The Usda Home Loan Program

The USDA loan program is one of the best mortgage loans available for qualifying borrowers.

Theres no down payment required, and mortgage insurance fees are typically lower than for conventional or FHA loans. USDA interest rates tend to be below-market, too.

To qualify for 100% financing, home buyers and refinancing homeowners must meet standards set by the U.S. Department of Agriculture, which insures these loans.

Luckily, USDA guidelines are more lenient than many other loan types.

What Factors Impact The Amount You Can Borrow

Lenders consider several factors in determining the amount you qualify for, including:

-

Your debt-to-income ratio. Our How much can I borrow calculator? depends on an accurate input of your income and recurring debt. Youll want to really hone those figures down to a fine point, because lenders will be using them too.

-

Your loan-to-value ratio. This ratio is a function of the amount of money you put down. If you want to drill down on this calculation, use NerdWallets loan-to-value calculator.

-

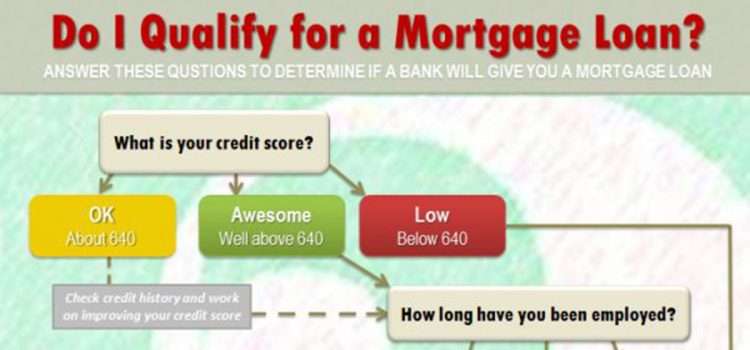

Your credit score. This number impacts the pricing of your loan, more than how much youll qualify for. But thats really important. If you dont know your score, get it here.

What Are The Costs Associated With A Csbfp Loan

Registration fee: The CSBFP registration fee is 2% of the total amount of the loan. The registration fee can be financed as part of the loan.

Interest rate: The interest rate may be variable or fixed. For a variable rate, the maximum chargeable is the lender’s prime lending rate plus 3%. For a fixed rate, the maximum chargeable is the lenders’ single family residential mortgage rate plus 3%.

Lender fees: Lenders may charge the same fees , that they charge for a conventional loan of the same amount. These fees are paid directly to the lender and cannot be financed under this program.

Recommended Reading: Amortize Car Loan

Cfpb Shifting From Dti Ratio To Loan Pricing

Both Fannie Mae and Freddie Mac have allowed higher DTI ratios for buyers carrying significant student debt.

While measuring debt-to-income is useful for getting a baseline feel for what you may qualify for, the CFPB proposed shifting mortgage qualification away from DTI to using a pricing based approach.

What Change did the CFPB Propose?

“the Bureau proposes to amend the General QM definition in Regulation Z to replace the DTI limit with a price-based approach.”

Why Did They Suggest the Change?

“The Bureau is proposing a price-based approach because it preliminarily concludes that a loans price, as measured by comparing a loans annual percentage rate to the average prime offer rate for a comparable transaction, is a strong indicator and more holistic and flexible measure of a consumers ability to repay than DTI alone.”

How Does This Impact Loan Qualification for Low-income Buyers?

“For eligibility for QM status under the General QM definition, the Bureau is proposing a price threshold for most loans as well as higher price thresholds for smaller loans, which is particularly important for manufactured housing and for minority consumers.”

More Reasons Why Fha Is A Great Loan

Now, since were on the topic of FHA loans FHA loans are unbelievably flexible, and I just want to share a little bit more awesomeness about FHA loans that really make this one of the best choices to qualify.

To purchase a home in 2022 first of all, the extremely low down payment, youre only required with FHA to use a three and a half percent of the purchase price as the down payment.

Now, remember the loan amount is the loan part, not the purchase price. So the loan amount is the purchase price. After youve made.

The loan amount is after youve made your down payment. So you only have to have a 3.5% down payment. And the great thing about this is whether theres one unit or four units.

If youre buying a duplex or a three-unit property or a four-unit property, that number goes way, way up. And whether youre paying, whether youre buying a single-family home for 420,680, or youre buying a four-unit property for $900,000, you still only have to put 3.5% down with an FHA loan.

You cannot do that with a conventional loan. The other great thing about FHA is its much more flexible with the credit scores. You can have much lower credit scores. In some cases, you can go be lowest 600 credit score and still qualify for an FHA loan.

You May Like: Car Loan Transfer To Another Person

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is, unless you have enough cash to purchase a property outright, which is unlikely. Use the mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

What Determines The Size Of My Loan

How much personal loan you can get depends on several factors unique to you, like your:

How much loan you should get depends on your budget. Use the calculator below to estimate the monthly payments for loans of different sizes:

Keep in mind the first four factors listed above will still influence how much you can borrow. If you have a lot of existing debt, you might not qualify for a large personal loan. In that situation, lenders could be afraid you won’t be able to pay back a large personal loan and your other debt. Below, we’ll explore these factors in more depth.

If you’re unemployed, check out our guide to getting a loan while unemployed for more information on what to list as income on a personal loan application.

You May Like: Do Lenders Verify Bank Statements

How Do Interest Rates Impact Affordability

Interest rates have a direct impact on VA loan affordability. Mortgage rates reflect the cost of borrowing money, and they can vary depending on the lender, the borrowers credit profile and more.

VA borrowers benefit from having the industrys lowest average interest rates.

More:See today’s VA loan interest rates

Using The Mortgage Qualifying Calculator

The Mortgage Qualifying Calculator is designed to be easy to use and largely self-explanatory. Just fill in the various fields with the information requested. Start by choosing if you want to base the calculation on your annual income, the purchase price of the home you’re looking at or the monthly payment you can afford. Then work down the page entering your other information and the calculator will figure out the other two values for you and display them in gray.

For example:

- Enter your annual income and the Mortgage Qualifying Calculator will determine the maximum purchase price you can afford and the associated monthly payment.

- Enter the purchase price and the calculator will tell you the income you need and the monthly payment required. Or,

- Enter the monthly payment you’re thinking of and the Mortgage Qualifying Calculator will tell you the income needed to qualify and the home purchase price that will cover.

Then go down the rest of the page entering the information requested. Your answers will be displayed in gray at the top of the page. Click “View report” for a detailed breakdown and an amortization report.

Read Also: Usaa Home Loan Credit Score Requirements

What Does The Mortgage Qualifying Calculator Do

This Mortgage Qualifying Calculator takes all the key information for a you’re considering and lets you determine any of three things: 1) How much income you need to qualify for the mortgage, or 2) How much you can borrow, or 3) what your total monthly payment will be for the loan.

To do this, the calculator takes into account your mortgage rate, down payment, length of the loan, closing costs, property taxes, homeowners’ insurance, points you want to pay and more. Or, if you don’t want to go into that much detail, you can omit some of those to get a ballpark figure for the loan you’re considering.

You can also enter information about your current debts, like your car payments, credit cards and other loans to figure out how those affect what you can afford. This Mortgage Qualifying Calculator also gives you a breakdown of what your monthly mortgage payments will be, shows how much you’ll pay in mortgage interest each month and over the life of the loan, and helps you figure how you might allocate your upfront cash on hand toward closing costs. On top of that, it also lets you easily adjust any of the figures by using a sliding scale, making it simple to see how changing one or more affects the result, so you can identify where how reducing one thing or increasing another affects the final result.This Mortgage Qualifying Caculator also summarizes all your information in a detailed report, including an amortization table, for easy reference.

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross houshold income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs, and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs â mortgage principal and interest, taxes, and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Gross Debt Service Ratio

Don’t Miss: Transferring An Auto Loan

What Is The Maximum Mortgage Calculator +

Our maximum mortgage calculator helps you calculate the maximum monthly mortgage payment and total mortgage amount you can afford. The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford. This calculator is for you if you are reviewing your financial stability as you get ready to purchase a property.

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

Also Check: Usaa Rv Loans

How Much House Can I Afford With A Va Loan

Eligible active duty or retired service members or their spouses can qualify for down payment-free . These loans have competitive mortgage rates but usually and dont require PMI, even if you put less than 20 percent down. These loans be a great option if you qualify and can help you get into a new home without overstretching your budget.

How Can I Spot A Personal Loan Scam

Unfortunately, there are plenty of scam artists willing to take advantage of borrowers desperate for a personal loan. Here are a few warning signs of personal loan scams to watch out for:

- Demanding money upfront: You should never have to pay money before getting your loan funds. A scammer might demand that you pay strange fees or require unusual payment methods that cant be tracked, such as a prepaid credit card.

- Using high-pressure sales tactics: Scammers will often pressure borrowers to make an instant decision for example, they might use language like limited-time offer or act now.

- Not requiring a credit check: Personal loan lenders usually perform a credit check to determine your creditworthiness. While there are some no-credit-check personal loans , other companies promising not to check your credit are likely a scam.

- Approaching you about the loan: Some lenders advertise through the mail with preapproved loan offers. But if a loan company approaches you out of the blue with an offer, it could be a scam.

- Not having a physical address: A legitimate loan company should have a physical address that you can verify. If you cant find location information for the lender, it could be a front for a scam.

- Not feeling comfortable with the company: Trust your instincts if something feels off, it probably is.

Learn More: Auto Loans for All Credit Types

You May Like: Do Loan Officers Get Commission

Save For A Bigger Down Payment

A larger down payment reduces the amount your lender needs to loan you. This makes your loan less risky for the lender because they lose less money if you default. Saving for a larger down payment can help you become a more appealing candidate for a loan and can even convince a lender to cut you some slack in other application areas. Use these tips to increase your down payment fund:

- Budget for savings. Take a look at your monthly budget and decide how much you can afford to save each month. Hold your down payment fund in a separate savings account and resist the temptation to spend any of it.

- Pick up a side hustle. In the on-demand “gig” economy, it’s never been easier to earn extra cash outside of your job. Drive for a ridesharing service, deliver food for local businesses or pick up a few spare tasks on a site like TaskRabbit.

- Sell some of your things. Sites like eBay, Poshmark and ThredUp make it simple to sell old things you no longer use. Search around your home for things you think you can sell and list them.

Notes On Using The Mortgage Income Calculator

This calculator provides a standard calculation of the income needed to obtain a mortgage of a certain amount based on common industry guidelines. These guidelines assume that your mortgage payments, including taxes, insurance, association fees and PMI/FHA insurance, should be no greater than 28 percent of your monthly gross income.

- FAQ: These guidelines assume that your mortgage payment and other monthly debt obligations combined should not exceed 36 percent of your monthly gross income.

Those are the base guidelines however, borrowers with excellent credit and healthy financial reserves can often exceed those guidelines, going as high as 41 percent of gross monthly income for mortgage payments and debt obligations combined. You may wish to take that into account when considering your own situation.

Read Also: 1-800-689-1789

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

What Is Available

- Based on your previous years annual income and family size, you could receive:

- up to $4,000 per eight-month school year for students enrolled in undergraduate programs that are less than two years in length.

- up to $1,000 per eight-month school year for students enrolled in undergraduate programs that are two or more years in length.

As family income increases, the grant amount decreases:

Income Thresholds for B.C. Access Grant for students enrolled in full-time programs of less than two years in length.

| Family size | For maximum grant | For grant cut-off |

|---|---|---|

| 1 | ||

| $84,933 | $164,298 |

Income Thresholds for B.C. Access Grant for students enrolled in full-time programs of two or more years in length.

| Family size | For maximum grant | For grant cut-off |

|---|---|---|

| 1 |

You may be eligible if you:

- apply and qualify for full-time StudentAid BC financial assistance

- have at least $1 of financial need assessed by the province

- attend a B.C. public post-secondary institution

Don’t Miss: Mlo License Ca

How Do I Pre

You will need to gather some important basic financial information before you can complete the mortgage affordability and pre-qualification calculator. This includes your total monthly income before taxes plus your total monthly debt payments .

Once you have your most current information gathered, enter your income and debt totals in our mortgage affordability and pre-qualification calculator. You will also need to have a basic idea of what type of mortgage financing you would like to have. Start by choosing your preferred mortgage loan term and the associated interest rate that you expect to obtain. Then enter the state in which you are looking to purchase. Finally, you will need to enter the percentage that you plan to put as a down payment. Remember, the down payment is an up-front payment, so you need to have that cash readily available.

Is 100k A Good Salary For A Family

A $100k salary is a good salary for an individual. Only 13% of single female households and 20% of single Male households bring in more than $100k. … While the average single male household makes $55,190. So 100k, in fact, is a good salary for a single person, but how does that measure up for a family of four?

Recommended Reading: Usaa Rv Loan Reviews