What Is A Maintenance Loan

Maintenance Loans are a type of Student Loan provided by the government, and they’re intended to help towards your living costs while you’re at university. Rent, bills, food, nights out all these things and more are what the Maintenance Loan is there to help you pay for.

Although you apply for the Maintenance Loan through the same process as you would a Tuition Fee Loan, and eventually make repayments on the two as a joint sum, the Maintenance Loan and the Tuition Fee Loan are technically two separate types of funding.

While we’re dead against students having to take on any debt to attend university, the current repayment terms on Student Loans are actually fairly manageable. As such, in most cases, we’d argue it’s best to take out both a Tuition Fee Loan and a Maintenance Loan, rather than one or the other .

Direct Subsidized/unsubsidized Loan Proration

Federal regulations require schools to prorate the Direct Loan amounts for graduating undergraduate students when their final period of enrollment is less than a full academic year . The loan limit proration determines the maximum loan amount that a student may borrow for the final term of study based on the degree they are earning.

Graduating undergraduate students who are only attending one semester of the academic year will have their Direct Loans prorated based on the number of credit hours they are enrolled.

Note: Graduate and professional students are excluded from the loan proration requirement

Bachelor’s Degree

What If You Dont Qualify For Federal Aid

Some students will hit the max of federal aid but still need more. In that case, they have a couple of options. Students can try to pay off some of the loans and then borrow more, up to the limit, again. If they dont want to or are unable to pay off some of their federal loans to take out more federal loans, they can opt for a private loan.

If students dont qualify for any federal aid, they might want to check the eligibility requirements and make sure there isnt a criterion theyre able to change. For example, if there was an academic requirement and their grades have slipped, they may be able to appeal that decision. This would require talking to the financial aid office at their school to see what they can do to become eligible again.

If all of a students eligibility information is correct and they still dont qualify for federal aid, they can look into grants and scholarships. When students submit their FAFSA®, their eligibility for certain grants will be considered. The school may also have information on local or institutional-based grant programs.

Grad students also have the option of doing a graduate assistantship, where they teach or work on research under the supervision of a professor. Assistantships sometimes pay a stipend or provide benefits like housing. Students can check with their schools to see if that option is available to them.

Don’t Miss: How To Get Loan Originator License

Direct Subsidized Loans Vs Direct Unsubsidized Loans

Only students who have financial need may receive Direct Subsidized Loans. The federal government does not charge interest on Direct Subsidized Loans while the borrower is enrolled on at least a half-time basis, during the grace and deferment periods, and during certain other periods .

If a student has received a determination of need for a Direct Subsidized Loan in an amount of $200 or less, the school may choose not to originate a Direct Subsidized Loan and may instead include that amount as part of a Direct Unsubsidized Loan.

Financial need is not an eligibility requirement to receive a Direct Unsubsidized Loan. The federal government generally charges interest on Direct Unsubsidized Loans during all periods, with limited exceptions .

Canada Student Grant For Full

This grant is available to full-time students in financial need. You are automatically assessed when you apply for student aid with your province or territory.

If you are in school part-time, see grant for part-time students.

Note: This grant is not available to students from the Northwest Territories, Nunavut and Quebec. They have their own student aid programs.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

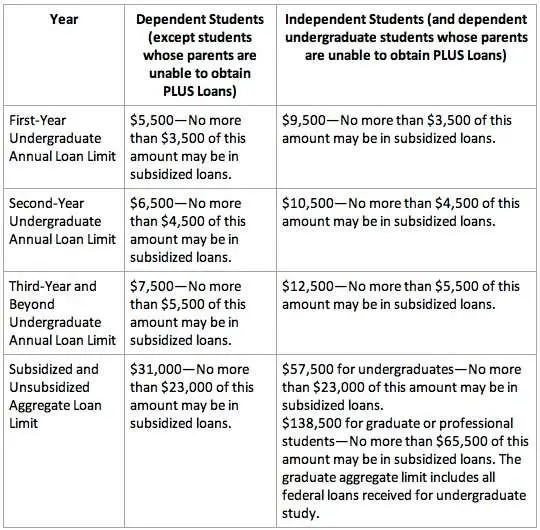

Undergraduate Federal Student Loan Limits

| Year | |

|---|---|

|

$7,500 |

$12,500 |

Total subsidized and unsubsidized loan limits over the course of your entire education include:

- Dependent: $31,000

- Independent: $57,500

Both dependent and independent students can borrow $23,000 in subsidized loans, but unsubsidized loans allow independent students to borrow more.

Ask Your Parents For Money

Credit: Rena Schild Shutterstock

Were not keen on Maintenance Loans being tied to household income, but the fact is that they are although at least in Wales its only used to determine the split between grant and loan, and not how much money you receive overall.

We wont go on for too long about why we dislike this way of doing things , but one of our biggest gripes is that we feel the funding bodies are nowhere clear enough about the fact that they expect your parents to support you financially if youre not receiving the maximum Maintenance Loan.

To put it another way: calculate the difference between your Maintenance Loan and the maximum amount available to a student in your living situation. The figure youre left with is how much the government expects your parents to give you every year.

Of course, plenty of parents whom the government thinks should be contributing are actually unable to , so the difficult conversation of asking them for financial support is made even more tricky.

Fortunately, weve put together a guide on asking your parents for money, as well as a calculator to help you work out exactly how much theyre expected to contribute.

Oh, and before you think you can hack the system by simply refusing to provide your funding body with your household income, theyre one step ahead of you. Students who dont submit this info are usually given the lowest Maintenance Loan by default.

Read Also: Becu Repossessed Cars

What To Consider When Choosing Medical Loans

When deciding where to turn for medical school loans, its important to first consider your goals, as well as the protections you hope to receive. Here are some things to keep in mind:

Compare your options to figure out what combination of federal and private medical school loans might work best for your situation.

How To Determine Your Federal Student Loan Maximum

The maximum federal student loan amount how much you can borrow as direct subsidized, direct unsubsidized, or direct parent PLUS loans varies depending on your situation as you complete your FAFSA . You can figure out the limit to what you can borrow at a particular time by answering these three questions:

Recommended Reading: Usaa Current Auto Loan Rates

Plus And Grad Plus Loan Limits

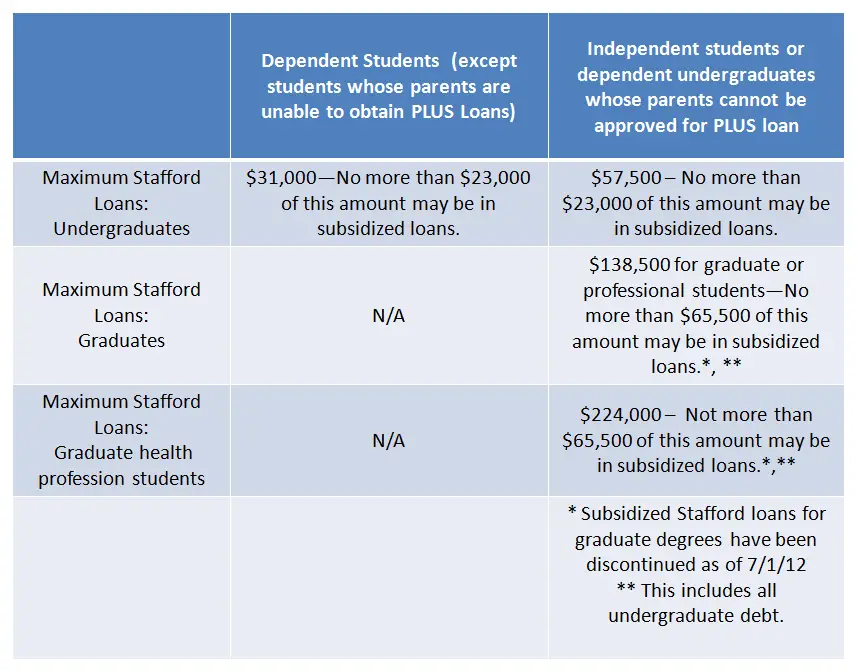

When federal Stafford Loans are not enough to cover the full cost of attendance, graduate-level students may qualify for a Grad PLUS Loan and parents of an undergraduate student may qualify for a Parent PLUS Loan.

Grad PLUS and Parent PLUS Loans differ from Stafford Loans in that they are only available to graduate-level students and parents of students who do not have an adverse credit history.

The loan limits for Grad PLUS and Parent PLUS Loans also differ from Stafford Loans. There is no annual limit as a set dollar amount, but students or parents may not borrow more than the total cost of attendance, less any other financial aid received.

What Is The Maximum Amount Of Student Loans For Graduate School

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Embarking on the journey to graduate school can be exciting, stressful, and confusing. Some programs require more tests some dont. There are applications to fill out once again, letters of recommendation to procure, and the anxiety of wondering if you will even get in.

On top of getting in, theres the stress of figuring out how its going to be paid for. Depending on the graduate program, more than half of graduate students take out loans to help pay the cost of attending, so its normal to need financial assistance.

Students applying for financial aid for graduate school are likely familiar with the process of applying for federal financial aid, but graduate students should be aware of the fact that theyre almost always considered independent, and many will want to learn the maximum amount they can borrow.

Graduate students are almost always considered independent.

You May Like: How To Calculate Amortization Schedule For Car Loan

Refusing To Originate A Loan Or Originating For Less Than Maximum Eligibility

On a case-by-case basis, you may refuse to originate a Direct Loan for an individual borrower, or you may originate a loan for an amount less than the borrowers maximum eligibility. If you choose to exercise this discretion, you must ensure that your decisions are made on a case-by- case basis and do not constitute a pattern or practice that denies access to Direct Loans for borrowers because of race, sex, color, income, religion, national origin, age, or disability status. When you make a decision not to originate a loan or to reduce the amount of the loan, you must document the reasons and provide the explanation to the student in writing. Also note that your school may not have a policy of limiting Direct Loan borrowing on an across-the-board or categorical basis. For example, you may not have a policy of limiting borrowing to the amount needed to cover the school charges, or not allowing otherwise eligible students to receive the additional Direct Unsubsidized Loan amounts that are available under the annual loan limits.

Find Out What’s Available Then Figure Out What You Can Pay Back

There are limits to almost everything in life, including how much you can borrow on student loans. Student loan limits are based on a variety of factors, including the type of loan , your year in school, and how much it costs to attend your school of choice.

Its important to keep in mind that the maximum amount you can borrow isnt necessarily the amount you should borrow. You should only borrow as much as you can expect to be able to pay back under the terms of the loanand the interest rate is part of that calculation. All this makes for a tricky landscape, which starts with knowing whats available.

Note that as a result of the 2020 economic crisis, the U.S. Department of Education has suspended loan payments, waived interest, and stopped collections through September 30, 2021.

Also Check: How Do You Find Your Student Loan Account Number

Transfer Into Standard Term Or Se9w Nonstandard Term Program

If a student enrolls in a program with standard terms or SE9W nonstandard terms after already having taken out a loan at another school with an overlapping academic year, the student initially may not receive more than the annual loan limit at the new school minus the amount received at the prior school.

However, the student may borrow again for a subsequent term within the same academic year at the new school if the term begins after the end of the academic year at the prior school. For a subsequent term that begins after the end of the prior schools academic year, but within the initial academic year at the new school, the student may borrow up to the difference between the applicable annual loan limit and the amount already received for the new schools academic year, if the students COA supports that amount.

Likewise, if a student transfers to a different program at the same school at the beginning of a new term within the same academic year, the students loan eligibility for the remaining term of the academic yearis equal to the difference between the applicable loan limit for the new program and the loan amount the student received for the prior program within the same academic year.

Example : Remaining Period Of Study Shorter Than An Academic Year With Less Than Half

Turner College has an academic year that covers three quarters: fall, winter, and spring. Linda, a dependent fourth-year undergraduate, will be enrolling in the fall and winter quarters, but not the spring quarter, and will graduate at the end of the winter term. Linda will be enrolled for 12 quarter hours during the fall quarter, but will be enrolled for only three hours in the winter quarter. Turner defines its academic year as 36 quarter hours and 30 weeks of instructional time.

Lindas final period of study is shorter than an academic year, so the annual loan limit must be prorated. However, because Linda will be enrolled less than half-time during the winter quarter , the loan period will cover the fall quarter only, and only the 12 quarter hours for the fall term are used to determine the prorated annual loan limit.

To determine the prorated loan limit for Lindas final period of study, convert the fraction based on the hours that Linda is expected to attend in the fall quarter and the hours in the academic year to a decimal . Multiply this decimal by the combined Direct Subsidized Loan and Direct Unsubsidized Loan annual loan limit for a dependent fourth-year undergraduate :

$7,500 x 0.33 = $2,475 combined subsidized/unsubsidized prorated annual loan limit.

To determine the maximum portion of the $2,475 prorated annual loan limit that Linda may receive in subsidized loan funds, multiply the maximum subsidized annual loan limit of $5,500 by the same decimal :

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Prorating Loan Limits For Remaining Periods Of Study Shorter Than Academic Year

You must also prorate loan limits for students enrolled in remaining periods of study shorter than an academic year. This circumstance can occur when a student is enrolled in a program that is one academic year or more in length, but the remaining period of study needed to complete the program will be shorter than an academic year. Proration is required only when it is known in advance that a student will be enrolled for a final period of study that is shorter than an academic year. If a student originally enrolls for a final period of study that is a full academic year in length, but completes the program early in less than a full academic year, it is not necessary to retroactively prorate the annual loan limit.

In a standard term program, or a credit-hour program using SE9W nonstandard terms, a remaining period of study is considered shorter than an academic year if the remaining period contains fewer terms than the number of terms covered by the schools Title IV academic year. For programs that are offered in an SAY, the number of terms covered in the schools Title IV academic year usually does not include a summer header or trailer term.

For all types of programs, where there is a remaining period of study less than an academic year, the annual loan limit for the students grade level is multiplied by the following fraction to determine the prorated loan limit:

How Much Should You Borrow

The low borrowing limits and interest rates on the most affordable federal loans for undergrads mean that most borrowers who finish their degrees can repay them.

But if you go on to grad school, its easier to take on the level of student loan debt thats more difficult to repay. The higher limits on PLUS loans can saddle you with six-figure loan debt.

You can use the Department of Educations College Scorecard to get an idea of how much debt its reasonable to take on with the degree you are pursuing.

Tip:

Don’t Miss: Va Loan For Modular Home

Student Maintenance Loans Guide 2021

The Maintenance Loan will probably be your main source of cash while you’re at uni. But how does it all work? And how much money will you get? Allow us to explain.

Credit: Roman Samborskyi , Bayliss photography Shutterstock

According to our National Student Money Survey, the Maintenance Loan is one of the main sources of money for students while they’re at uni.

So, as you’ll almost certainly be taking one out, it makes sense for you to get clued up on the eligibility criteria, the application process and how big a Maintenance Loan you’ll get, as well as how to pay it back and what to do if your loan isn’t enough.

In trademark Save the Student fashion, we’ve got you covered read on and we’ll answer all of your questions to make sure you get the most out of your Maintenance Loan.