When Should I Refinance My Car Loan

The best time to refinance your car loan is when it can save you money in the long term, but it may also help if youre hoping to catch a break on your monthly payments. Here are a few situations where it may make sense to refinance:

- Refinance car loan rates have gone down: Most car loan interest rates fluctuate based on the prime rate and other considerations. If you purchased your car a while ago, its possible that car loan rates have decreased since then.

- Youve improved your credit score: Even if market rates havent changed, improving your credit score may be enough to get a lower rate. The better your credit, the more favorable loan terms youll receive. If youve improved your credit score since signing for your initial loan, you may qualify for better loan terms.

- You got your initial loan from the dealer: Dealers tend to charge higher rates than banks and credit unions. If you took out your initial loan through dealer-arranged financing, refinancing directly with a lender could get you a lower rate.

- You need lower monthly payments: In some cases, refinancing a car loan may be your ticket to a more affordable payment, with or without a lower interest rate. If your budget is tight and you need to reduce your car payment, you could refinance your loan to a longer term . Keep in mind, though, that while you will pay less per month with this strategy, you can expect to pay more over the life of the longer loan.

Things To Consider Before Refinancing

Apply For Your New Loan

Once you’ve found an auto loan refinancing deal that you like, you can move forward with filling out an official application. If you’re approved, your lender will pay off your old loan and you’ll make payments to your new lender moving forward.

Your car title will also need to be transferred to your new lender. In many cases, the lender will take care of this themselves.

You should receive paperwork from your new lender that includes all the terms and conditions of your new loan. Make sure to store your loan paperwork in a safe, accessible place.

Also Check: Autosmart Becu

Can You Refinance An Auto Loan With Bad Credit

If your credit scores have dropped significantly since you took out your original car loan, it may be difficult to find refinancing that saves you money because lenders typically charge higher interest rates to applicants with lower credit scores. If your refinancing goal is lower monthly payments, however, you may be able to find an auto lender that specializes in borrowers with less-than-ideal credit. You may qualify for a new loan with a longer repayment period that’ll cost more over time than the original loan did, but the extra expense could be worth it if it means you can pay today’s bills more easily.

If you’re at risk of missing a payment on your original car loan and having difficulty finding refinancing options, reach out to your lender as quickly as possible to explain the situation. While they are not obligated to do so, some lenders will work with you and may even modify your original loan terms to give you lower paymentsin exchange for a higher interest rate and potential fees.

How Does Car Refinancing Work Tresl Auto Finance

Sep 3, 2020 When you refinance a car, you replace your current car loan with a new loan of different terms. In practice, auto refinancing is the process

5 days ago You need lower monthly payments: In some cases, refinancing a car loan may be your ticket to a more affordable payment, with or without a lower

Refinancing your auto loan is one way to get better terms and potentially reduce your interest rate and monthly payments, helping you save more money. An auto

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Homeowners May Want To Refinance While Rates Are Low

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today’s low rates may benefit from recent rate volatility.

Are you paying too much for your mortgage?

How Do You Refinance An Auto Loan

Refinancing an auto loan is a much faster process than, say, refinancing a mortgage. You should have all the necessary info on hand, including info about your current loan, like your monthly payment, your interest rate, and your loan term. Youâll also want to check with your current lender to see if youâll have to pay a prepayment penalty.

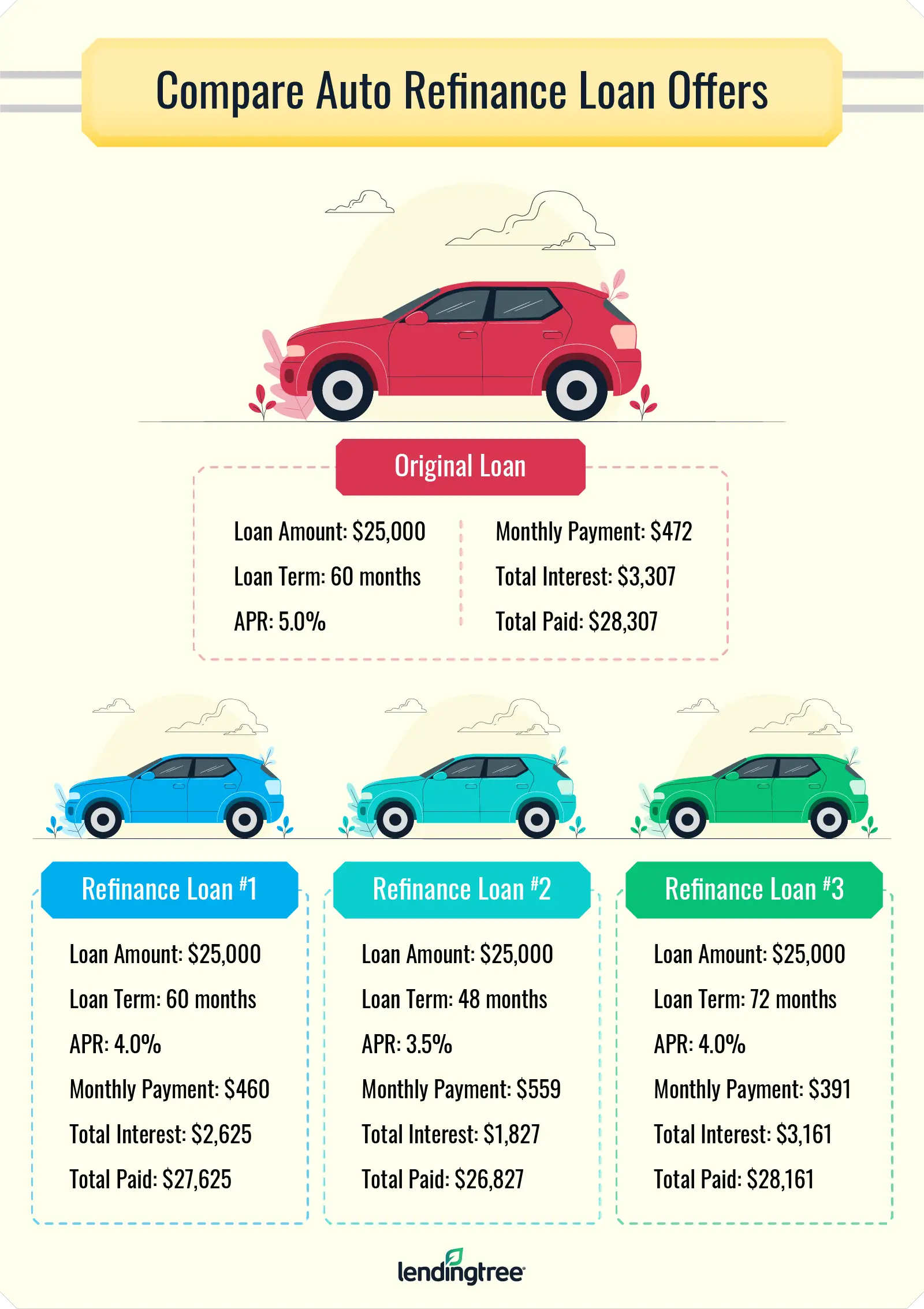

Just like any time you apply for a loan, you should apply with multiple lenders and then compare loan offers to see which is the best one . If youâre looking to save money, make sure youâre considering loan term as well as interest rate.

Once youâve crunched the numbers and decided on the loan thatâs right for you and your bank account, youâll sign a new loan agreement. Your loan will pay off your own loan and then youâll start making your new monthly payments.

You May Like: Usaa Current Used Car Loan Rates

What Happens To Gap Insurance If You Refinance

Gap insurance coverage is associated with a specific auto loan and is designed to cover a newly purchased vehicle in the event of an accident where the car is determined to be a total loss. It can’t be transferred or reassigned to another loan, even one that covers the same vehicle. When you refinance, your loan is paid off, and your gap coverage ends. If you want to maintain gap insurance on your car, you’ll need to purchase a new policy.

Does My Car Loan Qualify For A Refinance

Auto lenders have rules on which cars are eligible for an auto loan refinance. Most lenders wont refinance a loan for a car with more than 100,000 miles or with a salvage title.

The lender will also assess the cars value before approving a refinance request. If the value is too low, you wont qualify. The lender will calculate the cars loan-to-value ratio, which generally needs to be below 125% to qualify.

Before you apply to refinance your car loan, determine the LTV ratio. To find the cars current value, use sites like Kelley Blue Book, Edmunds and NADAguides. Take the average from all three sites to find a general estimate.

Calculating the LTV is simple. Divide the current loan balance by the cars value: the resulting percentage is the LTV. For example, lets say you have a $9,000 balance on a car worth $11,000. In this case, your LTV ratio would be 82%.

But if the current balance is $15,000 and the car is only worth $10,000, your LTV would be 150%. This is much higher than what most lenders allow, so refinancing is likely impossible.

Read Also: What Is An Rv Loan

Is My Credit Pulled When I Apply For An Auto Loan Refinance

Yes, any time you apply to refinance your current auto loan, you are creating a hard inquiry. All this means if the lender will review your credit report as part of their decision-making process for your new loan.

Keep in mind, the hard inquiry may cause a small dip in your credit score because a new loan often means added debt to the credit reporting agencies. With added debt, the chances of a borrower missing a payment increases, thus lowering your overall score.

However, once the credit reporting agency sees the old loan paid off, the amount of debt decreased and a few monthly payments made on time, your credit score should increase again.

You Have An Older Car

If you have a car thats 10 years or older, you may have difficulties finding a lender willing to refinance. Many lenders set limits on how old a vehicle can be in order to qualify for the loan. If you find yourself in a situation where you need to refinance, consider taking out a personal loan or trading in the vehicle as alternative options.

Don’t Miss: Drb Refinance Reviews

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Refinancing Can Ding Your Credit Score

If you need your credit score in tiptop shape for any reason, you may want to consider holding off on refinancing your auto loan. When you apply for a new loan, lenders will conduct a credit inquiry, which can take some points off your credit report.

If youâre just straddling the line between âgood creditâ and âgreat credit,â the process of refinancing your loan might keep you from that better score. However, as with all loans, making your payments in full and on time is good for your credit score, so taking a small hit to your credit score may be worth it in the long run, if it helps you avoid missing any payments or defaulting on a loan.

Itâs also worth noting that if you shop around with a few lenders, it wonât necessarily harm your credit score anymore than if you just applied with one. If multiple auto lenders conduct hard inquiries within a certain time frame, it will only count as a single inquiry, and the damage to your credit score will stay minimal.

You May Like: Usaa Car Interest Rates

Pros Of A Car Refinance

There are some benefits to refinancing. The process does not take long, and you can obtain a free quote to determine if these benefits apply to your case.

Here are several advantages of refinancing your car loan.

A Lower Interest Rate

If you had a poor credit score when you first purchased the car, your interest rate may be significantly lower than it is right now.

In addition, an individual who refinanced several years ago may also qualify for a lower rate because interest rates have fallen since they purchased the loan.

If the current interest rate you could obtain is one or more percent lower than what you are paying, consider refinancing. You will spend less overall to buy your car.

You Want to Consolidate Debt

Your vehicle is a valuable asset. As a result, it is possible to borrow against the value of it.

For example, if you own a car worth $12,000 but you only owe $8,000 on it, you may be able to borrow against that $4,000 value. You could use these funds to help you pay off debt or handle other financial needs.

In some situations, you can use this equity in your vehicle to pay off all of your credit cards . This, too, can save you money.

You Want a Lower Monthly Payment

There are several ways you could obtain a lower monthly payment on the loan.

First, if you secure a lower interest rate, the monthly payment will be lower as well. This could help make your budget a bit easier to manage. How much lower depends on the debt you owe, the interest rate, and the term.

You Need To Modify Your Monthly Payment

You may be in a much better financial situation now than when you bought your car. You may have a better job or more financial security. You may have paid off credit card or other debt. Less debt frees up how much you can pay per month. Paying more over a shorter-term loan, when combined with the lower interest rates that often come with a loan refinance, can save you a lot of money over the long haul.

On the other hand, if money is tight, think about refinancing into a longer-term loan. While you might end up paying more in interest, you can reduce your monthly payments and free up money you need right now.

You May Like: Does Va Loan Work For Manufactured Homes

Should I Refinance My Car Loan Before Buying A House

Experts say not to apply for credit before buying a house. But does this apply to car loan refinancing?

Refinancing your car can help you snag a lower interest rate and a lower monthly auto loan payment. But depending on your credit history, refinancing your car right before buying a home can impact your mortgage application.

If youre not sure what to do first buy a home or refinance your car loan heres what to think about.

2021 Auto Refinance Rates

Is It Easier To Refinance With My Current Lender

Can I refinance my car with the same lender? Can I refinance with a new lender? These kinds of questions are common among auto owners who are considering refinancing.

When you buy a car, you either shop around with different lenders for a loan or ask the auto dealer that you buy from to set up a loan for you. When you refinance, it is smart to engage in the same process of shopping around for the best possible option for you.

You are not locked into using the same lender that currently holds your loan. Your priority should be finding the most favorable loan terms possible, which typically means finding a lender that will offer you the lowest interest rate. In some cases, that may be your existing lenderin other cases, it will be a new lender. Rate shopping will give you a broader sense of the market and what constitutes a genuine deal.

While it may seem easier to stay with the same lender, any lender willing to give you a refinancing loan will work with you to make the process as seamless as possible. Theres no reason to be worried that switching to a new lender will make your journey with a loan more complex.

Read Also: How To Transfer Car Loan To Another Person

If I Refinance My Car Will I Lose My Warranty

No, if you refinance your current auto loan, you will not lose your manufacturer warranty assuming youre still within its thresholds. Your manufacturers promise that your vehicle will function as expected doesnt disappear simply because you take out a different loan.

Even if you refinance your vehicle into someone elses name, the manufacturers warranty would still be in effect.

But what about an extended warranty? In this case, the more appropriate term is vehicle service contract.

Auto Refinance Calculator

If I Refinance My Car Will I Lose My Vehicle Service Contract

No, not unless your particular VSC states otherwise. Even if you rolled your VSC into your original loan payment, your refinance loan would simply pay it off and your plan would still be in place.

For example, lets assume you purchased and financed a used truck. Since your down payment was minimal, you decided to play it safe and enter a VSC with the dealership. Now, you want to refinance your existing loan to get a lower interest rate. Your new loan would pay off the current loan, including the VSC.

In short, you already purchased your VSC. Your contract shouldnt be nullified if you refinance the car loan you used to initially pay for your VSC. The dealership still owns and is obligated to the contract.

Compare Auto Refinance Rates

Read Also: What Is The Maximum Fha Loan Amount In Texas

Time Remaining On Your Loan

Refinancing and extending your loan term can lower your payments and keep more money in your pocket each month but you may pay more in interest in the long run. On the other hand, refinancing to a lower interest rate at the same or shorter term as you have now will help you pay less overall.

If your answer to When should I refinance my car loan? is Soon, review our current refinance rates and take a look at our auto loan refinance calculator to get a better understanding of whether refinancing makes sense for you.

You may also like

What Should I Do

In an upside down car loan situation, there are a couple of ways that one can combat such a troubling situation. The best thing to do is to keep the car and pay the car loan down as quickly as possible. Don’t buy a new vehicle, because any dealer who would help you buy a new vehicle when you are already upside down is only going to make your situation worse.

Another option is to sell the car. If you sell the car and don’t have to buy a new one right away, you can use the amount you get from a sale to pay down the loan, and then work for the next several months until you pay off the difference. Just because you sell the car does not mean the bank will forgive the difference.

Some lending institutions will call the entire loan due at the sale of the vehicle, so you would need to work with your lender to turn the loan into a personal or signature loan. However, they will only do this for people with excellent credit.

Some people recommend turning in a car when you are upside down on a leased vehicle. This may relieve the immediate pressure, but has the same end result. When the lease is up, you will still have negative equity unless you have made substantial extra payments.

Also Check: What Credit Score Is Needed For Usaa Auto Loan