What Are The Steps To Calculate Simple Interest

Calculate the simple percentage by breaking down the formula. The accumulated total is obtained by multiplying the capital of the investment by the product one more time. Extract the data and modify the formula. If you encounter any problems, please check the formula and extract the information provided. Fill in the formula.

Average Length Of A Mortgage

As mortgages are the biggest loan youre likely to get, theyre often the longest, too.

Mortgages normally take 25, 30 or 35 years to pay back. Historically, the most popular length people opt for is 25 years, but in recent years the 30- and even 35-year mortgages are becoming more popular.

The reason longer mortgages are attractive is because they lower your monthly mortgage repayments. This makes is easier for people to afford a mortgage, helping people to get on the property ladder. Remember though, a longer mortgage means you end up paying substantially more over the lifetime of the mortgage.

Mortgage pay-off times actually vary a bit. This is for a few reasons.

Often people will remortgage every few years. This means you go back to a mortgage lender and thrash out a new mortgage deal, taking into consideration how much of your homes value youve paid off. Sometimes its possible to knock a couple of years off the total time youre paying your mortgage, as you could get a better deal.

Most people though will take the chance to lower their monthly repayments instead of shortening their mortgage term.

Some people also overpay each month on their mortgage. This means that the overall mortgage is lower, which makes the interest charged against it lower. All this means the mortgage itself can be paid off earlier.

Be careful though. Some mortgages charge fees for overpayments, or have a limit of how much can be paid. Go over the limit and you could get charged a fee.

Why Do Average Interest Rates Vary For Loans For New And Used Vehicles

Usually, the interest rate for a loan for a used car is going to be a little more than one for a new car because used cars can be viewed as less reliable than new cars. Finder.com shows that certain banks won’t even approve a loan for a car that’s older than 10 years or has a very high amount of mileage. The lender sees such vehicles as a risk because they are more likely to breakdown, making it difficult or impossible for the borrower to continue paying back the loan.

For example, a bank might offer a 3.74 percent rate for a new model but up that rate to 4.24 percent for a 2008 model even if it’s the same price. Used cars are usually less expensive than brand new models, so you may face a higher interest rate, but still save money in the long run. Longer auto loan terms on older models are typically not allowed for fear that the car won’t make it to the end of the payment calendar.

Also Check: What Do Mortgage Loan Officers Do

What Is A Mortgage Interest Rate

Mortgage interest rates reflect lenders cost of money, a cost that they pass on to you in the form of an interest rate. Your rate sets the amount of interest you pay over the life of your mortgage.

Even though nearly all mortgages come with fixed rates these days, small differences in interest rates can drive your monthly payments up or down. Over a 30-year term, that difference can add up. Just $50 a month equals more than $18,000 over the loans term. Knowing how interest rates factor into your loan pricing, as well as how your rate is determined, will help you evaluate your options and make the best decision for your situation.

What Factors Determine My Mortgage Rate

Lenders consider these factors when pricing your interest rate:

- Loan term

- Interest rate type

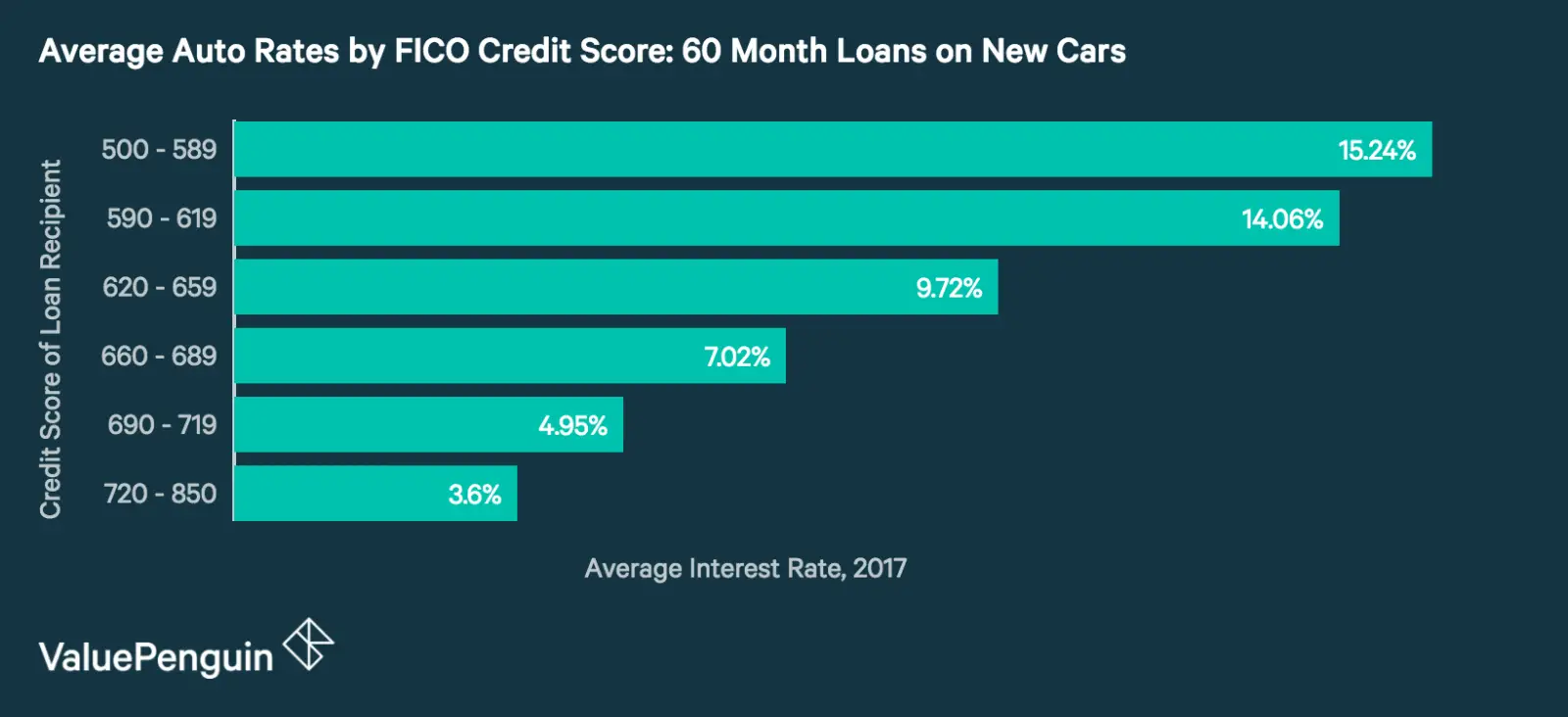

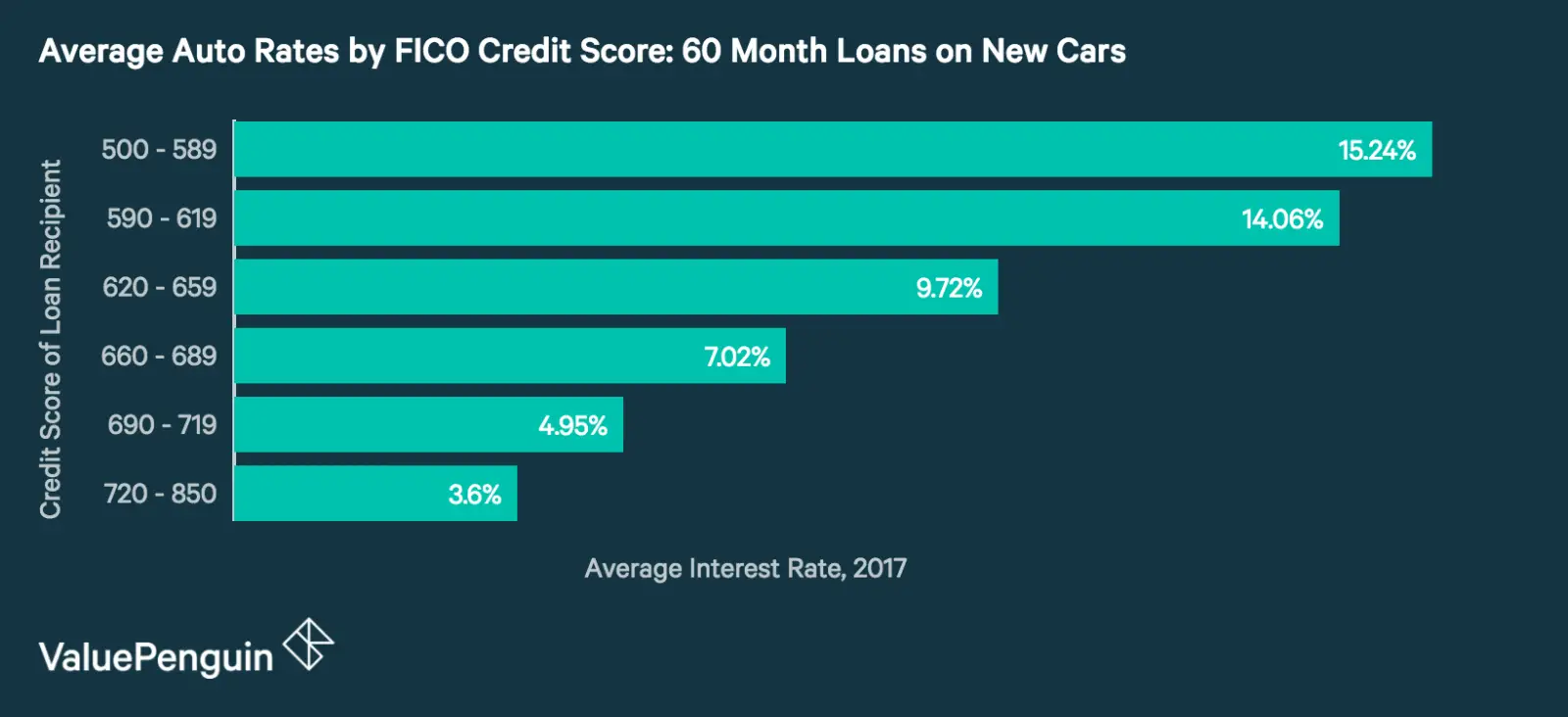

Your . Lenders have settled on this three-digit score as the most reliable predictor of whether youll make prompt payments. The higher your score, the less risk you pose and the lower rate youll pay.

Lenders also look at the amount of your down payment. For instance, if you put 20 percent down, youre viewed as a lower risk, and you might get a lower rate than someone whos financing nearly all of their home purchase. From the lenders viewpoint, the more skin the borrower has in the game, the more likely the mortgage will be repaid on time and in full.

Rolling additional closing costs into the loan affects your mortgage rate as well. With these costs added to what you owe, youll typically pay a higher interest rate than someone who pays those fees upfront. Borrowers might also pay higher rates for jumbo loans mortgages above the limits for conforming mortgages.

Use our mortgage calculator to see how different interest rates, down payments, loan amounts and loan terms would affect your monthly mortgage payments.

Don’t Miss: Credit Score For Usaa Auto Loan

Whats A Good Mortgage Rate

Mortgage rates can change drastically and oftenâor stay the same for many weeks. The important thing for borrowers to know is the current average rate. You can check Forbes Advisorâs mortgage rate tables to get the latest information.

The lower the rate, the less youâll pay on a mortgage. Todayâs rate environment is considered extremely well-priced for borrowers. However, depending on your financial situation, the rate youâre offered might be higher than what lenders advertise or what you see on rate tables.

If youâre hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

How To Calculate Monthly Interest Rate From Apr

- Find your current annual income and current balance on your credit card statement.

- Divide the current annual rate by 12 to find the monthly recurring rate.

- Multiply this number by your current balance.

How to calculate apr on credit cardHow do credit card companies determine their APR? This is how the annual credit card percentage is calculated. Interest on credit card balances is charged monthly. However, because the months vary in length, most card issuers use a daily periodic rate , which is the annual percentage divided by 365. The daily rate is multiplied by your daily balance co

Read Also: How To Transfer Car Loan To Another Person

How Do I Compare Current 30

Comparing 30-year fixed mortgage rates isnt as straightforward as looking at the mortgage interest rates you qualify for with different lenders. This is because a mortgage interest rate doesnt account for mortgage fees. To get an understanding of the overall cost of your home loan, you need to also compare annual percentage rates , which factor in other costs like loan origination fees and discount points.

After you apply for a mortgage youll get what is known as a Loan Estimate from the lender. Learning how to read a Loan Estimate is important because it shows an estimate of every fee the lender is charging you. Since every Loan Estimate form is the same, its a vital tool for comparing mortgage lenders and avoiding excessive fees.

How Do You Calculate Annual Percentage

To calculate the annual growth rate for the year, subtract the starting value from the ending value, then divide by the starting value. Multiply this result by 100 to get your growth rate as a percentage.

Is apr the same as interest rateHow can Apr be lower than the actual interest rate? Sometimes the annual interest rate on the ARM is lower than the interest rate. This may be the case in a declining interest rate environment where lenders may assume in their advertisements that your interest rate will be lower after the relaunch than when you got the loan.What is the difference between APR and mortgage interest r

You May Like: Does Va Loan Work For Manufactured Homes

Should You Buy Mortgage Points

Many lenders sell mortgage points . Buying points means youâd pay more up front to lower your mortgage rate which could save you money long-term. A mortgage discount point normally costs 1% of your loan amount and could shave 0.25% off your interest rate.

With a $200,000 mortgage loan, a point would cost $2,000. Buying two points would cost $4,000 which would be due, in cash, when you close the loan. These two discount points would translate into a 0.5% reduction to your interest rate.

Discount points could pay off but only if you keep the home loan long enough. Selling the home or refinancing the mortgage within a couple of years would short circuit the discount point strategy. But if you stayed in the loan indefinitely, you’d reach a break-even point after which the discount points would save you more and more over time.

Often, spending cash on a down payment instead of discount points saves more unless you know for sure you’re keeping the loan for years. If a larger down payment could help you avoid paying PMI premiums, put the money toward your down payment instead of discount points.

What Is Apr And Why Is It Important

The annual percentage or annual percentage is your interest rate, which is shown as an annual rate. The annual interest on the loan may include costs that may be charged to you, for example: B. start-up costs. The annual interest rate is important because it can give you a good idea of how much you need to pay to get a loan.

Read Also: Usaa Auto Loan Refinance

Determine Your Buying Power With A Mortgage Calculator

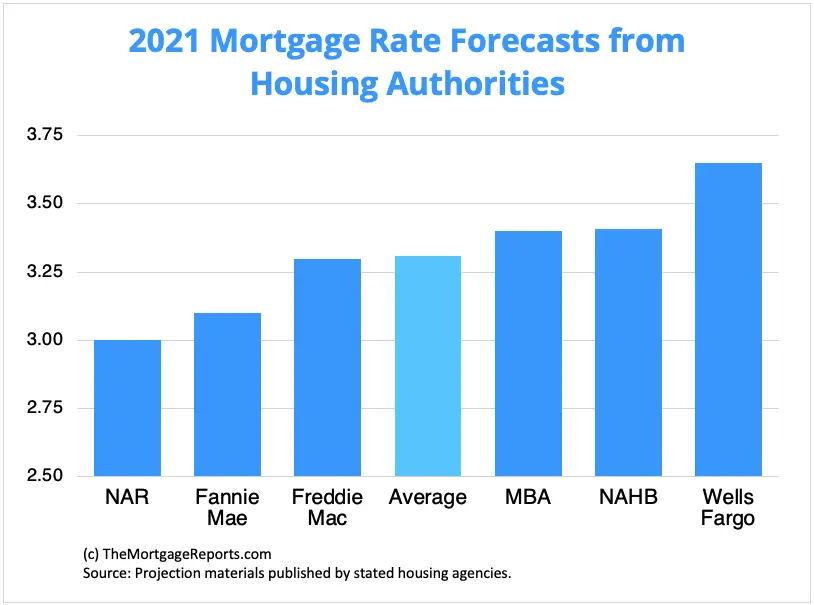

The charts and graphs on this page show the way 30year fixedrate mortgages have changed over time and continue to change.

To see how todays mortgage rates affect your borrowing power, use our mortgage calculator that includes PMI and other added costs.

Todays historically low interest rates have increased buying power by lowering monthly payments for borrowers throughout the spectrum.

How Are Interest Rates Determined

The goal of each monthly meeting is to determine the liquidity of funds within the country and establish prices that will keep the economy stable. If the circulation of money within the country is abundant, the prices will increase. If the circulation of money within the country is minimal, the prices will decrease. The goal is to find a balance that will keep the economy stable and full employment. It is generally easier for central banks of core economies to fight inflation rather than deflation, so they typically target a moderate postive rate of consumer price inflation around 2%.

The central bank lends money to retail banks at a discount interest rate. The consumer in turn borrows from the retail banks. The interest rates or Prime Interest Rates are determined by the rates assigned by the central bank to the retail bank. The central bank will raise interest rates when they want to discourage consumer borrowing and encourage more deposits. The deposits contribute to the overall worth of the bank. When the consumer deposits money, the bank can lend this money to another party to generate income from interest collected. The central bank will lower interest rates when they want to encourage consumer borrowing and increase spending.

Recommended Reading: Can I Roll My Closing Costs Into My Va Loan

How Do I Get A Mortgage

To get a mortgage, you need to start by getting your finances in order. Having a strong financial profile will a) increase your chances of being approved for a loan, and b) help you score a lower interest rate. Here are some steps you can take to beef up your finances:

- Figure out how much home you can afford. The general rule of thumb is that your monthly home expenses should be 28% or less of your gross monthly income.

- Find out what credit score you need. Each type of mortgage requires a different credit score, and requirements can vary by lender. You’ll probably need a score of at least 620 for a conventional mortgage. You can increase your score by making payments on time, paying down debt, and letting your credit age.

- Save for a down payment. Depending on which type of mortgage you get, you may need as much as 20% for a down payment. Putting down even more could land you a better interest rate.

- Check your debt-to-income ratio. Your DTI ratio is the amount you pay toward debts each month, divided by your gross monthly income. Many lenders want to see a DTI ratio of 36% or less, but it depends on which type of mortgage you get. To lower your ratio, pay down debt or consider ways to increase your income.

Then, it’s time to shop around and get quotes from multiple lenders before deciding which one to use.

Average Us Mortgage Rates

See Mortgage Rate Quotes for Your Home

The average rate for a 30-year fixed rate mortgage is currently 3.99%, with actual offered rates ranging from 3.13% to 7.84%.

Home loans with shorter terms or adjustable rate structures tend to have lower average interest rates.

While it’s useful to know what rates you can expect on average, the mortgage rates you’ll find will also depend on your individual credit history, loan amount, and down payment.

If you’re interested in finding out what current mortgage rate you might qualify for, use our rate tool at the top of the page to check mortgage rates for your chosen loan amount and location. No credit check required for estimated results.

You May Like: Drb Student Loan Refi

What Is A Mortgage

A mortgage is a type of secured loan provided by a financial institution to cover the cost of buying a home should you not have enough cash to pay for it upfront. You pay back the lender over an agreed-upon amount of time, including an additional interest payment, which you can consider the price of borrowing money.

Because a mortgage is a secured loan, it means you put your property up as collateral. Should you fail to make your payments over time, the lender can foreclose on, or repossess, your property. Learn more about how a mortgage works here.

What Is Apr And How Does It Affect Your Mortgage Amount

The annual interest rate is the additional cost associated with obtaining a home loan. The annual interest rate reflects the annual cost of the loan, including the interest rate plus other fees. Expressed as a percentage, as a percentage. The annual interest on mortgages generally includes fees such as startup fees and discount points.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Are Fha Mortgage Rates Usually Lower Than Conventional

FHA rates are typically lower than traditional interest rates because of the lower risk associated with these loans. But this is not always the case. There are many variables that affect the real interest rate on a home loan.

Does capital one auto finance offer gap insurance? YES, Capital one auto finance offer gap insurance.Capital One changed into based in 1988 and presents auto financing, mortgage, funding, banking, and credit card services.Gap insuranceWhen you have an accident and need to update your vehicle, a standard automobile insurance policy can pay the real coins price. If that real cash price is $10,000, but you owe $thirteen,000 in your car loan

How Does A Mortgage Work

A mortgage is a type of secured loan where the property often your home is the collateral. So youll never be able to take out a mortgage without having some sort of real estate attached to it. Mortgage loans are issued by banks, credit unions, and other different types of lenders.

Aside from paying the loan back, you pay for a mortgage in two ways: fees and interest. Interest is paid on your loan balance throughout the life of the loan, and is built into your monthly payment. Mortgage fees are usually paid upfront, and are part of the loans closing costs. Some fees may be charged annually or monthly, like private mortgage insurance.

Mortgages are repaid over what is known as the loan term. The most common loan term is 30 years. You can also get a mortgage with a shorter term, like 15 years. Short-term loans have higher monthly payments, but lower interest rates. Mortgages with longer terms have lower monthly payments, but youll typically pay a higher interest rate.

Read Also: How Do I Refinance My Car With Bad Credit

What Does Apr Mean For Credit Cards

A good credit card with 0% annual interest is a good option if you are financing a large purchase or paying off high-interest credit card debt. On the other hand, a credit card with a current low annual interest rate generally does not offer an initial promotion. This is the best option if you are looking for a long-term balance.

How Can I Calculate How Much My Ontario Mortgage Payments Would Be

Our Ontario Mortgage Payment Calculator will help you figure out how much youll pay with any rate you find on the site. It only takes a few minutes to use, so give it a try. You can modify the mortgage amount, mortgage term and type, amortization and payment type to see how your mortgage options and payment amount are impacted.

Also Check: Does Va Loan Work For Manufactured Homes