Do You Need A Lawyer Before Taking A Non

Sometimes, it can be difficult to understand how non-recourse loans work. You can take the help of a lawyer to understand the terms and conditions before signing the non-recourse loan agreement. A lawyer can help you understand the concepts like deficiency judgment or other concepts related to your loan.

The anti-deficiency laws may vary from state to state, and you will need the help of the lawyers to understand them better. These laws prevent the lenders from filing the deficiency lawsuits in case you are not able to pay back the loan.

Where To Obtain A Non

Given the lower level of personal liability that they entail, individual borrowers nearly always prefer a non-recourse loan. But, lenders arent always as happy to make them. For this reason, they can be a bit more elusive than borrowers would prefer.

Depending on the type of debt, loan amount, down payment, and market value of the collateral, there are two typical scenarios where a borrower may be able to obtain a non-recourse loan: relationship or government. In the first instance, an exceptionally strong borrower can leverage their relationship and their financial strength to negotiate non-recourse loan terms with their lender. For example, in our case, we have been in business for a long time and have borrowed and repaid dozens of loans. We have a strong history of performing as agreed and we produce a significant amount of business for our lenders so we dont hesitate to leverage our borrowing relationship to negotiate non-recourse terms.

In the other instance, there are specific loan programs designed to increase investment in certain property types where the loans are guaranteed by the United States government and are non-recourse to the individual borrowers. For example, the Federal National Mortgage Association or Fannie Mae is a major non-recourse lender in the multifamily space. These loans are guaranteed by the government because they are provided as an incentive to increase investment in multifamily housing across the United States.

How Do I Get A Loan Against Stocks

Securities-based lines of credit. What it is: Like margin, a securities-based line of credit offered through a bank allows you to borrow against the value of your portfolio, usually at variable interest rates. Assets are pledged as collateral and held in a separate brokerage account at a broker-dealer.

Also Check: Why Is Conventional Loan Better Than Fha

Interested In Learning More

First National Realty Partners is one of the countrys leading private equity commercial real estate investment firms. With an intentional focus on finding world-class, multi-tenanted assets including middle-market service-oriented retail shopping centers well below intrinsic value, we seek to create superior long-term, risk-adjusted returns for our investors while creating strong economic assets for the communities we invest in.

When financing all of our transactions, we first seek to obtain non-recourse financing. If it isnt available, we will consider alternatives as a last resort.

To learn more about our investment opportunities, contact us at 605-4966 or [email protected] for more information.

What Is Qualified Nonrecourse Financing

Qualified non-recourse financing is a type of financing that is only required to be repaid from the collateral of a loan rather than a borrowers personal assets. This type of financing is typically used for commercial property investments so if the borrower defaults on their agreement, the lender can only take possession of the property.

In some cases, lenders will have recourse on primary residence, so they can pursue other assets if the borrower misses a payment on a mortgage for example. In most cases, however, qualified non-recourse loans are common in commercial real estate finance and it is usually legal in most states for them to do this.

You May Like: How To Settle On Student Loan Debt

Leverage Can Be Powerful

Wisely used debt can help you grow your tax-sheltered retirement savings more aggressively than investing on an all cash basis.

The strategy is not without risk, as your IRA or 401 will need to pay the costs of borrowing whether there is cash flow from the property or not. Because of the tax implications of UDFI, extra complexity in terms of bookkeeping and tax filings will apply for IRA investors.

For investors who are able to scale the equity value of their IRA real estate portfolio faster, or generate higher cash-on-cash return for a particular project, the rewards are well worth it.

Do Banks Take Stock As Collateral

When loan stock is being used as collateral, the lender will find the highest value in shares of a business that are publicly traded and unrestricted these shares are easier to sell if the borrower is unable to repay the loan. Lenders may maintain physical control of the shares until the borrower pays off the loan.

Read Also: Can You Pay Off Sallie Mae Loan Early

What Is An Example Of A Non

A non-recourse loan, more broadly, is any consumer or commercial debt that is secured only by collateral. In case of default, the lender may not seize any assets of the borrower beyond the collateral. A mortgage loan is typically a non-recourse loan.

Do partners get basis for nonrecourse debt?

While the Section 752 rules provide that a partners share of partnership nonrecourse debt adds to that partners basis in the partnership interest, a partners share of nonrecourse debt generally does not generate basis for purposes of the Section 465 at-risk rules.

Are Fannie Mae loans non-recourse?

Fannie Mae and Freddie Mac loans used to buy or refinance apartment buildings are non-recourse, meaning that the debt is secured only by the loan collateral . If you default on a non-recourse loan, the lender can only recoup the pledged collateral.

The Ira Custodian And Non

The IRA custodian does not negotiate the loan for the IRA. It is also not the role of the provider to evaluate or approve the loan. Even though the loan is negotiated between the lender and the IRA holder, all legal documents associated with the loan are signed by the IRA custodian, not the IRA holder.

For more information about non-recourse lending, feel free to contact New Direction Trust Company at 877-742-1270 or by sending us a message through the Client Portal.

Recommended Reading: How Much Mortgage Loan Can I Qualify For

Once A Deficiency Judgment Is Obtained

If your state allows deficiency judgments, you can potentially escape liability once the bank get the judgment by filing for bankruptcy.

In Chapter 7 bankruptcy, you can discharge the deficiency, thereby relieving you of the debt. In Chapter 13 bankruptcy, you might have to pay a portion of the owed amount . When you complete all of your plan payments, the deficiency judgment will be discharged along with your other dischargeable debts.

What Is Dus Fannie Mae

FNMA has been a provider of financing for the multifamily market since 1987. Their Delegated Underwriting and Servicing program is the most popular financing option for multifamily borrowers. FNMA has partnered with 24 lenders that underwrite, fund, and service first lien loans on multifamily properties.

Do nonrecourse loans affect credit?

Failing to pay a non-recourse debt in full impacts a borrowers credit score. These types of loans also come with higher interest rates and are often available only to businesses and individuals with stellar credit.

Are mortgages non-recourse loans?

Most mortgages are also recourse loans, but there are 12 states that allow nonrecourse mortgages. If a borrower defaults on a mortgage in one of those states, the lender will only be able to repossess the home and not any other assets or sources of income.

Don’t Miss: Loan Direct Lender Bad Credit

How To Know If Your Loan Is Recourse Or Non

Your mortgage type will depend on your state, as there are 12 states that allow both recourse and non-recourse loans, namely- Alaska, Arizona, California, Connecticut, Idaho, Minnesota, North Carolina, North Dakota, Oregon, Texas, Utah and Washington. Usually, it would make no difference whether you have a recourse or non-recourse loan unless you fail to pay back the borrowed amount.

For other forms of loan, such as credit card debts or auto loans, look at the terms stated in the original documents or ask your lender in case you are uncertain. Work with your lender to avoid defaults, especially when you have a recourse loan.

When To Apply For Pre

Even though you have a better understanding of how recourse loans and non-recourse lawsuit loans work, you may not be sure whether you are eligible for pre-settlement funding. There are many instances in which you might be eligible for legal funding.

In many cases, when someone is awaiting an insurance settlement or going through a civil litigation process, they may be able to qualify for a non-recourse loan. Some of the more common types of instances in which you might apply for pre-settlement funding include:

- Car accident lawsuits

- Labor and employment law violations

- Slip and fall accident claims

- Lawsuits surrounding defective or malfunctioning products

These are only a few of the more common situations that may warrant legal funding. If you are involved in another type of legal situation but are awaiting settlement funds, you could still secure a lawsuit loan through High Rise Financial. Contact our loan specialists to explore your options today.

Recommended Reading: What Is An Sba 504 Loan

Non Recourse Loan Rates

A non-recourse loan rate is the interest rate you get on a commercial property if you are using qualified non-recourse financing. This type of financing is generally for investing in commercial property because it gives the lender no recourse on other assets. Non-recourse loans are risky for the lender because they can only take possession of the property if you miss a payment or default on your agreement. As such, non recourse loan interest rates can sometimes be higher.

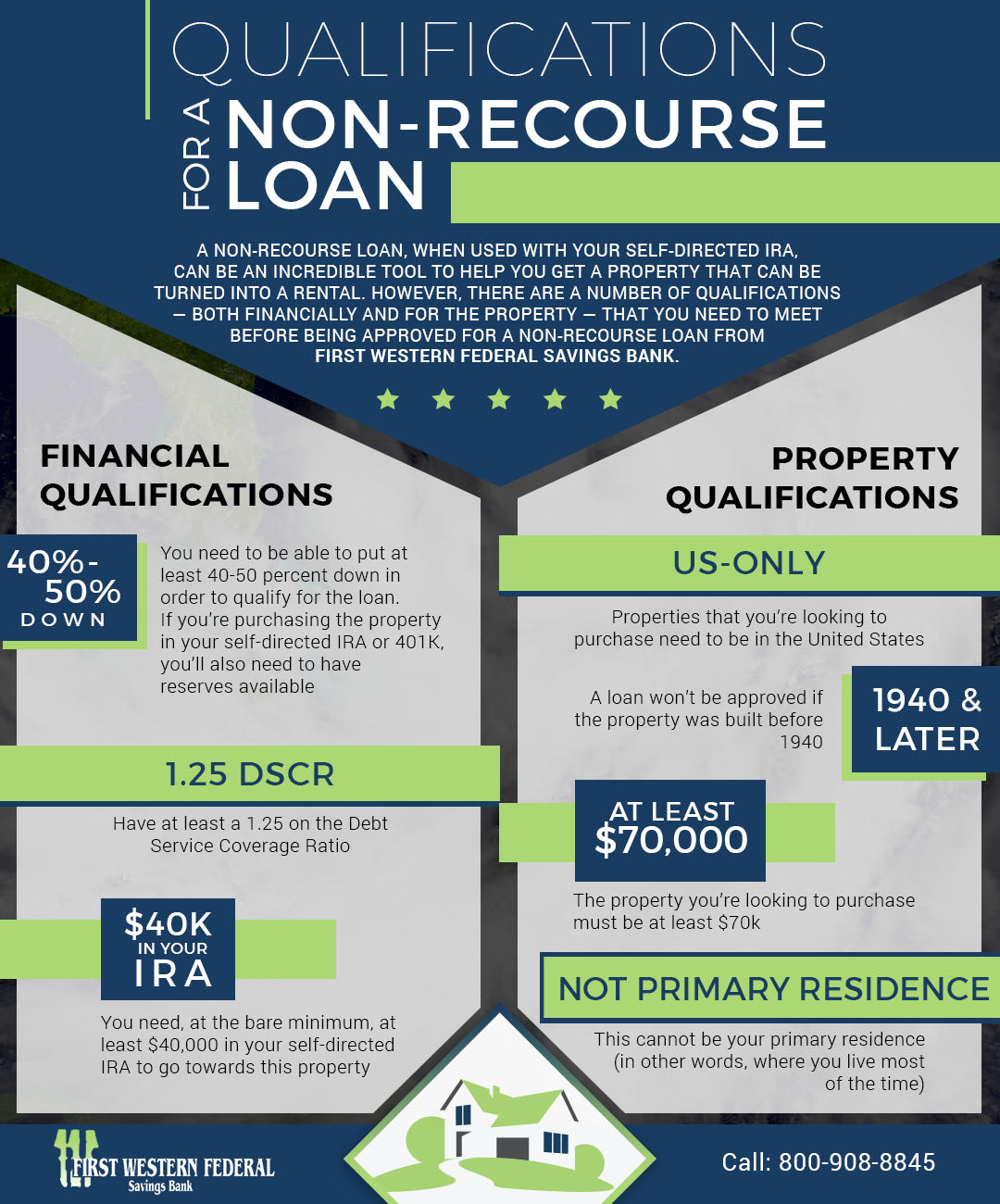

How To Qualify For Non

Because of the increased risk of non-recourse financing, commercial lenders often only accept certain property types and classes for non-recourse financing. For example, a Class A office or multifamily property in a major MSA may easily get a non-recourse loan, while a Class B retail property in a tertiary market is unlikely to qualify. Property income both past and present is also a determining factor, as well as the requested amount of leverage. In general, non-recourse loans typically have a higher interest rate than their recourse counterparts.

Non-recourse commercial mortgage loans are also generally only available to borrowers that are very strong financially. In these cases, a default is significantly less likely because the borrower has the financial means to make sure that the propertys income is used for the property. Commercial mortgage lenders will also require a very experienced borrower for making a non-recourse loan.

You May Like: How To Get Instant Loan Online

Examples Of Recourse And Non

Automobile loans are generally recourse loans if you fail to keep up with the due amount, the lender can repossess your vehicle and sell it for its market value.

Non-recourse loans can be availed by businesses or individuals with a good credit history. Most traditional financial institutions prefer giving out recourse loans to avoid the risk of loss in the event of defaults. Yet, if you have stellar credit scores, the lenders may be more willing to hand out a non-recourse loan, although at higher interest rates.

How Does A Stock Loan Work

Securities lending involves the owner of shares or bonds transferring them temporarily to a borrower. In return, the borrower transfers other shares, bonds or cash to the lender as collateral and pays a borrowing fee. Securities lending can, therefore, be used to incrementally increase fund returns for investors.

How do non-recourse loans work?

What Is a Non-Recourse Loan? A non-recourse loan is one where, in the case of default, a lender can seize the loan collateral. However, in contrast to a recourse loan, the lender cannot go after the borrowers other assetseven if the market value of the collateral is less than the outstanding debt.

Recommended Reading: Can You Refinance An Sba 504 Loan

How Recourse Loans Work

When a borrower defaults on a recourse debt, the lender can seize not only the loans collateral, but can also attempt to attach other assets to collect whats owed. In essence, the lender has additional recourse to recoup their losses.

Between recourse vs. nonrecourse debt, recourse debt favors the lender while nonrecourse debt favors the borrower.

Examples Of Recourse Loans

Most automobile loans are recourse loans. If the borrower defaults, the lender can repossess the car and sell it at fair market value. This amount may be less than the amount owed on the loan because vehicles depreciate significantly in their first couple of years. If there’s a balance left on the loan, the lender can go after the borrower’s other assets to recoup the remainder of the debt.

Most mortgage loans are recourse loans, except in 12 states that forbid recourse home loans. Those states are Alaska, Arizona, California, Connecticut, Idaho, Minnesota, North Carolina, North Dakota, Oregon, Texas, Utah, and Washington.

It is important to note that lenders don’t always pursue assets beyond the collateral in default cases, especially by individuals. Seizing assets is time-consuming and expensive, and a lender may write off a loss rather than continue to pursue it.

Investopedia / Sabrina Jiang

Don’t Miss: Debt Consolidation Loans For Fair Credit

How Does A Non

In many cases, loans involve some sort of collateral. With a non-recourse loan, though, the lender can no longer come after the borrower to make up the additional value of a loan once they have seized the collateral. A recourse loan works a bit differently, as the lenders are fully within their right to pursue the borrower for the full value of the loan. This remains true even after the collateral has been seized and sold.

For example, say you take out a non-recourse loan and put up your vehicle as collateral. If youre unable to pay off your loan, the lender can then seize your vehicle. But if the value of the vehicle is less than the loan amount due to depreciation or other factors, the lender cannot come after you for anything else you may own, such as a home or jewelry.

Since non-recourse loans are inherently more risky, their interest rates and fees tend to be higher than those of recourse loans. In addition, the credit requirements of a non-recourse loan are inherently higher than those of a recourse loan.

How To Get A Non

When it comes to applying for a non-recourse loan, the process is quite similar to that of any loan really. In order to apply, you should have a within the ranges of good, very good or excellent. Since non-recourse loans are typically riskier, lenders want to see that you have a good credit history and are therefore unlikely to default.

As with any loan, lenders come in all shapes and sizes, though many are banks. Once you find a suitable lender, gather the appropriate information, check if you prequalify and then complete an application for the loan.

Don’t Miss: How To Get An Sba 504 Loan

Why Do We Care About Non

Traditionally, loans were made on either a recourse or non-recourse basis. As to a borrower, a non-recourse loan meant that the lender would only look to its collateral in the event of a default and that the borrower did not have liability beyond the value of the collateral for repayment of the loan. With respect to the principals of the borrower, non-recourse meant that no personal guaranties were required by a lender and even further that the lender could not go beyond the borrower to hold the principals or officers of the borrower liable for the lenders losses on a loan, and therefore that only the borrower was responsible for repayment of the loan. In these non-recourse situations, lenders are often confronted with the fact that the lack of personal liability allowed and possibly incentivized distressed borrowers or unscrupulous principals to divert and misuse collateral and revenues almost with impunity. While the out-right theft of collateral by a principal of a borrower might provide a lender with the basis for a claim against a non-recourse borrower or a non-guarantor principal, the ability of a lender to succeed in court in this situation requires clear evidence of significant illegality by the parties involved.

Richard E. Gentilliis the senior commercial litigator with Hackett Feinberg and has successfully defended many lender liability claims over the years.

Recent Posts

The Difference Between Recourse And Non

I dont have the exact quote, but the star quarterback turned real estate mogul Roger Staubach was asked about his biggest regret in building his real estate portfolio. His response was he wouldnt have used debt with an unlimited personal guaranty attached to it. He felt that over years of experience a non-recourse approach was preferred.

That said, the point of this article isnt to judge the merits or pitfalls of either recourse or non-recourse loans, but to provide context and understanding about the two options.

So what is the difference between a recourse and a non-recourse loan? In commercial real estate both types of loans are common depending on the stage and type of financing. Lets look the difference between the two and well also examine whats covered in the Bad Boy carve outs common in non-recourse loan documents.

Recourse Loan Definition

A recourse loan is a loan where the borrower or guarantor are personally liable for repaying any outstanding balance on the loan, in addition to the collateral itself.

In other words, if the collateral securing a loan needs to be sold at foreclosure, but those proceeds arent adequate to cover the total amount owed on the loan, there is a deficiency in making the lender whole. Recourse enables the lender to go after the guarantor personally to cover this deficiency.

Non-Recourse Loan Definition

The Non-Recourse Loan Bad Boy Guaranty

Recourse vs Non-Recourse Loan Example

Non-Recourse

Recourse

| Cash |

Also Check: What Is Mortgage Loan Pre Approval