Sample Scenario Of Using An Fsa Loan

If you want to purchase a home and you want to use an FSA loan, the minimum credit score required is 550. This can be difficult for some people with lower scores but there are still lenders out there who will take some time to review your situation. In order to qualify, youll need to provide other types of documents such as employment records, bank statements, and pay stubs.

A USDA loan is a type of a government-insured loan that has interest rates below those of the private market. A recent study found that the average interest rate for a credit score of 620-640 is 6.35% for those with an average credit score of 660 it drops to 4.76%.

Your Credit History Is Important

Almost more important than your credit score is your credit history. Again, lenders look back at the last 12 months, at a minimum. Ideally, they do not want to see more than one 30-day late payment in the last year. Some lenders require no late payments within this timeframe, though.

Keep in mind, some lenders go back as far as a few years ago to see your payment patterns. They want to determine if you have a history of paying your debts late. For example, you may have a clean credit history for the last 12 months, but the year before you had several episodes of late payments. If the lender sees this pattern occur over a few years, it may raise a red flag. They may wonder if your late payment episodes will occur again in the coming months. In this case, they may ask for a Letter of Explanation regarding the late payment episodes to determine your eligibility.

The best way to prepare for a USDA mortgage is to clean up your credit as early as possible. Make sure you make your payments on time. If you can, pay your debts down as much as you can. You also need to make sure no creditors file any new collections or judgments against you. This can affect your credit score as well as your clean credit history.

Regardless of your credit score right now, you should shop around with different lenders. Some lenders have a higher threshold for risk than others. Shopping around gives you the chance to secure an approval as well as determine the lowest interest rate available to you.

Buyers Guide To Usda Mortgage Credit Score Requirements The Usda Mortgage Credit Rating Necessity Are Amazingly Affordable Particularly Considering That It Is A 0percent Down Mortgage

Szerz: BCS_Tomi | dec 29, 2021 | car title loans review |

Buyer& #8217 s Guide to USDA Mortgage Credit Score Requirements. The USDA mortgage credit rating necessity are amazingly affordable, particularly considering that it is a 0percent down mortgage.

Most loan providers require a 620 minimum credit rating, but if your get falls below that, youre however into the game. The U.S. section of farming doesnt ready a hard minimum, therefore loan providers can still agree a lesser rating.

Questioning exactly how? Well digest the USDA credit rating requisite and you skill to increase your chances of being qualified for a home loan.

Don’t Miss: Usaa Auto Loan Approval Odds

Find Additional Sources Of Cash For Down Payment And Closing Costs

If you dont have much savings but want to buy your home sooner than later, it cant hurt to consider other sources of cash. You can ask friends and family for gifts to assist with down payment or closing costs. The latter usually works out to 3-5% of your loan amount, on top of any required down payment.

You might also even sell something of value that you dont need and is just laying around the house to pad your down payment. A little creativity will go a long way, plus it could save you thousands if not tens of thousands of dollars as a homeowner. The bigger your down payment, the lower your loan amount and the less interest youll pay.

Tip #: Pay Off Outstanding Debt

One of the best ways to increase your credit score is to determine any outstanding debt you owe and pay on it until its paid in full. This is helpful for a couple of reasons. First, if your overall debt responsibilities go down, then you have room to take more on, which makes you less risky in your lenders eyes.

Lenders also look at something called a credit utilization ratio. Its the amount of spending power you use on your credit cards. The less you rely on your card, the better. To get your credit utilization, simply divide how much you owe on your card by how much spending power you have.

For example, if you typically charge $2,000 per month on your credit card and divide that by your total credit limit of $10,000, your credit utilization ratio is 20%.

Recommended Reading: Usaa Car Loan Credit Score

Usda Home Loan Income Limits

Guaranteed loans are available to moderate income earners, which the USDA defines as those earning up to 115% of the areas median income. For instance, a family of four buying a property in Calaveras County, California can earn up to $92,450 per year.

The income limits are generous. Typically, moderate earners find they are well within limits for the program.

Its also important to keep in mind that USDA takes into consideration all the income of the household. For instance, if a family with a 17-year-old child who has a job will have to disclose the childs income for USDA eligibility purposes. The childs income does not need to be on the loan application or used for qualification. But the lender will look at all household income when determining eligibility.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Firstloan Com Legit

A 660 Credit Score Can Get You Better Treatment

If you have a 660 credit score or higher, you may be able to streamline the USDA loan approval process with your lender. Borrowers that have a credit score of at least 660 may not have to provide as many documents to get through the approval process.

Having a higher credit score may also help to offset a high debt ratio. Normally, USDA lenders have to decline borrowers that have a 640 credit score and debt ratios that exceed 29/41. Even though many loan programs allow a total debt ratio of up to 43%, the USDA sticks to their 41% guideline unless you have that higher credit score.

Usda Loan Credit Score Minimum Steps

- Step 1: Visit the usda minimum credit score 2021 official website of the bank usda loans credit score needed

- Step 2: Log into usda loan credit score minimum internet banking portal with your user ID and password.

- Step 3: Select Card Activation

- Step 4: Type in your credit card number, your date of birth, and the expiry date.

- Step 5: Select Submit

- Step 6: Enter your ATM PIN and choose Submit

- Step 7: You will get an OTP on your mobile phone

- Step 8: Enter the OTP and select Continue

Recommended Reading: Texas Fha Loan Limits 2020

Why Do Most Lenders Require A 640 Credit Score For Usda Loans

Lenders prefer to use the USDA Guaranteed Underwriting System for an efficient, streamlined underwriting process. GUS analyzes your risk and eligibility as a borrower using a scorecard.

Automatic GUS approval requires you to have a credit score of 640 or higher with no outstanding federal judgments or significant delinquencies.

Even if you dont have a 640 credit score, its still possible to apply and be approved for a USDA loan. USDA allows lenders to underwrite and approve USDA home loans manually at the lenders discretion. Once cleared by your lender, the USDA must review your loan for final loan approval before you can close.

Regardless of credit score, all USDA loan applications must receive final loan approval from the USDA once cleared by the lender.

Does Usda Offer A Streamline Refinance Program

Yes. To qualify, the borrower must currently have a USDA loan currently and must live in the home. The new loan is subject to the standard funding fee and annual fee, just like purchase loans. Refinancing borrowers must qualify using current income but may qualify with higher ratios than generally accepted if the payment is dropping and they have made their current mortgage payments on time.

If the new funding fee is not being financed into the loan, the lender may not require a new appraisal.

Read Also: Can I Transfer Car Loan To Another Person

Usda Credit Score Guidelines

As a starting point, USDA defines a credit score as follows:

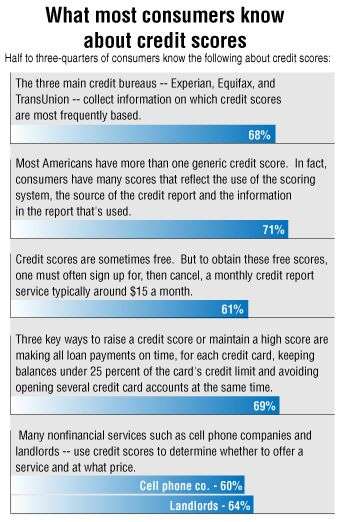

A credit score is a statistical number that evaluates an applicants creditworthiness based on their credit history. The credit score considers payment history, amounts owed, percentage of credit used, length of credit history, types of credit, and newly acquired credit.

As mentioned, USDA credit score guidelines no longer have a defined minimum credit score, but they do require that an applicant have a validated credit score.

However, USDA also states that, a validated score does not indicate the applicant has an acceptable credit history. A validated score confirms that one applicant has an eligible minimum credit history.

Furthermore, even though USDA guidelines do not have a defined minimum credit score, lenders may establish their own minimum credit score requirements which can vary from lender to lender.

One Of The Last Remaining 100% Financing Options

No money down loans appeared to have vanished during the housing bust, but USDA loans remained available throughout that time and are still available today. The growing popularity of the USDA loan has proven that zero-down loans are still in high demand.

Borrowers in designated rural areas should consider themselves lucky to have access to this low-cost, zero down loan option. Anyone looking for a home in a small town, suburban or rural area should contact a USDA loan professional to see whether they qualify for this great program.

You May Like: Directloantransfer

How Credit Scores Are Calculated

There are several factors that makeup how your credit scores are calculated. Lets look at the five factors FICO, the credit scoring model used by lenders, uses to calculate scores.

|

How Your Credit Score is Calculated |

|

|

Payment History 35% |

Payment history is how well you pay your bills on time. This includes late payments and collection accounts. |

| 30% |

The amount of available credit you’re using is called your . Try to keep your credit utilization ratio below 25%. |

|

Length of Credit 15% |

The longer your accounts stay open, the better your score will be. Don’t close credit cards is possible. |

|

Types of Credit 10% |

A mix of credit accounts such as credit cards, auto loans, mortgages will help improve your credit score. |

| 10% |

When a lenders pulls your credit it creates a hard inquiry. Multiple inquiries hurt your score count against you for 12 months. |

Is A Usda Loan Or An Fha Loan Better

USDA loans and FHA loans each have pros and cons. Which one is better for you depends on your circumstances.

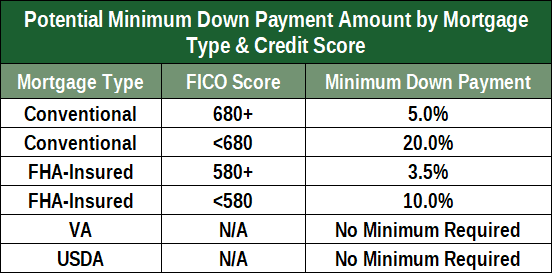

A USDA loan may be less costly than an FHA loan, so its worth considering a USDA loan first if you meet the eligibility requirements. USDA loans typically dont require down payments, making them attractive to homebuyers who dont have much money saved up. FHA loans, on the other hand, require down payments starting at 3.5%.

Direct loans from the USDA dont require you to pay for mortgage insurance, while FHA loans require monthly mortgage insurance as well as a one-time mortgage insurance premium upfront.

But FHA loans dont have income-eligibility caps like USDA loans do, so theyre available to people with a wider range of incomes. And you can use an FHA loan to buy an eligible home anywhere in the U.S., unlike USDA loans, which are restricted specifically to rural areas that meet population thresholds.

You arent excluded from any geographic location with an FHA loan, though the maximum amount you can borrow varies by county.

Read Also: Usaa Auto Loan Rates

Housing Repair Loans And Grants

The USDA also offers the Section 504 Home Repair program, which finances home improvements for very-low income homeowners in rural areas. To qualify you must have a family income below 50% of the area median income and be unable to find affordable credit elsewhere. In addition, if youre 62 or older and unable to pay for a repair loan, you may qualify for a grant through this program.

Minimum Credit Requirements To Qualify For A Usda Mortgage

-

620 Credit Score

-

Borrowers without a credit score are not eligible.

-

At least 2 active credit accounts reporting to the credit bureau

-

Minimum 12 months of repayment history on at least one credit account

At this time, USDA Mortgage Credit Guidelines are more flexible thanmany other mortgage programs but there are some credit deficiencies that the USDA will not overlook no matter what the credit score.

Don’t Miss: What Is A Loan Commitment Fee

We Dont Possess Credit Score Required For A Usda Loan And I Also Cant Afford An Advance Payment Is There In Whatever Way Im Able To Buy A House

Should you dont need good credit or lots of economy, it is possible to still being a resident.

FHA debts need a 580 credit rating with a 3.5per cent down-payment, and you can use gifts resources to cover that cost.

If youre a veteran or active-duty army servicemember, you may be eligible for a VA financing with a 0per cent advance payment.

Just like USDA loans, there is no government-mandated minimum credit history for a VA loan, so you may be considered with a reduced get. But some loan providers requires applicants to possess the very least 580 credit history.

Also some main-stream mortgage training bring a 3% deposit and a 620 minimal credit score criteria .

Heres something you should think about, though. Though there tend to be choices for people who have less credit rating and small savings, you might take time to develop your finances initial.

Running a home is a huge devotion that accompanies countless obligations. Lost costs or not having the ability to keep up with typical maintenance have lots of outcomes such as the reduction in the house or property.

If you dont posses a well established practice of spending less or having to pay expense promptly, it could be worth dealing with your credit rating, constructing the benefit, and starting solid cash control behavior that will aid your as a property owner.

What Credit Score Is Required For A Usda Home Loan

Many first-time buyers are a little worried about their credit score and how it will impact their ability to qualify for a mortgage loan. All lenders will look at the borrowers credit score, in addition to several other key financial indicators. These include, but are not limited to, income, debt-to-income ratio, employment history, savings and other debts.

The minimum credit score set by most USDA-qualified lenders will be 640. If you have a 640 FICO score or higher, you are off to a good start when applying for a USDA home loan. Again, this is not the only thing the lender and USDA will look at when underwriting and approving the loan. You could have a fantastic credit score, but be in bad shape in other areas. Or, you could be in great shape with all the rest of your finances, but have a low credit score for whatever reason.

You May Like: Capitalone Autoloans.com

Chapter : Credit Analysis Usda Rural Development

https://www.rd.usda.gov/files/3555-1chapter10.pdf

No credit score validation required. Manually Underwritten Loans without GUS: Lenders must select the middle of three scores, the lower of two , or the single reported score. A credit report with no score must refer to non-traditional tradeline requirements.

Usda Loan Requirements 2022 Usda Rural Development Loan

While not technically a non-prime mortgage, USDA loans are popular with borrowers that have lower credit scores and lower income. In fact, the USDA loan programs are intended for lower income individuals and families, and there are actually limits to how much money you can make.

Other names for USDA loans are USDA rural development loans and rural housing loans. All of these terms are talking about the thing. There are two different USDA programs, however. The USDA guaranteed loan, and the USDA direct loan. If you have really low income, you may want to look into a USDA direct loan. Most borrowers who get a USDA loan are financed through the USDA guaranteed loan though, which is the USDA loan program featured on this page.

What attracts many to the USDA guaranteed loan is that there is no down payment required.

You May Like: Refinance Through Usaa

What Are The Eligibility Requirements For A Usda Loan

The USDA loan program, like any other mortgage, has certain eligibility requirements you must meet. If you tick the following boxes, then you should be eligible for a USDA loan, if youre buying the right kind of property:

- Youre a U.S. citizen or a permanent resident with a Green Card

- Ability to prove creditworthiness

- The home would be your primary residence

- You meet income requirements

- Youre in good standing with all federal programs

- You can provide history or proof of on-time payments for bills such as rent or car loans

- The property is located in an eligible area