Delaware Fha Loan Rates

There are few mortgage options that allow down payments of 5% or less the FHA Loan is one of them. Delaware FHA Loans require borrowers to put a minimum of 3.5% down toward the purchase price of the home. This is perfect for borrowers who need to save the funds for emergencies, home repairs, moving costs, and other financial obligations. Borrowers can meet their minimum 3.5% down payment requirement by using grant programs, gift funds, or community second mortgage loans. Delaware FHA Rate-Term Refinance Loans, Delaware FHA Cash-Out Loans, and Delaware FHA Streamline Refinance Loans are available. FHA also offers a special Delaware FHA 203k Rehab Loan for purchasing properties that need repairs and/or upgrades.

Call 302-703-0727 to apply for a FHA Loan or APPLY ONLINE

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

What Credit Score Do You Need For An Fha Loan 2021

580FHA Credit Requirements for 2021 FHA Loan applicants must have a minimum FICO® score of 580 to qualify for the low down payment advantage which is currently at 3.5%. If your credit score is below 580, the down payment requirement is 10%. You can see why its important that your credit history is in good standing.

Read Also: Car Loan Amortization Formula

How To Qualify For An Fha Loan

You’ll need to satisfy a number of requirements to qualify for an FHA loan. It’s important to note that these are the FHA’s minimum requirements and lenders may have additional stipulations. To make sure you get the best FHA mortgage rate and loan terms, shop more than one FHA-approved lender and compare offers.

It’s important to note that lenders may have additional stipulations.

Abstract Of Cashs Information To Fha Loans

- The FHA doesnt lend cash, FHA-approved lenders do, however the FHA is answerable for settling the debt in case you dont pay.

- The commonest kind of FHA loan is the Fundamental House Mortgage Mortgage 203.

- To use for a 203 loan, you want a credit score rating of no less than 580 for a 3.5% down cost or 500579 for a ten% down cost.

- Not like standard mortgage loans, the down cost can come from your personal financial savings, reward funds or authorities packages.

- Its essential to pay month-to-month mortgage insurance coverage premiums and an upfront mortgage insurance coverage premium upon the origination of an FHA loan.

Read Also: What Is A Loan Commitment Fee

Dti Limits For Fha Loans: 31% / 43%

According to official FHA guidelines, borrowers are generally limited to having debt ratios of 31% on the front end, and 43% on the back end.

But the back-end ratio can be as high as 50% for certain borrowers, particularly those with good credit and other “compensating factors.” See the table below for a breakdown of debt-to-income, credit scores, and compensating factors.

Those are the current FHA DTI ratio limits for 2021. We expect these requirements to remain in place throughout the year, since HUD has not announced any changes to them. If they do update their debt ratio guidelines in 2022, we will update this page to reflect those changes.

How Does An Fha Loan Work

The Federal Housing Administration doesnt actually lend money to homebuyers. Instead, it guarantees loans, making lenders less wary of extending mortgages and helping more Americans build equity in a home of their own. When you shop around for an FHA loan youre really shopping for an FHA-backed loan.

Don’t Miss: Can You Refinance An Fha Loan

Fha Loan Limits For : Here’s What Investors Need To Know

Get our 43-Page Guide to Real Estate Investing Today!

Real estate has long been the go-to investment for those looking to build long-term wealth for generations. Let us help you navigate this asset class by signing up for our comprehensive real estate investing guide.

Last week, we covered how conforming loan limits will be changing in the new year. But just as the Federal Housing Finance Agency changes its guidelines annually, so do other entities — namely, the Department of Housing and Urban Development. In fact, just a few days after FHFA’s announcement, HUD came out with similar news: Its loan limits are changing for 2021, too.

We’ll get into the details later, but the gist is that FHA loans are going up about $24,000 on the low end and around $57,000 in higher-cost markets . Obviously, this could open some doors for investors, particularly those looking to stay competitive in today’s ultra-competitive housing .

Are you planning some new investments in 2021? Think an FHA loan may be the way to finance them? Here’s what you need to know.

Do I Need A Jumbo Loan

There are always cases where potential homebuyers want to a purchase a house that exceeds the FHA’s loan limit for that county. In this case, FHA Jumbo Loans come into play.

Jumbo loans are mortgages which exceed the FHA’s county limit for home loans in a given zip code. When a lender approves a jumbo loan, they are essentially taking on an even greater risk. That’s why the FHA has a more stringent set of requirements for borrowers looking to apply for such a large loan.

Instead of the FHA’s established minimum credit score of 580, the minimum for a jumbo loan is 600, and 640 for refinances. Additionally, jumbo loan borrowers cannot receive down payment assistance the FHA mandates that the minimum 3.5% down payment is paid with the homebuyer’s own funds to ensure there are sufficient financial resources to cover closing costs.

An FHA Jumbo Loan might require two separate appraisals if the market is declining or the borrower is making a down payment of 5% or less. It is also important to note that FHA jumbo loans typically have higher interest rates than conventional jumbo loans. Keep in mind that FHA lending limits vary by area, which means what constitutes a Jumbo Loan in one county isn’t the same as another.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

How To Find An Fha Lender And Apply For An Fha Loan

FHA borrowers get their home loans from FHA-approved lenders, which can have different rates, costs and underwriting standards even for the same loan. FHA loans are available through many sources, from the biggest banks and credit unions to community banks and independent mortgage lenders.

Applying for an FHA loan requires a few key steps:

- Know your budget. Before you submit an application for an FHA loan, youll want to know how much you can afford to spend on a home. Consider your current income, expenses and savings, and use Bankrates mortgage calculator to estimate your monthly payments based on different home prices and different sizes of down payment.

- Compile your documents. Applying to borrow a large chunk of money means handing over a complete look under the hood of your finances. Before you apply for an FHA loan, have all these documents ready to go: two years of tax returns two recent pay stubs your drivers license and full statements of your assets and any other places where you hold money).

- Compare your offers.Getting preapproved with multiple lenders is helpful so you can compare different rates and terms to make sure youre getting the best deal.

What Are The Current Fha And Va Loan Limits In Texas

HOME LOANS | Aug 16, 2021 8:00:00 AM | by TTCU

Texas residents have an array of choices when it comes to home loan options. Conventional, Federal Housing Administration and Department of Veterans Affairs loans can all help potential borrowers obtain the money they need to purchase a home.

Each type of loan has different requirements, regulations and limits, so lets take a closer look at VA and FHA loans and their limits in Texas:

Also Check: Firstloan Com Legit

How Much Of My Reserve Mortgage Limit May I Access

Prior to 2013, borrowers could take out 100 percent of their net principal balance in one lump sum. However, new safety measures now restrict the amount of proceeds borrowers may take out in the first year. As of 2020, the amount a borrower may access in the first year is limited to:

- The greater of 60 percent of the approved loan amount, or

- The sum of mandatory obligations plus 10 percent of the reverse mortgage principal limit

For example, if John has no existing obligations and qualifies for a $100,000 reverse mortgage loan, he may access up to $60,000 in the first year. However, if John had an existing $70,000 mortgage, he would be able to receive more moneyup to $80,000 in the first year .

Depending on your circumstances, HECM guidelines may require funds set aside from your reverse mortgage in order to pay for homeowners insurance, property taxes, and necessary maintenance repairs. In this case, the lender will retain a portion of the borrowed money in a set-aside account in order to cover mandatory expenses in the upcoming years.

How To Qualify For An Fha Loan In Midland County Texas

The minimum loan amount in Midland County is $5,000 dollars and may go up to $685,400depending on home size and loan type.In order to qualify for an FHA loan, you must be planning to live in the home.Although a loan can include some renovation costs,FHA loans cannot be used for real estate investments in Midland County.

Additionally, your loan amount cannot exceed the value of home you are purchasing. Learn more about FHA Loan Requirements.

You May Like: What Do Mortgage Loan Officers Do

Down Payment Assistance In 2021

Down payment assistance programs make the mortgage process more affordable for eligible applicants who are interested in purchasing a home but need financial help to do so. Money is usually provided in the form of a non-repayable grant, a forgivable loan, or a low interest loan. Homebuyer education courses may be required.

Typically, a property being purchased must serve as the applicants primary residence and must be located within a specific city, county, or state. It may also need to fall within a program’s maximum purchase price limits. Income limits may apply, and will look something like this :

- 1 person household: $39,050

How Fha Loan Limits Are Determined

Where do these limits come from? How are they determined?

These are two of the most common questions we receive from mortgage shoppers. Heres a quick overview, starting with the geographical nature of these caps:

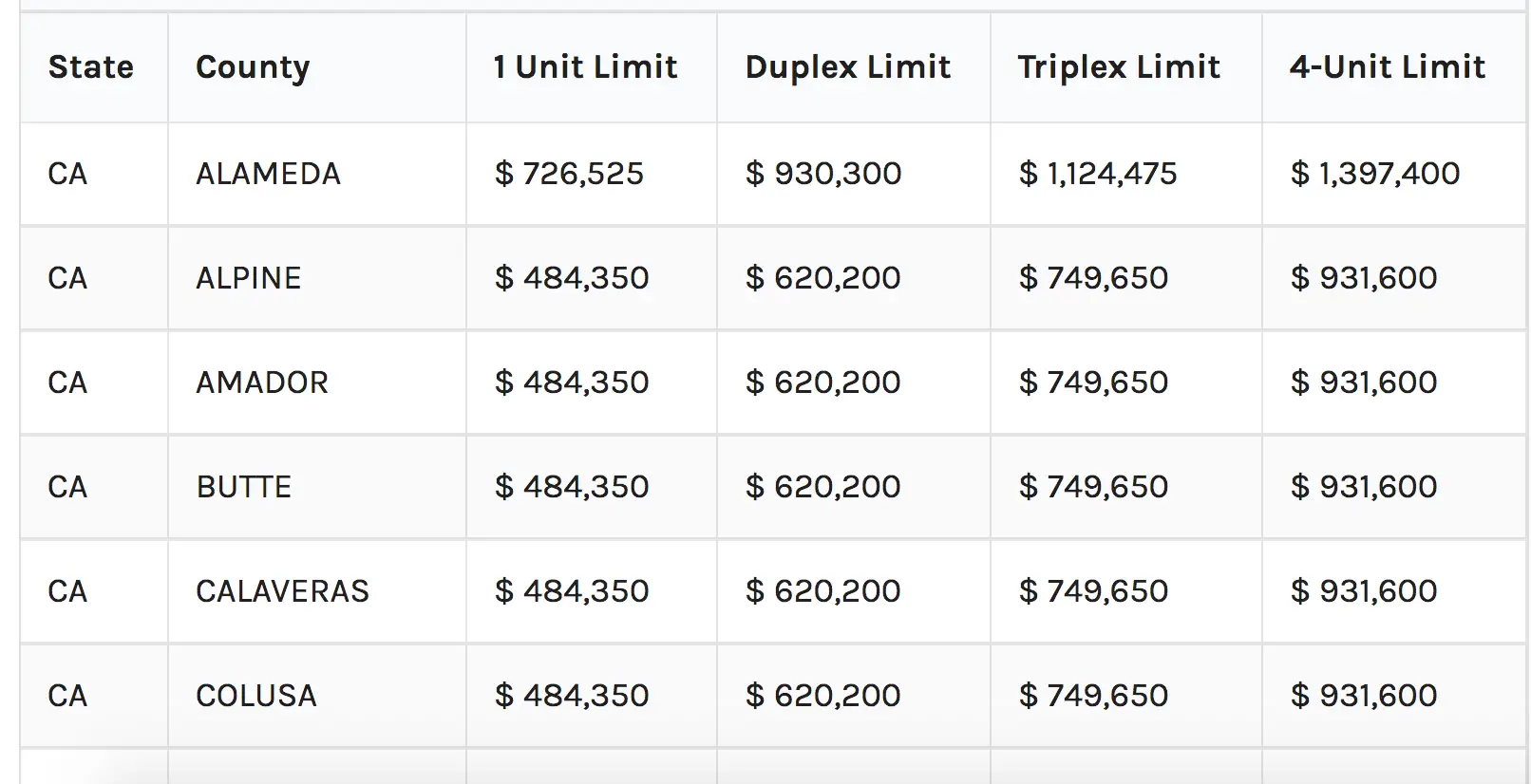

FHA loan limits are determined by the county where the home is located, except for properties that are located in metropolitan or micropolitan statistical areas. In metro areas, the limits are set using the county with the highest median home price within the metropolitan statistical area, according to HUD.

Thats the geographical aspect of it. The maximum lending amounts for this program are based on a percentage of conforming loan limits, which are set by the Federal Housing Finance Agency and are based on home prices. For instance, FHAs minimum national loan limit floor for low-cost areas is typically set at 65% of the national conforming amount for the U.S.

Heres what home buyers and mortgage shoppers need to know:

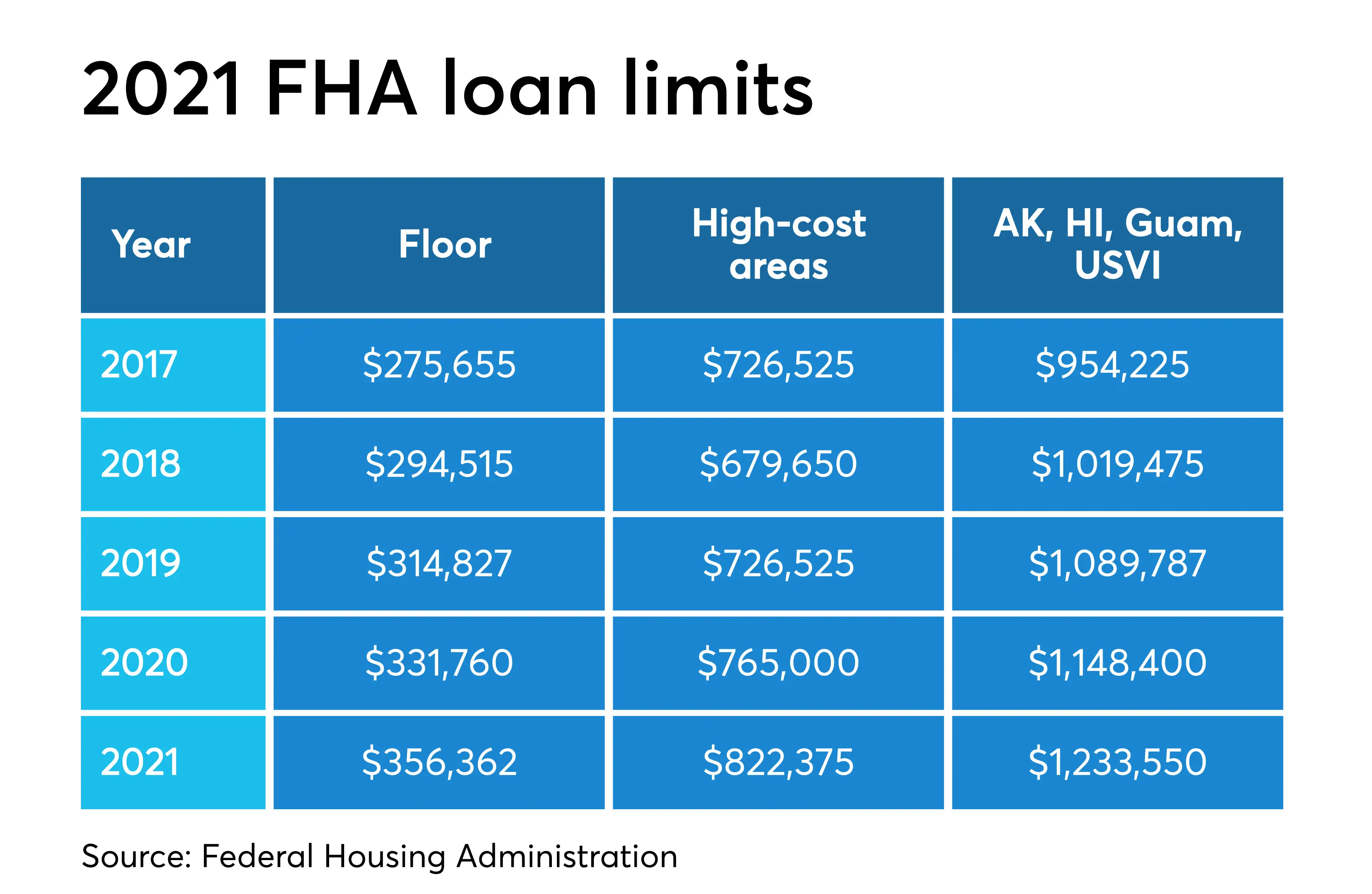

The 2021 FHA limits vary from one county to the next. They are based on the Home Price Index and get updated or at least reviewed every year. They were increased from 2020 to 2021 in most counties, to account for home-price gains that occurred during the previous year. To find the current and complete loan limits for your area, you must first find your county within the PDF documents above.

Recommended Reading: Fha Mortgage Refinance Rate

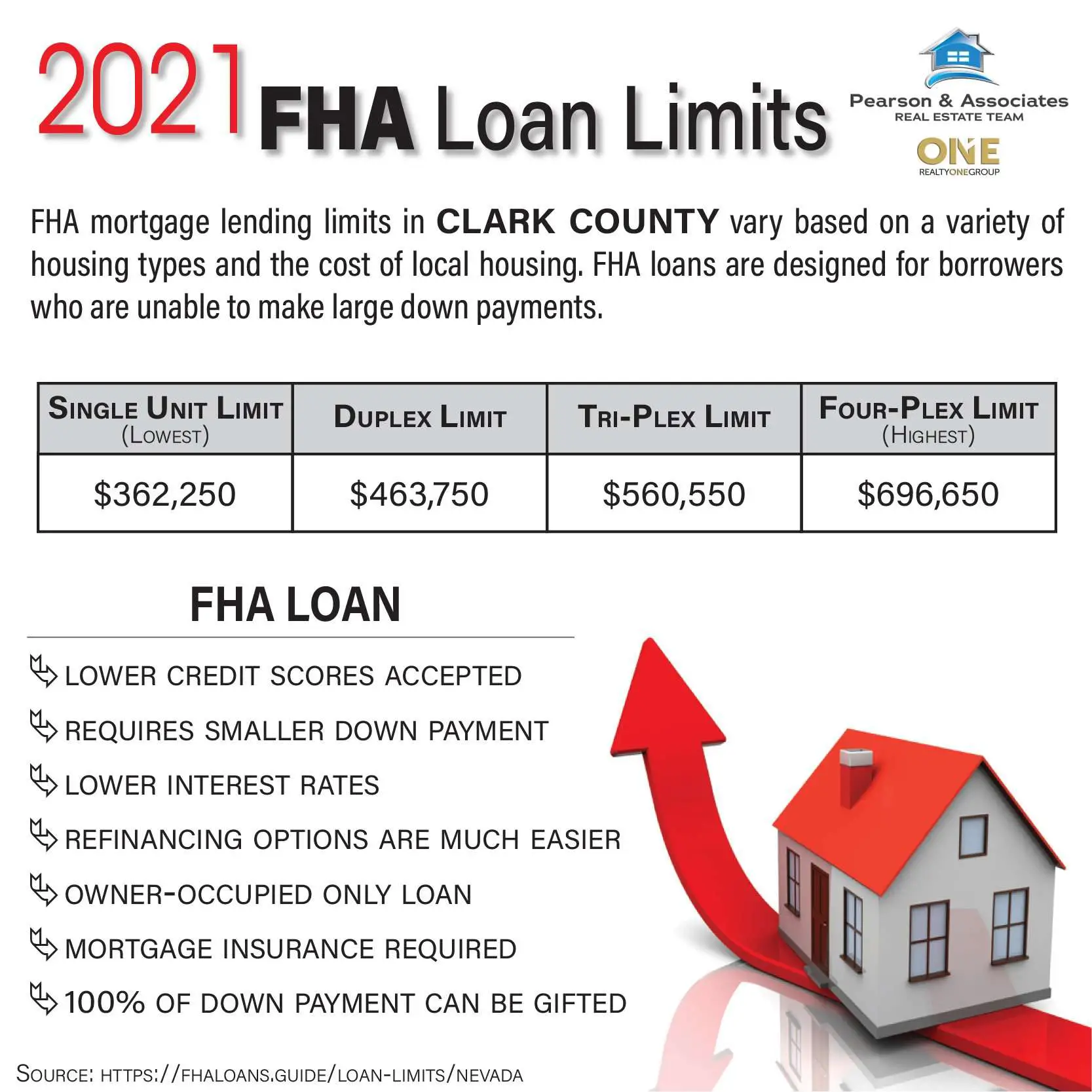

Loan Limits Based On Home Type

Since FHA loans are exclusively for owner-occupants, many people don’t realize that they are able to buy more than a single-family house. The FHA insures loans to purchase a duplex, triplex, or four-unit property as long as the borrower continues to live in one of the units. Taking this into account, the FHA determines its lending limits based on the property type as well.

Not all government agencies make this distinction. The U.S. Department of Veterans Affairs and the U.S. Department of Agriculture guarantee home loans as well, but their limits work differently than the FHA. The VA has no limits on the purchase price for a home, but eligible borrowers receive a home loan “entitlement.” This is the maximum amount that the VA will guarantee the lender in the case of the buyer defaulting. The only “limit” is what the lender agrees to loan to a borrower based on their own requirements.

The USDA also guarantees a portion of home loans meant for homebuyers in rural areas. Instead of lending limits based on property type, the USDA sets a maximum limit on household income to ensure that the people taking advantage of the affordable financing options are low and moderate-income families for whom it’s meant.

Fha Mortgage Health Statistics

Historically, this market share has experienced lows and highs for a number of reasons, and it’s currently starting to go into a low point even with its popularity with the Millennial age group. The FHA’s mortgage market share by dollar volume was just 17.3% in the last quarter of 2016. A few reasons for this share shift are:

Housing Bubble

During the housing bubble credit standards were loose on conforming mortgages. This meant marginal home buyers had less incentive to seek out FHA loans since almost anyone with a pulse could “qualify” for a standard conforming mortgage.

Housing Market Crash

The FHA offers mortgages to people with lower credit scores and thin credit histories. When credit dried up in the wake of the housing market crash & many ARM loans reset many people rushed into FHA loans.

Fee Adjustment

Once the United States housing bubble crashed, the liquidity people had access to was drastically reduced. This caused an FHA share boost after the crash and this. The slow recovery, in turn, caused the FHA default rate shoot up and any cash reserves that the FHA set aside for emergencies was quickly depleted. To offset the losses, in 2013 the FHA to increase its fees. The fee increase caused dollar share of FHA loans to slide as:

- many people defaulted

- new borrowers preferred conforming loans which were in many cases cheaper on a relative basis

- people with strong credit profiles who used FHA loans refinanced into conventional mortgages

Recommended Reading: Usaa Used Auto Loan

Overview Of 2021 Fha Loan Limits

Below you will find the 2021 FHA loan limits for low-cost areas, high-cost areas, and special exceptions for areas like Alaska and Hawaii with expensive construction costs.

Low-Cost AreasThe FHAs national low-cost area mortgage limits for 2021 are set at 65% of the national conforming limit of $510,400 . Here are the specific amounts for this category, by property type:

- One-unit: $356,362

- Four-unit: $2,372,625

Interested In Conforming Loan Limits

Some homeowners are looking for Conforming Loan Limits and there are additional opportunities for homeowners under Fannie Mae or Freddie Mac lending guidelines. As mentioned above the ceiling for conforming loan amounts was also raised recently and this should help the housing market in 2019.

At JB Mortgage Capital, Inc. we offer low FHA mortgage rates and one-on-one personal service. If you are looking for a new FHA mortgage please be sure to give us a call at 1-800-550-5538 or send us a message from our website.

Recommended Reading: Drb Student Loan Refinance Reviews

Fha Loans Make It Possible For Some People To Get A Mortgage Without A Large Down Payment

Saving up for a big down payment on a home is a financial obstacle for many would-be homeowners. Fortunately, FHA loans can help homebuyers afford a mortgage loan by offering flexible home loan requirements, including low down payments and lower minimum credit scores.

To help you figure out whether an FHA loan makes sense for you, well go over the basic requirements for qualifying for an FHA loan including the conditions that borrowers, and the property they want to buy, must meet. Lets dive in.

Fha Loan Limits By Property Type

FHA loan limits vary by property type. They are lowest for one-unit properties, increase for two-unit properties, increase again for three-unit properties and max out for four-unit properties.

If you want to use an FHA loan to buy a duplex, the limit will be higher than if you want to use an FHA loan to buy a single-family house. And you can, in fact, use an FHA loan to buy a multi-unit property, up to four units, as long as you live in one of the units as your primary residence.

Don’t Miss: Usaa Car Loan Credit Score