We Help You Navigate The Mortgage Maze

Home loans are no longer just about signing up for 25 years and making regular loan payments nor even just about trying to pay off the mortgage as quickly as possible. Flexibility and peace of mind are just as important, and there’s a range of loan options that offer such benefits. However, these extras can cost money, and the key feature is still the interest rate.

On this page:

Home Equity Lines Of Credit

A HELOC is a secured form of credit. The lender uses your home as a guarantee that youll pay back the money you borrow. Most major financial institutions offer a HELOC combined with a mortgage under their own brand name. Its also sometimes called a readvanceable mortgage.

HELOCs are revolving credit. You can borrow money, pay it back, and borrow it again, up to a maximum credit limit. It combines a HELOC and a fixed-term mortgage.

You usually have no fixed repayment amounts for a home equity line of credit. Your lender generally only requires you to pay interest on the money you use.

Who Has The Best Rate Home Loan In Australia

Unfortunately, there is no one lender that offers the best rates in Australia. If that were the case, then comparison websites would not exist.

Home loan rates will differ across each home loan lender and for different home owners, as determined by the lender’s eligibility criteria. Rates are also subject to change depending on the Australian economy, the RBAs cash rate and the decisions of the bank. What is more important is that you choose a home loan rate that best fits your personal goals, such as having in-person customer service options, allowing interest-only repayments, or offering a redraw facility.

Also Check: Va Loan Requirements For Mobile Homes

What Option Is Right For Me

When it comes to choosing the right mortgage term and payment options, you should assess the risk involved with each, as well as how each option fits into your budget.

It’s wise to determine how much you can afford monthly, including the cost of your taxes and insurance. Another great tip: Try to borrow as little as possible, so you do not end up underwater on your mortgage.

Generally speaking, a fixed-rate traditional mortgage is the best option. These options usually offer the best interest rates, as well as a set payment throughout the life of the loan. You’ll also likely be able to avoid paying PMI if you choose this option and put 20% down.

Another point to consider: If you cannot the afford mortgage payments on a 30-year mortgage with a fixed rate, you likely are not in a position to buy a home.

But there are some things you can do to work toward your goal of buying a home.

- Work to improve your , so you qualify for better interest rates, which means a lower monthly payment.

- Save up a larger down payment. This will reduce the amount that you need to borrow, which can make your mortgage payments more affordable and your interest rate lower.

- You may also consider buying a fixer-upper or moving to a different city or neighborhood that has more affordable housing options.

Can You Afford A 3% Rate Rise

Another good question to ask yourself before applying for any home loan is whether you can afford to repay higher mortgage repayments if rates were to increase. Statistically, over a 2030-year home loan term interest rates may hike, and you need to be prepared. A good rule of thumb is to test your ability to afford mortgage repayments at least 3% higher. Ideally, you want to try to keep your mortgage repayments under 30% of your income, as paying a higher percentage is considered to be mortgage stress.

Recommended Reading: Can I Transfer My Mortgage Loan To Another Bank

Where To Find Home Buying Assistance As A Single Parent

Many people are pleasantly surprised by how easily they qualify for home loans as single parents. Others have to spend some time getting their credit scores and DTIs straight before they apply.

But finding the help and advice you need should be easy.

A good place to start is with the U.S. Department of Housing and Urban Development . It provides lists of homebuyer education programs and down payment assistance programs by state.

Simply click on the name of the state where you want to buy. And then keep clicking links until you drill down to the information you need.

Oh, and according to that website, HUD sponsors housing counseling agencies throughout the country to provide free or low-cost advice. Search online for a housing counseling agency near you, or call HUDs interactive voice system at: 569-4287.

A good housing counselor should do much of the heavy lifting for you, advising on whether youre likely to qualify for a mortgage, helping you to pick the right type of loan, and guiding you to your best choice of DPA.

Happy house hunting!

Popular Articles

Resources

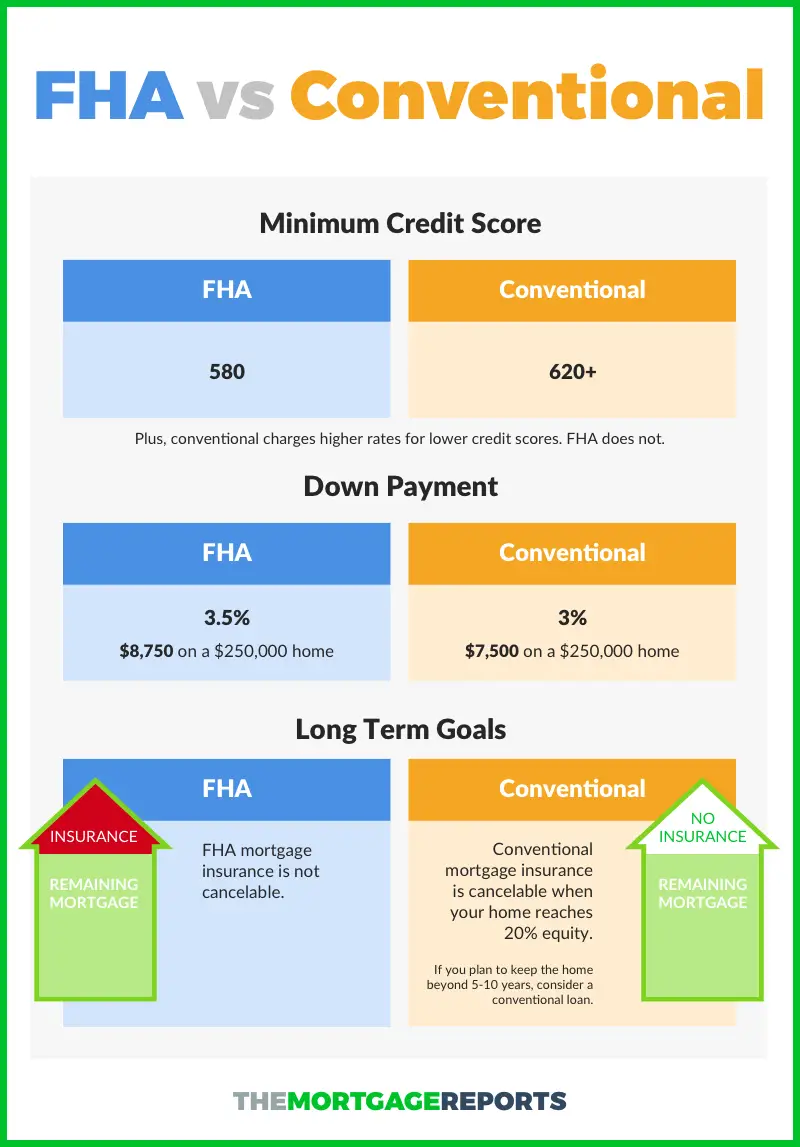

Conventional 97 Loan Benefits For Firsttime Home Buyers

- Buy with just 3% down

- Mortgage insurance is cancellable

- No upfront insurance fee

- Minimum 620 credit score

Conventional loans also dont require an upfront insurance fee, which can save you money on your closing costs.

Finally, conventional loans arent an option if you have poor credit.

Youll need at least a 620 credit rating to qualify for a conventional loan, so if your scores below that, an FHA mortgage may be a better choice.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

When Is Mooncake Festival In Malaysia

Kuala Lumpur is where Malaysians visit Thean Hou temple to celebrate the mooncake festival. People sing prayers as lanterns are strung around the temples six tiers. Penang, where the festival is celebrated in great style, is also very popular. During the lantern parade at Georgetown, you will see an astonishing display.

Home Equity Loan Fees

Generally, fees should be disclosed by the lender, under federal law, although there are some fees that are not required to be disclosed. Borrowers certainly have the right to ask what those undisclosed fees are, though. Fees that require disclosure include application fees, points, annual account fees, and transaction fees, to name a few. Lenders are not required to disclose fees for things like photocopying related to the loan, returned check or stop payment fees, and others.

Recommended Reading: Becu Lienholder Address

Are Durians In Season Now

Do durians have a durian season? Now! ! However, the bumper crop usually arrives between June and September, with a minor season between December and usly, the bumper crop typically arrives between June and September, with a minor season from December to February. Though it will be hard to miss there will be durian stalls popping up everywhere and its pungent scent will overpower you.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Read Also: Usaa Auto Loan Refinance

Best For Lower Interest Rates

Secured personal loans often come with lower interest rates than unsecured personal loans. Thats because the lender may consider a secured loan to be less risky theres an asset backing up your loan. If you dont mind pledging collateral and youre confident you can pay back your loan, a secured loan may help you save money on interest.

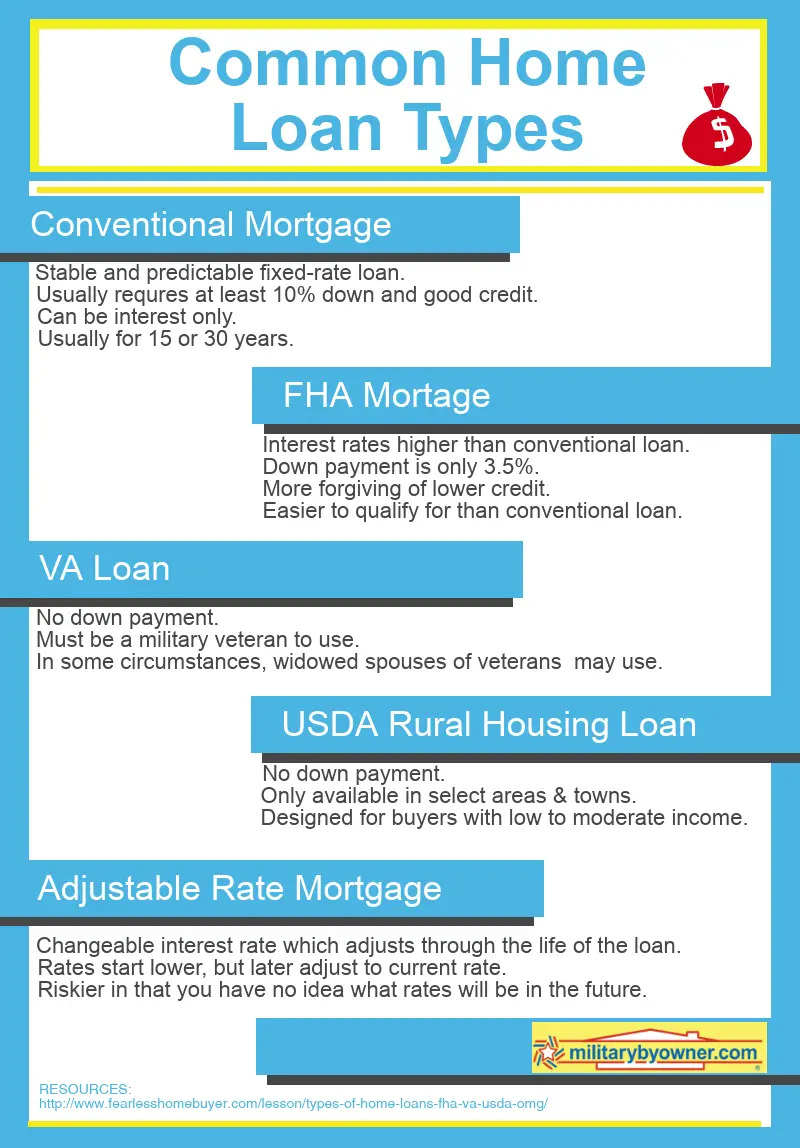

Types Of Mortgage Loans For Buyers And Refinancers

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Many types of mortgage loans exist, and they are designed to appeal to a wide range of borrowers’ needs.

For each type of mortgage listed below, youll see its advantages and the kind of borrower it’s best for. This page concludes with a glossary of terms describing different types of mortgage loans.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Jumbo Loan Or Conforming Loan

The last thing to consider is whether you want a jumbo loan or conforming loan. Lets take a look at the difference between the two.

A conforming loan is any home loan that follows Fannie Mae and Freddie Macs conforming guidelines. These guidelines include credit, income, assets requirements and loan amount. Currently the limit in most parts of the country is $417,000, but in certain designated high-price markets it can be as high as $938,250. Wondering if youre in a high-cost county? Here is the entire list of conforming loan limits for high-cost counties in certain states.

Loans that exceed this amount are called jumbo loans. Theyre also referred to as non-conforming mortgages. Why would you want a jumbo loan? The easiest answer is because it allows you to buy a higher-priced home, if you can afford it. But these loans have flexibility that conforming loans dont have, such as not always requiring mortgage insurance when the down payment is less than 20 percent. Why wouldnt you want a jumbo loan? Compared to conforming loans, interest rates will be higher. And they often require higher down payments and excellent credit, which can make them more difficult to qualify for.

You can read more about these and other programs here. Its also a good idea to talk to a local lender to hear more about their options get prepared by familiarizing yourself with mortgage-related terms using our handy glossary.

AFFORDABILITY CALCULATOR

Best For Debt Consolidation And Major Purchases

If you have high-interest credit card debt, a personal loan may help you pay off that debt sooner. To consolidate your debt with a personal loan, youd apply for a loan in the amount you owe on your credit cards. Then, if youre approved for the full amount, youd use the loan funds to pay your credit cards off, instead making monthly payments on your personal loan.

Depending on your credit, a personal loan may offer a lower interest rate than your credit card and a lower interest rate could mean big savings. It may help to get an idea of what the average debt consolidation rate is.

A personal loan may also be a good choice if you want to finance a major purchase, like a home improvement project, or you have other big costs like medical bills or moving expenses.

Don’t Miss: How Can I Refinance My Car Loan With Bad Credit

Know How Mortgage Interest Rates Work

The price you’ll pay to borrow the money for your home, the interest rate, is another key to choosing the best mortgage loan. Mortgage rates move a lot in fact all day, every day that the bond market is open. Without going all Wall Street on you, here’s what you’ll want to know: You can lock in your loan’s interest rate over the long term, or let it move with the market and adjust once a year.

A guaranteed-for-the-life-of-the-loan fixed-rate mortgage may start out a little higher than the go-with-the-market adjustable-rate mortgage, or ARM. But the lower ARM rate that resets once a year after an initial term of three, five, seven or 10 years, can go anywhere up, down or sideways.

You can lock in your loan’s interest rate over the long term, or let it move with the market and adjust once a year.

Pataky says to ask yourself, “what are your intentions for this house?” Are you on a five-year plan and then expect to move up to a better house or across the country?

“So you start with, ‘what’s the I plan to stay in this property, or retain a mortgage on this property,'” Pataky says.

If you are certain you’ll move, refinance or pay off the mortgage before the guaranteed rate on an ARM expires, the adjustable-rate mortgage may be a good option. However, if you live in the house for seven years and decide you want to stay in the home, interest rates available for a refinance into a fixed rate loan may be considerably higher by then.

/5 And 5/1 Hybrid Arms

The 5/5 and the 5/1 adjustable rate mortgages are amongst the other types of ARMs in which the monthly payment and the interest rate does not change for 5 years. The beginning of the 6th year is when every 5 years the interest rate is adjusted. Thats every year for the 5/1 ARM and every 5 years for the 5/5. These particular ARMs are best if the homeowner plans on living in the home for a period greater than 5 years and can accept the changes later on.

You May Like: Usaa Auto Loan Interest Rates

Start By Putting Money Aside For A Down Payment

When youre looking to purchase a house, its critical to plan your finances. Your monthly plan should be set up to allow for a specific sum of savings to be made. This sum will be applied to the down payment. Based on the loan type you pick and your provider, your down payment might vary from 2.25 percent to 20% of the homes buying price.

Having money regularly transferred from your paycheck to a savings account is a terrific method to save money on a monthly basis. You wont be attracted to spend the money you have saved for your down payment if you do it this way.

How Personal Loan Works

Personal loans are a type of installment Loan. It means, when you apply for a PersonalLoan, the lender gives you money that you have to pay back with interest in monthly payments over the Loan term. Usually, the Loan term of Personal loans ranges from 12 to 84 months or more depending on the Loan amount. When you pay the full Loan amount your account will be closed. The Loan amount for a PersonalLoan varies depending on the lender but typically ranges from $1,500 to as much as $100,000. What PersonalLoan amount you will qualify for depends on your credit history. If you have a healthy credit score then you will easily qualify for a large PersonalLoan. Below is a detailed step-by-step instruction on how PersonalLoan works

1. First, decide the amount of PersonalLoan that you want

2. Next, compile all the required documents

3. Choose a bank or credit union where you want to apply for the loan

4. Now, apply for the Loan amount

5. Submit all the required documents

6. Next, the lender will check all the documents to find out your credit-worthiness

7. If you clear all the requirements then the lender will make an offer

8. Make sure you check all the Loan terms like interest rate, Loan term, etc.

9. Once you accept the offer from the lender, the lender will transfer the money to your bank account

Also Check: What Car Can I Afford Calculator

What To Consider When Getting A Government

If you’re unable to qualify for a conventional loan, or your priority is getting a loan with as low a down payment as possible, government-insured loans can be a great option. They’re ideal for eligible borrowers with low cash savings.

Government-insured loans are also a good option for homebuyers with bad credit. An FHA loan permits credit scores of 580 and above with a down payment of 3.5%, and it sometimes will allow credit scores as low as 500 with a down payment of 10% or more. While VA loans don’t have an official credit score minimum, most lenders require a score of around 620. USDA loans typically require a score of 640 or above, and you can’t earn more than a certain amount .

Keep in mind that not all lenders offer government-backed loans. You’ll need to research local and online lenders to findes that do offer these loans and compare rates before deciding on one.

Fixed Rate Home Loans

With a fixed loan, the interest rate and repayments are set. It can be a good choice if you want to know exactly how much you need to pay off each fortnight or month. People often choose this option if they think interest rates are going up. This is because the amount you pay is locked in for the term of the loan, which is usually between 1 and 5 years. But you might end up paying more if rates go down .

You May Like: What Credit Score Is Needed For Usaa Auto Loan