How To Calculate Loan Amortization

You can find an online calculator that will find a complete amortization schedule for you with periodic payments and writing off the principal amount. However, you can also prepare your loan amortization schedule by hand or in MS excel. Lets look at the formula periodic payments in the loan amortization.

What will you need:

The following formula will be applied for the monthly payments in the amortization schedule:

p = a//

in this formula, the annotations represent the following:

a = total amount of loan

r= interest rate

n = total number of payments in the total period of the loan calculated by frequency of payments.

Examples Of Loan Commitments

Loan commitments come in several different types and can vary slightly by the type of loan:

Revolving Secured Loan: An example is a home equity line of credit . If you are approved for a HELOC, then you have a certain maximum loan amount, but as long as you make the payments on the loan, you can use the principal, pay it off, and use it again. Bear in mind that your home is the collateral for the loan.

Revolving Unsecured Loan: An example is a credit card loan. You will have a credit limit on your credit card. When you draw down part of your credit card limit by making a purchase, you can use it again after you pay it off. There is no collateral associated with a credit card.

Non-Revolving Secured Loan: An example is a home mortgage. It is secured by collateral, which is your home. When the home is paid off, the account is closed. The first mortgage on a home is a non-revolving secured loan. Another example is your automobile loan.

Non-Revolving Unsecured Loan: An example is a personal loan you take out from a commercial bank for some reason, perhaps . Another example is a student loan.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Mortgage Loan Officer Salary Plus Commission

Opendoor Ratings: What You Must See Inside A Hot Sellers Industry Selling Your Home Is A Lengthy Process

Opendoor Ratings: What You Must See. Inside a hot sellers industry, selling your home is a lengthy process.

Weeks can move through the energy your talk with an agent until you eventually take a seat at completion dining table. And therefores if you learn a seller quickly if not, it will take period. So what will you do if you need to go quickly?

Thats when you might think about an instant money sale to a business enterprise such as for example Opendoor. Was Opendoor your very best option? Before you decide, lets examine the way they run and read some of the Opendoor ratings on the web.

What Exactly Is A Rental And The Way Do I Get Free From One

In 2019, virtually 29percent of payday loans in WV new motors comprise rented into the U.S. Despite having some leased automobiles, not everybody recognizes rent agreements along with their end-of-lease alternatives. A lease is essentially any time a car dealership will let you obtain their property for a regular monthly pay.

We strive to be certain that you may be pleased. Find out below the reasons reliability usa!

Read Also: Get A Loan Without Proof Of Income

What Is A Payday Loan

A payday loan is a type of short-term borrowing where a lender will extend high-interest credit based on your income. Its principal is typically a portion of your next paycheck. Payday loans charge high interest rates for short-term immediate credit. They are also called cash advance loans or check advance loans.

Obtaining A Payday Loan

Payday loan providers are typically small credit merchants with physical stores that allow on-site credit applications and approval. Some payday loan services also may be available through online lenders.

To complete a payday loan application, you must provide pay stubs from your employer that show your current level of income. Payday lenders often base their loan principal on a percentage of the borrowers predicted short-term income. Many also use a borrowers wages as collateral. Lenders generally do not conduct a full credit check or consider your ability to repay the loan.

In the U.S., as of 2020, 13 states and the District of Columbia have banned payday loans.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

What Is An Amortized Loan

An amortized loan is defined as,

a type of loan or debt financing that is paid back to the lender within a specified time. The repayment structure of such a loan is such that every periodic payment has an interest amount and a certain amount of the principal.

A more formal definition of the amortized loan will be,

An amortized loan is a scheduled loan in which periodic payments consist of interest amount and a portion of the principal amount.

Extended Definition Of Loan Relationships

There are two important extensions to this definition.

- First, some money debts that do not involve the lending of money are within the loan relationships rules. The best example of this is that of interest arising on a trade debt. See CFM30200.

- Second, securities are brought within the rules by CTA09/S303 which extends the meaning of the lending of money to cases where there is no actual lending of money, but an instrument issued for the purposes of representing security for a money debt. For example, a company may buy an asset by issuing a loan note. There has been no lending of money, but the loan note is a loan relationship.

So loan relationship is wide term that encompasses a wide range of financial arrangements, from simple debt such as an overdraft, to complex financial instruments.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Loan Origination Explained In 4 Minutes Or Less

Loan origination is the qualification and verification process that begins a new loan. It starts with submitting documents for pre-qualification, which are analyzed by the banker. A loan is fully originated at closing or when the loan is fully in effect.

In between, there are quite a few communication steps for lenders and their underwriters to complete to ensure the loan meets legal standards while also moving forward in a timely fashion. Learning about the loan origination process can help you better understand any holdups in the process and ask any needed questions along the way.

Definition And Examples Of Loan Origination

Loan origination is most generally the start of a loan, but it requires a legal and standardized process. Loan origination standards ensure that loans are issued in ways that arent too risky, with many rules and requirements coming from regulations published in the wake of the housing crisis in 2008. The Federal Deposit Insurance Corporation is involved in standards for originating loans as well.

Loan origination can be a fairly rapid process for smaller loans or loans that are secured, such as many car loans. For larger loans like mortgage loans, there is additional paperwork, and the process may take multiple days or weeks before the financing is fully available to the borrower.

Read Also: What To Do If Lender Rejects Your Loan Application

What Does Principal Mean

What is the definition of principal? Principal is a commonly used term in business. In practice, it refers to the amount of debt outstanding at a certain moment. This amount is used to calculate interest expenses for the period. Keep in mind that interest expenses, either accrued or accumulated, are not part of the outstanding balance unless the loan is compounded.

In a regular loan, the outstanding balance amount will change after each payment is made. The total loan payment is typically made up of two parts: principal and interest. As the principal payments are applied to the loan balance, the outstanding loan amount owed is reduced.

From the perspective of the bank, the principal is the amount loaned to the customer and after each payment is received the bank will calculate what the current outstanding balance is. In some cases, as is the case with bonds, interest is paid periodically, but the principal of the bond is paid when the bond maturity date is reached.

Heres a brief example.

What Is Loan Origination

Loan origination is the term used to describe the process that occurs when a buyer obtains a mortgage loan from a lender. It involves several stages, starting with the loan application by the borrower, the submission of appropriate documentation, the lenders assessment of the application and the final granting of the loan.

Don’t Miss: How To Get Loan Originator License

How Does Loan Origination Work

The loan origination process begins with an applicant submitting documentation and data to the lender. This information may be less comprehensive for a small secured loan versus a large loan, but in both cases, , income and assets, and information about what the loan will be used for will all be taken into account.

Most lenders will then take all the required documentation and input the key data into an automated underwriting software product or an underwriter will manually determine exactly the loan limits for which the borrower qualifies.

The representative of the lender will discuss potential terms and interest rates with the borrower, since they may qualify for a different rate for a longer-term loan, or if the loan is a fixed-rate versus an adjustable-rate. If the terms are acceptable, they can agree to move forward, originating the loan.

All this work is compensated in the form of a fee that is included in the loan. For home mortgages, a typical mortgage origination fee is between 0.5% to 1% of the loan amount.

You will know the amount of your origination fee ahead of time as each lender must include it in your loan estimate. Origination fees can generally only increase under certain circumstances.

Simple Vs Compound Interest

The interest rate on loans can be set at simple or compound interest. Simple interest is interest on the principal loan. Banks almost never charge borrowers simple interest. For example, let’s say an individual takes out a $300,000 mortgage from the bank, and the loan agreement stipulates that the interest rate on the loan is 15% annually. As a result, the borrower will have to pay the bank a total of $345,000 or $300,000 x 1.15.

Compound interest is interest on interest and means more money in interest has to be paid by the borrower. The interest is not only applied to the principal but also the accumulated interest of previous periods. The bank assumes that at the end of the first year, the borrower owes it the principal plus interest for that year. At the end of the second year, the borrower owes it the principal and the interest for the first year plus the interest on interest for the first year.

With compounding, the interest owed is higher than that of the simple interest method because interest is charged monthly on the principal loan amount, including accrued interest from the previous months. For shorter time frames, the calculation of interest is similar for both methods. As the lending time increases, the disparity between the two types of interest calculations grows.

If you’re looking to take out a loan to pay for personal expenses, then a personal loan calculator can help you find the interest rate that best suits your needs.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Income From Discharge Of Indebtedness

Although a loan does not start out as income to the borrower, it becomes income to the borrower if the borrower is discharged of indebtedness.:111 Thus, if a debt is discharged, then the borrower essentially has received income equal to the amount of the indebtedness. The Internal Revenue Code lists “Income from Discharge of Indebtedness” in Section 61 as a source of gross income.

Example: X owes Y $50,000. If Y discharges the indebtedness, then X no longer owes Y $50,000. For purposes of calculating income, this is treated the same way as if Y gave X $50,000.

Things To Consider Before Applying For A Loan

For individuals planning to apply for loans, there are a few things they should first look into. They include:

1. Credit Score and Credit History

If a person has a good FICO ScoreA FICO score, more commonly known as a credit score, is a three-digit number that is used to assess how likely a person is to repay the credit if the individual is given a credit card or if a lender loans them money. FICO scores are also used to help determine the interest rate on any credit extended and history, it shows the lender that hes capable of making repayments on time. So, the higher the credit score, the higher the likelihood of the individual getting approved for a loan. With a good credit score, an individual is also has a better chance of getting favorable terms.

2. Income

Before applying for any kind of loan, another aspect that an individual should evaluate is his income. For an employee, they will have to submit pay stubs, W-2 forms, and a salary letter from their employer. However, if the applicant is self-employed, all he needs to submit is his tax return for the past two or more years and invoices where applicable.

3. Monthly Obligations

You May Like: Usaa Refinance Auto

Loan Amortization: Definition Example Calculation How Does It Work

A famous Danish proverb says,

Promises make debt, and debt make promises.

Corporate finance and personal finance both focuses on two main sources of financing: debt and equity. Debt financing is the mode when businesses and individuals borrow money from financial institutions. The borrowed amount is called a loan, and it is paid back to the lender on pre-decided terms of payment.

Businesses go toward debt financing when they want to purchase a plant, machinery, land, product research. In personal finance, bank loans are usually dedicated to real estate purchases, car purchases, etc. An interest percentage is paid to the bank until the loan is repaid.

There are specific types of loans that are amortized and other types that are not amortized. This article will have a general overview of loan amortization, how it works, and what types of amortized, and which ones are not.

So lets get into it.

Types Of Amortizing Loans

Not all loans are amortized loans. Instead, there are certain types of loans that can be amortized. In personal finance, the following are the most common types of amortization loans:

Home loan

Home loans are usually fixed-mortgage loans spread over 15 to 30 years. The borrower has security that he will pay the fixed interest respect regardless of the market fluctuations. However, another type of flexible-rate mortgage also exists when the lender has the power to change the rate.

Personal loan

Personal loans were taken from online lenders, credit unions, and other financial institutions like banks fall in the category of personal loans and are usually amortized. The terms of personal loans can vary. However, most typically, such loans are spread over three to five years.

Auto loan

Auto loans or car loans are borrowed for car purchases. The loan schedule consists of a down payment and periodic payments of interest+principal. Such loans are usually for five years or less. The borrower can extend the loan, but it can put you at the risk of paying more than the resale value of your vehicle.

Student loans

Student loans cover the tuition fees, education costs, college expenses, etc., for the students during studies. The repayment of student loans depends on who is the lender federal loans or private loans. Private loans usually have higher interest rates, and federal loans are issued at subsidized rates.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

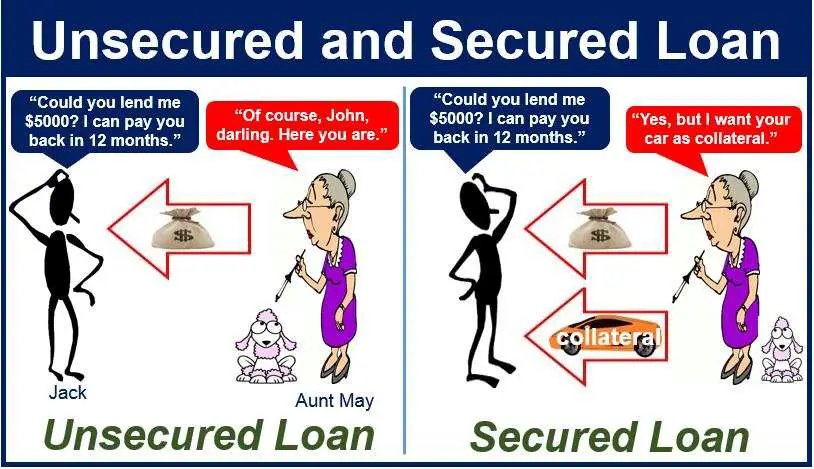

Secured And Unsecured Loan Commitments

Both revolving and non-revolving loans can be either secured or unsecured. Secured loan commitments are backed by an asset that can be seized if the loan is not paid. This asset is called collateral. Secured loan commitments are usually made in the case of mortgage loans and automobile loans. Unsecured loan commitments, like credit card loans and student loans, are not secured by collateral.

Efforts To Regulate Payday Loans

Efforts to regulate payday lenders were proposed in 2016 under the Obama administration and put in place in 2017, when the Consumer Financial Protection Bureau , under then-Director Richard Cordray, passed rules to protect consumers from what Cordray referred to as debt traps. The rules included a mandatory underwriting provision requiring lenders to assess a borrowers ability to repay a loan and still meet everyday living expenses before the loan is made. The rules also required lenders to provide written notice before trying to collect from a borrowers bank account, and further required that after two unsuccessful attempts to debit an account, the lender could not try again without the permission of the borrower. These rules were first proposed in 2016 and set to take effect in 2019.

In February 2019, the CFPBthen under the Trump administration and Director Kathleen L. Kraningerissued proposed rules to revoke the mandatory underwriting provision and delay implementation of the 2017 rules. In June 2019, the CFPB issued a final rule delaying the August 2019 compliance date, and on July 7, 2020, it issued a final rule revoking the mandatory underwriting provision but leaving in place the limitation of repeated attempts by payday lenders to collect from a borrowers bank account. Under the Biden administration, it is likely that new leadership at the CFPB once again will take up stricter rules for payday lending.

You May Like: What Happens If You Default On Sba Loan