Borrowers Who Are Public Servants

In early October, the Education Department unveiled sweeping changes to its largely failed Public Service Loan Forgiveness program, which was developed to relieve public servantsâincluding teachers, firefighters, social workers, and other government or nonprofit employeesâof federal student loan debt. The changes immediately canceled $1.7 billion in student loan debt.

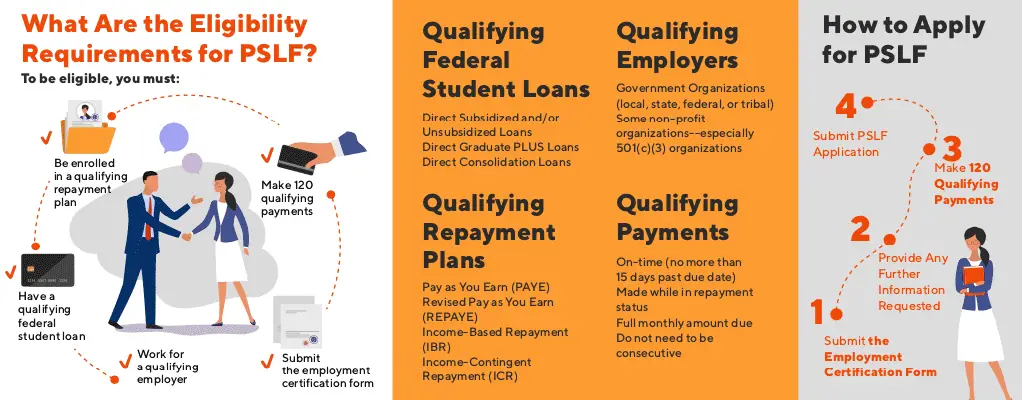

PSLF launched in 2007, requiring borrowers to hold a public sector job, be enrolled in a repayment plan, and make 120 on-time student loan payments. While that seems straightforward, 98% of borrowers who applied for forgiveness since PSLFâs inception were denied by the program due to a number of hurdles with the approval process. Changes to the program will ease the application process, according to the Education Department.

PSLFâs overhaul made 22,000 borrowers automatically eligible for forgiveness âwithout the need for further action on their part,â according to the Education Department. Another 27,000 borrowers could qualify for a collective $2.8 billion in forgiveness if they âcertify additional periods of employment,â according to the department. Long-term changes to the program could benefit more than a half-million borrowers because the PSLF program didnât count certain payments made on federal loans. Borrowers will need to consolidate any non-qualifying loans under the federal Direct Loan program to have the PSLF program work for them.

Public Service Loan Forgiveness Has Automatic Student Loan Forgiveness But Theres A Catch

There have been major changes recently to student loan forgiveness, especially for the Public Service Loan Forgiveness program. . The U.S. Department of Education has said $2 billion of student loans will be cancelled within weeks. This is good news for public servants who work full-time for a qualified non-profit or public service employer, make 120 monthly payments and meet other requirements. Historically, the program has rejected as many as 99% of applicants, but that should change going forward as requirements have been loosened so that more student loan borrowers can qualify. While student loan borrowers will get automatic student loan forgiveness after meeting the programs requirements, student loan forgiveness is not automatic for a limited waiver for student loan forgiveness. . Through October 31, 2022, student loan borrowers can apply for a limited waiver for student loan forgiveness and count previously ineligible student loan payments. Importantly, this limited student loan forgiveness is temporary.

How to apply: You can apply for the Public Service Loan Forgiveness program. You can also apply for a limited waiver for public service loan forgiveness.

What Are The Benefits Of Student Loan Forgiveness Programs

Student loans can be financially crippling for many college graduates, so qualifying for a forgiveness program can make a huge difference in eliminating some or all of that burden. Also, two of the programs allow for reducing your monthly payments based on your income, so it can also relieve current budget issues.

Even if you only qualify for $5,000 in student loan forgiveness through the Teacher Loan Forgiveness program, that saves you thousands of dollars in principal and interest payments.

Recommended Reading: How To Get Loan Originator License

Follow Up With Your Servicer

After the form is complete, make a copy and keep for your records. Then submit the completed and signed form to the address on the form, or if no address is listed, then to your servicer. Be sure to follow up. It is likely that the organization servicing your loan will change. Each year, you should resubmit the Employment Certification Form for Public Service Loan Forgiveness form so that you can keep track of your qualifying payments and make sure you stay on the road toward loan forgiveness.

Leaves And Change In Employment

Loan forgiveness is not pro-rated. If you leave government in the middle of the year, you’re not entitled to any portion of the loan forgiveness for that year and you must start making payments on the B.C. portion of your Canada-B.C. integrated student loan.

If you return to full-time studies, you’re not eligible as your loans will be in non-payment status during that time. You can re-apply when you return to work.

- For less than 3 months during the 12 month service period being reviewed, you’re eligible for loan forgiveness

- For 3 months or more during the 12 month service period being reviewed, you’re ineligible to receive loan forgiveness and will be removed from the program

Employees on general leave can’t apply while on leave, but are invited to apply or reapply to the program once they return to work.

Don’t Miss: Refinance Avant

Who May Need To Consolidate Their Loans

If you have Federal Family Education Loan Program loans, Federal Perkins Loans or other types of federal student loans that arent direct loans, you must consolidate them into the direct loan program by Oct. 31, 2022, according to Federal Student Aid.

This is important for borrowers because you can’t receive credit for payments if you consolidate after that date. Once the consolidation process is complete, you must then submit a PSLF form to your loan servicer.

The help tool on the Federal Student Aid website will be updated in the coming months to process applications for borrowers in the Federal Family Education Loan Program and those with Perkins loans.

Right now, employment can still be verified for them in Step 1 of the help tool, and loan consolidation can still be requested, Federal Student Aid said on its website. But an application for the Public Service Loan Forgiveness program through the tool may not be available in the near term for those borrowers.

Student Loan Discharge For Special Circumstances

While student loan discharge isnt the same as forgiveness, it could leave you debt-free. In rare circumstances, borrowers can get their student loans completely canceled.

There are several situations when you could qualify for student loan discharge, including:

- Closed school

If you think you could qualify or want to learn more, speak with your loan servicer.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

You Have Direct Loans And Youve Already Had Some Pslf Employment Certified

If youve already applied for PSLF and had at least some employment certified, the Department will award any additional payments we can without further action from you. If necessary, Federal Student Aid may contact you to ask you to certify additional months of employment. You should look out for an email from Federal Student Aid in the coming weeks to let you know how many additional payments we have preliminarily determined to be qualifying. You dont need to do anything until you receive an updated payment count or other communication from us.

If you know that you have qualifying employment that you have not yet certified with us, we recommend you certify that employment now by using the PSLF Help Tool at www.StudentAid.gov/pslf.

How Student Loan Forgiveness Works

Student debt has reached an all-time high in the U.S. According to a report by EducationData.org, student loan debt has reached $1.73 trillion, with over $1.56 trillion making up the Federal Loan Portfolio. It’s reported that as many as 43 million Americans owe an average of nearly $40,000. In some cases, borrowers may be able to get their loans forgiven or canceled. Student loan forgiveness releases a borrower from their obligation to repay part or all of their federal student loan debt.

The prospect of seeing that debt evaporate may seem like a dream come true. In reality, though, not that many people end up being eligible. Requirements vary depending on the type of loan, but most offer forgiveness only for those employed in certain public service occupations. These include teachers, government service, military service, and AmeriCorps.

As noted above, there are a number of different loan programs that qualify for student loan forgiveness, including the:

- Direct Loan program

- Perkins Loan program

There are also repayment plans offered to student loan borrowers that include the forgiveness of some of their debt. There can be situations in which a loan is forgiven because the educational institution defrauded the student in some way. We discuss this more in detail below.

Don’t Miss: Can You Get A Va Loan On A Manufactured Home

Student Loan Repayment For Doctors And Health Care Professionals

The National Health Service Corps offers loan repayment assistance to qualifying health care profession. The program offers $50,000 in loan forgiveness to licensed doctors, dentists, and or clinicians who agree to work for at least two years in an eligible position.

The Student to Service program is available to doctors in their final year of medical school. Youll commit to spending at least three years in a qualified position. In exchange, youll receive up to $120,000 of loan forgiveness.

The Indian Health Services Loan Repayment Program grants up to $40,000 in loan forgiveness. In exchange, doctors agree to work for two years in an American Indian or Alaskan native community. And once those two years are up, you have the option to renew your contract and receive additional loan forgiveness.

If you work primarily in a research position, you might want to look into the National Institutes of Healths loan repayment program. The military also offers loan forgiveness for doctors and health care professionals. And there are state programs available across the country.

Borrowers With Total And Permanent Disabilities

In a $5.8 billion round announced in August, the Education Department said it would wipe out student loan debt for 323,000 borrowers with total and permanent disabilities that prevent them from being able to work.

As long as the borrower is registered as having a âtotal and permanentâ disability by the Social Security Administration , discharges will be given automatically. The SSA started sharing this information with the FSA office in September through a data match. Borrowers who have a registered TPD will start to have their loans automatically discharged, and the Education Department will notify borrowers when that happens. The department expects this to happen âby the end of the year,â it said in the August announcement.

âThis change reduces red tape with the aim of making processes as simple as possible for borrowers who need support,â Cardona said in an August statement.

TPD borrowers no longer have to fill out a separate application to receive relief, according to the Education Department, which announced it would change how it monitors TPD borrowers. Previously, these borrowersâ income were monitored for three years after receiving TPD status, and if a borrowerâs income met a certain threshold, then the loans could be reinstated. The Education Department in August stopped sending these automatic income information requests. The department said, as part of the August announcement, it would also propose eliminating the monitoring period entirely.

Read Also: Does Va Loan Work For Manufactured Homes

Borrower Defense To Repayment Charge

If your school misled you, engaged in misconduct or violated certain state laws, you may be eligible for federal student loan forgiveness.

If you are eligible, you may be able to have all or part of your federal Direct Loans forgiven, or you could be reimbursed for the money youve already paid toward your loans. In order to qualify for borrower defense, you can apply through the online application on the Federal Student Aid website. You may need to submit extra electronic documentation during the application process, so review the required documentation before applying.

Maximizing The Investment Value Of Your Education

Every investment we make has a return. The return on your investment in education is a direct measure of the value you receive from your educational choices relative to what they might have cost you. Maximizing Value for Students and Our State, the Colorado Department of Higher Education‘s Annual Return on Investment Report offers Colorado students a better understanding of the value of different career paths and skill sets. The department also has online tools to help Coloradans maximize the return on investment they receive from the educational loans they take out over time.

Don’t Miss: Does Va Loan Work For Manufactured Homes

Loan Forgiveness For Lawyers

There are about a million jokes about lawyers being bloodsuckers on society, but the federal loan program begs to differ. There is a financial incentive for lawyers to practice in public service or government offices in order to have some portion of their law school loan forgiven.

For example, the Department of Justice provides up to $60,000 in loan forgiveness for lawyers who work there for at least three years. The Air Force Judge Advocate program offers up to $65,000 in loan forgiveness.

The best place to start looking might be your own law school, since several colleges forgive some or all of the student loans for students who make less than $60,000 a year.

That amount varies, so check with your school to get actual requirements and amount forgiven. If you cant qualify for a forgiveness program, look into refinancing your law school debt.

What Is An Sba Loan

An SBA loan is a small-business loan. Itâs granted by the U.S. Small Business Administration and then issued by a bank or other participating lender.

An SBA loan of $150,000 or less comes with a guarantee of up to 85%. The SBA loan guarantee for loans over $150,000 is up to 75%.

There are four main types of SBA loans in the U.S. including:

- Microloans of up to $50,0000 given for starting a business, buying equipment or inventory, and working capital. Community-based nonprofit organizations process microloans.

- The 7 loan program, the original SBA loan program, with a federal guarantee on loans up to $5 million. 7 loans are used for equipment purposes, working capital, and business expansion. Specialized lenders, credit unions, and banks process 7 loans.

- The 504 loan program with federally guaranteed loans also up to $5 million for buying facilities, land, and machinery. Nonprofits and private-sector lenders process 504 loans.

- Disaster loans of up to $2 million available to small businesses affected by emergencies like a natural disaster. The SBA processes disaster loans.

The original 7 lending program remains the most popular.

Don’t Miss: Who Can Qualify For An Fha Loan

Are There Any Drawbacks To Sba Loan Forgiveness

When your business is failing and youâre swimming in debt, any bit of relief seems like a miracle. However, if you cannot refinance your SBA loan and need loan forgiveness, understand that it comes with a few drawbacks.

First, you must dissolve your business entirely and liquidate all business property. This helps to bring down the amount of debt owed.

Second, be aware that asking for SBA loan forgiveness negatively impacts your business credit records. It can adversely affect your personal credit as well if you signed as the guarantor on the defaulted SBA loan.

Finally, business owners who receive loan forgiveness from it SBA will find it much more difficult to get approved for federal-based business loans in the future.

Original Public Service Loan Forgiveness Requirements

The original PSLF program has four main requirements. In order to be eligible for forgiveness, a person must:

While that may sound simple, in practice it was anything but. These requirements turned out to be more confusing and restrictive than initially planned. Many issues arose as borrowers tried to follow the rules. One common problem borrowers faced was payments that were a penny off or a day late not being counted towards the 120 qualifying payments. Also, neither FFEL loans nor Perkins loans were eligible for PSLF. Many people did not realize that those types of loans needed to be consolidated into Direct loans to qualify. Finally, there was a lot of poor guidance and, in some cases, wrong information from student loan servicers given to borrowers regarding their progress towards PSLF.

Don’t Miss: Loan Without Income Proof

Will You Get Credit For Payments That Previously Failed To Qualify For Pslf

Payments previously disqualified due to technical requirements, such as payments made late or in an incorrect amount, will be counted toward the PSLF, according to the DOE.

The Department will automatically adjust PSLF payment counts for payments made on or before , for borrowers affected by this issue who have already certified some employment for PSLF, a DOE fact sheet brings out. Borrowers who have not yet applied for PSLF forgiveness or certified employment but do so by , will benefit from these temporary rules as well.

Drawbacks Of Student Loan Forgiveness And Repayment Plans

Income-based repayment can also have a downside. More interest will accrue on your loan because the repayment is stretched over a longer period of time. “Loan payments under IBR and PAYE can be negatively amortized, digging the borrower into a deeper hole,” Kantrowitz notes. “Borrowers who expect to have a significant increase in their income a few years into repayment should perhaps prefer a repayment plan like extended repayment or graduated repayment, where the monthly payment will be at least as much as the new interest that accrues, and the loan balance will not increase.”

“Remember, payments change annually based on income. When your income rises, your payment can, too,” notes Reyna Gobel, author of CliffsNotes Graduation Debt: How to Manage Student Loans and Live Your Life.

Even if you succeed in lowering monthly payments, don’t go on a spending spree with the newly available funds, she adds. If you’re currently racking up more debt because you expect these plans in the future: Stop! You never know what will or won’t exist for graduates if the law changes in the future. Ask yourself, ‘Could I afford to repay this on a regular Extended Repayment Plan?’ If not, you could be getting yourself into very high debt and a difficult situation.”

If you choose to participate in any loan-forgiveness program, be sure to obtain written verification of the amount that will be forgiven and under what circumstances.

Don’t Miss: How To Calculate Amortization Schedule For Car Loan