Is There More Than One Kind Of Fha Loan

The most commonly-used type of FHA loan is the 203, a standard fixed-rate mortgage. The 203 is the FHA loan with the lowest down payment minimum. Plus, there is no minimum income requirement to qualify for the loan. If the home you want to finance is within FHA loan limits, you have decent credit and a sufficiently low debt-to-income ratio, you may be a shoe-in.

Another option is the 203, designed to help people who want to make significant improvements to the house they are financing. The 203 loan combines a normal mortgage with a home improvement loan, saving you the time, hassle and expense of applying for two separate loans.

C Cltvs And Subordinate Financing

Any existing subordinate financing must be subordinated to the streamline refi mortgage. A new subordinate financing may be permitted if its proceeds are used either:

- to reduce the existing mortgages principal amount, or

- to finance the discount points, origination fees, and other closing costs incurred in the refinance.

The FHA does not have a maximum combined loan-to-value limit for streamline refinances.

In the previous guidance, the calculation of the maximum loan amount would depend on whether the streamline refi has an appraisal or none. The current handbook notes that appraisals are not required on streamline refinances. And whether the lender has received one does not have a bearing on the eligibility or calculation of the maximum mortgage amount on streamline refinances.

Understanding Federal Housing Administration Loans

It’s important to note that with an FHA loan, the FHA doesn’t actually lend you money for a mortgage. Instead, you get a loan from an FHA-approved lender, like a bank or another financial institution. However, the FHA guarantees the loan. Some people refer to it as an FHA-insured loan, for that reason.

In order to secure the guarantee of the FHA, borrowers that qualify for an FHA loan are also required to purchase mortgage insurance, and premium payments are made to FHA. Your lender bears less risk because the FHA will pay a claim to the lender if you default on the loan.

While Federal Federal Housing Administration Loans require lower down payments and credit scores than conventional loans, they do carry other stringent requirements.

| How Long You Pay the Annual Mortgage Insurance Premium |

|---|

| TERM |

Is An FHA Mortgage Still A Bargain?

You May Like: Can You Refinance Sallie Mae Student Loans

What To Do If You Don’t Qualify For A Conforming Loan In 2022

If you want to borrow more than the FHFA allows in 2022, a jumbo loan may be an option. Jumbo loans are simply mortgages for people who need more than the FHFA normally allows. They typically have stricter eligibility requirements and higher interest rates than conforming loans. Jumbo loans are riskier for lenders, so companies make it harder to qualify to decrease the likelihood of a borrower defaulting on payments.

Each lender has its own requirements for jumbo loans, but you’ll probably need a higher credit score, lower debt-to-income ratio, and bigger down payment than you would for a conforming loan. Expect to need at least a 700 credit score and 20% or more for a down payment. You also may need a debt-to-income ratio of 36% to 45%.

The better your credit score, DTI ratio, and down payment, the more you may be approved to borrow with a jumbo loan.

What if your credit and debt profiles aren’t strong enough for a conforming or jumbo loan? You may want to apply for an FHA mortgage, which is for people with credit scores as low as 580 and a DTI ratio of 43% or lower. The borrowing limit depends on where you live, and you can find the limit for your county here.

You may qualify for a VA mortgage if you’re a military member, or a USDA mortgage if you’re buying in a rural area. Neither of these types of home loans requires a down payment. VA mortgages do not have a borrowing limit, and USDA mortgages usually have the same limits as conforming loans.

Borrowers With Low Credit Scores Can Benefit From Fha Loans

FHA loans have less stringent requirements on credit scores and can be more attractive to first-time buyers.

“FHA loans are available with low down payment options and lower minimum credit score limits, but youll also have to pay mortgage insurance,” Rocket Mortgage said in its blog. “The option of a low down payment and more lenient credit requirements can make FHA loans particularly attractive for first-time homebuyers, although you dont have to be a first-time homebuyer in order to qualify.”

Some FHA loan requirements include:

- A credit score of at least 580 for a 3.5% down payment

- A credit score of 500 to 579 for a 10% down payment

- A debt-to-income ratio of less than 43%

Borrowers must also be using the home as their primary residence, have a steady income and proof of employment, and they will be required to pay a mortgage insurance premium in their monthly payment.

If you are interested in seeing if you qualify for an FHA loan for your home purchase or refinance, or want to lower your monthly mortgage payment, contact Credible to speak to a home loan expert and get all of your questions answered.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at and your question might be answered by Credible in our Money Expert column.

Don’t Miss: What Car Loan Can I Afford Calculator

Conventional Loan Limits For 2022

Conventional loan limits are established by the FHFA and ultimately can vary based on you county. That being said, home prices rose an average of 18.05% across the nation, and in turn the lending limits for conventional loans have also increased.

Previously, the 2021 general loan limit was $548,250. Now in 2022, the baseline conventional loan limit has increased to $647,200. As a result Conventional Loan Limits for 2022 saw a whopping increase of $98,950 for a 1-unit property!

However, this number has increase even more for those areas which are considered high-cost.

For more information go to the Federal Housing Finance Agencys announcement.

How New Fha Loan Limits Are Calculated

The FHA limits loans to 115% of the median home price in a county. A median price is not the same thing as an average price, although the two numbers may be similar. The FHA uses the median price to estimate the typical price of a typical house.

Home prices vary from county to county, so the FHA takes this into account when it sets its county loan limits. For example, the FHA loan limit for New York County is $822,375 in 2021. The loan limit for Niagara County is $356,362. The current median home price in New York City is higher than that in Buffalo, so the limit is higher as a result.

These median home prices are based on the Home Price Index as calculated by the Federal Housing Finance Agency and includes figures for the 50 states and the District of Columbia.

If you are thinking about buying a house, knowing your FHA county loan limit and how much money you might be able to borrow is important. It is also important to decide how much money you can afford to spend on a house. You can use our Mortgage Affordability Calculator to get an estimate of a house price you may be able to afford.

Freedom Mortgage is the #1 FHA lender1 in the United States. Your Freedom Mortgage Loan Advisor can help you explore options to make the right decision about an FHA loan. Get Started todayor call us at .

1. Inside Mortgage Finance, Jan-Mar 2021

Other Insights

Recommended Reading: Drb Loan Consolidation Reviews

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

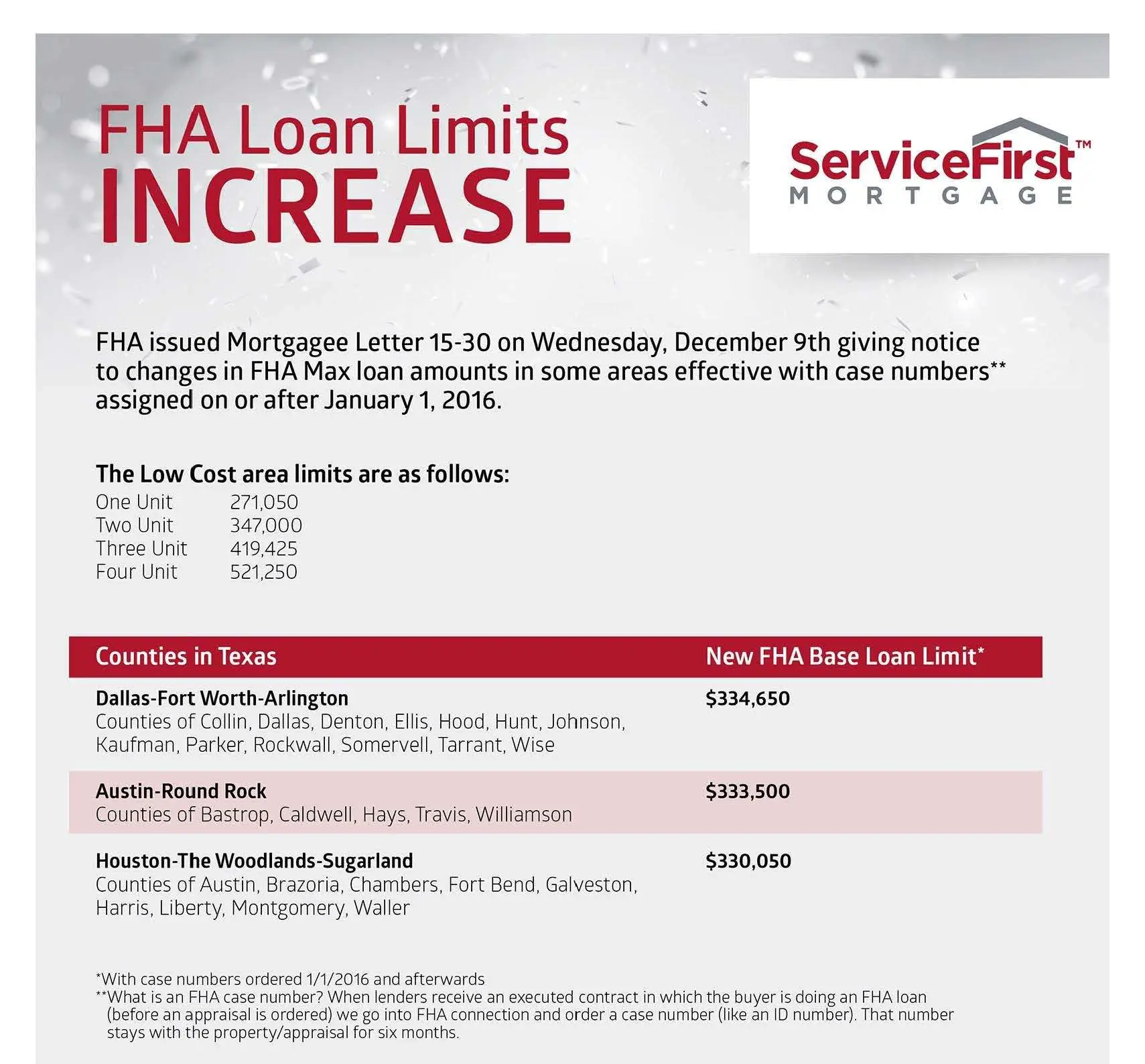

Fha Announces Increased Single

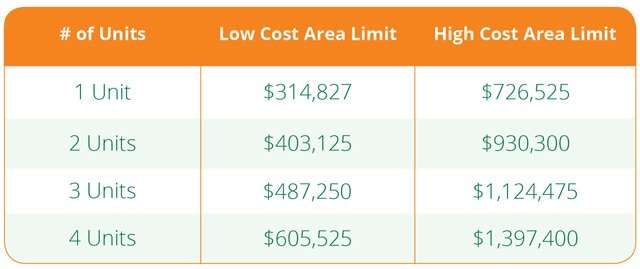

The Federal Housing Administration yesterday announced the county loan limits for its single-family mortgage insurance programs for 2020 and issued a Mortgagee Letter that increases the minimum loan limit for low-cost areas and the maximum loan limit for high-cost areas.

FHA currently sets the loan limit for most counties at 115 percent of the countys median home price. Mortgages that exceed the limit are not eligible for FHA insurance. In addition, FHA establishes a floor for low-cost areas, which it defines as counties where the median home price is 65 percent or less of the Federal Housing Finance Agencys conforming loan limit. Similarly, FHA also establishes a maximum loan limit for high-cost areas, where the median home price reaches or exceeds 150 percent of the conforming loan limit.

Last month, FHFA announced it was increasing Fannie Mae and Freddie Macs conforming loan limit for 2020 to $510,400 from $484,350, a just-over-five percent increase. HUDs Mortgagee Letter increases FHAs loan limits for low-cost and high-cost areas to reflect this change. Specifically, the low-cost limit will increase to $331,760 from $314,827, and the high-cost loan limit will increase to $765,600 from $726,525. The loan limits for Alaska, Hawaii, Guam, and the Virgin Islands are set at $1,148,400 to reflect high construction costs.

The new limits will apply to all loans assigned FHA case numbers on or after January 1, 2020.

Read Also: How To Get A Loan Officer License In California

Usda Maximum Loan Amount In Florida Alabama Tennessee And Texas

Believe it or not, there is actually no USDA Maximum Loan Amount in Florida, Alabama, Tennessee, and Texas. Hold on a second, is this a joke? Believe it or not it is true!

USDA maximum loan amounts are based on the borrowers USDA loan qualifying ability. Since there is no set maximum sales price for a USDA loan, this also means NO maximum USDA mortgage amount!

Thankfully, USDA income limits also increased earlier in 2021. This recent USDA income limit increase results in making it easier for homebuyers who are trying to qualify for higher priced homes.

Thus, without a loan limit a USDA mortgage can be a powerful option!

Fha Multifamiliy Housing Loan Limits

FHA loan limits for multifamily housing in 2022 have increased. The Federal Housing Administration announced that the 2022 multifamily loan purchase caps for Fannie Mae and Freddie Mac will be $78 billion for each a combined total of $156 billion to support the multifamily market.

The 2022 caps, which increased from $70 billion for each Enterprise in 2021, are based on FHFAs projections of the overall growth of the multifamily originations market.

At least 50% of the Enterprises multifamily loans are required to be used for affordable housing. FHFA also requires at least 25% of the Enterprises multifamily business be affordable to residents at or below 60% of area median income , up from 20% in 2021.

In addition, FHFA has changed certain definitions of multifamily mission-driven affordable housing in Appendix A of the Conservatorship Scorecard. In 2022, FHFA will allow loans on affordable units in cost-burdened renter markets and loans to finance energy or water efficiency improvements with units affordable at or below 60% of AMI to be classified as mission-driven.

FHFA will continue to monitor impacts of COVID-19 on the multifamily mortgage market and will update the multifamily caps and mission-driven requirements if adjustments are warranted. However, to prevent market disruption, if FHFA determines that the actual size of the 2022 market is smaller than was initially projected, FHFA will not reduce the caps.

You May Like: Usaa Car Refinance

Maximum Fha Loan Amount In Florida Alabama Tennessee And Texas

HUD announced on November 30, 2021 that it would increase FHA loan limits in 2022. These new maximum FHA loan amounts for calendar year 2022 are effective for case numbers assigned on or after January 1, 2022.

Overall, the maximum FHA standard low-cost area mortgage loan limit for a one-unit property has increased from $356,362 in 2021 to $420,680 in 2022! Additionally, the respective loan amounts have also increased for 2,3, and 4 unit properties that are eligible for FHA financing. They are listed here:

- One-unit property: $420,680

- Three-unit property: $651,050

- Four-unit property: $809,150

As a reminder high cost area limits allow for even higher maximum FHA mortgage loan limits.

For a complete list of FHA loan limits visit the FHAs loan limits page, here.

A Main Or Second Home

For owner-occupied properties, the maximum base loan amount would be whichever is the lesser of: the current mortgages outstanding principal balance as of the month before the mortgage disbursement, plus the interest due on the current mortgage and the MIP due on the current mortgage or the current mortgages original principal balance, less any UFMIP refund.

It would look like this: maximum insurable mortgage = outstanding principal balance/original principal balance + new UFMIP UFMIP refund.

For properties that are not owner-occupied like second homes or investment properties, they will be refinanced based on the outstanding loan balance as of the month before the mortgage disbursement date, or the original principal balance, including the UFMIP, whichever is lesser. Again, the UFMIP refund, if any, is excluded from the maximum mortgage amount.

Read Also: Loan Officer License Ca

Fha Multifamily Loan Limits

The Federal Housing Administration also backsmortgages on 2-, 3-, and 4-unit properties. These types of homes have higherloan limits than single-family residences.

FHA multifamily loan limits

| $1,909,125 | $2,372,625 |

Although FHA allows multifamily home loans, theproperty must still be considered a primary residence. That means thehomebuyer needs to live in one of the units full time.

In other words, an FHA loan cannot be used topurchase an investment property. However, you can use an FHA mortgage topurchase a 2-4 unit property, live in one unit, and rent out the others.

In this way its possible to get a multifamily loanup to $1.5 million with a low-rate FHA loan and just 3.5% down payment.

They Dont Always Align With The Conforming Limits

FHA loan limits can be different from the conforming limits . For instance, the lowest FHA limit in Californias more affordable counties is currently set at $356,362. But the conforming cap within those same counties is currently set at $548,250. So when you research maximum loan amounts, you have to look at the type of mortgage program you plan to use. You also have to zero in on your specific county.

Read Also: How To Apply Loan In Sss

Theyre Based On The Conforming Limits Set By Fhfa

FHA loan limits in California are derived from the limits established by the Federal Housing Finance Agency, or FHFA. This agency sets the maximum size for conventional and conforming mortgage products. The Federal Housing Administration takes those conforming limits and applies a formula to determine the maximum FHA loan amount for counties in California.

The Floor And Ceiling Lending Caps

According to the Department of Housing and Urban Development, the maximum FHA lending amount for high-cost metropolitan areas rose to $822,375 for calendar year 2021 . In areas with lower housing costs, the FHA limit can be as low as $356,362.

Obviously, theres a broad spectrum in between.

These are the floor and ceiling limits for FHA loans in 2021. In all other areas, loan limits are typically set at 115% of the median home price for the county, as determined by HUD. By design, the maximum FHA lending amounts are intended to be slightly higher than the median home price within a particular area. This makes the program suitable for buyers seeking a modestly priced home.

In most real estate markets, the 2021 limits should give buyers plenty of properties to choose from. But it wont accommodate those who are shopping on the higher end of the price spectrum nor is it intended to. The FHA loan program was created to support low- and moderate-income home buyers, particularly those with limited cash saved for a down payment.

Don’t Miss: How Do I Find Out My Auto Loan Account Number

Can You Exceed Fha Limits

The FHA has a maximum loan amount that it will insure, which is known as the FHA Lending Limit. If you are looking to buy a house that exceeds this limit, you are required to pay the difference as your down payment. These limits, however, vary according to the loan, the property type, and state and county you live in.

Fha Limits Arizona 2021

It is important to know the Arizona FHA loan limits because they impact a variety of down payment assistance programs offered in Arizona. Many of the down payment assistant programs that are available in Arizona have maximum loan amounts that are higher than the FHA loan limits in the county where you are looking to buy your home. So, you are capped by the FHA limits. If that is the case, you will not be able to use an FHA loan to be qualified for the maximum loan amount available for the down payment assistance program you have chosen.

The current FHA loan limit in the majority of the counties in Arizona is $331,760 for a single family residence. This is FHAs loan limit floor which is 65% of the conforming loan limit. The Coconino County FHA loan limit is higher because it is considered a high-cost area.

Recommended Reading: How Much To Loan Officers Make