What To Expect In The Current Market

Essentially, when you refinance a mortgage, you pay off the mortgage you have, replacing it with a new one. The aim is to obtain a new loan at a lower interest rate and, possibly, with a shorter-term loan. Ideally, the results would be a lower monthly payment and lower interest for the life of the loan.

If youre considering trading a 30-year mortgage for a 15-year loan, the payment is significantly higher, says Greg McBride, senior vice president and chief financial analyst for Bankrate.com. Look at your broader financial goals. Would you prefer to pay more into your 401 plan for retirement than toward a higher monthly mortgage payment?

However, Lee says if you are not saving on total interest over the life of the loan or on your monthly payment, its not worth refinancing.

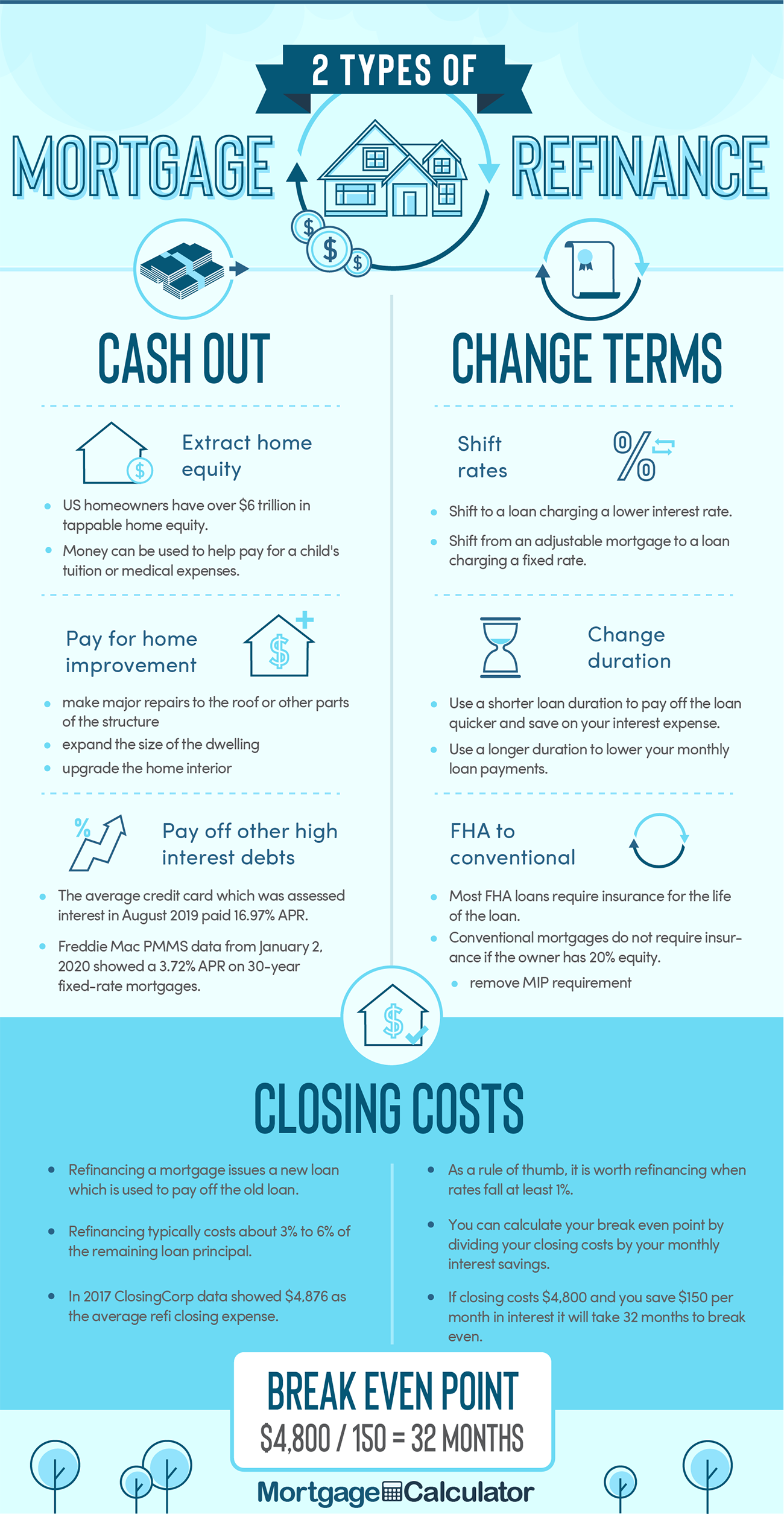

Another reason to refinance can be to take cash out of your home. If you have sufficient equity in your property, you might want a cash-out refinance to use some of that cash to pay off credit card debt or to complete home improvement projects, such as a new roof or addition. For example, if your home is worth $600,000 and you owe $200,000, your home equity is $400,000 . You might refinance with a $250,000 loan amount to obtain $50,000 in cash.

If you refinance at a shorter term, your monthly payment may be higher than it is now. However, if you havent done a refi and want to take advantage of the lower mortgage interest rates, and want cash, you can refinance, he says.

Does Refinancing Affect My Credit

Refinancing a mortgage can also have some impact on your credit, but its usually minimal. This can occur for multiple reasons:

- Mortgage lenders conduct a credit check to see if you qualify for a refinance, and this appears on your credit report. A single inquiry can shave up to five points off your score. When you apply for a mortgage refinance, it triggers a hard credit inquiry that may lower your credit score by only a few points, but this will be temporary, explains Matt Hackett, operations manager at Equity Now, a direct mortgage lender in New York City.

- If you plan to apply for other types of debt, such as a car loan or credit card, in addition to refinancing, your credit score can also be affected.

- When you refinance, youre closing one loan and opening another. Your credit history makes up 15 percent of your score, so having one loan close and then taking on a new one shortens the duration, impacting your score.

In general, these effects will only be felt for a short period of time. If youre concerned about hurting your score while you compare refinance offers, try to shop for loans within a 45-day window. Any credit pulls related to your refinance in this timeframe will only be counted as one inquiry.

With additional reporting by TJ Porter and Dhara Singh

What Is Mortgage Refinancing

Refinancing a mortgage means you get a new home loan to replace your existing one, with the option to withdraw a portion of your homes equity out as cash in the process. If you can refinance into a loan that has a lower interest rate than youre currently paying, you could save money on your monthly payment and interest you pay over the term of the loan.

You May Like: Is It Easy To Get Loan From Credit Union

How A Mortgage Refinance Helps Homeowners

Your personal finances arebound to change over the years. Youll build home equity; your income mayincrease; maybe youll pay off debts and improve your credit score.;

As your finances improve,youll likely have access to better mortgage options than you did when youbought your home.

In addition, mortgageinterest rates are constantly in flux.

If rates have fallen sinceyou took out a home loan, theres a good chance you can refinance to a lowerrate and save even if your finances look exactly as they did when you boughtthe house.

You can also change the featuresof your home loan when you refinance.

You can choose the number of years in your loan ; you can choose the nature of your interest rate ; and, you can even choose what you pay in mortgage closing costs.

Many homeowners refinance to get a lower mortgage rate. But a refinance mortgage can also help you pay your home off more quickly, eliminate mortgage insurance, or tap your home equity to pay off debt or fund home improvements.

Why Do People Refinance Their Home Mortgage Loan

- Main

-

Refinancing your home mortgage allows you to pay off your original mortgage with a new loan. Typically, people refinance their original mortgage loan for one or more reasons:

- to earn a better interest rate,

- to convert a variable rate to a fixed rate ,

- to reduce monthly payments by extending the repayment term of the loan , or

- to reduce interest charges paid over the life of the loan by reducing the repayment term of the loan.

Recommended Reading: Can I Refinance My Sallie Mae Loan

Example: Refinancing Vs Home Equity Loan

Let’s say that 10 years ago, when you first purchased your home, interest rates were 5% on your 30-year fixed-rate mortgage. Now, in 2020, you can get a mortgage at an interest rate of 3.5%. Those one-and-a-half points can potentially knock hundreds of dollars a month off your payment, and even more off the total cost of financing your home over the term of the loan. A refinance would be to your advantagein this case.

Or, maybe you already have a low interest rate, but youre looking for some extra cash to pay for a new roof, add a deck to your home, or pay for your child’s college education. This is where a home equity loan might become attractive.

How To Calculate Your Break

Lets say your new mortgage saves you $192 a month and closing costs are $3,000.

$3,000 / $192 a month in savings = 15.6 months to break even

If you plan to sell the house before you break even, refinancing is not a good strategy.

to crunch the numbers with recommended mortgage and refinance calculators.

Recommended Reading: What Kind Of Loan For Rental Property

He Promised That If I Co

‘My husband is a business owner, and received a $500,000 Small Business Administration loan.’

Dear Moneyist,

I am considering a divorce after 30 years of marriage.;

My husband never added my name to the family home he purchased with his previous wife. Seven years ago, I co-signed the mortgage to refinance the house. He promised that if I co-signed, he would add me to the deed.

After checking the assessors database, I found this was not the case. If we divorced, would our refinancing turn our house into community property?

My husband is a business owner and received a $500,000 Small Business Administration loan.;I am currently not involved in the business. Would this loan be considered community property?

The Wife;

You can email The Moneyist with any financial and ethical questions related to coronavirus at [email protected], and follow Quentin Fottrell on;

Dear Wife,

Ah, the old Add you to the mortgage, but not to the deed trick. It is not as uncommon as you might think.

Your story is a cautionary tale to always put everything in writing, even and especially with a spouse of several decades. Co-signing on a mortgage based on a promise is not advisable. Obviously, tell your husband that you are aware he did not add you to the deed as promised, and ask him to fulfill this pledge to you and be a man of his word. If he refuses, you are indeed in a vulnerable position.

The answer, as often happens, is longer and more complex than the question. I hope this helps.

How To Shop For A Mortgage

Shopping around and comparing offers is critical to get the best deal on your mortgage refinance. Make sure to get quotes from at least three lenders, and pay attention not just to the interest rate but also to the fees they charge and other terms. Sometimes its a better deal to choose a slightly higher interest loan if the other aspects are favorable.

Recommended Reading: Can I Buy Two Houses With Va Loan

Come To The Closing With Cash If Needed

The closing disclosure, as well as the loan estimate, will list how much money you need to pay out of pocket to close the mortgage.

What to consider: You might be able to finance those costs, which typically amount to a few thousand dollars, but youll likely pay more for it through a higher rate or loan amount. In most cases, it makes more financial sense to pay the costs upfront.

Should I Refinance My Mortgage

If interest rates have dropped since you signed your mortgage, you might think about;refinancingOpens a popup.. But before you take the leap, there are a few things to consider.

When you refinance your mortgage, you replace your existing mortgage with a new one on different terms. To find out if you qualify, your;lender calculates your loan-to-value ratio by dividing;the;balance owing on your mortgage and any other debts secured by your property into the current value of your property.;If your loan-to-value ratio is lower than 80%, you can refinance.;

The lender also looks at your monthly income and debt payments. You may need to provide a copy of your T4 slip, notice of assessment or a recent pay stub; your mortgage statement; a recent property tax bill; and recent asset statements for your investments, RRSPs and savings accounts.

You May Like: How To Apply For Loan Consolidation

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Keep Tabs On Your Loan

Store copies of your closing paperwork in a safe location and set up auto-payments to make sure you stay current on your mortgage. Some banks will also give you a lower rate if you sign up for auto-payment.

What to consider:;Your lender might resell your loan on the secondary market either immediately after closing or years later. That means youll owe mortgage payments to a different company, so keep an eye out for mail notifying you of any such changes.

Also Check: How Much Will My Student Loan Payment Be

How Much Does It Cost To Refinance A Mortgage

7-minute read

Think youd benefit from a refinance? You might! A refinance can allow you to change the terms of your mortgage loan to make it easier to pay your bills or get cash out of your equity.

But like a home purchase, refinancing generally requires the payment of closing costs. In the case of a refi, you can expect to pay 2% 3% of the remaining principal on your mortgage in closing costs.

Well look at a breakdown of the cost of refinancing a mortgage and the benefits of doing so. Finally, well help you decide if a refinance is right for you.

Do The Math And Prepare

Before you refinance your mortgage, its important to be sure that refinancing is a financially sound move based on your situation. Before you start applying for offers:

- Check your credit to make sure you can qualify for a new loan.

- Make sure you have enough equity in your home usually at least 20 percent.

- Check current interest rates to see whats available.

- Make sure you can fit the new payment in your monthly budget.

Also Check: Can I Transfer My Mortgage Loan To Another Bank

How Long Does It Take To Refinance A Mortgage

The time it takes to refinance depends on your lender as well as how long it takes to complete inspections, appraisals, credit checks and other requirements. Many lenders websites allow you to read about different loan products, compare interest rates, fill out loan applications and submit documents.

Within the past few years, technology has streamlined the mortgage process tremendously, says Liu. With online applications, mobile document-scanning apps and e-signatures, borrowers can perform most tasks without printing a single document. Most refinances can be closed within 30 days.

Use Bankrates mortgage calculator to compare your own loan scenarios:

- See what happens when you input different mortgage terms .

- Reveal the amortization schedule to see how much total interest you would pay.

Locking In Your Interest Rate

After you get approved, you may be given the option to lock your interest rate so it doesnt change before the loan closes.

Rate locks last anywhere from 15 60 days. The rate lock period depends on a few factors like your location, loan type and lender. If your loan doesnt close before the lock period ends, you may be required to extend the rate lock, which may cost money.

You might also be given the option to float your rate, which means not locking it before proceeding with the loan. This may allow you to get a lower rate, but it also puts you at risk for getting a higher one. In some cases, you might be able to get the best of both worlds with a float-down option, but if youre happy with rates at the time youre applying, then its generally a good idea to go ahead and lock your rate.

Read Also: Can I Pay My Golden 1 Auto Loan Online

What Is Loan Refinancing

Refinancing a loan allows a borrower to replace their current debt obligation with one that has more favorable terms. Through this process, a borrower takes out a new loan to pay off their existing debt, and the terms of the old loan are replaced by the updated agreement. This enables borrowers to redo their loan to get a lower monthly payment, different term length or a more convenient payment structure. Most consumer lenders who offer traditional loans also offer refinancing options. However, for products like mortgages and car loans, refinancing loans tend to come with slightly higher interest rates than purchase loans.

The primary reason borrowers refinance is to get a more affordable loan. A lot of the time, a refinance can lower the interest rate. For example, a homeowner with good credit who took out a 30 year mortgage in 2006 would likely be paying an interest rate between 6% and 7%. Today, the most qualified borrowers can receive interest rates lower than 4%. Accordingly, that homeowner could shave more than 2% off of their interest rate by refinancing their loan, saving them hundreds of dollars a month.

| 30 Year Mortgage Before Refinancing | After Refinancing |

|---|---|

| $514 |

When Its A Good Idea To Refinance Your Mortgage

Generally, if refinancing will save you money, help you build equity and pay off your mortgage faster, its a good decision. With rates this low, even people who have fairly new mortgages may be able to benefit from refinancing.

Consider refinancing if you can lower your interest rate by one-half to three-quarters of a percentage point this can substantially lower your monthly payment.

Make sure your total monthly savings offset the cost of refinancing, however. It may not be a good idea if you plan to move in the next two years, which gives you little time to recoup the cost.

The question of when to refinance is not just about interest rates, either; its about your credit being good enough to qualify for the right refinance loan. Mortgage interest rates are determined by market factors, including the yields on long-term Treasury bonds, and the best rates and terms go to those with the best credit.

Your financial goals, how long you plan to stay in your home, how much equity you have in the home and your overall financial condition are important considerations when it comes to refinancing. Ask yourself the right questions.

Also Check: How To Return Ppp Loan

You May Want To Refinance If You

- Have an adjustable-rate mortgage.Adjustable-rate mortgages keep your rate the same for the first few years, then change it periodically, usually once per year. Because rates are at all-time lows these days, you may want to refinance into a fixed-rate mortgage so you can lock in a super-low rate permanently, rather than risk an increase later.

- Could get a significantly lower rate. If you bought your home a few months ago and see rates are just a smidgen lower now than they were then, you may decide it’s not worth refinancing. But if you got your initial mortgage years ago, you may be able to lock in a drastically lower rate now; which could save you tens of thousands of dollars in interest over the years.;

- Want a new loan term. You may want to refinance into a longer term so you can have lower monthly payments. Or into a shorter term so you can pay off your mortgage sooner.

- Have big plans for a cash-out refinance. A;cash-out refinance;can be a great tool for achieving other financial goals. Maybe you want to pay down high-interest credit card debt, renovate your home, or go back to school. You can use the equity you’ve gained in your home to cover these costs.