How Do Lenders Come Up With My Rate

A few different factors help lenders determine the car loan interest rates youll be offered. The more well-rounded your application, the better your chances of scoring a low rate. Although there are many factors that may play a role in your interest rate, these are the four main points lenders consider when reviewing your application:

- Those with higher scores generally have access to lower rates, so improving your credit history is an important part of getting a low interest rate on your car loan.

- Income. Lenders consider your income because it reflects your ability to pay back the loan. They also want to see a low debt-to-income ratio to make sure you can afford your loan.

- Loan term. The loan term impacts the interest rate that youre offered as well as how much interest youll pay over the life of the loan. A lender could offer you a lower interest rate on a longer loan term, but this doesnt mean youll save money: youll pay more interest on a longer loan term.

- Vehicle. Your vehicles make and model can also play a role car loan rates, especially if youre buying a used car. Since its possible that your car will be used as collateral to secure the loan, lenders often charge higher interest for cars that are of poorer quality and are more likely to break down.

Lightstream: Best Auto Loan Rates For Unsecured Car Loans

- New and used auto loan APRs start at 2.49% with the autopay option

- Terms range from 2484 months

- Amounts range from $5,000$100,000

The online lender LightStream offers no restrictions based on vehicle age, mileage, make or model and the starting rate for new, used and refinance car loans are the same, because these loans are unsecured. While most people shy away from unsecured car loans, thinking their APR will be high, LightStream was the most popular choice on LendingTree in Q1 2021, offering one of the lowest average rates across all credit scores.

WHAT WE LIKE

LightStream says it will beat any qualified rate by 0.10 percentage points and it has a $100 customer satisfaction guarantee, though terms apply.

WHERE IT MAY FALL SHORT

LightStream heavily prefers borrowers with credit scores above FICO 660 and low debt-to-income.

HOW TO APPLY

The only way to apply directly is through the LightStream website.

Auto Loans In Utah And The West New & Used Options

Fixed auto loan interest rates as low as 2.74% APR with MyStyle but the average borrower will need a score in the low 700s for a new car loan and;Do I need to be a Mountain America Credit Union member to apply for an auto loan?How do I refinance a car loan?

Additionally, make sure you understand the other terms surrounding the auto loan and auto loan rates; dont focus on the payment alone. What is the Average;

Don’t Miss: How To Transfer Car Loan To Another Person

Example: How To Calculate Apr For A Car Loan

Suppose you want to purchase a car for $15,000. Using a car loan service, you find a lender that agrees to give you a 60 month car loan for this amount at a 6% interest rate . Your loan will come with $200 in prepaid finance charges, meaning your principal will be $15,200 . What would your APR be?

To figure out your APR, first track down your monthly payment. If you are curious how car payments are calculated, here is the formula:

Basically, all you need to know to calculate your car loan payment is the length of your loan in months, your principal, and your note rate . If you plug in the numbers , you will find that your monthly payment for this loan is about $293.86.

To find your APR, you theoretically could use the same equation. Your payment under your note rate and APR should be the same. All that changes when calculating APR in this equation is that you would use the amount financed in place of your principal. Ultimately, you would plug in your monthly payment and amount financed and solve for the interest rate part of the equation which is not easy to do mathematically since the interest rate appears twice in the equation.

Still, the APR you would get if you did this would be about 6.55%. The graphic below illustrates how the note rate and APR will give you the same monthly payment and finance charge for your loan.

Average Mortgage Interest Rate

The national average mortgage interest rate for borrowers with good credit scores on a 30-year fixed-rate loan in 2017 was 4%. The rate will will pay mostly depends on the type of mortgage you get, its term length, and your credit score. While mortgage interest rates differ somewhat by state, those differences tend to be minimal. The most common mortgage loans are 15- and 30-year fixed-rate mortgages, which provide an unvarying monthly rate over the duration of the loan, and 5/1 hybrid adjustable-rate mortgages, which have a fixed rate for the first five years, after which they adjust annually.

Other types of mortgage loans offered include FHA loans, which are designed for lower-income consumers; VA loans, designed for veterans; and interest-only mortgages, which allow the borrower to pay only interest for their first few years, and so reduce their monthly payment. FHA and VA loans are backed by the government but the rates for these mortgages can vary, because they fluctuate based on the market and the borrower. For more information on mortgage payments, check our full analysis here.

Don’t Miss: Who Can Loan Me Money

What’s The Interest Rate On An Auto Loan

The interest rate is set by the lender and it depends on many things, including the bank’s policy and market factors such as what other lenders are charging for their loans. On the customer side, the lender will look at your repayment history and credit score to determine how creditworthy you are. Lenders tend to offer their best rates to the most creditworthy customers who have a very high likelihood of paying back the loan in full and on time.

Generally, the right credit score depends on whether youre buying a new or used car and the lender youre interested in. According to the consumer credit reporting agency Experian, buyers in the market for new car financing had an average score of 722 in 2017. For used cars, the average credit score dropped to 682. However, a bunch of loans will go to borrowers with credit scores below those figures; it depends how much the car dealer wants to sell the car to you.

Since the interest charge represents the lender’s profit, it’s fair to say that most lenders will charge the maximum rate they think you will pay. For most people, cars are indispensable you need one to get to and from your job and wherever else you need to go. If your credit is weak, then you may have slim pickings when shopping for loans. Auto lenders know this, and that is why they fix the highest rate they can get away with.

Usury Rates By State 2018

At the time of publication, the general state usury limits are as set out below. Note that some states have different rates for loan contracts where a rate is written into the contract, versus a general loan agreement where no rate is specified. Since most auto finance loan rates will be written into a contract, we’ve given you the written rate.

5 percent: Iowa, Michigan, Wisconsin

6 percent: Alabama, Maine, Maryland, Massachusetts, Minnesota, North Dakota, Oklahoma, Pennsylvania, Texas

7 percent: California, Wyoming

12 percent: Colorado, Connecticut, Idaho, Louisiana, Rhode Island, Vermont, Washington

15 percent: Montana, New Mexico, South Dakota

16 percent: Nebraska, New Jersey, New York, Georgia

17 percent: Arkansas

21 percent: Indiana

Some states have fluctuating rates. The usury rate for Delaware is 5 percent over the Federal Reserve discount rate from time to time. In Nevada, the rate is the prime rate of the largest Nevada bank plus 2 percent. Florida determines the rate yearly; Illinois determines the rate periodically. The District of Columbia has its own rate of 24 percent.

You May Like: Who Should I Refinance My Car Loan With

Should You Get An Auto Loan From A Bank Or Dealership

It’s worth shopping at both banks and dealerships for an auto loan. New car dealers and manufacturers, just like banks, can have attractive loan products. Depending on the borrower’s credit score and market-driven circumstances, the interest rate offered by a car dealer can be as low as zero percent or under the going rates offered by banks.

It’s important to keep dealership financing as a possibility, but make sure to look for auto financing before deciding where to buy a car. Know your credit score and search online for bank and other lender rates. This should give you a range of what you can expect in the open market and help you determine if seller financing is a better deal for you.

Select Automakers: Best For New Car Buyers With Excellent Credit

- 0.00% financing

- 1284 months

- Unspecified amounts

Oftentimes, the financing arms of auto manufacturers will offer special low and 0.00% financing deals on new cars to customers with excellent credit. It could be worth your while to apply to the automaker of the vehicle you want, but we always recommend that you come with your own auto loan preapproval.

WHAT WE LIKE

Its hard to beat 0% financing. You can see more here on the current 0% APR deals.

WHERE IT MAY FALL SHORT

Besides the high credit requirement, these deals are only on new or CPO vehicles and automakers have model restrictions. A great APR deal may only be available on a specific model and trim during a certain time period. And deals may differ by location.

Recommended Reading: How To Get Better Interest Rate On Car Loan

Loyalty Programme Introduced By Hyundai For New Customers

A new loyalty programme known as Hyundai Mobility Membership has been launched by Hyundai. Individuals who buy a car on or before 13 August 2020 will be eligible to avail the membership. However, according to Hyundai, all existing customers will also be eligible for the membership in the next phase. The steps that are involved to enrol for the programme are installing the Hyundai Mobility Membership app are registration, interest selection, details of the vehicle, and completing the registration. Details such as the email ID, mobile number, and VIN are needed to complete the registration. The three categories of the programme are lifestyle, mobility, and core. Hyundai has entered into a partnership with several companies so that various benefits will be provided under the programme. Various needs of the vehicle such as tyres, oil, and accessories are provided under the programme.

18 August 2020

Can I Get An Auto Loan With Bad Credit

It is possible to get a car loan with bad credit, although having bad credit will raise the rates you’re offered. If you’re having trouble getting approved or finding acceptable rates, try taking these steps:

- Improve your credit: Before applying for an auto loan, pay down as much debt as you can and avoid opening new accounts, like credit cards.

- Make a large down payment: Making a larger down payment will lower your monthly payment, but it could also help you qualify for better rates.

- Consider a co-signer: A co-signer with good credit will take on some responsibility for your loan if you default, but they can also help you qualify.

Don’t Miss: When To Apply For Ppp Loan Forgiveness

What Should You Consider When Choosing An Auto Loan

There’s a lot to take into account when choosing an auto loan. Your credit score, for example, has a major impact on the rates you get. The best rates typically go to those with excellent credit. At the end of Q1 2021, the average credit score was 734 for a new-car loan and 663 for a used car loan, according to a report from Experian.

In Q2 2020, borrowers who received the lowest rates had a score of 781 or higher. Those borrowers, also known as super-prime borrowers, received an average APR of 3.24% for new cars and 4.08% for used cars. Prime borrowers with a credit score between 661 and 780 received an average APR of 4.21% for new loans and 6.05% for used loans, while nonprime borrowers with credit scores between 601 and 660 received an average APR of 7.14% for new car loans and 11.41% for used.

It’s also important to consider what term fits your financial situation. Longer terms generally have lower payments but cost more over the life of the loan.

Used Cars For Sale At Phil Long

We are experts on loan rates for used cars here at Phil Long. We’ve been giving out used car loans for decades on the;best used cars;in the Colorado Springs area. We do everything we can to get you behind the wheel of a vehicle you love at a price you’ll love. We will work with you to figure out the best way to get your monthly payments down. Stop by today for a test drive and to find out what used car loan rates we can offer you!

Recommended Reading: How To Apply For Direct Loan

Ford Partners With Jiosaavn And Google Search To Promote The Freestyle Flair

Ford India has launched a new campaign of the Ford Freestyle Flair Edition with JioSaavn and Google search. Ford has come out with a fun, quirky, and unique way to promote the Freestyle Flair. The company has used the search behaviour on Google and JioSaavn to bring out the exciting character of the car. Google search continues to be a key feature in car research and purchase. Around 68% of individuals use search without an idea of buying a car and around 98% of the buyers use the feature to purchase a car. Ford wishes to launch the new features of the car during the festive season in the country.

1 September 2020

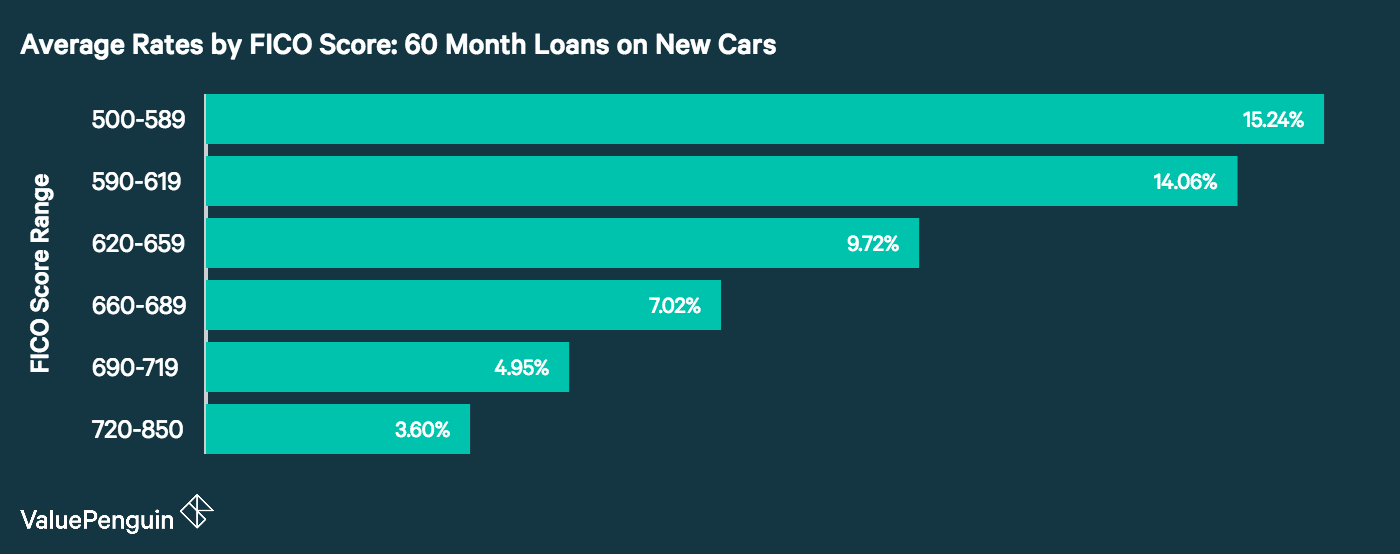

What Is The Average Auto Loan Rate For Each Credit Score

When you apply for a car loan, the financial institution offering the loan will look at your credit score to determine your score range, from deep subprime all the way up to super prime. The higher your and score range, the lower your interest rate is likely to be.

Using the most recently available data from Experian, we found the average auto loan interest rate by credit score for both new and used cars. You can see all of the data in the table below.

| Deep subprime | 14.66% | 21.07% |

On average, those with higher credit scores are offered lower interest rates on auto loans. Note that interest rates for car loans are higher for used cars than for new ones, though having a better credit score still helps keep rates low.;

While credit scores are one factor that banks and credit unions use to determine the interest rate on a car loan, there are several other factors they use as well.;

Read Also: Is It Too Late To Apply For Ppp Loan

What Is The Difference Between An Auto Loan And A Personal Loan

It’s possible to use a personal loan or an auto loan to finance a vehicle, but the two differ in some important ways:

- Purpose: Personal loans are unsecured or secured and can be used for many different purposes, including to finance a vehicle, pay for a vacation, or make improvements to a home. Car loans, however, are strictly to finance a vehicle and are secured against the vehicle you purchase. The vehicle serves as collateral.

- Interest rates: Because auto loans are secured, rates on car loans are generally lower than personal loans.

- Availability: Auto loans are typically easier to obtain than personal loans, especially for those with a poor credit history.

Average Interest Rates On Used Cars

Used cars generally come with higher interest rates than new cars. This is because most used vehicles are no longer covered under warranty, and it can be difficult to gauge their exact value. Used cars also have higher mileage, more wear and tear, and are generally less reliable than new vehicles.

While the interest rate may be higher on a used car loan, the amount you finance is likely to be lower due to depreciation.

Here are the average interest rates on auto loans for used vehicles at the end of 2019, according Experians report:

| Average Interest Rate for a Used Car Loan | |

| Super Prime 781 to 850 | 4.43% |

| Deep Subprime 300 to 500 | 19.81% |

You May Like: Is Homeowners Insurance Included In Fha Loan

What Kind Of Interest Rates Should You Expect

Before you start shopping for a vehicle, its a good idea to sit down and establish a budget. Determining how much money you can afford to spend on a car loan each month will help you make the right decision when it comes time to buy.

In addition to things like insurance and total cost of ownership, a factor that plays a role in your monthly loan payment is your interest rate. Interest rates are largely determined by your credit score. A good credit score usually means youll receive a low interest rate, while a bad credit scores can mean a higher interest rate.

How much interest youll be paying will affect how much can you afford in payments a month. Thats why figuring out what kind of interest rate you should expect;before;you start car shopping is important.

A good credit score tells a lender youre reliable and have a history of trustworthy financial decisions. In the eyes of a lender, youre seen as a low risk candidate and so you should receive a lower interest rate.

A history of late payments, a high debt-to-income ratio, and outstanding debt are all factors that contribute to a bad credit score. Keep in mind, a lower credit score doesnt mean you cant get a new car loan, it just means the process can be slightly more difficult.

If your credit score is 700 or higher, youre considered to have good-to-excellent credit. When you apply for a new car loan, you should expect to be quoted an interest rate of around 3 4%.