Is Apr The Same As Apy

No. Annual percentage yield refers to the yearly rate of return on your investment in a fixed savings account. The rate of interest is different from APR because it applies to money that comes into your account, instead of money that goes to lenders. Plus, it factors in compound interest.

References

How To Get A Great Apr On A New Personal Loan

Your creditworthiness and that of your cosigner or co-borrower, if applicable is the primary factor in determining your interest rate and APR on a personal loan. If you have a good payment history on your credit report, a good or better as a result, and stable employment history, its possible that youll qualify for a good APR, perhaps even a single-digit one.

With that said, a great APR for one borrower may not be so great for another. A truly great APR allows you to repay your balance on time, or ideally ahead of schedule, without harming other aspects of your personal finances.

If you prequalify for personal loans to receive APR quotes, only to find them too high for your situation, you could pause your applications and instead work on your credit score, or enlist a personal loan co-applicant.

What Does Variable Apr Mean

If an , then it can change over time. With some loans, you know exactly how much youll pay in interest: you know how much youll borrow, how long youll take to pay it back, and what interest rate is used for interest charges. Loans with a variable APR are different. The interest rate might be higher or lower in the future than it is today.

Variable-rate loans are risky because you might think you can afford to borrow given todays rate, but you may end up paying a lot more than you expected. On the other hand, youll typically get a lower initial interest rate if youre willing to assume the risks of using a variable APR. In some cases, variable APRs are the only option availabletake it or leave it.

Recommended Reading: What Type Of Personal Loan Should I Get

What Is An Interest Rate

An interest rate is an amount a lender charges you to borrow money. Its always expressed as a percentage such as 4% or 6.2%. You pay interest as either a fixed rate that stays the same for the entire loan or a variable rate that changes periodically.

Part of each monthly mortgage payment goes toward paying down your loan principal the amount you borrowed and part goes toward interest. The portion applied to the principal reduces your loan balance and builds your home equity over time.

When your loan balance is high, you owe more interest, so most of your monthly payment goes toward interest initially. As you pay down your mortgage, you owe a little less interest each month, and more of your payment goes toward the principal.

Eventually, most of your payment goes toward the principal until finally the principal and interest are paid in full. This process is called amortization. Heres an example showing how payments change over the life of a $300,000, 30-year loan:

Mortgage loan graph

Lenders use a standard formula to calculate how much of each payment goes toward the principal vs. interest so you pay off the loan on time. You can use an online mortgage amortization calculator to compare the monthly principal and interest payments for various loan amounts, terms, and interest rates.

What Affects Your Apr

The APR youre offered by a lender will depend on your credit score and how well youve borrowed in the past. If youve always repaid debts on time and havent exceeded your credit limit, youll be offered a more competitive APR than someone who has regularly missed payments and is therefore seen as a greater risk.

Lenders will also look at your annual salary and household spending before deciding what APR to offer. The amount you want to borrow and the length of time you want to borrow for will also be taken into account.

For personal loans, youll usually find that the more you want to borrow and the longer the term, the lower the APR will be. However, you should always ensure youre only borrowing what you can afford to pay back.

Recommended Reading: Student Loan Early Payoff Calculator

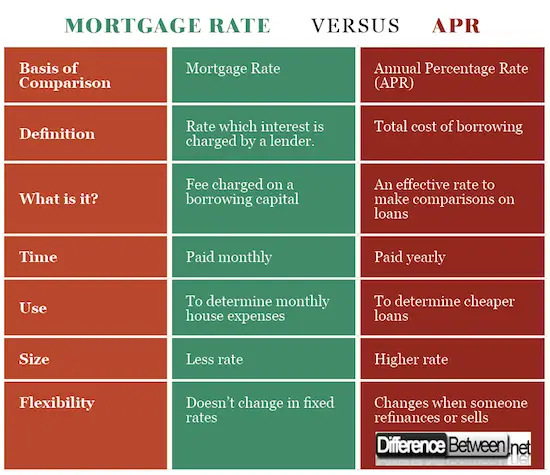

Whats The Difference Between Apr And Interest Rate

The interest rate and APR both represent the cost of borrowing money, but there are a few key differences.

| Interest rate | |

|---|---|

| Usually higher than the interest rate. | |

| Incomplete picture of loan costs. | More accurately reflects the cost of borrowing. |

| Less accurate way to compare lenders because it doesnt consider fees, which vary by lender. | Apples-to-apples way to compare loan offers with different interest rates, discount points, and fees. |

| Top priority if you plan to keep the mortgage for fewer than five or six years. | Most valuable if youre focused on the total cost of the loan for its entire term. |

Disadvantages Of Annual Percentage Rate

The APR isnt always an accurate reflection of the total cost of borrowing. In fact, it may understate the actual cost of a loan. Thats because the calculations assume long-term repayment schedules. The costs and fees are spread too thin with APR calculations for loans that are repaid faster or have shorter repayment periods. For instance, the average annual impact of mortgage closing costs is much smaller when those costs are assumed to have been spread over 30 years instead of seven to 10 years.

Read Also: Citizens Bank Car Loan Rates

What Is The Difference Between Interest Rate And Apr

Interest rate and APR are related, but different. The interest rate is the cost paid to borrow money and can be found in a loan agreement or credit card disclosure. APR is the combination of the interest rate, fees, and other costs associated with borrowing money in a given year, and is expressed as a percentage.

As an example, for a mortgage loan, the interest rate is the amount the lender charges for lending money. The APR, on the other hand, includes the interest rate, as well as other costs such as broker fees, closing costs, points, and other fees associated with the loan, such as insurance premiums or taxes. It is important to note that the APR should be used when comparing loans, since it gives a more accurate picture of the true cost of borrowing money.

- Donât be fooled by a lower interest rate. APR generally provides a more accurate measure of the cost of borrowing money, since it takes into account additional fees and costs.

- Pay attention to fees associated with the loan, since they can affect the APR.

- Compare APR when shopping for a loan – It is a more accurate measure of the true cost associated with borrowing money.

What’s The Difference Between A Fixed And Variable Apy

Unlike a fixed APY, a variable APY fluctuates as interest rates change. If the Federal Reserve raises rates, APYs often follow. Likewise, when rates decrease, APYs go down. This applies to savings and checking accounts as well as CDs, though those are more likely to have a fixed interest rate of return.

Read Also: Can I Get Loan Without Interest

How To Get A Great Apr On A Personal Loan

The factors that determine the APR on a personal loan are similar to those used in all lending decisions. Lenders typically consider your credit report, credit score, employment history and income before extending a loan offer.

Often, lenders use credit scores to help decide which applications warrant full considerationruling out candidates whose scores don’t meet a threshold for a particular loan. Applicants with lower credit scores may not even be considered for the loans with the best available APRs.

To get the best loan terms available to you, it can be worthwhile to take a few preliminary steps before you apply for a personal loan:

- Review your credit reports, including the one from Experian, for accuracy and submit any corrections to the national credit bureaus .

How To Calculate Your Credit Card Interest

The formula to determine how much interest you owe on your outstanding balance varies by bank, but generally works like this: Lets say your cards APR is 17 percent, and your average daily balance during a 25-day billing cycle is $2,000.

Find your daily rate by dividing the Annual Percentage Rate by 365 days.

$23.30

Your monthly interest charge

Keep in mind some accounts have multiple APRs, so this calculation may be applied for each one. Check your monthly statement and cardholder agreement for additional information on how each APR is applied.

Also Check: Personal Loan 620 Credit Score

Why Do We Need Both

The primary difference between the two is that your interest rate helps estimate what your monthly payment will be. On the other hand, APR calculates the total cost of the loan. Therefore, using both can help you make a truer loan comparison.

If youre interested in determining your monthly payment, interest rate is probably what you want to focus on. Just dont forget to include any taxes, insurance, and mortgage insurance when calculating your monthly payment.

Personal Loan Apr Vs Interest Rate: Whats The Difference

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Understanding the concepts of interest rates versus APRs for personal loans can help you secure a loan with the lowest possible cost. Interest rate is a percentage of a loan paid to the lender, while APR is a broader measure of the cost of a loan, including interest and origination fee. In other words, interest rate is just one factor in measuring APR. The lower your APR, the lower the overall cost of a loan will be.

Recommended Reading: Does Fha Loan On Manufactured Homes

Why Is The Annual Percentage Rate Disclosed

Consumer protection laws require companies to disclose the APRs associated with their product offerings in order to prevent companies from misleading customers. For instance, if they were not required to disclose the APR, a company might advertise a low monthly interest rate while implying to customers that it was an annual rate. This could mislead a customer into comparing a seemingly low monthly rate against a seemingly high annual one. By requiring all companies to disclose their APRs, customers are presented with an apples to apples comparison.

How To Calculate Apy

Here’s the formula for calculating the annual percentage yield:

APY = ^n – 1

- i = interest rate, expressed as a decimal

- n = number of times the interest is compounded. If quarterly, it compounds 4 times. If monthly, it compounds 12 times.

If you deposit $1,000 for one year at a 3% interest rate, and it compounds quarterly, you will have $1,030.33 at the end of the year.

- ^4-1= 0.03034 = 3.034%

- $1,000 ^4-1 = $1,030.33

Don’t Miss: What Is An Fha Construction Loan

What Is An Annual Percentage Yield

It tells you how much youâll earn by depositing money into a savings account.

This article was assisted by an AI engine and reviewed, fact-checked and edited by our editorial staff.

The annual percentage yield, or APY, represents what youâll earn in a year on an account that pays interest, like a savings account, certificate of deposit or money-market account. The higher the APY, the faster your money grows. Read on to learn more about yields and how they work.

Donât Miss: Pnc Growth Account Interest Rate

Whats The Difference Between Apr Vs Apy

Theres another important number to consider when taking out a loan or applying for a credit card: the annual percentage yield.

As previously mentioned, APR is a measure of the yearly cost of your loan if your loan is based on simple interest. APY is used in cases where interest is compounded, such as with savings accounts or credit card debt. In the APR calculation example, the borrower paid $120 in interest for a $2,000 loan. That means that they were charged 6% of the principal, calculated once, which would be the simple interest.

In some cases, interest on your loan is compounded, or calculated at a regular interval and then added to the principal owed. When interest is next compounded, its calculated using the now higher principal amount. This is how credit cards and adjustable-rate mortgages work. APY represents the annual cost of your credit card or loan while also factoring in how often interest is applied to the balance you owe on the card or loan.

Read Also: Does Advance Auto Loan Tools

Can I Lower The Apr On My Credit Card

Most credit cards use a variable interest rate, which means that it changes based on a number of factors. However, sometimes you can negotiate a lower APR with your credit card company by calling them and making a formal request. This option can be extremely beneficial if youre trying to pay off your outstanding balance or reduce a significant amount of credit card debt.

Is Apr Fixed When You Take Out A Loan

With most personal loans, the APR is fixed and will stay the same for the whole loan term, so you know exactly how much you need to pay back each month. But some loans may have variable APRs. This means that the rate can change over time, so your monthly payments could go up or down. Before you apply to borrow money, check which type of APR youre being offered so you know what to expect.

Recommended Reading: How Much Interest On 10000 Loan

Getting The Annual Percentage Rate

Individuals or businesses are not always on the paying end of the APR. When an individual or business maintains a deposit account at a financial institution, they can earn interest on their deposits. The bank or other financial institution pays the account holder interest because the bank is essentially borrowing the account holders money. In this scenario, the account holder will receive the quoted APR for the deposit account.

Note that lending institutions always offer an APR on deposit accounts that is significantly lower than the APR they charge for loans. This is how banks make money. They borrow deposit account money at a low interest rate, and then loan the money out at a higher interest rate.

How To Calculate Apr On A Mortgage

If youre comparing mortgages or loans, its a good idea to know exactly how APR is calculated. Having a firm grasp of the concept will better inform your search, and it never hurts to check the math! If you know the amount of fees and interest youll be expected to pay on a loan, then determining the APR is relatively simple :

Read Also: Current Home Equity Loan Rate

What Is Annual Percentage Rate

Annual percentage rate refers to the yearly interest generated by a sum that’s charged to borrowers or paid to investors. APR is expressed as a percentage that represents the actual yearly cost of funds over the term of a loan or income earned on an investment. This includes any fees or additional costs associated with the transaction but does not take compounding into account. The APR provides consumers with a bottom-line number they can compare among lenders, credit cards, or investment products.

How Is An Apy Different From An Apr

An APR, or annual percentage rate, typically applies to financial arrangements where you’re borrowing money or using credit. You’ll often see an APR quoted for a loan or , and the lower the rate, the less you will pay in interest. In contrast, an APY applies to financial arrangements where you deposit funds and earn interest.

Don’t Miss: How Much Is The Us Student Loan Debt

What Does Representative Apr Mean

Again, this is a term that you may have come across before especially in advertising.

FCA guidelines state that when lenders include certain content in their advertising, they are required to display their Representative APR.

This is the APR that a lender can reasonably expect to offer to at least 51% of successful applicants.

It allows potential borrowers to make a rough comparison between different lenders when shopping around for a loan.

You should bear in mind that this may not necessarily be the rate you are offered when you apply for a personal loan. The lender may offer you a higher rate than the advertised representative APR based on their assessment of your personal circumstances.

How To Compare Personal Loan Rates

Because APR comprises more than just interest rate, looking at APRs from various lenders side by side will help you make more objective, apples-to-apples comparisons. Confirm that the person loan preapproval you might receive shows APR so that you can shop around to make an informed decision.

Also, keep in mind that some lenders advertise APRs that already account for discounts, such as an autopay discount that shaves percentage points off the interest rate.

Here are examples of lenders that promote ranges of APRs for personal loans:

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site . LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

Read Also: How To Get Out Of Student Loan Collections