How The Dealer Gets Paid

And yes, they do! Dealers have a point-share agreement with the finance companies they accept. That means the loan company or bank will give them a point or a share of the interest fees you pay for processing the loan. So even if youre not financing through the dealership, the dealer gets paid if they are in the Auto Navigator database.

I all, it was the simplest transaction weve ever had. In the past we have financed with the dealership and while the rate was goodusually better than the banks it took forever. This time the loan approval process was a breeze. That the dealer had to print out literally dozens of pieces of paperwork, and reprint most of them because I found mistakes on almost every single one, well, thats not Capital Ones fault.

But maybe its their opportunity to make that part better, too.

Financed Car Insurance Requirements

Most people dont buy a car outright they take out a car loan to pay for it. That means the car is still owned by the lender until the loan is paid off.

Are there car loan insurance requirements? Yes. The lender will want you to have full coverage car insurance on the financed car to protect their investment.

Otherwise, if the car is damaged or totaled, the lender would have to get the money from you for repairs or to replace it, which is much harder than having the insurance company pay for it.

Full coverage car insurance consists of the following:

- Liability insurance pays for property damage and injuries to others in accidents you cause

- Collision insurance pays for damage to your car regardless of who caused the accident

- Comprehensive insurance pays for damage to your car from flooding, hail, fire, vandalism, falling objects or animal collisions, and also covers theft

Capital One Auto Finance Application Process

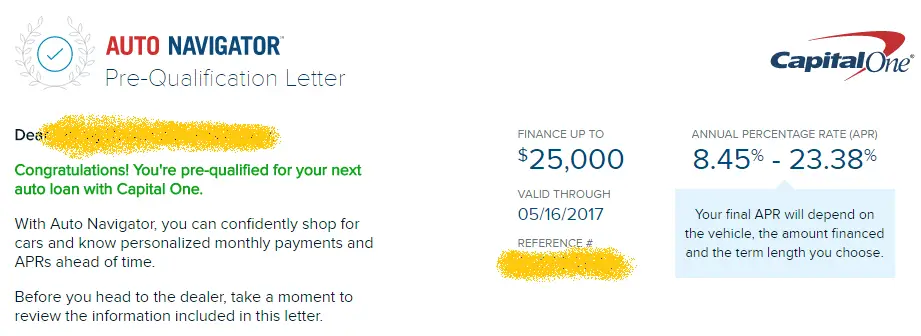

While you can apply for pre-qualification online, youll need to apply for a car loan through a participating dealership. You can bring your pre-qualification letter with you to streamline this process. Remember, its good for 30 days.

When you officially apply for a car loan through a dealership, Capital One will run a hard credit inquiry and give you your official financing terms.

Recommended Reading: Usaa Used Car Interest Rates

Negative Capital One Auto Loan Reviews

Many Capital One customers complain about not finding the same offers they were quoted after prequalification when they visited a participating dealer or financial institution.

I had to sit out of work due to the . I asked for them to put one payment on the end of my loan so it wouldn’t hurt my credit or have me stressed out. To no avail, they basically said no, you need to find a way to make the payment and maybe it won’t get reported to the credit bureaus.

– L.T. via Trustpilot

Don’t ever think about applying for an auto loan from them. Its a total nightmare. They basically damage your credit, and when you walk into the dealership with the approval you will find completely different numbers Stay away

– via Trustpilot

Buy Smarter With Pre Approval At Nj State Auto

When you get pre approved, youll be empowered to buy smarter and set more realistic expectations on what you can afford. Your prequalification will include the total amount you can borrow, interest rate, and potential monthly payments. Equipped with this information, you can effectively budget and consider the rest of your expenses, such as:

- Auto insurance

Don’t Miss: Using Va Home Loan For Investment Property

Auto Loan Refinancing Requirements

If youre buying a used car, the amount you want to finance must be at least $4,000. Furthermore, the vehicle cannot be older than 10 years or have more than 120,000 miles.

To refinance, your outstanding loan amount must be between $7,500 and $50,000 and you must be current on it. Your car must also be no more than seven years old, and your current loan servicer cannot be Capital One. If you own a vehicle thats no longer being manufactured, its ineligible for refinancing.

Capital One Auto Refinance Details

Capital One offers auto refinance loans for used and new cars, light trucks, minivans and SUVs owned for personal use. You can apply for these loans individually or jointly. Getting a cosigner for your auto loan refinancing can be a smart idea if you have poor credit or youre looking to get a lower annual percentage rate .

Heres a closer look at what Capital One auto refinance offers:

| Loan Amount Range |

| Based on your credit profile |

| Loan Term |

You May Like: What Is The Fha Loan Limit In Texas

Is Capital One Right For You

Our Auto Navigator tool does a soft credit check for pre-qualification. The tool allows you to check even on minor finance details if you are buying on a tight budget. Remember, we provide loans to those who want to build their credit score. We offer a handy loan calculator if you’re going to check numbers before applying for pre-qualification. Our network of dealers is from all states except Alaska and Hawaii, with millions of cars in our inventory.

How We Rate Capital One

| Overall Rating | |

|---|---|

| Customer Experience | 8.0 |

While its best known for its credit card offerings, Capital One also provides financial services including refinancing auto loans. Capital One auto refinance allows you to prequalify to refinance your vehicle without hurting your credit score. This makes it an excellent choice for borrowers who want to explore all of their options.

In this article, we at the Home Media reviews team will explain how Capital One auto refinancing works, how long the application process takes and who typically qualifies. We recommend reaching out to several providers to find the best auto loan and refinancing rates.

Headquarters: McLean, Va.Better Business Bureau rating:A

Capital One was founded in 1994 in Richmond, Va., as a credit card company. Its now the nations sixth-largest retail bank and the largest auto loan provider in the banking industry. Borrowers can get auto loans or refinance existing auto loans through Capital One. However, auto loan services arent available in Alaska or Hawaii.

The financial institution has an average customer service reputation. Capital One is accredited by the BBB and holds an A rating from the organization.

You May Like: Auto Loans For Self Employed

Best For Excellent Credit: Lightstream

- : New/Used/Refinance: 2.49% to 9.49%, Lease Buyout: 3.49% to 10.49%

- Loan range: $5,000 to $100,000

- Loan length: 24 to 84 months

- Available in all 50 states

If you have a good or excellent credit score, you might want to consider LightStream in addition to Bank of America. A part of SunTrust Bank, Lightstream focuses on auto loans to customers with good or better credit.

Because it focuses on a narrow subset of customers, its rates don’t go too high For a 36-month loan for a new car purchase between $10,000 and $24,999, interest rates range from 2.49% to 6.79%. However, borrowers with lower credit scores may find better rates elsewhere.

Best Way To Buy A Car

I had not so great credit wasnt getting approved for auto loans below 11% got pre approved and found the car I wanted. Called customer service before I went to the auto place to have everything solid. Went to buy the car, the dealer told me it was sopposed to be $71 more dollars than what capital one had said. I called cap 1 customer service back from the dealership and put them on speaker. Suddenly the dealership changed their mind and was ok with my price and payment. Dealers will always try to get money out of you. They will do it in finance. I ended up getting a loan for 6% thru capital one!

Don’t Miss: Interest Rate For Car Loan With 650 Credit Score

Capital One Reviews And Reputation

Capital One is accredited and holds an A rating from the Better Business Bureau . It was named one of the best places to work by Fortune magazine in 2017 and is well regarded within the financial services industry.

Despite this, Capital Ones online customer review profile is average. It has a 1.1 out of 5.0-star customer rating on the BBB website and a Trustpilot score of 1.3 out of 5.0 stars. Its important to note a few things about these low ratings. First, many customer reviews mention Capital Ones banking services, not its auto loans. Second, although auto loans are only a small part of Capital Ones business, complaints from banking customers may still speak to the overall quality of the company.

Finally, keep in mind that Capital One is a large company with many products and services, millions of customers, and billions of dollars of revenue. Though there are thousands of complaints online, these represent a small fraction of total Capital One customers.

What Sets It Apart

Capital One is known for its credit card options, but the company also offers tools to help you find and finance your next vehicle. Not only can you filter your search by dealer and car, but loan terms could include the price of the car as well as the tax, title and other relevant fees, lowering your total out-of-pocket cost.

Not all dealerships work with Capital One and if you dont already have an account, you wont be able to apply. You can compare more car loan options to see what other rates you might qualify for.

Recommended Reading: Gustan Cho Mortgage Reviews

Getting An Auto Loan With Bad Credit Here’s What You Need To Know

If you’re shopping for a car loan with bad credit, you could benefit a lot by doing your research and shopping around when looking for an auto loan. Avoid any “buy here, pay here” financing, as these loans often come with exorbitant interest rates and high monthly payments, which could cause you to default on your payments.

A local credit union might be a good place to start if you have a bad credit score sometimes lenders like these can be more forgiving and offer lower interest rates than big banks.

Make Sure You Have Good Credit

Having a good credit score is essential if you want to get approved for an auto loan with decent terms. In general, a good FICO® Score ranges from 670 to 739, and a higher score is even better.

Auto lenders typically use the FICO 8 or FICO Auto Score models to determine your score. Keep in mind, though, that lenders may have their own rubric for determining what they consider to be good or not. But if your credit score is at least in the good range, you’ll have a relatively good chance of getting approved.

Also, note that lenders may choose to approve you for a car loan even if you have a less-than-ideal credit score. But they may charge you a higher interest rate or require a cosigner with strong, established credit. Some lenders specialize in working with people who have bad credit scores, but these loans can be expensive, so it’s a good idea to work on improving your score before you apply.

Read Also: One Main Financial Approval Odds

How To Bank With Capital One

Capital One bank accounts are opened online through the Capital One website. Customers can use an existing Capital One login or create a new one. You’ll need to input personal information like:

- Name

- Social Security number

Capital One is a great banking option for individuals comfortable doing most of their banking online. There are enough account options to appeal to a wide range of people. With few local branches, most banking is either done through an online account or Capital Ones mobile app. Its not the right bank for you if you enjoy stopping in at your local branch for in-person banking service. While Capital One doesnt offer the highest rates compared to other banks, its rates are consistently high overall.

Is Capital One Trustworthy

Capital One is rated an A by the Better Business Bureau. The BBB, a non-profit organization focused on consumer protection and trust, determines its ratings by evaluating a business’ responses to consumer complaints, honesty in advertising, and clarity about business practices.

Keep in mind that a top-notch BBB score doesn’t ensure you’ll have a good relationship with a company.

Capital One does have one recent controversy. The US Treasury Department fined Capital One $80 million after the Office of the Comptroller of the Currency said the bank’s poor security around its cloud-based services helped to account for a 2019 data breach in which a hacker accessed over 140,000 social security numbers and 80,000 bank account numbers.

Don’t Miss: Used Car Loan Rates Usaa

Be Able To Prove Your Identity And Residence

If you’re getting a loan from the bank or credit union you use regularly, you may not need to provide this information. If you’re working with a lender for the first time, however, you may need to provide a government-issued ID and proof of residence.

This is primarily because the lender wants to know where the car will be parked in case you default on payments and it needs to repossess the vehicle.

Again, requirements can vary by lender, but in general, a driver’s license or other government-issued ID with your current address can satisfy both. If you don’t have that, you can also provide a utility bill, lease agreement or bank statement with your address on it to prove your residence.

You Can Shop For A Car In The Auto Navigator App Too

Then I could shop from the cars in the Auto Navigator database. There are a number of filters for different types of cars, price, features, etc, and I could set a distance from home. I liked that I could shop with a dealer that wasnt close to homeIm willing to drive a ways to get the car at the price I want. As it turned out, we drove to a dealer about an hour away, so I was glad to have my financing lined up it wouldnt be convenient to come back to process loan paperwork.

Luckily for us, the car we were eyeing was at a dealer in the Auto Navigator database. So, we went to take a test drive.

Even when negotiating the purchase at the dealership I could adjust the terms of the loan on my Auto Navigator app, changing the downpayment, price and loan length to see the interest rate and monthly payment. This is so great when youre in a negotiation the power of the sale is literally in your hands.

Related: Buying a New Car? 9 Things You Need To KnowRight there on the Window Sticker

Don’t Miss: Usaa Loans For Bad Credit

What Apr Does Capital One Auto Offer On Its Car Loans

Capital One Auto offers a fixed apr car loan productthat ranges from 3.99% APR.

Your APR can vary depending on several factors, such as your credit score. Find out what your credit score is and whether there is any false or inaccurate information in your credit history with these credit monitoring tools.

Capital One Rates Fees And Terms

Capital One rates start at 3.99% APR for borrowers with excellent credit. However the rate you get can be affected by factors such as your credit score, credit history, debt-to-income ratio as well as the type of car you choose. It isnt clear what fees you could be charged or the maximum APR it offers.

But unlike many lenders, its upfront about the amount you can borrow. You can finance as little as $4,000 through Capital One, and loan terms last anywhere from 36 to 72 months.

Also Check: Credit Score For Usaa Personal Loan

Finalize The Details At The Dealer

Of the nearly 17,000 franchise car dealerships in the U.S., more than 12,000 partner with Capital One, so it shouldnt be difficult to find a participating dealer near you. You could also search by Vehicle Identification Number or for cars within a mile range of your ZIP code on the Capital One website.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Read Also: Usaa Refinancing Car Loan

Capital One Bank Customer Service

Customer service is available in a variety of ways, including:

- Phone

Customers can also track their accounts through a mobile banking app, which includes mobile deposit and bill pay features as well as access to your credit score and a card locking feature. The app has outstanding reviews, currently, a 4.8-out-of-5 on the App Store and 4.7 rating on .

Capital One Auto Finance Application Requirements

To qualify for a Capital One auto loan, youll need a minimum credit score of 500. Depending on your credit score, you will also need a minimum monthly income of at least $1,500 to $1,800. Capital One auto loans are available to residents of all states except Alaska and Hawaii. However, you cant use these car loans to purchase Oldsmobile, Daewoo, Saab, Suzuki, and Isuzu vehicles.

When youre ready to apply for a car loan, youll need to provide the following information:

- Personal information, including your address, email address, your drivers license, and your Social Security number

- Financial information, including your annual gross income and contact information for your employer

- Proof of residence, like a copy of a utility bill or a mortgage statement

- Proof of income, like a copy of a pay stub or three recent bank statements

Capital One does allow cosigners, which can increase your chances of being approved if you have poor credit. If you are applying for a Capital One car loan with a cosigner, they will need to be prepared to provide all of the above information, too.

Read Also: Auto Loan 650 Credit Score