Time Limits For Loans

Since 2013, Direct Loan statutory requirements have limited a first-time borrowers eligibility for Direct Subsidized Loans to a period not to exceed 150% of the length of the borrowers educational program. In addition, under certain conditions, the requirements have caused first-time borrowers who have met or exceeded the 150% limit to lose the interest subsidy on their Direct Subsidized Loans. The FAFSA Simplification Act, part of the Consolidated Appropriations Act, 2021 provides for a repeal of the 150% Subsidized Usage Limit Applies requirements.

Federal loan servicers will retroactively apply subsidy benefits to any period of time, such as an in-school deferment, during which a borrower would have been entitled to subsidy benefits. This may include removing accrued interest and reapplying payments, where appropriate.

Contact yourFederal Loan Servicerwith questions regarding your subsidized loan eligibility.

What Is The Average Maintenance Loan

The average Maintenance Loan is approximately £5,640 a year, based on calculations we made using data from our National Student Money Survey and information supplied by the Student Loans Company.

However, as we’ve explained above, the amount you’ll receive isn’t really affected by what the ‘average’ student gets. Instead, the size of your Maintenance Loan will be determined by your household income, where you’ll be living while studying and, of course, where in the UK you normally live.

Talk To Your Financial Aid Office

The federal government isnt the only place that offers aid states and colleges have programs, too.

So talk to your financial aid office and ask if theres anything it can do. Perhaps it can offer some need- or merit-based aid or recommend a local scholarship program. It also might be able to help you find aid from your state.

Read Also: How Do I Refinance An Auto Loan

Public Service And Teacher Loan Forgiveness

Public Service Loan Forgiveness is available after 10 years of qualifying payments and employment, only for Direct Loans . The Teacher Loan Forgiveness Program is available for loans in both the Direct and FFEL programs. All federal loans issued since July 1, 2010 are Direct Loans. Teachers with Perkins loans may be eligible for a loan cancellation if they meet certain requirements. More information for teachers can be found at studentaid.gov.

Federal Student Loan Lifetime Limits

Federal loans have both annual and lifetime limits. The limits can vary by student, depending on three factors, including:

Your year in school

The type of loan you choose

Your dependency status

Independent students, who the U.S. Department of Education considers to be on their own financially, can borrow more than dependent students who can typically get help from their parents.

Even if youre financially independent of your parents, the definition of an independent student is fairly strict, and if you are under the age of 24, youll need to confirm you qualify as an independent student.

If youre not sure what you qualify as, see your guidance counselor or an admissions counselor who may be able to help. Heres how the loan limits shake out depending on your status and year in school, straight from the U.S. Department of Education:

| Year In School | |

|---|---|

| $31,000no more than $23,000 can be subsidized | $57,000 for undergraduatesno more than $23,000 can be subsidized

$138,500 for graduate and professional studentsno more than $65,500 can be subsidized |

*Except students whose parents are unable to obtain PLUS Loans**And dependent undergraduate students whose parents are unable to obtain PLUS Loans.

Note that the lifetime limit for graduate and professional students includes the amount in federal loans you borrowed during your undergraduate studies.

Recommended Reading: Does Va Loan Work For Manufactured Homes

Subsidized And Unsubsidized Loan Limits

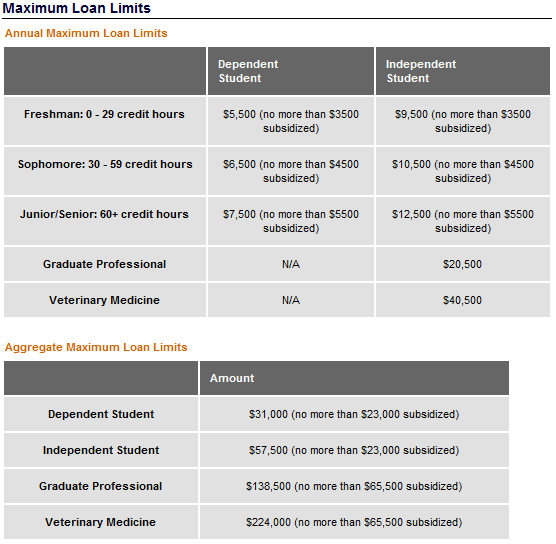

The amount you can borrow through the Federal Direct Loan Program is determined by your dependency status and classification in college. The annual and aggregate loan limits are listed in the charts below.

| Undergraduate Annual Loan Limits |

|---|

| Health Professions* Aggregate Loan Limits | $224,000 |

* Some professional students may be eligible for increased unsubsidized loan limits. Contact your adviser to determine if you are eligible.

Plus And Grad Plus Loan Limits

When federal Stafford Loans are not enough to cover the full cost of attendance, graduate-level students may qualify for a Grad PLUS Loan and parents of an undergraduate student may qualify for a Parent PLUS Loan.

Grad PLUS and Parent PLUS Loans differ from Stafford Loans in that they are only available to graduate-level students and parents of students who do not have an adverse credit history.

The loan limits for Grad PLUS and Parent PLUS Loans also differ from Stafford Loans. There is no annual limit as a set dollar amount, but students or parents may not borrow more than the total cost of attendance, less any other financial aid received.

Read Also: How To Transfer Car Loan To Another Person

Private Student Loan Limit

Private student loan lifetime limits vary between lenders. You can get private student loans from banks or credit unions, which have their own sets of terms and conditions for the amount you can borrow in your lifetime. Most private student loan providers set their limits at the cost of attendance in your school.

The total cost of attendance in your school factors your tuition fees, school supplies, and transportation, and anything else your private student lender may decide that counts. Your status as a graduate student may also give you access to higher lifetime limits if a private student loan lender values certain studies or degrees.

Be sure to compare all the limits of the private student loan lenders of your choice before settling for one provider. You want to make sure you have enough funding to get you through school without exceeding the amount you can realistically repay.

Undergraduate Aggregate Loan Limits

As an undergraduate student, you may qualify for Direct Subsidized or Direct Unsubsidized loans. Subsidized loans are only for borrowers with financial need, while anyone can use Direct Unsubsidized loans, regardless of the state of their finances.

For independent undergraduate students, the aggregate loan limit for Direct Subsidized and Unsubsidized loans is $57,500. Of that amount, no more than $23,000 can be in Subsidized loans.

For dependent undergraduate students, the aggregate loan limit is $31,000, and no more than $23,000 can be in Subsidized loans.

Don’t Miss: What Is An Rv Loan

Advocates Are Disappointed With The Departments Initial Proposal

The new EICR plan details are, for now, just a proposal by the Department of Education, which was released as part of negotiated rulemaking. Negotiated rulemaking is a long, complicated process that involves a series of public hearings by a rulemaking committee. The committee is made up of various stakeholders and representatives including borrowers, advocates, lenders, schools, and government officials. Rulemakers must reach consensus to finalize changes to federal student loan programs and the rules that would govern new programs.

Advocates for borrowers on the negotiated rulemaking committee expressed strong reservations this week about the proposed EICR plan. Borrower advocates and legal services representatives criticized the Department for excluding graduate school borrowers and Parent PLUS borrowers, and for not making the poverty exclusion, repayment plan formula, and forgiveness provisions simpler and more generous. Advocates also criticized the plans treatment of interest accrual. The committee failed to reach consensus on the programs details, which means the rulemaking process will continue.

It could take many more months for the new EICR plan to be finalized.

Subsidized And Unsubsidized Loans

Subsidized Loans are loans for undergraduate students with financial need, as determined by your cost of attendance minus expected family contribution and other financial aid . Subsidized Loans do not accrue interest while you are in school at least half-time or during deferment periods.

Unsubsidized Loans are loans for both undergraduate and graduate students that are not based on financial need. Eligibility is determined by your cost of attendance minus other financial aid . Interest is charged during in-school, deferment, and grace periods. Unlike a subsidized loan, you are responsible for the interest from the time the unsubsidized loan is disbursed until its paid in full. You can choose to pay the interest or allow it to accrue and be capitalized . Capitalizing the interest will increase the amount you have to repay. See for more important information on the capitalization of interest.

| Loan Type |

|---|

| Requirement | |

|---|---|

| Deferment | You may receive a deferment if you are enrolled in school at least half-time or for unemployment or economic hardship |

| Repayment | There is a 6 month grace period that starts the day after you graduate, leave school, or drop below half-time enrollment. You do not have to begin making payments until your grace period ends. |

More information regarding student loans, program requirements, and managing repayment can be found at .

Recommended Reading: Is Bayview Loan Servicing Legitimate

What Is The Interest Rate On Maintenance Loans

For students from England and Wales, the interest rate on Maintenance Loans is currently anything up to 4.5%. If youre still at uni, interest will be charged at the full 4.5%, but if youve graduated, interest will be charged between 1.5% and 4.5% depending on how much youre earning.

For students from Northern Ireland and Scotland, the interest rate on Maintenance Loans is currently 1.1%. Simple as that!

Its worth bearing in mind that the interest rates on Maintenance Loans can change every year based on inflation. For a full explainer of how it all works, have a read of this guide.

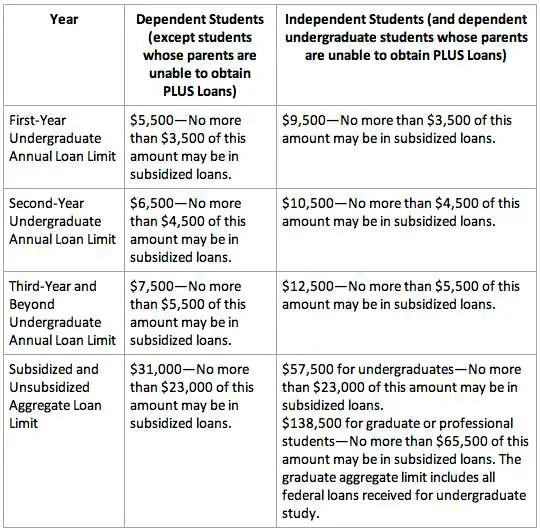

Undergraduate Federal Student Loan Limits

| Year | |

|---|---|

|

$7,500 |

$12,500 |

Total subsidized and unsubsidized loan limits over the course of your entire education include:

- Dependent: $31,000

- Independent: $57,500

Both dependent and independent students can borrow $23,000 in subsidized loans, but unsubsidized loans allow independent students to borrow more.

Recommended Reading: How Do You Find Your Student Loan Account Number

If Parents Refuse To File The Fafsa

If a dependent undergraduate students parents refuse to complete the FAFSA , the colleges financial aid administrator may allow the student to borrow additional Direct Unsubsidized Loans despite the incomplete FAFSA. The student, however, will not be eligible for the Direct Subsidized Loan, the Federal Pell Grant, or other forms of federal student aid.

How Much Maintenance Loan Will You Get

The size of the Maintenance Loan you’re entitled to will depend on the following three factors:

It’s easiest to break things down by country, so just scroll through to where you currently live to see how big a Maintenance Loan you could receive .

And remember: your Maintenance Loan is provided by the part of the UK you normally live in, not where you will be studying. So, for example, if you lived in Northern Ireland but planned to study in Scotland, you’d apply for funding from Student Finance Northern Ireland.

Don’t Miss: Sss Loan Eligibility

Subsidized And Unsubsidized Loan Examples

Example 1:

Alberta Gator is a first year dependent undergraduate student. Her cost of attendance for Fall and Spring terms is $17,600. Albertas expected family contribution is $10,000 and her other financial aid totals $9,000.

Because Albertas EFC and other financial Aid exceed her Cost of Attendance, she is not eligible for need-based, Subsidized Loans. She is, however, eligible for an Unsubsidized Loan. The amount she would be awarded would be $5,500. Even though her cost of attendance minus other financial aid is $8,600, she can only receive up to her annual loan maximum .

Ascent Student Loans Disclosures

Ascent loans are funded by Bank of Lake Mills, Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations and terms and conditions may apply. For Ascent Terms and Conditions please visit: AscentFunding.com/Ts& Cs

Rates are effective as of 09/01/2021 and reflect an automatic payment discount of either 0.25% OR 1.00% . Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized bank account each month. For Ascent rates and repayment examples please visit: AscentFunding.com/Rates.

1% Cash Back Graduation Reward subject to terms and conditions, please visit AscentFunding.com/Cashback. Cosigned Credit-Based Loan student borrowers must meet certain minimum credit criteria. The minimum score required is subject to change and may depend on the credit score of your cosigner. Lowest APRs are available for the most creditworthy applicants and may require a cosigner.

Read Also: Becu Used Car Loan

Consider A Private Student Loan

If youve reached your limit on federal student loans but still need some assistance paying for your tuition, you might consider taking out a new private student loan. There are options for fixed or variable private student loans, and some lenders like SoFi offer flexible repayment options. Partial, deferred, or interest-only payments put a bit less strain on your budget.

Undergraduate Federal Loan Limits

Federal undergraduate loans have various limits, depending on the type of loan, what year of school the student is applying for, as well as whether the student is considered a dependent or independent. An undergraduate student is considered independent if he or she meets any one of the criteria below:

- Is married

- Will be 24 years old before January 1 of the school year for which theyre applying

- Has been legally emancipated from parents or guardians

- Has a child or dependent

- Is on active duty or a veteran of the U.S. armed forces

- Was orphaned or in foster care after age 13

- Was determined to be an unaccompanied/homeless youth

Once you know if you are borrowing as a dependent or independent undergraduate student, review the tables below to see how much you can borrow each year you are enrolled.

Don’t Miss: How To Calculate Amortization Schedule For Car Loan

When Do You Start Repaying Your Maintenance Loan

No matter where youre from in the UK, youll only start repaying your Maintenance Loan from the April after youve graduated and even then youll need to be earning over the repayment threshold for your type of loan.

The current repayment thresholds for UK graduates are:

- Students from England and Wales £26,575 a year before tax

- Students from Scotland and Northern Ireland £19,390 before tax.

Like the interest rates on Maintenance Loans, the repayment thresholds can change each year. Any change is usually a positive one , but again, check out our Student Loan repayments guide for a full explanation.

How Student Loan Limits Are Calculated

When you take out a student loan, both the annual and aggregate loan limits are applied to the loan amount. Each type of loan limit represents a restriction on the amount you can borrow.

Sometimes, you may want to borrow an amount that satisfies the annual limit, but you will qualify for a lower amount because your total debt would exceed the aggregate loan limit. You will then be restricted to the lower loan amount.

For example:

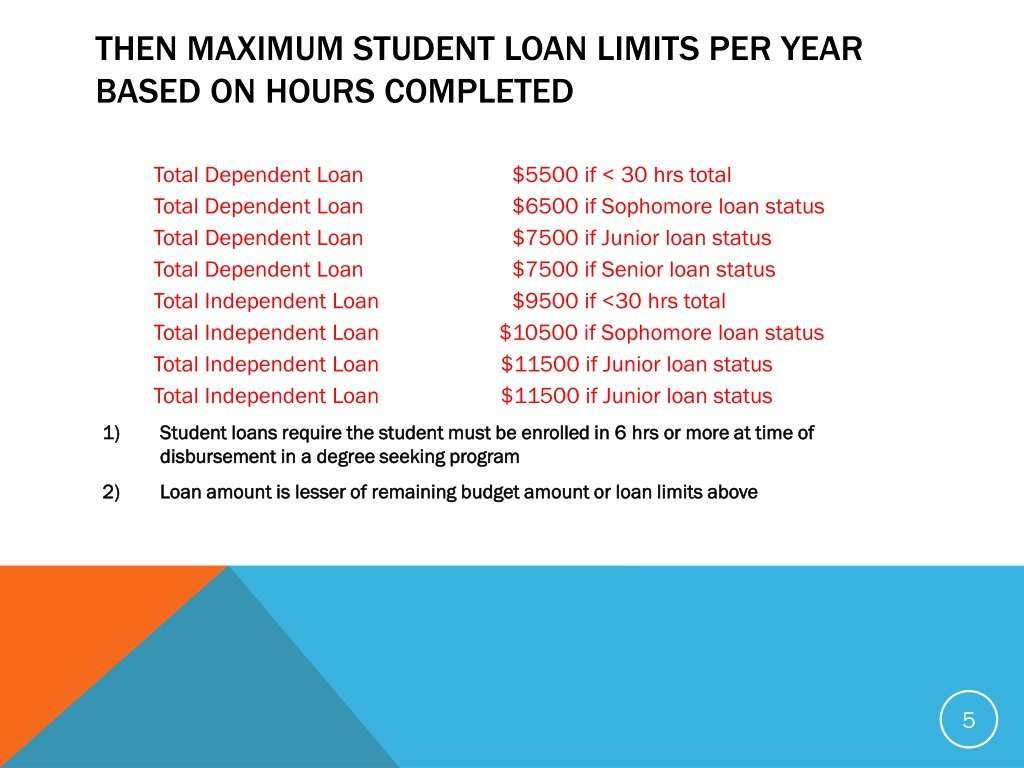

The Direct Unsubsidized Loan has annual limits for dependent undergraduate students based on the students year in school. The 2021-2022 loan limits are:

- $5,500 for freshmen

- $6,500 for sophomores

- $7,500 per year for juniors, seniors, and any additional undergraduate years of study

The Direct Unsubsidized Loan also has an aggregate loan limit of $31,000 for dependent undergraduate students.

Suppose a dependent undergraduate student in a 5-year engineering degree program borrows the annual maximum for each of the first four years, for a total of $27,000. During the students fifth year the annual limit would be $7,500. However, as the next table shows, the remaining aggregate loan eligibility is only $4,000 after the end of the fourth year. So, the student cant borrow the $7,500 annual maximum as a fifth-year senior. Instead, this student can borrow no more than $4,000.

Student Loan Limits By College Year| Year |

|---|

| $0 |

Read Also: How To Get Loan Originator License

Find Out What’s Available Then Figure Out What You Can Pay Back

There are limits to almost everything in life, including how much you can borrow on student loans. Student loan limits are based on a variety of factors, including the type of loan , your year in school, and how much it costs to attend your school of choice.

Its important to keep in mind that the maximum amount you can borrow isnt necessarily the amount you should borrow. You should only borrow as much as you can expect to be able to pay back under the terms of the loanand the interest rate is part of that calculation. All this makes for a tricky landscape, which starts with knowing whats available.

Note that as a result of the 2020 economic crisis, the U.S. Department of Education has suspended loan payments, waived interest, and stopped collections through September 30, 2021.