Consumers Are Taking Action Against Usury Lawbreakers

In New York state, the most a lender can charge for annualized interest is 16 percent. However, one of our New York clients was charged an annualized interest rate of nearly 24 percent for his vehicle loan.

He would have had to pay nearly double the purchase price of the vehicle by the time he made his final payment. But he seeks to avoid that outcome by fighting back.

They also may be able to get back all the interest they already paid that was more than the 16 percent annual legal limit.

The Verdict: Should I Get A Car Loan

As long as you choose a loan that fits your budget and you make regular payments, a car loan is a great option if you dont have a wad of cash stashed under the mattress. Understanding car loan rates in Canada can be daunting, but if you keep in mind the tips and information above, youll be able to successfully navigate the process and get a car loan for your next vehicle.;

If you liked this article, you may also like:

Dealer Financing Vs Car Loan Rates

Dealership financing is often more expensive than borrowing from a third-party lender. But there are some situations where you can get a better deal, such as:

- When it offers 0% financing. Some dealerships offer financing as low as 0% especially if they want to move certain models out of the lot.

- When you have a preapproved loan. You can use your preapproved loan from another lender as leverage to get a better rate at the dealership.

- When you want to negotiate. Even if you arent preapproved, dealerships are often flexible about rates and terms on their loans, unlike other car loan providers.

Can I really get a car loan with a 0% APR?

Its possible, but it depends on your credit and most deals are only available from manufacturers on new cars. Often, youll need nearly perfect credit to qualify, and its usually only available for certain makes and models.

Agreeing to a 0% APR auto loan may also mean foregoing other offers or promotions, like a manufacturers rebate. Ultimately, if you qualify, youll want to crunch the numbers to make sure its the best deal for you.

LEARN MORE: What dealerships dont want you to know about 0% car loans

Read Also: How To Apply Loan In Sss

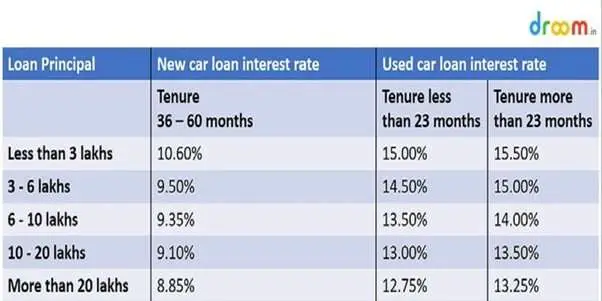

What Is A Good Interest Rate For Your Car Loan Mercedes

The higher the credit score, the lower your interest rate. After youve consulted our chart for a rate estimate, plan for the rate you want. Once you have a;

Annual Percentage Rates Rates for each loan amount and term combination below are shown in a minimum to maximum range because LightStream rates and;

Generally, the higher your credit score, the lower the interest rate on your loan. Plus, it doesnt hurt to be ready to negotiate; you may be able to;

Whats The Best Possible Apr

When it comes to APR, it seems like everyones looking for that magic number: zero percent. This may sound great when you hear it in car commercials, but the truth is that very few people actually qualify for zero percent financing.

Whether youre getting a direct loan or financing through a dealer, your APR depends largely on your credit. The better your credit, the lower the APR youll likely qualify for. All lenders have their own idea of what a good credit score is, but, typically, you should fall into that category if your score is 700 or above. Even with a score of 700, though, you may not qualify for a zero percent APR.

So, you have to know how to get the best APR possible, and getting that means paying attention to two things in particular: the APR being offered by lenders and automakers and your own credit score.

Don’t Miss: What Is The Max Home Loan I Can Get

Banks And Credit Unions

Most banks who offer auto loans provide similar rates as low as 3% to the most qualified customers. However, there is much variance amongst banks in the highest allowed APR, with top rates ranging from as low as 6% to as high as 25%. Banks who provide higher rate loans will generally accept applicants with worse credit, while more risk averse lenders wont offer loans to applicants with scores below the mid-600s.

The typical large bank has specific eligibility requirements for loans, including a mileage and age maximum for cars, and a dollar minimum for loans.

Generally, credit unions extend loans at lower interest rates than banks, have more flexible payment schedules, and require lower loan minimums . However, credit unions tend to offer loans exclusively to their membership, which is often restricted to certain locations, professions, or social associations.

| Financial Institution |

|---|

| 14.99% |

What Are Average Apr Rates

According to U.S. News and World Report, these are the average auto loan rates as of August 2020:

- 750 or higher credit score: 4.65% for new, 4.90% for used, 4.20% for refinancing.

- 700-749:;4.73% for new, 4.98% for used, 4.69% for refinancing.

- 600-699: 4.83% for new, 5.08% for used, 7.15% for refinancing.

- 451-599: 15.72% for new, 15.97% for used, 12.54% for refinancing.

These numbers are just an estimate. Once you do get your APR, compare it to other lenders to make sure youre getting the best deal available.

Recommended Reading: Can I Pay Off Personal Loan Early

Get Started On The Loan Process At Federico Chrysler Dodge Jeep Ram

Once youve found the car you like, use our payment calculator tool to estimate your monthly payments. Our finance center can help you with the pre-approval process and get you behind the wheel of your dream vehicle at a reasonable rate. Contact us to compare rates or to get the process started today. Well be for you every step of the car-buying process.

- Inventory

Best Credit Union For Auto Loans: Consumers Credit Union

;Consumers Credit Union

- As low as 2.24%

- Minimum loan amount: None

-

No minimum or maximum loan amount

-

Offers new, used, and refinance loans

-

Offers transparent rates and terms

-

Lowest rates require excellent credit

-

Membership in credit union is required

Consumers Credit Union offers auto loan rates to its members as low as 2.24% for new car loans up to 60 months. Like other credit unions, it requires membership, but it’s easy to join. You can become a member by paying a one-time $5 membership fee. There are no geographic or employer requirements.

CCU doesn’t have a minimum or maximum loan amount. Your loan is approved based on your credit score, credit report, and vehicle information. There’s also no minimum loan termyou submit a request based on what you need.

Generally, borrowers with excellent credit will qualify for the lowest rates from Consumers Credit Union. But even members who have less than excellent credit have access to discounts. There’s a 0.5% discount available for those who autopay from a CCU account. The discount falls to 0.25% for those who make automatic payments from an outside financial institution.

Don’t Miss: Is My Home Loan Secured

Auto Approve: Best For Auto Refinance

- Car refinance APRs start at 2.25%

- Terms range from 12120 months

- Amounts up to $150,000

Auto Approve was the most popular choice for auto loan refinance on the Lending Tree platform by far in Q1, 2021 and it averaged one of the lowest APRs on closed loans. The company does a soft credit pull to show you potential refinance offers from lenders and once you choose an offer, that lender will do a hard credit pull to produce an official offer for your approval.

WHAT WE LIKE

Auto Approve offers lease buyouts and refinancing for motorcycles, boats, RVs and ATVs as well.

WHERE IT MAY FALL SHORT

If you have a specific refinance lender in mind, such as a local credit union, apply to them directly as Auto Approve doesnt have a public list of its lender partners.

HOW TO APPLY

Go to AutoApprove.com and hit the apply button.

Buying Used Could Mean Higher Interest Rates

Buying a new car may be more expensive, all in all, than buying used. But, new and used auto loan interest rates are rather different, no matter your credit score. Based on Experian data, Insider calculated the difference between new and used interest rates. On average, used car financing costs about four percentage points more than new financing.;

| Super Prime | 1.32% |

The gap between how much more a used car costs to finance narrows as credit scores increase, but even for the best credit scores, a used car will cost over 1% more to finance than a new car.;

Used cars are more expensive to finance because they’re a higher risk. Used cars often have lower values, plus a bigger chance that they could be totaled in an accident and the financing company could lose money. That risk gets passed on in the form of higher interest rates, no matter the borrower’s credit score.;

Recommended Reading: What Is Portfolio Loan In Real Estate

Recap: Best Car Loan Rates Of 2021

At the end of the day, you can lower the total price you pay for a new or used vehicle by ensuring youve found a good deal on your car loan interest rate. When you compare car loans, dont forget to do your research on each part of the process. If you already have a car loan with a high interest rate and think you could qualify for a lower one, you may want to consider refinancing.

Where Do I Start

Now that you know how your credit score and the type of vehicle you are purchasing can affect your loan conditions and APR, its a good idea to start looking around.

Local lenders strive to give members the lowest rates possible. At Baton Rouge Telco, we offer some of the most competitive loan rates around. We welcome you to search through our options and learn more about the features and benefits of our auto loans.

Don’t Miss: What’s Better Refinance Or Home Equity Loan

What Happens If A Rate Is Deemed Usurious

If you’ve inadvertently signed a loan with an illegal interest rate, then you may have a number of remedies available to you. Generally, you can sue the lender for money damages. In some states, you can sue for the extra interest you’ve paid above the legal amount. Other states let you claim back all the interest you paid over a specific period and not just the usurious amount. And others still let you claim back double or even triple the amount of usurious interest it depends on where you live.

North Dakota, for instance, has some of the harshest penalties in the country. If the lender screws up, it must pay you back twice the amount of interest as well as 25 percent of the principal amount of the loan. The lender also forfeits interest for the rest of the loan term, which basically takes away all the lender’s profit.

In some cases, if the lender acted maliciously or fraudulently, you may be able to recover punitive damages. These damages are not connected to your loss but are awarded to punish the lender. The lender may also be liable for criminal penalties. These are pretty stiff in some states, amounting to imprisonment and six-figure fines.

What Should You Consider When Choosing An Auto Loan

There’s a lot to take into account when choosing an auto loan. Your credit score, for example, has a major impact on the rates you get. The best rates typically go to those with excellent credit. At the end of Q1 2021, the average credit score was 734 for a new-car loan and 663 for a used car loan, according to a report from Experian.

In Q2 2020, borrowers who received the lowest rates had a score of 781 or higher. Those borrowers, also known as super-prime borrowers, received an average APR of 3.24% for new cars and 4.08% for used cars. Prime borrowers with a credit score between 661 and 780 received an average APR of 4.21% for new loans and 6.05% for used loans, while nonprime borrowers with credit scores between 601 and 660 received an average APR of 7.14% for new car loans and 11.41% for used.

It’s also important to consider what term fits your financial situation. Longer terms generally have lower payments but cost more over the life of the loan.

Also Check: Will Refinancing My Auto Loan Help My Credit

Summary Of Auto Loans For Good And Bad Credit

| Lender |

|---|

|

20.58% |

Loan terms:;Some lenders offer loans for up to 84 months. However, its best to pay off a car loan quickly since cars depreciate rapidly. Owing more on the loan than the car is worth is called being underwater or;upside down, which is a risky financial situation. Also, the best interest rates are available for shorter loan terms. NerdWallet recommends 60 months for new cars and 36 months for used cars.

Soft vs. hard credit pull:;Some lenders do a soft pull of your credit to pre-qualify you for a loan. This doesnt damage your credit score, but it also doesnt guarantee youll be approved for a loan or get the exact rate youre quoted. Other providers run a full credit check, which temporarily lowers your credit score by a few points. But again, your final rate could differ slightly from your preapproval quote. A hard pull will be required in all cases before a loan is finalized.

Rate shopping:;Applying to several lenders helps you find the most competitive interest rate. However, it can lead to your being contacted by multiple lenders, or even dealers when you apply for a purchase loan, especially if you use a service that compares offers for you .

Restrictions:;Some lenders only work with a network of dealerships. Others wont lend;money to buy cars from private sellers. Lenders may also exclude some makes of cars, certain models and types of vehicles, such as electric cars.

Auto loan rate data courtesy Experian updated 9/2/2021.

Best Auto Loan Rates Of 2021

May 10, 2021 Less desirable loan costs such as a high interest rate or unnecessary fees can be easy to overlook if the payments are spread over a long period;

Boat and recreational vehicles must be used for recreational purposes only. Boats: New boat loan of $20,000 for 3 years at 5.95% APR will have a monthly payment;

Also Check: Is It Too Late To Apply For Ppp Loan

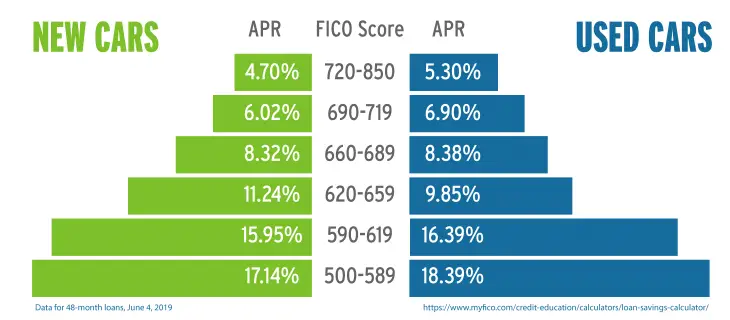

Average Auto Loan Rates By Credit Score

Consumers with high credit scores, 760 or above, are considered to be prime loan applicants and can be approved for interest rates as low as 3%, while those with lower scores are riskier investments for lenders and generally pay higher interest rates, as high as 20%. Scores below 580 are indicative of a consumers poor financial history, which can include late monthly payments, debt defaults, or bankruptcy.

Consumers with excellent credit profiles typically pay interest rates below the 60 month average of 4.21%, while those with credit profiles in need of improvement should expect to pay much higher rates. The median credit score for consumers who obtain auto loans is 711. Consumers in this range should expect to pay rates close to the 5.27% mean.

When combined with other factors relevant to an applicants auto loan request, including liquid capital, the cost of the car, and the overall ability to repay the loan amount, credit scores indicate to lenders the riskiness of extending a loan to an applicant. Ranging from 300 to 850, FICO credit scores are computed by assessing credit payment history, outstanding debt, and the length of time which an individual has maintained a credit line.

How Does A Car Loan Work

In order to apply for a car loan, start by filling out a lenders car loan application form. On this form, you will be required to answer questions about your personal and financial information. Additionally, you will likely have to submit several other documents that may include any monthly debt obligations you have, monthly housing costs, notices of assessment, and other information including the make and model of the vehicle you plan to purchase.

Once all the paperwork has been submitted, your file will be reviewed by a lending specialist who will determine if you qualify for the loan. Keep in mind that applying with multiple lenders within a short period of time can actually have a negative effect on your credit score, so youll want to make sure to choose wisely.

If you are unsure if you will be able to afford the vehicle that you have chosen, you can do a pre-qualification. A pre-qualification is essentially the same as applying for a car loan, but your credit score isnt used during this process which means you can avoid a potential negative impact on your credit score.

Once you have been approved for the loan, you will either receive a lump sum for the amount in your bank account or if you are borrowing from the dealership itself, youll be able to take the vehicle and then start making the payments.

Don’t Miss: How To Get An Rv Loan With Bad Credit

How Do You Get Prequalified For An Auto Loan

You can get prequalified for an auto loan online and without ever leaving your home. All you have to do is select one of the lenders on this list and choose its online option to get prequalified or apply for a loan. Many lenders let you get prequalified for an auto loan without a hard inquiry on your credit report.