First Why Should I Get A Home Equity Loan

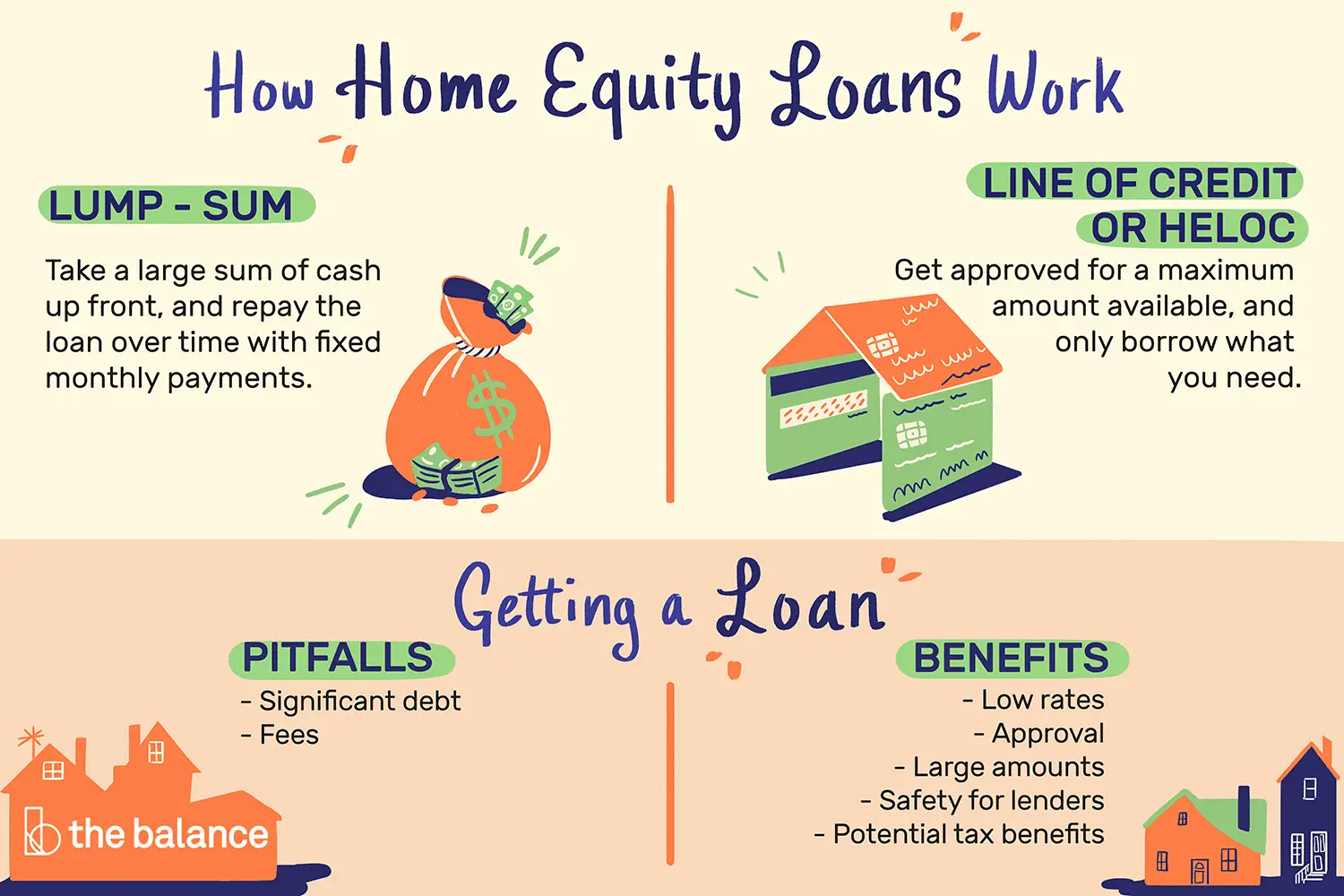

You may hear the terms home equity loan and home equity line of credit thrown around together. Theyre similar in that they allow you to borrow money against your home. However, the former provides you with a lump sum of cash, while the latter lets you draw money as you need it.

Homeowners are often drawn to home equity loans because these loans allow homeowners to borrow large amounts of money that might otherwise be difficult to obtain with credit cards or personal loans. Homeowners might use these lump sums to consolidate debt or pay off unexpected life expenses.

But banks and other large financial institutions are hesitant to give loans to borrowers with lower credit scores because they consider those borrowers to be a risky investment. But its still possible to qualify for a home equity loan with bad credit.

Consider Boosting Your Credit First

To increase your chances of getting approved, work on improving your credit and reducing your debt relative to your income.

- Check your credit report to see if there are any errors, such as lines of credit you didnt open or other issues, such as overdue payments.

- Pay bills on time every month. At the very least, make the minimum payment, but try to pay the balance off completely.

- Dont close credit cards after you pay them off. Either leave them alone or have a small, recurring payment every month. Closing cards reduces your and can cause your credit score to dip.

- Dont max out or open new credit cards. Maxing your cards out gives you a high , making you look like an irresponsible credit user.

- Pay down existing credit card debt to stay below the recommended 30 percent utilization rate.

Fixing your credit wont happen overnight. It takes discipline and time. But the rewards boosting your creditworthiness and gaining financial freedom are worth it.

Get A Home Equity Loan With Bad Credit

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

To get a home equity loan with bad credit, youll need more income, more home equity and less total debt than someone with good credit. Youll also pay a higher rate than you would if you had better credit, but it may be worth it to pay off high-interest debt or make some home improvements to boost your homes value.

Recommended Reading: Fha County Loan Limits Texas

Why Are There Closing Costs For A Home Equity Loan

Closing costs are needed in order to set up the home equity loan or home equity line of credit. The closing costs can cover the fee for the property appraisal to find the value of the home, the application fee, attorneys fees, a title search on the property, the mortgage preparation and filing fees, and the property and title insurance. Overall, you may be looking at fees that total up to between two and five percent of the total amount of the loan.

Get Your Free Credit Score & Monitoring

Plus Weekly Updates From Our 50+ Experts

When Does A Home Equity Loan Make Sense

While the pandemic created unique challenges in nearly every sector of the economy, the US housing market surprised everyone by holding strong, and that pattern has continued into 2021.

Recent data from the National Association of Realtors shows that, from June 2020 to June 2021, the median price for single-family existing homes saw a near-record year-over-year increase of 22.9%. And interest rates for many financial products continue teetering near record lows.

This has left many consumers wondering if nows the best time to access the equity thats built up in their homes over the last few years. If you have a lot of cash trapped in your home, its smart to learn more about home equity products, how they work and how you can use them to reach specific financial goals. Lets take a deeper look at home equity loans and why now may be a great time to consider one.

You May Like: What Is The Maximum Fha Loan Amount In Texas

How To Calculate Home Equity

To calculate how much home equity you potentially have, subtract the liens against your house from its current value:

Most of the time, a bank will lend up to 80 percent of your homes equity. Lets say your house is worth $250,000 and you owe $100,000 on your mortgage. You have $150,000 in home equity, 80 percent of which is $120,000. Sometimes there will be a minimum amount you can borrow, usually between $10,000$25,000. Its important to remember that different lenders will offer you different rates. Be sure to thoroughly compare the best home equity loans before you make a decision.

| Label |

|---|

Where To Apply For A Home Equity Loan If You Have Bad Credit

If youre looking for a home equity loan with bad credit, there are a number of lenders that may be able to help you out.

-

Banks and credit unions. The bank or credit union where you have an account may offer you more competitive rates and terms than other lenders. However, banks and credit unions have stricter requirements so they may not approve you for a home equity loan if your credit score falls below a minimum threshold.

-

Non-prime home equity lenders. Non-prime lenders may be able to offer you a home equity loan that simply wont be available at a bank or credit union. However, youll likely get a higher interest rate.

-

Online lender comparison sites. These sites can help you easily find out the bad credit home equity loan options available to you based on your credit score and other information.

You May Like: Usaa Personal Loan With Cosigner

Home Equity Line Of Credit Calculator Faqs

You can calculate home equity by subtracting the amount owed due to the mortgage from the current estimated value of the house. You may also make use of our Home Equity Line of Credit Calculator to determine further how much you can borrow based on your current home equity.

A home equity loan provides a line of credit from which you can borrow over time up until a specific limit. The loan, however, is secured by the equity of your home. The loan is to be repaid over a period, and failure to do so leads to foreclosure of the home used as collateral.

The amount of money you can get for a Home Equity Loan is chiefly determined by how much equity your home currently has. Your equity, in turn, is arrived at by subtracting the amount you owe in mortgage loans from the current value of your home. Most lenders offer only 75-90% of your current home equity up for borrowing.

An equity line of credit calculator shows you how much you can borrow based on your current home equity. It also clarifies how that amount will vary with a change in the value of your home.

To use an equity line of credit calculator, you feed in the current estimated value of your home, then the amount owed on your mortgage, and the loan-to-value ratio which your lender offers. The calculator provides you with the line of credit that would currently be available to you. The calculator also reveals what line of credit that will be available to you if the appraisal value of your home changes.

What Kind Of Credit Score Do You Need To Get A Home Loan

Your credit score is an important measure of your financial stability and health. It’s at the core of any loan or line of credit, including home loans. A credit score not only determines your loan approval but the terms of the loan, too. If your credit score is good, you’ll enjoy lower interest rates and payments. If you have bad credit, expect to pay more for your loan upfront and over the life of the mortgage. In general, credit scores are ranked like this:

Recommended Reading: Can I Buy A Mobile Home With A Va Loan

Avoid Two Mortgages With A Cash

With home equity loans, theres more predictability than with home equity lines of credit. Youll still be taking out a second mortgage, which means youll have two hefty payments to make each month.

If youre concerned about your ability to juggle two mortgages, you may want to choose a cash-out refinance instead. A cash-out refinance will pay off your primary mortgage and allow you to borrow against your existing equity. This loan option is particularly compelling if interest rates are currently lower than when you purchased your home, as it will replace your existing mortgage with a new loan that has a different interest rate and terms.

To learn more about cash-out refinances and find out how much money you can obtain from your home equity, create a Rocket Mortgage® account.

Get approved to refinance.

Home Equity Loans Guide

Home equity loans and home equity lines of credit allow homeowners to borrow money against their homes equity.

Borrowing against your home equity is one way to finance home renovations instead of using a home improvement loan. Both home equity loans and HELOCs are tax-deductible when funds are used for home renovations. Below we will discuss how to get a home equity loan and the different options available.

Don’t Miss: Oneaz Auto Loan

Other Companies We Considered

The following lenders may have a higher complaint ratio with the CFPB, lacked price transparency or werent featured in J.D. Powers 2021 Primary Customer Satisfaction Study, which means they didn’t make our top list. Nevertheless, they may have other features worth considering, especially if youre interested in a home equity line of credit.

PNC

How Can I Determine How Much Equity I Have In My Home

To determine how much equity you have in your home, you’ll need two numbers.

The first is how much you still owe on your mortgage. That number may be on your monthly mortgage statement or the mortgage amortization table provided by your lender. Or, you can simply call your lender and ask.

The second number is how much your home is currently worth. You can get a ballpark estimate by asking a local real estate agent or checking what homes comparable to yours have sold for recently. For a more precise estimate, you can hire a professional real estate appraiser.

Also Check: How Much Do Loan Officers Make In Commission

What Is A Heloc

A HELOC is a line of credit that operates similar to a credit card. As with a home equity loan, your home is the collateral that secures the loan. This loan product lets you borrow money on an as-needed basis. At the beginning of the loan, theres a draw period that typically lasts for 10 years. During this draw period, youre responsible for making interest-only payments.

However, once the draw period ends, youre required to begin making payments toward the interest and principal portion of the remaining balance. Also, if you sell your home during the loans term, youll have to pay off the remaining balance in full.

Unlike home equity loans, HELOCs typically have variable interest rates. To secure the best interest rate, you need to have a good to excellent credit score, a good debt-to-income ratio and a healthy income.

How A Heloc Affects Your Credit Score

Although a HELOC acts a lot like a credit card, giving you ongoing access to your homes equity, theres one big difference when it comes to your : Some bureaus treat HELOCs of a certain size like installment loans rather than revolving lines of credit.

This means borrowing 100% of your HELOC limit may not have the same negative effect as maxing out your credit card. Like any line of credit, a new HELOC on your report will likely reduce your credit score temporarily. However, if you borrow responsibly making timely payments and not utilizing the full credit line your HELOC could help you improve your credit score over time.

Recommended Reading: Can You Get A Va Loan On A Manufactured Home

Harmful Home Equity Practices

You could lose your home and your money if you borrow from unscrupulous lenders who offer you a high-cost loan based on the equity you have in your home. Certain lenders target homeowners who are older or who have low incomes or credit problems and then try to take advantage of them by using deceptive, unfair, or other unlawful practices. Be on the lookout for:

- Loan Flipping: The lender encourages you to repeatedly refinance the loan and often, to borrow more money. Each time you refinance, you pay additional fees and interest points. That increases your debt.

- Insurance Packing: The lender adds credit insurance, or other insurance products that you may not need to your loan.

- Bait and Switch: The lender offers one set of loan terms when you apply, then pressures you to accept higher charges when you sign to complete the transaction.

- Equity Stripping: The lender gives you a loan based on the equity in your home, not on your ability to repay. If you cant make the payments, you could end up losing your home.

What Documents Are Needed

Getting a home equity loan is a thorough process. Youll need to pull together the following information and documents:

- Property information .

- Estimated property value.

- Personal information .

- Employment and income information.

- Debts such as auto loans, student loans, credit cards, current mortgage and home equity accounts.

- A completed and signed Internal Revenue Service Form 4506T.

- Copy of your most recent pay stub that reflects earnings for the past month and year to date.

- The most recent two years of W-2 forms from your employer.

- Self-employed borrowers will need the most recent two years of personal IRS tax return documents , the most recent two years K-1s from the partnership, LLC or S Corporation.

- Proof of homeowners, hazard and flood insurance.

Don’t Miss: Usaa Rv Loans

What Percentage Can You Borrow On A Home Equity Loan

Most home equity lenders allow you to borrow 80-85% of your homes equity, minus the mortgage balance. Therefore, you need 15-20% equity to qualify for a home equity loan.

To build your home equity, pay down your mortgage. You can speed up the process by paying more than the minimum monthly installments. Also, make home improvements through renovations that improve its value.

However, the actual amount you will get depends on other factors like your credit score, income, debt repayment history, and debt to income ratio.

What Your Credit History Says About You

While your credit score is a key measure for determining your creditworthiness, lenders also like to check your credit report to see if there are any red flags.

For example, it’s possible to have a decent credit score but have bankruptcy on your credit report from a few years ago. In this situation, the bankruptcy could hurt your chances of getting approved.

More important, lenders will want to see how you’ve handled past mortgage loans. If you have a short sale or foreclosure on your report, it could be a deal breaker.

Again, check your credit report to make sure there aren’t any errors or fraudulent accounts. If you’ve filed bankruptcy in the last few years or have a short sale or foreclosure, you may still have a chance of getting a home equity loan. It just means you’ll need to do more legwork to find lenders that are willing to work with you.

Don’t Miss: Usaa Auto Loan Application

Can I Get A Mortgage If My Credit Score Is Low

When we talk about minimum credit scores required to get approved for a mortgage, were talking about conventional lenders, such as big banks. These traditional lenders are usually quite stringent about their mortgage approval requirements, including the credit scores needed for mortgage approval.

There are options for bad credit borrowers who are looking for a mortgage to finance a home purchase. Credit unions, trust companies, and subprime lenders are potential sources for mortgages for borrowers who cant qualify with their banks because of their sub-par credit scores. These sources often deal with people who may be viewed as risky to conventional lenders.

Have you considered a bridge loan to help purchase the home of your dreams?

It should be noted that if you do plan to apply for a mortgage with one of these lenders with a bad credit score, you will likely pay a higher interest rate than you would if you had a higher credit score and applied with a conventional lender.

Thats why its best to consider taking the time to improve your credit score before applying for a mortgage. That way youll have an easier time getting approved for a home loan and clinch a lower rate, which will make your mortgage less expensive.

Loans Canada Lookout