Stay Sharp And Get The Best Deal

Buying your first home is a big deal. But, unfortunately, its also one of the most complex financial transactions youre likely to make during your lifetime. To avoid paying more than you have to, make it a point to pay close attention to the terms of your mortgage. The Loan Estimate is a great tool to help you see your total loan costs.

Shop around, compare mortgage lenders, and ask about origination fees ahead of time. Some lenders try to shift them to other titles or find other ways to make money. However, if you compare total costs and run the numbers, getting the best deal for you should be possible.

Different Types Of Lenders

There are different types of lenders including community banks, credit unions, national banks, mortgage brokers, mortgage bankers, and online lenders. Each state has a housing organization that closely works with lenders of all kinds and may be a good place for you to start with.

Every state has a mission based housing finance that sells tax-exempt bonds to support discounted home loans to first-time homebuyers and veterans. They also provide down payment assistance to buyers.

There you have it! We hope you feel a bit more educated about the mortgage loan organization process now than you were earlier. These instructions can make you feel comfortable with what to expect ahead of buying a new property.

How Do Loan Origination Fees Work

Loan origination fees are a commonly misunderstood type of fee associated with mortgages and other types of loans. Many borrowers dont understand what the fee is intended for or whether its necessary. Thats OK its never too late to learn. This line item is an important fee to understand when comparing loan offers or deciding whether to take out a loan.

Lets take a look at what loan origination fees are, what they pay for, and how loans without this fee arent always the best deal for your needs.

In This Article

Don’t Miss: Mountain America Credit Union Refinance Rates

How A Mortgage Crm Works With A Los System

To streamline your mortgage lending process, having a LOS system is not enough. You will need a mortgage CRM that can work well with your loan origination software to ensure that there are no lead leakages or setbacks in your lending process.

Lets look at how a CRM and LOS work hand-in-hand throughout the stages of the loan origination process.

Agent Assisted Loan Application

The typical types of financial services organizations offering loans through the face to face channel have a long-term investment in ‘brick and mortar’ branches. Typically these are:

The appeal to customers of the loan offered directly in branches is the often long-standing relationship that a customer may have with the institution, the appearance of trustworthiness this type of institution has, and the perception that holding a larger portfolio of products with a single organization may lead to better terms. From a bank’s standpoint, cross-selling products to current customers offers an effective marketing opportunity, and agents in branches may be trained to handle the sale of many different types of financial products.

In a branch, customers typically sit with a sales agent who will assist the customer in completing the application form, selecting appropriate product options , collecting required documentation , selecting add-on products , and eventually signing a completed application.

A major complexity for the branch origination channel is making the process simple enough that sales agents can be easily trained to handle many different products, while ensuring that the many due diligence and disclosure requirements of the financial and banking regulators regionally are met.

Many back-office functions of loan origination continue from this point and are described in the Processing section below.

Also Check: Auto Loans For Self Employed

Stage : Credit Decisioning

Using an automated process for credit decisioning allows a degree of predictability in the process. Even if there are changes in the loan decisioning parameters such as interest rates or tenure, they can be implemented into the system without any significant delays.

What Is A Loan Origination System

A Loan Origination System is a mortgage software platform that takes a mortgage transaction from origination to post-closing.

It is best to think of your LOS software as a lock system in a canal, opening the gates to the next phase once it has all of the necessary information to proceed. The data can range from basic borrower contact information to confidential information, which must be stored securely.

Although every lender has their own loan fulfillment process, they usually follow the same principles and procedures. With these methods, LOS software can provide mortgage lenders with customizable support systems for every loans origination and fulfillment.

You May Like: Co Applicant For Home Loan

Streamlining Mortgage Services With Loan Origination Software

Loan origination software coupled with AI-powered chatbots and other mortgage automation tools can help lenders handle many aspects of loan origination and servicing without overwhelming their teams.

At Capacity, we focus on helping lenders stay on top of their game and become mortgage industry leaders.

Step : Loan Origination Process Review

Having researched and selected the loan origination system, youll see that based on its capabilities you have a pretty clear idea of the origination process you can implement with it. Now you need to put it on paper and analyze your business needs, borrowers preferred channels, risks, and unique selling propositions. Not to mention, the origination process of your local competitors and the international markets top performers. Because in the global world, if some technology is accessible to one company, chances are, it can be replicated and improved upon, no matter where you work.

And while the business model and logic are paramount, its extremely important to consult with a local regulations specialist to go through the ins-and-outs of the states requirements and avoid stepping on some regulatory land mine.

Once the process is set from the compliance standpoint, review it with your team, and once again go over the system you chose with your staff. You want input from people on different stages of your lending process involved in the discussion because a hands-on originator will be able to provide you with easy-to-miss details and you will come to more well-rounded decisions.

Read Also: Cap One Auto Loan

Step : Loan Origination Solution Configuration

Depending on the loan origination solution you choose, the time-to-market and customization options will differ. An advanced FinTech may be ready-to-use out of the box and deployed within days, but just as well you can get tangled in a confusing system that would take you and your team months before you actually start applying it to your loan origination process.

With the right software provider, you wont need to do much other than control the quality and completeness of the customization and decide when you want to deploy. If youre a small- to mid-size retailer, alternative lender, or just looking to offer in-house financing, chances are your lending automation needs will be more or less typical for the industry.

If thats the case, the completely operational end-to-end solution by TurnKey Lender can be deployed for your business within a day of signing the contract. If you want to customize the solution it can take a little more time, however, Turnkey Lender has the most robust solution with the fastest time-to-market. You get a flexible and scalable platform that our team can adjust to any of your business needs. The time-to-market will differ by packages, so you can choose which fits your business best:

- A ready-to-use boxed solution for end-to-end automation

- An Enterprise solution to address your unique needs and meet the requirements of a large-scale institution

You can email our team at if youd like to discuss your specific project and see what we can do for you.

Automation Of Loan Origination Process

As mentioned earlier, consumer lending is tightly regulated in India. Legislative reforms make it increasingly difficult for lenders to create sustainable revenue streams. A fully integrated, data-driven loan origination system can help lenders save money while reducing cycle times.

In a survey conducted by Moodys Analytics, 56% of bankers responded that their biggest challenge in initiating the loan process was manual collection of data and subsequent back and forth with the client.

Also Check: What Credit Score Does Usaa Use For Mortgage

Are Loan Origination Fees Negotiable

Origination fees and many of the lender-side fees are negotiable, so dont be afraid to ask your lender to reduce yours. Origination fees can be lowered by:

- A simple reduction of the fees by the lender

- The lender giving a credit to offset a portion, or all, of the origination fees

- Taking a higher interest rate to reduce your up-front costs

If you are still left with up-front costs, consider asking the seller to contribute to your closing costs. The odds of receiving seller contributions are market-dependent, so be sure to consult with your real estate agent about this.

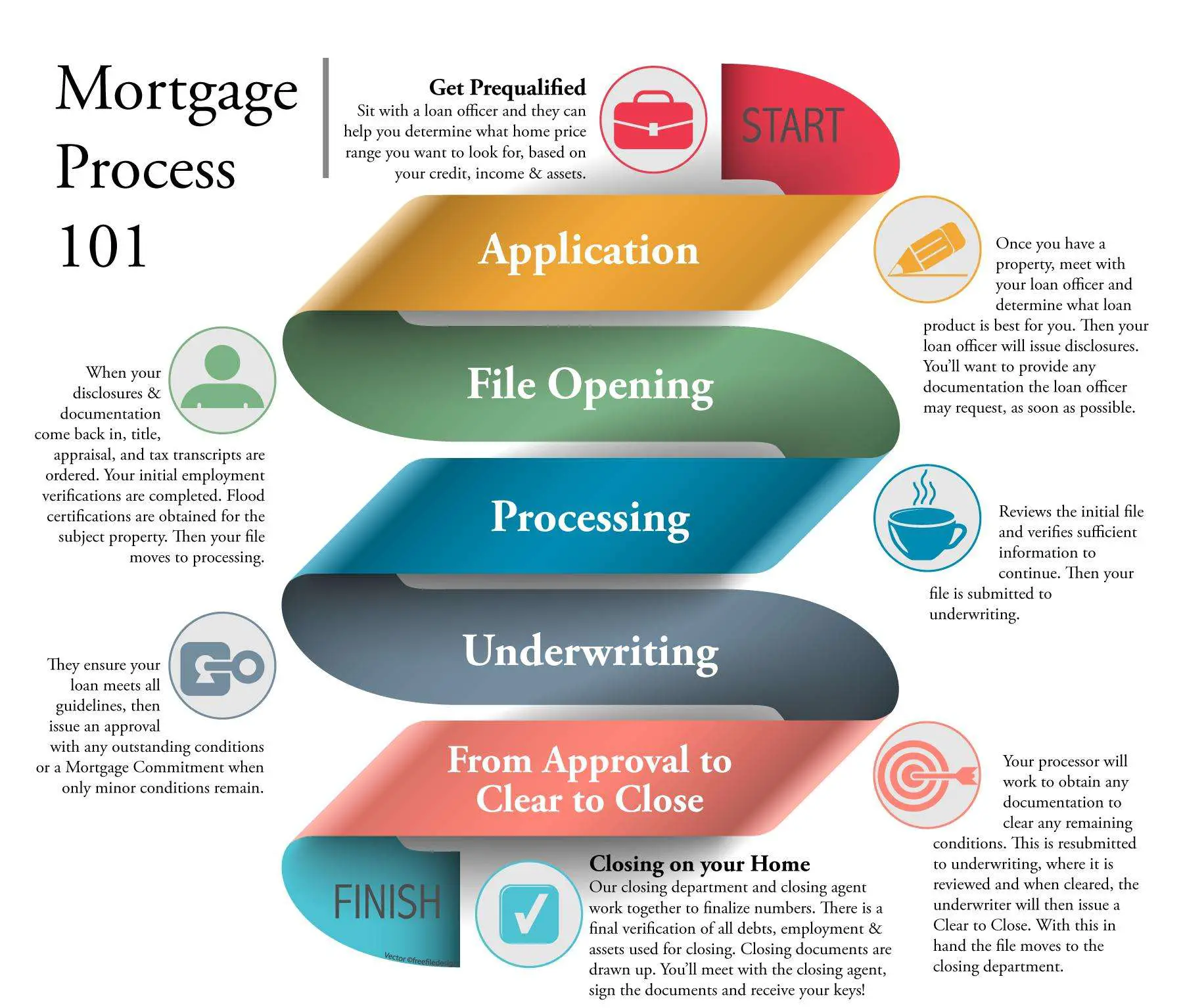

What Is The Loan Origination Process

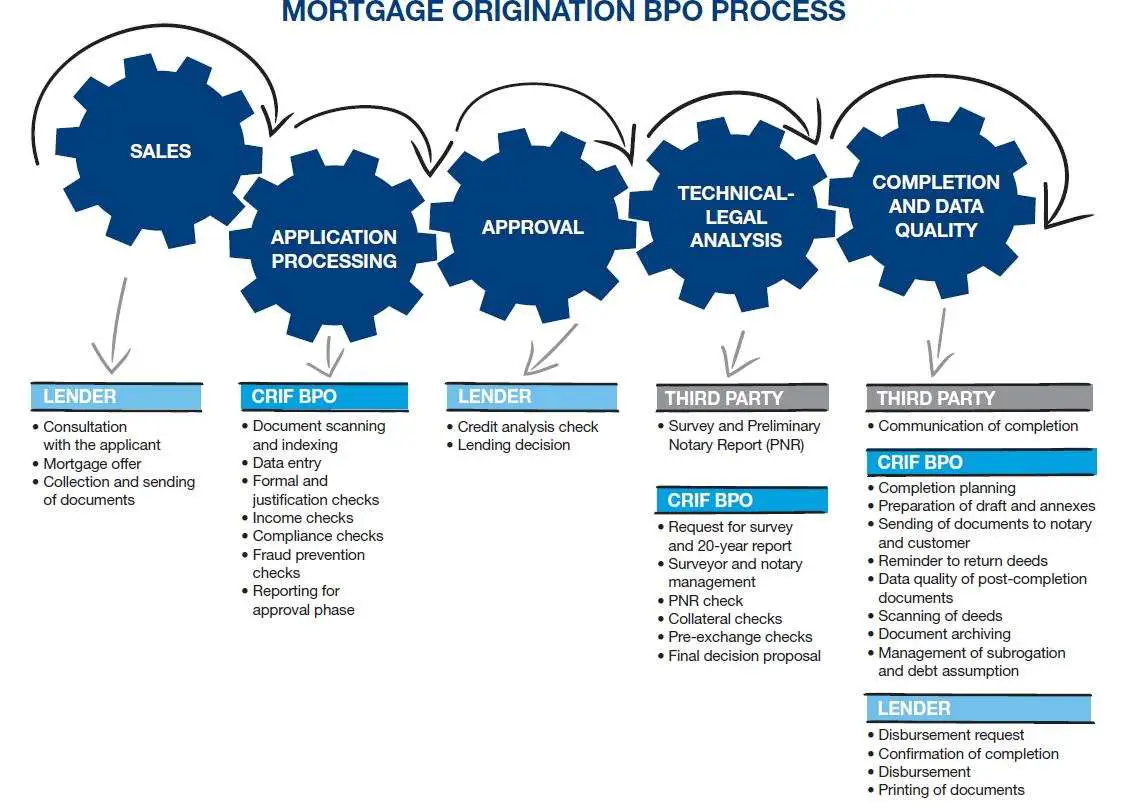

The mortgage loan origination process is always lengthy and exhaustive. This is because it is a high-risk business model. Lenders simply cant afford to sit back and relax in their line of work. Every approved loan amount goes into well over a hundred thousand dollars. The stakes are very high! To ensure that they dont come across fraudulent profiles, lenders initiate the extensive loan approval called loan origination.

Mortgage loan origination comprises of application acceptance, processing, property appraisal, loan underwriting, and loan approval. For all lenders, the complexity of loan origination is not a matter of choice. It is a necessity that must be handled well.

You May Like: How Much To Spend On Car Based On Income

Step : The Role Of Prequalification In The Digital Lending Process

The first point of contact lenders get with potential borrowers is prequalification. Once your digital loan origination solution is up-and-running and you have received a lead you need to request the personal information you need for AML and KYC compliance or analyze the info the lead submitted from a form on your website.

So in order for the prequalification to work smoothly, the loan origination software needs to have a flexible loan application form settings to collect and process the data that will actually help make an informed credit decision. Some of the data points you may need to collect include:

- Legal name

- Permanent address

- Occupation

- Position held and/or name of employer

- An official personal identification number or other unique identifier contained in an official document with a photo

- Type of bank account and income sources

- Signature

Note:

All that, including the signature, can be collected without ever visiting a branch with an e-signature service integration.

Check out an in-depth article about borrower identification in digital lending here.

Stages In Loan Origination Explained

December 9, 2019 By Team Finezza

Loan Origination is the foremost and most crucial stage in loan servicing. With a renewed focus on customer engagement & satisfaction, lenders are concentrating on the elements of design & delivery that fulfil customers expectations first.

The process differs for every lending company. All lenders are at liberty to choose a loan origination process that suits them, so they decide how it starts, the different stages that are involved within the process, and where it ends. The approval criteria differ for each loan type. Each companys individual loan origination process is the secret sauce that makes them different from the rest of the players in the market.

The process, when built to perfection, provides lenders with adequate insight across all stages of the journey. Improving the stages of loan origination can help players in the lending sector tap into uncaptured market segments. It also helps them win against the competition. Very often, loan origination practices involve the use of alternative data and send out SMS updates to customers to increase their chances of success.

Also Check: Auto Loan Payment Calculator Usaa

Loan Origination Explained In 4 Minutes Or Less

Loan origination is the qualification and verification process that begins a new loan. It starts with submitting documents for pre-qualification, which are analyzed by the banker. A loan is fully originated at closing or when the loan is fully in effect.

In between, there are quite a few communication steps for lenders and their underwriters to complete to ensure the loan meets legal standards while also moving forward in a timely fashion. Learning about the loan origination process can help you better understand any holdups in the process and ask any needed questions along the way.

Loan Approvals And Funding

Lastly, you can create an online mechanism for borrowers to sign off on loans. You can leverage e-signature software or biometrics to validate customer identities and automatically store document copies in your systems.

You should also enable same- or next-day account funding for smaller personal loans. Set the timeline expectations for larger amounts of funding in a personalized email.

Also Check: Are Auto Loans Amortized

Loan Origination Fees And You

One last thing to consider is the purpose of the loan. Mortgage loan origination fees are often tax-deductible. Personal loan origination fees are sometimes tax-deductible, depending on the purpose. If youre using a personal loan for qualifying business or educational expenses, these fees may also be deductible from your taxes. This is subject to changing tax laws and may vary by state. We recommend consulting with your accountant or tax preparer for more information.

If youre taking out a loan, remember to look at the whole picture to determine the cost of the loan. While an offer to waive the loan origination fee may be enticing, its essential to look at the interest rate and all the fees associated with the loan to see the actual total cost. Chances are, waiving the loan origination fee just means theyre making the money back somewhere in a less obvious fashion. Transparency is important when making major financial decisions.

Take, for example, a personal loan through Prosper. Prospers unique peer-to-peer lending model provides easy access to credit for many consumers, and the loan origination fee covers the actual costs of offering and servicing the loan. In addition, loans through Prosper reflect commitment to transparency including representing fees up-front, with no hidden gotchas.

When you add up all the costs of a loan, youll often find the loans with the most transparency about their fees and costs end up being the best deal.

Powerful & Easy To Use Loan Origination Software

Lending & Leasing as a Service origination software allows financial institutions to accept, process and decision credit applications in a paperless mode, with a single data entry process. All of these applications are controlled by a flexible workflow management system that can be configured to reflect the step in the companys underwriting processes.

Throughout the LLaaS implementation, DecisivEdge was much more than another vendor implementing software they have been a true partner, helping us every step of the way through our complex project. The DecisivEdge team embraced the constantly changing regulatory and legal process changes and, on the night before go-live, went above and beyond to make our conversion successful. I value the support we were given and have been reaffirmed that we chose DecisivEdge for this difficult conversion.

~ John Savage, CTO Microf LLC

Don’t Miss: Usaa Refinancing Car Loan

Advantages Of The Digital Loan Origination Process

Automation, whether you think its just a marketing buzzword or not, has already increased the efficiency of numerous industries worldwide including finance and banking. Lending is no exception.

A well-structured application processing system allows institutions to optimize decision-making and saves borrowers time, thereby making their services accessible to a wider audience. Analytical tools within the loan origination solution provide additional value by allowing lenders to continually improve efficiency and loan performance.

Benefits of using digital loan origination platform include:

- A single centralized system

- Elimination of manual loan processes

- A faster and more accurate underwriting process

- Better customer relationship management

- Simple and easy lending audits

- Diminished risks of data compromise

Developed using cloud and web technologies, a loan origination process flow provides a better customer experience and eliminates paper documents. Did you know that companies in the US only spend over $ 120 billion per year on printed forms? Most of these printed documents become outdated in around three months.

However, according to the Federal Reserve survey, most businesses keep following a paper-based approach thus 49% of borrowers still find the application process to be difficult.

How Does Loan Origination Work

The loan origination process begins with an applicant submitting documentation and data to the lender. This information may be less comprehensive for a small secured loan versus a large loan, but in both cases, , income and assets, and information about what the loan will be used for will all be taken into account.

Most lenders will then take all the required documentation and input the key data into an automated underwriting software product or an underwriter will manually determine exactly the loan limits for which the borrower qualifies.

The representative of the lender will discuss potential terms and interest rates with the borrower, since they may qualify for a different rate for a longer-term loan, or if the loan is a fixed-rate versus an adjustable-rate. If the terms are acceptable, they can agree to move forward, originating the loan.

All this work is compensated in the form of a fee that is included in the loan. For home mortgages, a typical mortgage origination fee is between 0.5% to 1% of the loan amount.

You will know the amount of your origination fee ahead of time as each lender must include it in your loan estimate. Origination fees can generally only increase under certain circumstances.

You May Like: Can You Use A Va Loan For Investment Property

How To Apply For A Mortgage

It can be time-consuming and sometimes stressful to go through the mortgage origination process, so preparation is key.

1. Check your credit. Check to confirm that your credit score meets minimum requirements and your report is error-free. The higher your score, the better your choices and less interest you pay.

Fix what needs to be fixed, and raise your score where you can by paying down debt and avoiding taking on more. Avoid any late payments on rent, credit cards, student loans or car loans, and be sure to keep the same job, if possible, because stability is crucial in the eyes of a lender.

2. Understand the type of mortgage you might want. From conventional to USDA loans, know the differences of each loan type and which one fits your finances and situation best.

3. Compare offers from different lenders. Its crucial for your budget to find the best lender for your situation. Rouse recommends talking to a number of lenders. Ask your friends, family and real estate agent who they would recommend.

Find a lender to whom you can relate, in whom you have confidence. Choose one and get preapproved before finding the right Realtor to help in searching for a home, Rouse says.

Note there are different types of lenders national banks, community banks, credit unions, mortgage brokers, mortgage bankers and online lenders. Each state has a housing organization, as well, which generally works with lenders of all kinds, and may be a good place to start.