Apply For An Fha Or Lower

With at least a 580 score and a 3.5% down payment, you may be able to qualify for an FHA loan. Some lenders, however, have higher credit score requirements, so you may not be approved by all lenders.

FHA loan, you must pay mortgage insurance, also known as a mortgage insurance premium, for the life of your loan. Mortgage insurance benefits the lender because it protects them against the possibility of you defaulting on your loan payments. The mortgage insurance premium is currently 1.75% upfront, then 0.75% to.855% annually.

Suppose you are a veteran, VA loans are the best choice the VA doesnt set an entrance limit credit score, but lenders typically prefer borrowers with a 660 or higher score. The same can be said for USDA loans, which are available to some borrowers in rural and suburban areas, though lenders prefer borrowers with a credit score of 640 or higher.

Why Is A Subsidized Loan Better Than An Unsubsidized Loan

The government pays the interest on subsidized loans while youre in school up to six months after graduation. Subsidized loans have lower interest rates than unsubsidized loans. Unsubsidized loans can be used for graduate school. You dont need to demonstrate financial need for an unsubsidized loan.

What is the average length of a personal loan? Personal loan amounts can range from $1,000 to $100,000, while loan terms range from 12 months to 84 months. A longer loan term will result in lower monthly payments, but higher interest costs.

Credit Score Needed To Get A Mortgage

While your credit score is an essential consideration in home loan eligibility, it is not the only one. Lenders are also concerned with the following factors:

- Down payment: Depending on the loans and the lenders, youll need to put down a minimum of 0% to 5%.

- Debt-to-income ratio : You should have a DTI of 36% or less. It cannot exceed 45% to 50% of your income in most cases.

- Cash reserves: With a low credit score or a low down payment, you may need to pay 6 months worth of mortgage in the bank.

Minimum credit score to buy a house by loan type:

Note: on này thêm vào chèn offer

Borrow $2,000 for 12 months with a 19.9% representative APR and a monthly repayment of $183.63.

Total repayment will be $2,203.56.

- FHA loan: 500

Minimum credit score required: 500 or 580

If your credit score is around the 500s, your best option for a home loan is one that the Federal Housing Administration insures. The credit score requirements vary depending on how much money you intend to put down.

Heres how it works:

- Minimum 500 credit score, requires 10% down payment

- Minimum 580 credit score, requires 3.5% down payment

- Conventional loan: 620

Minimum credit score required: 620

Though a conventional loan with a credit score as low as 620 may be possible, these mortgages frequently require higher scores.

- VA loan: 620

No minimum credit score is required officially, though many lenders prefer 620.

- USDA loan: 640

No minimum credit score is required officially, though most lenders prefer 640.

Read Also: Car Loans With A 600 Credit Score

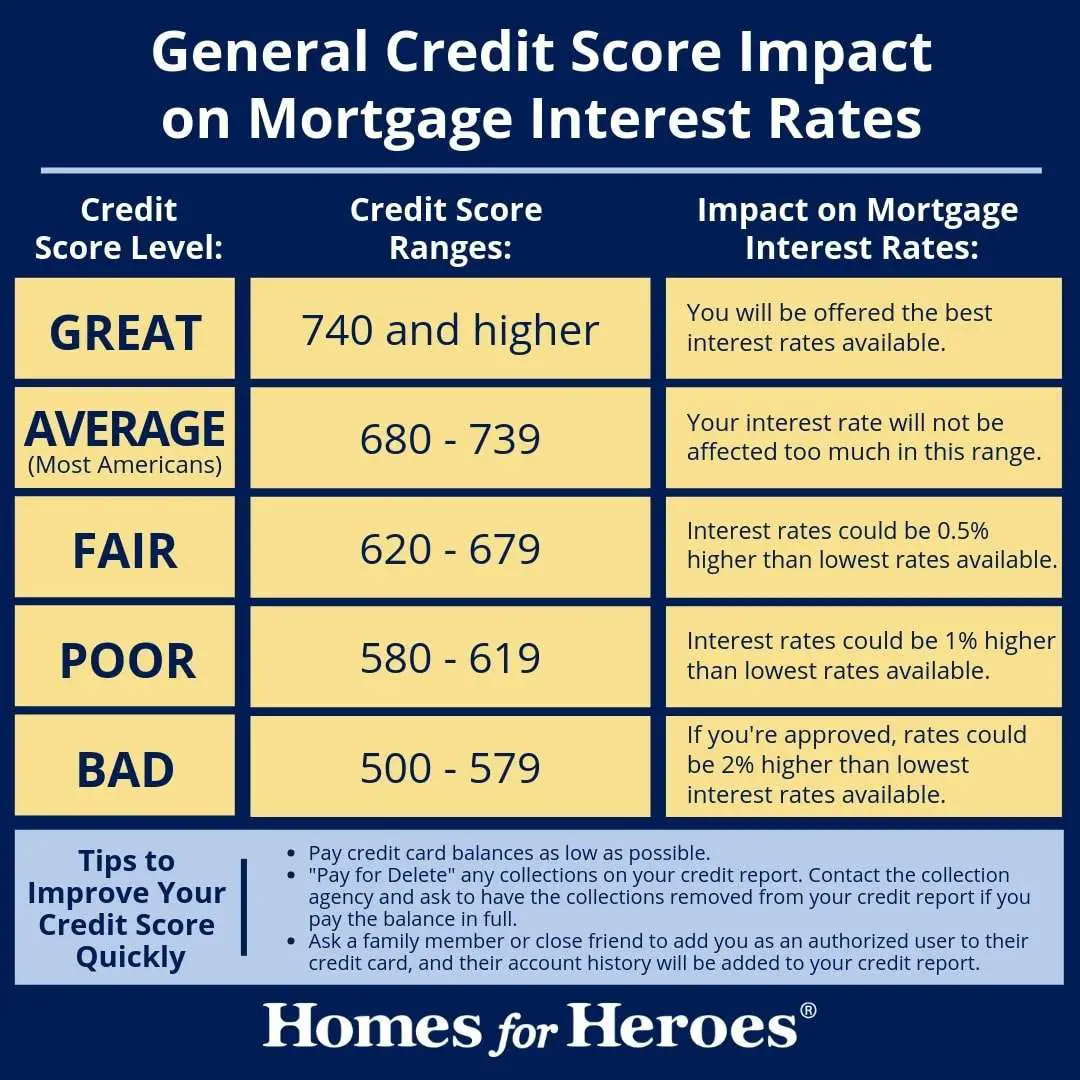

How Your Credit Impacts Your Mortgage Approval

Good credit is key to buying a home. That’s because lenders see your credit score as an indication of how well you handle financial responsibility. That three-digit number gives them an idea of how risky it is to lend to you after all, they want to make sure you pay back what you borrow, especially for a large purchase like a house. Your score could be the difference between getting an approval for a mortgage and getting turned down.

Your credit also impacts your mortgage approval another way: it might be used to help determine the rate and terms of your mortgage. If you have a higher credit score, you might get a lower interest rate or more flexible payment terms.

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Also Check: Usaa Auto Refinance Rates

What Should My Credit Score Be To Get The Best Mortgage Rates

Hereâs a brief overview of what your credit score looks like to lenders and mortgage brokers. The higher your credit score, the better rates you can qualify for.

-

741 or more: Wow â your credit score is excellent! This is where the best mortgage rates live.

-

713 to 740: You have a good credit score. You should receive a very good interest rate on your mortgage and have plenty of options.

-

660 to 712: This is considered a fair credit score by lenders. However, once you get to 660, youâll be entering average credit score territory.

-

575 to 659: In the eyes of banks and lenders, this is a below-average credit score. If your credit score is below 640, you might have trouble getting a conventional mortgage from a bank or online lender. Consider working on improving your credit score before applying for a mortgage.

-

300 to 574: Your credit score is poor and needs improvement, but thatâs OK. As your credit stands right now, youâd be considered a high-risk borrower. Even if youâre approved for a mortgage, you would end up paying extremely high interest rates. You should make an effort to improve your credit score in order to access better mortgage rates in the future.

For every 20-point increment that your credit score drops, youâll likely see small changes in the interest rate youâre offered. Lenders typically adjust their offer rates each time your credit score moves up or down by 20 points.

Excellent Credit Score Home Loans

An excellent credit score of 750 and above is the best place to be when youre shopping for a mortgage. It will help you get the lowest interest rate whether you want a conventional, USDA, VA, or FHA loan:

- Conventional loan: With an excellent credit score, youll be able to get competitive bids from multiple lenders on a conventional loan. And, if youre putting down less than 20%, an excellent credit score will help you get the most favorable PMI premiums.

- USDA or VA loan: Qualifying borrowers with excellent credit might still choose a USDA or VA loan if they dont have a down payment.

- FHA loan: Theres little reason to get an FHA loan when you have excellent credit. You will probably qualify for a conventional loan and avoid paying the FHAs mortgage insurance premiums. An exception might be if your DTI ratio, including your proposed mortgage payment, is 45% to 50% and youve been rejected by multiple lenders for a conventional loan.

Find Out: 800 Credit Score Mortgage Rate: What Kind of Rates Can You Get?Other factors your lender will consider for your mortgage rate:

- Income: Youll need a documented history showing two years of steady income in the same line of work.

- Debt: Your debt cannot consume so much of your income that your mortgage and living expenses wont be manageable.

- Down payment: The higher your down payment, the less risky you are to lenders. The gold standard is 20% or more.

Find Out: How to Get the Best Mortgage Rates

Read Also: How Long Do Sba Loans Take

Ways To Increase Credit Score Quickly

While a CIBIL score proves your financial mettle, being able to service a loan hinges on another parameter as well, such as your debt-to-income ratio. To get a home loan that matches both your CIBIL score and your debt-to-income ratio, use a Home Loan Eligibility Calculator or simply before applying and avail home financing on personalized terms. Single-step verification here gives you instant approval through a customized home loan deal.

DISCLAIMER:While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent inaccuracies or typographical errors or delays in updating the information. The material contained in this site, and on associated web pages, is for reference and general information purpose and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. In case any inconsistencies observed, please click onreach us.

*Terms and conditions apply

Credit Score Home Loan Options

Now that you have established that you have the minimum credit score of 620 that lenders will be basing their judgment on, what would be the best type of mortgage for you?

The answer: it will still depend on your particular circumstances.

Just as you want to buy a house for your own personal reasons, there is also no cookie-cutter mortgage deal that would be the best fit for everyone.

Lets take a look at some of the home loans you can choose from.

You May Like: Which Of These Loan Options Is Strongly Recommended For First-time Buyers

Work On Rebuilding Your Credit

If you find that you cannot obtain a loan, you should take steps to improve your creditworthiness. Examine your credit report again to determine what is affecting your credit score, and then take steps to improve it. Consider lowering your debt-to-income ratio by increasing your income, paying off debts, or both.

Consider using credit monitoring tools some are free, while others are provided by your credit card issuer to keep track of your credit score and determine when its time to apply for a home loan.

Have you discovered an answer to the question: How to buy a house with bad credit? Yes, but you may face numerous challenges along your way. If you have good or excellent credit, the down payment or interest rate is not a big deal. Therefore the best solution right now is to find a way to improve your credit as much as possible. Allow HanFincal to provide you with sound financial advice to boost your financial health.

==> Read More:

Who Sets Va Loan Credit Score Requirements

It’s important to understand the VA’s role in the VA loan process. The VA doesn’t set a minimum credit score requirement but instructs lenders to make sound judgments.

The VA’s role is to oversee the program and guarantee a portion of each loan in case of default. But the VA does not issue loans, and the agency does not enforce credit score minimums. Private lenders handle both of these duties.

Most VA lenders use credit score benchmarks. Applicants with scores below a lender’s standard usually can’t be approved for VA financing. That minimum will vary from lender to lender.

You May Like: Usaa Auto Pre Approval

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Why Is It Important To Get Pre

Getting pre-approved for a mortgage gives a person bargaining power since they have mortgage financing already lined up and can therefore make an offer to the seller of a home in which they are interested. Otherwise the prospective buyer would have to go out and apply for a mortgage before making an offer and potentially lose the opportunity to bid on a home.

Read Also: Car Loan Interest Rate With 600 Credit Score

What Credit Score Is Needed For A Va Loan

Qualifying service members, veterans and surviving spouses can buy homes with little or no down payment and no private mortgage insurance requirements, thanks to housing benefits from the U.S. Department of Veterans Affairs, commonly known as VA loans. Issuers of VA loans have some discretion in setting minimum credit score requirements, but they may accept applications from borrowers with FICO® Scores as low as 620.

Want To Buy A House Heres The Credit Score Youll Need To Do It

Andy Smith is a Certified Financial Planner , licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

Your credit score plays a major role in your ability to secure a mortgage loan. Not only does it impact your initial qualification for a loan, but it also influences your interest rate, down payment requirements, and other terms of your mortgage.

Are you considering buying a house, and making sure your credit is ready? Heres what you need to know.

Don’t Miss: Can I Buy Land With A Va Loan

Does Bajaj Finserv Check Your Cibil Score For Home Loan And Balance Transfer

Yes. Like other lenders, Bajaj Finserv also checks your CIBIL score before giving the green signal on a home loan or a home loan balance transfer application. The Bajaj Finserv Home Loan offers you high-value financing, up to Rs. 5 crore, at one of the lowest interest rates in the country. You can repay your loan via a tenor of up to 30 years and make prepayments and foreclose your loan at no additional charge. Since it is an economical solution, you may want to transfer your existing home loan to Bajaj Finserv. You can do so quickly and with minimal documentation.

As a general rule, the minimum score for a home loan is 750. The minimum score for a balance transfer can be slightly lower and depends on internal policies and other factors.

What If I Fall Short On Credit Requirements

Potential VA loan borrowers needn’t abandon their dreams of homeownership due to a low credit score. The best feature of credit is its fluidity. Your credit changes constantly.

Improve your fiscal habits, and your credit score will gain positive momentum. But knowing what improvements to make can be tricky. Should you pay off high-interest debt? Should you cancel certain credit cards? How should you handle that bankruptcy looming over your credit report?

If you’re considering a VA loan but need help navigating your credit options, get some free help from the Veterans United credit consultant team.

Our credit consultants work on behalf of service members who fall short of VA loan requirements. Working with a credit consultant is a no-cost process, but not necessarily an easy one. Improving your credit requires commitment and hard work. If you’re ready to make the necessary changes to pursue a VA home loan, partner with a helpful advocate.

Read Also: Bayview Loan Servicing Payments

Can You Get A Mortgage With Bad Credit

A bad credit score for a mortgage is below 620. While its possible to get a mortgage with bad credit, youll pay higher interest rates and have higher monthly payments.

If your credit is lower than the minimum required, you might still be able to get the loan if you add a co-signer to the mortgage, make a larger down payment or lower your debt-to-income ratio.

What Is The Difference Between Pre

Both pre-qualification and pre-approval involve a review of an applicant’s credit report. The difference is the degree of credit review. Pre-qualification involves a quick review of one’s credit and only provides a potential borrower with a general idea of how much mortgage they could qualify for and under what terms. Pre-approval involves a full credit review, while only offered for a limited time window, provides the potential borrower with a solid offer of credit from a lender with which they can use to make good faith offers on homes for sale.

Also Check: Prosper Loan Denied After Funding

What Are The Risks Associated With Private Home Loans

In general, the biggest risk youll face when you take a bad credit home loan is being unable to make the monthly mortgage payment. The result may be the loss of your home through foreclosure. Some mortgages are especially risky, including those that charge adjustable rates or interest only,

To avoid this kind of fate, you want to know all the facts concerning a subprime mortgage or home equity loan.

The Home Ownership and Equity Protection Act of 1994 was enhanced in 2013 by a new rule meant to protect consumers who take out high-interest home loans. The 2013 Rule applies to lenders who charge high interest rates .

The Rule applies to mortgages, refinancings, home equity loans, and home equity lines of credit .

The HOEPA was created in 1994 to protect borrowers who take out high-interest mortgages.

Under the 2013 Rule, high-cost lenders must disclose certain information, such as prepayment penalties and other fees. In addition, these lenders must recommend borrower counseling.

A recent study found that certain lenders price their interest charges right below the mortgage rate threshold that triggers the Rule. The study indicates that certain lenders are willing to forego higher interest rates to skirt the HOEPA rules.

The advice to prospective borrowers is to read the fine print before agreeing to a subprime mortgage contract.