Best For Fair Credit: Carvana

Carvana

For fair credit borrowers in the market for a used vehicle, Carvana provides the ability to shop online for financing and a vehicle at the same time. It has no minimum credit score requirement, providing a financing solution for those with damaged credit.

-

Entirely online dealer and lender

-

No negotiation

-

Excellent credit borrowers get the lowest rates

-

Minimum income requirement of $4,000 annually

-

Only for used vehicles

As with most lenders, borrowers with the best credit get Carvana’s most competitive rates. Carvana does not advertise its rates or publish a table, but you can estimate your monthly payment with an online calculator. That said, even the calculator does not reveal the rate it is using. You must prequalify to know what your interest rate will be.

Carvana is a completely online used car dealer that also provides direct financing. It makes it possible to secure financing, shop for a vehicle, and get a used vehicle delivered without leaving your house. There is no credit score minimum for its financing program, making this an attractive option for fair credit borrowers. However, you must have an income of at least $4,000 annually and no active bankruptcies.

Production Starts For The Skoda Octavia Ahead Of Its Launch In The Country

Production has begun for the Skoda Octavia ahead of its launch in India. The car will launch later in April and deliveries will begin from the end of May. The car was earlier spotted testing in the country. Some of the main features of the vehicle are leather upholstery, three-zone climate control, and an electric sunroof. The car is powered by a 2.0-litre petrol engine that is BS6 compliant. The vehicle is expected to be priced between Rs.18 lakh and Rs.24 lakh. The new Octavia will compete against the Hyundai Elantra.

7 April 2021

Best For Bad Credit: Oportun

Oportun

- Capped at 35.99%

- Minimum loan amount: $300

Opportun is our choice as the best for bad credit since it offers personal loans with limited credit score requirements and an easy online application, and funds available within 24 hours.

-

Wide range of credit situations accepted

-

Easy online application with instant approval

-

Pre-qualify with a soft credit check

-

Only available in 35 states

-

High interest rates

Having less-than-perfect credit shouldnt keep you from getting the car you need. While you shouldnt expect the low rates those with great credit receive, you can avoid overpaying with Oportun. Through this online lender, you can get a loan for a car that you purchase from an auto dealer or a private party. Since buying through a private party can be cheaper, this can save you big bucks over dealerships.

Oportun will lend to people with limited or no credit history. You should have proof of income to apply. Loan amounts can range from $300 to $10,000, so you can get the car you want. Best of all, Oportun does not require a hard credit check when prequalifying and checking rates. So, looking around wont hurt the score youre trying to fix. The application takes only a few minutes, is completely online, and results in an instant decision. If you live in one of the states where Oportun is available, this is an excellent choice.

Recommended Reading: Does Collateral Have To Equal Loan Amount

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You’ll need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you’ll use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

What Is The Difference Between An Auto Loan And A Personal Loan

It’s possible to use a personal loan or an auto loan to finance a vehicle, but the two differ in some important ways:

- Purpose: Personal loans are unsecured or secured and can be used for many different purposes, including to finance a vehicle, pay for a vacation, or make improvements to a home. Car loans, however, are strictly to finance a vehicle and are secured against the vehicle you purchase. The vehicle serves as collateral.

- Interest rates: Because auto loans are secured, rates on car loans are generally lower than personal loans.

- Availability: Auto loans are typically easier to obtain than personal loans, especially for those with a poor credit history.

Read Also: Loan License California

Foreclosing A Car Loan

When you take a car loan, you can repay it in equated monthly instalments till the end of the repayment tenure. However, if you decide to pay off the outstanding loan amount before your tenure ends, you will be foreclosing or prepaying your loan. The foreclosure/prepayment facility is offered by most lenders for a penalty fee though some lenders may allow you to foreclose/prepay your car loan without charging you any penalty.

You can foreclose your car loan if your income has increased and you wish to clear off your liability. It also takes away your burden of having to make monthly EMI payments. Foreclosing a car loan will release the hypothecation on the car and give you full ownership.

As stated above, some lenders may charge you a penalty on loan foreclosure. Hence, before you decide to foreclose a loan, it is a good idea to go through the clauses associated with it carefully.

The Kia Sonet Gtx+ Automatics Launched In India At A Price Point Of Rs1289 Lakh

The Kia Sonet was launched recently in India. However, the price tags of the top-variant models of the car were not revealed at the time of the launch. The automakers have recently revealed the prices of the petrol and diesel variants of the top-spec model.

The Kia Sonet GTX+ will be available in both petrol and diesel variants and will come with automatic transmission setups. Both the cars have been priced at Rs.12.89 lakh . As per the latest revelations of the prices, the petrol range of the car now starts at Rs.6.71 lakh and goes up to Rs.12.89 lakh and the diesel variant starts at Rs.8.05 lakh and goes up to Rs.12.89 lakh. There is a total of 17 different trims of the car on the basis of the engine, trim, and so on. The two petrol unit variants of the car churns out 83 hp and 120 hp respectively. The diesel unit is a 1.5-litre setup which churns out 100 to 115 hp of max power and 240 Nm to 250 Nm of peak torque.

30 September 2020

Read Also: What Credit Bureau Does Usaa Use For Auto Loans

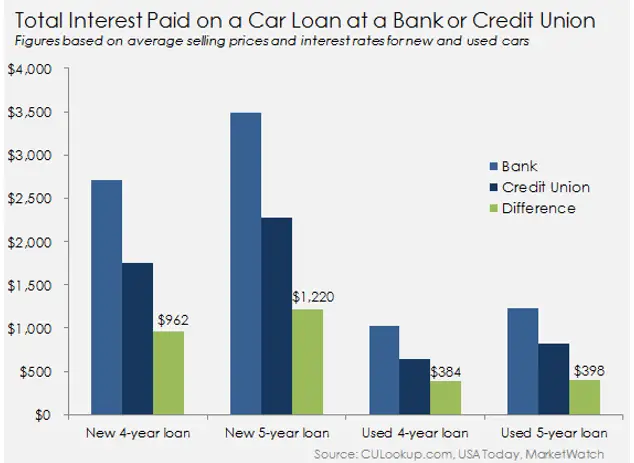

Where Can I Find Competitive Car Loan Rates In Canada

Comparing car loan rates offered by different banks, credit unions and online lenders is critical to finding the deal thats best for you.

- Banks or credit unions. Since you have an established relationship with your bank already, it might be easier to get approved for a car loan, even if you dont have the best credit. Banks and credit unions also tend to offer the most competitive rates.

- Online lenders. Some online lenders may be willing to provide car loans for fair or poor credit, even if they cant get approval from their bank though they may not get the lowest car loan rates available. Online lenders also tend to be the quickest to approve loans and disburse funds.

Heres How To Get The Lowest Interest Rate You Qualify For

If youre shopping for a new car, you may also be shopping for an auto loan to pay for it. Investopedias auto loan calculator and regularly updated ratings of the best auto loan rates can help you find a good loan with an attractive interest rate. Heres what else you need to know to get the best rate possible.

Recommended Reading: Usaa Pre Approval Car Loan

How Do You Get A Better Rate For A Car Loan

There are many ways for you to influence your chance of getting a better rate. Lets take a look at a few of them:

Improve Your Credit Score Before Applying

Improving your credit score doesnt happen overnight. Over time, you need to show that you are responsible with your debts. This includes making your credit card payments on time and keeping the balance within 30% of your limit and building a diverse but manageable combination of debt. For more information about improving your credit score, check out Loans Canadas article on Improving Your Credit Score.

Increase Down Payment

No-money-down car loans may seem like a great deal, especially if you have trouble saving however, this route can almost certainly guarantee you a higher interest rate. Consider waiting a little longer before purchasing your car so that you have a sizeable down payment. Experts recommend at least 20%.

Get A Co-signer

Compare, Research, and Consider Pre-Approval

If you want to be prepared and well informed about the different deals and interest rates available to you, you might want to consider pre-approval for a loan. Dont worry a pre-approval wont damage your credit score. On the contrary, they can actually be quite helpful in helping you assess what youre eligible for. Furthermore, being able to compare rates with loans you are pre-approved for gives you more knowledge and in turn more power in negotiating a rate with a dealership.

Negotiate

Best For Used Cars: Lightstream

LightStream

- 2.49% to 9.49%

- Minimum loan amount: $5,000

LightStream offers several auto loans, including unsecured loans for borrowers with excellent credit that dont use the car as collateral, securing our spot as the best for used cars.

-

Offers secured and unsecured auto loans

-

No restrictions on make, model, or mileage

-

0.5% autopay discount

-

No pre-approval process

The online lending arm of SunTrust Bank, LightStream makes it easy to apply for a loan and get funding the very same day, helping buyers negotiate a better purchase price with their cash in hand. It will also beat other lenders offers by 0.10% and offers a 0.5% discount for setting up monthly auto payments.

Borrowers with excellent credit even have the option to take out unsecured loans that dont use your vehicle as collateral. If you cant make payments, your car wont be repossessed, though it can still have a serious impact on your credit. Since LightStream doesnt use a car as collateral, it has no restrictions on the age, mileage, make, or model of a vehicle.

LightStream also offers no pre-approval process, which means applying for a loan requires a hard credit check. As a result, its a better option for borrowers with high credit scores who can afford to lose a few points from the credit inquiry.

Read Also: What You Need To Qualify For A Home Loan

Used Car Loan Features And Benefits

- Flexible repayment terms are offered by certain lenders.

- The documentation process is simple and minimum paperwork needs to be submitted.

- Depreciation rates and insurance costs are lower for a used car when compared to a new car.

- The loan amount will be less when compared to a new car loan. Therefore, the monthly payments will reduce.

- Up to 90% of the cars value may be provided as a loan.

- It is easy to apply for the loan and most lenders allow you to complete the process online.

- Most banks offer a long repayment tenure.

Simple Rules For Saving Money

1. Get preapproved for a loan before you set foot in a dealer’s lot.

“The single best advice I can give to people is to get preapproved for a car loan from your bank, a credit union or an online lender,” says Philip Reed. He’s an automotive expert who writes a column for the personal finance site NerdWallet. He also worked undercover at an auto dealership to learn the secrets of the business when he worked for the car-buying site Edmunds.com. So Reed is going to pull back the curtain on the car-buying game.

For one thing, he says, getting a loan from a lender outside the car dealership prompts buyers to think about a crucial question: “How much car can I afford? You want to do that before a salesperson has you falling in love with the limited model with the sunroof and leather seats.”

Reed says getting preapproved also reveals any problems with your credit. So before you start car shopping, you might want to build up your credit score or get erroneous information off your credit report.

And shop around for the best interest rate. “People are being charged more for interest rates than they should be based upon their creditworthiness,” says John Van Alst, a lawyer with the National Consumer Law Center.

If you take that bad deal, you could pay thousands of dollars more in interest. Van Alst says the dealership and its finance company, “they’ll split that extra money.”

Read Also: Average Motorcycle Apr

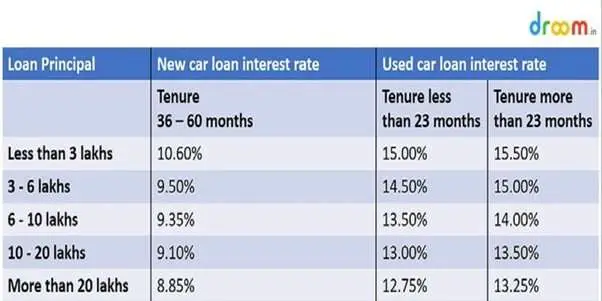

Are Interest Rates Higher On Used Cars

Yes and no. Yes, on average interest rates are higher for used cars No, interest rates on used cars are not always higher than new car interest rates. There are several reasons that the loan rates for used cars can be higher than loan rates on new cars. The first reason is due to the resale value. On a new vehicle, resale value is easier to predict, so the bank knows what they will receive in return on interest or on repossession.

Furthermore, lenders want you to buy a new car, so they lower the interest rate as an incentive to buy new. The third reason is due to credit scores. Most of the time, people with good credit tend to purchase new cars, while people with lower credit scores opt to buy used instead. New car interest rates are not always lower than used car interest rates. In some cases where credit score plays a heavy role in your interest rate, you could see a higher interest rate on a new car versus a used car if you didn’t qualify for certain incentives or new car financing bonuses that would normally lower your interest rate because your credit score wasn’t high enough.

Factors Affecting Used Car Loan Interest Rate

Some of the factors affecting used car loan interest rates are listed as follows:

- Age : One of the crucial factors that determine the rate of interest on a used car loan is the age of the vehicle, as it becomes risky for the bank if you default on your loan. That is why, the banks also charge a high rate of interest on used car loans.

- : Your credit history and the ability to repay the car loans on time also affects the used car loan interest rate. If you have a credit score of above 700, banks easily approve your loan at an economical rate of interest.

- Down Payment : The amount of down payment you make on your car loan also impacts the car loan rates. The higher the down payment, the lower will be the rate of interest.

- Income Level : Lenders assess your commitments, your debt, and income ratio to ensure you can repay your loan without any default. The lower the debt-income ratio, the better it is.

FAQs

Is a guarantor required for a used car loan?

Bringing in a guarantor is not required in most of the cases. However, in case the applicant’s income is not meeting the minimum eligible criterion or if the cibil score is lower than expected, the bank may ask for the guarantor.

What is the maximum tenure for the used car loan repayment?

The maximum tenure for the used car loan is upto 7 years. But it is always advisable to apply for shorter tenure as longer tenure will mean higher interest.

Is there any need for collateral security for a used car loan?

Also Check: Usaa Car Loan Refinance

Can I Get 0% Financing On A Car Loan

You may see dealerships advertising 0% financing on their cars. With 0% financing, you buy the car at the agreed-on price, and then make payments on the principal of the car with no interest for a number of months. However, keep these points in mind:

- 0% interest may only be offered for part of the loan term.

- To be approved, youll need spectacular credit .

- Negotiating the car price will be difficult.

- 0% interest car financing is only available to certain models.

- You may not get as much money for your trade-in vehicle.

- The loan structure will likely be set in stone.

Boost Your Credit Card Iq

5. Don’t buy any add-ons at the dealership.

If you’ve bought a car, you know how this works. You’ve been at the dealership for hours, you’re tired, you’ve settled on a price, you’ve haggled over the trade-in then you get handed off to the finance manager.

“You’re led to this back office. They’ll often refer to it as the box,” says Van Alst. This is where the dealership will try to sell you extended warranties, tire protection plans, paint protection plans, something called gap insurance. Dealerships make a lot of money on this stuff. And Van Alst says it’s often very overpriced and most people have no idea how to figure out a fair price.

“Is this add-on, you know, being marked up 300%? You don’t really know any of that,” Van Alst says. He and Reed say a good strategy, especially with a new car, is to just say no to everything. He says especially with longer-term loans, there’s more wiggle room for dealers to try to sell you the extras. The finance person might try to tell you, “It’s only a little more money per month.” But that money adds up.

“Concerning the extended factory warranty, you can always buy it later,” says Reed. “So if you’re buying a new car, you can buy it in three years from now, just before it goes out of warranty.” At that point, if you want the extended warranty, he says, you should call several dealerships and ask for the best price each can offer.

You May Like: What Credit Score Do You Need For Usaa Credit Card