Mortgage Calculator: How Much Can I Borrow

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

How Much Interest Can Cost

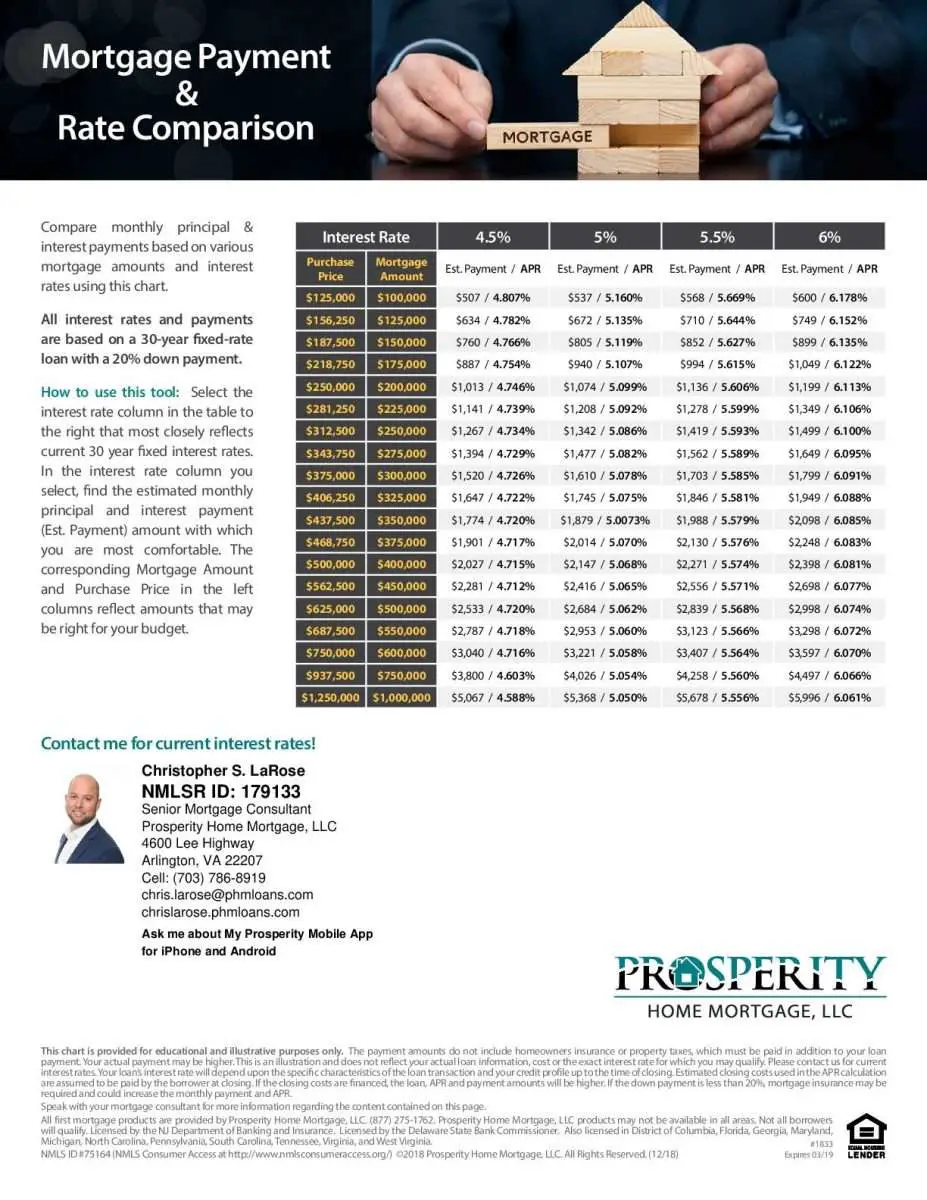

Your interest rate and how its calculated affects your regular mortgage payments. A mortgage is usually a large amount of money. Therefore, small differences in the interest rate can have a significant impact on your costs.

Figure 1: Example of monthly mortgage payment for a mortgage of $300,000.00 with an amortization of 25 years at various interest rates

| Interest cost over 5 years | Interest cost over 25 years |

|---|---|

| 2.50% | |

| $73,097.91 | $233,738.23 |

Make sure your home is within your budget. Consider if youre comfortable with the possibility of interest rates increasing. Determine if your budget could handle higher payments. If not, you may be overextending yourself.

What Monthly Expenses Do You Have

! Please enter an amount less than }.

Estimate your monthly expenses such as groceries, transportation, child care, insurance, shopping, media and regular contributions to savings.

Please do not include rent or housing expenses.

If you’re buying a home with a spouse, partner, friend or family member, include their monthly expenses as well.

If this amount is higher than your monthly income before taxes, please contact us to discuss your options.

Step 6 of 6

Read Also: Usaa Car Loan Application

Mortgage Credit Insurance Other Services

Mortgage credit insurance comes into play if you are faced with circumstances that prevent you from repaying your debt – for instance, in the case of death, illness or job loss.

Lenders can require that you buy a mortgage credit policy.

They may propose a policy to you in a package with your mortgage credit agreement but this cannot be made a condition for you to obtain the mortgage credit.

You are always free to look for better conditions from other insurers, as long as the level of guarantee offered by different policies is equivalent to what is required by the lender.

Lenders can, however, oblige you to open a payment or savings account with them, from which you will repay the loan.

Determining The Right Down Payment Amount

A purchase calculator can help you determine the down payment you need. There are minimum down payments for various loan types, but even beyond that, a higher down payment can mean a lower monthly payment and the ability to avoid mortgage insurance.

On the flip side, a higher down payment represents a more significant hurdle, particularly for first-time home buyers who dont have an existing home to sell to help fund that down payment. The calculator can show you options so that you can balance the amount of the down payment with the monthly mortgage payment itself.

Also Check: How To Get Loan Originator License

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross houshold income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs, and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs â mortgage principal and interest, taxes, and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Gross Debt Service Ratio

We Will Support You Throughout Your Homebuying Journey

Your dedicated expert will help you understand your options and apply for the best mortgage

Partnering with 750+ lenders to find you the best matching offer

Does this German mortgage calculator guarantee Ill receive a mortgage?

This German mortgage calculator is designed to help you determine the estimated amount you can get from over 750 mortgage lenders in Germany. However, German banks have different guidelines when it comes to rating the creditworthiness of applicants for a mortgage. For us to find the best mortgage for you, we need more information about you, your financial situation, and your future plans. With this information, our financing experts can explain your possible options in detail and provide a free personalized mortgage recommendation. Book your free consultation.

Are the results of the German mortgage calculator binding? How do I get a financing proposal?

The results of the German mortgage calculator are realistic sample calculations. However, they do not represent a financing proposal or a financing confirmation. For us to find the optimal mortgage for you, we need to know your personal financial situation.

Nevertheless, our mortgage calculator is a good start in your search for the best mortgage. In the next step, our financing experts will discuss your financing options with you during a free, no-obligation online consultation, taking into account your situation, wants, and needs. Book your free consultation.

What is an annuity mortgage?

Don’t Miss: Refinance Through Usaa

Determining Your Mortgage Rate

Several market-based and personal factors have a direct impact on your mortgage rate. None of them can be removed from the process.

On the market side, the biggest direct influence is from the bond market which is where the MBS that provide the funding for residential mortgages are traded. In turn, this market is impacted by the moves of the Federal Reserve which is moved to act based on indicators in the economy overall.

Beyond movement in the market, personal financial situations play a big role. The relative levels of risk associated with mortgage-backed securities are based on factors including a persons credit score, their down payment or level of the existing equity, how they plan to occupy the property and their purpose in getting the mortgage.

Now that you have a better understanding of how mortgage rates are set, perhaps youll be more prepared and know what you can do in order to get a better rate. If youre ready to apply, you can get started online!

How Much House Can I Afford

5-min read

So, youre thinking of buying your first home. Thats exciting. As you begin your house hunting adventure, do your homework and figure out how much you can comfortably afford.

Lets look at three key factors before you start shopping: your monthly mortgage payment, closing costs and ongoing expenses.

Don’t Miss: How Does Pmi Work On Fha Loan

Factors Within Your Control

Your credit score

Maintaining a good can make a big difference, since it shows mortgage lenders that youre responsible about paying your bills. Generally speaking, people with higher scores get lower rates.

Heres one example of how that might play out, based on the Lending Trees February 2021 Mortgage Offers Report:

- Homebuyers with credit scores of at least 760 were offered average annual percentage rates of 2.86% for 30-year, fixed-rate loans.

- Homebuyers with scores of 680 to 719 were offered average APRs of 3.09%.

- Based on the APR difference, the second group of borrowers would pay almost $13,231 more over the life of a 30-year mortgage.

Your down payment

Generally speaking, the more you put down, the lower your mortgage rate will be because a bigger upfront payment reduces the lenders risk. A down payment of 20% means other benefits, including eliminating the need for private mortgage insurance.

If you can put down at least 20% without busting your budget, it could lower your monthly payments.

You loan type

Conforming loans are those that can be purchased by Freddie Mac or Fannie Mae. They usually have the lowest interest rates. However, if you cant put 20% as your down payment amount, youll have to buy private mortgage insurance.

Non-conforming loans, which cannot be sold to Freddie Mac or Fannie Mae, arent available from every lender. If you go this route, look for a mortgage interest rate thats competitive with conforming loan rates.

Your mortgage term

How Your Mortgage Choices Can Affect Your Future

Mortgage lenders charge a penalty fee when you break your contract. This means, if you sell your home, you could owe the lender thousands of dollars in penalty fees.

You could also pay penalty fees if you pay off your mortgage early. Unless you plan on owning your home until you pay it in full, you may need flexibility on your mortgage.

Options related to mortgage flexibility include if your mortgage:

- is open or closed

Read Also: Fha Limits Texas

How Forbes Advisor Estimates Your Monthly Mortgage Payment

Forbes Advisors mortgage calculator makes it easy to estimate your monthly mortgage payment using your home price, down payment and other loan details. Based on that information, it also calculates how much of each monthly payment will go toward interest and how much will cover the loan principal. You can also view how much youll pay in principal and interest each year of your mortgage term.

To make these calculations, our tool uses this data:

- Home price. This is the amount you plan to spend on a home.

- Down payment amount. The amount of money you will pay to the sellers at closing. This amount is subtracted from the home price to determine the amount youll be financing with the mortgage.

- Interest rate. If youve already started shopping for a mortgage, enter the interest rate offered by the lender. If not, check out the current average mortgage rate to estimate your potential payments.

- Loan term. The loan term is the length of the mortgage in years. The most popular terms are for 15 and 30 years, but other terms are available.

- Additional monthly costs. In addition to principal and interest, the calculator considers costs associated with property taxes, private mortgage insurance , homeowners insurance and homeowners association fees.

How Much Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford . Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Also Check: Fha Limits In Texas

Tips For Getting A Better Interest Rate

There are a number of ways that you can try to get a better interest rate from your mortgage lender. Some of the important ones are:

Pay a higher down payment:This is the most effective way to get lower interest rate on your mortgage. Try to save money for some time and then apply for a mortgage, it will definitely reduce your overall cost for the house.

Compare the different options:It is always a good idea to explore your options while buying a house. Compare different lenders and their mortgage plans.

Improve your credit score:Try to gain the trust of your lender by improving your credit score. Dont max out your credit card limit, pay your debts and bills. It will definitely help you to get a lower interest rate from your lender.

Keep an eye on the economy:Wait for the interest rates to go down in your area. Observe the past trends and make an informed decision.

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Don’t Miss: Usaa Used Car Loan Restrictions

How Your Lender Sets Your Interest Rate

Lenders set the interest rate for your mortgage. They consider factors to help them determine your cost.

These factors can include:

- the length of your mortgage term

- their current prime and posted interest rate

- if you qualify for a discounted interest rate

- the type of interest you choose

- your credit history

- if youre self-employed

Lenders typically offer higher interest rates when the term length is longer. Its not always the case.

How To Get The Best Mortgage Rate

Your mortgage’s interest rate can impact your monthly payment and the total cost of your loan if you don’t move or refinance your mortgage. If you want to get the best rate, you can:

- Shop around and compare loan offers from different lenders and for different types of loans.

- Don’t apply for other credit accounts in the months leading up to your mortgage application.

- Try to improve your credit before applying.

- Save up for a larger down payment.

- Borrow less by buying a less expensive home.

Also Check: What Does Unsubsidized Loan Mean

How To Save Interest On Your Mortgage

Now that you know a bit more about how interest is calculated lets look at the ways you can actually pay less of it.

- Get the best rate. Shopping around for a better interest rate can save you thousands of dollars. If you already own a home, you may want to consider refinancing with your current lender or switching to a new lender.

- Make frequent payments. Make frequent payments. Because there are a little over 4 weeks in a month, if you make bi-weekly payments instead of monthly payments, youll end up making 2 extra payments a year.

- Make extra payments. The quicker you pay down your loan amount, the less interest youll need to pay on your smaller outstanding balance. If you have a variable interest rate, you can save even more by making extra payments when interest rates are low. Be mindful of early repayment penalties on closed mortgages.

- Choose a shorter loan term. The longer you take to pay off your loan, the more interest youll end up paying. Remember, banks calculate interest on your loan amount daily, so choosing a 25-year loan term instead of 30 years can make a big difference.

What Percentage Of Your Income Should Go Towards Your Mortgage

Your salary makes up a big part in determining how much house you can afford. On one hand, you may want to see how much you could afford with your current salary. Or, you may want to figure out how much income you need to afford the house you really want. Either way, this guide will help you determine how much of your income you should put toward your mortgage payments every month.

You May Like: Usaa Car Loan Pre Approval

Whats Behind Your Mortgage Rate

Never miss an article from Bank of Canada when you sign up for email alerts.

Buying a home is probably the biggest purchase youll ever make. If youre like most people, you wont pay cashyoull borrow most of the money by taking out a mortgage. And over the life of the mortgage, youll pay a lot in interest.

Small changes in interest rates can make a big difference in how much youll pay. So its important that you understand what determines the interest rate on your mortgage, even if you already own a home.

Many factors go into the interest rate you pay.

Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

Recommended Reading: Does Usaa Refinance Student Loans

The Best Home Loan Option For You

Any good calculator will help determine what might be a good loan product for you based on what you might qualify for. Youll usually see several options.

Its worth noting that you must qualify, so dont take what the mortgage calculator says as gospel. A Home Loan Expert will better be able to tell you what you qualify for when they take a more detailed look at your financial history. However, it does give you a starting point in terms of things to think about.