Fha Loans In Nc And Sc

Are you looking for an FHA loan in North Carolina or South Carolina? Dash Home Loans offers FHA loans for qualified home buyers throughout the Carolinas.

FHA loans, which are backed by the Federal Housing Administration , may help qualify for a home if you do not meet other requirements. Theyre ideal for individuals and families with low to moderate income and less than perfect credit scores.

More About Fha Loan Down Payments

1) Remember, the FHA does not offer down payment assistance. That doesn’t mean the agency doesn’t provide resources that can help you locate a DPA program in your area. These programs must meet adhere to federal regulations when providing down payment help to borrowers.

2) If you are concerned about your ability to credit qualify for an FHA mortgage, talk to a participating lender and ask some advice about your chances and what can help get you closer to loan approval. There’s no substitute for good credit and you’ll want to review your credit report long before you start filling out loan paperwork.

3) Your rental history can help boost your credit if you pay on time and have a pattern of doing so. But the catch is that your landlord must report this activity to the credit agencies. You’ll need a minimum of 12 months of on-time rent and utility payments anything less can seriously hurt your chances for loan approval.

Why The Change In Credit Score Requirements

The COVID-19 pandemic forced mortgage lenders to raise credit score standards on most loans. With many homeowners struggling to stay current with their payments, lenders are doing what they can to minimize risk. We encourage you to look into these mortgage lending changes yourself and to get in touch with our team for further assistance.

You May Like: How Can I Refinance My Car Loan With Bad Credit

Ask Freedom Mortgage About Fha Loans

Freedom Mortgage is the #1 FHA lender2 in the United States. To get started with your FHA loan application, contact a Freedom Mortgage Loan Advisor by visiting our Get Started page or by calling .

See Chapter 3 of the HUD Handbook 4150.2 for more information on the health and safety requirements of homes purchased with FHA loans. All chapters of the handbook can be found here.

Federal Housing Administration Minimum Property Standards

When a homebuyer takes out a mortgage, the property serves as collateral for the loan. In other words, if the borrower stops making the mortgage payments, the mortgage lender will eventually foreclose and take possession of the house. The lender will then sell the house as a way of reclaiming as much of the money still owed on the loan as possible.

Requiring that the property meet minimum standards protects the lender. It means that the property should be easier to sell and command a higher price if the lender has to seize it.

At the same time, this requirement also protects the borrower: It means they will not be burdened with costly home repair bills and maintenance from the start. In addition, with a fundamentally sound place to live, the borrower may have more of an incentive to make their payments in order to keep the home.

Also Check: Usaa Preferred Car Dealers

Termites And Other Insect Infestations

Termites can significantly damage the structure of any building made of or containing wood. Unfortunately, the damage can occur long before its discovered which means it may be severe by the time an appraiser identifies it, and it can be costly to remediate.

FHA appraisers also look for signs of other pest infestations, including rodents and cockroaches. If the house shows signs of termites, a licensed termite inspector will need to inspect the home and rid it of infestation. Any damage will also need to be repaired.

Homebuyers can pay for in-depth pest inspections before they close on the home as well. A pest inspector will investigate the possibility of not just rodents, roaches, and termites, but wasps, carpenter ants, bedbugs and fleas, and other harmful pests.

Related reading: FHA Loan Requirements 2021| Rates & Eligibility

Why Work With Dash Home Loans For Fha Loans

Dash Home Loans offers FHA loans in NC and FHA loans in SC. When you apply for an FHA loan with us, our team will go to work to help you find the best rates available to you. Well discuss each type of FHA loan, what the qualifications are, and help you understand the options available based on your unique situation.

When you apply, we can give you an idea of how much of a home loan you qualify for as well so you have a better idea of just how much house you can afford. If you already have a home with a specific purchase price in mind, our team can use an FHA loan mortgage calculator, to provide insight into what your estimated monthly payment will be.

But most importantly, applying for an FHA loan from Dash means youll experience a simpler, easier mortgage process with the best support available. Skeptical? Check out our reviews.

You May Like: What To Do If Lender Rejects Your Loan Application

Where To Learn More

This FHA document checklist was adapted from HUD Handbook 4155.1, Chapter 1, Section B. Youll find this handbook on our HUD guidelines page. You can also find it on the HUD.gov website with a quick Google search. Chapter 1 of this handbook provides a lot of supporting information relating to documentation requirements. Its well worth a read, for anyone planning to use this program.

Disclaimer: This article explains the standard documentation requirements for FHA loans and also provides a minimum document checklist. This is a partial list that does not cover all possible lending scenarios. While this checklist includes some of the most commonly requested documents, it is not exhaustive. Your lender might require additional forms that are not listed above. Every lending scenario is different because every borrower is different. Mortgage companies typically provide borrowers with a complete list of FHA documents needed to close the loan. Borrowers can request a paperwork checklist before applying for this program, or any other type of financing.

Fha Mortgage Insurance Requirements

Lenders are willing to offer FHA loans because they know that in the worst case scenario, where they have to foreclose on a home, the FHA will pay them back. That’s why you’ll sometimes see the FHA described as insuring home loans.

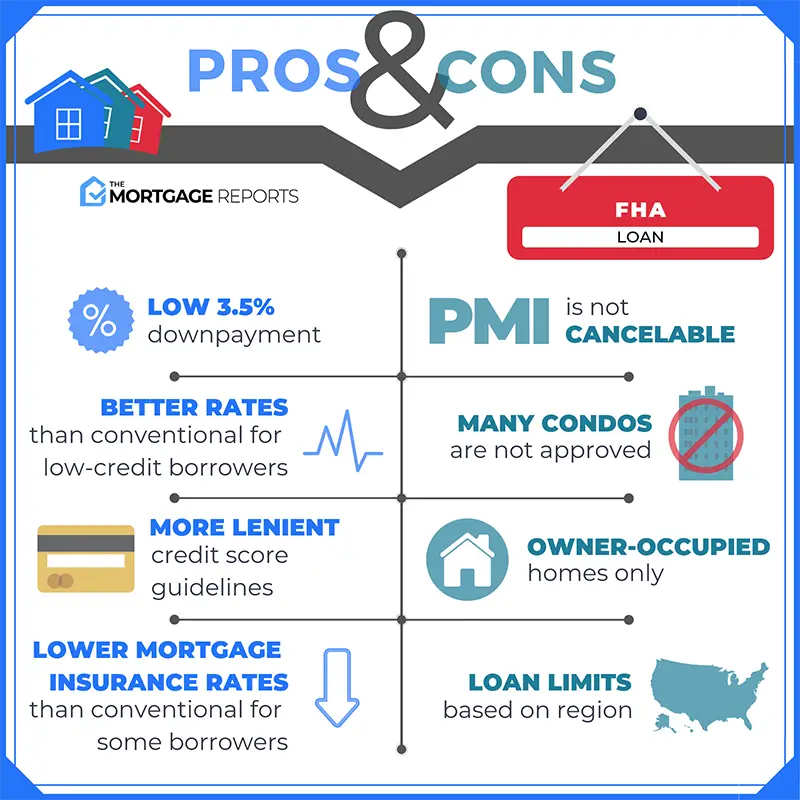

That FHA backing is funded by you, the homeowner, via FHA mortgage insurance. You’ll be required to make an upfront mortgage insurance premium equal to 1.75% of the loan amount at closing, though this can be rolled into the loan. After that, you’ll make monthly mortgage insurance payments. If your down payment is 10% or more, you’ll have to make these payments for 11 years.

But if you make a down payment of less than 10% on an FHA loan, the only way to get out of paying monthly FHA mortgage insurance is to refinance into a conventional loan. FHA mortgage insurance can’t be canceled the way private mortgage insurance can. The amount of insurance you’ll pay is calculated based on the length and total cost of your mortgage as well as the amount of your down payment.

You May Like: Loan Processor License California

Yes Or No For Down Payment Sources

What if you can’t come up with the entire down payment on your own? Lenders will require the full amount of money as the required down payment, but friends, family, and employers can make a down payment gift to you that reduces your financial burden. That money is required to be verified by the lender as having come from an approved source.

The FHA doesn’t just list who may give such a gift–it also has rules discussing who MAY NOT provide gift funds for an FHA loan down payment. The gift donor may not be a person or entity with an interest in the sale of the property, such as the seller, real estate agent, or the builder.

FHA loan rules are specific and clear in these areas to insure fairness and to preserve the integrity of the home buying process with FHA loan funds.

Why Rent When You Can Own With An Fha Loan

The down payment is the out-of-pocket investment you make when you buy your property. The required amount is generally calculated as a percentage of the purchase price, determined by the requirements of the loan. This upfront payment is essentially seen as your investment in the mortgage, since you stand to lose it if you’re unable to meet your monthly payment obligations.

Don’t Miss: Which Bank Is Better For Personal Loan

How To Find An Fha Lender And Apply For An Fha Loan

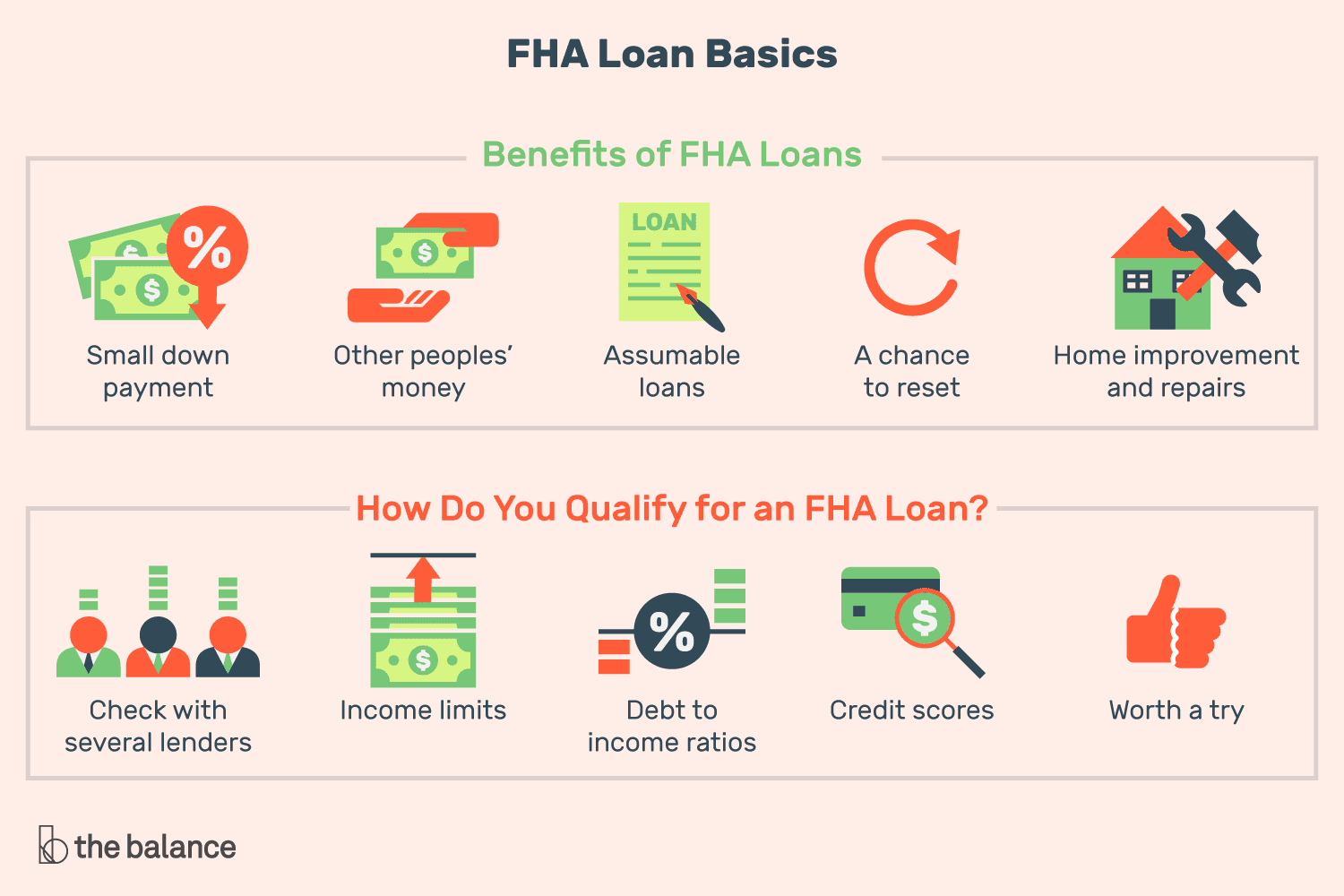

FHA borrowers get their home loans from FHA-approved lenders, which can have different rates, costs and underwriting standards even for the same loan. FHA loans are available through many sources, from the biggest banks and credit unions to community banks and independent mortgage lenders.

Applying for an FHA loan requires a few key steps:

- Know your budget. Before you submit an application for an FHA loan, youll want to know how much you can afford to spend on a home. Consider your current income, expenses and savings, and use Bankrates mortgage calculator to estimate your monthly payments based on different home prices and different sizes of down payment.

- Compile your documents. Applying to borrow a large chunk of money means handing over a complete look under the hood of your finances. Before you apply for an FHA loan, have all these documents ready to go: two years of tax returns two recent pay stubs your drivers license and full statements of your assets and any other places where you hold money).

- Compare your offers.Getting preapproved with multiple lenders is helpful so you can compare different rates and terms to make sure youre getting the best deal.

Fha Appraisal Vs Inspection

Appraisals and inspections are not the same thing, and its important to understand the difference.

Your mortgage lender will require an appraisal to assess the fair market value of the home. The appraiser will also look for signs of structural integrity and livability, verify that there is sufficient access to heat, water, sewage, and electricity, and theyll note any potential hazards.

Appraisals are mandatory in the homebuying process, and youll pay for the appraisal fee at closing. The cost is typically around $500, though FHA appraisals can cost a little more, and fees may vary based on where you live.

As useful as appraisals are, they are not meant to be home inspections. A licensed home inspector goes much deeper than an appraiser.

Inspections are not mandatory but that doesnt mean you should skip them. If appraisals are largely for the lenders benefit, inspections are for yours.

A home inspector will provide an in-depth look at the condition of your home. Theyll test the plumbing, heating, and electrical systems, and theyll also look for structural issues. An inspector checks the appliances, and they can also test for high levels of radon or mold. You can also request a pest inspection to check for signs of termite damage or rodent infestations.

A general inspection is usually around $500, and you pay that out of pocket. If you decide to get specialist inspections, such as a pest or septic inspection, those can range from $150 to several hundred dollars.

Read Also: How Much To Loan Officers Make

How To Avoid Borrowing Too Much

Theres nothing worse than taking out a loan just to have it increase your monthly bill. To avoid the pitfalls, you should set a limit on the amount that you are willing to borrow. Then check your credit score and how much income you make use this information to determine what kind of loan is best for you.

In order to avoid borrowing a lot of money, you should know your budget and how much you can afford to borrow. Youll also have to determine how long you need the loan for and whether or not that time frame is more than one year. If it is more than one year, make sure that the lender has a good amount of time to collect on your loan before they start charging interest.

The Home Inspection And Appraisal

The FHA home appraisal is required before closing to determine the market value of the property. Depending on the size of the house, the average appraisal cost is $300-$600. The FHA home inspections are done before closing to ensure the home meets minimum property requirements. Home inspections cost $250-$400 on average, depending on the homes square footage.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

What Happens If The Appraiser Marks Something For Further Repair

The appraiser may note that items need to be corrected or may need further inspection. If so, they will mark it “as-repaired” meaning, the value of the home and eligibility for meeting the Minimum Property Requirements is conditionally based on the repair of the item.

Some conditions are fixable and can easily be addressed with repairs, in which case, the home will be approved conditionally. But in other instances where significant repairs are necessary, the lender may reject the property.

How Do Fha Loans Work

FHA loans are backed by the Federal Housing Administration, which means that, if you default on the loan, the federal government guarantees to the lender that it will answer for the loan.

The FHA doesnt lend you the money directly instead, you borrow from an FHA-approved lender like a bank or credit union.

You May Like: How To Find Student Loan Number

Be Safe Not Sorry With Your Credit

Obviously, it’s better to have good credit than bad credit when applying for any loan. Don’t take your credit history for granted, though, because you might find an error or inaccuracy that could hurt your chances of qualifying for an FHA loan. Instead of going through the headache of disputing your application with your agency and holding up the process, be proactive and make sure your credit score and ratings are where they should be before approaching the FHA.

Fha Loans And Credit Score

There are a lot of factors that determine your , including:

- The type of credit you have

- Whether you pay your bills on time

- The amount you owe on your credit cards

- How much new and recent credit youve taken on

If you have a higher score, you might be able to qualify with a higher debt-to-income ratio, or DTI. DTI refers to the percentage of your monthly gross income that goes toward paying debts. Your DTI is your total monthly debt payments divided by your monthly gross income . This figure is expressed as a percentage.

To determine your own DTI ratio, divide your debts by your monthly gross income. For example, if your debts, which include your student loans and car loan, reach $2,000 per month and your income is $8,000 per month, your DTI is 25%.

The lower your DTI, the better off youll be. If you do happen to have a higher DTI, you could still qualify for an FHA loan if you have a higher credit score.

The FHA states that your monthly mortgage payment should be no more than 31% of your monthly gross income and that your DTI should not exceed 43% of monthly gross income in certain circumstances if your loan is being manually underwritten. As noted above, if you have a higher credit score, you may be able to qualify with a higher DTI.

You May Like: Va Home Loan For Mobile Home

Benefits Of Fha Loans: Low Down Payments And Less Strict Credit Score Requirements

Typically an FHA loan is one of the easiest types of mortgage loans to qualify for because it requires a low down payment and you can have less-than-perfect credit. For FHA loans, down payment of 3.5 percent is required for maximum financing. Borrowers with credit scores as low as 500 can qualify for an FHA loan.

Borrowers who cannot afford a 20 percent down payment, have a lower credit score, or cant get approved for private mortgage insurance should look into whether an FHA loan is the best option for their personal scenario.

Another advantage of an FHA loan it is an assumable mortgage which means if you want to sell your home, the buyer can assume the loan you have. People who have low or bad credit, have undergone a bankruptcy or have been foreclosed upon may be able to still qualify for an FHA loan.

What Are The Types Of Fha Loans

The FHA offers a variety of loan options, from fairly standard purchase loans to products designed to meet highly specific needs. Here’s an overview of FHA loans commonly used to buy a house:

» MORE: Learn more about FHA 203 loans and Title I loans

|

FHA Loan Type |

|

|---|---|

|

Can be used to make improvements that make the home more energy-efficient. |

The home must be professionally assessed to qualify. Improvements must be deemed cost-effective. |

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Fha Loan Down Payments

Your down payment is a percentage of the purchase price of a home and is the upfront amount you put down for that home. The minimum down payment youre able to make on an FHA loan is directly linked to your credit score. Your credit score is a number that ranges from 300 850 and is used to indicate your creditworthiness.

An FHA loan requires a minimum 3.5% down payment for credit scores of 580 and higher. If you can make a 10% down payment, your credit score can be in the 500 579 range. Rocket Mortgage® requires a minimum credit score of 580 for FHA loans. A mortgage calculator can help you estimate your monthly payments, and you can see how your down payment amount affects them.

Note that cash down payments can be made with gift assistance for an FHA loan, but they must be well-documented to ensure that the gift assistance is in fact a gift and not a loan in disguise.