How Does A Parent Plus Loan Work

10 Minute Read | September 24, 2021

A Parent PLUS Loan is anything but a plus for your financial goals. In fact, this kind of borrowing is a special kind of toxic because it involves a student and their mom or dad. The only thing worse than debt is the kind that hangs over a family relationship! But dont freak out if youre already in one. There are steps you can take to pay it off fast. And if youre just considering taking on a Parent PLUS Loan, were going to talk you through how it worksand how it fails.

Fill Out The Fafsa And Check Your Student Aid Award

Before you apply for a parent PLUS loan, your student needs to submit the FAFSA and receive their financial award notice. Unlike the parent PLUS loan application, the FAFSA application doesn’t ask about your credit history, and there’s no credit check. So, completing the FAFSA does not impact your credit score in any way.

Schools your child has been accepted to will use the information from the completed FAFSA to determine how much financial assistance your child is eligible for. If your student has been accepted to more than one school, the financial aid awarded will likely differ for each. If at that point you determine you will need more financial assistance for your child to attend the school of their choice, you can apply for a parent PLUS loan.

Keep in mind that your student will need to fill out the FAFSA for each school year, and you will need to apply for a new parent PLUS loan each school year you require it.

What If I Am Denied For A Direct Plus Loan

Dependent undergraduate students, if your parent is unable to secure a PLUS loan, you may be eligible for additional unsubsidized loans to help pay for your education. You would need to provide the PLUS Loan Application and the denial letter from the Department of Education. The additional Unsubsidized Loan your are eligible for would be offered on your Student Center after processing.

Recommended Reading: How Do Lenders Verify Bank Statements

How Are Loan Proceeds Paid

Loan proceeds are applied by the Coe College Office of Financial Aid directly to the student account, provided that all administrative requirements have been met. A loan for two terms will be divided in half. We will send an email to the address you provide on the Parent Loan application to let you know that the loan is approved and the final loan amount. Please review this email and contact our office with any questions.

Why You Should Plan Carefully When Borrowing A Parent Loan

Once youve carefully researched loan options and learned when and how to apply for a parent PLUS loan, you can make an informed decision about how best to fund your childs education.

Remember to consider how student loan debt will affect your future. You dont want to jeopardize your retirement security, so find the most affordable loan you can and consider creating a plan for early repayment.

Christy Rakoczy and Andrew Pentis contributed to this report.

Also Check: Usaa Personal Loan Credit Requirements

Can You Transfer A Federal Parent Plus Loan To A Student

You cannot transfer responsibility for the PLUS loan to your student through the Department of Education. However, you can refinance Parent PLUS Loans with a private lender that allows your child, if theyre creditworthy, to assume responsibility for the new loan.

Note that any time you refinance a federal loan with a private lender, you replace the loan with a private loan and lose borrower protections that come with federal student loans.

Parent Plus Loan Deadlines

Because the Parent PLUS Loan requires the FAFSA, students should follow the appropriate FAFSA deadline .

The FAFSA opens on October 1st every year for the upcoming school year. It closes on June 30 of the school year the FAFSA is used for. For example, the 21/22 FAFSA opened on Oct 1, 2020, and it will close on June 30, 2022.

Remember, the Parent PLUS loan includes the extra step of the supplementary application, so keep that in mind!

Recommended: Nitro $2,000 Scholarship for Parents

Recommended Reading: Bayview Mortgage Modification

What To Avoid In Your Parent Plus Application

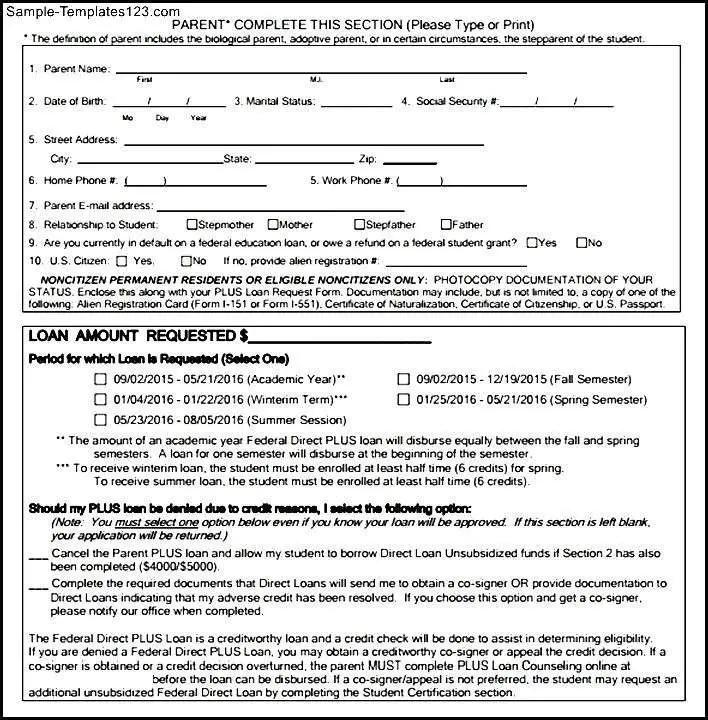

When filling out the parent PLUS application, make sure that you have all the correct information and fully understand the eligibility requirements. Here are a few key things to avoid when applying:

- Dont apply before your child completes the FAFSA. Although the parent must fill out the application for the parent PLUS loan, the child must complete the FAFSA first.

- Dont apply if you are not the parent of an eligible college student. Only parents biological or adoptive can apply for a parent PLUS loan. Grandparents do not qualify. However, a stepparent may apply in certain cases.

- Remove any credit freezes you may have before applying. If you have a security freeze on your credit file, you must remove the freezes with each credit bureau before submitting your application. If you do not, your application will not be processed.

- Apply using the correct process for your childs school. Most schools use the online application through the Department of Educations website. However, some schools have a different process. When you are filling out the application, select the correct school and the website will let you know how to apply.

Parent Plus Loan Limits

You can borrow up to your childs full cost of attendance each school year, minus all other student aid. Your childs school sets the cost of attendance, which is a sum of all education-related expenses.

Student aid such as scholarships, grants, or your childs student loans are applied to this total cost. The difference between student aid granted and remaining costs is how much you can borrow with parent PLUS loans.

Read Also: Rv Payment Calculator Usaa

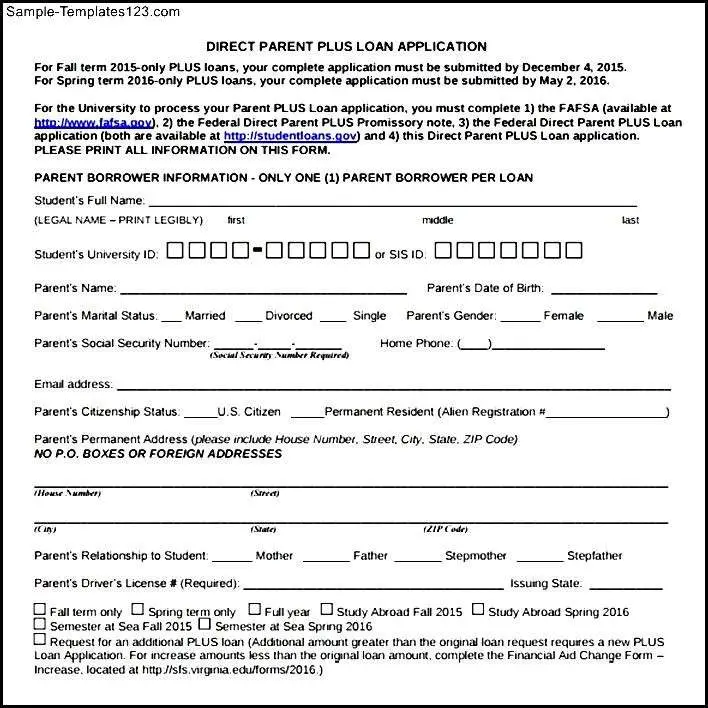

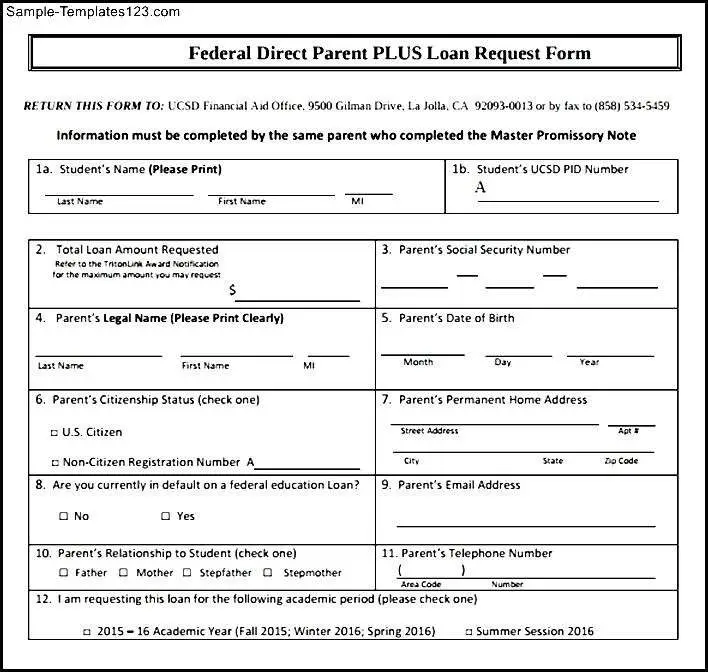

Applying For A Parent Plus Loan

The first step to apply for a Parent PLUS Loan is to complete the FAFSA® form with the student. Then, parents can log in at StudentLoans.gov, choose the Parent Borrowers tab, and the Apply for a PLUS Loan link.

Most schools require you to apply for Direct PLUS Loans online, however, some may have different application processes that you must follow. Studentaid.gov provides a list of schools that allow you to apply online. If your school is not on this list, check with the schools financial aid office to verify the application process you must follow.

Those who qualify for a Parent PLUS loan, will have to sign a Direct PLUS Loan Master Promissory Note . This document verifies that the borrower agrees to the terms of the loan. Each school may have a different process, double check with the financial aid office to ensure you understand the specific process for your students school of choice.

Keep in mind, those borrowing more than one parent PLUS loan for separate children, will need to sign multiple MPNs.

You Can Borrow Up To The Total Cost Of Attendance

Federal loans for undergraduate students have annual and aggregate limits, preventing a student from taking on more debt. By contrast, parent PLUS loans dont have limits. You can borrow up to the school-certified cost of attendance. And if you have multiple children, you can take out PLUS loans for each child.

Read Also: Defaulting On Sba Loan

Parent Plus Loans Pros And Cons

-

Borrow beyond federal student loan limits for undergraduates, up to your students full cost of attendance.

-

Get fixed student loan rates. All PLUS loan borrowers get the same fixed student loan rate, set by law each school year.

-

Access to federal student loan benefits such as forbearance, deferment, and even forgiveness.

-

Choose from four repayment plans, including an income-driven option.

-

The parent is legally responsible to repay this student loannot the student.

-

Non-adverse credit history required to qualify for a parent PLUS loan.

-

PLUS Loan rates are 2.55 percentage points higher than federal student loans for undergraduates.

-

High origination fee, taken out of loan funds before disbursement.

-

Not eligible for all federal student loan repayment plans.

Financing Your Childs College Education

As a parent, you want the very best for your child. If youd like to help them pay for college and intend to take out student loans on their behalf, you can use parent PLUS loans to cover some or all of the cost. Youll have to apply for parent plus loans annually to get the aid you need.

However, student loans should be the last resort. Make sure you and your child maximize other financial options, including grants, scholarships and work-study programs, before borrowing money.

Don’t Miss: Usaa Used Auto Rates

Federal Parent Plus Loan Consolidation

If you have multiple parent student loans, federal loan consolidation is one option that can give you some relief. With this approach, you apply for a Direct Consolidation Loan for the total amount of your federal loans. Afterward, youll have just one loan instead of several, and you can even get a longer repayment term. Direct Consolidation Loans can have terms as long as 30 years.

If youre wondering how to consolidate parent PLUS Loans, the process is pretty simple: you can apply for a Direct Consolidation Loan online. Federal loan consolidation is free, and the application takes just a few minutes to complete.

Why Parent Plus Loans Dont Automatically Renew Each Year

Youre required to apply for the Parent PLUS Loan annually if youd like to receive funding for the year. This is because federal financial aid is distributed annually based on your childs Free Application for Federal Student Aid .

There are a lot of factors that go into determining financial aid , including:

- Your familys income and size,

- The number of children in college within your household, and

- Your childs cost of attendance .

These variables often fluctuate from year-to-year. Therefore, families are required to submit the FAFSA each academic year.

Additionally, unlike with other federal student loans, the Parent PLUS Loan requires a credit check. Your credit history can make or break whether youre approved for a Parent PLUS Loan. The U.S. Department of Education will evaluate your credit each year before handing over loan funds.

However, if you dont need or want a Parent PLUS Loan, theres no need to apply for it each year.

You May Like: Usaa Auto Loans Rates

Need Money For College

Summary of how Parent PLUS Loans work

- Applying for Parent PLUS loans starts by filling out the FAFSA.

- The next step is downloading a promissory note from the school financial aid website.

- The approved loan amount can be up to the full cost of attendance minus other forms of financial aid.

- Parent PLUS loans arent an all or nothing game. You can choose to borrow part of the amount offered and find other sources for the remaining cost of attendance.

Parent PLUS loan eligibility requirements

The eligibility requirements for a Parent PLUS loan are fairly simple. You must be the biological or adoptive parent of a dependent undergraduate student enrolled at least half-time. You generally must meet minimal credit standards, and the student must meet general eligibility requirements for financial aid.

Student eligibility requirements are also straightforward. Students must be a U.S. citizen or eligible non-citizen, and not have previous student loan defaults that havent been resolved or consolidated into a federal direct loan. Male students who are citizens and age 18 to 25 need to register for the Selective Services. Parents also must be U.S. citizens or eligible non-citizens.

If you dont qualify, there are alternative ways to get funding that the federal government supplies.

Heres what you need to know about the credit requirements for a Parent PLUS Loan:

In the two years before the date your credit is pulled:

In the five years before the date your credit is pulled:

These Loans Can Help Pay For Collegewhile Also Leading To Debt Troubles

Imagine this scenario: Your son or daughter has been out of college for over a decade and moved on to a successful career. Your own career is coming to a close and retirement is only a few years away. And yet, you still owe thousands of dollars for your childs college bills. This scenario is a reality for many parents who take out federal Direct PLUS Loans. While these loans might seem like an easy way for parents to help their child with education costs, in far too many cases, they put the parents financial security and retirement at risk.

You May Like: Drb Vs Sofi

How To Apply For A Private Student Loan

After you have done your research, it is time to fill out a private school loan application. Remember, if your credit score is below the excellent range, you will have a harder time getting a competitive APR rate. If you have the time to raise your credit score before applying for a private student loan, then do so. If your credit score is still too low or your credit history hasnt been fully established, you will need to find a family member or trusted individual with an excellent credit history that doesnt mind cosigning a loan with you. Being a cosigner is a big financial responsibilityif for some reason you fail to pay your loan, your cosigner will be responsible.

Filling out a private school loan application is straightforward, but you and your co-signer will need a few important documents, including the following:

- Your social security number

- Monthly rent or mortgage receipts

- Any other information that lays out your financial status.

You should also be prepared to share the following:

- The name of the college you are attending

- When youll be graduating

- Total college costs

- And how much you are requesting to borrow to cover those costs

You will also need to fill out the Private Education Loan Applicant Self-Certification form, which is provided by your school and will show the lender exactly what costs you face for your education.

Lender And Bonus Disclosure

All rates listed represent APR range. Commonbond: If you refinance over $100,000 through this site, $500 of the cash bonus listed above is provided directly by Student Loan Planner.

CommonBond Disclosures: Refinancing

Offered terms are subject to change and state law restriction. Loans are offered by CommonBond Lending, LLC , NMLS Consumer Access. If you are approved for a loan, the interest rate offered will depend on your credit profile, your application, the loan term selected and will be within the ranges of rates shown. If you choose to complete an application, we will conduct a hard credit pull, which may affect your credit score. All Annual Percentage Rates displayed assume borrowers enroll in auto pay and account for the 0.25% reduction in interest rate. All variable rates are based on a 1-month LIBOR assumption of 0.15% effective Jan 1, 2021 and may increase after consummation.

CommonBond Disclosures: Private, In-School Loans

Student Loan Planner® Disclosures

Don’t Miss: Maximum Fha Loan Amount In Texas

Parent Plus Loans Are Federal Student Loans Issued Directly To Parents They Take A Look At Your Credit Offer Some Flexibility In Repayment Options And The Ability To Fill Funding Gaps After Exhausting Federal Student Loans To Students Grants And Scholarships For The 2019

1. How do Parent PLUS loans work?

When families fill out the FAFSA, one of the options offered for funding are Parent PLUS loans. These loans are meant to supplement school, state, and other federal financial aid offered. is the first step. A credit assessment is performed to determine any late payments and recent defaults.

Then, parents fill out a promissory note from the school itself. The form may be downloaded from the schools financial aid office webpage or given to parents another way. Youll want to contact the school for their individual procedure.

Parent Plus Loans are awarded for up to the full cost of attendance minus other financial aid students received. Funds are sent directly to the school. Refunds for amounts beyond what is owed to the school are sent to the parent or to the student with the parents permission.

Important note: Parents dont have to borrow the full amount offered. For instance, families may decide to pay some of the money offered in the form of PLUS loans with one or a combination of installment plans from the college, tax credits, student income, their own income, and .

Options If Your Parent Plus Loan Is Denied

Not everyone will qualify for a parent PLUS loan, but if youre denied you can try these alternatives:

- Get an endorser for your Parent PLUS Loan. This is equivalent to a co-signer: someone with non-adverse credit who agrees to repay the loan if you dont.

- Document extenuating circumstances. Some examples of extenuating circumstances: adverse information thats incorrect, older than reported, or for accounts that are part of a bankruptcy settlement or otherwise resolved. Start the credit appeal process to provide proof of your extenuating circumstances. Youll also need to complete PLUS credit counseling.

If these steps dont work, and your parent PLUS loan is denied, even that can have an upside. Students whose parents cant get PLUS loans can gain access to more federal student loans.

A dependent first-year student can only borrow up to $5,500 in federal student loans per school year, for example. But that limit goes up to $9,500 if the students parents were denied PLUS Loans.

Read Also: Bayview Loan Servicing Tucson Az

What To Do If You Have A Plus Loan

If you took out a Direct PLUS Loan for your childs education and are struggling to pay it back, consolidation might be an option. Be aware, though, that while increasing the length of your loan will decrease your monthly payments, it will also increase the total amount you will have paid by the end.

Refinancing the PLUS loan is another possibility. In fact, even if you are not struggling to repay your loan, its worth looking into refinancing to see if you can secure a lower interest rate and monthly payments.

The smartest financial move is to try to pay as much as you can toward the loan while youre still earning money, even if it means you have to tighten your budget, and not take it with you into retirement.

Also try to avoid borrowing against your retirement funds, such as 401 plans, or cashing out of them early to cover the loan costs. Instead, if you are nearing retirement, consider working a few more years, if you are in any position to do so, to pay off the loan before retirement.

Read Also: Becu Car Repossession