How Do I Apply For A Boat Loan

While every lender will have its own unique application process, in most cases, youll need to provide the same information when applying for a boat loan.

Once you have financing, you can start to shop for a boat that suits your needs just dont let a salesperson talk you into buying more than you can afford.

Will I need to know what boat I want before I apply?

It depends on the lender. Some might ask for a model and make, while others might allow you to apply for a ballpark amount, based on your budget. If youre unsure, ask your lender whats required ahead of time.

Are Boat Loans Hard To Get

Youll typically need good to excellent credit and verifiable income to qualify for a boat loan. If you have poor or fair credit and can wait to take out a loan, it could be a good idea to build your credit before applying.

Tip:

Keep in mind that with secured boat loans, the people applying for the loan typically need to be listed on the vessel title. This means that if you apply with a cosigner, theyll most likely need to be on the boat title.

Some manufacturers and dealers also offer their own in-house financing, which might be easier to qualify for. Be sure to consider all of your options to choose what works best for you.

Learn More: Bad Credit Loans

How Much Can I Borrow

How much you can borrow generally depends on the price of your boat. Typically, you can fund 90% to 100% of the value of your boat. Minimum loan amounts can start anywhere from $2,000 to $15,000, depending on the lender.

Dont forget the down payment

Like car loans and mortgages, boat loans often require a down payment. Generally, youre required to cover at least 10% of the cost. But lenders tend to favor applicants that can front at least 20% of the boats cost. To avoid over-borrowing, we recommend saving up as much as you can for a down payment so you dont need to borrow as much. The less you borrow, the less interest youll pay.

Remember: Boats are more like cars than houses. Once you make a purchase, your vessel will begin to depreciate. If you borrow a large amount with a lengthy term, you may end up paying more in the long run than its really worth.

You May Like: Veteran Loans For Mobile Homes

Have You Got A Question About Boat Loan

Yes we finance every type of marine vehicle you can think of, from sailcruisers, yachts, dinghys, motorcruisers, powerboats, keelboats, trailer sailers and more.

Yes we finance all kinds of transactions whether your chosen boat is new or used, or from a dealer or private seller.

Yes Savvy helps many people with bad credit get approval for boat loans and marine finance. 9/10 applications are approved!

Yes We help the self-employed and retirees find the great deals on boat loans. You can speak to one of our consultants to find out more.

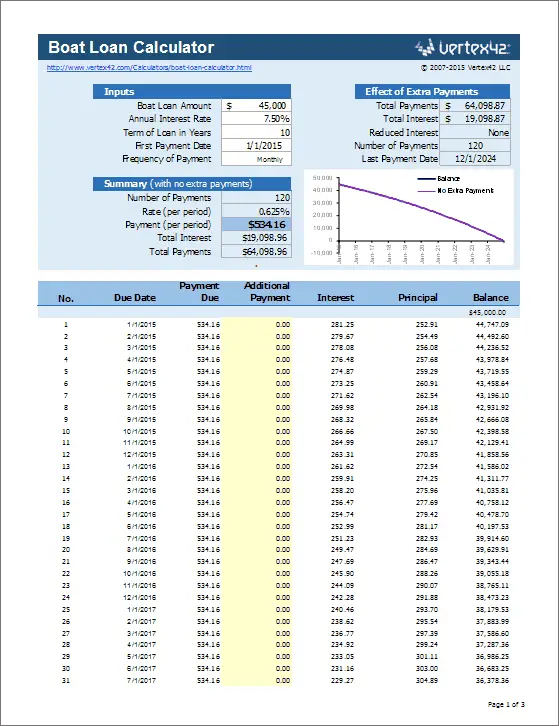

Yes you can use our online loan calculator to get a clearer understanding of how much a loan will cost. Its free and easy to use.

Yes we have a range of commercial boat loan options to suit your needs. Click here for more information on our offering of marine finance options for business.

What Is A Boat And Marine Loan

Although boat and marine loans can be borrowed from many select lenders across the country, particularly those located near bodies of water, Loans Canada can match you with the lender of your choosing, no matter where you live.

A marine or boat loan is a type of financing thats used to purchase almost any seafaring vessel. From sailboats to ski-dos to fishing boats. A boat loan from a specialty lender, private lender, or big bank allows you to make this large purchase, often by transferring the money directly to the dealer, although some lenders do offer direct deposit to the borrower. Once the funds are received, you would repay the loan through a series of equal installments.

Recommended Reading: Usaa Refinance Auto Loan Rates

Types Of Loans For Marine Financing And Boat Financing

In Canada, there are many financial companies that can offer you loans for the purposes of financing boats and other marine crafts, including but not limited to:

Secured Boat Or Marine Loans

Similar to other vehicle-based financing options, most boat and marine loans will be secured by using the crafts title as collateral. This means that the lender will retain ownership over the vessels title until your repayment plan is complete. If you default on too many payments, they would have the right to seize and resell the asset. In exchange for this collateral, you will often have access to better rates and more credit.

A secured loan is probably the better choice when you feel comfortable using your marine vehicle as collateral and if youre having a hard time qualifying due to lesser financial health. Nonetheless, you must keep in mind that defaulting could have a worse outcome than with unsecured financing .

Unsecured Loans

While some boat and marine financing do involve collateral, you can also apply for a traditional unsecured loan, which is safer if youd prefer not to risk losing your boat in the event of default.

The ultimate drawback here is that your interest rate may be higher and the conditions of the loan less favorable due to the lack of security provided. So, if you are going to apply for a large unsecured boat and marine loan, its best to do it when you have a good income, a decent credit score, and otherwise healthy finances.

Loans Canada Lookout

Where Can You Apply For A Boat Or Marine Loan

Many of Canadas largest financial institutions provide boat and marine financing. Some borrowers prefer to apply with their bank or because they offer higher security, lower interest rates and better payment plans than private lenders. Plus, as members, applicants could score the odd in-house benefit.

The only problem is that banks and credit unions have tougher loan requirements. So, if you have bad credit, a low income or lots of debt, youll likely be rejected. Thats when an alternative lender or private lender can help. They typically have more flexible requirements in comparison to traditional lenders.

However, due to the added risk they take, they may charge higher rates and fees for smaller loans. During your search for marine vehicle financing, its important to take your time and shop around to find the best deal possible.

Also Check: Usaa Auto Loan Bad Credit

How To Calculate Default Rate

Default rate is the number of defaults a company has compared to the number of loans it has outstanding. The default rate shows the percentage of loans that were defaulted on over a specific period. Usually the period analyzed is monthly, quarterly, semi-annually or annually. The higher the default rate a company has, the worse it is at issuing solid debt and collecting on the debt issued. Analysts can use the same calculation to see the rate a single company defaults on its loans.

The Average Interest Rate On Car Loans

There are many advertised interest rates, but keep in mind that theyre designed to entice customers so it tends to be a tad low. When you walk in to a dealer, you get surprised that theres more than meets the eye.

Typically, the average interest rate on car loans is set at almost 5% to a whopping 17%. So, whats the most relevant rate for you? A good way to know is to line it up with your prevailing credit score. Ideally, the higher the credit score and the newer the car, the better. Your home ownership and strong employment background would also establish your capacity to pay. The purpose of the car would also contribute to your chances of a good interest rate with possibly cheaper repayments.

Some loans have low interest rates but may have caveats that cause you to pay more over the years and vice versa. Its crucial to know what the best possible interest rate suits your unique situation.

Don’t Miss: Auto Refinance Calculator Usaa

How Do I Get A Boat Loan

To get a boat loan, you should check your credit and shop around for a boat and boat loan that will fit within your budget. Lenders consider boats to be luxuries, not necessities, so unless your credit score is relatively high and your debt-to-income ratio relatively low, you may find loan approval difficult or face high rates. Heres more on how to buy a boat.

Best Overall: Bank Of The West

Bank of the West

Bank of the West is our top overall pick for a boat loan. The lender features low rates, flexible loan amounts, and widespread availability, making it a great choice for borrowers with good credit looking to purchase a boat.

-

Loans up to $5 million

-

Repayment terms between four and 20 years

-

Available in all 50 states

-

Full-time and liveaboard accepted

-

Fees can be rolled into loan

-

Rates as low as 3.59% APR

-

No cosigners allowed

Bank of the West is arguably one of the most popular watercraft lenders around. Founded in 1874, Bank of the West, also known as Essex Credit, operates and provides loans to creditworthy borrowers in all 50 states. Boat loans through Bank of the West can range from $10,000 all the way up to $5 million, with repayment terms from four to 20 years depending on the loan amount.

While the wide range of loan amounts and repayment terms is great, this lender wins our best overall spot because of the types of boats it accepts. Bank of the West offers to finance for boat model year 2001 or newer. Allowed boats include standard and custom power, sailboats, multi-hull boats, pontoon boats, electrical boats, high-performance boats, houseboats, and wood hull boats. One of Essexs few exceptions is boats that are capable of speeds of 99 mph or higher.

Recommended Reading: Bayview Loan Servicing Tucson

How You Can Compare Boat Loans

Finding the right financing for your boat is important. When you’re comparing your options, keep the following questions in mind:

- What is the interest rate?The interest rate for this type of loan varies depending on what provider you go with, but rates for secured loans are generally low. Make sure you select a loan with a competitive interest rate that will help you save money in the long run.

- Are there fixed repayments?Some boat loans offer fixed repayments. It’s important to think about whether you want fixed repayments or if you prefer a variable loan to take advantage of market fluctuations.

- What is the loan limit?The limit of your boat loan also varies with providers. Have in mind a rough estimate of how much money you need to borrow and find a boat loan that meets these needs. It’s important you don’t borrow more money than you need and are able to make repayments so you don’t default.

- How long will your loan term be?The length of your loan term tends to be longer with a boat loan, but some may extend only up to seven years. It’s still important to select a loan that gives you enough time to pay off your debt. Do your calculations and figure out how long it will take you to pay off the amount you want to borrow.

- Is the loan secured or unsecured.?Boat loans can be secured or unsecured, so you need to consider which one is the better option for you so you can select a loan that matches up with what you want.

How much does a boat cost?

What Is A Good Interest Rate On A Used Boat Loan

While used boat loans can occasionally have rates higher than those offered for new boats, this isnt always the case. In fact, many lenders offer the same competitive rates whether youre buying used, new, or even refinancing. Because of this, applicants can expect to find used boat loans with rates in the 4% to 5% APR range.

For instance, Bank of the West our overall top pickoffers interest rates starting at 3.59% APR for watercraft over $50,000, whether the boat is new or used.

Recommended Reading: Loan Officer License Ca

Your Credit Score And Average Interest Rates

If you dont know your credit score, chances are, youre one of 2.7 million Aussies who are too afraid to ask. Knowing your credit score allows you to fix your credit history if necessary. Equifax offers a credit score band for you to gain some insight on where you are if youre looking at an interest rate on a car loan:

- Excellent 833 1,200

Savvy is rated 4.8 for customer satisfaction by 2749customers.

How Long Is A Boat Loan Term

Boat loan terms can stretch for as long as 20 years, due to loan amounts that can reach into the millions. But just because you can finance a boat for that long doesnt mean you should. Its possible to finance even large amounts for relatively short terms that said, it might be difficult to find terms for less than two years, even for inexpensive boats. Heres more on how long you can finance a boat.

You May Like: When Does Pmi Fall Off Fha Loan

Best For Bad Credit: Southeast Financial

Southeast Financial

For borrowers with bad credit, Southwest Financial is a good choice for a boat loan. This lender has no minimum credit score requirements, and loans are available even for borrowers with past bankruptcies.

-

No minimum credit score requirement

-

Discharged bankruptcies okay

-

Rates starting at 4.49% APR

-

Not available in Alaska or Hawaii

-

$20,000 minimum loan

-

High debt ratios may be a limiting factor

With a history dating back to 1936, Southeast Financial has been providing loans and other financial products to customers across the country for over 80 years. When it comes to boat loans, though, Southeast Financial excels at connecting borrowers with poor credit to lenders willing to finance their purchase.

Through Southeast Financial, subprime borrowers can access boat loans ranging from $20,000 all the way up to $4 million, with no published credit score minimum. Borrowers with low credit scores or high debt ratios may not qualify for the best possible rates, but loans are available even to those with past bankruptcies.

New and used boat loans are not available in Alaska or Hawaii, and borrowers are only allowed to finance their purchase if the boat is intended for recreational useno full-timers or liveaboards allowed. Repayment terms may vary according to the loan amount but are available all the way up to 15 years.

Can You Get A Boat Loan On An Old Boat

Getting approved for a boat loan on an older watercraft can be tricky, but it is certainly possible. Some lenders will offer used and refi loans on boats as old as 19 years. If the boat is of high value, you may even find lenders willing to finance a watercraft as old as 25 or 30 years.

Expect that interest rates for old boat loans may be higher than those for newer boats, and you may even encounter higher down payment requirements.

If youre unable to find a lender willing to finance your old boat purchase, consider taking out a personal loan instead.

Recommended Reading: Average Apr For Motorcycle

How Long Are Boat Loans

Unlike car loans, which typically last anywhere from 3-7 years, on average, boat loans are more similar to a home loan in length. You can expect boat loans to be in the 15-20 year range. The higher the cost of the boat and the less you put towards the down payment, the longer your loan term will be. However, shorter-term boat loans definitely exist. It is possible to get loans with a 24-87 month length, especially if the boat youre purchasing is in a lower pricing tier, such as in between $10,000 and $50,000.

How Does A Boat Loan Work

A boat loan can be a secured personal loan that is designed to specifically finance a boat, a more general secured loan that allows boats to be used as a guarantee, or an unsecured personal loan. If you’re looking for a competitive rate you may want to consider using the boat as security for the loan.

Boats are expensive so you will find these loans offer larger loan amounts and may give you long repayment terms. Depending on the loan, there may be a balloon payment at the end of the loan term.

Read Also: Sss Loan Application

The Real Score On 0% Car Loans

That 0% interest rate is tempting, alright. But it may come with some caveats. Oftentimes, 0% rates are only applicable at the beginning of the term and not throughout the life of your loan. On top of that, such an offer tends to hit you with higher monthly repayments because youre paying the full price of the cars value, compromising your negotiation power. Another set of caveats is that 0% interests typically apply to certain car makes and models only which apparently limits your buying power.

You should also read the fine print first before signing up with any dealer. If you feel like you need a guide, contact any of our dedicated finance specialists to help you out.

How Much Does It Cost To Own A Boat In Canada

Watercraft come in all shapes, models, and prices, so it can be tough to calculate how much your own vehicle would cost you in the long run. Youll also have to decide whether youd like to purchase a used or new model. Obviously, a full-sized houseboat will end up costing much more than a dinghy with an outboard motor.

For the sake of argument, lets say youre trying to purchase a regular leisure-style motorboat for fishing, water skiing, and other activities. In that case, you would have to consider these kinds of basic costs:

Recommended Reading: Fha Refinance Mortgage Insurance