How To Get Loan Forgiveness With An Income

You must take a few key steps to qualify for loan forgiveness under an income-driven plan:

This period of deferment counts toward your required number of payments if your loan payments are paused due to economic hardship. Those months also count toward your required repayment time if your payment is set to $0 for some months based on your available income.

The PAYE plan is specifically designed for new borrowers. You cant have had an outstanding Direct or Federal Family Education Loan when you received a new loan after Oct. 1, 2007. You must also have received a Direct Loan disbursement after Oct. 1, 2011.

Extended Repayment Options For Parent Plus Loans

|

Loan Balance |

|

|

$60,000 or more |

30 years |

If the borrower has not consolidated their federal loans, they are eligible for a 25-year repayment term if the total loan balance is $30,000 or more.

The monthly loan payments will be lower under extended repayment than under standard repayment, but the total interest paid will be greater.

These Student Loan Borrowers Would Be Excluded From The New Income

The Department made clear in comments accompanying its proposed EICR regulations that it wants to limit EICR to undergraduate loans only. The Department is proposing to make EICR only available to undergraduate loans, wrote officials in comments alongside regulatory language limiting EICR to Direct Subsidized Loans made to undergraduate students, Direct Unsubsidized Loans made to undergraduate students, and Direct Consolidation Loans that repaid only loans received for undergraduate study. This means that any graduate student loans would be ineligible for EICR, and Direct federal consolidation loans that combined undergraduate and graduate student loans would also be ineligible.

The Departments proposal would also effectively exclude federal Parent PLUS borrowers. Parent PLUS loans are loans issued to the parent of a college student . Parent PLUS loans have historically been excluded from IDR plans, although consolidated Parent PLUS loans can potentially be repaid under ICR, by far the most expensive of the IDR options. The Departments proposed EICR plan would appear to have no benefits for Parent PLUS borrowers, leaving these borrowers effectively stuck with ICR as their only option.

You May Like: Avant Refinance Loan Application

Example : Graduate Borrower With A Family Size Of 1 With An Agi Of $75000 Per Year And An Eligible Federal Student Loan Balance Of $50000

- Income Contingent Repayment : ICR is open to any Direct federal student loan, including Direct consolidation loans that contain Parent PLUS loans . This higher income borrowers monthly payment under ICR would be around $506 per month.

- Income Based Repayment :IBR is open to any Direct or FFEL-program federal student loan, except for Parent PLUS loans or consolidation loans that contain Parent PLUS loans. But IBR has a partial financial hardship limit borrowers with calculated payments that exceed what their monthly payments would be under a 10-year Standard plan would not be eligible. Under IBR, this borrower would not have a partial financial hardship and would be ineligible.

- Pay As You Earn and Revised Pay As You Earn : PAYE and REPAYE are available for Direct federal loans, except for Parent PLUS loans or consolidation loans that contain Parent PLUS loans. The same borrowers monthly payment under PAYE and REPAYE would be around $475 per month.

- Expanded Income Contingent Repayment : Under the Departments proposals, EICR would exclude federal graduate student loans and Parent PLUS loans, including consolidation loans that repaid undergraduate and graduate school loans or Parent PLUS loans. Such borrowers would not be able to utilize EICR, and would only be able to repay their loans under the other IDR plans.

What Are The Benefits Of A Repayment Plan

The right student loan repayment plan can make your payments more affordable while you search for a job and navigate life after graduation.

If you opt for a graduated repayment plan, for instance, you’ll make lower payments to start, allowing for some flexibility in the first few years of repayment. An income-driven repayment plan can keep your bills manageable if your loan balance is high compared to your income and you need a long-term affordability solution.

A mortgage repayment plan can be beneficial if you’d otherwise be at risk of foreclosure. If you’re coming back from a short period of financial hardship, perhaps due to job loss or medical bills, choosing a repayment plan can get your mortgage back into good standing.

Even if you can’t afford to enter a repayment plan now, you may be able to put your mortgage into forbearance until you can. Let your lender know if you’re expecting a bonus from work or another additional source of income, and the lender may let you pause payments and start a repayment plan when your income increases.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

How Much Will You Pay Under Bidens Proposed New Income Based Plan For Student Loans

WASHINGTON, DC – DECEMBER 15: U.S. President Joe Biden speaks to reporters on the South Lawn of the … White House December 15, 2021 in Washington, DC.

Last week, Department of Education negotiators debated a proposed new student loan repayment plan that would be tied to a borrowers income. The plan is controversial for a number of reasons, with advocates for student loan borrowers arguing it is too restrictive and not particularly financially beneficial. If the plan is enacted, heres what it might mean for student loan borrowers.

Student Loan Repayment Plans: Which Type Is The Best Deal

Student loan repayment plan selection through the Department of Education is left entirely up to the borrower, so it’s important to understand the differences between them. Which student loan repayment plan is the best fit for you?

Loading…

- By Qiana ChavaiaWise Bread

In recent years, the U.S. Department of Education has implemented a flexible solution to help borrowers with financial difficulty repay their federal student loan debt, also known as income-driven repayment plans. These plans calibrate monthly payments based on the individual’s income. Most applicants will qualify for at least one of the three types of repayment plans. However, selecting a plan type is entirely up to the borrower, which makes it critical to understand the differences before entering into a binding agreement.

Recommended Reading: How To Get Loan Originator License

You Want The Lowest Monthly Payment

Income-driven plans adjust your monthly payments based on your income and family size. To calculate your monthly payment, most plans look at your discretionary income, which is defined as the difference between your overall income and 150% of the federal poverty guideline.

For example, the 150% guideline for a single person in 2021 is $19,320. So, if you make $30,000, your discretionary income would be $10,680. On an income-driven plan, your payment would be capped at 10%, 15% or 20% of that total, or between $1,068 and $2,136.

If youre looking for the lowest monthly payment, PAYE or REPAYE could be your best options, since they cap your bills at 10% of your income. IBR could also reduce your payment to 10%, but only if you were a new borrower on or after July 1, 2014.

While this consideration still leaves you with several options, its a good place to start. Whats more, Federal Student Aid can help you find a plan with the lowest payment when you submit your application.

When you fill out your application, you can choose I want the income-driven repayment plan with the lowest monthly payment so the system can choose the right plan for you. With this option, you dont have to figure out which income-driven repayment plan is best for you your loan servicer will pick for you.

But if you want to understand why one plan stands out over another, read on to learn about some more important differences among the income-driven repayment plans.

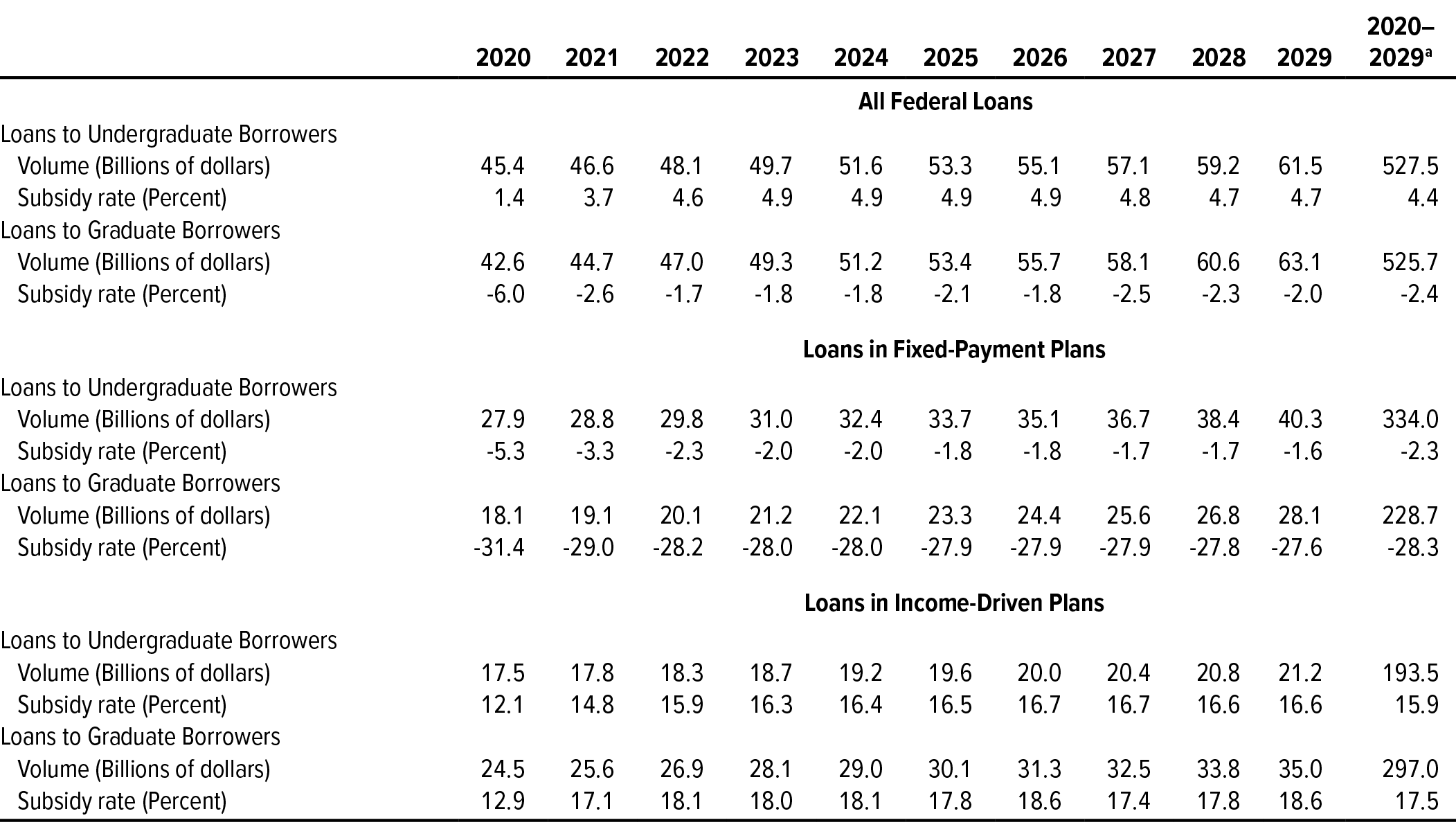

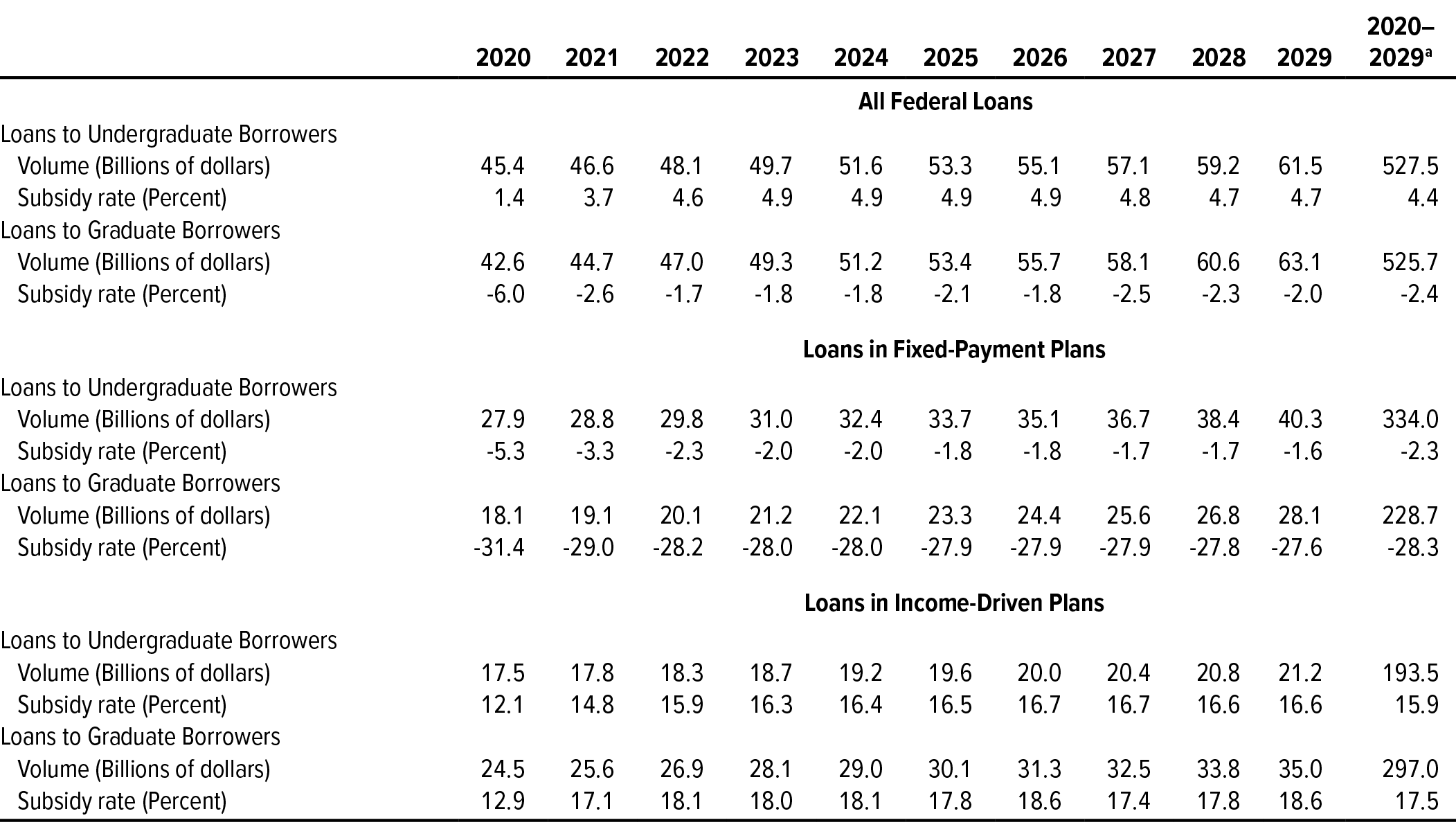

Details On New Student Loan Income

The Department of Education has released significant new details on its proposal for a new federal student loan repayment plan that would be based on a borrowers income. While certain low-income borrowers could see some benefits under the new plan, other student loan borrowers could be completely excluded, disappointing advocates for borrowers. Heres the latest.

Read Also: How To Calculate Amortization Schedule For Car Loan

Income Sensitive Repayment Plan

The Income Sensitive Repayment Plan is aimed at borrowers in low-paying jobs. It is a short-term solution for borrowers facing major financial problems. Only Federal Family Education Loans are eligible.

MONTHLY PAYMENTBetween 4% and 25% of borrowers gross monthly income. Borrower chooses what percentage.

TIME FRAMEUsing ISR for more than 1-2 years will dramatically increase the amount of interest you pay on your loan. If financial woes continue, consider consolidating loans.

COMPARISONWhile you pay more for your loan over time, your outstanding balance can be forgiven after 10 years, based on certain qualifications. You could pay income tax on amount forgiven.

Eligible Loans

- FFEL Consolidation Loans

Education Department Releases A New Income Based Repayment Plan For Federal Student Loans

There are currently several Income-Driven Repayment plans. IDR describes this collection of plans, which some advocates have likened to an alphabet soup of confusing repayment options. Theres Income Contingent Repayment , Income Based Repayment , Pay As You Earn , and Revised Pay As You Earn .

IDR plans are supposed to provide an affordable monthly payment for borrowers, one that is tied to a borrowers income and family size, regardless of how much they owe. The ICR, IBR, PAYE, and REPAYE plans all exclude an initial amount of income under a poverty exemption, and then rely on a formula based on the amount of a borrowers Adjusted Gross Income, or AGI, above that initial exclusion. Payments must be recalculated each year, and thus will change over time in accordance with changes to the borrowers financial situation. Any remaining balance is forgiven after 20 or 25 years , although this could be a taxable event for many borrowers.

Heres how the EICR plan would fare as compared to the current IDR options.

You May Like: Can I Refinance My Car Loan With The Same Lender

Qualifying For Loan Forgiveness

If you’re planning to apply for the Public Service Loan Forgiveness program or a similar program, it may make sense to go with the repayment plan that requires you to pay less money overall.

With PSLF, for instance, you need to make 120 qualifying payments in addition to meeting other requirements. If you have a 10-year standard repayment plan, there won’t be anything left over to forgive once you make your qualifying payments.

An income-driven repayment plan is typically best if you’re planning to pursue loan forgiveness.

Learn About The Different Student Loan Repayment Plans

Your first step in choosing your best repayment plan for your student loans is learning about your options.

Federal student loans come with eight different plans. Not every loan type qualifies for every plan, but you can follow the links to learn about each plan and its eligibility requirements in full detail.

- Standard repayment: This plan spans 10 years. Youll have the same fixed payments every month.

- Graduated repayment: This plan also gives you 10 years to pay off your debt, but with one key difference: Your monthly payments will start out small and increase regularly, generally every two years.

- Extended repayment: This plan lowers your monthly payments and extends your repayment term to up to 25 years. You can choose fixed payments, which stay the same every month, or graduated payments, which increase over time.

- Income-driven repayment : IDR plans cap your monthly payments at 10% to 20% of your discretionary income. They include:

- Income-Sensitive Repayment

Most of the income-driven plans end in loan forgiveness if you havent paid off your balance after 20 or 25 years.

If you dont request an alternative plan, youll make payments on your federal loans under the standard 10-year repayment plan. But for some borrowers, the standard plan is too burdensome. For others, though, this approach is not aggressive enough for paying off debt.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Private Loan Repayment Options

Private student loans don’t have the same repayment plan options that are offered by the Department of Education. Rather, the loan terms are set by your lender when you take out the loan.

Private loans have terms ranging from 1 year to 20 years, and the interest rate can be fixed or variable. We break down the best private loans here so you can see how yours compares.

Most lenders offer some or all of the following types of plans:

- Immediate Repayment – This is where you start making monthly payments immediately

- Deferment In School – This is where your payment is deferred while you’re in school, and typically for 6 months after you graduate

- Set Monthly Payment In School – This is where you have a small, set monthly payment while in school

- Interest Only In School – This is where you pay only your accrued interest each month while in school

If you already have private loans, the typical way to change your repayment plan is to simply refinance your student loan into another student loan with better rates or terms. You can find our guide to Student Loan Refinancing here.

Whats The Best Student Loan Repayment Plan

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

The best federal student loan repayment plan is the plan that works for you. You’ll automatically start out in the standard repayment plan, but you’ll have the ability to change to a student loan repayment plan that’s based on your income.

Written bythe Upsolve Team. Reviewed byAttorney Andrea Wimmer

The student loan repayment plan that works for you!

The best federal student loan repayment plan for student loan borrowers is simply a payment plan that works for them. Repayment plans are not one size fits all. There are specific factors that are taken into consideration when determining the best repayment payment plan for you, like your annual income, the total amount of your debt, family size, and your current financial situation.

Knowing the key differences, benefits, and financial impact of the different federal student loan repayment programs will empower you to choose the option that empowers you to take charge of your finances. Whatâs most important is to know that you are not locked into the standard repayment plan, which often comes at a higher monthly payment than other repayment plans. The bottom line is, you have options!

Recommended Reading: Used Car Loan Calculator Usaa

Whats The First Thing I Need To Do

Make sure your student loan servicer the entity hired by the government to collect and manage your payments can find you. Go to your servicers website and verify that it has your latest contact details: email address, mailing address and phone number.

Not sure who your servicer is? Go to StudentAid.gov and locate your account dashboard and scroll down to the My Loan Servicers section. You can also call the Federal Student Aid Information Center at 1-800-433-3243.

Federal Student Loan Forgiveness Discharge Or Cancellation

We all know that student loan debt is one of the few types of debt that is rarely forgiven. It is excluded from bankruptcy filings and can be garnished from your wages if you default. However, there are several circumstances in which the federal government will grant borrowers forgiveness, discharge, or cancellation of their federal student loans.

Most borrowers who are interested in learning about the loan forgiveness program, whereby all or a portion of federal student loan debt is forgiven if you volunteer time, serve in the military or certain public service positions, practice medicine, teach in low-income communities, or responsibly make payments for at least 20 or 25 years under one of the aforementioned income-driven repayment plans . Such circumstances include:

- Public interest loan forgiveness: Under IBR and PAYE, borrowers who make regular monthly payments and work in the non-profit or public sector for 10 years can have the balance of their student loans after that time forgiven.

- Everyone else’s loan balances are forgiven after 20 years of consecutive monthly payments under PAYE, and 25 under IBR.

- Be forewarned that PAYE is facing changes, including the likelihood that only $57,500 of debt can be forgiven, so understand what you’re likely to owe at the end of your repayment term. This change only applies to new PAYE borrowers, so act before December of 2015 to get grandfathered into the more generous current version of the plan, if you qualify.

Get stories that

You May Like: Va Home Loan Manufactured Home

In Our Previous Articles We Gave Information About The Public Service Loan Forgiveness Program

This program is an excellent opportunity for government and nonprofit employees. A student who benefits from the Public Service Loan Forgiveness Program is eligible to get rid of loan balance forgiven tax-free after making 120 qualifying loan payments.

Student can benefit from the Public Service Loan Forgiveness Program by making most of those payments on a federal income-driven repayment plan.

In order to understand the whole process, you should have some knowledge about the Student Loan Repayment Program Options. These options depend on your social income and your financial situation as well. In this article, we will introduce you the programs that could help you deal with the problem.