You Can’t Get Voluntary Student Loan Repayments Back

If youre charged more than you should be for your income, you can ask for a refund .

But if you choose to overpay, you cant get the cash back if you change your mind. It also makes no difference to the size of your monthly repayments, as theyre based on your current income, not what you owe.

Imagine you overpay, but later find yourself skint and needing to borrow more money from another lender. Itll probably cost you much more than what youve saved on your Student Loan.

In short: be very sure you wont need the cash again before overpaying!

Nurse Corps Loan Program

The Nurse Corps Repayment Program helps registered nurses , superior apply registered nurses , and nurse college by paying as much as 85% of their unpaid nursing schooling debt.

You should work at an eligible Critical Shortage Facility in a excessive want space , and have attended an accredited college of nursing . You should additionally fulfill two years of labor on this space.

You can study extra about this program right here.

Related:;Dont neglect to take a look at our full information to Student Loan Forgiveness For Nurses.

How Do I Switch Repayment Plans

Now that weve got all of the technical mumbo jumbo out of the way this is the easy part.

To switch student loan repayment plans, all you have to do is contact your loan servicer and let them know that you want to enroll in one of the other plans.

Each servicer is going to have a slightly different process for actually moving you from one plan to another, so you may have to fill out some paperwork or push some digital buttons to make it all happen, but the process is really easy compared to figuring out which plan will actually work best for you.

Don’t Miss: How Long Does It Take To Get Student Loan Money

Federal Student Loan Repayment

Most undergraduate students in the United States have either subsidized or unsubsidized federal loans.

For subsidized loans, the government pays the interest for you while youre in school, during your six-month grace period after graduation and while your loan is in deferment. For unsubsidized federal loans, youre responsible for the interest that accrues as soon as funds are disbursed, though you can choose to defer payments until after graduation. In that case, any loan interest that accrues would be added to your total loan balance.

Federal loans dont require a co-signer and are put on the standard repayment plan by default.

What Is The Interest Rate On Plan 4 Student Loans

As we explained above, Scottish students used to repay their Student Loans under Plan 1. As part of the move to Plan 4, most of the key components were retained including the way interest is calculated.

This means that, like Plan 1, the rate at which Plan 4 Student Loans accrue interest is usually set in September of each year, and is determined by whichever is lowest between:

- The RPI rate from March of the same year

- The Bank of England base rate plus 1%.

You can to jump back to Plan 1 for a more detailed explanation of how the interest works, but the key point to bear in mind is that the Bank of England base rate plus 1% is currently lower than the RPI rate from March 2021 .

Therefore, the interest rate on Plan 4 Student Loans is 1.1%; and that applies whether you’re still studying or have graduated.

Don’t Miss: How To Apply For Direct Loan

Strategies To Pay Off Student Loan Debt Faster Experian

Strategies to Help You Pay Down Student Loans Faster · 2. Know the pros and cons of refinancing student loans to lower your monthly payment · 3;

Learn the best ways to manage education debt · Know What You Owe · Evaluate Repayment Options · Use the Grace Period · Consolidate or Refinance? · Pay Loans;

Consider Enrolling In Auto

If you enroll in auto-debit, your servicer will automatically withdraw money from your bank account so youre less likely to miss a payment. Many servicers and lenders offer an interest rate reduction for those who set up auto-debit, which could save you hundreds or thousands of dollars over the life of the loan!

Also Check: Is Prosper Personal Loan Legit

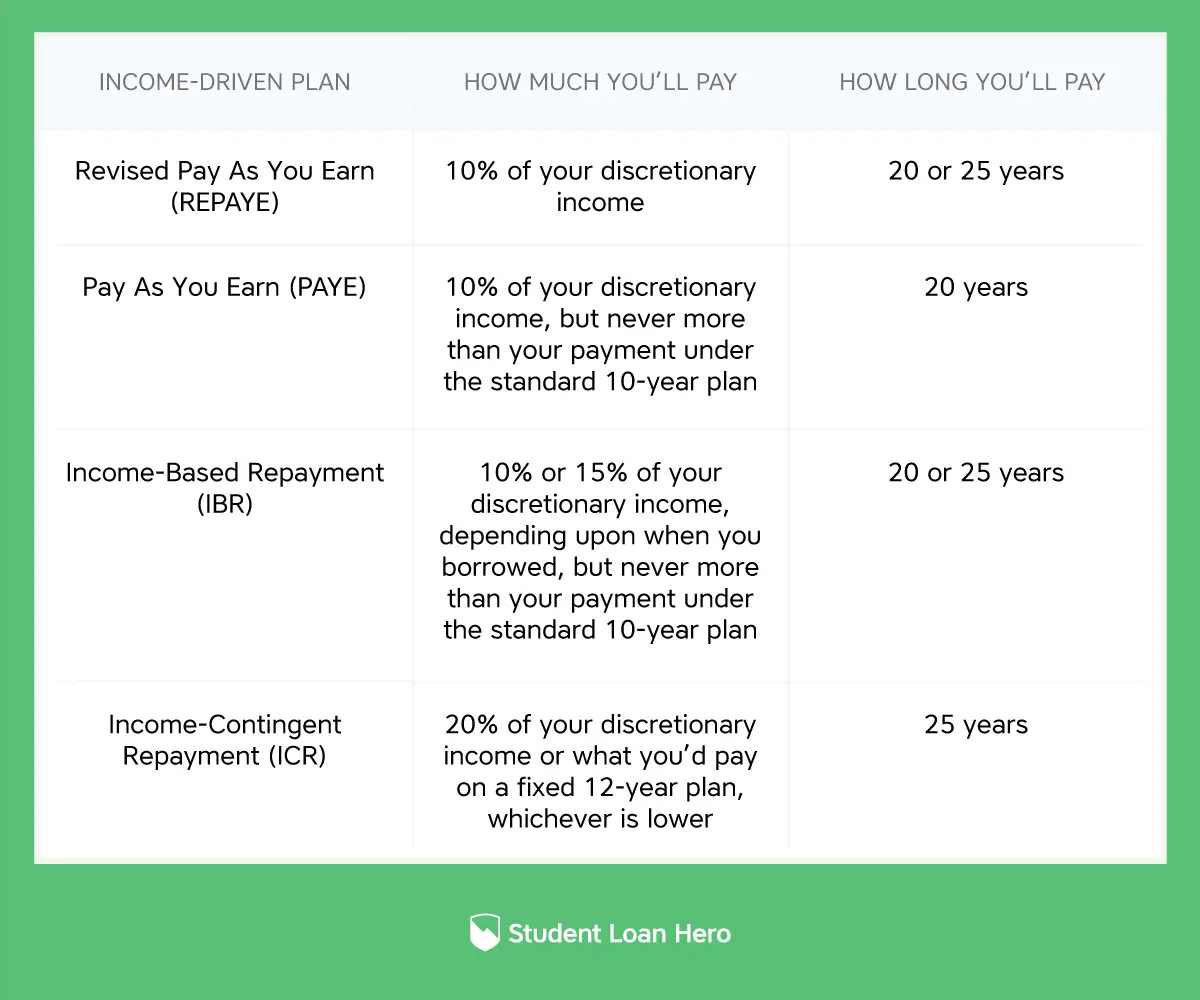

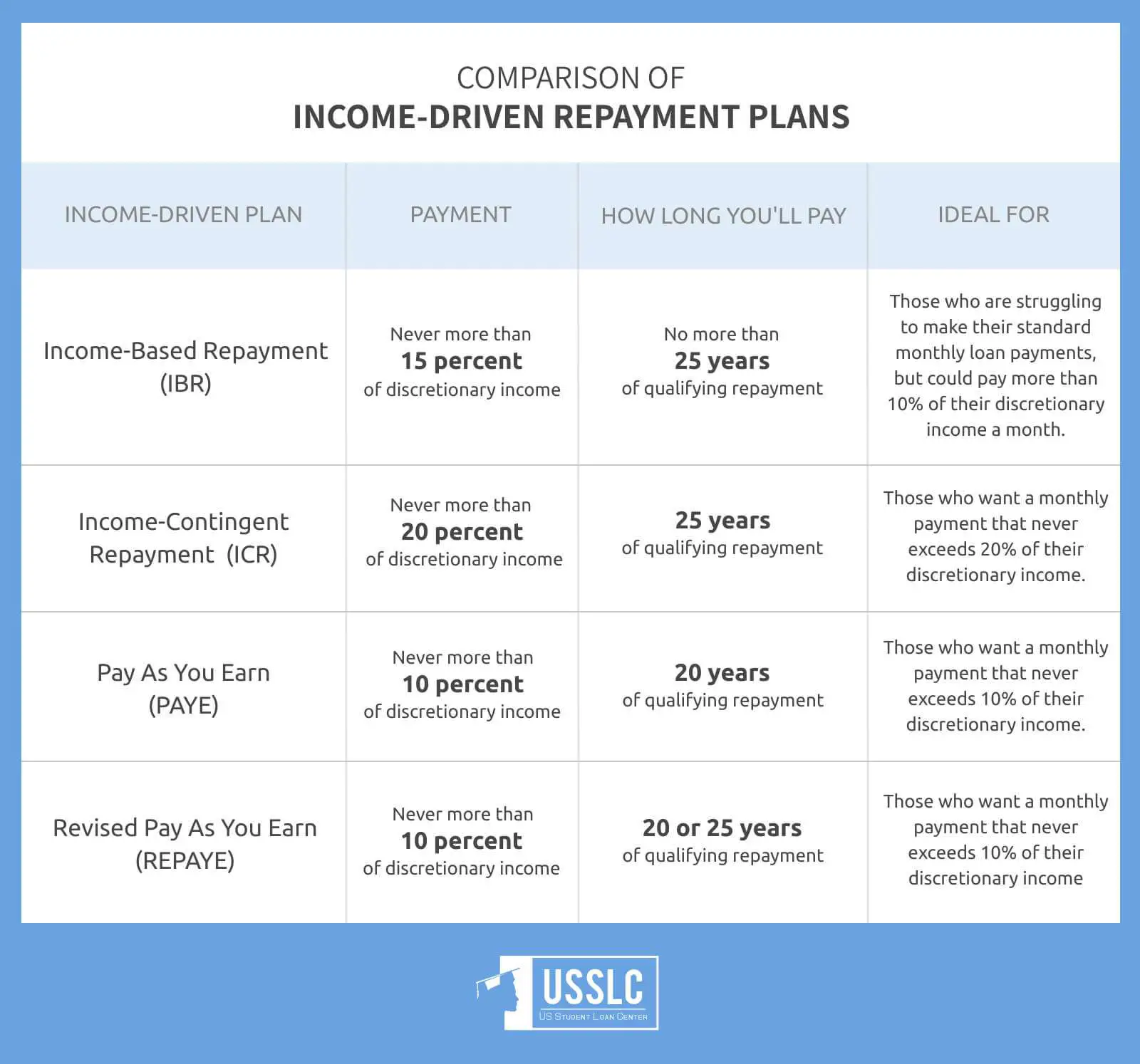

Pay As You Earn Repayment Plan

- Who’s eligible: Borrowers who received a disbursement of a Direct Loan on or after October 1, 2011.

- How it works:PAYE takes monthly payments at 10% of discretionary income, but never exceeds what you would pay on a Standard Repayment Plan.

- Who it’s good for: People who need a low monthly payment and/or are interested in Public Service Loan Forgiveness.

- Who it’s not good for: Borrowers whose income fluctuates significantly from one year to the next.

How To Choose The Best Student Loan Repayment Plan For You

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

*; ; ; ; ; *; ; ; ; ; *

Plus:FAQs: Student loan repayment

Don’t Miss: Can I Roll Closing Costs Into Loan

Refinance Student Loansif It Makes Sense

Before you go running into the arms of an all-too-eager lender, know that refinancing student loans is;not the right move for everyone. If someone told you this is the absolute best way to pay off student loans, they were lying. But that doesnt mean you shouldnt at least look into refinancing.

When you refinance, youre taking all your loansfederal, private, often a mix of bothto a lender who pays them off for you. And now you owe this new lender the money they just fronted you.

With a refinance, the goal is to;secure a better rate and better payment termswhich means you pay less each month and for a shorter amount of time to one lender instead of more money for a longer period of time to one or more lenders.

If youre in a position to keep paying the same amount you were paying before you refinanced, even better. Because that means youre throwing more at the principal each month than you were before and avoiding more interest. Plusand heres the best partif youve got other debt outside your newly refinanced student loan, you can ramp up your debt snowball even faster once you knock out that student loan.

Remember though, youre refinancing to;get a;better;rate and payment terms. If thats not what youre being offered, dont refinance. Its a bad deal. Make sure to do your homework and read the fine print, or you could end up deeper in the hole than you were before.;;

Student Loan Repayment Guide 2021

Your Student Loan is probably the biggest amount of money you’ve borrowed in your life so far. But do you totally understand the Student Loan repayment terms? We’re here to clue you up!

Credit: Marina Sun , Syda Productions Shutterstock

If youre like two in five;students, your loan agreement is a bit like your appendix: you know youve got one, but youre not entirely sure how it works. And that’s not a good thing!

With tuition fees over £9,000 and interest being added all the time, your Student Loan debt is bigger than ever. As such, its easy to ignore the details when it comes to repaying it all but the reality is that the Student Loan isnt as complicated as you might think.

Weve scoured the small print and broken it down into manageable chunks, meaning you can get to grips with Student Loan repayments and then get on with your life.

You May Like: What Is Portfolio Loan In Real Estate

Pay As You Earn Repayment

Pay as You Earn is the newest student loan program. It applies only to loans taken out after October, 2011. So, if you have old debts, this wont work for you. Otherwise, this is the program that delivers the lowest monthly payments possible. In general, your payment requirement would be roughly 10% of your AGI. However, there is an additional rule that allows you to skip payments entirely or reduce them if you fall below your states Federal Poverty Line. This is the program you use if you face extreme financial hardship and simply cant afford your payments. You can also use this program to qualify for PSLF.

Review Your Budget And Make A Plan

Now is a great opportunity to review your finances and make a plan for resuming payments. You may need to cut spending in certain areas to make sure you have room in your budget for when payment is due or pull from your emergency fund. Even though the forbearance period has been extended, its still a good idea to take this time to prepare for the future. Sooner or later, your monthly payments will start again and its better to be ahead of the curve.

Don’t Miss: How To Apply Loan In Sss

Ways To Pay Off Your Student Loans Faster Federal

Bags of money, representing the costs you can save with extra payments. Making extra loan payments lowers your overall cost. One easy way to pay off your loan;

Apr 8, 2021 8 ways to pay off your student loans fast · Make additional payments. · Establish a college repayment fund. · Start early with a part-time job in;

Jun 28, 2021 If you have a small student loan balance, traditional advice says to pay off student loans as quickly as possible; · If you have a large student;

Standard Repayment Plan Drawbacks

Cons of the standard repayment plan include:

- Larger monthly payments. Since youre on track to pay off your loans sooner, youll have higher monthly payments. This might seem daunting at first, especially early on in your career when you arent earning as much as someone who is further along or earning more money. If you cant afford the monthly payments, you may want to look into other repayment plans.

Read Also: When To Apply For Ppp Loan Forgiveness

Pay More Than The Minimum Payment

Youve probably heard this one before. If youre only paying the minimum payment each month, youre not getting anywhere fast.;You might not even be breaking even with the interest youre piling up!;By making larger payments, youll be able to attack the amount you owe at a quicker rate.;Start playing around with that;Student Loan Payoff Calculator;to figure out how fast you can pay off your loans by making extra payments.

Heres an example:

- Lets say you have the;typical amount of student loan debt that the average student graduates with, which is $38,792.1;

- With a 5.8% interest rate and a 10-year loan term , youd be looking at a minimum monthly payment of;$426.78.2

- Because of interest, your total repayment amount would be;$51,489thats $12,697 more than your original loan!;Yikes. That blows.

- But lets say you decided to pay just 20% more than your minimum payment each month .;That would put your monthly payment at $512.14which means youd pay off your entire loan in about eight years and save $2,794.04 in interest ! Thats more like it.

- If you paid;over;20% more than your minimum payment each month,;youd pay off your loan even faster .;You get the picture!

All that said, if youre having trouble even making the minimum payment each month, you might think the idea of paying more money is a pipe dream. With that in mind . . .

How Does The Income

One of the most confusing parts of the process of understanding how the IBR Plan works is that there are two different forms of the plan, one for people who borrowed their loans between 2009 and July 1st, 2014, and another for people who borrowed their loans after 2014.

So let me first show you a quick overview of how these two plans compare to each other, as your opinion of the IBR Plans utility is going to be heavily impacted by when you borrowed your student loans.

| IBR Plan | |||

|---|---|---|---|

| 25 Years | |||

| IBR | Direct or FFEL Loan Borrowers with a Partial Financial Hardship who got their 1st loan after July 1st, 2014 | 10% of Discretionary Income | 20 Years |

Now that we understand that there are two different plans with different options for borrowers, please understand that the rest of this post is going to refer specifically to the NEW IBR Plan, the one that sets monthly payments at 10% of discretionary income, and which offers Forgiveness at the 20 year mark.

So what is discretionary income? Typically, it means the money left over after youve paid for basic costs of living, like your rent, mortgage, food and utility bills, but for the Income-Driven Repayment Plans, discretionary income is calculated in a more specific way.

Don’t Miss: Is There Any Loan For Buying Land

Indian Health Services Loan Repayment Program

The Indian Health Service Loan Repayment Program awards as much as $20,000 per 12 months for the reimbursement of your certified student loans in change for an preliminary two-year service obligation to apply full time at an Indian well being program web site.

You can study extra about this program right here.

Whats The Earliest My Payment Could Be Due

Student loan payments will resume at the end of January, but thats not necessarily when your student loan payments are due. Look out for a billing statement or some notice from your loan servicer in the next few months to find out your specific due date. The Department of Education suggests visiting its FAQ page regularly between now and then for any general updates.

Don’t Miss: What Kind Of Loan Do I Need To Buy Land

National Health Service Corps

The National Health Service Corps provides tax-free loan reimbursement help to help certified well being care suppliers who select to take their expertise the place theyre most wanted.

Licensed well being care suppliers might earn as much as $50,000 towards student loans in change for a two-year dedication at an NHSC-approved web site by way of the NHSC Loan Repayment Program .

Accepted contributors might function major care medical, dental, or psychological/behavioral well being clinicians and might select to serve longer for extra loan reimbursement help.

Priority consideration is given to eligible candidates whose NHSC-approved web site has a HPSA rating of 26 to 14, in descending order. Eligible candidates might obtain as much as $50,000 in loan reimbursement for an preliminary service dedication till funding is exhausted.

You can study extra about this program right here.

You Can Enroll Yourself Or Hire Someone To Help

All these plans allow you to enroll through the StudentAid.gov website. However, as you see from reading through this article, things can get complicated. If you have debts from various federal programs that you want to roll in together, the paperwork to get there can be complex. So, while you can do it on your own, you may not necessarily want to.

In this case, you hire a student loan debt relief company to help you. These companies are essentially document preparation services they help you fill out the paperwork in the right order. However, having someone who knows all the rules can be beneficial. The more complex your debt, the more you may need help.

Also Check: How To Get Loan Signing Jobs

Ways To Repay Your Private Student Loans

Unlike federal student loans, private student loans dont have a standard student loan repayment process. However, they may have unique student loan repayment plans that other lenders dont offer.

For instance, some private lenders require you to start repayment as soon as funds are disbursed, while others let you make interest-only payments while in school or defer any payments until you leave school. Others may give you the option to pay interest plus a small monthly payment like $25 while youre in school in order to begin chipping away at your balance early.

When planning your private student loan payoff, its best to speak to your lender directly to learn more about your loan repayment options and decide which makes the most sense for you.

How Much Are Plan 1 Student Loan Repayments

Youll only start making Student Finance repayments once youve left your course and are earning enough.

The repayment threshold for Plan 1 loans is currently £19,895/year before tax.

This threshold has risen in April of each year since 2012, so make sure you keep up to date with the figure. And remember: if you earn less than that in taxable income , you wont pay anything back until youre back above the threshold.

Once you earn more than the threshold, repayments kick in and you pay 9% on the amount above the threshold. So, if you earn £24,895 , youll pay 9% of £5,000, which is £450 for the year.

Heres what your monthly repayments could look like. If youre self-employed, use this as a guide to how much you should be putting away for your annual tax return:

| Annual salary | |

|---|---|

| £50,000 | £226 |

Student Loan repayments come with weekly and monthly thresholds, too. This means that even if you have a salary that falls below the annual threshold, receiving a bonus or completing extra shifts could mean you end up crossing the threshold and making a Student Finance repayment.

However, if at the end of the financial year your annual earnings are still below the annual repayment threshold, you’ll be entitled to a refund. Head over to our guide to Student Loan refunds to find out how to go about claiming your money back.

Read Also: Are Jumbo Loan Rates Higher Than Conventional