How To Figure Out The Full Cost Of A Car Loan

Cheryl Knight

Taking out a car loan is one of the most common ways to finance purchasing a car. This is especially true if you are buying a new car, which usually costs too much to pay for in cash. Buyers most often use the aid of a car loan to cover the higher cost of a new car. A part of this higher cost are the finance charges that loan grantors charge loan applicants for their service and time. You have basically two ways to figure out the finance charges you have to pay for a car loan, on a monthly basis or over the lifetime of the loan.

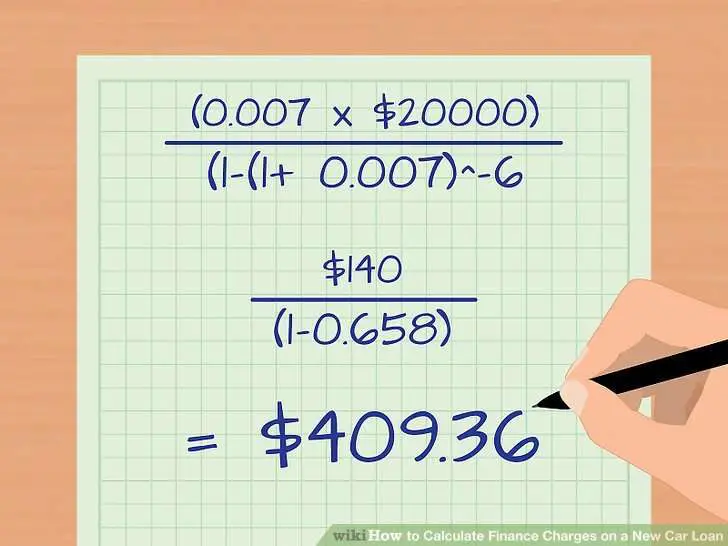

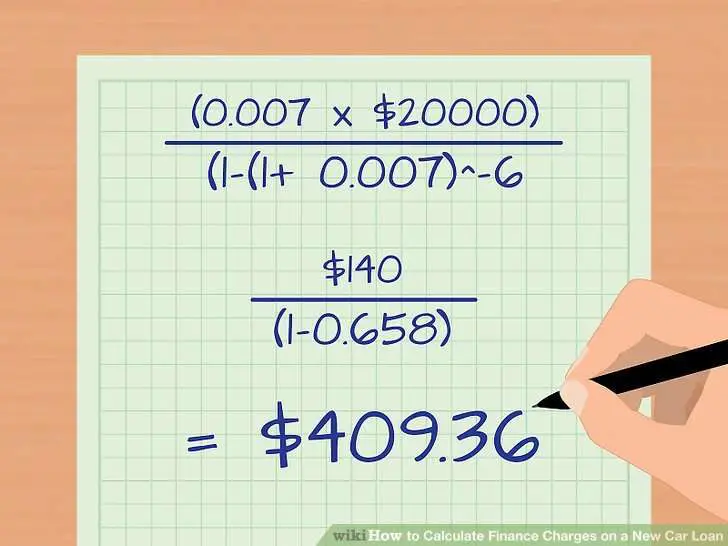

Calculating Your Monthly Finance Charges

Historical Auto Loan Rates

Auto loan rates are at historically low levels as a result of an overall low interest rate environment. Over the last decade, the average interest rate on a 48 month auto loan from a commercial bank has fallen by over 40%. This is largely a result of the 2009 financial crisis, after which interest rates were lowered to incentivize consumers to stimulate the economy by spending on items like cars rather than saving.

Loans from auto finance companies have historically carried lower rates than loans from commercial banks. The large car manufacturers have “captive finance” arms that exclusively provide loans for consumers purchasing the parent companys cars this enables automakers to provide lower rates, as the car purchase, rather than the interest, is the manufacturers primary revenue stream.

*The Federal Reserve stopped reporting data on auto finance company interest rates after 2011.

Read Also: How Much To Loan Officers Make

How Do Capital One Auto Loans Work

Right off the bat, the biggest advantage of using Capital One Auto Finance is the type of credit inquiry on your credit report.

Capital One does a soft pull, meaning they will not inquire for a hard inquiry, dinging your credit when youre just shopping around for a personal loan.

That means qualifying for a Capital One car loan credit application wont impact your credit score.

When youre ready to get started with Capital One Auto, place in your personal information like your name, social security number, employer, address, and phone number and its Navigator tool will show you all the offer terms.

Additionally, you can search their database for the car you want through their approved participating dealerships. Once youve found your car, take your offer to the dealership to complete the process.

Keep in mind that snagging a pre-approval does not automatically guarantee approval for financing. Additionally, your final terms will depend on the hard credit inquiry performed by the participating dealer.

At this point, you can choose to use either the Capital One Auto Finance option or whatever the company your particular dealership has to offer.

The Capital One Auto Navigator will also help you determine your baseline interest rate before you head to the dealership. This way, youll have a solid idea of what interest rate youll get.

It also helps you estimate your monthly payment, so youll know in advance what works best for your budget.

Other Factors Affect Your Finance Charges

Despite the usefulness of online loan calculators or manual car loan formulas in determining the total cost of your loan, there remain several factors that are not included in the calculation. These include your credit score and the other fees that differ from one lender to another.

Your credit rating affects the interest rate of your loan. The average interest rates associated with credit scores are usually the following:

- 740-850: Excellent 0 to 3.2% interest rate

- 680-739: Average 4.5% interest rate

- 680 and below: Subprime 6.5 12.9% interest rate

Hidden Fees

There are several fees that are not usually factored in when calculating car financing but affect the total cost of your loan. These include:

- One-time application fee

- Early Repayment Penalty

- Missed or Late Payment Fee

Most of these fees are not mentioned while youre still inquiring for a car loan or asking for a pre-approval, but they can have a significant effect on the total cost of your loan. Hence, they are sometimes called hidden fees.

Not all lenders charge hidden fees. If they do, the amount varies from one lender to another. It is important to shop for car loans and know all the charges involved before taking out one.

Don’t Miss: How Do I Get My Student Loan Number

Motor Vehicle Loan Contracts

All motor vehicle loan contracts should specifically outline the interest rate, annual percentage rate, finance charge, late fees, default of contract conditions, and insurance or other contract requirements.

- Interest Rate, is the annual percentage you will pay based on the original amount of the loan.

- The most common way motor vehicle loan interest is calculated is by using the Simple Interest Method. Simple interest is determined by multiplying the interest rate by the principal by the number of payments.

How Much Can You Borrow

Using Capital One Auto, you can choose to apply for either a joint or a single loan. This will help cover the costs of a new or used vehicle.

With new car loans, you can borrow between $4,000 and $50,000 from Capital One to finance the vehicle.

If you decide to purchase a used car, the vehicle must be no more than 7 years old and has to have fewer than 120,000 miles. Be sure to factor in the trade-in value of your former car if this case applies to you.

There are a few states in which the vehicle year can be 10-12 years old.

Also Check: Transfer Car Loan To Another Bank

Auto Loan Length Still Matters

Even with an identical APR, youll end up paying more in interest over the course of a longer term loan. For instance, a buyer who takes out a $25,000 loan with a 3 percent APR for 48 months will have a higher monthly payment by more than $100, but will end up paying nearly $400 less in additional interest versus the same loan at 60 months. Use an auto loan calculator to decide which is the better deal.

Other Types Of Finance Charges

Aside from credit cards, other types of credit come with finance charges too. Finance charges are how lenders make money and, often, how they protect their investments.

Heres how finance charges may be calculated on a few common types of loans.

- Mortgages: Finance charges may include the total amount of interest plus loan charges . This is also known as your total cost of credit, and its included in your Truth-in-Lending disclosure.

- Auto Loans: Finance charges may include any costs that you have to pay according to the terms of the loan. These costs may consist of interest fees, application fees, filing fees, etc.

- Personal Loans: Finance charges include all interest and any fees that you must pay to take out the loan.

Read Also: Refinance Avant

Dealer Fees To Watch Out For When Buying A Car

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

When its time to sign the final paperwork for your new car, its a good bet that the lines are blurring together and you just want to go home. One last look could save you money. Some dealer fees are required, but many arent. Stripping away unwanted add-ons could save hundreds, even thousands, off your costs. Well help you differentiate whats necessary and what isnt, and what to expect in your state.

Go Autos Car Loan Calculator

Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehiclelets say $8,000 to $10,000is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car. But loans come with monthly payments, and it can be hard to figure out how much youre likely to pay once you factor in things like the loan term, the interest rate, the payment frequency, and the trade-in value. To be totally honest, its pretty confusing. But dont worry. Our car loan calculator can do all the hard work for you.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

What Should I Pay For A New Car

To find out what you should pay for a new car, look up the cars value on an industry guide: NADAguides, Kelley Blue Book or Edmunds. All three are completely free for consumers to use. Dealer prices may be higher or lower, but we recommend not paying more than the guidebook value. Heres more on how to value a car.

Clarifying The Terms Of Your Loan

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Finding Charges On A Bill

Finance charges can be listed in several places on your monthly credit card billing statement. On the first page of your billing statement, you’ll see an account summary listing your balance, payments, credits, purchases, and any interest charges.

In the breakout of transactions made on your account during the billing cycle, you’ll see a line item for your finance charge and the date the finance charge was assessed.

In a separate section that breaks down your interest charges, you’ll see a list of your finance charges by the type of balances you’re carrying. For example, if you have a purchase balance and a transfer balance, you’ll see details of the finance charges for each. Different types of transactions and balances may come with different interest rates and grace periods.

For mortgages, monthly payments are separated into principal and interest payments, in addition to extra costs like property taxes. In this case, the “principal” portion of payments wouldn’t qualify as a finance chargeit simply goes toward reducing your debt balance. The interest payments, on the other hand, are a finance charge.

Average Auto Loan Rates By Credit Score

Consumers with high credit scores, 760 or above, are considered to be prime loan applicants and can be approved for interest rates as low as 3%, while those with lower scores are riskier investments for lenders and generally pay higher interest rates, as high as 20%. Scores below 580 are indicative of a consumers poor financial history, which can include late monthly payments, debt defaults, or bankruptcy.

Consumers with excellent credit profiles typically pay interest rates below the 60 month average of 4.21%, while those with credit profiles in need of improvement should expect to pay much higher rates. The median credit score for consumers who obtain auto loans is 711. Consumers in this range should expect to pay rates close to the 5.27% mean.

When combined with other factors relevant to an applicants auto loan request, including liquid capital, the cost of the car, and the overall ability to repay the loan amount, credit scores indicate to lenders the riskiness of extending a loan to an applicant. Ranging from 300 to 850, FICO credit scores are computed by assessing credit payment history, outstanding debt, and the length of time which an individual has maintained a credit line.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Calculating Your Loan’s Total Finance Charges

Car Dealer Fees By State

Here is a state-by-state table showing the estimated amount you could expect to pay in required fees when purchasing a new or used car from a dealership. We used Edmunds data: the maximum car tax rates, the average Department of Motor Vehicle fees and the median document fees in every state. Then we did math based on the average new car price of $39,259 and used car price of $22,351 to estimate what you would pay in fees. If you buy a car that costs more or less your fees will go up or down, accordingly.

| State |

| $2,500 |

Source: Edmunds and LendingTree

Note that the table above does not include new car destination fees. As we mentioned earlier, this can tack on as much as $1,700 to the cost of your car.

Recommended Reading: Usaa Certified Dealers List

How Much Would You Like To Borrow:

Please review and adjust your amounts for down payment, trade-in and cash incentive. Their current total is equal to orexceeds the vehicle purchase price.

Reminderthe minimum borrowing amount is $7,500. Therefore the total price of the vehicle less any down payment, trade-in, and cash incentive cannot be below this amount.

Interest Rate

How Do These 3 Factors Affect Your Monthly Payment

A lower monthly payment always sounds good, but its important to look at the bigger financial picture: That lower payment could also mean youre paying more for your car over the life of the loan. Let’s see how adjusting each of the 3 factors can affect your monthly payment:

- A lower loan amount. Let’s say youre considering a $25,000 car loan, but you make a $2,000 down payment or negotiate the price of the car down by $2,000. Your loan amount becomes $23,000, which saves you $44.27 per month .

- A lower APR. Consider that same $25,000 car loan and lets assume a 4-year term. One financial institution offers a 3.00% APR and another offers a 2.00% APR. Taking the lower APR will save you $10.98 per month.

- A longer loan term. Extending a $25,000 loan from 4 years to 5 years lowers your monthly payment by $104.14, but, youll end up paying $391.85 more in interest charges over the life of the loan.

Use the Bank of America auto loan calculator to adjust the numbers and see how differences in loan amount, APR and loan term can affect your monthly payment.

You May Like: What Credit Score Is Needed For Usaa Auto Loan