Can A First Time Home Buyer Get A Rehab Loan

FHA 203 Rehabilitation mortgages allow first-time homebuyers to take advantage of below-market interest rate loans that cover costs of purchasing and making full or limited renovations to your dream home. This program may also be used to finance abandoned or foreclosed properties.

How To Qualify For A 203k Loan From The Fha

You can get an FHA 203 loan via a bank or a credit union. Either way, these loans are accessible for many borrowers. Not all lenders will offer FHA 203 loans, but many will. Its important to note that borrowers still need to obtain home insurance on the property when they use this loan. Here are some requirements for an FHA 203 loan:

- Borrowers tend to require a credit score of at least 500 to qualify for an FHA 203 loan, but some lenders may ask for a higher credit score

- Down Payment Lenders will want a minimum downpayment of 3.5 percent on an FHA 203 loan. Of course, the larger the down payment, the better! If your credit score is between 579 and 500, youll have to place a 10 percent down payment.

- Loan limits The FHA does have loan limits depending on your location. As a result, youll have to research the loan limits in your county. Your desired home might be too expensive for an FHA 203 loan.

Here are some other requirements:

How Much Can You Borrow With A 203 Loan

FHA 203 loan limits are imposed on the rehab costs for both limited and standard 203 loans heres a breakdown.

| Loan Type |

- Enhancing accessibility for a person with disabilities

- Making energy conservation improvements

Neither program allows what FHA calls recreational or luxury improvements. This includes installing features like a hot tub, tennis court or barbecue pit.

Recommended Reading: Usaa Auto Loans Review

What Repairs Can I Do

There are two types of 203k loans. Which one you choose depends on the extent of the repair work.

Limited 203k mortgage

This option allows you to do most cosmetic repair work, including things like kitchens and bathrooms.

The stated limit to costs is $35,000. However, an FHA 203k loan requires a buffer equal to 15 percent of the total bids.

This buffer is called a contingency. Its a just in case fund to cover cost overruns by your contractor. .

So, your real maximum repair costs can be around $31,000.

Most nonstructural, nonluxury items are acceptable:

- Kitchen and bathroom remodels

For more information on the standard vs. limited 203k, see: Should You Choose A Standard Or Limited 203k?

What you cant do with the 203k loan

While FHA 203k guidelines are fairly lenient, there are some things you cannot use the rehab funds for. For example:

- Minor landscaping

- Adding a luxury amenity like a tennis court, barbecue area, or swimming pool

- Projects that will take longer than 6 months

In these cases, other options might be a better fit, such as getting a home equity loan after purchase, or other alternatives mentioned in the next section.

Are Fha 203 Loans A Good Idea

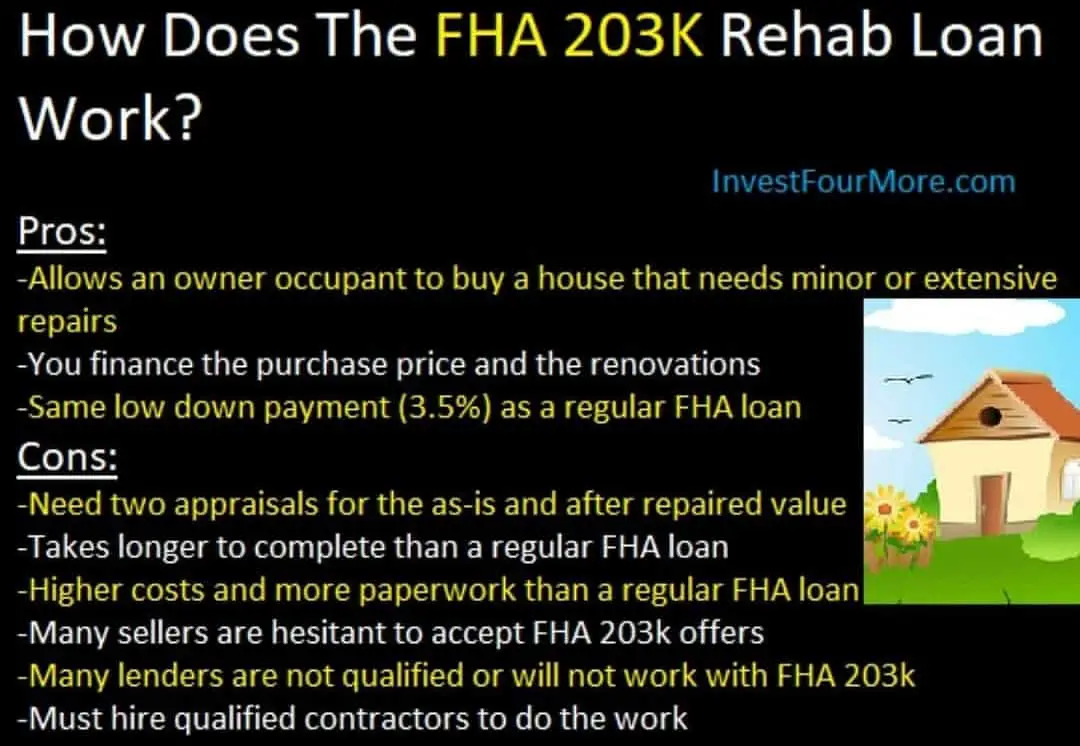

If youre buying a fixer-upper, or fixing up a home you already own, the FHA 203 mortgage may be a good option, but be sure to weigh the pros and cons against your unique financial needs.

The HomeStyle loan from Fannie Mae and the CHOICERenovation loan from Freddie Mac are two common conventional renovation loans. They might be a better fit for those with higher credit scores or the desire for improvements the FHA considers luxuries.

Recommended Reading: Usaa Bad Credit Auto Loans

What Are The Pros And Cons Of These Loans

The main benefit of these loans is that they give you the ability to buy a home in need of repairs that you might not otherwise have been able to afford to buy. Plus, the down payment requirements are minimal, and often you get decent interest rates .

The downsides are that not all properties qualify, there are limits on the funding you can get and applying for the loan isnt easy. For example, to apply for the loan you may need to hire an independent consultant to prepare the exhibits required . Get more information on 203k loans.

Current Mortgage Rates

How Much Money Can You Get

The maximum amount of money a lender will give you under an FHA 203k depends on the type of loan you get .

With a regular FHA 203k, the minimum amount you can borrow is $5,000.

With a regular FHA 203k loan, the maximum amount you can get on a purchase loan is the lesser of these two amounts:

- The appropriate Loan-to-Value ratio from the Purchase Loan-to-Value Limits, multiplied by the lesser of:

- 110 percent of the After Improved Value , or

- the Adjusted As-Is Value, plus the following:

- Financeable Repair and Improvement Costs, for Standard 203 or Limited 203

- Financeable Mortgage Fees, for Standard 203 or Limited 203

- Financeable Contingency Reserves, for Standard 203 or Limited 203 and

- Financeable Mortgage Payment Reserves, for Standard 203 only.

Refinance limits are similar but also take into account the amount of the existing debt and fees of the existing loan.

With a streamlined loan, you can get a loan for the purchase price of the home plus up to $35,000 with no minimum repair cost plus the cost for energy improvements. To determine the as-is value of the property or the estimated value of the property post-repair, you may need to have an appraisal done. You will be required to put down 3.5 percent, but the money can come from a family member, employer or charitable organization.

Read Also: Usaa Auto Refinance Phone Number

Who Is Eligible For An Fha 203 Loan

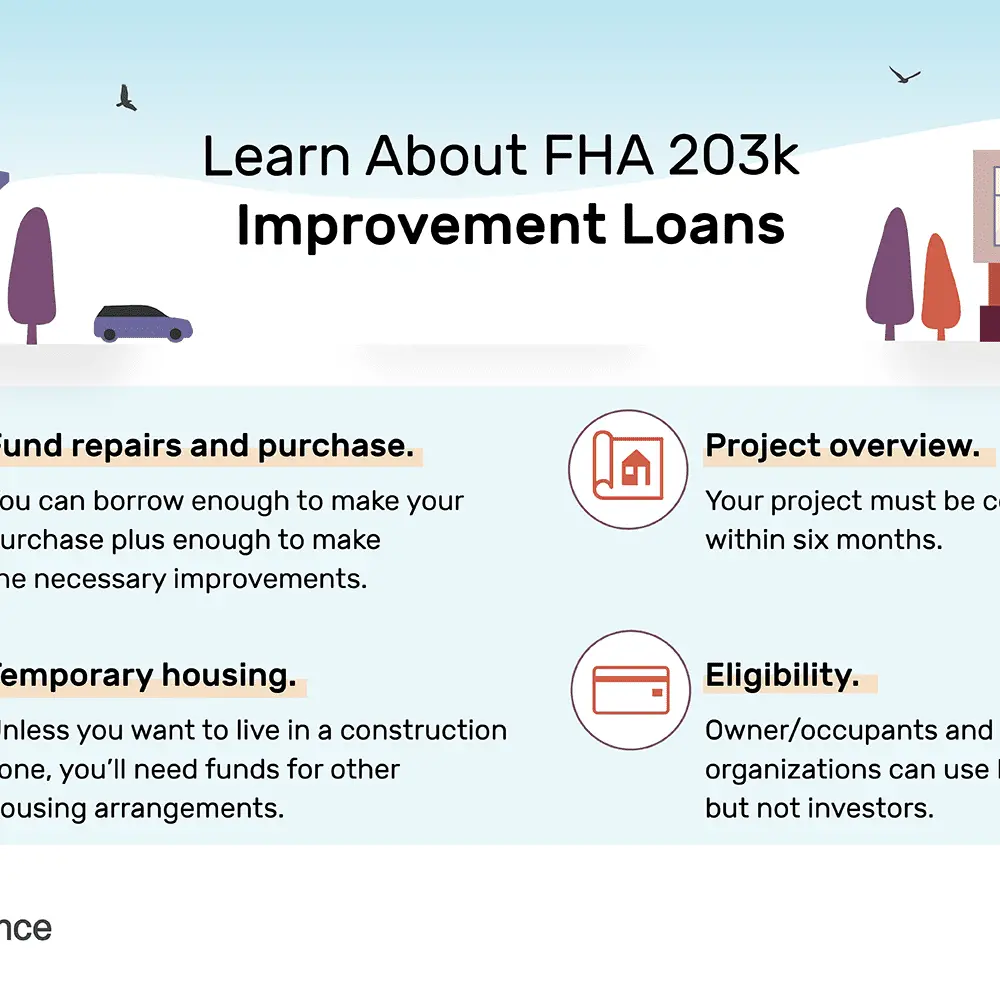

Individuals and nonprofit organizations can use an FHA 203 loan, but investors cannot.

Most of the eligibility guidelines for regular FHA loans apply to 203 loans. They include a minimum credit score of 580 and at least a 3.5% down payment. Applicants with a score as low as 500 will typically need to put 10% down. Those with credit scores of less than 500 are not eligible for FHA-insured loans.

Your debt-to-income ratio typically cant exceed 43%. Additionally, you must be able to qualify for the costs of the renovations and the purchase price.

Recommended: What Credit Score is Needed to Buy a House?

How An Fha 203 Loan Works

An FHA 203 loan is backed by the Federal Housing Administration .Funds obtained through a rehab loan, which can take the form of a 15- or 30-year fixed-rate mortgage, or adjustable-rate mortgage , can be applied to expenses associated with both materials and labor. Because these mortgages are insured by the government, the 203 loan may come with more flexible qualification terms and requirements than a conventional home loan.

The expenses associated with home improvement and repair efforts are added to the total that you elect to borrow and can be paid off over a period of years as you pay off the monthly premiums associated with your mortgage. Rehab loan offerings can provide a cost-effective way to pay for many home improvements . As with any mortgage, youll need to qualify to obtain one based on your income, credit history, credit score, debt-to-income ratio and other factors.

Bear in mind that work covered under an FHA 203 loan must start within 30 days of closing, and projects must be completed within a maximum of 6 months time.

Recommended Reading: Co-applicant In Home Loan

Home Renovation Loan Alternatives

There are several reasons the FHA 203k might not be your best option.

You may need only a few thousand dollars for minor work, for example. Or your renovation might be too luxurious or pricey for FHA guidelines. You might want to do the work yourself.

Or youd prefer a loan that doesnt require mortgage insurance for life.

In that case, there are other loans, and at least one might be a better fit:

For more information and help deciding which type of loan to use, see: 6 types of home improvement loans which one is best for you?

Fha 203 Vs Construction Loans

Though an FHA 203 loan is a type of FHA construction loan, it’s possible to get construction loans outside of the FHA program. A construction loan is typically a short-term loan that provides funding to cover the cost of building or rehabbing a home.

Construction loans may have higher interest rates than conventional mortgage loans. The money may be paid out in installments as construction gets underway and continues, rather than as a lump sum. The balance due on a construction loan may be paid in a lump sum at the end of the loan term. Alternately, homeowners may choose to convert a construction loan to a conventional mortgage.

If your lender doesnt allow for automatic conversion of a construction loan to a conventional mortgage, you may need to apply for a brand-new loan to avoid having to make one large balloon payment.

Don’t Miss: Are Loans Bad For Your Credit

What Exactly Is An Fha Section 203

While the idea of purchasing an inexpensive home in need of work and fixing it up to your expectations sounds like a good idea, not everything is always as it seems. Many borrowers come to find out that remodeling a home would cost much more than they had originally anticipated. Some lenders will not even offer interested buyers a mortgage for such homes as these fixer-uppers are often considered uninhabitable. If you are willing to put in the work, an FHA Section 203 might be right for you.

An FHA Section 203 loan is a type of home loan that is backed by the federal government. It is only available to buyers who are interested in purchasing an older or damaged home that requires repairs or renovations. When you work with a mortgage broker to purchase a home, the broker can connect you with a lender who will provide you with the financing needed to purchase or refinance the home as well as provide extra funds to complete any necessary renovations to one or more rooms.

What You Should Know Quick Overview Of 203k Loans:

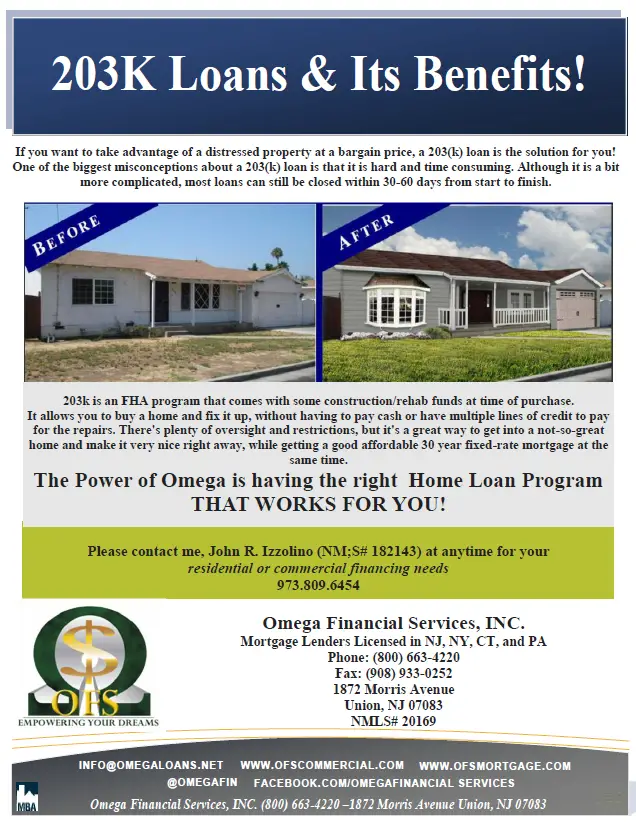

In simple terms, the 203k loan is a type of home improvement loan program insured through the FHA that works by allowing homebuyers the ability to finance the purchase and costs of upgrades through one single mortgage. The 203k loan can also work as a refinance option for homeowners who want to add basic cosmetic or structural improvements to their home.

It is important to remember that neither the FHA or HUD do not actually lend the money to a borrower. Instead, the FHA Insures a loan that is provided by an FHA approved lender.

While the borrower eligibility requirements for a 203k loan follow standard FHA lending guidelines, there are a few extra steps involving a contractor, inspector and HUD consultant to ensure the property meets FHAs insurance standards.

Read Also: Usaa Auto Loan Credit Requirements

Definitions And Examples Of Fha 203 Loans

FHA 203 loans make it possible for people to rehabilitate properties that need some help and turn them into homes. Sometimes the location is good and the property has potential, but you need to make a few significant improvements. Without those repairs, the home might not be suitable for living, and lenders might be unwilling to fund loans on a property with problems. These loans give homebuyers an incentive to take such properties off the market and make them a valuable part of the community again.

How To Find An Fha 203k Contractor

We recommend that you look for a contractor who has experience in dealing with FHA 203k loans. There is additional paperwork that they will need to complete before the process can begin. They also need to be familiar with how they are reimbursed for the work through this program.

Your local home improvement store may be able to recommend a contractor who has done work through this program before.

The contractor must provide a Work Write Up which is an estimate of costs and time to complete the project. The lender will have to review the contractors ability to complete the job professionally, timely and within budget.

Also Check: How To Transfer Car Loan To Another Bank

Benefits Of An Fha 203k Loan

The main benefit is having the ability to finance the purchase price and the renovation costs all with one loan and with a great interest rate. The 203k guidelines also allow for the funds to cover the costs of your temporary housing while the remodeling is being done.

The 203k rehabilitation loan can also be used for a refinance where you would be able to cash out the funds needed for the repairs on a home that you already own.

Contact A Mortgage Broker Today

Buying a home that needs extensive work is a big decision. If you decide to progress with the sale, you will need to consider how you will pay for the repairs and renovations needed to modernize the home. An FHA Section 203 loan is one option for paying for renovations your house may need to make it a functional home. Before making a choice, determine if it is more cost-effective to buy a fixer-upper or purchase a move-in ready home. Contact a mortgage broker in your area today to talk about your options.

Also Check: Loan Officer License Ca

Can Be An Fha 203 Loan Suitable For Me Personally

Other basic eligibility and loan features consist of:

Have at the very least a 620 FICO.

Need not be a first-time homebuyer in purchase to meet the requirements.

In the event the renovation is considerable and also you cannot are now living in the true home during construction, you might be in a position to fund as much as 6 months of mortgage repayments during renovations in the event that house is viewed as uninhabitable by the HUD Consultant.

Optimum loan quantity under a 203 purchase loan, is 96.5% for the value? that is after-improved. For refinancing, the most loan quantity is 97.75 % associated with the value that is after-improved To look at the loan that is current by county,

Though some restrictions and special rules use, 203 loans enables you to buy and refurbish condos ? , two-to-four unit properties?, and mixed-use properties, along with single-family residences and houses in planned product developments.

What To Expect When Applying For A 203 Mortgage Loan

Getting only one mortgage for both the construction and the purchase of your home might be the preferable choice since it reduces cost and paperwork but remember that a 203 mortgage is more complicated than a traditional mortgage. This is because it accomplishes two goals with only one mortgage.

Dont expect your FHA 203 lender to write a check to cover planned repairs by simply relying on your smile and promise to use the money as you planned. Borrowers must follow clearly defined steps to complete a 203 successfully. If you set your heart on an otherwise perfect home that needs T.L.C., this is how the 203 loan approval process works.

203 Pre-Approval Process

The most sensible approach to any mortgage financing undertaking is to begin by selecting an FHA-approved lender to analyze your particular financial situation before finding your dream home. Get a pre-approval letter before you even begin looking for a property.

Property

With your pre-approval in hand, you can begin to search for that perfect property, which, remember, must also meet FHAs 203 guidelines.

203 Offer Preparation

Complete the FHA mortgage application after your lender gives you an approval to move ahead with the loan process. This usually requires you paying an application fee.

203 Offer Acceptance

Closing

If you have never been involved in to a mortgage closing, you might be surprised at what seems like an endless pile of paperwork you must sign and initial at closing.

Renovation

Don’t Miss: Ussa Car Loans

The Types Of Improvements That Borrowers Can Make Using A 203k Home Loan Include:

-

structural alterations and reconstruction

-

modernization of the home’s function

-

elimination of health and safety hazards

-

changes that improve appearance

-

replacing plumbing installing a well and/or septic system

-

adding or replacing roofing, gutters, and downspouts

-

adding or replacing floors and/or floor treatments

-

major landscape work and site improvements

-

enhancing accessibility for a disabled person

-

making energy conservation improvements

What Is The Fha 203k

First of all, let’s agree that a house someone else has lived in is most likely not going to be your style. Whether it’s the paint, the carpet or a lack of modern efficiencies, since you didn’t design it you’re probably going to want to make some changes.

Next, let’s consider this: we’re all very busy. Work, play, family, volunteering, exercising and other activities keep us busy and pack our nights and weekends – unless you’re working nights and weekends in which case you’re packing your days. Either way, working on your new house with a DIY plan sounds great and can work out for some, most of us probably want to enjoy life and come home to the home we love, not the house we have to work on.

This is where a home improvement loan like the FHA 203k comes into play. This mortgage option helps you buy the house and roll the costs of professional remodeling right into the same loan. There’s no hidden interest rate or additional mortgage you need to take out. You’re not borrowing on a credit card … you’re adding value to the house by fixing it up so you can borrow against that after-improved value.

Watch the video below as Renovation Lending Director Joe Daly explains what the 203k loan is, in under 3 minutes.

Read Also: How Much Does My Loan Cost