What Is A Fico Auto Score

A FICO® auto score is a type of credit score that emphasizes your past auto loan payments.

Auto-industry lenders typically look into your FICO auto score to understand how responsible youve been with car payments and whether youre a trustworthy candidate for credit. Many lenders will use your FICO® auto score to help them determine if they should approve you for a loan.

Heres your guide on what is a FICO auto score and an auto loan credit report.

Check Your Credit Score

Checking your Experian credit score can give you an idea of your chances of getting approved with certain lenders and what loan terms and costs you can expect. If your credit score is in poor shape and you’re not in a rush to buy a new car, consider working on improving it before you apply. Ways to build your credit include:

- Check your credit reports for errors and dispute them with the credit reporting agencies.

- Check your credit report for legitimate issues in your credit history that need to be addressed, such as late payments, collection accounts and high credit card balances.

- Get caught up on late payments, if applicable, and continue to pay your debts on time going forward.

- Keep your credit card balances low relative to their credit limits.

- Avoid borrowing money unnecessarily.

If you have bad credit and need a car now, getting a cosigner, making a large down payment and looking for a second-chance car loan can help improve your chances of getting financing.

How To Use The Reverse Auto Loan Calculator

If you know what you can afford each month, a reverse auto loan calculator can tell you how that translates into the total amount you can borrow. Of course, there are variables: the length of the loan and the interest rate you get.

Below you can see how your loan amount changes by moving the sliders for payment and loan term. We’ve provided average rates by credit tier as determined by Experian Automotive.

About the authors:Philip Reed is an automotive expert who writes a syndicated column forNerdWallet that has been carried by USA Today, Yahoo Finance and others. He is the author of 10 books.Read more

Shannon Bradley covers auto loans for NerdWallet. She spent more than 30 years in banking as a writer of financial education content.Read more

Read Also: Average Interest Rate For Commercial Real Estate Loan

Settling A Car Loan Will Lower Your Credit Score

When you settle a car loan, the immediate impact on your credit score is negative. Your when you settle an auto loan, but the amount the credit score goes down varies by situation. In general, the higher your score is at the start, the more it will go down if you settle your loan.

However, settling your car loan could be the best option for you in the long term. Your credit score will be negatively affected every time you miss a payment. If you are struggling to make regular payments and cant pay off the auto loan completely, settling your auto loan will allow you to start rebuilding your credit.

Once the loan is settled your credit score will initially go down, but you can then focus on building it back up. You can work to make other payments on time, pay down other debts and raise your credit score again. Opening new lines of credit could negatively affect your credit, so you may want to avoid new accounts until your credit score is in better shape.

What Credit Score Do You Need To Buy A Car In 2020

Rather than asking, “What credit score do you need to buy a car?” it’s a better idea to ask, “What credit score do you need to get a good deal on an auto loan?”

Its always in a dealerships advantage to sell you a car, so the salespeople are going to do everything to secure financing for you, even if your credit isnt stellaralbeit sometimes at ridiculous interest rates.

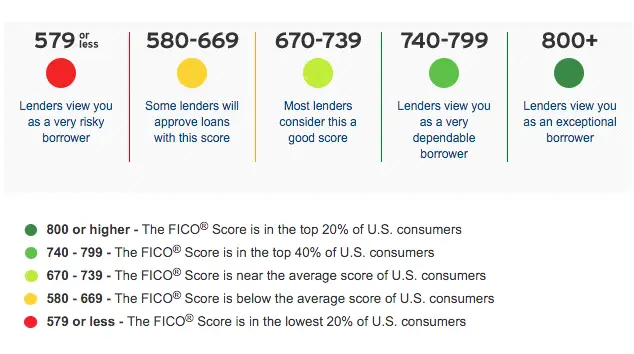

Typically, a will put you in a good position to find favorable auto loan terms. If your credit score is lower, youll probably be offered a higher interest rate. And the lower it is, the more youre likely to pay. If your credit score is very poorless than 450then you may not be able to get a car loan.

Recommended Reading: Usaa Auto Lease Calculator

Reverse Auto Loan Calculator: What Your Payment Buys

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here’s how we make money.

If you know how much car payment you can afford each month, a reverse auto loan calculator can tell you how that translates into the total amount you can borrow. But, of course, there are variables: the length of the loan and the interest rate you get.

Say you have decided that you can afford to spend $400 a month on a car. How far that goes depends on your interest rate. At 3.5%, $400 payments buy you a $22,000 loan for 60 months. At 9.5%, you could finance a $19,000 loan. The loan length has an even more dramatic effect that 9.5% loan stretched out to 84 months would finance $24,500.

Below you can see how your loan amount changes by moving the sliders for payment and loan term. We’ve provided average rates by credit tier as determined by Experian Automotive.

Car Loans And Credit Score In Summary

Does buying a car with a loan hurt your credit? In short, slightly, but only temporarily, if you make timely payments. Remember, when you apply for an auto loan, a hard inquiry is performed on your credit that lowers your FICO score by five to 10 points.

Do car payments build credit? Yes, they can, but only if you make timely payments consistently. Reliably repaying your auto loan demonstrates your trustworthiness to credit bureaus and can raise your credit score over time. Late payments, however, will only hurt your credit.

When you’re in the market for a new-to-you car, you probably want to sell your old one. But if you prefer the ease and convenience of trading in, who can you trust to give you fair value? At Shift, you can get a fair offer, better than at the dealership, driven by powerful machine learning algorithms and tons of data. With Shift there is no need to spend the extra time waxing and washing the car. A little dirt will not affect the quote, and we fully detail the cars ourselves anyway before listing them for sale.

Read Also: Capital One Auto Loan Approval

Shop Around For The Best Interest Rate

More likely than not, you didnt buy the very first car you saw when you pulled up to the dealership. There may have been a car prominently placed at the entrance, but you obviously werent forced to buy that particular vehicle. Similarly, you arent tied to the first lender you come across. You can shop around you may even find a better interest rate, better loan terms, and more accommodating lender.

Used Car Loans And Financing With Ridetime

What do you do when you get denied for a loan or what is offered to you is way up your budget? As mentioned, you keep looking. RideTime has a vast network of lenders where youll get approved regardless of credit history.

RideTime can provide you with a used car even because of bad credit history when other dealerships cant. And even if you have bad credit from divorce, repossessions, or bankruptcy youll most likely be approved as long as you can provide the requirements.

Cars are a necessity. Suppose you have a good credit score kudos to you. Youll have no problems in having credit approved. However, if youve got bad credit, dont fret. RideTime can provide you with a quality used car even if you have the minimum credit score for a car loan.

Don’t Miss: Apply For Capital One Auto Loan

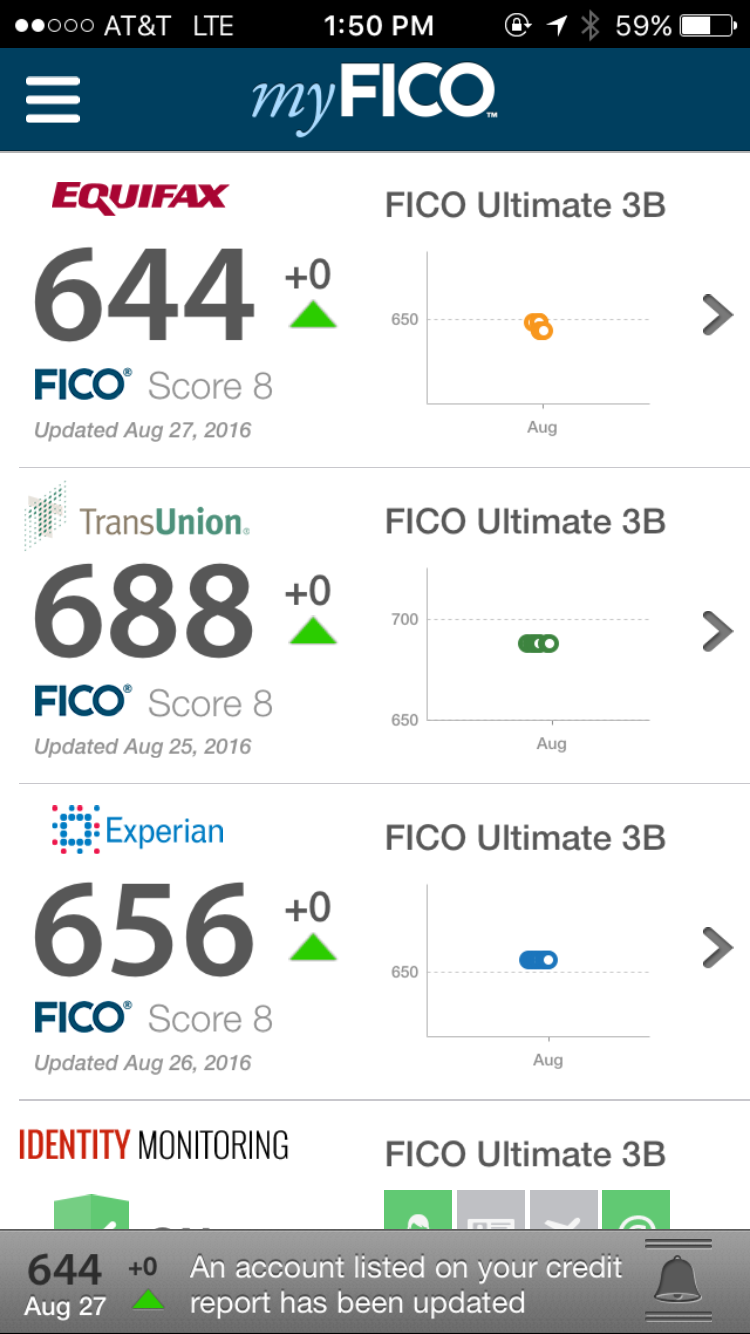

How To Access Your Fico Auto Scores

While some credit scores can be monitored for free, you may have to hand over some cash if you want access to your FICO® Auto Scores. When you pay $39.95 a month through FICO, you can monitor a handful of your credit reports and scores, including your FICO® Auto Scores.

Before you pay for credit monitoring though, note that there are several versions of the FICO® Auto Score model. Monitoring just one doesnt guarantee youll see the same version your lender pulls. Consider calling your prospective lenders financing department to see which version they use, and check to see which scores youll get through the monitoring service, before paying for your scores.

Carvana: Best Fully Online Experience

Overview: Carvana lets you shop for a car online and pick up your purchase from a giant car vending machine. Its process lets you enjoy a unique experience, yet Carvana also offers competitive car loan rates and terms.

Perks: Carvana is a great option for those who want to shop for their new car from home, as well as those with poor credit. Carvanas only requirements are that you are at least 18 years old, make $4,000 in yearly income and have no active bankruptcies. When you prequalify, Carvana does not make a hard inquiry on your credit, so your credit score wont be impacted a hard inquiry is made only once you place an order.

What to watch out for: After you are prequalified, you have 45 days to make a purchase from Carvana inventory and either pick up the car, have it delivered to you or fly to the car and then drive it back.

| Lender |

|---|

| Varies |

You May Like: Usaa Refinance Auto Loan Rates

Could A Car Loan Drop My Credit Score

Now you have all the facts. How do these facts correlate to a car loan? The answer is simple.

A car loan is a major financial commitment.

It must be thought about and planned carefully. You should take a serious wide scope view of your finances, past, and present.

This is the only way to determine whether or not you could afford repayments.

A car loan is more often than not secured against the vehicle you purchase. That means, if you fail to make the agreed monthly repayments, you will have the vehicle repossessed.

If it is repossessed you will no longer physically have access to the car. However, you are still responsible for any outstanding credit taken out to purchase it.

Repossession is common after failed attempts from the lender to recover the money unpaid.

If this happens, it can drop your credit score significantly. As can not paying your monthly fee. Any default such as this will mark your credit file for a large number of years.

Therefore it will be extremely difficult to enter any credit arrangement in the future, should this happen.

Other ways a car loan can drop your credit score include the initial search. Any hard search on your credit file drops your score.

This has a somewhat short term impact, and after an initial period of positive repayment, your score will build back up.

Lastly, the loan itself could potentially drop your credit score and also make it difficult to obtain other lines of borrowing.

How To Shop For A Car Loan

When youre borrowing a significant amount of money, you will want to find the lowest interest rate possible. During this process, you will likely allow several lenders to run credit checks.

Multiple credit checks will deduct points from your credit score under normal circumstances, so excessive hard inquiries should be avoided. However, when it comes to auto loans, there is an exception.

Also Check: When Can You Refinance An Fha Loan

How Much Will A Car Loan Drop My Credit Score

Not everyone has the option to save up their earnings in order to purchase a suitable vehicle outright.

When this is the case, the need arises for alternative means of purchase.

Thankfully, there are options suited to most types of income and circumstances. These are called car loans.

You may be reluctant to take out a car loan because of the impact it may potentially have on your credit score.

This guide is going to help you understand the relationship between a car loan and your credit score, specifically whether or not it will drop your credit score.

Bad credit can be a hard obstacle to get past, and nobody needs that stress. So its good to be informed before you make such a large decision.

Getting A Car Loan Without A Cibil Score

Taking a car loan with a good CIBIL score come with perks, like more attractive interest rates and other goodies. However, with CIBIL scores taking the centre stage with all forms of credit, loans and credit cards, it may seem impossible to even think about a car loan without a credit history. But that is not always true. Some financial institutions may still offer car loans albeit at higher interest rates.

The reason banks are willing to extend this offer to car loan applicants with a bad CIBIL rating is because car loans are secured with the vehicle so funded serving as collateral. This reduces the risk lenders take by approving such loans.

Even if you meet all the criteria for a car loan, a poor CIBIL score could deny you your dream car. A good credit score could mean better rates. Therefore, it is of utmost importance that you take extra care to build, maintain or rectify your credit history.

Don’t Miss: Becu Ppp Forgiveness

What Is A Credit Score And How Does It Impact My Creditworthiness

Your credit score is a number that lenders use to determine your creditworthiness. This number is based on the information in your credit report. A higher credit score means you are more likely to be approved for a loan or credit card. A lower credit score means you are less likely to be approved for a loan or credit card.

How To Check Your Credit Score & Report In Canada

Many people think if you pull your credit report from the two major credit bureaus TransUnion or Equifax, that it will contain your credit score also. This is not always the case. But its still essential to check your credit report for errors and correct reporting, to ensure your credit score is always accurate. Your credit reporting agency will provide you with a monthly copy for free. Requesting this report on a monthly basis will not affect your credit score.

Requesting your credit score is often separate from your credit report. Both may charge a fee for your request. Its also important to note that each credit reporting agency uses its own bespoke scoring algorithm, which may differ from each other. Learn more about why your credit score may vary depending on where you check here.Its important to note, you can often check your credit score for free through your bank, financial institution or any significant financial technology website such as .

Don’t Miss: Usaa Refinance Car Loan

Car Debt Settlement Vs Repossession

Settling your car loan is different from vehicle repossession. With an auto loan settlement, you make an agreement with the lender to pay a portion of your original debt. Your debt is then considered settled. However, you will have to pay taxes on any amount of a debt that is forgiven.

With repossession, the lender will take back your car and sell it to pay off some or all of your loan debt. If the car is sold for less than the amount of your debt, you may still owe money to the lender. This is called a deficiency payment. You can either turn in your car and allow the lender to repossess it voluntarily, or it may have the right to repossess your vehicle without your consent if you fail to make your loan payments.

Both car debt settlement and repossession will impact your credit score for the worse. And, since both are often preceded by late payments, you may have multiple negative marks in your credit history.

The best option for your credit is always to pay off your debt in full, but thats often too tall of an ask. If you cant do that, try to work with your lender to find the best solution. You may want to talk to a credit counselor to determine what would be best for your situation.

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You’ll need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you’ll use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

Read Also: What Is The Fha Loan Limit In Texas

How Your Credit Score Affects Your Car Loan Or Lease

If youve been shopping for a new vehicle, you may have also started paying closer attention to your credit score. Your credit score will have animpact on your loan & lease approval and will also determine the interest rate on your auto loan.

So what is a FICO credit score and what role does it play in financing a vehicle?