Home Loan Interest Rates And Emi In Top 15 Banks In July 2021

Looking for the best home loan product, to fund the purchase of your dream home? Housing.com News looks at the interest rates, EMI and processing fees offered by the major banks in July 2021, to help you make the right choice

With markets opening up after the second wave of COVID-19 and most states allowing partial relaxations from the lockdown restrictions, the Indian economy could be on a path to recovery. Globally, the central banks of all major economies are closely monitoring inflation levels and they expect the recent spike in inflation to largely remain transitory. The RBI is also keeping a close watch on the inflation, while continuing with an accommodative stance on key policy rates. Consequently, no immediate change in the interest rate seems possible, in the near future. However, a continuous surge in crude oil prices, could easily spoil the entire plan. Further escalation in crude prices, can push inflation out of control, in absence of an immediate monetary tightening.

New variants of COVID-19 have also been reported, recently. Hence, the economic trajectory will depend on whether India successfully contains the third wave or not and how quickly India vaccinates its people.

|

0.50% of the loan amount subject to a maximum of Rs 15,000 . |

Note:

The EMI is based on a loan amount of Rs one lakh for a tenure of 20 years.

Data taken from respective banks website, as on July 11, 2021.

Metro Areas With More Banks Offer Lower Rates

Along with shopping around, where you live can affect your interest rate. Borrowers in metropolitan areas with a dense concentration of banks typically received a lower interest rate than their counterparts in areas with fewer banks, according to the Haus report. The difference between the areas with the highest concentration of banks and the lowest was about 35 bps.

Dubuque, Iowa Springfield, Illinois and Lima, Ohio had the cheapest mortgage rates while Sandusky, Ohio McAllen, Texas and Danville, Virginia were among the most expensive places for home loans.

If theres less competition in an area banks can afford to raise their prices without losing business, McLaughlin says. This is especially true if borrowers choose to use local, brick-and-mortar banks rather than online banks, for example.

Another reason why areas with fewer banks might charge more is that these areas are likely rural or away from urban cores, where home prices are lower, McLaughlin says.

Loan size affects interest rates based on two main factors: mortgage processing costs and risk. Smaller loans offer less exposure to banks, but they can be more costly.

For folks in areas where mortgage rates are several basis points higher than the national average, go beyond brick-and-mortar banks. Online lenders are accessible from anywhere and might offer a more competitive rate than whats available locally.

Determine What Mortgage Is Right For You

When finding current mortgage rates, the first step is to decide what type of mortgage best suits your goals and budget. Most borrowers opt for 30-year mortgages, but thats not the only choice. Typically, 15-year mortgages have lower rates but larger monthly payments than the more popular 30-year mortgage. Adjustable-rate mortgages usually have lower rates to begin with, but the downside is that youre not locked into that rate, so it can change over the life of your loan.

Read Also: Does Va Loan Work For Manufactured Homes

What Is The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing the money, and it is advertised as a percentage of the loan. APR stands for annual percentage rate, and it includes the interest rate plus other fees associated with the mortgage. So the APR will provide you with a better idea of the total cost of financing the loan. You may find lenders offering the same interest rate and monthly payments, but if one is charging higher upfront fees, then the APR will be higher.

The Federal Truth in Lending Act requires lenders to disclose the APR, but which fees are included in it can vary. So when comparing APRs of different lenders, ask which fees arent included for better comparison.

Heres The Secret To Finding Low Mortgage Rates

Getty

Rate watchers are eagerly keeping tabs on mortgage interest rates, as they continue to slide. The 30-year fixed-rate fell to 3.07% over the Fourth of July weekend, another milestone low, according to Freddie Mac. But the reality is not everyone will qualify for a mortgage rate that low.

and down payment are both significant factors in the rate you get, but so is where you live and which lender you choose. A recent report by Haus, a home-financing startup, showed that getting a low rate was not entirely dependent on your credit profile.

Lenders look at FICO scores to help determine interest rates. Financial prudence is going to be wrapped up in credit score. But where you live and which lender you use is also going to have an impact on your rate, says Ralph McLaughlin, chief economist at Haus.

The report, which is based on Haus analysis of more than 8.5 million mortgage originations between 2012 and 2018 of borrowers with the same down payment, existing debt and credit score, produced two compelling results:

- Who you choose as your lender could impact your mortgage rate by three-quarters of a percentage point.

- Where you live matters, as there was more than a third of a percentage point difference in rates across metropolitan areas.

Here well look at what those results mean for todays borrowers and what you can do to improve your chances of getting a low rate as quickly as possible.

Don’t Miss: How To Transfer Car Loan To Another Person

What Is Mortgage Stress

You may know that borrowers can run the risk of mortgage stress if interest rates increase, but what is mortgage stress?

Various banks and mortgage lenders define mortgage stress differently. One common benchmark is when a household has to devote at least 30 per cent of its pre-tax income to servicing its mortgage.

Households that are coping reasonably well with their monthly repayments can find themselves suffering mortgage stress if interest rates suddenly increase, or increase by a significant amount in a short period of time.

For example, between October 2009 and November 2010, the Reserve Bank of Australia increased the official cash rate by 1.50 percentage points. Imagine if you took out a home loan at, say, 4.50 per cent, and your lender then increased your interest rate by 1.50 percentage points over the next 13 months. Heres what would happen if you had a 30-year loan for $350,000, $500,000, $650,000 or $800,000:

| $350,000 | |

|---|---|

| $604 | $743 |

The great thing about a home loan calculator is that you can use it to research what would need to happen for you to fall into mortgage stress, and then plan accordingly.

Where Can I Find An Interest Rate Under 2 Per Cent

Home loan rates change regularly for a range of different reasons, meaning it could be more or less difficult to find an interest rate under 2 per cent depending on the state of the market.

At the time of writing, the RateCity database has a number of home loans with advertised rates of under 2 per cent, however this will typically fluctuate with the market.

In order to determine whether a home loan charges low or high interest, it may be helpful to understand what the average is at the time of your comparison. The Reserve Bank of Australia records average home loan interest rates in Australia, which might help you get a better idea of what to expect.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Axis Home Loan Interest Rate

| Rate of interest on home loans | Best rate |

| 8.55% |

Maximum tenure: 30 years

Processing fees: Up to 1% of the loan amount, with the minimum amount capped at Rs 10,000.

Affordability scale: Average

Advantages: The bank is a pioneer in terms of rewarding credit-worthy individuals and has been among the first to offer them lower rates of interest.

Disadvantages: While most banks offered a processing fee waiver in view of the festive season and the Coronavirus pandemic starting October 2020, Axis Bank continues to charge this duty. Also, the processing fee of this bank is comparatively higher than what is charged by other banks.

How Long Should My Mortgage Be

When applying for a mortgage, the type of loan will usually determine how long youll have your mortgage. For instance, you can choose from conventional mortgages on 15-year and 30-year terms. With a shorter term, youll pay a higher monthly rate, though your total interest will be lower than a 30-year loan. If you have a high monthly income as well as long-term stability for the foreseeable future, a 15-year loan would make sense to save money in the long-term. However, a 30-year term would be better for someone who needs to make lower monthly payments.

Don’t Miss: How To Transfer A Car Loan

Comparing Mortgage Rates With Ratehubca

Whether you’re considering using a bank or broker, a variable or fixed mortgage rate, or a one to a ten-year term, we can help. Our tools find the best mortgage rates for every category and type of lender, personalized to you. Ratehub.ca is an independent source, so weâre able to provide unbiased guidance and education on getting the best mortgage to suit your needs.

Tips To Get The Lowest Mortgage Rate

If you want the lowest mortgage rate available, you have to shop around. Thats the number one rule.

But there are other strategies you can use to get lower offers from the lenders you talk to.

Don’t Miss: How To Transfer A Car Loan To Someone Else

Yes Bank Lowers Home Loan Rates Check How It Compares With Other Banks

2 min read.Livemint

- YES Bank has unveiled a festival offer, under which customers can get loans at 6.7% per annum

| Listen to this article |

Following suit after State Bank of India , ICICI Bank, Punjab National Bank and several other financial institutions, private lender YES bank has announced that it is lowering home loan rates at 6.7% per annum during the festive season for a limited period.

YES Bank is currently offering home loans with interest rates ranging from 8.95% to 11.80%, as per the website. “The home loan rates announced today among the most competitive interest rates in the retail consumer market,” an official statement from the Bank said.

Tax benefits claimed on home loans get reversed if hous …

The 90 days offer from the Bank, provides an additional 0.05% benefit for prospective salaried women home buyers.

Under this offer, salaried home buyers can enjoy flexible loan tenure of up to 35 years at affordable EMI options and zero prepayment charges with minimal documentation. The offer is applicable for home loans for property purchase as well as balance transfers from other lenders.

In September many banks and financial instutions have announced a reduction in home and car loan rates. Let us check how YES Bank’s rates fare with other banks.

ICICI Bank: The Bank’s customers can avail of attractive interest rate starting from 6.70% and processing fee starting from 1,100 on fresh home loans and balance transfer of home loans from other banks.

Home Loan Interest Rates And Emi In Top 15 Banks In September 2021

Looking for the best home loan product, to fund the purchase of your dream home? Housing.com News looks at the interest rates, EMI and processing fees offered by the major banks in September 2021, to help you make the right choice

With the festive season 2021 around the corner, the good news is that COVID-19 cases have significantly decreased in the last few months. Banks have started coming up with offers, such as discounts on home loan interest rates and zero processing charges. The interest rate has come down to as low as 6.5% per annum and the real estate sector has been buoyed by the much-needed growth push due to increased participation from home buyers.

Indias Consumer Price Index , i.e., the retail inflation rate in August 2021, fell to 5.3%, close to a four-month low level. Easing retail inflation will support the RBI to continue with an accommodative stance, when it comes to the policy rate decision. This means, the interest rate may remain at the current level in the coming months, unless there is any sudden spike in inflation. The COVID-19 third wave is anticipated to hit during October to November 2021. A surge in COVID-19 cases could spoil the recovery of the Indian economy, as well as the revival plan of the realty sector.

Read Also: What Car Loan Can I Afford Calculator

Have A Long And Consistent Work History

On top of a good credit score, mortgage lenders also want to see a consistent and long-tenured work history. If you’ve been working at the same place for many years and have consistent or growing annual income, lenders will be more likely to give you a home loan with an attractive rate.

Conversely, if you’ve changed jobs multiple times recently, lenders may be more leery of giving you a big loan because your income isn’t as reliable. A loan officer will verify your employment status before you make an offer on a home and before the closing date of a home purchase. If you’ve changed jobs or quit during the closing process, it could jeopardize your ability to get a home loan.

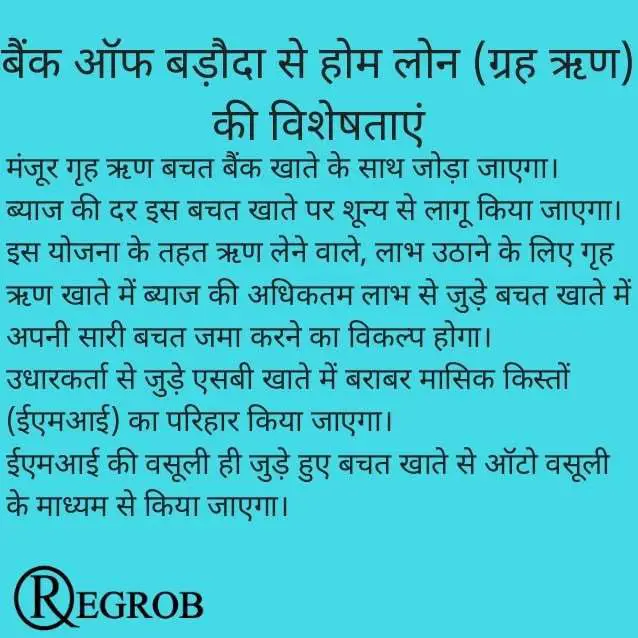

Bank Of Baroda Offering Home Loan To Customers At The Lowest Interest Rate

Bank of Baroda is offering home loans to customers at the lowest interest rate i.e. 6.50 percent and why it is best for retail loans at present, Executive Director of Bank of Baroda Vikramaditya Singh Khichi spoke to Anurag Shah in details.

New Delhi: Several banks are giving a stiff competition to each other in the home loans segment this festive season. The home loan segment is dominated by banks that give lucrative offers with the rate of interest being the key element for buyers to choose a particular bank’s home loan.

Bank of Baroda is offering home loans to customers at the lowest interest rate i.e. 6.50 percent and why it is best for retail loans at present, Executive Director of Bank of Baroda Vikramaditya Singh Khichi spoke to Anurag Shah in details.

Excerpts…

Best time for retail loan offers are out, while the home loan at 6.50% offers lowest interest rate. There are also offers also for customers with balance transfer

The Bank is also giving other attractive deals for its customers like zero processing charge on home loan while the retail loan offers open during the festive season.

With the gradual turnaround in the economy, there is an increase in demand while the reality sector looks towards recovery in economy.

Customers can use the facilities and services of BoB World Digital Banking Platform. BoB is offering over 220 simultaneous services on the BoB World app. The BoB World is a super app and an all in one platform.

You May Like: What Car Loan Can I Afford Calculator

Home Loan Interest Rates Offered By Different Banks

Take a look at the latest interest rates being offered by banks for availing Home Loans.

| Interest Rates on Home Loans | ||

| Institution | Loan 30 Lac< = Rs 75 Lac | Loan > =Rs 75 Lac |

| * Applicable Variable / Semi Fixed for 2 to 3 years Rates* | ||

| ** 1 Year MCLR ref rate | ||

| ***8.35% onwards | ||

| ^MCLR Reset frequency for Home Loans Half Yearly | ||

| ^*For Plain Home Loan with MCLR Reset frequency for Home Loans 6 Months | ||

| **^additional charge as per risk rating of applicant | ||

| Note : | ||

| Fixed/Floating Rates that vary with tenures within the specified loan amounts are indicated as a range. Fixed interest rates may be subject to a revision after a specified tenure depending on the banks t& c. Some banks/FIs allows fixed rate only for a definite period and thereafter prevailing floating rates are made applicable. (Rates as on 2 Mar 18 | ||

| Data taken from respective banks website |

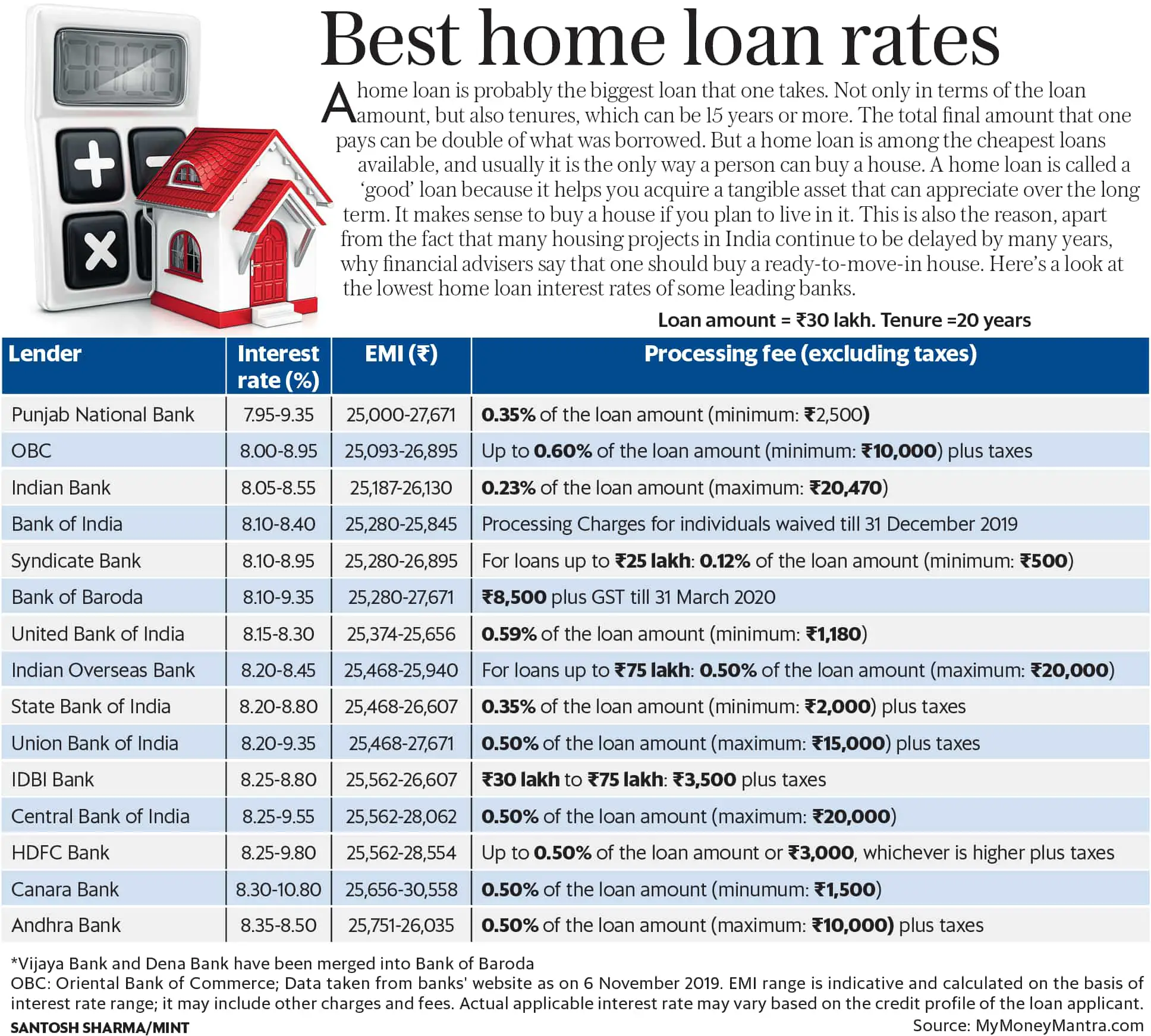

Home Loan Interest Rates And Emi In Top 15 Banks In March 2020

Looking for the best home loan product, to fund the purchase of your dream home? Housing.com News looks at the interest rates, EMI and processing fees offered by the major banks in March 2020, to help you make the right choice

In the last one month, the fear of coronavirus has taken gigantic shape. The businesses have taken a severe hit globally. Industrys output as well as the demand has plummeted sharply. Crude oil prices have crashed below $40 level. Amid global economic turmoil, the Indian realty market is not spared and it is also facing the heat. Many corona cases have been reported in India as well. In the coming few weeks, the realty market may witness further decline in the demand and supply. The fed has already cut the interest rate by 50 basis point and several other economies have followed the trend however, the RBI is yet to take a step forward towards policy rate cut. Experts have the consensus that the RBI will soon cut the REPO rate by around 25 to 50 basis points in the coming days. Under the REPO based lending the home loan borrowers are expected to get the quick benefit of any further rate cut by the RBI.

Don’t Miss: What Is The Maximum Fha Loan Amount In Texas