What Should I Do With Form 1098

You should use your Form 1098-E to help determine if you qualify for a student loan interest deduction and how much you might be able to deduct.

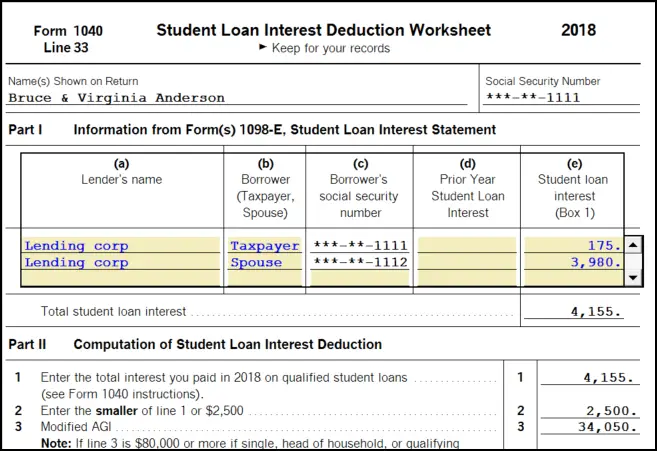

To determine what portion of the interest you paid is deductible, check the number in Box 1 of Form 1098-E and complete the student loan interest deduction worksheet, which typically comes with the instructions for your Form 1040 federal income tax return.

After youve done your calculations, you should save Form 1098-E and all your tax records for at least three years. Thats generally how long the IRS has to audit your return, although there are exceptions. The IRS recommends you keep any documents that prove how much income youve earned and anything that supports tax credits or deductions you claim.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Who Sends Form 1098

The 1098-E is sent out by loan “servicers”companies that collect loan payments. Some lenders service their own loans; others hire an outside company to handle it. Loan servicers must send a 1098-E to anyone who pays at least $600 in student loan interest, and they generally must send the forms out by the end of January. If you have outstanding loans with more than one servicer, you may receive multiple 1098-E forms.

Also Check: What Is The Current Sba Loan Interest Rate

You Must Still Include Student Loan Help From An Employer For 2019

The CARES Act, a U.S. government response to the COVID-19 pandemic, allows employers to make tax-free student loan payments of up to $5,250 per employee, for the remainder of 2020. This may help when you file your 2020 taxes, if you have an employer who participates in this program. For your 2019 taxes filed in 2020, if you received student loan payback assistance from an employer, its possible that money will be considered taxable income.

About Student Loan Interest

The longer you take to pay off your loan, the more interest will accrue, increasing the amount you will need to repay.

Interest rates vary depending on the type of loan and lender, as well as the year the loan was disbursed if it is a FFELP or Direct Loan from the U.S. Department of Education.

These details are generally found in the agreement and disclosures you received when you took out your student loan.

Recommended Reading: Can I Refinance My Sallie Mae Loan

When Box 2 Is Checked

If Box 2 of Form 1098-E is checked, it means that the amount reported in Box 1 doesn’t include the loan’s origination fees and/or any capitalized interest. Only loans you took out before September 1, 2004, however, should have box 2 checked.

An origination fee is typically a percentage of your loan that’s withheld from the disbursed funds. You can include a portion of this fee as deductible interest. Dividing the origination fee by the number of years you have to pay off the loan gives you the amount you can treat as student loan interest each year. And if the lender capitalized for unpaid accrued interest, you calculate the portion that’s deductible each year in the same way as the origination fee.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Maximizing Your Student Loan Interest Claim

Student loan interest payment doesnt have to be claimed on the year it was paid. CRA allows you to accumulate 5 years worth of interest payments and claim them in one year. Because you cannot claim a refund for your student loan interest alone, do not claim it on a year when you dont owe taxes. Instead, save the claim and carry it forward to any subsequent year.

For example; if the interest you paid on your student loans for the last tax year equals $500, but you owe nothing in taxes, dont waste the claim. Instead, save it for next year or the following year, and use it to offset your taxes owed for those possibly higher earning years.

You May Like: What Is Portfolio Loan In Real Estate

You Dont Need To Itemize To Take A Student Loan Interest Deduction

The student loan interest deduction is an above-the-line tax deduction, which means the deduction directly reduces your adjusted gross income. You input the amount of deductible interest, and it reduces your adjusted gross income.

Being able to claim the deduction without itemizing could be a big benefit. If using the standard deduction makes sense for you, you dont have to worry about missing out on the student loan deduction.

The Deduction Could Save You Hundreds

The exact amount the deduction will save you varies depending on your tax bracket. The value of the student loan interest deduction will change if your tax bracket does.

You can estimate how much your deduction will be worth by multiplying your deductible interest by your tax bracket. For example, if youre in the 25% tax bracket and you take a $2,500 deduction, your deduction would be worth $625 .

Your deduction reduces the amount of income taxed at your highest marginal rate, so this calculation works in most situations. This is because taking the deduction means you have less income being taxed at the highest rate you pay.

If your deduction drops you down to a lower tax bracket, the calculation is more complicated because youre avoiding taxes on some of the income taxed at your highest marginal rate, as well as some of the income that is taxed at the lower rate.

To make it easy to estimate how much your deduction is worth, you can use our student loan interest deduction calculator. Youll need to input details about your income, your tax filing status, whether you were claimed as a dependent and the amount of student loan interest paid.

Recommended Reading: What Car Loan Can I Afford Calculator

What Kinds Of Loans Qualify For The Credit

Interest on student loans can only be claimed if you received the loan under:

- the Canada Student Loans Act

- the Canada Student Financial Assistance Act

- the Apprentice Loans Act

- similar provincial or territorial government laws

Loans from other institutions cant be claimed, and you cant claim the interest you paid if you consolidated your student loan with other debts.

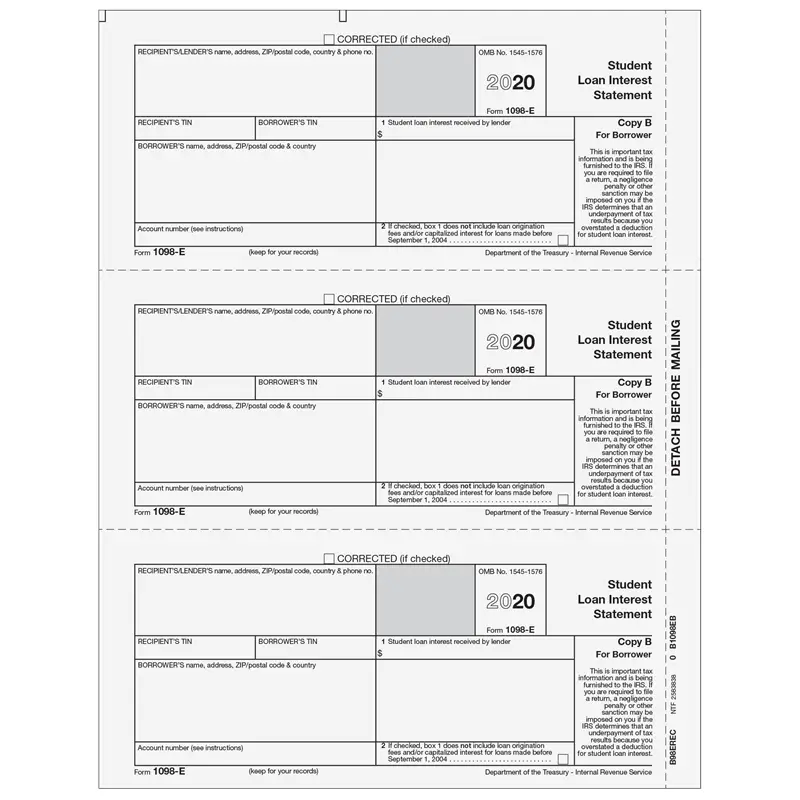

What Is A 1098

OVERVIEW

If you’re currently paying off a student loan, you may get Form 1098-E in the mail from each of your lenders. Your lenders have to report how much interest you pay annually. Student loan interest can be deductible on federal tax returns, but receiving a 1098-E doesn’t always mean you’re eligible to take the deduction.

Recommended Reading: How To Transfer Car Loan To Another Person

What Is The Student Loan Interest Deduction

The term student loan interest deduction refers to a federal income tax;deduction that allows borrowers to subtract up to $2,500 of the interest paid on qualified student loans from their taxable income. It is one of several tax breaks available to students and their parents to help pay for higher education. Individuals must meet certain eligibility criteria, including filing status and income level, in order to qualify for the deduction.

How To Read Form Tax Form 1098

Form 1098-E is pretty straightforward. The total amount of interest you paid during the year will appear in Box 1. Thats the number youll use to calculate the amount of your deduction, at least in most cases. It includes payments made through 5 p.m. on Dec. 31 of the tax year. It does not include any principal you paid, which is not tax deductible.

If you see a checkmark in Box 2, this indicates that the amount in Box 1 does not include capitalized interest or loan origination fees. These extra charges are deductible, but only if associated with a loan taken out before Sept. 1, 2004.

You can take a deduction up to $2,500 or total interest paid, whichever is less. Enter the deduction on line 20 of Schedule 1 of the Form 1040. Form 1040 changed significantly in 2018 and again in tax year 2020.Tax returns for years before 2018 do not include Schedule 1. Use line 33 directly on Form 1040not on Schedule 1if youre claiming the deduction for the tax year 2017 or earlier.

Don’t Miss: Can You Ask For More Federal Student Loan

Medical And Parental Leave Forms

To apply for leave or to extend your leave, complete the Medical and Parental Leave Application form .

If applying for medical leave, or changing from parental to medical leave, complete section A of the Medical Professional Attestation for Medical Leave form . You need a medical professional to complete and sign section B of the form.

Paper versions are available through the National Student Loans Service Centre .

How To Read Form 1098

There are two boxes on the 1098-E form youll use to fill out your tax return: Box 1 and Box 2.

Box 1 is your student loan interest summary; its the total dollar amount you paid in interest during the tax year.

Box 1 may also list any loan origination fees or capitalized interest, if you took out your loan on Sept. 1, 2004 or later.

For any loans opened before Sept. 1, 2004, you may qualify to deduct those origination fees or capitalized interest. Those wont be reported in Box 1, but youll see a check mark in Box 2. Otherwise, itll likely be empty.

You can go here to see an example of Form 1098-E.

Once you receive the form, its up to you to include this information when you file your taxes.

You May Like: How To Get Better Interest Rate On Car Loan

Not All Loans Are Eligible For The Student Loan Interest Deduction

The student loan interest deduction may be available to you if you meet certain key criteria. According to the IRS, student loan interest is tax deductible if:

- You took out the student loan for yourself, your spouse or any person who was a dependent at the time when you borrowed. The deduction is available for both federal loans and private loans.

- The loan was taken out to cover the costs of educational expenses during an academic year. You can only deduct interest if the student loan covered school-related expenses, including tuition or room and board. If you funded personal expenses not directly related to your education, like buying a car while in school, youre supposed to reduce your deduction.

- You were legally obligated to pay the interest on the student loan. If you pay on your childs student loan but arent obligated to pay the interest, you cant deduct it.

What Exactly Is The 1098

Officially known as the Student Loan Interest Statement, Form 1098-E is a tax form that all of your student loan lenders must send you if you paid $600 or more of interest during the tax year. The form lists all the interest included in your loan payments through the full tax year. This form helps eligible borrowers to claim a partial or full deduction on that interest paid when filing taxes. Youll do this by inputting the allowable amount into your main tax form, the 1040.

Keep in mind that just because you receive a 1098-E does not mean you automatically qualify for the deduction.

Don’t Miss: Can I Get An Emergency Loan With Bad Credit

The Student Loan Interest Deduction Allows You To Deduct Up To $2500

If you meet all of the eligibility criteria, the maximum amount of interest you can deduct per year is $2,500. If you paid more than this amount, you cannot deduct the additional interest paid.

This is a deduction, not a credit. That means you subtract the amount of deductible interest from your taxable income. For example, if you had $45,000 in taxable income last year and paid the full $2,500 in deductible student loan interest, your deduction would reduce your taxable income to $42,500.

Deductions arent worth as much as , but they can still save you money. If youre still in school, you may be eligible for tax credits such as the American Opportunity Tax Credit. However, there are no tax credits for student loan interest; the deduction is your only option to save on your taxes based on paying your student loans.

Is The Amount Of Interest Higher Than You Expected

Capitalized interest may be counted as interest paid on the 1098E. That capitalized interest and your origination fees may be tax deductible. If you have more questions on your 1098-E, please contact a tax advisor.

Please note: Because fewer loan payments were required and interest rates were at 0% for much of 2020, your interest paid was likely lower than in previous years.

Recommended Reading: How Long Can You Finance An Rv Loan

Completing Your Tax Return

On line 31900 of your return, enter the eligible amount of interest paid on a student loan.

Remember to claim the corresponding provincial or territorial non-refundable tax credit on line 58520 of your provincial or territorial Form 428.

For more information about your student loan and interest paid, visit Student Financial Assistance.

Your Student Loan Servicer Will Send You A Form To Help Claim The Deduction

If youre planning on claiming the student loan interest deduction, you dont have to worry about keeping track of interest all year long. Your student loan servicer will send you a 1098-E form giving you the total amount of interest you paid.

Just take the information from the box that says Student loan interest received by lender, and input that number when you file your taxes. If you use an online program to do your taxes, the program will prompt you to provide the necessary information. That way, you can effortlessly claim your student loan interest deduction and enjoy a tax break in exchange for all of that interest you have to pay.

You May Like: Does Refinancing Car Loan Hurt Credit

Tax Information For Cosigners

Cosigners on Sallie Mae student loans will be notified of the total amount of interest paid on eligible loans, not necessarily the interest they paid. This notification is solely informative. The borrower on the loan will receive the applicable tax form. We encourage you to contact your borrower to obtain tax forms, if needed.

Can You Claim The Deduction For A Dependent

Typically, the only person who can claim the interest rate deduction is the person who actually paid the interest. Therefore, if the student loan is in your name and youve paid the interest, youre the person who can claim the deduction.

On the other hand, if your parents claim you as a dependent and they took out the loan to pay for your education, theyre the ones who can claim the deduction. However, keep in mind that if someone made an interest payment on your behalfs such as your employer or someone giving you a gift youre still able to claim the deduction.

You May Like: What Is The Maximum Va Loan Entitlement

American Opportunity Tax Credit

The American Opportunity Tax Credit allows taxpayers to receive a credit for qualified expenses paid for the higher education of an eligible student during their first four years at a post-secondary institution. The total credit is capped at $2,500 per student per year. Taxpayers receive 100% of the credit for the first $2,000 spent in expenses and 25% for the next $2,000 spent for that student.

Youre Not Eligible If Youre A Dependent Or If You File Taxes As Married Filing Separately

There are a few final key eligibility criteria to meet, even if you fulfill other requirements in terms of income and having an eligible loan. In order to be eligible to claim the deduction:

- You must not be declared as a dependent on anyone elses tax return. Parents often claim children as dependents.

- You must not file your taxes as married, filing separately.

If youre a dependent or are married, but filing your taxes separately, youre out of luck theres nothing you can do to get the student loan interest deduction.

Read Also: Is Bayview Loan Servicing Legitimate

What If I Dont Get A 1098

You might not get a 1098-E form if you paid less than $600 in interest on a student loan in a single year. If you havent received a 1098-E form but think you should have, contact your loan servicer and ask how much you paid in interest. And if you paid student loan interest that was less that $600, you may still be able to deduct that interest without a 1098-E, provided you meet all the requirements for the deduction.

Your loan servicers contact information should be on its website or your loan statements. If you have an online account where you make payments, you might be able to download your Form 1098-E from your account.

You also might not get the form if youre still in school and have yet to start repaying your student loans. If youre still attending school, check whether you or your parents can claim any education tax credits to save a little money on their taxes.