Payments Resume 60 Days Following The End Of The Pause

Millions of borrowers are currently taking advantage of the administrative forbearance period initiated by the CARES Act in March 2020. Eligible loans include all federally held student loans, plus privately held FFEL loans that are in default.

With the forbearance period set to expire on June 30, 2023 or when the litigation over loan forgiveness is resolved borrowers who have not been making payments need to prepare to resume paying their balances. The Department of Education has said that borrowers can expect information and resources about resuming payments leading up to this date.

In the meantime, you can visit the Federal Student Aid website and your loan servicers website to ensure that your contact details are up to date so that youre informed when payments are set to resume.

Student Loan Repayment Freeze Extended Again: Here Are 7 Key Things To Know

The pause on student loan repayments have been extended once again, as the debt relief plan is tied up in courts.

STATEN ISLAND, N.Y. Millions of federal student loan borrowers were preparing to start repayments at the start of the new year, but President Joe Biden has announced yet another extension as the student loan forgiveness plan is tied up in court.

, Biden gave the update on the student debt relief plan that aims to help working- and middle-class borrowers by forgiving some of their debt. It provides eligible borrowers with full or partial discharge of loans up to $20,000 to Federal Pell Grant recipients and up to $10,000 to non-Pell Grant recipients.

But the plan has been blocked by a U.S. District Court in Texas. As a result, the StudentAid.gov website isnt accepting applications, and the government is seeking to overturn the orders.

And now, the federal government is extending the pause on student loan repayments while the courts make a decision about the plan.

Here are seven things to know about the pause extension.

When were student loan payments set to resume?

Borrowers were preparing to start repayments on Jan. 1, 2023, a day after the pause would officially end. However, many borrowers would have been able to apply for student loan debt relief before payments resumed.

What is the Biden administration doing about the court order?

Now, applications are no longer being accepted.

Why is the pause being extended?

I’m Already On An Idr Plan My Income Is Substantially Lower Than Before The Covid

Yes, you sure can. If your income has changed significantly, you can request a new payment amount based on your current income. To do so, visitStudentAid.gov,select the button next to “Recalculate my monthly payment,” and complete the recalculation request. You canalso call Great Lakes at 236-4300 to request an IDR plan recalculation over the phone. If you areapproved for a lower payment, after the payment pause ends, your monthly payments will resume at the newlower amount.

You May Like: Why Do Loan Companies Sell Loans

If Youre Pursuing Public Service Loan Forgiveness

Make sure you submit a new PSLF Employment Certification form and update your income and family size before the student loan recertification deadline, March 2023. The Education Department is allowing borrowers to self-report their income through July 31, 2022. That means you dont have to submit a tax return or pay stub when you report your income. If you submit the IDR application online, select Ill report my own income when you get to Step 2.

Note: Last October, the Education Department announced it would give retroactive credit toward public service forgiveness to borrowers working full-time for the government or an eligible nonprofit who hadnt yet had their loans forgiven. To receive credit, borrowers had to apply before the PSLF Waiver ended on October 31, 2022.

As of November, over 260 thousand borrowers have received over $24 billion in loan cancellations through the Public Service Loan Forgiveness Program and its waiver.

The U.S. Department of Education is continuing its work to improve PSLF. A few weeks back, it announced proposed changes to the regulations that would allow more payments to qualify for PSLF and allow some deferments and forbearances to count toward PSLF.

Unable To Repay Student Loans

If you cant pay the full amount due on time or have to miss a student loan payment, your loan may be considered delinquent and you may be charged late fees. Contact your loan servicer immediately for help, and ask them about your options.

Learn the latest about the Student Debt Relief Plan, which courts have blocked. The plan would cancel up to $20,000 of student loan debt for Pell Grant recipients and up to $10,000 for other borrowers.

Learn about the new extension to the COVID-19 emergency relief pause in federal student loan repayments. Payments will restart sometime in 2023. The exact date depends on other events.

Read Also: What To Do If Your Home Loan Is Denied

My Loans Were In Default What Happens To Me

You will also receive a clean slate and your loans will be deemed in good standing, the Education Department said.

The Education Department has said that this will happen automatically, though the timing and details are still unclear. More information will be posted on StudentAid.gov as it becomes available.

The goal is to make it easier for defaulted borrowers to enter a repayment plan based on their income, which, depending on their circumstances, may not require any payments at all. Otherwise, it will simply buy them more time before they fall into default again, after roughly nine months of nonpayment.

It often takes a year or more for an account to move into collections. At that point, the federal government can take your tax refund, up to 15 percent of your paycheck or part of your Social Security benefits.

This clean-slate action restarts the clock. It would be at least August 2023 before we see anyone experience the draconian collection tactics, said Persis Yu, policy director and managing counsel at the Student Borrower Protection Center.

Student Loans Are On Hold Should You Pay Anyway

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Find the latest

-

Keep your guard up: How to spot a student loan scam

Payments are currently suspended, without interest, for most federal student loan borrowers until sometime in 2023. This policy does not apply to private student loans.

Unless the president orders forbearance to be extended once more, the repayment clock starts again 60 days after the department is allowed to implement the program or ongoing litigation is resolved, or 60 days after June 30, 2023 whichever comes first.

Borrowers can still make payments to lower their debt during this period of suspended payments, called a forbearance. According to the latest federal data, a total of 500,000 borrowers continued making payments during the pause. Contact your servicer if you have further questions.

» MORE: When Will Student Loan Payments Resume? It Depends.

While the Biden administration has unveiled a broad cancellation plan for up to $20,000 in federal loan debt, any remaining debt will be waiting for you when repayment begins at the end of the forbearance, unless the policy changes again.

Heres how to decide what to do next.

You May Like: How Do I Find Out My Student Loan Number

Bring Your Contact Information Up

If you’ve moved or changed your email address or phone number since March 2020, update your contact information onyour account. Visit your Welcome page and select the Manage Profile sectionto confirm your address, email address, and phone number are correct. If your name has changed, pleasegive us a call.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

You May Like: What Is The Maximum Va Loan Guarantee

Student Loan Repayment Delayed Again To Future Date In 2023

The Biden administration has announced another extension for repayment of federal student loans to an unspecified date in 2023 due to legal challenges that have blocked implementation of the student loan debt relief program. The previous payment moratorium was set to expire on December 31, 2022.

Under the new extension, student loan payments will resume 60 days after the student loan debt relief program is implemented or the lawsuits are resolved. If the courts have not resolved the issue by June 30, 2023, payments will start 60 days after that.1

When Will The Student Loan Payment Pause Expire

The pause will now expire on June 30, 2023 unless the courts make a final decision on debt forgiveness before that, in which case payments will resume 60 days later, according to a press release from the Department of Education.

If the courts have not reached a decision by June 30, payments will resume 60 days after that.

You May Like: How Much Home Loan Eligibility Calculator

Biden Extends Student Loan Pause In Response To Court Battle Over Student Loan Forgiveness

Bidens unprecedented student loan forgiveness program, first announced in August, would cancel $10,000 or more in student loan debt for up to 40 million borrowers. But earlier this month, a federal court in Texas struck down the program as illegal. Then, the 8th Circuit Court of Appeals granted a nationwide preliminary injunction blocking the program. The legal challenges were filed by conservative-leaning organizations and Republican state attorneys general.

The Biden administration is appealing the adverse rulings, and the legality of the initiative will end up before the U.S. Supreme Court. The Education Department announced an extension of the student loan pause while the legal process plays out.

Callous efforts to block student debt relief in the courts have caused tremendous financial uncertainty for millions of borrowers who cannot set their family budgets or even plan for the holidays without a clear picture of their student debt obligations, and its just plain wrong, said U.S. Secretary of Education Miguel Cardona in a statement. I want borrowers to know that the Biden-Harris Administration has their backs and were as committed as ever to fighting to deliver essential student debt relief to tens of millions of Americans. Were extending the payment pause because it would be deeply unfair to ask borrowers to pay a debt that they wouldnt have to pay, were it not for the baseless lawsuits brought by Republican officials and special interests.

What Are The Legal Challenges To The Student Loan Forgiveness Plan

In November, a Texas judge ruled that Biden’s plan to erase as much as $20,000 in student loans per eligible borrower was an unconstitutional use of legislative powers by the executive branch.

The Justice Department originally argued that the Higher Education Relief Opportunities for Students Act of 2003 gave the administration license to “alleviate the hardship that federal student loan recipients may suffer as a result of national emergencies.”

But Judge Mark Pittman ruled that the Heroes Act “does not provide the executive branch clear congressional authorization to create a $400 billion student loan forgiveness program.”

The White House appealed Pittman’s ruling, but a federal appeals court issued an injunction against the relief plan during the appeals process.

There are also other legal hurdles: In September, Nebraska, Missouri, Arkansas, Iowa, Kansas and South Carolina filed suit, claiming Biden’s plan threatened tax revenues from companies that invest in and service student loans.

“It will unfairly burden working-class families and those who chose not to take out loans or have paid them off with even more economic woes,” Missouri Attorney General Schmitt said in a statement at the time. “The Biden Administration’s unlawful edict will only worsen inflation at a time when many Americans are struggling to get by.”

Also Check: Is Car Loan Interest Tax Deductible

Start Planning For Repayment Now

Regardless of how you handle the remaining forbearance period, start preparing for repayment now. The pause could end sooner than June 30 if the Supreme Court rules on Bidens debt cancellation plan before then.

Practice making these payments now, says Kristen Ahlenius, director of education at Your Money Line, a workplace financial wellness company. Take the equivalent of what you would pay toward your student loans and use these funds to increase your emergency fund or pay off some other liabilities. Youll be prepared in case student loan forgiveness remains struck down and improve your financial health in the interim.

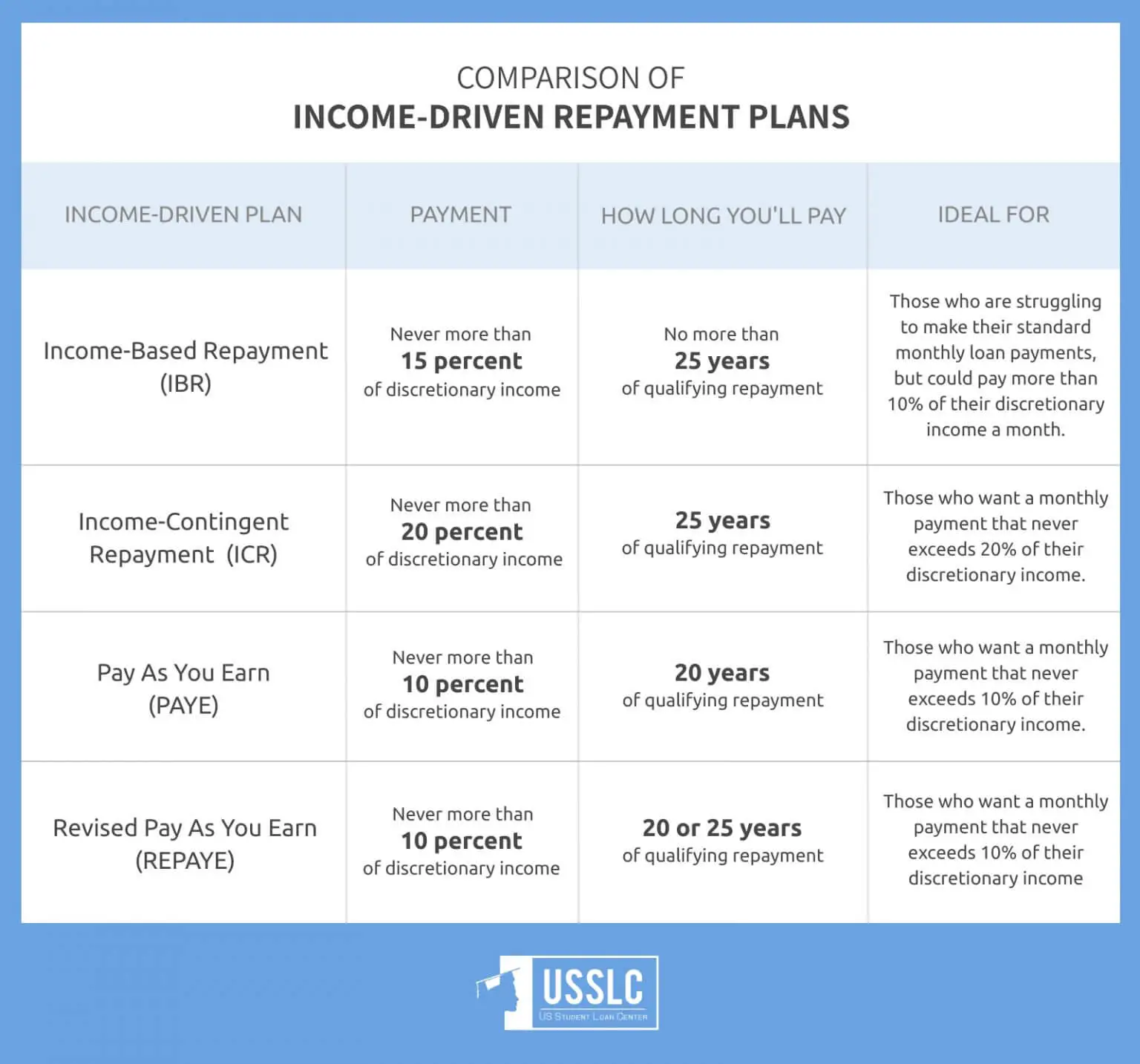

Call your loan provider to confirm what your monthly payments will be. This amount could decrease if cancellation happens, but its best to plan for the worst. If you wont be able to cover the full amount, ask about enrolling in an income-driven repayment plan. These plans cap your monthly payments at a certain percentage of your disposable income, lowering them to a more manageable amount while also extending the life of your loan. If your income is low enough, your payments could be $0.

A previous version of this article misstated the name of Your Money Line, a financial wellness company. It has been corrected here.

More From NerdWallet

Student Loan Forgiveness: What We Know Heading Into 2023

There has been a lot of discussion ever since the pandemic struck about student loans in the U.S., from suspension of payments to outright loan forgiveness.

Take Our Poll: Are You In Favor of More Inflation Relief in 2023?

While the Biden Administration has been pushing hard to forgive many student loans, it has met some opposition, so temporary fixes have been put in place and extended time and time again. Although things may change, there are currently some important deadlines and dates in place regarding student loan forgiveness in 2023. Borrowers should take heed and be on the outlook for any developing news.

Recommended Reading: What Is The Eligibility For Personal Loan

Watch For Notices From Us

Great Lakes and Federal Student Aid have sent, and will continue to send, communications to help get you prepared forrepayment. Read these notices carefully, as they have important tips about what to expect.

As the end of the payment pause grows nearer, we will send you a billing statement about three weeks beforeyour due date. If you previously had a bill pay service set up with your bank, you may have to set that backup again. Refer to “I previously made monthly payments using a bill pay service. How do I continue usingthat payment method when repayment starts?” in theFAQs below.

In addition, if you were previously using Auto Pay to make your monthly payments before March 13, 2020, and you haven’t confirmed your enrollment, you’ll still need to confirm by logging in to your mygreatlakes.org account, selecting Payments, then selecting Auto Pay.

If you haven’t already, you must confirm that you want to remain in Auto Pay for your payments to be madeusing that method. If you do not elect to stay enrolled in Auto Pay, it willbe cancelled, you’ll lose the 0.25% reduction on your interest rate, and you’ll need to make other paymentarrangements when the COVID-19 payment pause ends. Log in to yourmygreatlakes.org account, and you’ll beprompted to confirm enrollment in Auto Pay.

Will My Payment Amount Change After The Payment Pause Ends

If you were in repayment before the payment pause, your monthly payment amount should not change unless youhave applied for an income-driven repayment plan or a recertification or recalculation of your IDR payment during the pause. If you were in a deferment or forbearance before the payment pause, it may be necessary to adjust your monthly payment amount to ensure you’re able to repay your loan within the remaining term.

Don’t Miss: Will Banks Loan On Manufactured Homes

History Of The Student Loan Payment Freeze

Under the CARES Act, student loan payments were originally set to restart on September 30, 2020.

The Trump Administration extended the deferment twice, through January 31, 2021.

Since taking office, President Biden has extended the payment freeze five times.

Within hours of becoming president, Biden pushed the deadline from January 31 to September 30, 2021.

In August 2021, the Biden Administration announced another loan extension and noted loans would be paused until January 31, 2022.

On December 22, 2021, the administration then announced that student loan repayment would be paused for another 90 days – until May 1, 2022.

Less than a month before the May 1 deadline, President Biden pushed back student loan payments until the end of August.

And in late August, as the deadline loomed once more, Biden pushed the freeze back until the end of the year.

According to the president, this will be the last extension of the repayment moratorium.

Borrowers should plan to resume payments in January 2023, the US Department of Education said in a statement.

Why Did The Biden Administration Extend The Payment Pause

Biden campaigned on student debt relief through mass forgiveness and updates to some of the existing forgiveness and repayment programs. But his plan to forgive $10,000 for federal student loan borrowers and $20,000 for Pell Grant recipients has been stalled by politically motivated lawsuits.

When announcing the forgiveness plan, Biden said it was time to restart loan payments since the country had made good progress recovering from the economic fallout of the pandemic.

“We’ve wound down pandemic relief programs like the ones for unemployment insurance and small businesses,” he said in August. “It’s time we do the same thing for student loans,” he added, setting the original December 31 expiration date.

But since forgiveness is currently in limbo, the administration feels it owes it to borrowers to try to have a final answer before payments resume.

Read Also: When Can You Refinance An Fha Loan To Conventional