How Do I Get A Car Loan

The process of getting a car loan is similar to that of getting any other type of loan. Here’s how to start:

- Shop around: It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto loan. Try to find lenders that have APRs and repayment terms that will fit your budget.

- Prequalify: Prequalifying with lenders is often the first step of the application process, and it lets you see your potential rates without a hard credit check

- Complete your application: To complete your application, you’ll likely need details about your car, including the purchase agreement, registration and title. You’ll also need documentation like proof of income, proof of residence and a driver’s license.

- Begin making payments on your loan: Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

Tips To Get The Shortest

The shorter you can get your auto loan term, the better. Not only does it ensure that you pay less in interest, but itll also result in you paying off the debt sooner. That means youll have that extra cash every month to put toward other important things. The best ways to shorten your auto loan include:

- Making the room in your budget for the higher monthly payment.

- Choosing a more affordable vehicle.

- Putting more money down on the car purchase or trading in your current vehicle.

- Negotiating with the dealer to reduce the sales price of the car, making payments more affordable.

- Taking a longer repayment term at the start, and then refinancing your loan when your budget allows for a higher monthly payment.

- Taking the longer term and making additional payments to pay the car off ahead of schedule.

As you consider these and other options, keep your current situation and needs and your long-term goals in mind. Theres no auto loan length that works best for everyone, so understanding yourself will help you find the best path forward.

Alternatives To An 84

There are a number of alternatives to 84-month car loans that could help you save money in the long run. Lets take a closer look at some of them.

- Lease a car. If youre thinking about taking out an 84-month car loan because youd like lower monthly payments, leasing from a car dealer could be the way to go. Since lease payments are based on a cars depreciation during the time youre driving it instead of the purchase price, leasing may come with lower monthly payments.

- Select a more affordable used car. It may be tempting to take out an 84-month loan for your brand-new dream car but if that means big financial hardship, you should consider a used car that costs less.

- Save for a larger down payment. The more money you put down on a car, the less youll have to finance and the lower your monthly loan payments may be. Taking the time to save for a larger down payment could allow you to take out a shorter loan term and still enjoy lower monthly payments.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

How Do I Get The Best Interest Rate

To get the best interest rates, you should speak to a lender in person. Lenders are very aware of their competitors and will often offer better rates if you are a more attractive customer. They might also offer an introductory rate for the first few months so they can win your business.

The best interest rate is the one that you qualify for based on your credit score and current monthly income. If you are trying to pay less than the outstanding balance, then you should create a budget with a lower amount of monthly income. This will help your lender decide whether or not they can approve you for a loan.

Best For Fair Credit: Carvana

Carvana

For fair credit borrowers in the market for a used vehicle, Carvana provides the ability to shop online for financing and a vehicle at the same time. It has no minimum credit score requirement, providing a financing solution for those with damaged credit.

-

Entirely online dealer and lender

-

No negotiation

-

Excellent credit borrowers get the lowest rates

-

Minimum income requirement of $4,000 annually

-

Only for used vehicles

As with most lenders, borrowers with the best credit get Carvana’s most competitive rates. Carvana does not advertise its rates or publish a table, but you can estimate your monthly payment with an online calculator. That said, even the calculator does not reveal the rate it is using. You must prequalify to know what your interest rate will be.

Carvana is a completely online used car dealer that also provides direct financing. It makes it possible to secure financing, shop for a vehicle, and get a used vehicle delivered without leaving your house. There is no credit score minimum for its financing program, making this an attractive option for fair credit borrowers. However, you must have an income of at least $4,000 annually and no active bankruptcies.

You May Like: Va Loan Manufactured Home With Land

What Is The Difference Between An Auto Loan And A Personal Loan

It’s possible to use a personal loan or an auto loan to finance a vehicle, but the two differ in some important ways:

- Purpose: Personal loans are unsecured or secured and can be used for many different purposes, including to finance a vehicle, pay for a vacation, or make improvements to a home. Car loans, however, are strictly to finance a vehicle and are secured against the vehicle you purchase. The vehicle serves as collateral.

- Interest rates: Because auto loans are secured, rates on car loans are generally lower than personal loans.

- Availability: Auto loans are typically easier to obtain than personal loans, especially for those with a poor credit history.

Youll Likely Pay More Interest

A longer car loan term usually means paying more in interest over the life of the loan.

Lets say your loan amount is $20,000, with a 4.5% interest rate, excluding sales tax and fees. This is what the difference looks like.

| Car price |

|---|

| $3,352 |

Ultimately, youd pay about $980 more in interest for the longer car loan.

If you have the money, paying back an 84-month auto loan early can help you save on the total amount of interest youll pay. But some lenders charge prepayment penalties , so if youre thinking of going this route, check the terms of your loan agreement.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

The Bankrate Guide To Choosing The Best Auto Loans

Auto loans let you borrow the money you need to purchase a car. Since car loans are considered secured, they require you to use the automobile youre buying as collateral for the loan.

This is both good news and bad news. The fact that your loan is secured does put your car at risk of repossession if you dont repay the loan, but having collateral typically helps you qualify for lower interest rates and better auto loan terms.

Auto loans typically come with fixed interest rates and loan terms ranging from two to seven years, but its possible to negotiate different terms depending on your lender.

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure the content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

Buy Now Make Extra Payments

You could make additional payments to pay the loan off early or build up equity. If youre buying a vehicle at the average price of $38,378, an 84-month loan would be $602.19 per month, and youd pay $12,206 in interest. If you pay an extra $100 per month, you could save $2,298 in interest and own the car in just over five years instead of seven years.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

You Pay More For The Car With An Extended Term Loan

Simply because of the fact you are paying over a longer period of time, you will pay more in interest costs. But that is only part of the problem. Because extended term loans are a higher risk for lenders, they charge a higher interest rate for the loans. While you can find some low interest deals on extended term loans, your credit has to be flawless in order to qualify for them.

Shop With Your Preapproval

If youre successful in getting preapproved, youll receive a loan quote that shows much you qualify for, the interest rate and the length of the loan. You can use this information when you go shopping at the dealer. Youll know how much you can afford to spend on the car. And youll be able to compare financing offers.

Recommended Reading: Transfer Car Loan To Another Bank

Are 72 Month Or 84 Month Auto Loans A Bad Idea

Many or all of the companies featured provide compensation to LendEDU. These commissions are how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear on our site.

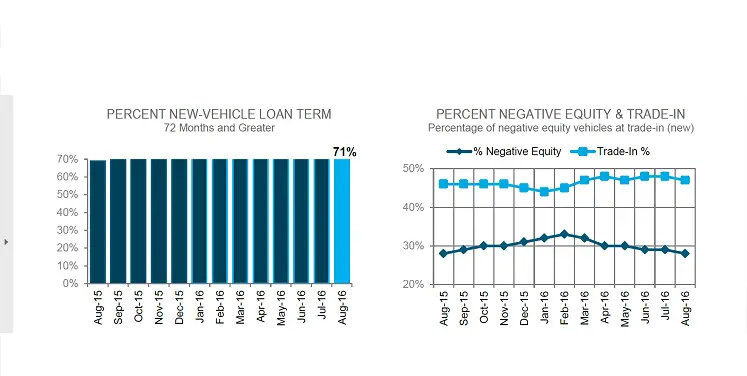

An increasing number of new car buyers are stretching their car loans out further and further. Just five years ago the average loan term for new car purchases was around 60 months, but recently the New York Fed reported that the average loan term is 68.8 months. Thats already two weeks longer than last year. Long story short, auto loans are being taken out with longer repayment terms.

New-car loans of 61 to 72 months, referred to as extended term loans, now make up more than 40 percent of outstanding loans, and 33 percent of longer-term loans are in the 73 to 84-month range according to LendEDU. Thats nearly three quarters of new loan originations that stretch beyond the more conventional 60-month term. Whats behind this trend, and what does it mean for new car buyers and the auto industry?

What Is An 84

An 84-month auto loan is a seven-year loan. While three- and five-year auto loans were most common for buyers in previous years, theres a rising trend of long-term auto financing. For example, in 2019, more than 18% of loan terms were for 84 months or longerthat figure rose to almost 21% in 2020, and its now more than 22%.

Don’t Miss: Pre Approved Auto Loan Usaa

How To Make A Shorter Car Loan Term More Affordable

If you dont want to be tied to a loan for 84 months or more, how do you make a shorter loan more affordable? The key to this is a down payment. Putting money down reduces the amount you need to finance, which lowers the amount of interest charges you end up paying. Basically, the larger the down payment, the more affordable the loan is in the long run. Not to mention, a large down payment can help you shorten your loan term while still netting a monthly payment fits your budget.

For example, let’s say you finance a $12,000 vehicle with a nine percent interest rate. Here’s what an 84-month auto loan looks like compared to one with a 60-month term:

| Monthly Payment |

| $2,356.85 | $11,956.85 |

This is why a down payment works in your favor. You not only lower each and every monthly payment you have to make, you also save money on interest charges.

How Do I Refinance A Car Loan

Refinancing your auto loan is a great and easy way to save money on your car payments and to lower the interest rate on your auto loan.

In order to refinance your auto loan, youll need to gather the right information and documents. All the necessary information would be the car mileage, VIN number, current car loan numbers, drivers license, and income verification. After gathering this information, you can refinance your loan with the same lender or with a different financial institution.

After applying, the bank or credit union will check your credit history and let you know if you qualify for a lower interest rate. After approval, the bank or credit union will work with you to set your new loan term to a lower monthly car payment.

You May Like: Can Mortgage Lenders Verify Bank Statements

Best Bank For Auto Loans: Bank Of America

Bank of America

- As low as 2.39%

- Minimum loan amount: $7,500

Bank of America auto loans come with the backing of a major financial institution. Low rates and a big selection of loan options make it a major competitor in the auto loan landscape. In J.D. Power’s 2020 Consumer Financing Satisfaction Study, which deals with auto loans, Bank of America ranked seventh out of 12 in its segment and scored equal to the average.

-

Offers new, used, and refinance auto loans

-

Transparent rates and terms online

-

Well-known financial institution

-

Restrictions on which vehicles it will finance

-

High minimum loan amount

Bank of America is a large financial institution offering a number of auto loan options, including new, used, refinance, lease buyout, and private party loans.

For the most creditworthy borrowers, APRs start at 2.39% for new vehicles. Used vehicle loans start at 2.59% APR, while refinances start at 3.39% APR. Customers of the bank who are Preferred Rewards members can get up to a 0.5% discount on their rate.

BofA provides a no-fee online application that it claims can offer a decision within 60 seconds. You can choose from a 48-, 60-, or 72-month term online, but there are additional options ranging from 12 to 75 months if you complete the application process at a branch or over the phone.

Where To Buy Car Stereo Online

Category: Cars 1. Car Audio Online: Stereos, Speakers, Subs & Amps Crutchfield Shopping for Car Audio & Video? Our Virginia-based experts love helping folks find Get FREE 2-day shipping and free lifetime tech support with your order.Car speakers · Car amplifiers · Equalizers & signal processors · Satellite radio

You May Like: Va Loan For Mobile Home And Land

You May Owe More Than Your Car Is Worth

Since a new car starts losing value the moment you drive it off the lot, an 84-month auto car loan can also put you at higher risk of going upside down on your loan.

That means you may end up with negative equity owing more than your car is worth. In that case, if you want or need to sell your car before its paid off, you may not break even, much less turn a profit.

And if your car gets totaled in an accident before its paid off, the insurer may only cover the book value of the car very possibly an amount less than what you owe. Even if the car isnt drivable, you could still be responsible for making the monthly payments until its paid off.

Make A Large Down Payment

You could pay 20% or more of the purchase price upfront. That reduces the amount you borrow. However, you should also avoid financing fees such as taxes, registration and dealer fees, and add-ons such as the dealers paint protection coating or vehicle service plan.

When you put more down on your vehicle, youre less likely to become upside down, and you may be able to avoid guaranteed auto protection or GAP insurance. GAP insurance covers the difference between the loan balance and the cars value in the event the car is a total loss.

Also Check: Can I Refinance My Sofi Personal Loan

Shop Cr’s Car Buying Service From Home

The Consumer Reports Build & Buy Car Buying Service is evolving to face the challenges of shopper needs during the pandemic. The core service engages a nationwide network of over 16,000 participating dealers to provide up-front pricing information and a certificate to receive guaranteed savings off the manufacturers suggested retail price. A growing number of dealerships are enrolled in a Buy From Home program, enabling buyers to complete the buying process without going to the dealership. Participating dealerships will take you through the paperwork remotely and deliver a sanitized vehicle right to your home, all at a fair price. When using the Build & Buy Car Buying Service, accessed by clicking the “View Pricing with Incentives” links on our car model pages, you will find Buy From Home participants denoted by a special banner that says, Buy from Home: Have your vehicle delivered to you and complete your paperwork at home.

Benjamin Preston

Best For Bad Credit: Myautoloan

MyAutoLoan

- As low as 2.49%

- Minimum loan amount: $8,000

myAutoloan not only offers reasonable low rates, but it also has lenders that work with people who have a history of credit problems. The marketplace provides a great opportunity for borrowers with poor credit to shop deals from multiple lenders at once.

-

Accepts borrowers with poor credit

-

Offers new, used, and refinance loans

-

Higher minimum loan amount requirements

-

Not available in Hawaii or Alaska

myAutoloan is a marketplace that allows you to compare multiple offers from lenders based on your credit profile. This type of company can help you cast a wide net and get the best offer available. It offers new, used, refinance, private party, and lease buyout loans.

Speed is one of myAutoloan’s benefits. Its online form takes just a couple of minutes to fill out and, once submitted, matches you with up to 4 lender offers. After you choose a lender, you can receive an online certificate or a check within as little as 24 hours.

Requirements in myAutoloan’s market vary by lender, but they say they have lenders who work with borrowers with lower scores.

Read Also: Is Bayview Loan Servicing Legitimate