Citibank’s Lowest Home Loan Interest Rate Offers At 675%

Citibank is now offering home loan to its customers starting at 6.75% p.a. The interest rate charged by Citibank is lower than interest rates offered by some of the leading lenders and finance houses in India. The bank has also decided to waive off the processing fee on home loans till 31 December 2020.

Citibank has linked its interest rate to its 91-day treasury bill which is unlike the other lenders who have linked their interest rate to the Reserve Bank of Indias repo rate. So far, linking of interest to an external benchmark which is treasury bill for Citi has been effective for them since the RBIs repo has fallen 115 basis points.

19 November 2020

Buying A Home Home Loan Interest Rates 101

Buying a house is one of the biggest decisions in life and, albeit an exciting one, it is not to be taken lightly, especially when it concerns home loans, lending rates and repayments.

Gerrit Disbergen, Director of Engel & Völkers Financial Services, gives the lowdown of everything you need to know about interest rates:

Personal interest rate

A personal interest rate is as unique as a home and the individual who buys it. It is determined using a number of criteria and is based on the clients risk profile. Interest rate is one of the key costs to consider when comparing home loans.

Prime lending rate, prime minus and prime plus

The prime lending rate is currently 10%, and is effectively the starting point that banks use to calculate interest rates for clients. It covers the banks basic profit margin, which is then set higher or lower based on the applicants risk profile. A riskier individual would get an above-prime loan, which would be at prime plus, for example, prime plus 1% making it a lending rate of 11%. A low-risk client could get prime or lower, for example prime minus 1%, which means a lending rate of 9%.

What determines interest rates?

The repo rate changes according to economic climate. Higher interest rates make borrowing money more expensive, thus deterring people from making big investments, so there is less money circulating in the economy, which slows down inflation. To kick-start a sluggish economy, interest rates are lowered to encourage investment.

Average Mortgage Interest Rate By Credit Score

National rates aren’t the only thing that can sway your mortgage rates personal information like your credit history also can affect the price you’ll pay to borrow.;

Your is a number calculated based on your borrowing, credit use, and repayment history, and the score you receive between 300 and 850 acts like a grade point average for how you use credit. You can check your credit score online for free. The higher your score is, the less you’ll pay to borrow money. Generally, 620 is the minimum credit score needed to buy a house, with some exceptions for government-backed loans.

Data from credit scoring company FICO shows that the lower your credit score, the more you’ll pay for credit. Here’s the average interest rate by credit level for a 30-year fixed-rate mortgage of $300,000:

| FICO Score |

According to FICO, only people with credit scores above 660 will truly see interest rates around the national average.;;

Read Also: Is There Any Loan For Buying Land

How Do I Get A Mortgage

To get a mortgage, you need to start by getting your finances in order. Having a strong financial profile will a) increase your chances of being approved for a loan, and b) help you score a lower interest rate. Here are some steps you can take to beef up your finances:

- Figure out how much home you can afford.;The general rule of thumb is that your monthly home expenses should be 28% or less of your gross monthly income.

- Find out what credit score you need.;Each type of mortgage requires a different credit score, and requirements can vary by lender. You’ll probably need a score of at least 620 for a conventional mortgage. You can;increase your score;by making payments on time, paying down debt, and letting your credit age.

- Save for a down payment.;Depending on which type of mortgage you get, you may need as much as 20% for a down payment. Putting down even more could land you a better interest rate.

- Check your debt-to-income ratio.;Your DTI ratio is the amount you pay toward debts each month, divided by your gross monthly income. Many lenders want to see a DTI ratio of 36% or less, but it depends on which type of mortgage you get. To lower your ratio, pay down debt or consider ways to increase your income.

Then, it’s time to shop around and get quotes from multiple lenders before deciding which one to use.;

What Are Todays Mortgage Rates

The average 30-year fixed mortgage rate rose to 3.05 percent, up 2 basis points from a week ago.The 15-year fixed mortgage rate rose to 2.30 percent, up 1 basis point from a week ago.To compare todays customized rates from a variety of trusted lenders, use Bankrates mortgage rates comparison tool.

| 3-month trend |

|---|

| 3.380% |

You May Like: What Is The Role Of Co Applicant In Home Loan

Is It Worth Working With A Mortgage Broker

There are advantages to getting a mortgage directly from a lender as well as getting a mortgage through a broker, but there are differences. While going directly to your current bank lets you consolidate your financial products, using a broker allows you to shop around quickly and easily, at no cost to you.

Luckily, you donât need to choose one of the other. You can speak to multiple banks and multiple mortgage brokers if you want to. Ratehub.ca is a great place to start, as we compare the best mortgage rates in Canada from multiple lenders and mortgage brokers. Once youâve compared your options, we can put you in contact with your chosen provider.

Best Home Loan For Buildings Under Construction

While properties that are still under construction may have more risks than a completed property, developers often incentivize buyers with per-square-foot discounts, absorption of stamp duties, or other administrative costs. Besides the monetary savings arising from an early purchase, you may be able to benefit from a lower interest rate as wellBUC loan rates are not necessarily higher when compared with loans for completed properties.

Besides the possibility of conversion when the property receives its TOP, note that there are loan packages that are not valid for buildings under construction.

| Bank |

You May Like: How To Calculate Maximum Loan Amount Fha Streamline

Choosing The Right Loan Type

Each loan type is designed for different situations. Sometimes, only one loan type will fit your situation. If multiple options fit your situation, try out scenarios and ask lenders to provide several quotes so you can see which type offers the best deal overall.

Conventional

- VA:;For veterans, servicemembers, or surviving spouses

- USDA:;For low- to middle-income borrowers in rural areas

- Local:;For low- to middle-income borrowers, first-time homebuyers, or public service employees

Loans are subject to basic government regulation.;

Generally, your lender must document and verify your income, employment, assets, debts, and credit history to determine whether you can afford to repay the loan.

Ask lenders if the loan they are offering you meets the governments;Qualified Mortgage;standard.;

Qualified Mortgages are those that are safest for you, the borrower.

Pradhan Mantri Awas Yojana

A special Housing Loan scheme for First Time Home Buyers by the Government of India. All families having income of Rs 3 lakh to Rs 6 lakh are eligible under this scheme provided they plan to purchase or construct their first pucca house. For all details and benefits under the scheme For list of statutory towns eligible under the scheme visit the official website of National Housing Bank.

Read Also: Can I Roll Closing Costs Into Loan

How Do I Find The Best Mortgage Rate

Finding the best home mortgage rate is a matter of knowing your goals and picking the right tool to get the job done. The best mortgage for you may not always be the one with the lowest interest rate. Factors like how long you plan on living in your home will impact your decision.

If you plan on living in your new home long-term, then a fixed-rate mortgage is ideal. Mortgage rates today are very reasonable for fixed-rate 10-, 15-, or 30-year mortgages, and being able to lock in low rates is a smart choice. But you can get lower mortgage rates with some adjustable-rate loans. So if you plan on only keeping your home for three to 10 years, then you may be able to pay less interest with an ARM.

Finance Of America Mortgage

Overview

Founded in 1984, Finance of America Mortgage is headquartered in Pennsylvania and serves all 50 states. It closed over 53,000 loans in 2019, making it one of the largest lenders in the country.

What to keep in mind

Finance of America Mortgage offers a wide range of loan products, from government-backed loans to conventional mortgages for both home purchases and mortgage refinancing. It even offers renovation loans and home equity lines of credit .

However, it doesnt offer a fully online application process and rates and fees arent available on its website. So youll need to make a call or visit one of the lenders physical locations to complete your application.

Also Check: What Kind Of Car Loan Interest Rate Can I Get

Tata Housing Offers Fixed Home Loan Rates For Buyers For A Year

Tata Housing Development Company has announced ‘Wow is Now’ scheme for homebuyers under which they will pay only 3.99% interest rate for a period of 12 months and the rest would be taken;care of;by the company. The scheme is applicable to;ten;projects until November 20.

The scheme has been launched after taking into;consideration;7%;rate of interest per annum from the bank as the maximum limit.

As per;the scheme, the;borrower;will also receive a gift voucher ranging from Rs.25,000 to Rs.8 lakh depending on the property,;after;the booking. The voucher would be issued after the payment of 10%;of the amount;and the registration of property.

The campaign is extended across 10 Tata Housing projects.

22 October 2020

Average 5/1 Arm Rates

Average 5/1 ARMs tend to feature lower rates than comparable 30-year and 15-year home loans, at least during the initial 5 year promotional period.

Rates will adjust to market rates, plus a spread, following the expiration of the initial 5 year period.

Here are the current average 5/1 adjustable rates mortgage rates for each state.

Average 5/1-ARM Rates by State

| State |

|---|

Rates assume a loan amount of $200,000 and a loan-to-value ratio of 80%.

While ARMs do offer lower monthly payments in the short run, the variable interest rates on 5/1 ARMs means that your monthly payments adjust to market rates upon expiration of the temporary promotional rate period.

This means that your monthly payments may increase significantly on an annual basis, especially if interest rates are on the rise.

This makes them a risky proposition unless you’re committed to selling or refinancing the property within a few years.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Also Check: How Much Is My Student Loan Repayment

Status Quo Likely To Be Maintained By The Rbi On Home Loan Interest Rates

According to several experts, the RBI will likely maintain a status quo on the benchmark interest rate. The outcome of the next monetary policy meet will be announced on 5 February. The Finance Minister Nirmala Sitharaman unveiled the budget on 1 February 2021 in the Lok Sabha. According to the Economic Advisor of Brickwork Ratings, a pause is expected to be continued by the Monetary Policy Committee. He further added that the reduction in the inflation rate was due to the fall in food prices.

3 February 2021

Best Mortgage Rates In Canada

-

Answer a few quick questions and see the lowest rates you can qualify for.

-

Apply online

Apply for your mortgage instantly and easily using our secure online application.

-

Connect with our mortgage advisors

Questions or comments? Book a call and one of our mortgage advisors will walk you through all the details

Don’t Miss: Who Will Loan Money With Bad Credit

Historical Canada Mortgage Rates

Looking at historical mortgage rates is a good way to understand which types of mortgage attract higher rates. They also make it easier to understand whether weâre currently in a low or higher rate environment, relatively speaking.

Here are some of Canadaâs mortgage rates for different types of mortgage over the past five years.

| 2016 |

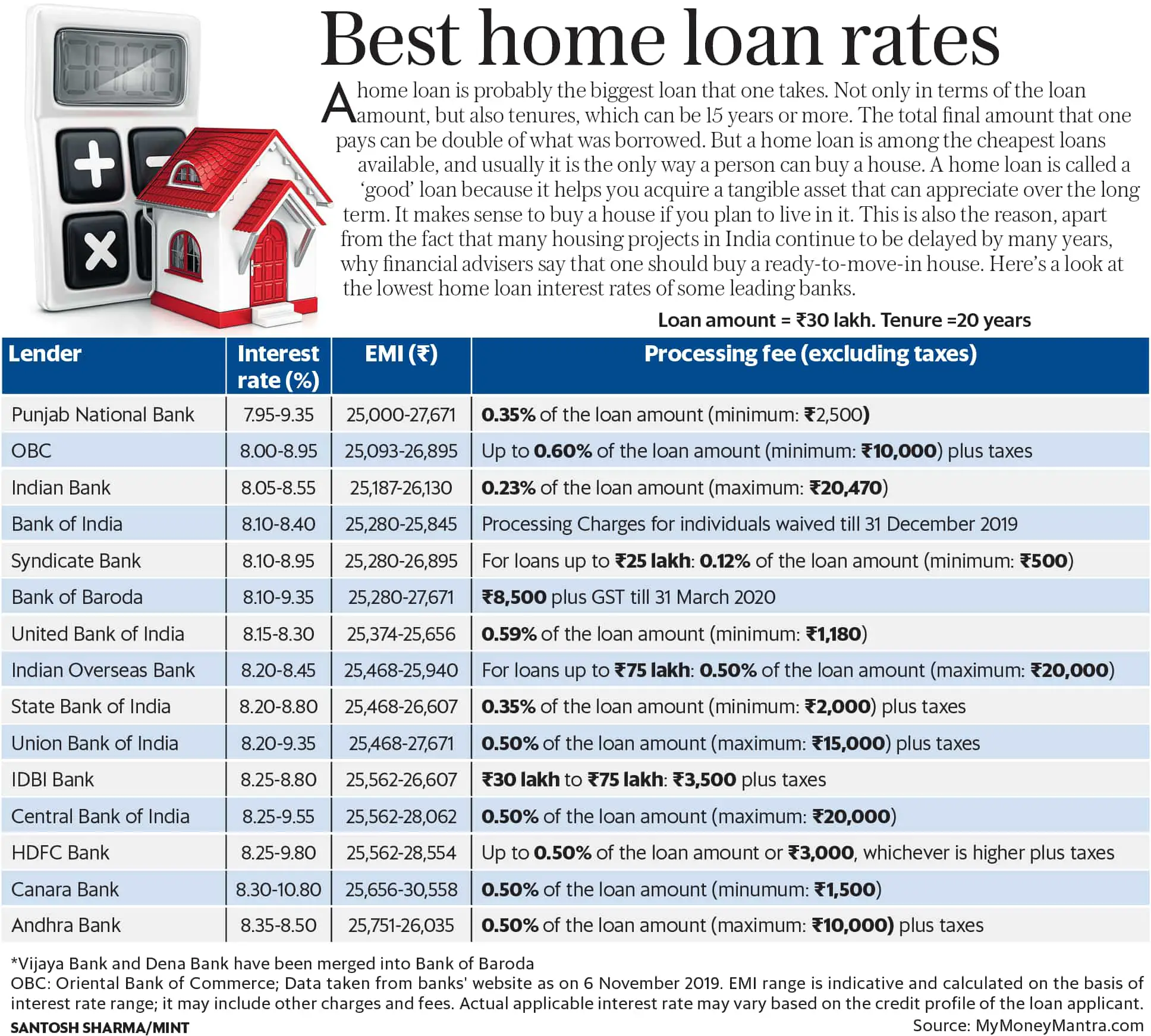

Home Loan Interest Rates Cut By Banks: Check New Rates

All the leading banks in India have been lowering their home loan interest rates under their festive offers, they are cutting the interest rates by around 40-60 bps for borrowers with credit scores more than 800, for a loan of above Rs. 75 lakh. Leading banks like SBI, Bank of Baroda, HDFC, Punjab National bank , and Kotak Mahindra Bank have announced the home loan cuts. According to Renu Sud Karnad, Managing Director, HDFC Ltd., “Record low-interest rates, subsidies under PMAY and the tax benefits have helped.”

Also Check: Can I Get An Auto Loan With No Credit

Renting Vs Buying A Home

However, over the long term, buying a home can be a good way to increase your net worth. And when you buy, you can lock in a fixed interest rate, which means your monthly payments are less likely to increase compared to renting. Owning a home also has the added benefit of providing a stronger sense of stability for you and your family. And when you own, you have the freedom to customize your living space however you like.

Additional Deductions Up To Rs15 Lakh Can Be Claimed On Home Loan Interest

On 1 February 2021, the government extended the last date to claim deductions of the home loan interest until 31 March 2021. Currently, deductions of up to Rs.1.5 lakh can be claimed until 31 March 2020. The Rs.1.5 lakh is above the Rs.2 lakh deduction that can be claimed. The deductions can be claimed by individuals who are buying a house for the first time. However, the cost of the house cannot be more than Rs.45 lakh. According to the Finance Minister, the government sees affordable housing as a priority.

3 February 2021

Read Also: How To Get Personal Loan With Low Interest

How Does A Mortgage Work

A mortgage is a type of secured loan where the property often your home is the collateral. So youll never be able to take out a mortgage without having some sort of real estate attached to it. Mortgage loans are issued by banks, credit unions, and other different types of lenders.

Aside from paying the loan back, you pay for a mortgage in two ways: fees and interest. Interest is paid on your loan balance throughout the life of the loan, and is built into your monthly payment. Mortgage fees are usually paid upfront, and are part of the loans closing costs. Some fees may be charged annually or monthly, like private mortgage insurance.

Mortgages are repaid over what is known as the loan term. The most common loan term is 30 years. You can also get a mortgage with a shorter term, like 15 years. Short-term loans have higher monthly payments, but lower interest rates. Mortgages with longer terms have lower monthly payments, but youll typically pay a higher interest rate.

What Are The Factors Affecting Home Loan Interest Rates

;The following factors can impact your home loan rates:

CIBIL score

Your CIBIL score represents your creditworthiness and repayment capability, and it significantly affects the interest rate you have to pay. The higher your CIBIL score, ideally over 750, the more competitive housing loan rates you can get.

Job profile

A steady source of income, secure job and employment with a reliable employer assure the lender of your repayment capacity and ultimately affect your housing loan interest rates.

Income

Besides your job profile, lenders consider your monthly income to evaluate your financial fitness. The greater your income is, the better your home loan eligibility. Thats why if you have any additional income sources like rental income, part-time business, etc., highlight them. You can also apply with a co-applicant, and by pooling your incomes together, you can easily qualify for a low interest home loan.

Debt-to-income ratio

To review your ability to pay off additional debt, lenders check your debt-to-income ratio. If your monthly debt payments are significantly draining your monthly income, you will become a high-risk borrower. In that case, the lender may charge you a higher interest on house loan.

You May Like: What Are The Qualifications For First Time Home Buyers Loan

Which Loan Is Right For You

When choosing a mortgage, you need to consider a wide range of personal factors and balance them with the economic realities of an ever-changing marketplace. Individuals;personal finances;often experience periods of advance and decline, interest rates rise and fall, and the strength of the;economy;waxes and wanes. To put your loan selection into the context of these factors, consider the following questions:

- How large a mortgage payment can you afford today?

- Could you still afford an ARM if interest rates rise?

- How long do you intend to live on the;property?

- In what direction are interest rates heading, and do you anticipate that trend to continue?

If you are considering an ARM, you should run the numbers to determine the worst-case scenario. If you can still afford it if the mortgage resets to the maximum cap in the future, an ARM will save you money every month. Ideally, you should use the savings compared to a fixed-rate mortgage to make extra principal payments each month, so that the total loan is smaller when the reset occurs, further lowering costs.

If interest rates are high and expected to fall, an ARM will ensure that you get to take advantage of the drop, as youre not locked into a particular rate. If interest rates are climbing or a steady, predictable payment is important to you, a fixed-rate mortgage may be the way to go.