Gift Letter For The Down Payment

If you use a gift for your down payment your lender will require a gift letter explaining the funds are a gift and do not need to be repaid.

If you received the gift from family or friends. They may be asked for a copy of their bank statement or a statement from the account they provided the gift from. The person giving the down payment gift will also need to provide a gift letter stating theyre not expecting repayment.

Loan Application Information Required

The first thing youll do when applying for a mortgage is complete a federally required mortgage application. Regardless of whether the application is in the paper format linked here, an online form, or done verbally with your loan officer, this linked document contains the application with the information youll need to provide, including:

- Full name, birth date, Social Security number, and phone number

- Residence history for at least two years. If youre a renter, your rent payment is needed. If youre an owner, all mortgage, insurance and tax figures are needed for your primary residence and all other properties owned.

- Employment history for at least two years, including company name, address, phone number, and your title.

- Income history for at least two years. If you receive commissions, bonuses, or are self-employed, you must provide two years of bonus, commission, or self-employed income received. Most lenders average variable and self-employed income over two years.

- Asset account balances including all checking, savings, investment, and retirement accounts.

- Debt payments and balances for credit cards, mortgages, student loans, car loans, alimony, child support, or any other fixed debt obligations.

- Confirmation whether youve had bankruptcies or foreclosures within the past seven years, whether youre party to any lawsuits, or you co-sign on any loans.

- Confirmation if any part of your down payment will be borrowed.

Why Do I Need A Home Inspection

A home inspection is an added expense that some first-time homebuyers dont expect and might feel safe declining, but professional inspectors often notice things most of us dont. This step is especially important if youre buying an existing home as opposed to a newly constructed home, which might come with a builders warranty. If the home needs big repairs you cant see, an inspection helps you negotiate with the current homeowner to have the issues fixed before closing or adjust the price accordingly so you have extra funds to address the repairs once you own the home.During the inspection, be sure to ask questions and bring a checklist of things you want information on. Note that a comprehensive inspection should not only bring defects and problem areas to your attention, it should also highlight the positive aspects of a home as well. When you receive the final report, prioritize the issues and decide whether you want to negotiate those items with the sellers. Remember: Every deal is different and negotiable.

Read Also: Usaa Auto Loan Calculator

Applying For A Mortgage

A few documents are needed to get a loan file through underwriting. Some of the information will be gathered online or over the phone. A lot of it will already be stated on some documents you’ll provide, like employer address which can be found on a pay stub. While the list looks long, it won’t take much effort to round them up. The lists below will help you keep track. Your loan officer will also indicate which items will not be needed and also help you prioritize which items to send in first.

How Do I Know If My Mortgage Will Be Approved

Your credit score is determined based on your past payment history and borrowing behavior. When you apply for a mortgage, checking your credit score is one of the first things most lenders do. The higher your score, the more likely it is youll be approved for a mortgage and the better your interest rate will be.

Recommended Reading: Can I Buy A Manufactured Home With A Va Loan

Underwriting Clear To Close

This is what everyone wants to hear. We have final underwriting approval and clear to close. Final underwriting approval means any underwriting stipulations have been satisfied. The earlier this can happen, the better. Next, the file moves to the closing department. So, everyone should feel very good at this point. Yet, its not done yet.

What Information Must Be Documented On A Loan Application

Documenting the Loan Application

A loan application must be documented on the the Uniform Residential Loan Application . A complete, signed, and dated version of the final Form 1003 must always be included in the loan file. The final Form 1003 must reflect the income, assets, debts, and final loan terms used in the underwriting process.

If either the note or the security instrument and the final Form 1003 will be executed pursuant to a power of attorney in accordance with this Guide, then the initial Form 1003 must be personally signed by the borrower and included in the mortgage file. See B8-2-03, Signature Requirements for Security Instruments, B8-3-03, Signature Requirements for Notes, and B8-5-05, Requirements for Use of a Power of Attorney, for additional information. However, a power of attorney may be used to execute both the initial and final Form 1003 in any of the following circumstances:

- a borrower is on military service with the United States armed forces serving outside the United States or deployed aboard a United States vessel, as long as the power of attorney

- expressly states an intention to secure a loan on a specific property, or

- complies with the requirements under the VA Lenders Handbook relating to powers of attorney for VA-insured mortgage loans, or

You May Like: Refinance Avant

What Is Considered An Official Mortgage Application

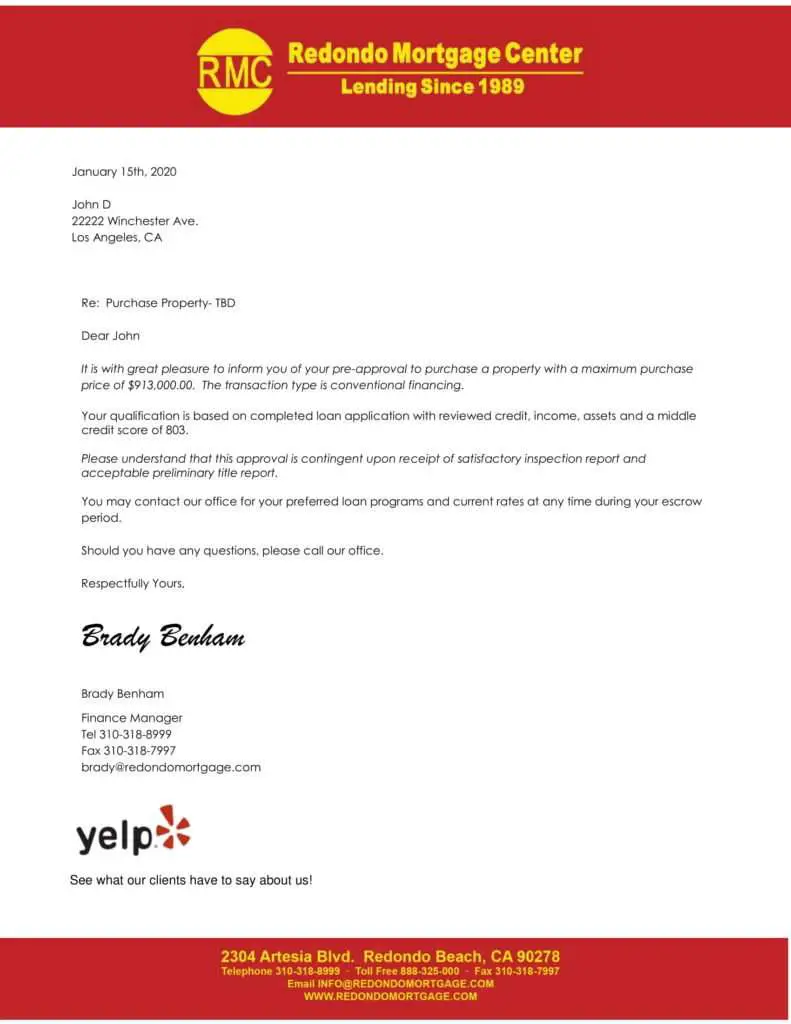

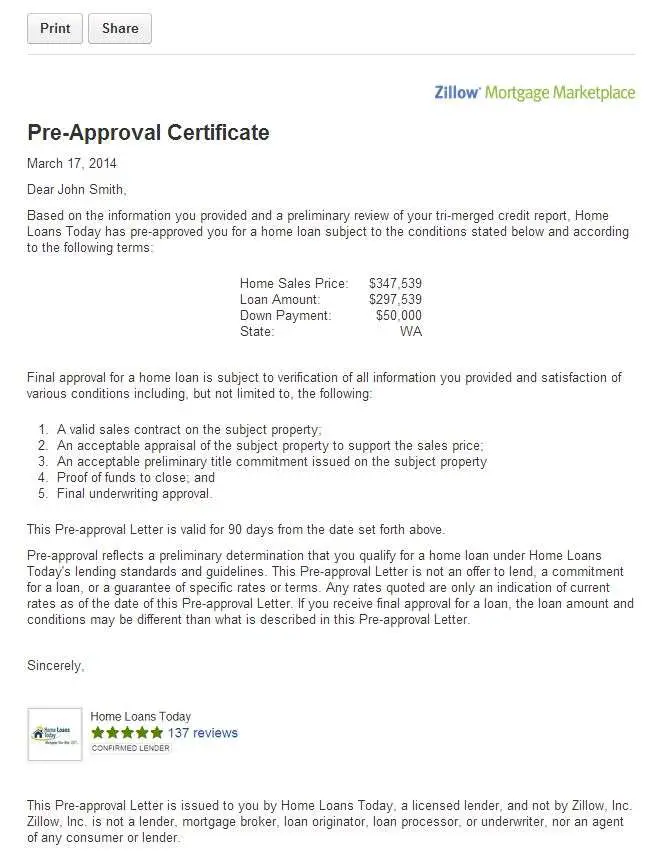

This question might seem a bit odd at first, but there can be different stages for a loan application. Typically, the difference is when someone has submitted a loan application to a lender but has yet to pick out a property. When submitting an application in order to receive a preapproval letter, there are certain things the lender will need before a preapproval can be delivered. One, youll need to provide written authorization for the lender to pull your credit report and retrieve credit scores. Loan programs today have minimum credit score requirements. Before any approval letter is issued, credit will need to be reviewed.

Lenders must also determine affordability. When issuing a preapproval letter, its typically after the borrower and the loan officer have had a conversation about monthly payments, down payments and closing costs. This prequalification is the result of a general conversation between the two regarding current credit status, employment, assets and other items. When these items are reviewed and confirmed, its at that point where a preapproval letter can be issued.

Name

Information For Government Monitoring Purposes

In the final section, youll be asked if youd like to share the information on the application with the government so that they can ensure the lender is compliant with federal laws pertaining to discrimination. If you do want to share this information, you and any co-borrowers can indicate your ethnicity, race and sex in this section. If you dont, youll simply check off I do not wish to furnish this information.

Recommended Reading: What Is The Maximum Fha Loan Amount In Texas

Should I Get A Conventional Or Government

The answer depends upon your situation. If you have good credit, have the ability to make the required down payment, and have a steady employment history, a conventional mortgage might be the right option for you. Conventional loans often carry favorable interest rates and terms.

An FHA loan might be a good option for those who are not perfect applicants. This might include a lower credit score, an inconsistent work history, or other blemishes that could deter a lender on a conventional loan. An FHA loan carries a government guarantee, which gives the lender a bit more security.

If you are a veteran, a VA loan might be a good option for you. Again, the government guarantee allows the lender to risk you even if your financial situation doesnt match up with what might be required for a conventional loan.

Learn More About Home Loans

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

Also Check: How To Get Loan Originator License

Receive A Loan Estimate

Within 3 days of your application, youll receive an initial disclosure packet from your lender, including your Loan Estimate, which is a standardized form that details the estimated amount of the loan, interest rate, monthly payment and total closing costs. The Loan Estimate will also include other information, including what kind of taxes and insurance you may need to pay, and how the interest rate and monthly payments may change in the future.

At this point, the lender has not yet approved or denied your mortgage application. After reviewing, if you want to move ahead with the loan application, youll sign an Intent to Proceed, and the lender will request additional financial information from you.

Review The Final Mortgage Closing Disclosure

Youre almost done! At this point, youll get to review your final closing disclosure. Thanks to the Consumer Financial Protection Bureau’s “Know before You Owe” disclosure rule, your lender is required to give you an initial loan estimate at the time of application, and then an updated closing disclosure, which will help you further understand the terms and fees prior to committing to the mortgage and signing on the dotted line.

Youll have three daysnot including Sundaysto review this closing disclosure, compare it with your initial Loan Estimate, ask questions and make sure you understand all the fees and terms of the loan prior to signing your final loan documents.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

What Is Initial Disclosure Document Definition

Initial disclosure document definition is needed, according to federal law, when people have to disclose certain information before getting a discovery request.3 min read

The initial disclosure document definition is needed, according to federal law, when people have to disclose certain information before getting a discovery request.

Get Your Approval Letter

Once you find the best mortgage solution for your needs, you can see if youre approved online. If you are, well send you a Prequalified Approval Letter that you can use to begin house hunting. If you want an even stronger approval, you may want to consider contacting a Home Loan Expert and applying for a Verified Approval.

Tested. Trusted. Top-rated.

Don’t Miss: Get A Loan Without Proof Of Income

Tips For Applying For A Mortgage

Overall, preparation is key when applying for a mortgage. In addition to having all of your paperwork in order, there are a few things you can do to help ensure a successful application:

- Document the source of the down payment. If a family member is helping you make a down payment, for example, have them sign a gift letter confirming where the funds came from and what they will be used for.

- Keep your job the same. If you can help it, avoid quitting your job or starting a new one while your application is being processed. The lender can deny your loan if your employment situation changes.

- Refrain from large purchases. Big-ticket charges can be a red flag to lenders, who may become concerned about your capacity to afford the mortgage. Ditto to opening a new line of credit or missing a debt payment, which can impact your credit history. If youre preapproved for a $500,000 mortgage for a home that youre purchasing for $600,000, youre close to the maximum affordability, explains Melony Swasey, a real estate agent with Unlimited Sothebys International Realty in Jamaica Plain, Massachusetts. Then suddenly you buy a car with a car note that could affect whether you get approved.

What Should I Know Before Applying For A Mortgage

7 Things to Know Before Applying for a Home Loan

- Pay All Your Bills on Time.

- Be Wary of Employment Changes.

- Do Your Own Research.

- See What You Can Afford.

- Choose Carefully.

- Hold Off on Opening New Accounts.

- Hold Off on Closing Existing Accounts.

- Shop Confidently with the Power Buying Process

Also Check: Usaa Auto Loan Credit Score Requirements

Next Steps: Can You Afford To Buy A House

Your lenders goal is to assess you as a borrower and ensure you can make your payments on time.

If youre thinking about a home purchase in the near future, these are some good questions to ask yourself to prepare for the home-buying process.

- How much down payment can you afford? A higher down payment is often a good sign for the lender about your finances.

- What is your debt-to-income ratio? Youll likely need to keep this number below 43%.

- What monthly mortgage payment can you comfortably afford in your budget?

- Are you prepared for closing costs, such as an appraisal or prepaid property taxes?

About the author:

Read More

Can I Get Mortgage Without Proof Of Income

You may find it harder to be approved for a mortgage without proof of a regular income, but there are specialist lenders who you can apply to. Many borrowers wont have any trouble providing proof of their income to get a mortgage, while others, such as freelancers or self-employed people, may struggle.

You May Like: Usaa Auto Loan Refinance Rates

What Documents Should I Receive Before Closing On A Mortgage Loan

Beforeclosing on a mortgage, you can expect to receive documents required by stateand federal law and contractual documents.

You can expect to receive various types of documents:

Documents required byfederal law

These documents informyou of the key terms, provisions, and costs of your loan. They outline your keyrights and responsibilities as a borrower, and record the transaction between youand your lender.

These documents include:

Tip:

Contractual documents include:

- A promissory note, which describes what you are agreeing to. It provides you with details regarding your loan, including:

- The amount you owe

- The interest rate of the mortgage loan

- The dates when the payments are to be made

- The total amount you will pay

- The length of time for repayment

- Whether and how the payment amounts can change

- The place where the payments are to be sent

- A mortgage or security instrument: This explains your responsibilities and rights as a borrower. The mortgage grants the lender or servicer the right to foreclose on your home if you fail to make payments as youve agreed.

- State and local government-mandated documents: These are documents that fulfill state and local government requirements, generally for the purpose of collecting information and protecting you.

- Lender documents: These are documents added by the lender, for example, an affidavit of occupancy.

The CFPB has resources to help you review your closing documents:

The 8 Steps Of The Mortgage Process

Anything is easier when you break it down.

When youre a first-time homebuyer, the mortgage process can be a little intimidating. Applying for a loan, meeting all the requirements, and closing the deal can be a somewhat lengthy, exacting process. But when you realize that the whole thing breaks down into just eight steps, its much easier to get your head around it and go back to being your confident self.

And remember: every homeowner was a first-time homebuyer once. They got through the eight steps, and so will you.

Also Check: Usaa Pre Approval Car Loan

What You Need To Apply For A Mortgage

Your lender will ask you numerous questions on the mortgage application, so youll need to know things like contact information, specific dates, numbers and more. Here are the main documents and information youll need to answer them:

- Employment information

- Income information

- Additional income information from the past two years

- Bank statements from the past three months or other retirement accounts)

- Form 4506-T or 4506T-EZ from your loan officer authorizing the lender to access your tax return

- Signed purchase contract

If youre self-employed, own a business or get paid through commissions, youll likely also need to provide additional information such as:

- Federal tax returns from the past two years, including business tax returns

- Business records from the past several years

Note your lender may request more documents during the underwriting process. This is common and expected sometimes, a lender just needs more information so that they can clearly understand your risk level and determine your ability to repay.