key takeaways about your business.

First, they give lenders details about what your business is, where its going and how its managed. Thats why a strong business plan is so important. Equally important, they show lenders how prepared your business is to take on debt. If your lender thinks you cant afford loan repayments, you wont get approved.

What Documentation Will I Need To Provide For The Sba 7 Loan

Generally, youll need to include the following documentation with your application package:

-

Agreement to purchase the business

-

Letter of intent to buy the business

-

Business tax returns for the past three years

-

Any outstanding business debt

-

Financial statements, including a balance sheet, profit and loss, and income projection.

The SBA allows applicants to get help filling out the application paperwork, but your lender will be required to submit information about who gave you help to the SBA, so youll need to document who this person is as well.

Read Also: How Much Car Loan Can I Afford Calculator

Can You Get An Sba Loan With No Money

This depends largely on your business’s overall financial situation. If your company is struggling because of some outside event, like a hurricane or earthquake, you may be able to qualify, even if you’re in a dire financial situation.

This is also true for companies affected by the COVID-19 pandemic and other major economic events. But, if your business has been poorly run and you have a bad financial history that is not the result of a national event, you may still not qualify with the SBA for a loan.

Where To Find An Sba Loan

Outside of disaster loans, which are issued by the SBA, SBA loans are issued by banks, credit unions, community development organizations, nonprofit institutions, and online lenders. The SBA provides a guarantee on the loan that protects the lender from loss in the event that you default on repayment. Some lenders make the process of applying for an SBA loan easier than others, such as online lenders who will help you get your paperwork in order.

If you dont know the SBA loan qualifications and necessary steps, qualifying for an SBA loan can be difficult. To make it easier, weve developed a comprehensive SBA loan document checklist to assist with the SBA application process.

Lendio is an online lending platform that connects you to more than 70 lenders, offering SBA 7, 504, and SBA Express loans with an online application. It will help you source the best possible loan offers with its online portal.

Don’t Miss: How Old Can A Manufactured Home Be For Va Financing

What If My Sba Disaster Loan Application Is Denied

SBA disaster loan applications can be denied for a few different reasons the most common being a shaky credit history and a demonstrated inability to repay loans.

If youve been denied an SBA disaster loan, you have up to 6 months to submit an appeal to the SBAs Disaster Assistance Processing and Disbursement Center . If your application is denied again, you have another opportunity to appeal the decision.

Apply to multiple lenders with just one application

Sba 7 Loan Overview: Amounts Rates And Terms

Theres a lot of parts to SBA loans. You have maximum loan amounts, use of proceeds, repayment terms, guaranty fees, interest rates, and much more.

Heres a brief overview of the main characteristics of SBA 7 loans in 2021:

- Maximum loan amount: $5 million

- Repayment terms: Generally up to 7 years for working capital, 10 years for equipment, and 25 years for real estate.

- Interest rates: Loans less than 7 years: $0 $25,000 Prime + 4.25%, $25,001 $50,000 P + 3.25%, over $50,000 Prime + 2.25% Loans 7 years or longer: 0 $25,000 Prime + 4.75%, $25,001 $50,000 P + 3.75%, over $50,000 Prime + 2.75%

- Percent of guaranty: 85% guaranty for loans of $150,000 or less 75% guaranty for loans greater than $150,000

- Guaranty fee: $150,000 or less = 2% $150,001-$700,000 = 3.0% $700,000- $1,000,000 = 3.5% plus 3.75% on guaranty portion over $1million*

*The guaranty fee is charged on the guaranteed portion of your loannot the entirety of it.

Also Check: Usaa Current Used Car Loan Rates

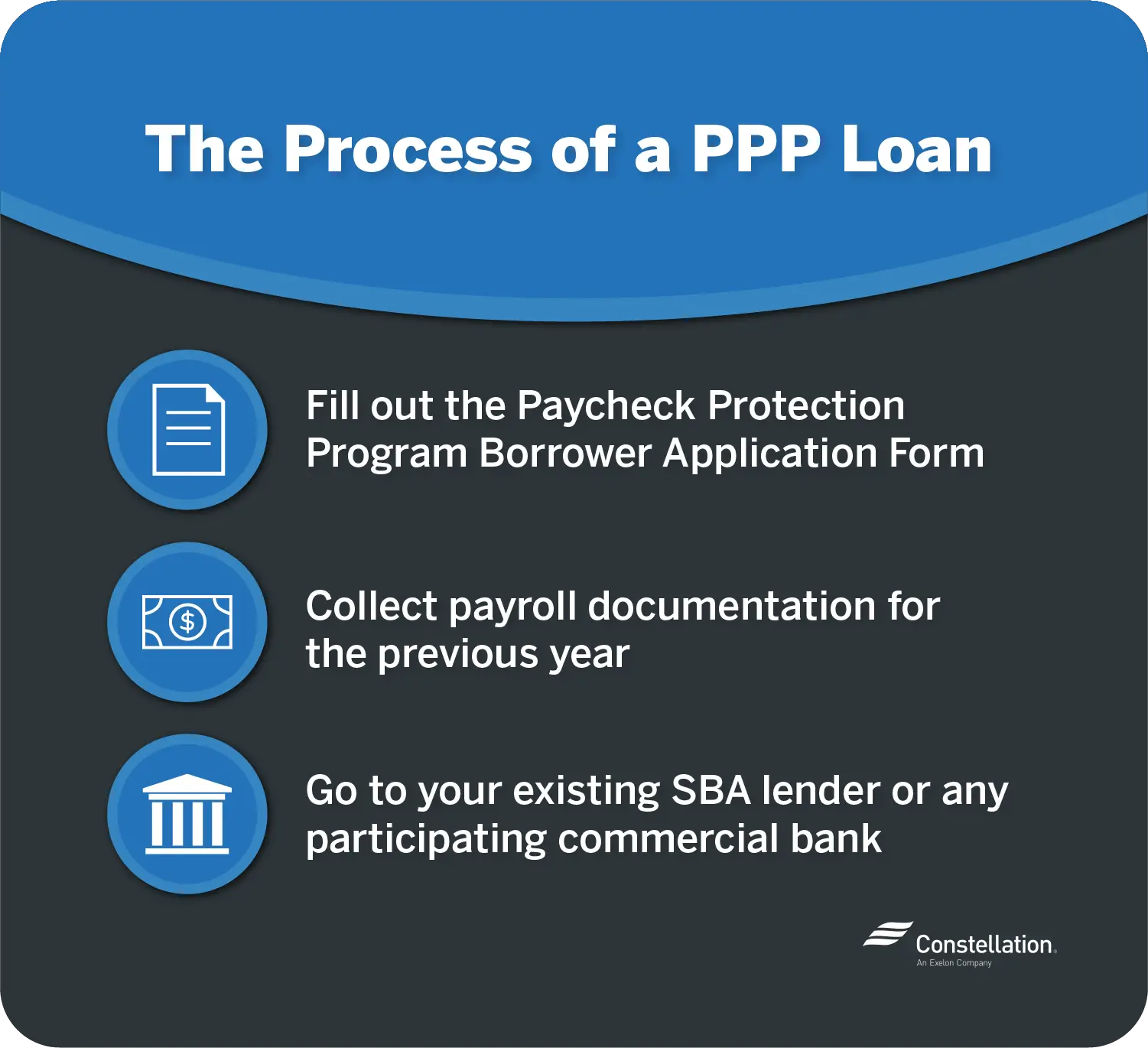

How To Fill Out An Sba Disaster Loan Application

You will first be presented with options regarding how many employees your business currently has. Next, a checklist of legal eligibility requirements is shown with options such as the applicant is not engaged in any illegal activity as defined by Federal guidelines and the applicant is not in the business of lobbying. This is used as a filtering process to determine whether or not you are eligible to apply.

After completing the above questionnaire and having determined that you are eligible, the first step in completing your application is to fill out your business information: business legal name, gross revenue, cost of goods sold, etc.

Followed by this will be a page to fill out business owners information, and then a page with additional information expectations. Once complete, you will be provided with a summary to review submit once you are comfortable with all answers.

What Is A Credit Score

A serves as a lenders point of reference to determine the creditworthiness of a potential loan borrower. Scores fall between 300 and 850 and are determined by the borrowers credit history and the current financial standing of his or her business.

For a bank or SBA-accredited financial center to trust you , you must have a credit score of 580 or higher. A good credit score reflects that you pay your bills on time and that lenders can trust you will make timely payments in the future.

Also Check: Usaa Pre Approved Car Loan

Temporary Sba Loan Changes

The latest coronavirus relief bill has temporarily changed some SBA loan features to promote lending and assist borrowers.

The following changes are on top of additional relief programs for small businesses, such as the Paycheck Protection Program and Economic Injury Disaster Loans, and went into effect Feb. 1:

-

Loan limits increased. As of Jan. 1, 2021, the borrowing limit for SBA Express loans was increased from $350,000 to $1 million. That maximum will permanently drop to $500,000 on Oct. 1, 2021.

-

Fees waived. For 7 and 504 loans, the SBA will eliminate fees for both lenders and borrowers.

-

Loan guarantees increased. Until Oct. 1, 2021, the SBA will guarantee 90% of loans from its 7 program and 75% for SBA Express loans of more than $350,000. The maximum SBA guarantee is usually 85% for loans up to $150,000, 75% for loans greater than $150,000 and 50% for Express loans.

-

Payments covered. The government will make monthly payments of up to $9,000 on eligible SBA loans. The number of payments you can receive will depend on when your loan was approved, issued or disbursed.

The SBA provided updated guidance on Feb. 16, 2021, regarding payment relief options for eligible 7 and 504 loans:

Payments are subject to the availability of funds, so the number covered may change in the future.

Additional Requirements For Obtaining A Small

Personal credit that is in good standing can help you qualify for reduced rates and more lending possibilities. Consider improving your credit score if you dont require business finance right away.

Several personal finance websites, including NerdWallet, provide free credit score access if you dont know your credit score or want to keep track of it on a regular basis. Keep track of your accomplishments and expand your options for financing your company.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan