Conventional Loans Vs Fha Loans

Conventional loans have stricter credit requirements than FHA loans. FHA loans, which are backed by the Federal Housing Administration, offer the ability to get approved with a credit score as low as 580 and a minimum down payment of 3.5%. While conventional loans offer a slightly smaller down payment , you must have a credit score of at least 620 to qualify.

When youre deciding between a conventional loan and an FHA loan, its important to consider the cost of mortgage insurance. If you put less than 10% down on an FHA loan, youll have to pay a mortgage insurance premium for the life of your loan regardless of how much equity you have. On the other hand, you wont have to pay private mortgage insurance on a conventional loan once you reach 20% equity.

What Conforming Loan Programs Can You Use

Conforming loans are conventional loans or those backed by Fannie Mae or Freddie Mac. They must meet the above loan limit guidelines and the qualifying guidelines for the loan program.

The basic conforming loan programs include:

- Fixed-rate loans 10, 25, 20, 25, and 30-year fixed-rate loans

- ARM loans 5/1, 7/1, or 10/1 ARM loans

Like we said above, you need good qualifying factors to qualify for conforming loans. This means you have good credit, money to put down, and a decent debt-to-income ratio. The requirements seem strict but they are flexible and great for first-time homebuyers and subsequent homebuyers.

Borrowers can choose which loan term they feel most comfortable with and can afford. Keep in mind, ARM loans are more affordable initially, but then the rate adjusts annually. For example, if you borrow a 5/1 ARM loan you have a fixed rate for 5 years and then it adjusts annually, based on the chosen index and margin.

Will The California 2022 Conventional Loan Limits Increase

Just as the nations conventional loan limits will increase, so will California 2022 conventional loan limits. The average conventional loan limit in California for 2022 will be $625,000 just like it is in other areas of the country.

This is the standard limit, that if you exceed, youd need jumbo financing to buy a home. However, in certain areas of California, there are higher costs, and the areas have higher limits as a result.

Some of the high-cost areas of California include:

- Alameda $822,375

- Ventura $739,450

- Yolo $598,000

Unless you buy a home a high-cost area, conforming loan limits of $625,000 prevail. If you need to borrow any more than this amount, youll need a non-conforming or Jumbo loan that may have higher interest rates and/or tougher qualifying requirements. Fortunately, many counties within California have higher limits because of the high cost of living there.

Before you jump into a jumbo loan and jump through the hoops involved, let us help you determine if a conventional loan will be a better option.

How Do California 2022 Conforming Loan Limits Work?

Conventional loan limits pertain to conforming loans, aka Freddie Mac and Fannie Mae loans. All loans that fall within their guidelines conform to the Fannie Mae or Freddie Mac rules. These loans have the benefit of backing by Fannie Mae or Freddie Mac which means if a borrower defaults, the lender wont lose all the money invested in the loan.

Fannie Mae or Freddie Mac loan

Read Also: How To Get Loan Originator License

Jumbo Loan Vs Conventional Loan Rates

Do jumbo loans have higher rates?You might think a higher loan amount means a higher interest rate…But not so fast.Just like conventional loan rates, jumbo loan rates are based on your qualifying factors.Borrowers can qualify for attractive jumbo loan rates that are comparable to conventional rates. The key to a great interest rate is to have a large down payment, low DTI ratio and great credit.

When You Should Consider A Conventional Loan

If youre buying an average home and dont need to borrow more than $548,250, consider a conventional loan. It can also be a good option if you dont have a strong credit rating.Because even if you put down less than 20% and pay private mortgage insurance , you can still come out ahead. Heres why:You dont want to over-extend your finances.If you have too much of your income going to your house payment, you might sacrifice saving for retirement, vacations or other financial goals.

Read Also: Used Car Loan Calculator Usaa

Californias 2021 Conventional Conforming County Loan Limit

For 2021, the FHFA set the baseline conforming loan limit for 1 unit properties at $548,250 for Conventional financing and up to $822,375 on high cost counties California.

What is a Conforming loan? A conforming home loan must meet, or conform to certain criteria or guidelines set forth by Government Sponsored Entities Freddie Mac and Fannie Mae. The loan amount is just one of those criteria needed to be classified as a conforming loan.

What is a High Balance or high-cost county loan limit? Loan limits are derived by median home prices in a particular county and have a ceiling of 150% of the baseline mortgage limit. Loan amounts between $548,250 and $822,375 are referred to agency High Balance or Super Conforming loans because they exceed the baseline limit.

What Is Amortgage Loan Limit

A loanlimit is the maximum amount you can borrowunder certain mortgage programs.

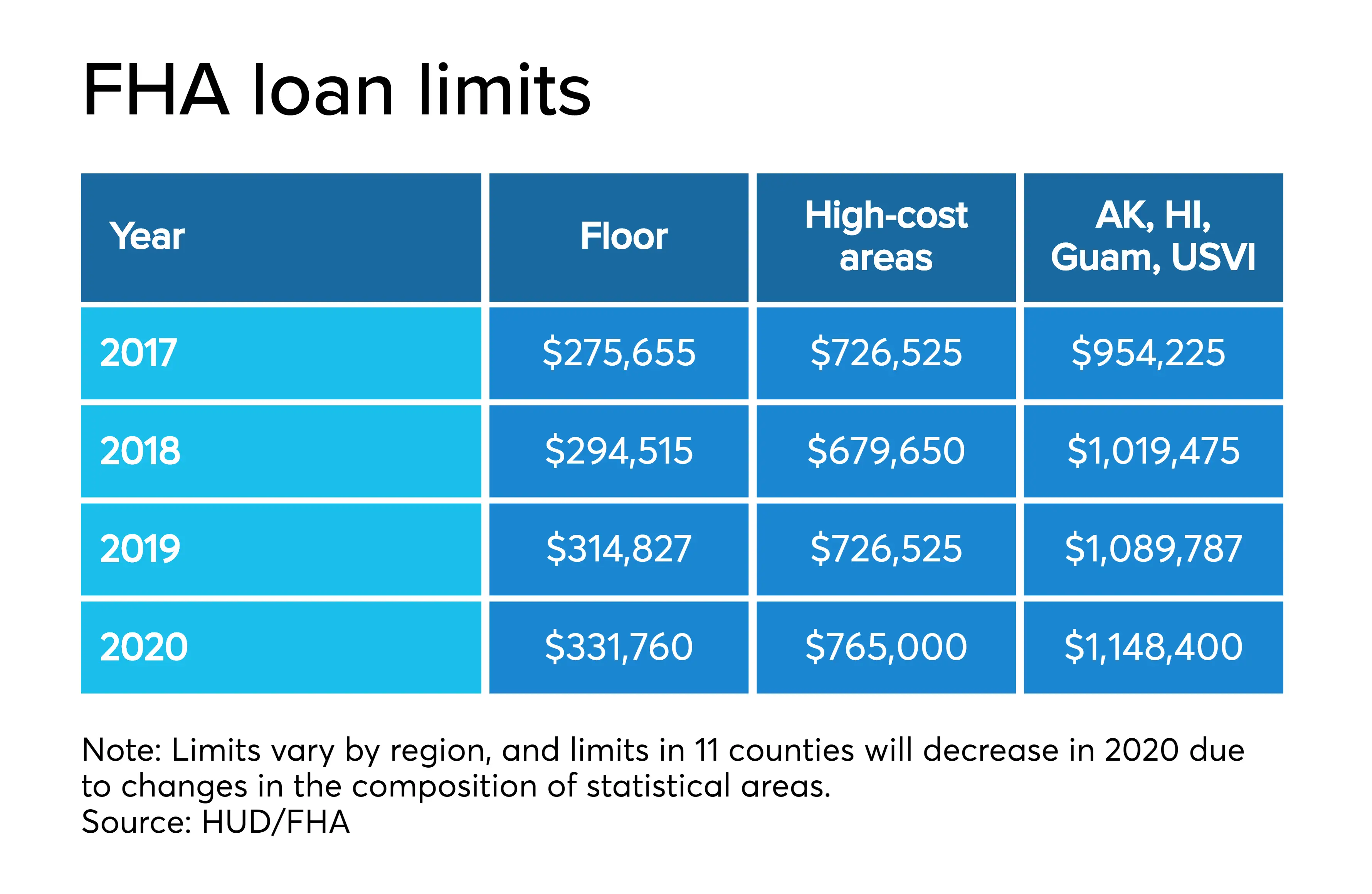

Thereis not just one loan limit, but many. Conventional mortgages adhere to one setof loan limits, and FHA another.VA loans did away with limits altogether in 2020.

In the world of conforming loans, Fannie Mae and FreddieMac limit borrowable amounts to keep their nationwide programs available tothose who need them.

For instance, Fannie Mae doesnt want a $10 million loangoing through its system. Thats a lot of risk wrapped up in onetransaction, and the agency would rather issue many smaller loans to more homebuyers.

Fortunately,loan limits are on the rise in 2021 to reflect risinghome prices across the country.

You May Like: Does Va Loan Work For Manufactured Homes

Rising Prices Bring Higher Limits In :

At the end of 2020, federal housing officials increased the conforming loan limits for California and in a November 24th, 2020 press release, the Federal Housing Finance Agency stated:

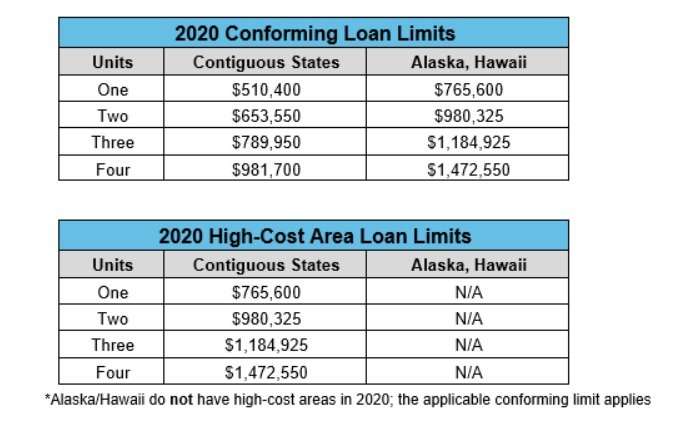

Washington, D.C. The Federal Housing Finance Agency today announced the maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2021. In most of the U.S., the 2021 maximum conforming loan limit for one-unit properties will be $548,250, an increase from $510,400 in 2020

Baseline Limit

The Housing and Economic Recovery Act requires that the baseline CLL be adjusted each year for Fannie Mae and Freddie Mac to reflect the change in the average U.S. home price. Earlier today, FHFA published its third-quarter 2020 FHFA House Price Index report, which includes estimates for the increase in the average U.S. home value over the last four quarters. According to the seasonally adjusted, expanded-data FHFA HPI, house prices increased 7.42 percent, on average, between the third quarters of 2019 and 2020. Therefore, the baseline maximum CLL it in 2021 will increase by the same percentage.

Since 2008 the FHFA has used the HERA formula to calculate Conforming loan limits.

Conforming Loan Limits For All California Counties

The table below contains the 2021 conforming limits for all 58 counties in California, listed in alphabetical order. In this table, 1 unit refers to a single-family home, 2 unit refers to a duplex-style home with two separate residents, and so on.

| COUNTY | |

| $848,500 | $1,054,500 |

For additional information and housing market commentary, continue reading below. You can also view FHA mortgage loan limits here.

Don’t Miss: Can I Roll My Closing Costs Into My Va Loan

Pros And Cons Of A Jumbo Loan Vs Conventional

All loans, conforming or non-conforming, jumbo or conventional, have pros and cons.

|

Jumbo Loans |

|

|---|---|

|

|

|

Cons:

|

Cons:

|

Did You Know?

Mortgage rates have hit all-time lows in recent months. Some people have been able to take advantage of the opportunity and secure a historically low rate. Since rates change all the time, give us a call at 901-651-9935 for an up-to-date rate quote.

When Is A Loan Considered Jumbo In Your Area

A jumbo loan is a type of mortgage that is too high to be guaranteed by Fannie Mae or Freddie Mac, which are government-sponsored enterprises that set mortgage underwriting standards and purchase qualified loans from lenders. Loans that can be purchased by Fannie Mae or Freddie Mac also called conforming loans are considered safer investments for lenders than jumbo loans, and it can be easier for borrowers to meet their requirements.

With home prices rising in most areas of the United States, the FHFA has increased conforming loan limits for 2021. How large a loan you can get before its considered jumbo depends on where you live, as certain more expensive areas like Hawaii or San Francisco have higher limits. If youre concerned about meeting the more stringent lender criteria required for approval for a jumbo loan, these new limits could allow you to finance a high-priced home with a conventional loan instead.

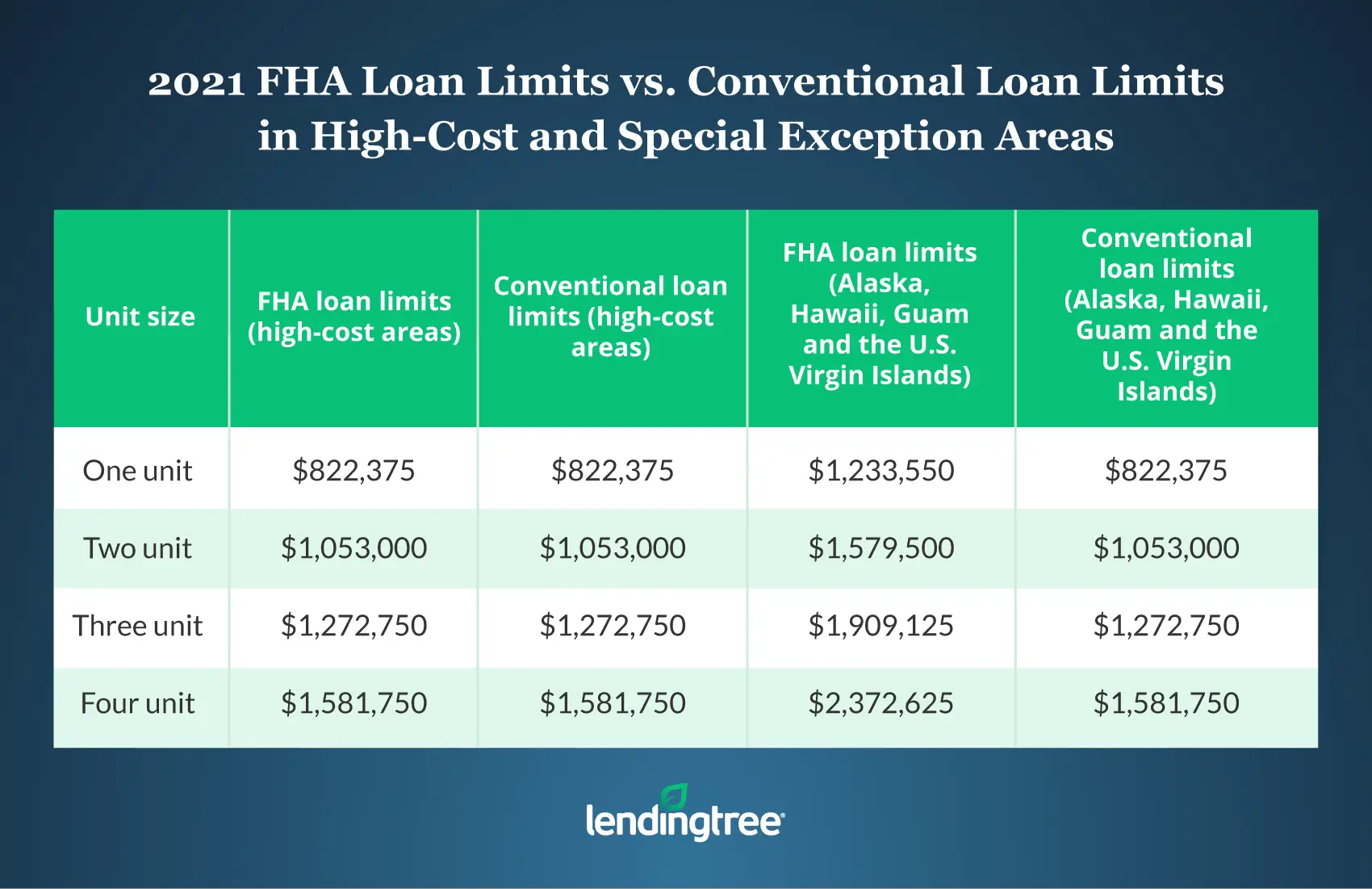

For 2021, the maximum limits for conforming loans are:

-

$548,250 for a single-family home in most areas of the country.

-

Up to $822,375 for high-cost areas where single-family home prices tend to be above average. When setting conforming loan limits, the FHFA has defined high-cost areas as places where 115% of the local median home value is more than $548,250.

You can find the exact conforming loan limits for your area using the tool below.

» MORE: Find and compare the best jumbo mortgage rates

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

When You Should Consider A Jumbo Loan

Choosing the right loan is just as important as choosing the right house. Youll carry your mortgage with you for the next 15 to 30 years!So, is a jumbo loan better than a conventional loan?Not necessarily.Unless you need a higher loan amount, a conventional can be a good fit. For example, if youre buying a luxury home or a home in a high-cost area, your loan needs may exceed the conforming loan limit for a conventional loan. In that case, a jumbo loan may be your only option.

You Shouldn’t Have To Choose

Too many borrowers think they must choose between the convenience of an online lender and the hands-on service you might get from the “small guys.”

But We Believe You Can Have It All!

Many Lenders Have Announced Increases In Their 2022 Conforming Loan Limits For California

Increased home prices and higher demand for more homes fueled a major surge in not only home values but also conforming loan limits. Government regulators realized the changes that were necessary to make homeownership possible for more borrowers. As a result, California 2022 conforming loan limits are increasing as much as $75,000, bringing the maximum loan limit to $625,000.

| 1 Unit | |

| 2021 Baseline National Conforming Loan Limit | $548,250 |

| $1,202,000 |

With the recent run-up in-home price appreciation affecting many markets throughout the country, we wanted to step in and provide support for borrowers, said Kimberly Nichols, Senior Managing Director of Broker Direct Lending at PennyMac. This will specifically help those trying to purchase a home or access equity in their property while rates are relatively low.

The industry is also predicting an increase for high-cost areas such as LA County and Orange County in California to be raised from $822,375 to $937,500 in 2022.

Even though the increase isnt official yet, several lenders have jumped the gun and are already writing loans exceeding the 2021 conforming loan limit of $548,250.

Higher conventional loan limits are on the horizon, and we may even be able to find you a lender that is already using the 2022 conforming loan limits.

We will continue to update this page as more information comes out on the 2022 California conforming loan limits.

Read Also: Apply For Avant Loan

Simplicity Mortgage Is A Mortgage Brokerage Located In Port Orange Florida

Simplicity works with borrowers looking for for real estate financing in all areas of Florida. Our service area includes Volusia and Flagler counties, Palm Coast, Ormond Beach, Ormond by the Sea, Deland, Daytona Beach, Daytona Beach Shores, Port Orange, Ponce Inlet, New Smyrna Beach, Orlando, Jacksonville, and all surrounding areas of Florida.

What Do These Changes Mean For Prospective Homebuyers

If youre planning on purchasing a home priced below half a million dollars, conforming loan limits have no impact on your life. However, if you have your eye on a property above the previous limit, you will now be able to purchase the home with a conventional mortgage, as opposed to a jumbo mortgage.

This is great news for anyone who wants to purchase a highly-priced home but doesnt want to jump through the extra hoops required to secure a jumbo mortgage. A conventional mortgage will almost certainly come with a lower interest rate and require smaller down payments than a jumbo mortgage because conventional mortgages are considered less risky investments by lenders. With these new limits in place, it could be easier than ever to secure the home of your dreams.

You May Like: What To Do If Lender Rejects Your Loan Application

Can I Borrow More Than The Limit For My County

Yes, but only if you have the income to support it. When a person borrows an amount that exceeds the conforming limit for the county where the home is located, its known as a jumbo loan. Mortgage lenders often have stricter criteria for such borrowers, since there is more money being loaned out and therefore a higher risk.

Borrowers seeking a jumbo loan typically need to have better credit and larger down payments, compared to those who are applying for a smaller conforming mortgage.

Who Sets The Loan Limits

The limits are set each year by the Federal Housing Finance Agency, which regulates Fannie Mae and Freddie Mac.

Limits are meant to reflect average home prices in the U.S., and are based on the agencys annual home price index. With the housing market increasingly competitive in the year of Covid-19, its not surprising that conforming loan limits are rising alongside sale prices.

There was a sizable increase this year in the max loan amount allowed for a mortgage to be a conventional loan before it needs to be a jumbo loan. This is great news for homebuyers because it offers increased flexibility when they look to purchase their next home, said Bill Banfield, executive vice president of capital markets for Rocket Mortgage, in an email.

The increase in the loan limits, however, may not be keeping up with some especially competitive markets in the country. Angela Moorman, a residential loan originator at First Home Bank, said shes seeing more jumbo loans due to rapidly increasing home prices in the Indianapolis area.

Its pushing the low, affordable housing market out of whack, Moorman said.

Read Also: How Can I Refinance My Car Loan With Bad Credit

Conforming Loan Limits Increase To $548250 For Most Areas

Conforming loan limits are on the rise.

Home buyers in most of the U.S. can now get a conforming loan up to $548,250 with just 3% down.

And the single-family loan limit is over $822,000 in high-cost areas.

Multifamily home buyers get a nice increase inbuying power, too, with limits for 2-4-unit properties topping $1 million insome areas.

On top of this, were seeing ultra-low interest rates carry over from 2020 into 2021.

Put all it together, and you get incrediblepurchase and refinance opportunities for home buyers and homeowners alike.

Fannie Mae And Freddie Mac

Conventional loans follow Fannie Mae or Freddie Mac underwriting guidelines. Conventional minimum loan limits are set nationwide.

Conventional loan limits can be higher than the conforming loan limit in high cost Counties. High cost Counties get to enjoy all of the benefits of traditional conforming underwriting guidelines.

Conventional loans allow as little as a 3% to 5% down payment when buying your primary residence.

You can find FHA and VA Loan limits here.

Recommended Reading: Sofi Vs Drb

Jumbo Loan Vs Conventional: Which Is Better In 2021

- Jumbo Loan vs Conventional: Which is Better In 2021?

Before you look at houses, you need to know how much you can afford. It doesnt make much sense to shop for a home if you dont know how much money a bank will let you borrow.But heres the thing:No mortgage is one-size-fits-all. Each has different requirements and parameters, and you may be considering jumbo loans vs conventional loans.Knowing the difference and which is best for you can make your home buying journey that much better.

How Are They Determined

The methodology for creating these limits is outlined within the Housing and Economic Recovery Act of 2008, or HERA. This act requires the Federal Housing Finance Agency to establish and maintain an index for tracking average home prices in counties across the country. In short, HERA ties loan limits to median home values.

In most cases, the conforming loan limit for a particular county is set at 115% of the median home value for the area. It cannot, however, be more than 50% above the baseline mentioned at the top of this page.

Also Check: Defaulting On Sba Disaster Loan