Fha Loan Application Process

The FHA does not make loans. Rather, it insures loans made by private lenders. The first step in obtaining an FHA loan is to contact several lenders and/or mortgage brokers and ask them if they are FHA-Approved by the U.S. Department of Housing and Urban Development to originate FHA loans. Except in certain situations, it is also not possible to have two or more FHA loans at the same time.

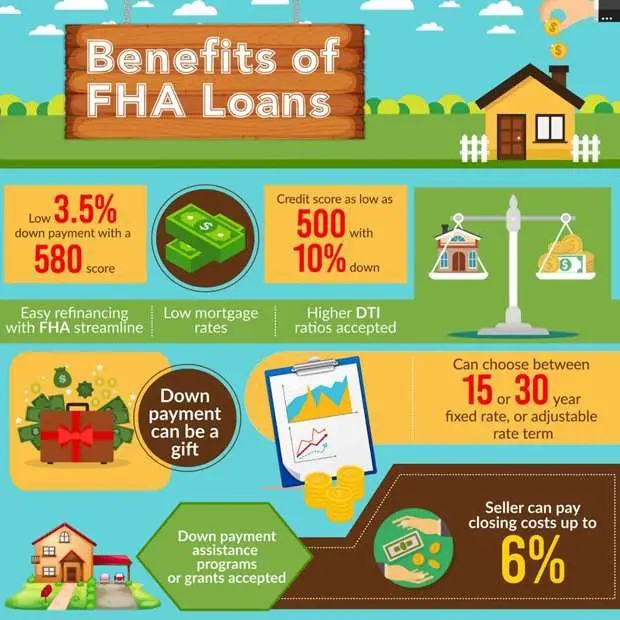

Second, the potential lender assesses the prospective home buyer for risk. The analysis of one’s debt-to-income ratio enables the buyer to know what type of home can be afforded based on monthly income and expenses and is one risk metric considered by the lender. Other factors, e.g. payment history on other debts, are considered and used to make decisions regarding eligibility and terms for a loan. FHA loans require a minimum FICOscore of 580 to qualify for 3.5% down or 500 for 10% down. Additionally, the lender checks the financial history of the person getting the loan to see whether they have been delinquent on loans owed to the U.S. government if they are, they do not qualify for a FHA loan.:131 Mortgage lenders can add their own rules, also known as overlays on top of these minimum standards. As each lender sets its own rates and terms, comparison shopping is important in this market.

FHA also allows gifts to be used for down payment from the following sources:

How Fha Loans Work

FHA loans come in 15- and 30-year terms with fixed interest rates. The agencys flexible underwriting standards are designed to help borrowers who do not have pristine credit or a high income and cash savings become homeowners.

But theres a catch: Borrowers must pay FHA mortgage insurance. This coverage protects the lender from a loss if you default on the loan. Mortgage insurance is required on most loans when borrowers put down less than 20 percent. All FHA loans require the borrower to pay two mortgage insurance premiums:

- Upfront mortgage insurance premium: 1.75 percent of the loan amount, paid when the borrower gets the loan. The premium can be rolled into the financed loan amount.

- Annual mortgage insurance premium: 0.45 percent to 1.05 percent, depending on the loan term , the loan amount and the initial loan-to-value ratio, or LTV. This premium amount is divided by 12 and paid monthly.

So, if you borrow $150,000, your upfront mortgage insurance premium would be $2,625 and your annual premium would range from $675 to $1,575 , depending on the term.

FHA mortgage insurance premiums will be canceled after 11 years for most borrowers if they financed 90 percent or less of the propertys value and stay current with their monthly mortgage payments. Loans with an LTV ratio greater than 90 percent will carry insurance until the mortgage is fully repaid.

Why Do The Fha Property Requirements Exist

FHA loans are backed by the Federal Housing Administration , which is part of the U.S. Department of Housing and Urban Development .

These loans are designed to help low- to moderate-income folks on the path to homeownership. Borrowers with credit scores as low as 580 can qualify for FHA loans with just 3.5% down.

But because the government backs these mortgages, the FHA wants to make sure that borrowers are buying homes that are safe, livable, and will afford them good quality of life. They dont want low-income borrowers ending up with properties that are unsafe or that they cant afford to maintain.

Appraisals are required by lenders, but theyre good for you, too.

Recommended Reading: Va Manufactured Home Guidelines

What You Need To Know About An Fha Loan

FHA loans are loans issued by private lenders but backed by the Federal Housing Administration . Because they’re insured by the FHA, these loans bring home ownership into reach for low- or moderate-income buyers who might otherwise have a hard time getting approved by conventional lenders.

These loans are not right for everybody, but they have several appealing features, allowing buyers to:

- Make down payments as small as 3.5%

- Get approved despite thin credit or credit history problems

- Buy not only single-family homes, but condos, multi-unit properties, or manufactured homes

- Get funding beyond the amount of purchase for renovations and repairs through the FHA 203 program

- Fund a down payment with gift money or help from the seller

- Purchase a foreclosure

How Long Do Borrowers Have To Pay Fha Mortgage Insurance

The duration of your annual MIP will depend on the amortization term and LTV ratio on your loan origination date.

For loans with FHA case numbers assigned on or after June 3, 2013:

Borrowers will have to pay mortgage insurance for the entire loan term if the LTV is greater than 90% at the time the loan was originated. If your LTV was 90% or less, the borrower will pay mortgage insurance for the mortgage term or 11 years, whichever occurs first.

| Term |

|---|

Also Check: What Credit Bureau Does Usaa Use For Auto Loans

Why Work With Dash Home Loans For Fha Loans

Dash Home Loans offers FHA loans in NC and FHA loans in SC. When you apply for an FHA loan with us, our team will go to work to help you find the best rates available to you. Well discuss each type of FHA loan, what the qualifications are, and help you understand the options available based on your unique situation.

When you apply, we can give you an idea of how much of a home loan you qualify for as well so you have a better idea of just how much house you can afford. If you already have a home with a specific purchase price in mind, our team can use an FHA loan mortgage calculator, to provide insight into what your estimated monthly payment will be.

But most importantly, applying for an FHA loan from Dash means youll experience a simpler, easier mortgage process with the best support available. Skeptical? Check out our reviews.

Why Have Fha Loans Become So Popular Again

During the housing boom, FHA loans were not so widely used. In 2007, FHA loans only made up about 3% of all loans funded nationally. During that time, FHA loans were not as attractive as conventional loans due to FHAs loan limit restrictions, higher mortgage insurance costs and stricter appraisal guidelines. At that time, conventional loan products offered interest only options, 100% financing choices and low doc alternatives that tended to outshine the benefits offered by FHA loans.

Today, just about all of the loan products that previously competed with FHA loans are no longer available. Lenders now consider the previous products to be too risky and many people blame those loan products for being the root cause of the financial crisis and ultimately responsible for undermining the entire world economy.

In 2018, it was estimated that one out of every five mortgage loans originated in the United States is an FHA Loan! This is because FHA loans are considered easier to qualify for while also offering a lower down payment than the 20% required for most conventional loans. Another factor that has made FHA loans more competitive is the fact that real estate values have decreased, yet FHA loan limits remain unchanged. Therefore, many more homes are eligible for FHA financing than ever before based on the maximum loan sizes available in relation to typical sales prices.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

How To Apply For An Fha Home Loan

The first step in applying for an FHA home loan is to contact an approved FHA lender. FedHome Loan Centers is an approved broker for all types of government loan products including FHA insured loans.

One of our Government Loan Specialists can assist you every step of the way. An FHA loan is considered one of the easiest type of real estate loans to qualify for because it usually requires a low down payment and the borrower is allowed to have less-than-perfect credit.

FHA loans are not just for single family properties. You can also use an FHA loan to purchase or refinance a duplex, triplex, fourplex or condominium as long as the borrower will be occupying one of the units. FHA loans are not for investors or for the purchase of a vacation home.

In order to get the process rolling, you will need to provide your Loan Specialist with the following basic information:

- Borrower Address

- Social Security Number

- Employment Info

- Current Paystub

- Banking Statement

- Information about other real estate owned

- Federal W2s

- Federal Tax Returns , Income Statement and Business Balance Sheet

- Certificate of Eligibility ad DD-214

- Pay for a credit report and FHA appraisal of the property

To qualify for an FHA loan, generally you must be able to satisfy the following criteria:

Alternatives To Fha Home Loans

There are several government-backed and non-government options that also offer low down payments and flexible underwriting. They include:

FHA mortgage eligibility is not restricted to first-time or low-income buyers. Alternatives like VA mortgages are limited to eligible military and veteran applicants, and USDA loans have income restrictions and are available in less densely populated areas.

Conforming and conventional loans often require higher credit scores.

No single mortgage program is best for all home buyers, so its smart to compare.

Don’t Miss: Does Va Loan Work For Manufactured Homes

Fha Loan Vs Conventional Loan: Which Is Right For You

FHA loans are commonly compared to conventional home loans to determine which will best fit your situation.

When you meet with your Mortgage Coach at Dash Home Loans, well look at various types of loans available to you. Well help you compare FHA loans to conventional loans as well as others that are applicable in your situation. Our Mortgage Coaches are experienced and will provide in-depth information, but as youre researching loans yourself, here are a few differences to keep in mind:

- The minimum credit score for an FHA loan is 500. For a conventional loan, it is 620.

- Down payments for FHA loans are 3.5%, at least. For conventional loans, it is typically 3% to 20% depending on the lender.

- Loan terms for FHA loans are 15 or 30 years, while conventional loans offer 10, 15, 20, and 30 year loans.

- You have to purchase mortgage insurance with FHA loans, but not with most conventional loans.

- Conventional loans can be more restrictive with what is allowed to be used for gifts for down payment. One hundred percent of your down payment can be a gift with an FHA loan regardless of the down payment percentage. However, there are restrictions here too. If your credit score is below 620 and you get an FHA loan in NC, SC, or another state, you may need to pay at least 3.5% of the down payment yourself.

What Are Fha Loan Limits

FHA loan limits are defined by the region where you’re looking to purchase your home. The government calculates the median home price of the county where your home resides and multiplies it by 115 percent, which represents the maximum amount of your FHA loan. So for example, if the median home price of the county where your future home sits is $300,000, your FHA loan would cap at $345,000.

Don’t Miss: Usaa Rv Rates

Todays Fha Loan Rates

Current mortgage rates are hovering near record lows. And FHA rates are generally among the lowest.

Compare rates from FHA-approved lenders to find the most affordable loan. You can get started right here.

Popular Articles

Step by Step Guide

Youre Still Entitled To Required Disclosures

Buying an as-is home doesnt mean you give up your right to disclosures. State and federal regulations dictate what the seller has to tell you about known issues within the home.

Each state has its own disclosure laws on what a seller has to tell the buyer about known problems. Some state disclosure regulations include water damage, mold infestations, termites and even whether someone died on the property. If a seller doesn’t disclose a known problem thats within your states list of required disclosures, you may be able to sue for damages or repair costs.

The only current federal disclosure statute is for lead paint. If youre buying a home built before 1978, the seller needs to tell you if the home has ever had lead paint.

You may be able to use disclosure laws to your advantage as a buyer. As soon as a seller knows about an issue in the home, they have to tell every future buyer about it.

For example, lets say you live in a state that requires sellers to disclose mold damage. Your home inspection finds mold that the seller didnt know was there. Alerting the seller to the mold might make them more willing to negotiate with you after all, theyll have to disclose the mold to other buyers if you back out of the sale.

Recommended Reading: Usaa Auto Loans Bad Credit

Who Pays For The 2nd Appraisal On An Fha Flip

Buyer may not pay for the second appraisal. Must include documentation to support increased value. A lower value is used if the second appraisal is 5% lower than the first appraisal.

How do you get FHA 90 day rule?

Its very simple actually. Just make sure that your buyer uses a mortgage broker. The mortgage broker he uses must have lenders that he works with that require no title seasoning. Its also true that if your borrower must go FHA to purchase, you will have to wait the 90 days, and in some cases even 180 days.

What Will An Fha Appraiser Require To Be Fixed Before A Sale

The appraisers report may list areas that must be fixed before the lender will approve the loan. At that point, youll need to negotiate with the seller on who will pay for and manage the required repairs.

Examples of what an appraiser might flag:

- Broken or significantly cracked plaster or sheetrock walls

- Peeling paint

- Wood floors whose finish has worn off

- Badly soiled carpets

Once you receive the appraisal report, you can decide whether its worth negotiating with the seller or whether you want to back out of the sale. Relatively minor repairs, such as fixing peeling paint, may not be a dealbreaker.

But if the appraisal turns up major structural issues that are both costly and time-consuming, you may decide its best to find another home. Fortunately, FHA loans include appraisal contingencies that allow you to walk away from the sale with no financial penalty if the appraisal comes in low or reveals property issues.

Related reading: Crash Course in FHA Appraisal Requirements

Read Also: What Do Mortgage Loan Officers Do

Mortgage Insurance Is Required For An Fha Loan

You knew there had to be a catch, and here it is: Because an FHA loan does not have the strict standards of a conventional loan, it requires two kinds of mortgage insurance premiums: one is paid in full upfront – or, it can be financed into the mortgage – and the other is a monthly payment. Also, FHA loans require that the house meet certain conditions and must be appraised by an FHA-approved appraiser.

Upfront mortgage insurance premium Appropriately named, this is a one-time upfront monthly premium payment, which means borrowers will pay a premium of 1.75% of the home loan, regardless of their credit score. Example: $300,000 loan x 1.75% = $5,250. This sum can be paid upfront at closing as part of the settlement charges or can be rolled into the mortgage.

Annual MIP Called an annual premium, this is actually a monthly charge that will be figured into your mortgage payment. The amount of the mortgage insurance premium is a percentage of the loan amount, based on the borrowers loan-to-value ratio, loan size, and length of loan:

| Loan Term |

|---|

| Over $625,000 |

| Over 95% |

For example, the annual premium on a $300,000 loan with term of 30 years and LTV less than 95 percent would be $2,400: $300,000 x 0.80% = $2,400. To figure out the monthly payment, divide $2,400 by 12 months = $200. So, the monthly insurance premium would be $200 per month.

What Is Required For Fha Loan

FHA Loan Requirements

- FICO® score at least 580 = 3.5% down payment.

- FICO® score between 500 and 579 = 10% down payment.

- MIP is required.

- Debt-to-Income Ratio < 43%.

- The home must be the borrowers primary residence.

- Borrower must have steady income and proof of employment.

Where do i go to get an fha loan?

Summary of Best Lenders for FHA Loans in February 2020 Lender Best For Citibank NerdWallet rating Read review first-time home buyers Flagstar NerdWallet rating Read review first-time home buyers Navy Federal NerdWallet rating Read review low down payment Bank of America NerdWallet rating Read review low down payment

do FHA loans have income limits?income limitationsFHAloansisFHA loandoFHA loanloans areloan

Read Also: What Credit Score Is Needed For Usaa Auto Loan