Direct Unsubsidized Stafford Loans

For students without demonstrated financial need, an unsubsidized Federal Stafford Loan is available.

The interest rate on Direct Unsubsidized Loans is fixed at 6.8% for all borrowers . A fee of 1 percent is deducted from each disbursement.

Borrowers of the Unsubsidized Stafford Loan are required to pay interest on the loan while in school.

You may make monthly or quarterly interest payments to your lender — or you may choose to have your interest added to the principal of the loan. This is called “capitalization.” This can occur during:

- The grace period — the time before beginning repayment.

- Periods of authorized deferment — postponement.

- Periods of forbearance — authorized delay in loan principal payment.

Four repayment plans are available to borrowers with either subsidized or unsubsidized loans:

- The Standard Repayment Plan requires a fixed amount to be paid each month for up to 10 years.

What Are The Fees Associated With Stafford Student Loans

The federal government charges a 1.057% loan origination fee for Stafford Student Loans first disbursed on or after October 1, 2020 and before October 1, 2023. The federal government charges a 1.059% loan origination fee for Stafford Student Loans first disbursed on or after October 1, 2019 and before October 1, 2020. The loan fees or loan origination fee for a student and/or parent PLUS loans are listed online on studentaid.gov/interest-rates.

Direct Stafford Loan Drawback

Be it a subsidized or unsubsidized loan, one drawback that comes is you are taking it in a debt. And every debt comes with a risk factor while you make your decision. The major risk is defaulting your loan.

Defaulting means if a borrower has missed his payment continuously many times then it is said to be defaulting of loan. The no of payments will be decided by the lender.

Subsidized Loan

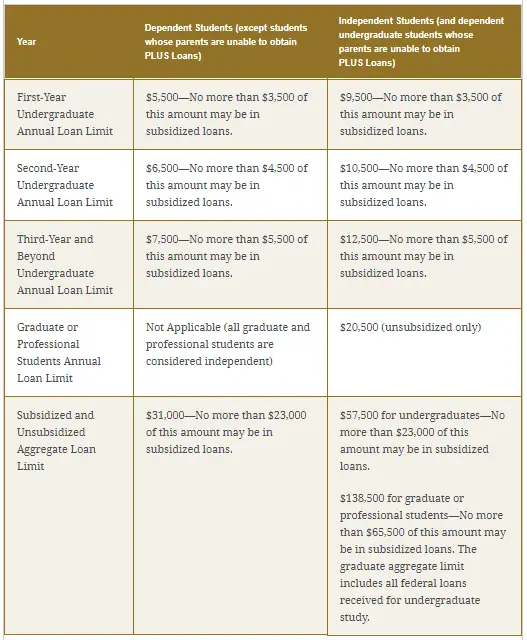

1 – Fixed borrowing amount – The downside of a subsidized loan is that the amount of money you can take as a loan is fixed and you cannot exceed that amount. The guideline which determines the amount of money you will receive is decided by your school and in which year you are.

2 – Increases only on a yearly basis – In the first year of school, most of the subsidized students are limited to $3,500. While in the second year $4,500, in the third year and fourth year is $5,500 according to the Department of Education.

Unsubsidized Loan

Every loan has its own pros and cons and in the unsubsidized loan, The borrower has to pay the whole amount of the Stafford loan interest rate starting from the very first day he borrowed the loan. If he is unable to pay the loan for any reason then the interest rate will be added to the total amount, and if any interest rate goes unpaid then it will become over time.

Read Also: What Jumbo Mortgage Loan Means

Direct Unsubsidized Loan Eligibility

To qualify for a Direct Unsubsidized Loan, you must:

- Be enrolled at least half-time in college

- Be enrolled in a program that will award you with a degree or certificate upon completion

- Be either an undergraduate, graduate, or professional student

You do not need to demonstrate financial need to qualify.

What Is The Interest Rate On A Direct Unsubsidized Loan

Federal student loan interest rates vary depending on the year in which they were disbursed. They are set by Congress.

Direct Unsubsidized Loans carry different interest rates depending on who is borrowing them: undergraduate vs. graduate/professional students

For undergraduate borrowers, Direct Unsubsidized Loans disbursed between July 1, 2019 and July 1, 2020 carry a 4.53% interest rate. Those disbursed between July 1, 2018 and July 1, 2019 carry an interest rate of 5.05%.

For graduate and professional borrowers, Direct Unsubsidized Loans disbursed between July 1, 2019 and July 1, 2020 carry a 6.08% interest rate. Those disbursed between July 1, 2018 and July 1, 2019 carry an interest rate of 6.6%.

Also Check: How Long Until You Can Refinance An Fha Loan

Loan Adjustment And Reinstatement

The online Loan Adjustment Request form is available at the start of each semester up until the adjustment/reinstatement deadline. If you would like your loan eligibility reviewed for either an increase or reinstatement, you may submit an online Loan Adjustment Request Form by the following deadlines:

2022-2023 Award Year Deadlines

| TBD |

How Do Stafford Loans Work

Stafford Loans are low-interest loans for undergraduate and graduate students. The interest rate for Stafford Loans first disbursed on or after July 1, 2020 and before July 1, 2021 is 2.75% for undergraduates and 4.30% for graduate students.

There are two types of Stafford Loans: subsidized and unsubsidized. Subsidized Stafford Loans are need-based loans. The federal government pays the interest while youre in school at least half-time, during your grace period, and during deferment periods. Unsubsidized Stafford Loans are not need-based loans. You are responsible for paying the interest on an unsubsidized loan while youre in school and during grace periods or deferment periods.

Read Also: Which Bank Gives Low Interest Personal Loan

Can I Consolidate Or Refinance Stafford Loans

You can consolidate Stafford Loans under the federal Direct Consolidation Program. This program will consolidate all eligible federal loan debt into one loan with an interest rate thats a weighted average of the interest rates on all the loans youre consolidating. Youll have a new servicer and loan term.

If you have good credit, you can refinance your Stafford Loans with a private lender. Its important to remember that refinancing federal loans into a private loan will cause you to lose some federal borrower benefits, such as deferment, forbearance, or income-driven repayment plans.

Credible makes it easy to see your prequalified private student loan rates from multiple lenders.

Compare student loan rates from top lenders

- Multiple lenders compete to get you the best rate

- Get actual rates, not estimated ones

- Finance almost any degree

Facing Trouble Repaying Your Loan

Make sure you contact your loan servicer when you are facing problem while repaying your loan, he will make you understand your loan option in the best way. For example- you have opted for a loan with high monthly repayment but now you want to change your repayment option to a lower repayment option or want to deferment or forbearance Which means temporarily stop your repayment for some time.

Don’t Miss: How To Get Statement Of Service For Va Loan

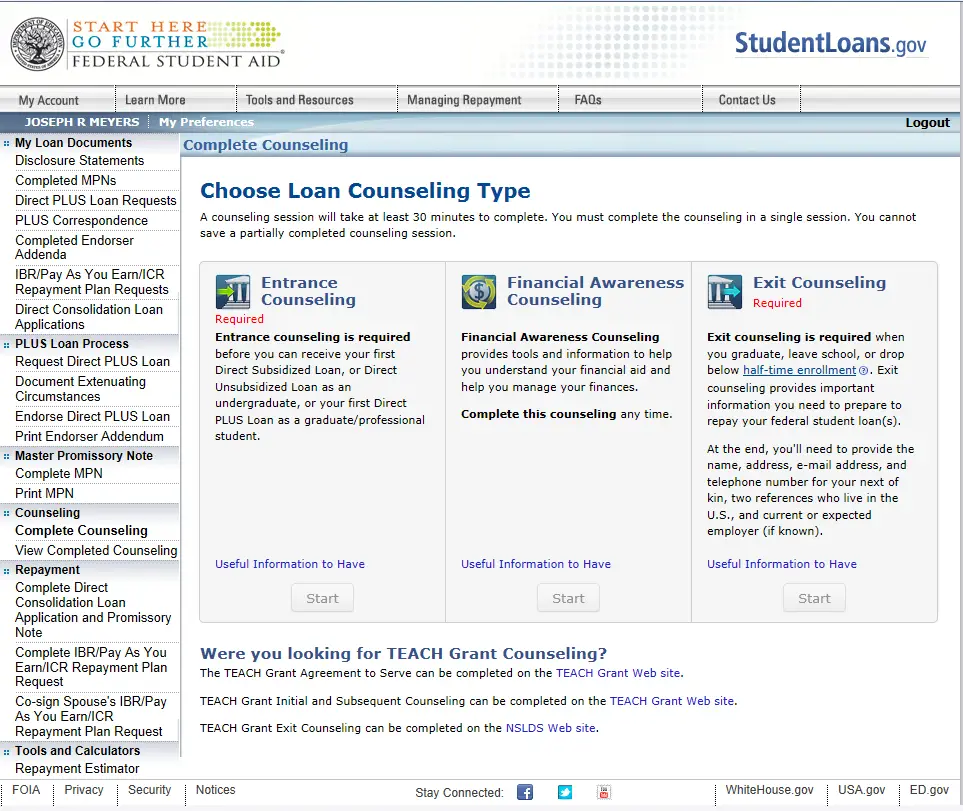

To Apply For A Federal Direct Unsubsidized Loan

To apply for a Federal Direct Unsubsidized Loan, the student must complete the FAFSA. If the student is eligible for a Federal Direct Unsubsidized Loan, the award amount will be posted on the students electronic Award Letter on SalukiNet.

A student is eligible to be considered for the Federal Direct Unsubsidized Stafford Loan if they:

- have a valid EFC on file in the Financial Aid Office.

- are enrolled in an eligible program on at least a half-time basis.

- have been awarded all subsidized loan eligibility.

- are making satisfactory academic progress.

- have not already borrowed the maximum aggregate Federal Direct Stafford Loan amount.

- are not ineligible for other reasons.

The Process Of Applying For Stafford Loans

Stafford Loans are available to the majority of students enrolled in higher-education institutions. However, there are some specific requirements a student needs to meet to be eligible for federal student loans. The student must be a U.S. citizen or an eligible non-citizen. They need to be enrolled in their program at least half-time or more. They must also submit the Free Application for Federal Student Aid before the yearly deadline. A full list of eligibility criteria is available on the Department of Education website.

The government awards Stafford Loans on a yearly basis. Students must re-submit the FAFSA each year they are in school to receive federal aid. That means each year, they must enroll in their institution at least half-time to continue qualifying for Stafford Loans. The main reasons for the annual renewal are that a students financial needs may differ from year to year and that tuition costs may rise each year, too.

FAFSA applications are free to fill out and fairly straightforward the information needed is fairly standard. To prepare, dependent students who are U.S. citizens should have ready their Social Security number and their parents Social Security numbers. Non-citizen applicants need to provide their Alien Registration number. To complete the application, students also need financial details like their parents tax information, bank account balances and more.

Read Also: Can I Include My Car Loan In Debt Consolidation

Who Is Eligible For A Dsl

A DSL has been very helpful in getting many students to their study destination and also to fulfiling their study dreams despite financial restrictions.

Due to the governments desire to help these students, they offer these loan programs. The idea of the program is to enable the students work hard while studying so as to earn more money to repay the loan.

For the cause of this program, undergraduate and graduate students are eligible for the DSL.

How Can I Get More Information About Stafford Loans

If youre considering taking out a Stafford Loan, you may want to get a Direct Stafford Loan Estimate. This estimate will give you an idea of how much money you can borrow and what the repayment terms may be.

To get a Direct Stafford Loan Estimate, contact the financial aid office at the school where youre considering enrolling. The office will need some information from you before they can provide an estimate, such as your expected enrollment status and whether you plan to attend school for a full academic year or just part of one.

Keep in mind that the Direct Stafford LoanEstimate is just that an estimate. The actual loan amount and terms may vary depending on factors such as your final enrollment decision, your actual enrollment status, and the availability of funds.

Also Check: Can I Deduct Home Equity Loan Interest

Are There Fees For A Direct Stafford Loans

Yes, there is a fee for Direct Stafford Loans, which is a percentage of the loan amount and is deducted from each loan payout. That percentage will vary depending on when the loan is first paid out. The loan fee is 1.066% for loans disbursed after Oct. 1, 2017, and before Oct. 1, 2018.

Make sure to read up on the different student loans to determine which one is the best fit for you before signing up.

Federal Stafford Loan Interest Rates

Your federal Stafford loan interest rate will vary according to the loan type and degree youre seeking.

According to the U.S. Department of Education, loans disbursed on or after July 1, 2018, and before July 1, 2019, have the following interest rates:

- Direct subsidized loans for undergraduates: 5.05% APR

- Direct unsubsidized loans for undergraduates: 5.05% APR

- Direct unsubsidized loans for students in graduate or professional programs: 6.6% APR

Also, dont forget about federal student loan fees. Federal Stafford loans include a 1.066% fee when they are disbursed before Oct. 1, 2018 and a 1.062% fee when they are disbursed on or after that date and before Oct. 1, 2019.

Federal Stafford loans also qualify for most repayment plans including standard, extended, graduated and income-driven which can run from 10 years up to 25 years.

Read Also: What Loan Option Is Recommended For First Time Buyers

What Is Required To Receive Federal Loan Funds

Direct Unsubsidized Loan Repayment Plans

Whether your Direct Loan is subsidized or unsubsidized, the U.S. Department of Education is your lender. That being said, your loan will be serviced by one of 11 federal student loan servicers. Your servicer will accept your monthly payments, advise you of your repayment options, and otherwise manage your loan.

Borrowers with Direct Unsubsidized Loans are typically eligible to enroll in the following repayment plans:

- Standard Repayment Plan

- Revised Pay As You Earn Repayment Plan

- Pay As You Earn Repayment Plan

- Income-Based Repayment Plan

- Income-Contingent Repayment Plan

- Income-Sensitive Repayment Plan

If you would like to change the repayment plan on your Direct Unsubsidized Loan, simply contact your loan servicer.

Also Check: How Often Do Loan Modifications Get Approved

Loan Repayment Plans Available

To meet the requirement of every individual borrower, there are a number of loan repayment options. In order to understand which repayment option is best for you, you can ask your loan servicer. In general, the repayment is for 10-25 years depending on the type of direct Stafford loan you have to opt for.

Student loan repayment is crucial for all borrowers, this phase of a borrower can either leave you devastated or help you build a credit score. It is advised to have an in-depth knowledge of all the student loan repayment options available.

Stafford Loan Origination Fees

Most federal loans charge disbursement fees that are a percentage of your loan amount. The fee is deducted from each loan you take out, meaning youll receive less money overall.

For loans issued between July 1, 2022, and June 30, 2023, the following disbursement fees apply:

- Direct subsidized and unsubsidized: 1.057%

- Direct PLUS: 4.228%

Lets say you took out a $10,000 direct parent PLUS Loan. Before the loan is disbursed, the U.S. Department of Education would deduct 4.228% of the loan amount$422.80and you would receive $9,577.20 to cover your education costs.

You May Like: What Is The Best Bad Credit Car Loan Company

Federal Direct Stafford Loans

Direct Stafford Loans, from the William D. Ford Federal Direct Loan Program, are low-interest loans for eligible students to help cover the cost of higher education at a four-year college or university, community college, or trade, career, or technical school. Eligible students borrow directly from the U.S. Department of Education at participating schools.

You must be enrolled as at least a half-time student to be eligible for a loan. Direct Loans include the following:

Direct Loans

What Is The Federal Stafford Loan Interest Rate

Congress sets federal student loan interest rates each year. The chart below shows the federal Stafford Loan interest rates for loans disbursed between July 1, 2022, and July 1, 2023:

| Direct Subsidized Loans |

|---|

| Source: StudentAid.gov |

These rates are fixed for the life of the loan. Interest rates may differ on loans with earlier disbursements, and rates for new loans may be higher or lower in the future.

Read Also: How To Apply For Government Loan

Federal Stafford Subsidized And Unsubsidized Loans

The federal government makes subsidized and unsubsidized Stafford loans to students attending participating schools across the country. The U.S. Department of Education is the lender.

The main difference between subsidized and unsubsidized Stafford Loans is that the subsidized Stafford is available only to those who can demonstrate financial need, and the interest is paid by the government while the student attends school at least half time. With the unsubsidized Stafford, the student pays the interest while enrolled.

If you encounter words you don’t understand, visit our loan terminology page and reference it while you read.

How Do I Get A Stafford Loan

To receive a Stafford Loan, you must first complete and submit the Free Application for Federal Student Aid form.You can get a Stafford Loan as a subsidized or unsubsidized loan. Subsidized means the government pays the interest while youre in college. Unsubsidized means you are responsible for the interest that accrues on the loan while youre in school and during your grace period. Stafford Loans are available to both undergraduate and graduate students. If youre an eligible undergraduate student, you can borrow up to $5,500-$7,500 a year, depending on what year you are in school and other factors. If youre a graduate or professional student, you can borrow up to $20,500-$40,500 a year in Stafford Loans.

To get a Stafford Loan, you must:-Complete the Free Application for Federal Student Aid form-Be enrolled at least half-time in an eligible degree or certificate program at an accredited school-Be enrolled in a program that leads to a degree or certificate-Be maintaining satisfactory academic progress in your course of study-Not have defaulted on any federal student loans

Recommended Reading: What Is Personal Loan Used For