What Is A Good Interest Rate For A Car Loan

The average APR for an auto loan was 9.46% in 2020, but its possible to get a lower rate, especially if your credit is strong. tend to offer some of the lowest starting rates weve seen if you meet their membership requirements, which may be easier than you think. Car manufacturers offer 0% financing, but those deals require high credit scores and only apply to certain models. Used car loans tend to have higher starting rates than new, but manufacturers do offer APR deals on certified pre-owned cars.

Schoolsfirst Federal Credit Union

Loan amount: Up to 100 percent of the MSRPTerms: 36 to 84 months

SchoolsFirst Federal Credit union offers many financing options and deals for its members. The credit union is partnered with companies like Autoland and Enterprise to bring customers exclusive savings. It also offers discounts on Guaranteed Asset Protection insurance and options for no payment for 90 days.

Along with all the different ways to save, SchoolsFirst also gives borrowers the choice of how to apply for a loan: online, on the phone or in person. Members include current and retired school employees and their families.

What Is The Difference Between An Auto Loan And A Personal Loan

It’s possible to use a personal loan or an auto loan to finance a vehicle, but the two differ in some important ways:

- Purpose: Personal loans are unsecured or secured and can be used for many different purposes, including to finance a vehicle, pay for a vacation, or make improvements to a home. Car loans, however, are strictly to finance a vehicle and are secured against the vehicle you purchase. The vehicle serves as collateral.

- Interest rates: Because auto loans are secured, rates on car loans are generally lower than personal loans.

- Availability: Auto loans are typically easier to obtain than personal loans, especially for those with a poor credit history.

Also Check: Mortgage Loan Officer Definition

Consumers Credit Union Review Details

Consumers Credit Union is an Illinois-based credit union that lends nationwide.

Consumers Credit Union offers refinancing for existing car loans, with no restrictions on vehicle age and mileage. Applying to refinance is easy: You can complete the process online or over the phone, and a representative will reach out to you. Most application decisions are made within 24 hours, and it offers same-day funding, although its average funding time is four days.

You can get a rate estimate from Consumers Credit Union with no impact on your credit. If you decide to refinance with Consumers, the lender will initiate a hard credit pull that will slightly lower your credit score. Once your refinancing loan is finalized, the funds will be sent to your previous lender to pay off your old loan.

Consumers offers automatic payment discounts: a 0.5% rate reduction with automatic payments from a Consumers Credit Union account and 0.25% rate reduction with automatic payments from another financial institution.

- You must become a member to get a loan.

Best for borrowers who value the services offered by a credit union.

Security Service Car And Truck Loan Rates

To view rates, enter your zip code above.

Your zip code is required so we may provide you with accurate rate information.

Membership eligibility required. Subject to credit approval. APR= Annual Percentage Rate. Rates effective as of 10/23/2021. Final rate is determined based upon term, creditworthiness, amount financed, and other criteria. Offer to refinance does not apply to current SSFCU loans. Other restrictions may apply. Rates are subject to change without notice. Offer ends 12/31/2021.

The minimum amount to finance for 60 month terms is $10,000.00. The minimum amount to finance for 66 month terms is $15,000.00. The minimum amount to finance for 67-75 month terms is $20,000.00. The minimum amount to finance for 76-84 month terms is $25,000.00. For vehicles over 100K miles, an additional 1.00% will be added to the rate.

View our Vehicle Loan Payment Examples.

Security Service offers a variety of terms and rates to assist our members in purchasing vehicles. Based on the year selected, the available terms and rates are displayed above.

- If a zip code entered is not in one of our service areas, the rates will default to Texas rates.

- Actual rate will be given at the time of closing based on terms of the loan and credit worthiness.

INSIDE

Recommended Reading: Can I Transfer My Mortgage To Another Bank

How Do Lenders Come Up With My Rate

A few different factors help lenders determine the car loan interest rates youll be offered. The more well-rounded your application, the better your chances of scoring a low rate. Although there are many factors that may play a role in your interest rate, these are the four main points lenders consider when reviewing your application:

- Those with higher scores generally have access to lower rates, so improving your credit history is an important part of getting a low interest rate on your car loan.

- Income. Lenders consider your income because it reflects your ability to pay back the loan. They also want to see a low debt-to-income ratio to make sure you can afford your loan.

- Loan term. The loan term impacts the interest rate that youre offered as well as how much interest youll pay over the life of the loan. A lender could offer you a lower interest rate on a longer loan term, but this doesnt mean youll save money: youll pay more interest on a longer loan term.

- Vehicle. Your vehicles make and model can also play a role car loan rates, especially if youre buying a used car. Since its possible that your car will be used as collateral to secure the loan, lenders often charge higher interest for cars that are of poorer quality and are more likely to break down.

Summary Of Auto Loans For Good And Bad Credit

| Lender |

|---|

|

20.58% |

Loan terms: Some lenders offer loans for up to 84 months. However, its best to pay off a car loan quickly since cars depreciate rapidly. Owing more on the loan than the car is worth is called being underwater or upside down, which is a risky financial situation. Also, the best interest rates are available for shorter loan terms. NerdWallet recommends 60 months for new cars and 36 months for used cars.

Soft vs. hard credit pull: Some lenders do a soft pull of your credit to pre-qualify you for a loan. This doesnt damage your credit score, but it also doesnt guarantee youll be approved for a loan or get the exact rate youre quoted. Other providers run a full credit check, which temporarily lowers your credit score by a few points. But again, your final rate could differ slightly from your preapproval quote. A hard pull will be required in all cases before a loan is finalized.

Rate shopping: Applying to several lenders helps you find the most competitive interest rate. However, it can lead to your being contacted by multiple lenders, or even dealers when you apply for a purchase loan, especially if you use a service that compares offers for you .

Restrictions: Some lenders only work with a network of dealerships. Others wont lend money to buy cars from private sellers. Lenders may also exclude some makes of cars, certain models and types of vehicles, such as electric cars.

Auto loan rate data courtesy Experian updated 9/2/2021.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Heres How To Pay A Car Payment With A Credit Card:

- Mobile payment services: One way to pay your car loan or lease with a credit card is to use a mobile payment app such as Venmo or PayPal as a middleman. These applications allow you to transfer money from user to user, and you can fund them with a credit card.

So, for example, you could use your credit card to pay a friend or family member through the app, and they can then make your car payment for you or give you the money to do it yourself. Just make sure you really trust the person, and be careful because payments may count as purchases or cash advances, depending on the service and the credit card issuer. But either way, there are fees involved. Venmo, for example, charges 3% of the transaction amount.

- Money transfer services: Companies like MoneyGram and Western Union allow you to directly pay a collection of participating billers, and you can fund the transaction with a credit card. However, this may be treated as a cash advance, which would mean expensive fees and interest charges would apply, in addition to the fees charged by the service. You can learn more about how this works from our explanation of how to transfer money from a credit card to a bank account.

The bottom line is that these options are far from ideal and should only be considered if youre in a real bind, or if you do the math and somehow find an opportunity to save. That could be the case if youre able to transfer part of an auto loan to a 0% balance transfer credit card, for example.

|

Category |

Best For Shopping Around For Refinancing: Lendingclub

LendingClub

- 2.99% to 24.99%

- Minimum loan amount: $4,000

Using a soft pull on your credit, LendingClub allows borrowers to instantly compare refinancing options

-

Easily compare refinance rates online

-

Pre-qualify with a soft credit check

-

No origination fees or prepayment penalties

-

Not available in all states

-

Some vehicle restrictions

Although LendingClub made a name for itself with peer-to-peer personal loans, the online lender now offers auto loan refinancing. If youre looking for ways to lower your monthly bills, LendingClub can help by showing you your refinancing options.

First, complete the initial application and get instant offers. This step is a soft pull on your credit that won’t change your score. Then you can compare the details of each proposal to see which best fits your needs. Whether you need to lower your interest rate, increase the length of your loan, or both, you can find the right lender.

Once you decide on an offer, you can finish the official application. The process is entirely online and easy. Although LendingClub is a broker, you won’t pay an origination fee for your loan. Finally, sit back and enjoy a smaller monthly payment. Rates start at 2.99%. Whether you’re sure you want to refinance or just seeing what’s out there, LendingClub is a great option.

Read Also: Avant Refinance Loan Application

Best For Tech Junkies: Carvana

Courtesy of Carvana

Carvana offers a completely online shopping experience, from financing to delivery with no minimum loan amounts and is our choice as the best for tech junkies.

-

Prequalify with a soft credit check

-

No minimum credit score requirement

-

End-to-end online shopping experience

-

Financing for Carvanas vehicles only

-

$4,000 minimum annual income required

-

Only used vehicles

It seems like every industry is cutting out go-betweens these days and the car industry is no exception. If you would rather skip the dealership and the bank altogether, Carvana is the site for you. Without ever leaving your home, you can apply for a car loan, choose your car and get it delivered. If you want to trade your old car in, you can do so while youre at it. Carvana will give you an offer and pick it up from your home.

Best of all, these loans aren’t just easy to get they are great deals for all kinds of borrowers. There is no minimum credit score, so anyone who is 18 years old, has no active bankruptcies and makes at least $4,000 per year is eligible.

What Credit Score Do Credit Unions Require For Auto Loans

There isnt a minimum credit score that all require for auto loans. It depends on the credit union, the type and age of the car, and the borrowers other qualifications such as employment history and income. The higher your credit score, the lower your rate will generally be. Typically, a credit score over 720 will give borrowers the absolute best rates.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Best Bank For Auto Loans: Bank Of America

Bank of America

- As low as 2.39%

- Minimum loan amount: $7,500

Bank of America auto loans come with the backing of a major financial institution. Low rates and a big selection of loan options make it a major competitor in the auto loan landscape. In J.D. Power’s 2020 Consumer Financing Satisfaction Study, which deals with auto loans, Bank of America ranked seventh out of 12 in its segment and scored equal to the average.

-

Offers new, used, and refinance auto loans

-

Transparent rates and terms online

-

Well-known financial institution

-

Restrictions on which vehicles it will finance

-

High minimum loan amount

Bank of America is a large financial institution offering a number of auto loan options, including new, used, refinance, lease buyout, and private party loans.

For the most creditworthy borrowers, APRs start at 2.39% for new vehicles. Used vehicle loans start at 2.59% APR, while refinances start at 3.39% APR. Customers of the bank who are Preferred Rewards members can get up to a 0.5% discount on their rate.

BofA provides a no-fee online application that it claims can offer a decision within 60 seconds. You can choose from a 48-, 60-, or 72-month term online, but there are additional options ranging from 12 to 75 months if you complete the application process at a branch or over the phone.

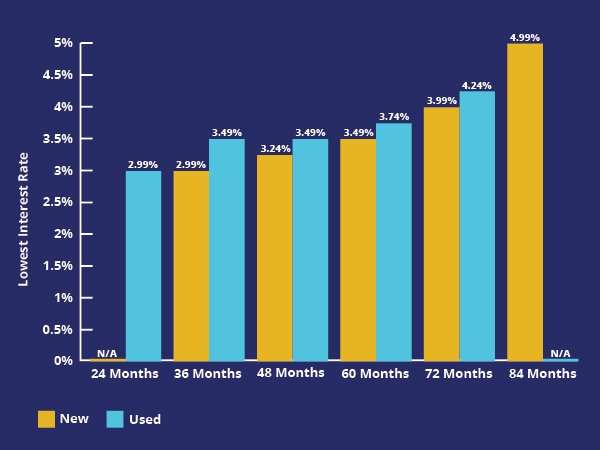

Loans Under 60 Months Have Lower Interest Rates

Loan terms can have some effect on your interest rate. In general, the longer you pay, the higher your interest rate is.

After 60 months, your loan is considered higher risk, and there are even bigger spikes in the amount you’ll pay to borrow. The average 72-month auto loan rate is almost 0.3% higher than the typical 36-month loan’s interest rate. That’s because there is a correlation between longer loan terms and nonpayment lenders worry that borrowers with a long loan term ultimately won’t pay them back in full. Over the 60-month mark, interest rates jump with each year added to the loan.

Data from S& P Global for new car purchases with a $25,000 loan shows how much the average interest rate changes:

| Loan term | |

| 72-month new car loan | 3.96% APR |

It’s best to keep your auto loan at 60 months or fewer, not only to save on interest, but also to keep your loan from becoming worth more than your car, also called being underwater. As cars get older, they lose value. It’s not only a risk to you, but also to your lender, and that risk is reflected in your interest rate.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

What Members Say About Our Accounts

-

Since visiting Superior Credit Union both Laurie and I have become members and moved money into investments through Superior. We have been VERY happy with the service provided by Tim Niebel and others that we have come in contact with. The customer service and value of being appreciated as a member by far surpasses any bank we have been in contact with or used. Prior to playing the Piggy Bank promotion, I had barely heard of Superior and after we talked to many of our friends who are members and got excellent reviews.

Bill & Laurie

-

Love the people working at my branch. They helped me not only set up a checking and savings account but also a 12 month CD. Thank you guys for the help.

Noel N.

-

John was very very helpful, gave me insight on savings accounts and helped me get what I needed quickly!

Dylan W.

Bank Of America: Best Big Bank Option

Overview: Bank of America offers flexible and convenient auto loans you can apply for directly on its website. Rates are competitive, and you can qualify for additional discounts if youre an eligible Bank of America customer.

Perks: Bank of America will finance a minimum of $7,500 and requires that the car be no more than 10 years old, with no more than 125,000 miles and valued at no less than $6,000. Financing is available in all 50 states and Washington, D.C. Bank of Americas APRs start at 2.89 percent for a new car and 2.99 percent for a used car.

If youre a Bank of America Preferred Rewards customer, you can qualify for a rate discount of up to 0.5 percent off.

What to watch out for: If you’re applying online, the term range you can apply for is limited you can pick only a 48-, 60 or 72-month term.

| Lender |

|---|

| None |

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Get In Your Dream Car Today

You’ve done your research, and you know what vehicle you want to buy now you need to find the best auto loan available. America First Credit Union members have access to some of the finest lending resources in town. With low interest percentages, affordable monthly payments and local service you can trust, we make it easy to maximize your buying power for your new or pre-owned car, truck or SUV.

At America First, we are a different kind of financial institution, providing trusted services that make us the leading Utah car loan provider. And we are now proud to offer excellent Nevada car loan options as well. Stop into one of our many local branches to learn more, apply online or call 1-800-999-3961.

Nasa Federal Credit Union

Loan amount: $5,000 to $125,000Terms: Up to 84 months

NASA Federal Credit Union offers flexible terms and low rates for new and used car financing as well as for auto loan refinancing. Members include current and retired employees of NASA Headquarters, any NASA Center or Facility or NAS, plus employees or members and their families of one of NFCUs partner companies or associations.

Members can apply online and get preapproved quickly. By having financing already in place, members have the advantage at the car dealership because they can focus on negotiating the car price instead of the loan terms. NASA Federal also has a credit protection product available to its members.

You May Like: Does Va Finance Mobile Homes