Do I Qualify For A Student Loan Tax Deduction

Youre good to go on the deduction if you meet the following requirements:

1. Your income is under a specific amount, depending on status and income.

Your modified adjusted gross income must be less than $85,000 or $170,000 if youre married and filing jointly. If you make between $70,000 and $85,000, your deduction might be less based on the IRSs phaseout rules. Well cover these in the next section.

What is your MAGI?

Your MAGI is like your adjusted gross income . But its modified by adding back in special deductions you mightve taken, like student loan interest, qualified tuition expenses and tuition fees. MAGI is a way of calculating your income to determine whether youre eligible for such tax benefits as IRA deductions and income tax credits. Of course, its also used to determine whether you qualify for the student loan tax deduction.

2. You fall under an accepted filing status.

You dont qualify if:

- Someone claims you as a dependent on their tax return.

- Youre married and filing your taxes separately.

3. Your student loan qualifies.

You have a qualified student loan if:

- You took out the loan solely for higher education expenses.

- You took out the loan for yourself, your spouse or your dependent.

- The loan is not from someone related to you or from a qualified employer plan.

4. The student qualifies.

If you took out a parent loan for someone in school, the student must have:

5. Your interest payments qualify.

You Should Still Be Able To Deduct Student Loan Interest If You Refinance

If you choose to refinance your student loans, your student loan interest is likely still eligible for tax deductions. However, if you refinance for more than the original value of your student loans, and use the additional amount for any other purpose aside from qualified educational expenses, you wont be able to deduct any interest paid on the loan.

How To Get The Student Loan Interest Deduction

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The student loan interest deduction is a tax break for college students and their parents who took on debt to pay for school. It allows you to deduct up to $2,500 in interest paid from your taxable income.

Due to the ongoing pandemic, interest on most federal student loans has been paused since March 13, 2020. You can still deduct interest paid before that date on your 2020 taxes, as well as interest on loans that weren’t eligible for this relief, like private student loans.

» MORE:

Student loan interest is deductible if your modified adjusted gross income, or MAGI, is less than $70,000 . If your MAGI was between $70,000 and $85,000 , you can deduct less than than the maximum $2,500.

The student loan interest deduction is not an itemized deduction it’s taken above-the-line. That means it’s subtracted from your taxable income to save you money. For example, if you fall into the 22% tax bracket, the maximum student loan interest deduction would put $550 back in your pocket.

If you qualify, you can take both the student loan interest deduction and the standard deduction.

» MORE:

» MORE:

Don’t Miss: How To Get Mlo License California

How To Calculate Your Deduction

Calculating your deduction begins with your MAGI. This is your all-important adjusted gross income before you take other tax deductions into account, including the student loan interest deduction you’re hoping to qualify for. You can’t deduct this first before calculating your MAGI. That would be like claiming a tax break twice for the same expense.

You must also add back the following exclusions and deductions if you took any of them, but these are somewhat uncommon:

- The foreign earned income exclusion

- The foreign housing exclusion

- The foreign housing deduction

- The income exclusions for residents of American Samoa or Puerto Rico

Most taxpayers will find that their MAGIs are very close toif not identical totheir AGIs. In the case of the student loan interest deduction, you might find that you only have to add back the deduction itself.

Divide your MAGI by $15,000 after you’ve calculated it. Convert the answer to a decimal with three decimal places. Use 1.000 for the calculation if it’s more than 1.000. If it’s less than 1.000, use it as is. Now multiply your student loan interest paid up to $2,500 by the decimal. The answer will be $2,500 or less.

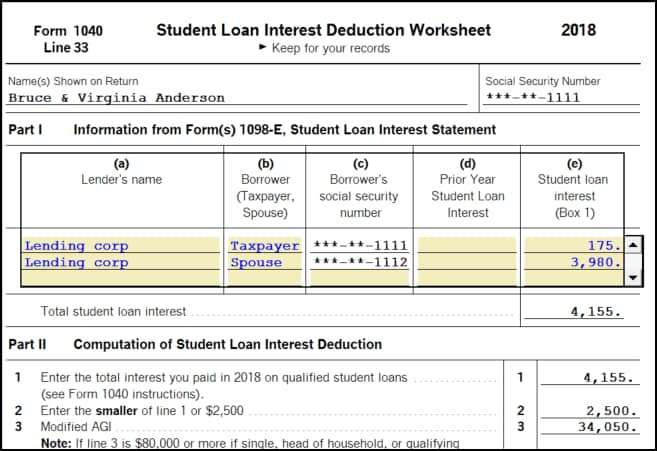

You won’t have to dig through all your student loan statements for the year, trying to track down how much interest you paid. Your lender should send you a Form 1098-E sometime after the first of the year. The amount of interest you paid is reported in Box 1 of the 2020 version of the form.

Student Loan Interest Deduction Phase

The phase-out ranges for this tax credit depend on your filing status. As of tax year 2020, the return you would file in 2021, they were:

| Filing Status | |

| $70,000 | $85,000 |

These figures are adjusted for inflation, so they can change slightly year to year. The IRS typically announces inflation adjustments at the end of the tax year. These thresholds were accurate as of November 2020.

You can deduct up to $2,500 in student loan interest or the actual amount of interest you paid, whichever is less, if your MAGI is under the threshold where the phase-out begins. Your limit is prorated if your MAGI falls within the phase-out rangefor example, $70,000 to $85,000 if you’re single.

Unfortunately, your student loan interest isn’t deductible at all if your income is more than the ceiling where the phase-out ends.

Don’t Miss: Avant Refinance Loan Application

How Does The Student Loan Interest Deduction Work

The student loan interest deduction is an above-the-line exclusion from income that you can use when filing your annual taxes with the Internal Revenue Service .

An above-the-line exclusion from income is also sometimes called an adjustment to income and it reduces the adjusted gross income on your federal income tax return. As a result, it also reduces your taxable income for the year.

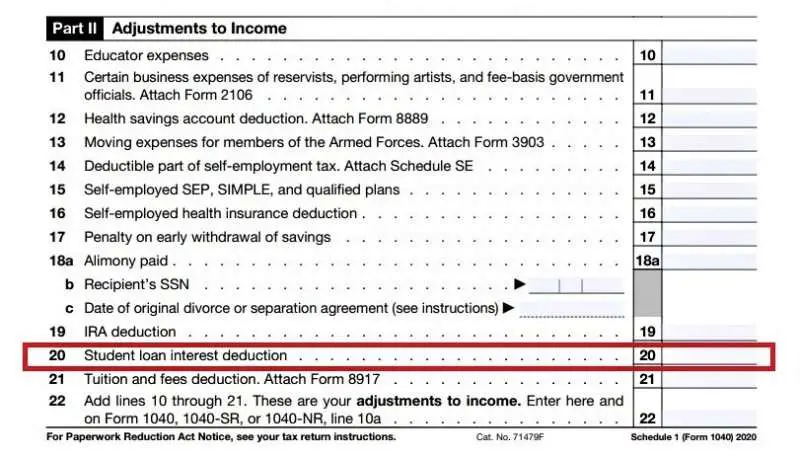

All youve got to do to claim student loan interest deduction is add the total amount of eligible student loan interest on IRS Form 1040.

You dont have to itemize loan interest payments to claim the deduction but well get to specific eligibility requirements and how to claim the deduction in a minute.

You should be able to receive this tax deduction for any interest that you paid on qualified college loans during the tax year, up to a total of $2,500.

If you paid less than $2,500 in student loan interest, the amount of your deduction is based on the total amount you paid. For example, if you only paid $1,500 in interest for a given tax year, your deduction is $1,500.

That means your taxable income will be reduced by $1,500.

Does Refinancing Affect My Student Loan Interest Deduction

It depends. You can most likely deduct student loan interest from your taxes after refinancing your student loans to get a better interest rate or more flexible loan term. However, you may not be able to deduct your student loan interest if you refinance for more than the original amount of your loan.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Where To Go For More Help With Student Loan Tax Deduction

To learn more specific tax information, see Chapter 4 of Publication 970: Tax Benefits for Higher Education at www.irs.gov.

To get hands-on guidance, get help from H& R Block. At H& R Block, you can find the expertise you need. Whether you file on your own with H& R Block Online or file with a tax pro. Well be there with you every step of the way.

Free tax filing for students Did you know some students can file for free with H& R Block? Its true! Learn more who can file for free with H& R Block Free Online.

Related Topics

Learn what to do if you e-filed and mailed in a tax return with help from the tax experts at H& R Block.

What Other Tax Breaks Can I Get For My Student Loans

There are a few more ways student loans can help you you can save on your taxes:

American opportunity tax credit

The American opportunity tax credit allows you or your parents to deduct up to $2,500 each year for the first four years of your higher education. To earn the tax credit, the student must attend a degree-granting at least half-time and must either be you, your spouse or a dependent listed on your taxes. You also must have a MAGI of $90,000 or less to qualify $180,000 for joint filers.

Lifetime learning credit

The lifetime learning credit allows you to deduct up to $2,000 a year while youre enrolled in a higher education program including undergraduate, graduate and even professional development courses. Theres no limit to how often you can use this, though your MAGI must not be more than $68,000 or more $136,000 for joint filers.

No taxes on some types of forgiveness

Before the 2018 tax reform, federal student loan borrowers who qualified for forgiveness or discharge had to pay income taxes on the amount the government canceled. Thats still the case in most situations. But now you dont have to pay income tax if you qualify for death or permanent disability discharge.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Student Loan Interest Deduction

The federal government offers a deduction for any amount you paid toward the interest of your student loans over the past calendar year.

The student loan interest deduction is non-itemized, which means you can claim it whether you choose to itemize your other deductions or go with the standard deduction.

The student loan interest deduction is reportable on Form 1040 in the AGI category.

Loan servicers make reporting this amount on your taxes easy: theyre required to send you a Form 1098-E stating how much you paid in interest.

The student loan tax deduction for paid interest is limited to $2,500, and its also limited by your income. If your modified adjusted gross income is above the requisite range, your eligibility will be eliminated.

Learn all of the requirements and qualifications for the student loan interest deduction on IRS.gov.

Can I Claim The Student Loan Deduction For Parent Plus Loans I Took Out For My Children

Yes, if you are paying interest on federal parent PLUS loans, or private parent student loans that you took out in your own name to pay for your childrens college expenses, you may be able to claim the interest deduction.

To claim the student loan deduction, you or your spouse must be legally responsible for paying the loan. If youre making payments on loans that your children took out in their own name, you cannot claim the student loan interest deduction. Your children cannot claim the deduction either if they are listed as dependents on your tax return.

Also Check: What Is Fha And Conventional Loan

What Filing Status Should You Use To Get The Deduction

If you’re being claimed as a dependent by anyone else on their federal filing a.k.a. mom and dad then you won’t be able to take the deduction. You also can’t take the deduction if you’re filing as married filing separately.

As long as you file as a single head of household or married filing jointly and don’t exceed the MAGI cap, then you should get a deduction up to $2500. #taxwin

Documents You Need To File Your Tax Return

Here are the documents youll need to file your tax return and claim your deduction:

- W-2: If you were employed in a job and paid income tax, youll need a W-2 from each of your employers to file your taxes accurately. Youll also need W-2s from any provider of taxable scholarships, grants or tuition assistance.

- 1098-E: To claim the student loan interest deduction, get a 1098-E from any loan servicer you sent payments to, so you can document all of the interest that you paid during the tax year.

- 1098-T: To be eligible to claim the American opportunity credit or the lifetime learning credit, youll need a Form 1098-T, Tuition Statement, from your school.

Recommended Reading: Penfed Exotic Car Financing

What Is Form 1098

Form 1098-E is a tax form that tells you how much you paid in interest on your student loans over the past year. Its sometimes called the Student Loan Interest Statement.

Youll need to file Form 1098-E to deduct student loan interest payments from your taxes. You can typically claim interest on payments for student loans youve used toward qualified education expenses. These expenses include tuition, room and board, supplies, textbooks and other expenses that come with studying for a degree.

Exceptions might include loans you used to pay for postgraduate expenses, like a bar study course or relocating for a medical residency, if your school doesnt consider them part of the cost of attendance. If youre paying off these types of student loans, talk to a tax specialist to find out if theyre eligible.

How Do You Claim A Student Loan Interest Deduction

Luckily, claiming a student loan interest deduction is relatively easy since you dont need to itemize your taxes to qualify.

If you paid more than $600 in student loan interest to a single lender, you should automatically be sent a copy of IRS Form 1098-E from your student loan provider.

This form states how much you paid in interest on a given qualified education loan.

But if you dont get sent a 1098-E form from your lender, dont panic. Typically, all youve got to do is call them and ask for confirmation of the total amount that you paid in student loan interest for that tax year.

You may also be able to access this information by logging into your account on the lenders website.

Although your lender should be able to provide you with the correct amount of interest paid, the IRS asks borrowers in the instructions for their 1098-E not to contact their lenders for explanations of the requirements and how to make an allowable deduction for interest paid.

Instead, that information is all available on the IRS website. But fortunately for you, its actually super simple to claim.

Once youve got the correct amount, all you need to do is enter that number on line 20 on Schedule 1 of IRS Form 1040 before submitting.

Don’t Miss: What Do Mortgage Loan Officers Do

How Do You Claim The Student Loan Interest Deduction

You claim this deduction when filing your taxes for the year. If you paid more than $600 in student loan interest during the year, your loan servicer is required to send you tax form 1098-E, which shows you exactly how much you paid in student loan interest during the year.

If you paid less than $600, you can still claim the deduction. Ask your loan servicer for a 1098-E or log into your loan account to get the total amount of interest paid.

Once you know how much you paid in interest, you can use the student loan deduction worksheet included in the instructions for the IRS Tax Form 1040. The worksheet will walk you through calculating your deduction. Once you know your deduction amount, youll enter it on your form 1040 Schedule 1.

If you use a tax preparation service, their questionnaire should ask you if youve paid student loan interest during the year. Be sure to answer yes and provide the amount of interest paid theyll take care of calculating the rest.

Student Loan Tax Incentives

The Taxpayer Relief Act of 1997 introduced several tax incentives on qualifying student loans. The Hope and Lifetime Learning credits provide the ability to take a tax credit for qualifying educational expense. TRA also provides a deduction for the interest paid on qualifying student loans. The Student Loan Interest Deduction is reported on anIRS Form 1098-E . The Hope and Lifetime Learning Credits are reported on anIRS Form 1098-T .

Beginning January 1, 1998, taxpayers may be eligible to claim a non-refundable Hope Scholarship Credit against federal income taxes. The Hope Scholarship Credit may be claimed for the qualified tuition and related expenses of each student in the taxpayer’s family who is enrolled at least half-time in one of the first two years of post-secondary education and who is enrolled in a program leading to a degree, certificate, or other recognized educational credential. The amount that may be claimed as a credit is generally equal to: 100 percent of the first $1,100 of the taxpayer’s out-of-pocket expenses for each student’s qualified tuition and related expenses, plus 50 percent of the next $1,100 of the taxpayer’s out-of-pocket expenses for each student’s qualified tuition and related expenses. Thus, the maximum credit a taxpayer may claim for a taxable year is $1,650 multiplied by the number of students in the family who meet the enrollment criteria described above.

Also Check: Auto Loan Usaa

Is Student Loan Interest Deductible

If youre wondering, is student loan interest deductible? The answer is yes. In fact, you could qualify to deduct up to $2,500 of student loan interest per return per year. You can claim the student loan interest tax deduction as an adjustment to income. You dont need to itemize deductions to claim it.

How Do You Know If Your Modified Adjusted Gross Income Is Under The Cap

The Internal Revenue Service provides for a deduction up to $2500, but the amount of your actual deduction depends on your MAGI.

If your MAGI is above $80,000 for a single person or $165,000 for a married couple filing jointly, you’re out of luck no deduction. And the amount of the deduction will be reduced if your income is between $65,000 and $80,000 or $135,000 and $165,000 .

You May Like: What Credit Score Is Needed For Usaa Auto Loan