Your Equity Amount Will Help You Pick The Best Option

The more youve paid toward your home mortgage, the more financial options you have as you accumulate equity. Home equity loans and refinances are two options to get cash out of your homeownership.

The two arent one and the same, though. While both rely on the equity youve built in your home, the similarities between these financial products stop there. From how theyre used and when to use them to what they cost, home equity loans and refinances are starkly different options, each with its own pros, cons, and best uses.

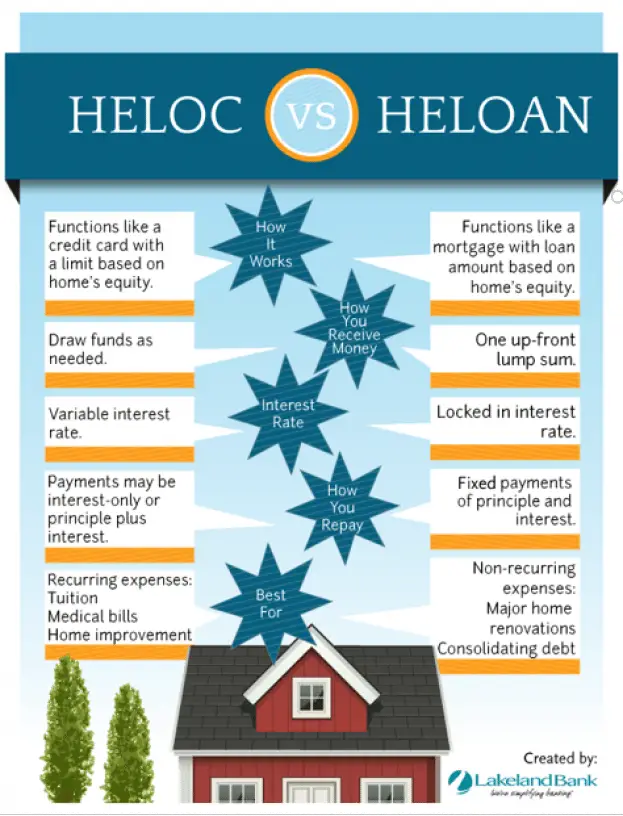

How A Home Equity Like Of Credit Works

Home equity lines of credit are another type of second mortgage that let you borrow cash from your home equity without changing the terms on your first mortgage.

In some ways, HELOCs are more like credit cards than home equity loans. Because you get a credit line you can borrow against, repay, and borrow again. And you pay interest only on your outstanding balance.

And HELOCs differ from HELs in another way.

Home equity loans are installment loans, like a mortgage or auto loan. You borrow a lump sum and pay it back in equal installments over the loans fixed term, usually at a fixed interest rate. So theyre predictable and easy to budget for.

But, with HELOCs, you typically get a loan in two parts.

- During your draw period you pay only interest, usually at a variable interest rate, on your current balance

- Then comes the repayment period, which can often last for half the draw period. During that time, you cant borrow any more but have to zero your debt before that period ends, while keeping up interest payments

HELOCs can be great for people whose incomes fluctuate a lot, such as contractors, freelancers, and those in seasonal jobs. But theyre dangerous for those who are bad money managers. If you tend to max out your credit cards, you may well do the same with a HELOC.

When To Use A Mortgage Over A Home Equity Loan

Choosing a cashout refinance over a home equity loan can be a good way to keep your monthly expenses low. Remember that payments are typically cheaper because youre only paying one mortgage rather than two.

A cashout refinance is also the better option if you need to refinance anyway. Suppose your current mortgage rate is 4% but you could refinance to a 3% one. Youd slash your monthly payments. And your savings would soon pay for your closing costs.

Of course, if you take a lot of cash out with your refinance, you may still end up with a higher monthly payment. But youll have that lump sum, too. And you can do anything you like with the funds, just as with a home equity loan.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Harmful Home Equity Practices

You could lose your home and your money if you borrow from unscrupulous lenders who offer you a high-cost loan based on the equity you have in your home. Certain lenders target homeowners who are older or who have low incomes or credit problems and then try to take advantage of them by using deceptive, unfair, or other unlawful practices. Be on the lookout for:

- Loan Flipping: The lender encourages you to repeatedly refinance the loan and often, to borrow more money. Each time you refinance, you pay additional fees and interest points. That increases your debt.

- Insurance Packing: The lender adds credit insurance, or other insurance products that you may not need to your loan.

- Bait and Switch: The lender offers one set of loan terms when you apply, then pressures you to accept higher charges when you sign to complete the transaction.

- Equity Stripping: The lender gives you a loan based on the equity in your home, not on your ability to repay. If you cant make the payments, you could end up losing your home.

Home Equity Loan Cons

Since home equity loans are a second mortgage, youre going to pay a higher rate than you would if it were your first mortgage because lenders assume youre going to make payments on your primary mortgage first.

Your home equity loan lender gets a lien on your house, but the primary lenders lien takes precedence. In exchange for the additional risk, the lender on the second mortgage will charge you more.

Additionally, home equity loans taken out to do things other than build, buy or improve your home haven’t featured tax-deductible interest since the 2017 tax year.

The last downside is that you have two mortgage payments to worry about. This last one is a big factor. Two mortgages can put a real strain on the monthly budget, so do the math and make sure you can make it work before you proceed.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

What Is Combined Loan To Value Ratio

One of the most important factors impacting your ability to obtain a home loan is whats known as the combined loan-to-value ratio. The CLTV is the borrowers overall mortgage debt load, expressed as a percentage of the homes fair market value.

Lenders calculate the combined loan to value ratio by adding up all mortgage debt and dividing the total by the homes current appraised value.

- Formula: / Appraised value

- Example: Morgan owes $60,000 on the primary mortgage and wants to take out a HELOC for up to $15,000. The house is worth $100,000. The CLTV is 75%: / $100,000 = 0.75

Lenders take the CLTV ratio into account when considering whether to approve your home equity loan application.

The CLTV, along with an analysis of monthly income, monthly debt and other factors, will help determine if you qualify for a home equity loan, and if so, how much you may be eligible to borrow, says Tiffany Brown, broker owner and loan originator for Motto Mortgage Summit.

Distinctive Features Of Cash

You’ve probably heard of a refinance before, and a cash-out refinance is the same thing, but you borrow extra so you’ll walk away with cash at closing. A cash-out refinance entirely replaces your existing mortgage with a new mortgage. You’ll get the new mortgage at today’s interest rates, which may be an improvement over the rate you originally got on your mortgage. The additional money you borrow is part of your mortgage, and you make just one monthly payment. However, you have to pay all of the closing costs associated with a refinance, which often amount to 3 percent to 6 percent of your mortgage amount.

Also Check: Does A Loan Processor Have To Be Licensed In California

When Refinancing Is Better

A cash-out refinance is usually the best choice if you can refinance at a significantly lower interest rate than you’re paying on your existing mortgage. It’s also a good option if you can’t afford to make the additional monthly payments that would be required on a home equity loan. Especially if you have had your mortgage several years already, adding to its balance and extending the repayment term back out to 30 years should not affect your monthly payments much.

Getting A Second Mortgage

A second mortgage is a second loan that you take on your home. You can borrow up to 80% of the appraised value of your home, minus the balance on your first mortgage.

The loan is secured against your home equity. While you pay off your second mortgage, you also need continue to pay off your first mortgage.

If you cant make your payments and your loan goes into default, you may lose your home. If thats the case, your home will be sold to pay off both your first and second mortgages. Your first mortgage lender would be paid first.

Don’t Miss: Loan Officer License Ca

Renewal Vs Refinance: Whats The Difference

Home mortgages in Canada are actually not normally paid off over the life of the term. This is because, usually, lenders amortize the loan for a period between 15 and 30 years. However, the longest allowable loan you can receive from a Canadian bank is for ten years.

The Difference Between Renewing and RefinancingA renewal of a mortgageRefinancingWhen is it Best to Refinance?

When To Use A Home Equity Loan Instead Of A Mortgage

A home equity loan is typically a better choice than a cashout refinance if your current mortgage is almost paid off, or if you already have an ultralow mortgage rate.

You might also opt for a home equity loan if you can afford a higher monthly payment and want to save more in the long run. Remember that a HEL will likely cost more monthtomonth but youll pay it off a lot sooner than a cashout mortgage.

Youll also save on closing costs. And, while the interest rate you pay may be higher, the fact youre borrowing less for a shorter period typically means youll be better off over the long term.

You can use our refinance calculator to run your numbers.

Don’t Miss: Refi An Fha Loan

What Is A Home Equity Loan

A home equity loan is a second loan thats separate from your mortgage and allows you to borrow against the equity in your home.

Unlike a cash-out refinance, a home equity loan doesnt replace the mortgage you currently have. Instead, its a second mortgage with a separate payment. For this reason, home equity loans tend to have higher interest rates than first mortgages. Rocket Mortgage® doesnt offer home equity loans at this time.

How Borrowing On Home Equity Works

You may be able to borrow money secured against your home equity. Typically, interest rates on loans secured against home equity can be much lower than other types of loans.

Not all financial institutions offer home equity financing options. Ask your financial institution which financing options they offer.

You must go through an approval process before you can borrow against your home equity. If youre approved, your lender may deposit the full amount you borrow in your bank account at once.

You can borrow up to 80% of the appraised value of your home.

From that amount, you must deduct the following:

- the balance on your mortgage

- your total HELOC amount, if you have one

- any other loans secured against your home

Your lender may agree to refinance your home with the following options:

- a second mortgage

- a loan or line of credit secured with your home

Also Check: What Credit Score Is Needed For Usaa Auto Loan

If You Decide To Cancel

If you decide to cancel, you must tell the lender in writing. You may not cancel by phone or in a face-to-face conversation with the lender. Your written notice must be mailed, filed electronically, or delivered, before midnight of the third business day.

If you cancel the contract, the security interest in your home also is cancelled, and you are not liable for any amount, including the finance charge. The lender has 20 days to return all money or property you paid as part of the transaction and to release any security interest in your home. If you received money or property from the creditor, you may keep it until the lender shows that your home is no longer being used as collateral and returns any money you have paid. Then, you must offer to return the lenders money or property. If the lender does not claim the money or property within 20 days, you may keep it.

If you have a bona fide personal financial emergency like damage to your home from a storm or other natural disaster you can waive your right to cancel and eliminate the three-day period. To waive your right, you must give the lender a written statement describing the emergency and stating that you are waiving your right to cancel. The statement must be dated and signed by you and anyone else who shares ownership of the home.

The federal three day cancellation rule doesnt apply in all situations when you are using your home for collateral. Exceptions include when:

How To Fund Your Retirement Years

This is the first part of a series that explores the subject of retired Canadians and their finances. For example, what is the difference between a mortgage refinance and a second mortgage? Is a home equity loan considered a second mortgage? We will try to answer important questions about accessing home equity loans for retirement income.

Most aging Canadians want to enjoy the comfort of staying in their own homes, but the rising cost of living and ever-increasing home maintenance expenses make it harder for them to do so. A 2018 national survey by Sun Life Financial found that a quarter of Canadian retirees are in debt. Benefits Canada quotes surveys by RBC Insurance and TD Bank showing that many Canadians are worried about not having sufficient funds post retirement.

Let us examine 3 reasons why Canadians are outliving their retirement savings.

Read Also: Can You Refinance An Fha Loan

Home Equity Lines Of Credit

A home equity line of credit also known as a HELOC is a revolving line of credit, much like a credit card. You can borrow as much as you need, any time you need it, by writing a check or using a credit card connected to the account. You may not exceed your credit limit. Because a HELOC is a line of credit, you make payments only on the amount you actually borrow, not the full amount available. HELOCs also may give you certain tax advantages unavailable with some kinds of loans. Talk to an accountant or tax adviser for details.

Like home equity loans, HELOCs require you to use your home as collateral for the loan. This may put your home at risk if your payment is late or you can’t make your payment at all. Loans with a large balloon payment a lump sum usually due at the end of a loan may lead you to borrow more money to pay off this debt, or they may put your home in jeopardy if you cant qualify for refinancing. And, if you sell your home, most plans require you to pay off your credit line at the same time.

Home Equity Loan Vs Mortgage: The Bottom Line

Chances are, this debate closed down for many readers when they learned that a cashout refinance would almost certainly be less costly in the short term. Many of us, especially if were younger, have no choice but to focus on minimizing our current outgoings and letting the future take care of itself.

But those who can afford to take a strategic view of their finances may well find that a home equity loan saves them money in the long run. And, for them, that really is the bottom line.

Recommended Reading: Transfer Car Loan To Another Bank

Why Use Equity Money Instead Of Refinancing The Property To Obtain Cash

For many people, using home equity is a better choice than a refinance of an existing mortgage. Which is best ultimately depends upon what the purpose is for adjusting a current financial situation and how much cash is needed.Home equity line of credit loans normally have a reasonably low interest rate versus other types of loans making it a potentially cheaper form of financing. HELOC is better if an existing mortgage has a low interest rate.

One of the smartest ways to use a home equity loan is for homeowners considering a remodel for their existing house with its already low mortgage rate rather than buying a bigger home at a higher interest rate. If a homeowner uses the equity in your home to finance a remodel, and can eventually add more value to your home.

A refinance of an existing mortgage may be preferred if a large amount of cash is desired, and repayments can be spread out over a longer time. Refinance loans are a good way to obtain a lower rate than exists with an old high rate mortgage.

Is The Interest Paid Tax

Interest paid on home equity loans and HELOCs should be tax-deductible so long as the funds you borrowed are used for home improvements. According to the IRS, the proceeds must be used to buy, build or substantially improve the taxpayers home that secures the loan.

A cash-out refinance is treated like any first-lien mortgage. If you itemize deductions for the 2020 tax year, you can deduct interest paid on the first $750,000 of the mortgage.

To dig into the details on either scenario, talk to a trusted tax advisor.

Don’t Miss: Defaulting On Sba Loan

Know Your Options: Heloc Home Equity Loan Or Cash

While a cash-out refinance makes the most sense in terms of current rates, its not the only option. Home equity loans and home equity lines of credit are common ways homeowners can tap into their home equity for things like home improvement, debt consolidation, or even paying for a childs college tuition.

| Cash-Out Refinance |

|---|

Home Equity Loans Vs Refinance Whats The Difference

With todays low rates, you might be hearing a lot about refinances and home equity loans. But do you know the differences between these two transactions? Both give you the opportunity to take advantage of your homes equity, but there are some key distinctions. Lets break down these types of home financing and what might work best for your situation.

Also Check: Fha Loan Maximum Texas